-

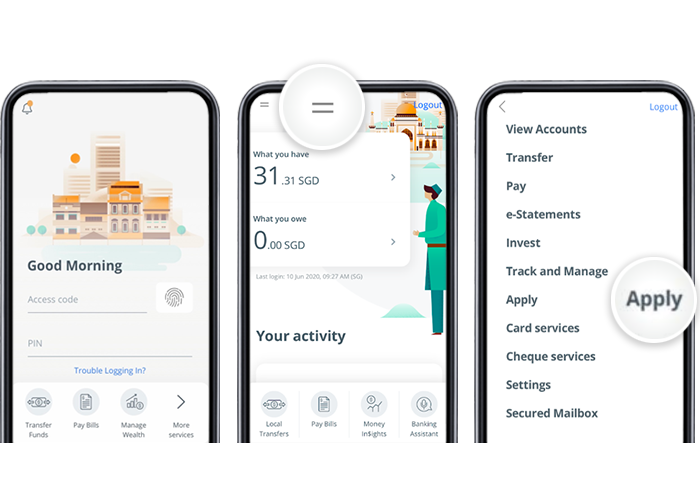

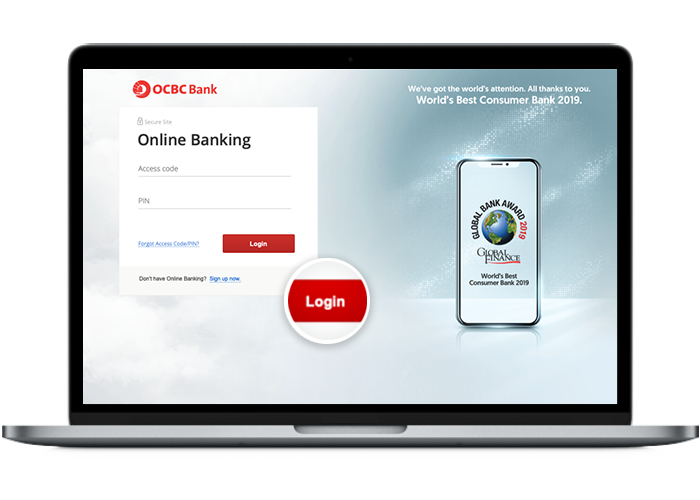

Step 1: Log in with your access code and PIN or fingerprint ID

On mobile app

Tap on the left menu bar and select “Apply”.

On desktop

-

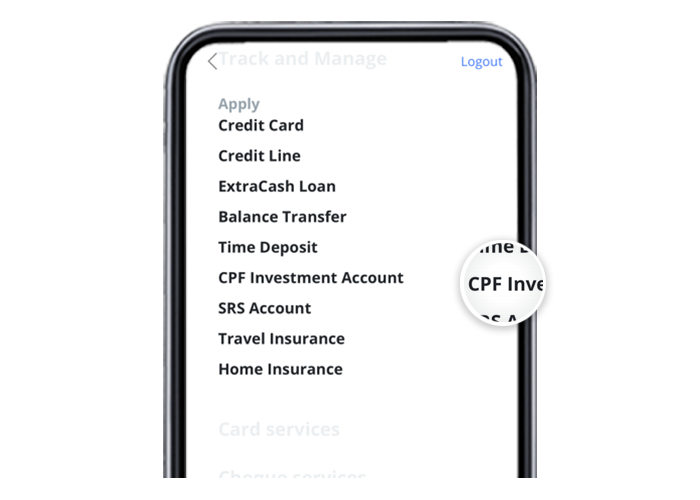

Step 2: Navigate to “CPF Investment Account” / Select CPFIS Account

On mobile app

Tap on “CPF Investment Account”.

On desktop

Click “Open an account”. Under Investment Account, select “CPFIS account”.

-

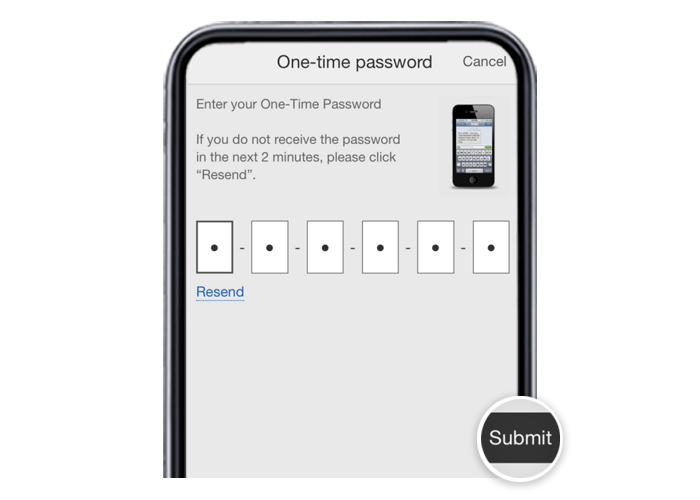

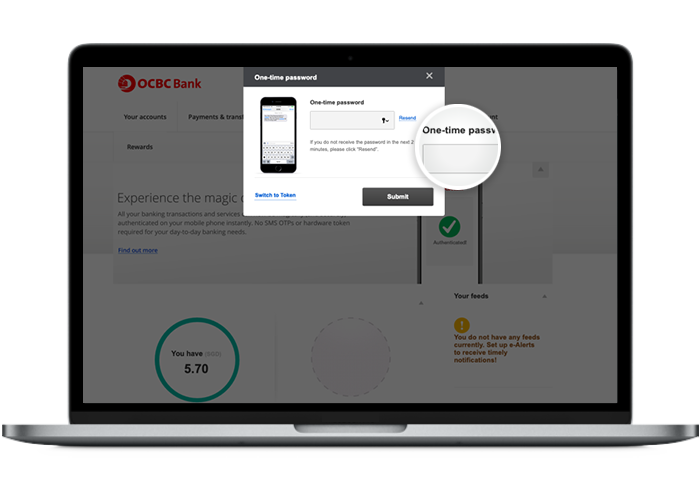

Step 3: Enter your One-Time Password sent through SMS

On mobile app

On desktop

-

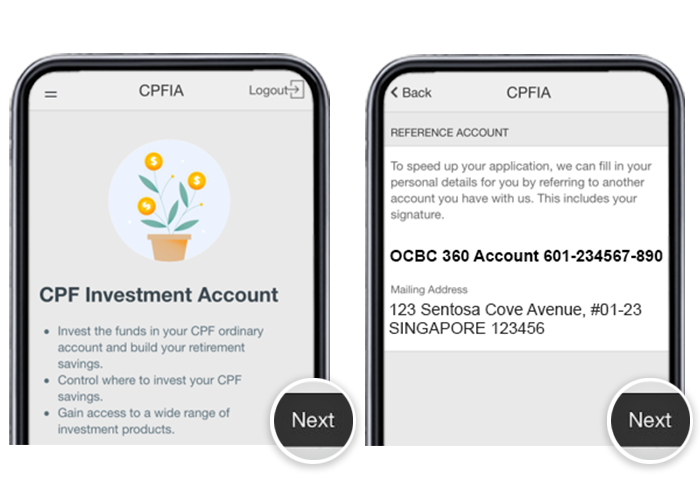

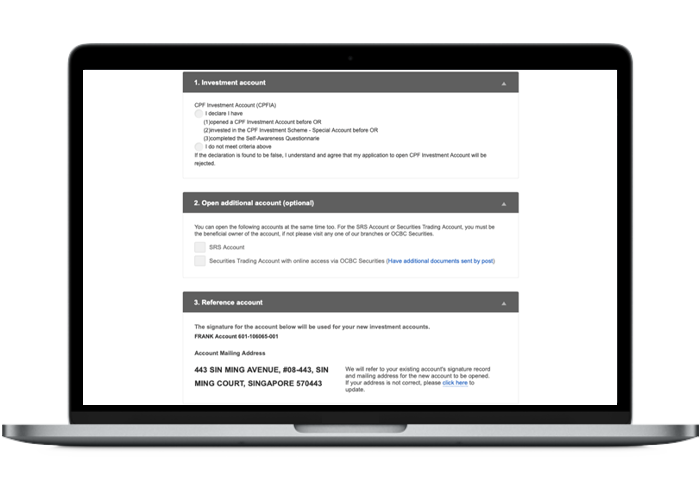

Step 4: Proceed with your application / Confirm your Account Address

On mobile app

On desktop

Select an option under “Investment account” and confirm your Account Address.

-

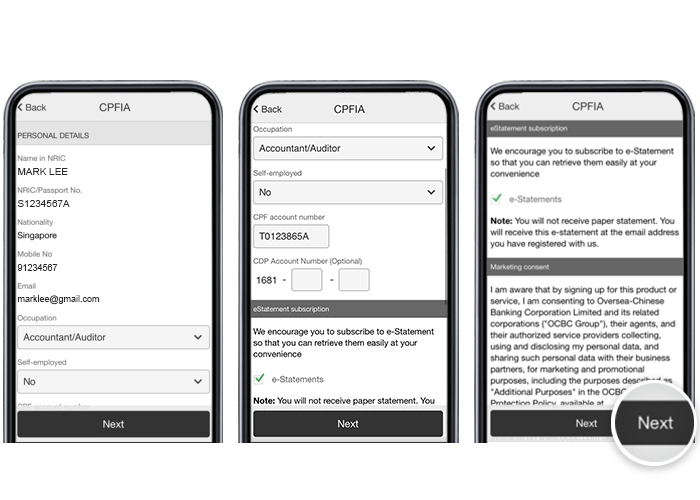

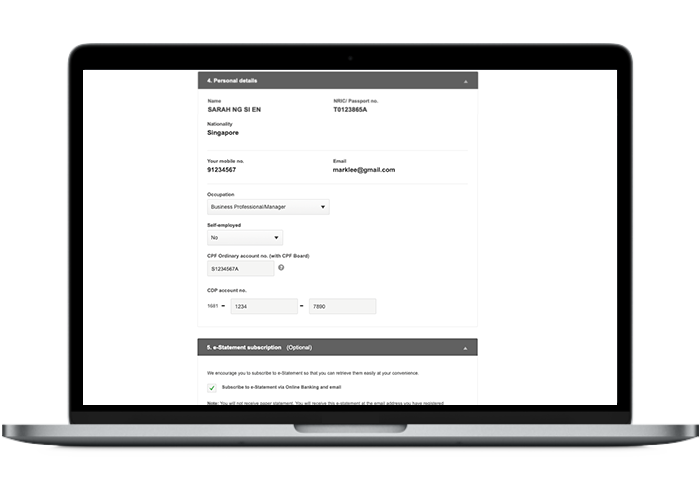

Step 5: Enter your personal details

On mobile app

On desktop

Select your occupation, self-employment status and fill in your CDP account number.

-

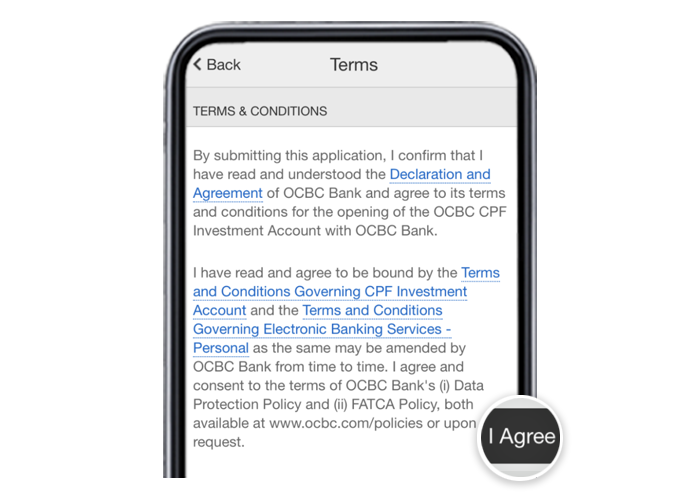

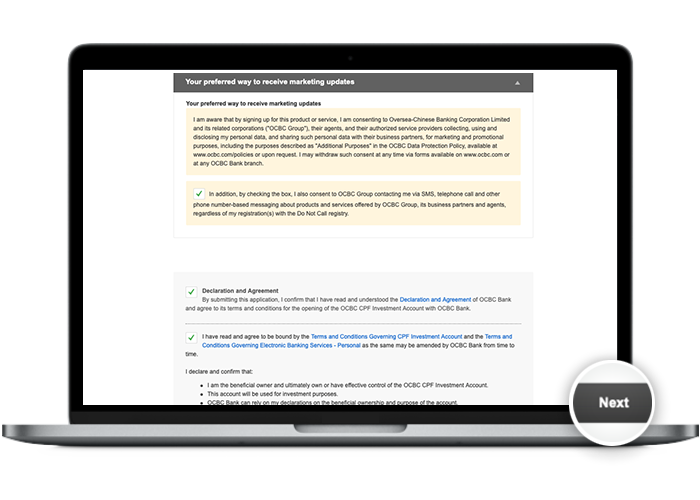

Step 6: Review and agree to the Terms & Conditions

On mobile app

On desktop

-

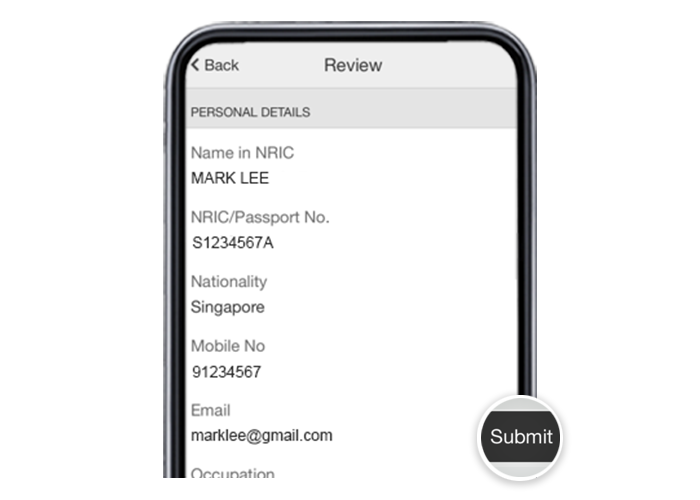

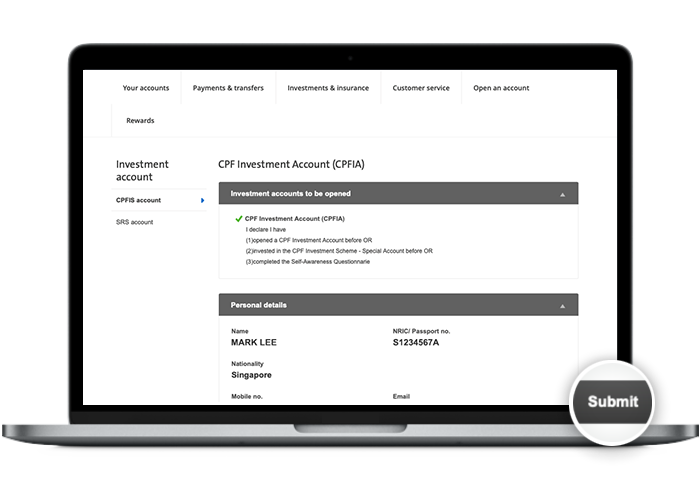

Step 7: Review and confirm all details before submitting your application

On mobile app

On desktop

-

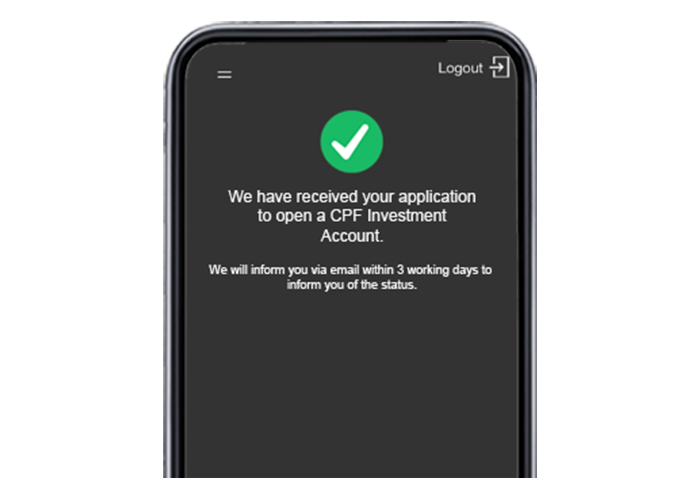

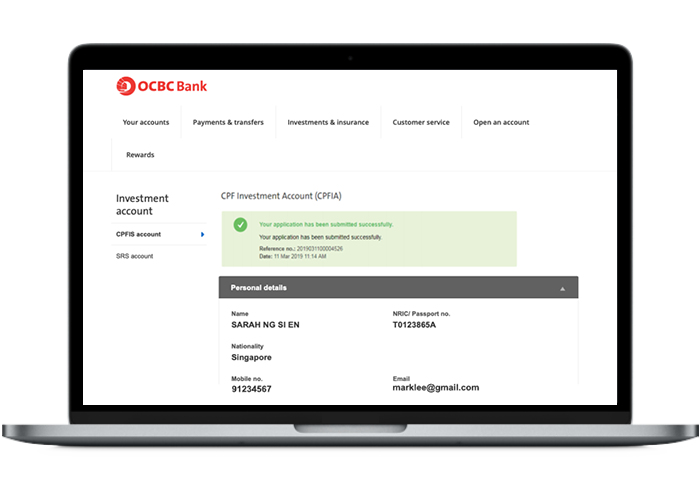

Step 8: And you’re done!

On mobile app

On desktop

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.