Step-by-step guides for Digital Banking

Get started

Application and updates

- Manage card e-Alerts

- Manage deposit e-Alerts

- Change Documents password

- Manage Statements

- Manage Letters

- View Statements and Letters

- Register for PayNow via SMS

- Register for PayNow via Digital Banking

- Online Banking Access Code and Pin

- Change PIN

- Update mailing address

- Check cheque status

- Request for cheque book

- Stop cheque transaction

- Enable Chinese Language

- Link-delink account

- Update personal details

- Register for OCBC Push Notifications

- Activate OCBC OneTouch or OCBC OneLook

- Apply for Global Savings Account

Payment/Transfer

- Bill payment

- Future or recurring bill payments

- Add billing organisations

- Transfer funds using OCBC app (Unique entity number)

- Transfer funds using OCBC Digital app (Account Number)

- Transfer funds using OCBC Digital app (NRIC/FIN Number)

- Setup GIRO

- Manage GIRO arrangements

- View and repeat last 5 Overseas Funds Transfer

- Add new payee for Overseas Funds Transfer

- Transfer funds to an existing payee for Overseas Funds Transfer

- Make foreign exchange fund transfers

- Manage transaction limits

- EDP and EDP+

Manage your cards

Managing Equities

- Open an Online Equities Account

- Access equities and view your portfolios

- Add a desired stock to watchlist

- Create, rename or delete watchlist

- Buy your stock - Pay Upfront (Lower Fees)

- Buy your stock (in SGD)

- Sell your stock (in SGD)

- Buy your stock (in foreign currency)

- Sell your stock (in foreign currency)

- Edit your orders

- Withdraw your orders

- View your e-Statements

- Settle your trades

Investments

Loans and Insurance

Apply for Digital Banking access

Check your account balances

Activate OneToken via SMS OTP and Email OTP

Activate OneToken via SMS OTP and Token Key

Activate OneToken via Hardware Token

Apply Credit Card

Manage card e-Alerts

Manage deposit e-Alerts

Change Documents password

Manage Statements

Manage Letters

View Statements and Letters

Register for PayNow via SMS

Register for PayNow via Digital Banking

Online Banking Access Code and Pin

Change PIN

Update mailing address

Check cheque status

Request for cheque book

Stop cheque transaction

Enable Chinese Language

Link-delink account

Update personal details

Register for OCBC Push Notifications

Activate OCBC OneTouch or OCBC OneLook

Apply for Global Savings Account

Bill payment

Future or recurring bill payments

Add billing organisations

Transfer funds using OCBC app (Unique entity number)

Transfer funds using OCBC Digital app (Account Number)

Transfer funds using OCBC Digital app (NRIC/FIN Number)

Setup GIRO

Manage GIRO arrangements

View and repeat last 5 Overseas Funds Transfer

Add new payee for Overseas Funds Transfer

Transfer funds to an existing payee for Overseas Funds Transfer

Make foreign exchange fund transfers

Manage transaction limits

EDP and EDP+

Activate credit/debit card

Request fee waiver

Manage card daily limit

Dispute transactions

Manage overseas card usage

Top up card

Reset card PIN

Replace card

Lock/unlock card

Report lost card

Link/unlink debit card to Global Savings Account

Open an Online Equities Account

Access equities and view your portfolios

Add a desired stock to watchlist

Create, rename or delete watchlist

Buy your stock - Pay Upfront (Lower Fees)

Buy your stock (in SGD)

Sell your stock (in SGD)

Buy your stock (in foreign currency)

Sell your stock (in foreign currency)

Edit your orders

Withdraw your orders

View your e-Statements

Settle your trades

Apply for Blue Chip Investment Plan (BCIP)

Apply for CPF Investment Account (CPFIA)

Apply for Supplementary Retirement Scheme (SRS) Account

Exchange Foreign Currencies

Set Rate Alerts

Set Auto-Execute Orders

Apply for Time Deposit

Apply for Credit Line

Perform Balance Transfer

Apply for ExtraCash Loan

Withdraw Time Deposit before maturity

How to make foreign exchange fund transfers

-

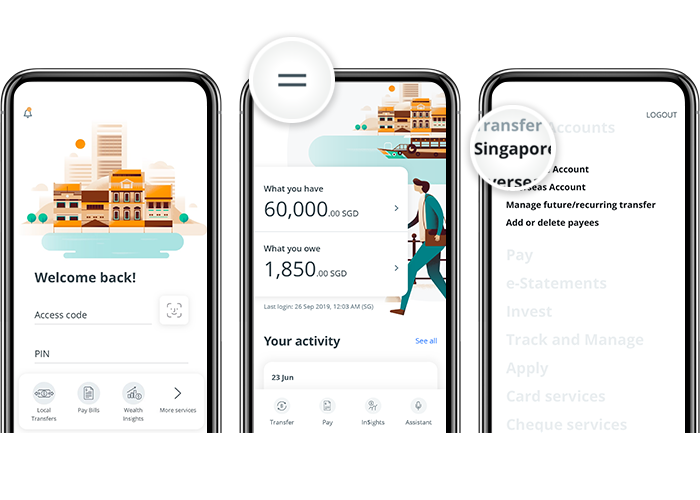

Step 1: Login with access code and PIN or face ID

Log in and tap on ‘Transfers’, followed by ‘Singapore Account’ within the menu bar on the top left.

-

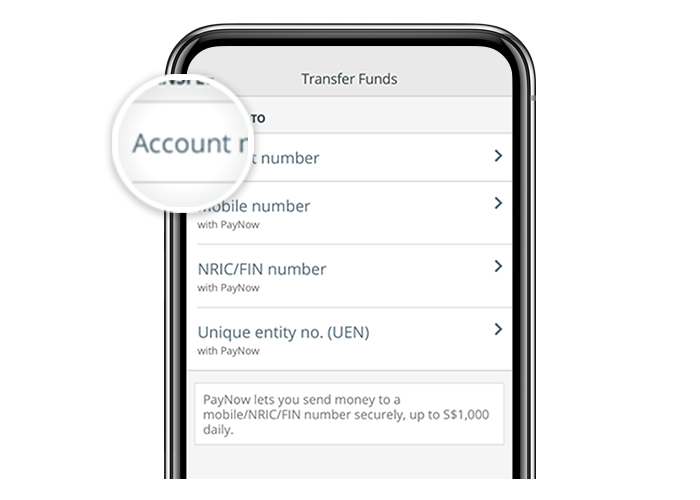

Step 2: Tap on ‘Account number’

-

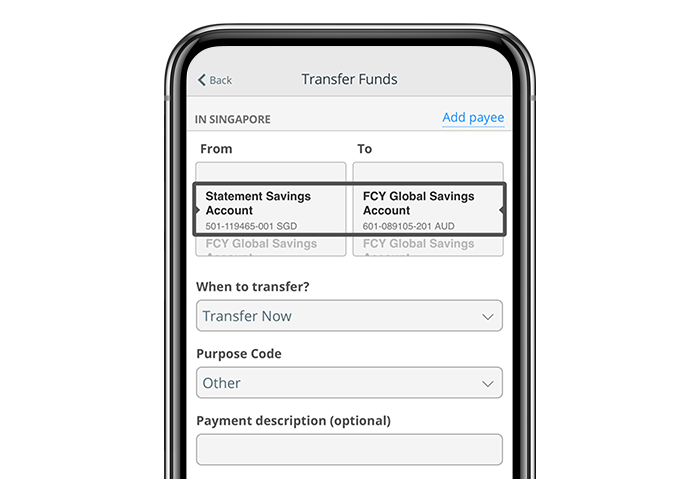

Step 3: Choose to transfer funds to a Global Savings Account or Premier Global Savings Account (for Premier clients)

-

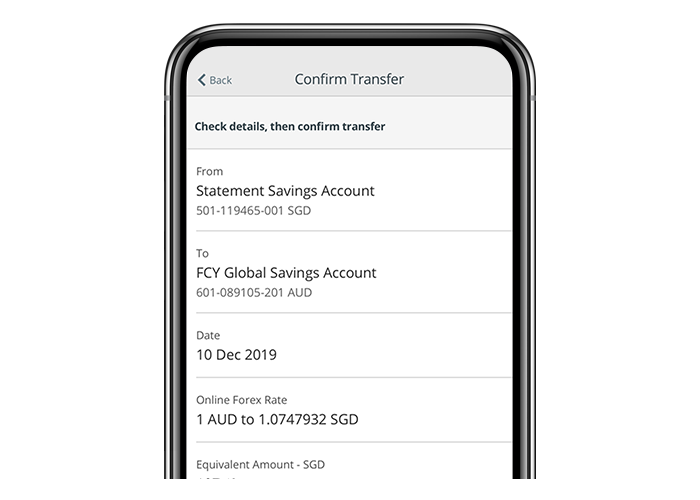

Step 4: And you’re done!

Confirm your transfer details.