Note: A cooling period will apply before these key account changes (add new payee, change email address/contact number or increase transaction limit) take effect. Please be guided by the on-screen instructions.

-

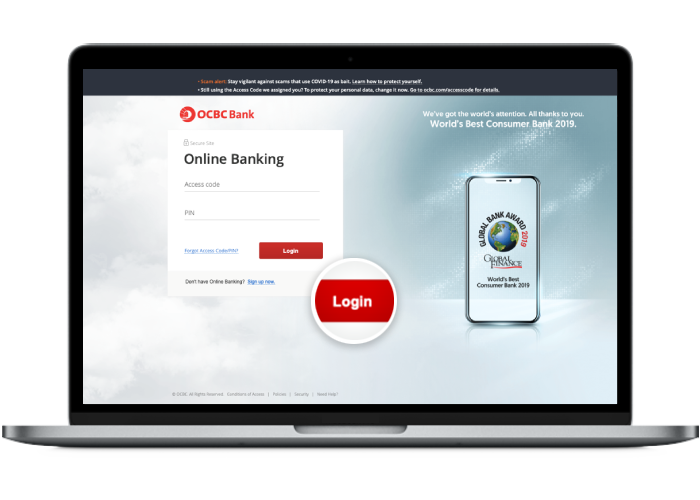

Step 1: Log in with your access code and PIN or fingerprint ID

On mobile app

On desktop

-

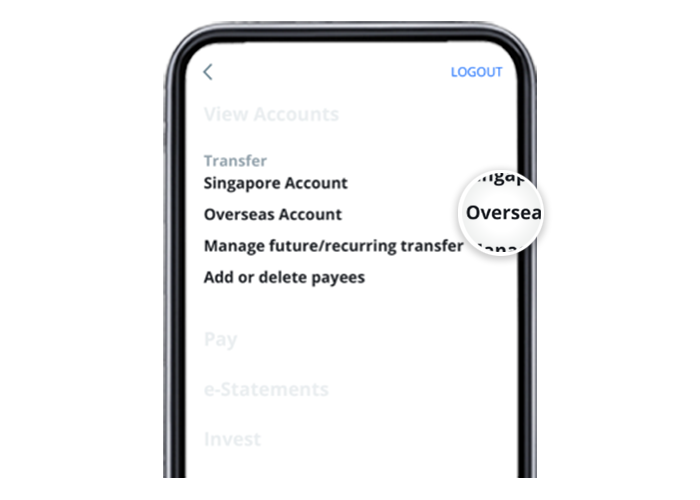

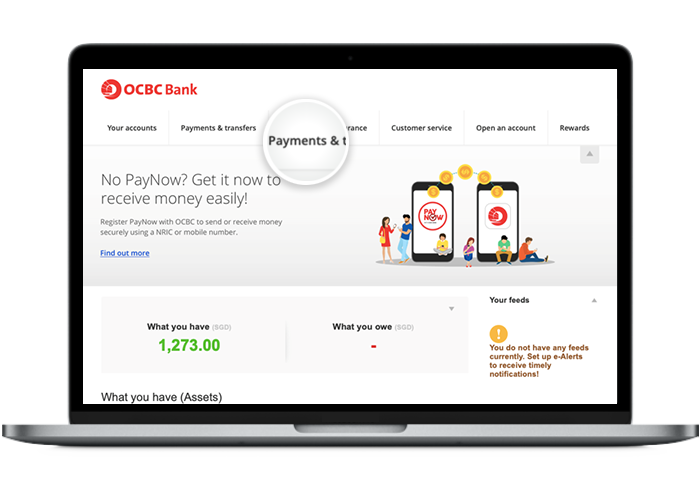

Step 2: Navigate to “Overseas Account” / “Payments and transfers”

On mobile app

Tap on the menu bar on the top left.

Tap on “Transfer” and select “Overseas Account”.

On desktop

Click on "Payments and transfers".

-

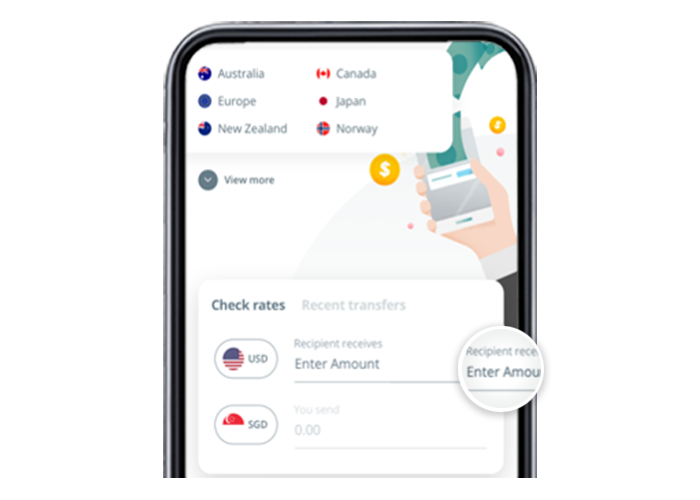

Step 3: Select the transaction currency and amount on mobile / Click on “to an account” on desktop

On mobile app

Choose the currency and enter the amount to be transferred.

On desktop

-

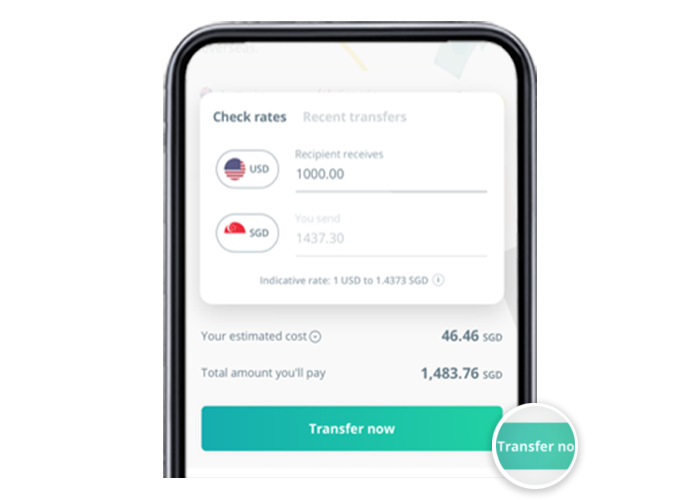

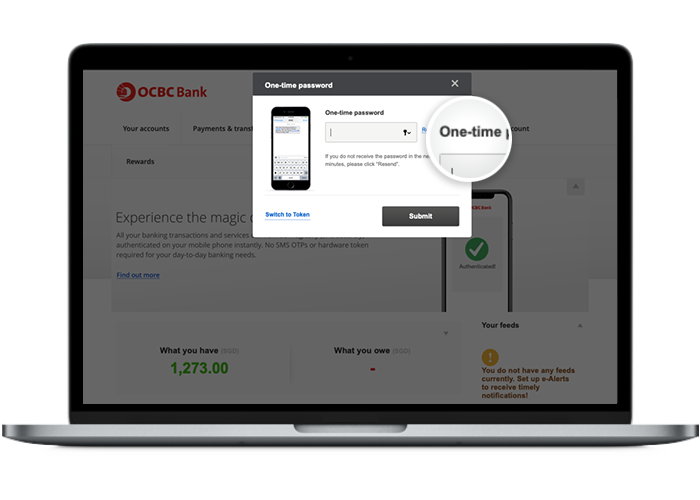

Step 4: Review the rates and fees on mobile / Authenticate action with your One-time password on desktop

On mobile app

Review the rates and fees payable and tap on “Transfer now”.

On desktop

Enter and submit the One-time password sent to you via SMS.

-

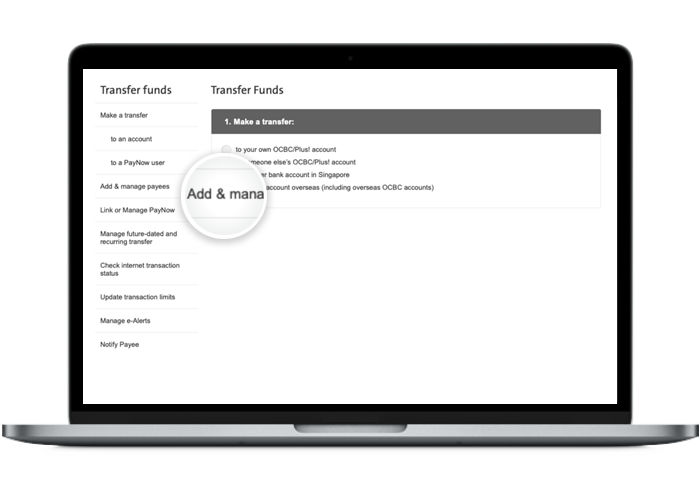

Step 5: Fill in the payee’s bank details on mobile / Click on "Add & manage payees" on desktop

On mobile app

Enter your payee’s personal and bank details.

On desktop

With effect from 27 January 2022, adding of new payee will take up to 24 hours to be effective.

-

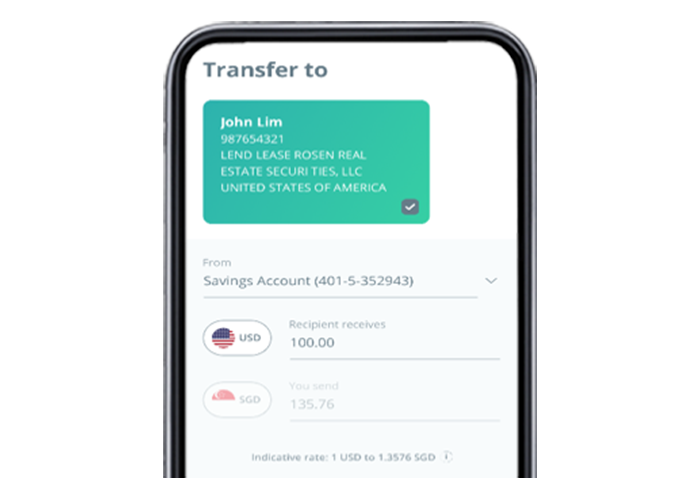

Step 6: Choose you account to transfer from (with SWIFT code) on mobile / Add an overseas payee’s account on desktop

On mobile app

If you know your payee’s SWIFT code, choose which account to transfer from and tick the relevant boxes.

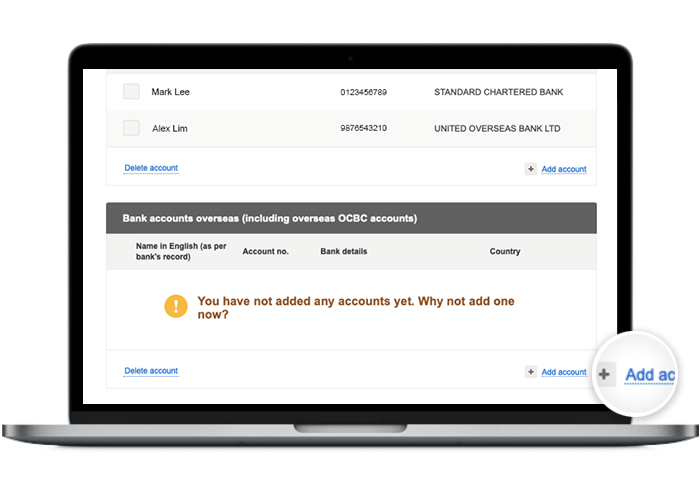

On desktop

Under the Bank accounts overseas (including overseas OCBC accounts) section, click on "Add account".

-

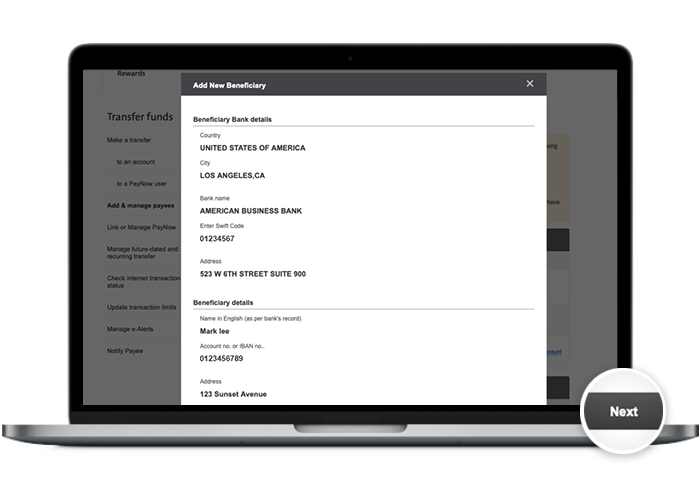

Step 7: Search for SWIFT code on mobile (no SWIFT code) / Fill in the payee’s personal bank details on desktop

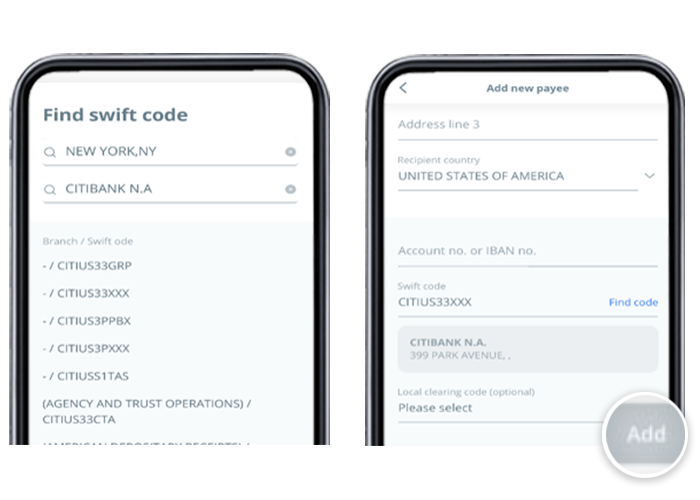

On mobile app

If you do not know the bank’s SWIFT code, search for the bank’s city, branch and select their SWIFT code.

Tap on “Add” once the details have been filled in.

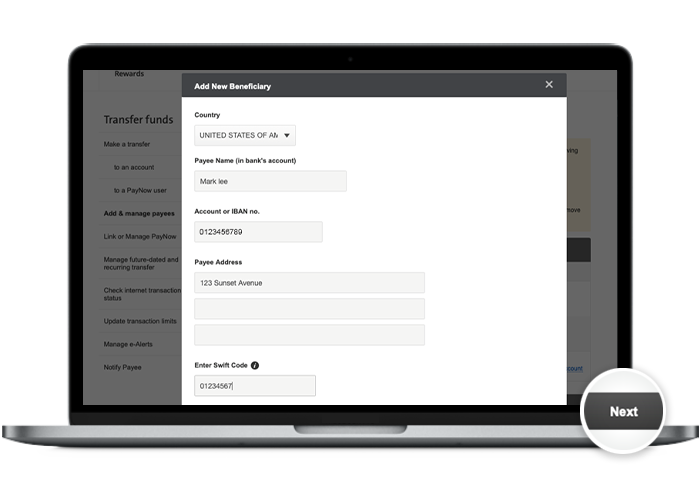

On desktop

If you do not have a SWIFT code, select the payee’s city of residence and bank name.

The SWIFT code will be populated automatically.

-

Step 8: Review the payee’s details and click on "Next"

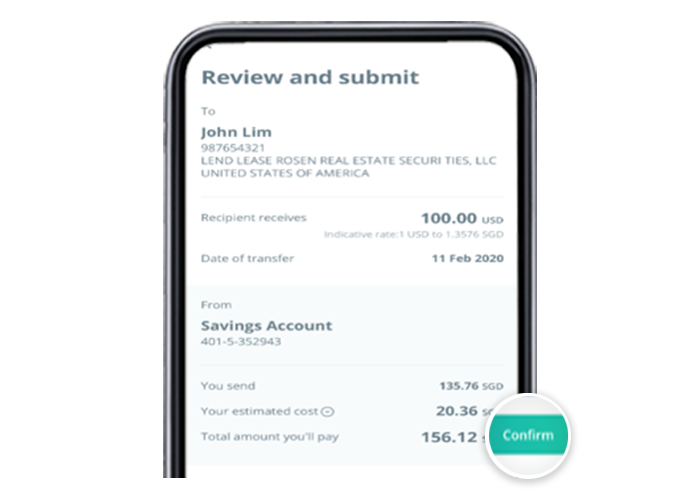

On mobile app

Review and confirm your transaction details.

On desktop

-

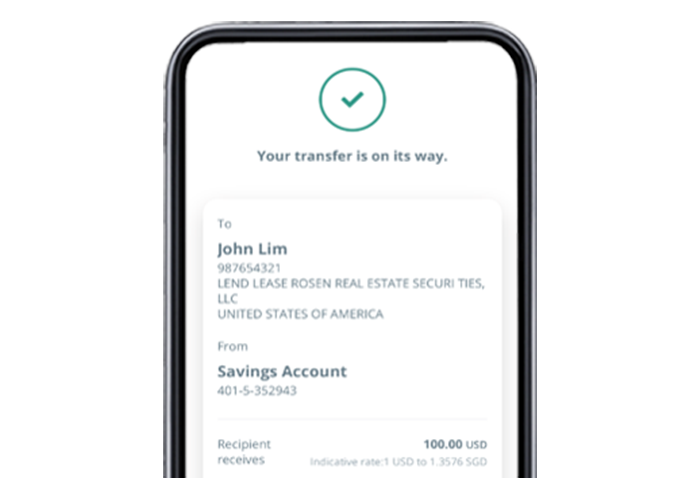

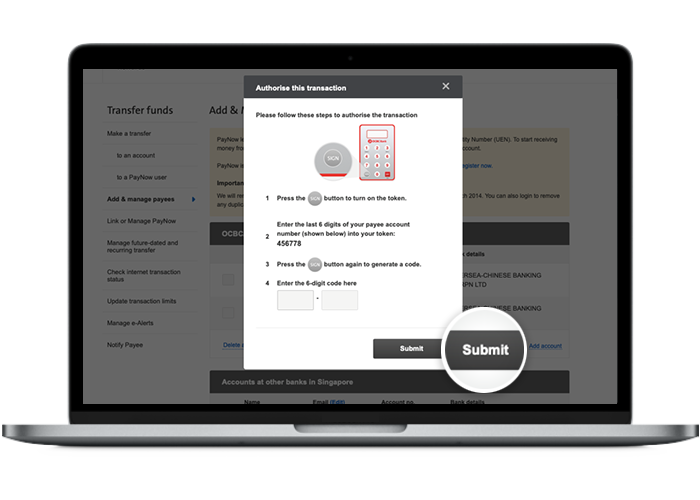

Step 9: And you’re done on mobile! / Follow the instructions on the screen to authorise the addition of the payee on desktop

On mobile app

Your transaction is on the way!

On desktop

-

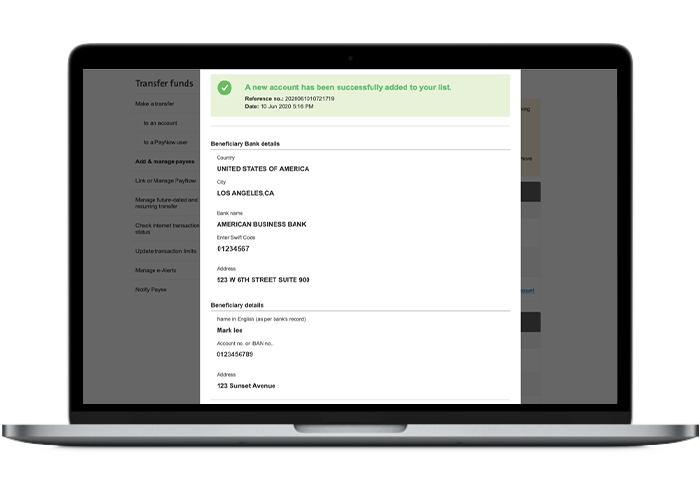

Step 10: And you’re done on desktop!

On desktop

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.