-

Step 1: Login to the OCBC app

Ensure that the OCBC app on your registered device is updated and in-app notifications are enabled

-

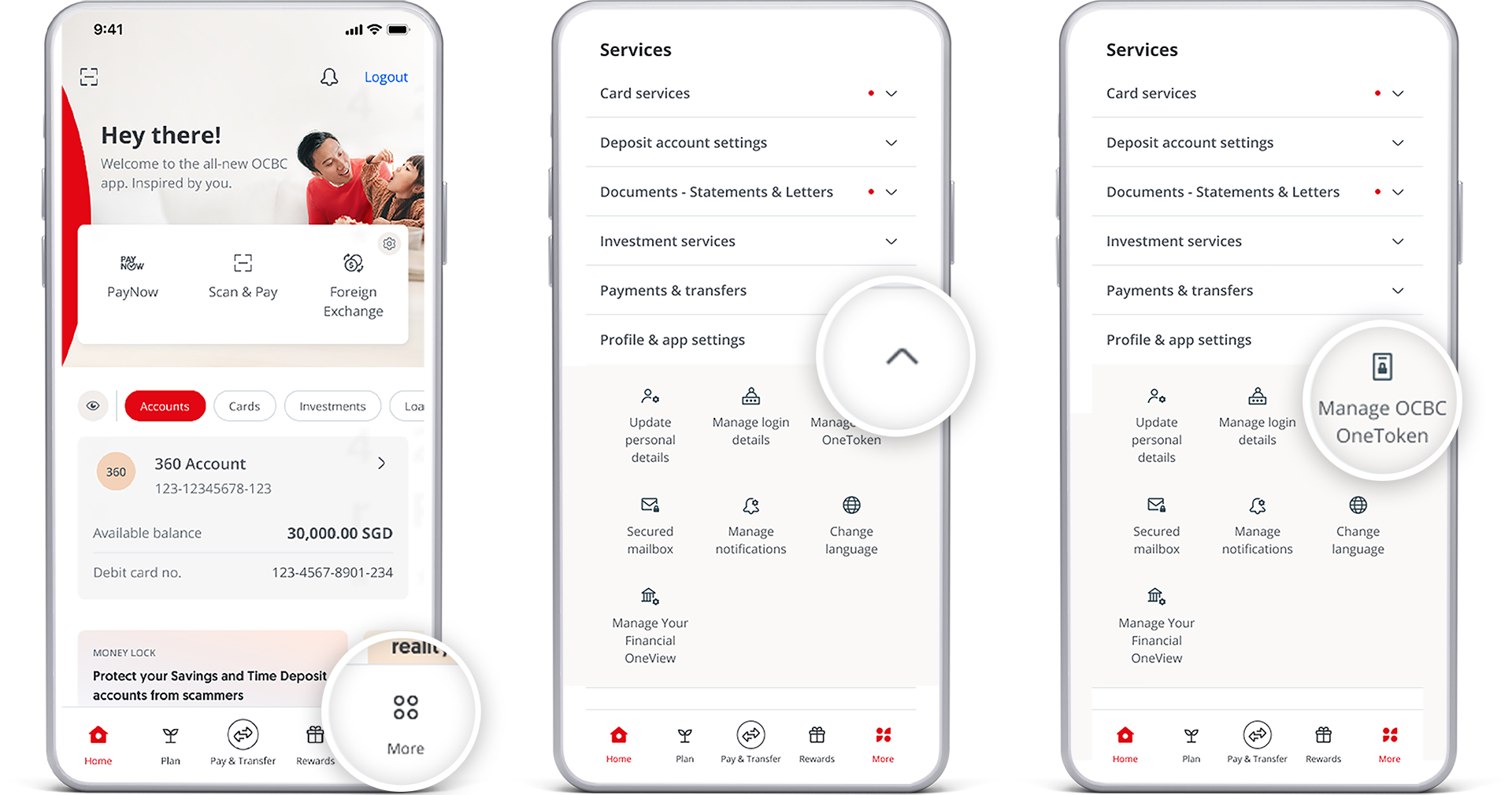

Step 2: Go to settings

- Tap the ‘More’ icon (bottom right-hand corner of the screen) and scroll down to ‘Services’

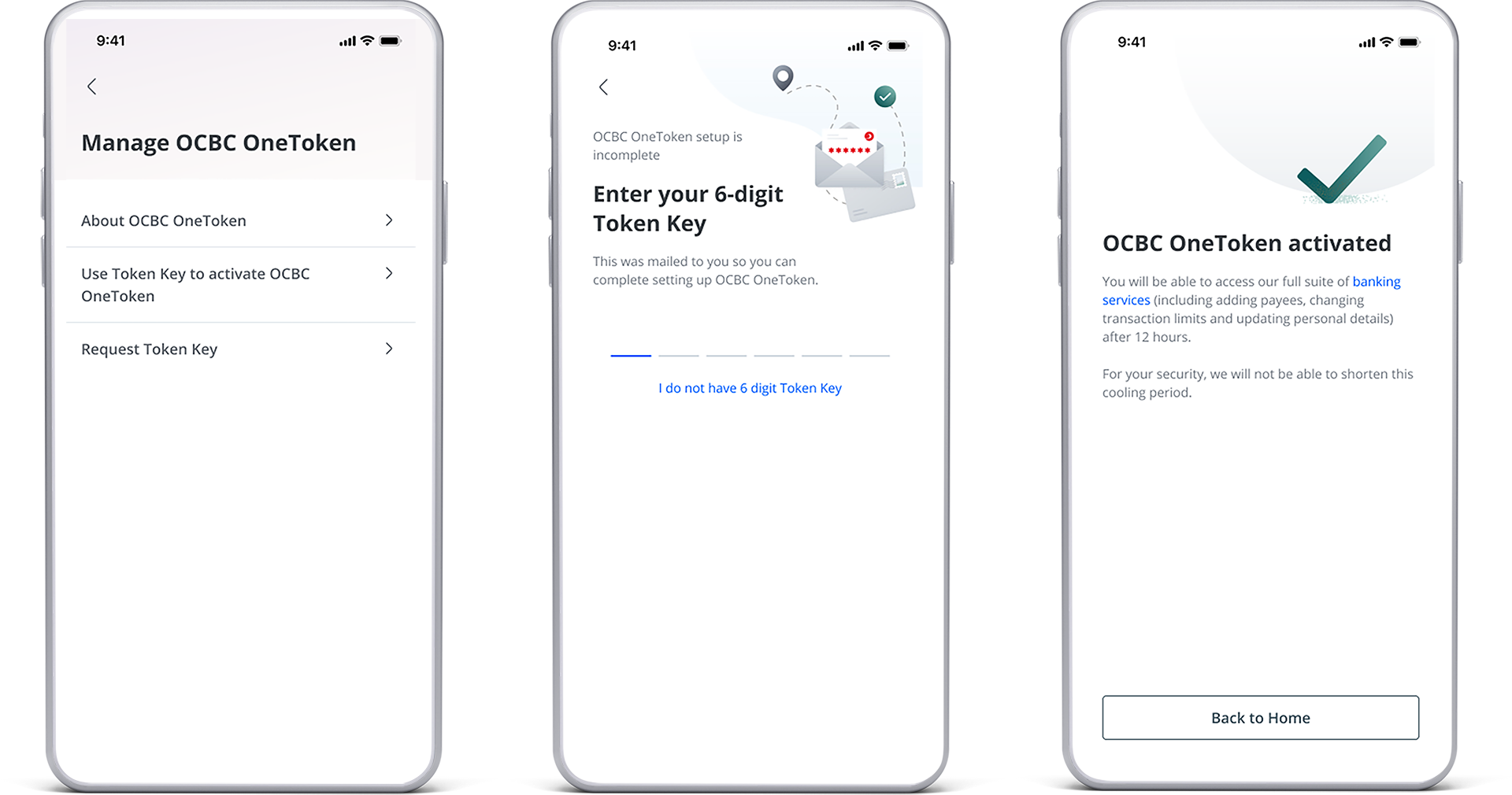

- Tap on ‘Profile & app settings’ > ‘Manage OCBC OneToken’

-

Step 3: Activate your OCBC OneToken

Select 'Activate using SMS OTP and Token Key'

-

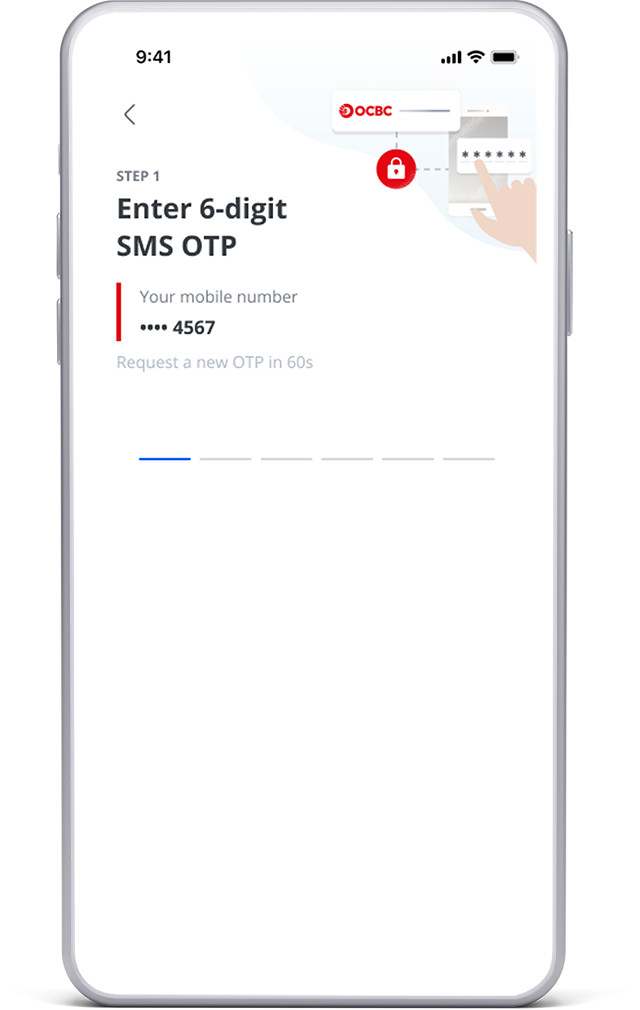

Step 4: Enter your SMS one-time password (OTP)

- Follow the on-screen instructions

- A 6-digit SMS OTP will be sent to your mobile number via SMS

- Enter the SMS OTP

-

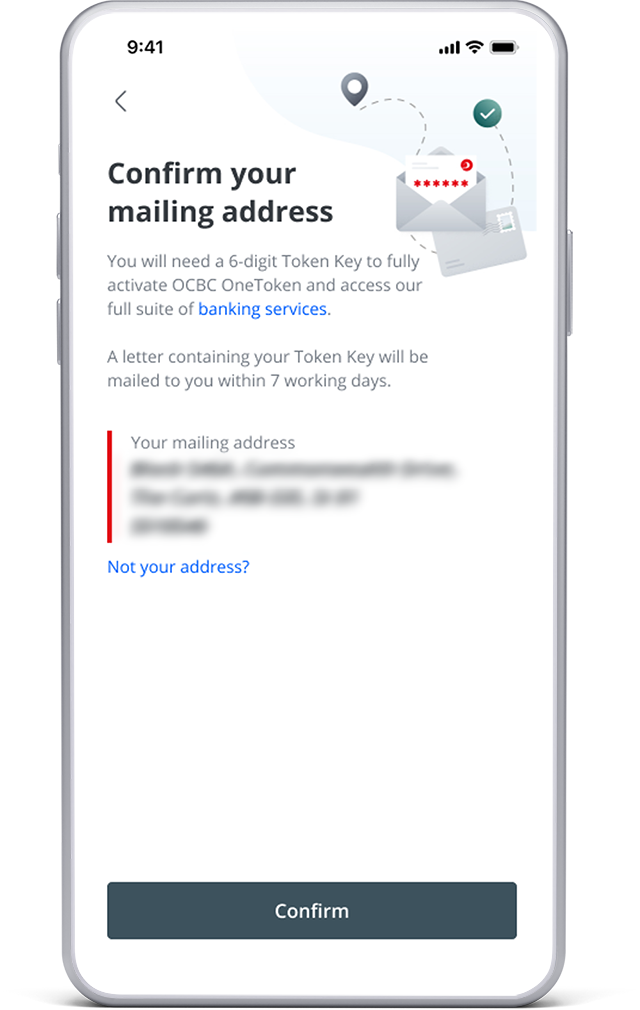

Step 5: Confirm your mailing address

Tap 'Confirm' to confirm your mailing address that the Token Key will be sent to via mail

-

Step 6: Your OCBC OneToken is almost fully activated

- You will receive your 6-digit Token Key via mail within 7 days, which is required to complete your OCBC OneToken activation.

- Once your OCBC OneToken is fully activated, you will be able to perform high risk transactions such as adding payees, changing personal particulars and changing transaction limits.

Until then, only low risk transactions can be carried out with OCBC OneToken, e.g. Bill payment, funds transfer to existing payee.

-

Step 7: Upon receiving your PIN mailer, enter your 6-digit Token Key

- A 6-digit Token Key Letter will be mailed to you to your registered address

- Upon receiving your PIN mailer, log in to your OCBC app

- Tap the ‘More’ icon (bottom right-hand corner of the screen) and scroll down to ‘Services’

- Tap on ‘Profile & app settings’ > ‘Manage OCBC OneToken’ > ’Enter Activation Code’

- Enter your 6-digit Token Key

- Your OCBC OneToken will be fully activated after 12 hours

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.