Understanding the financial wellness of Singaporeans

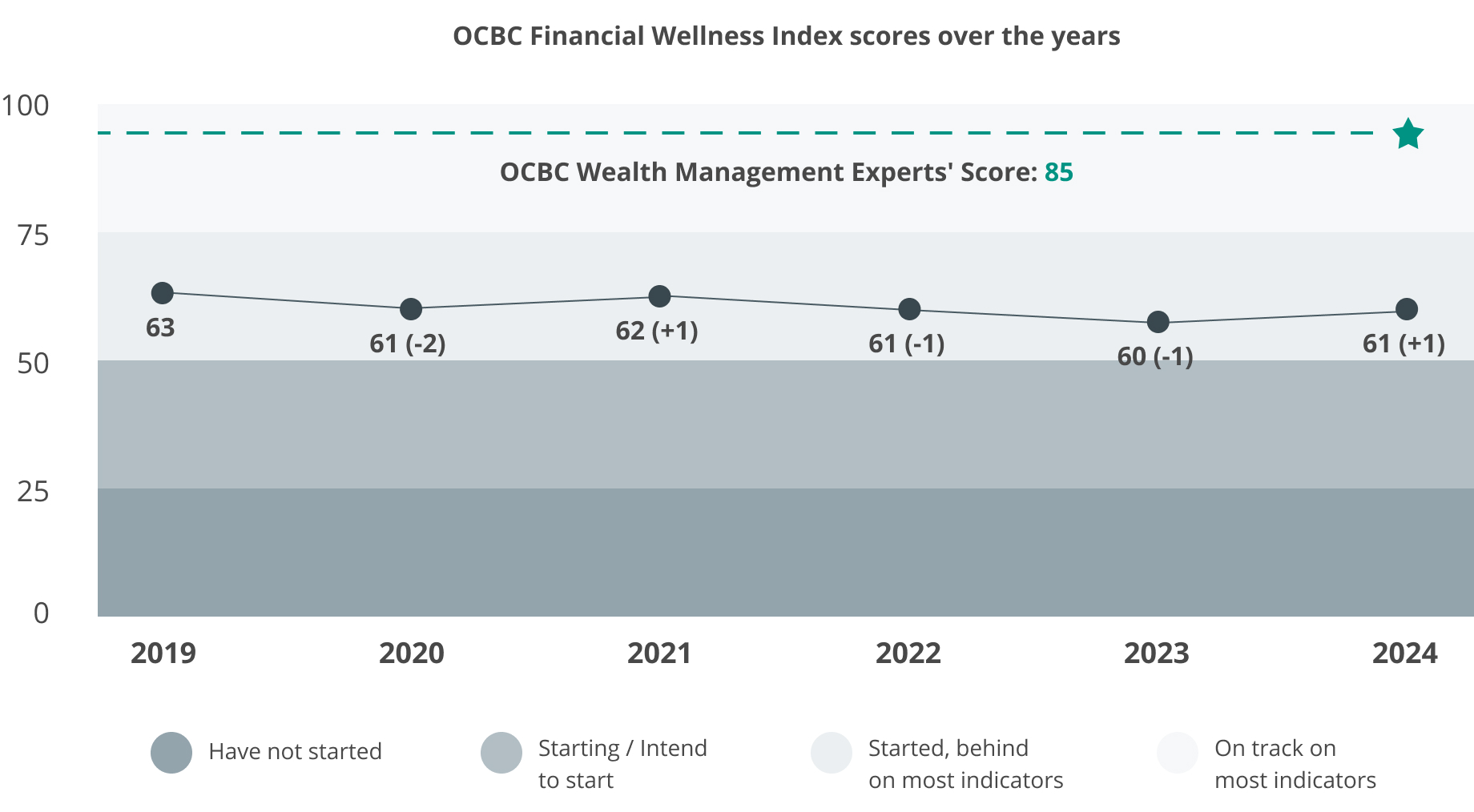

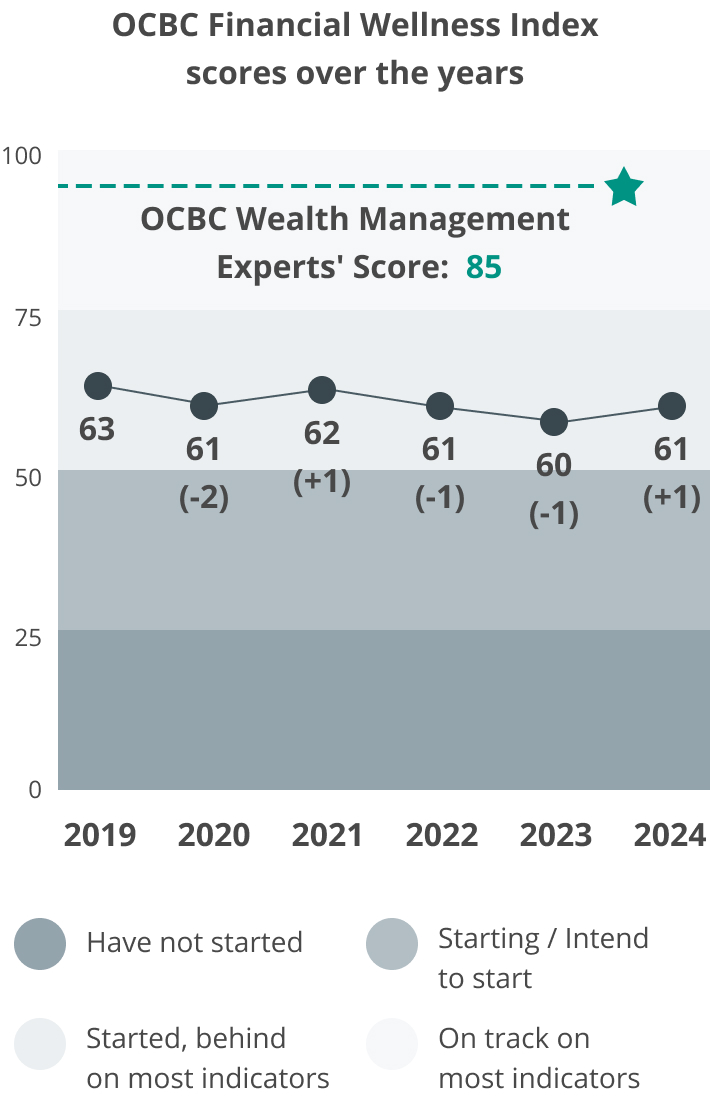

Launched in 2019, the OCBC Financial Wellness Index is the most comprehensive study on the financial health of Singaporeans.

The Index provides the bank with deep insights into consumers, which in turn helps us understand where our customers need more help in and develop even better solutions that can meet their needs.

Designed and formulated by OCBC, the Index is based on the 10 pillars of financial wellness as defined by the bank's wealth management experts.

Every year, around 2,000 working adults in Singapore aged between 21 and 65 are surveyed online on questions relating to their financial situation.

To assess how each respondent fares against these pillars, 24 indicators – standards and guidelines that are widely-accepted best practices in financial planning – are used to derive an individual score of a maximum of 100.

Based on their overall score, respondents are classified into various stages of financial

wellness –

Have not started (0-24): Respondents have hardly taken any action on most

indicators;

Intend to start (25-49): Respondents have just started or are intending to

start;

Started but behind (50-74): Respondents have started but are behind on most

indicators; and

Started and ahead (75-100): Ahead on almost all indicators.

How Singaporeans fared over the years:

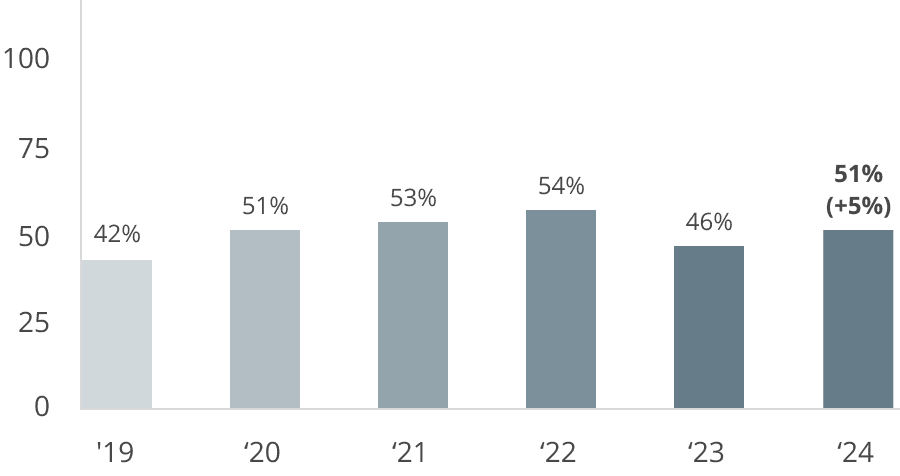

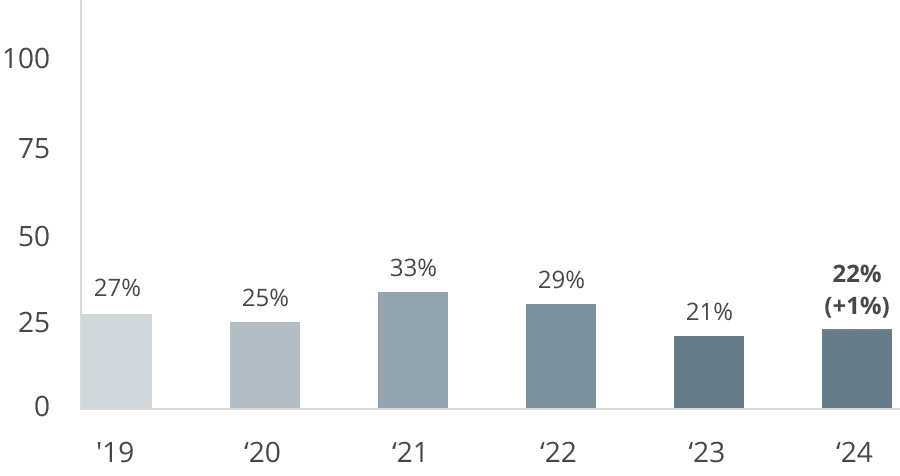

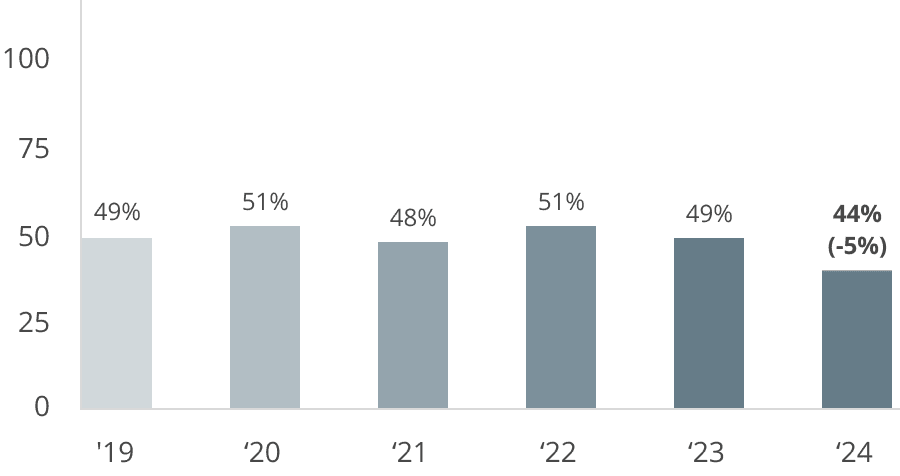

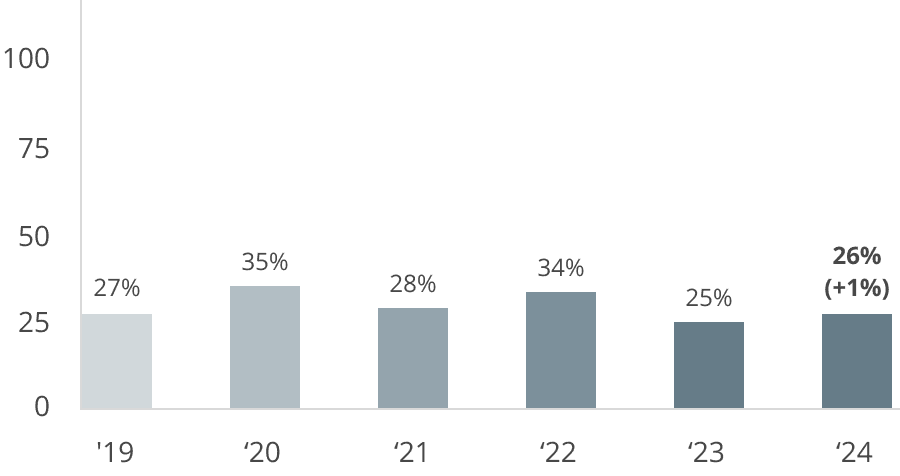

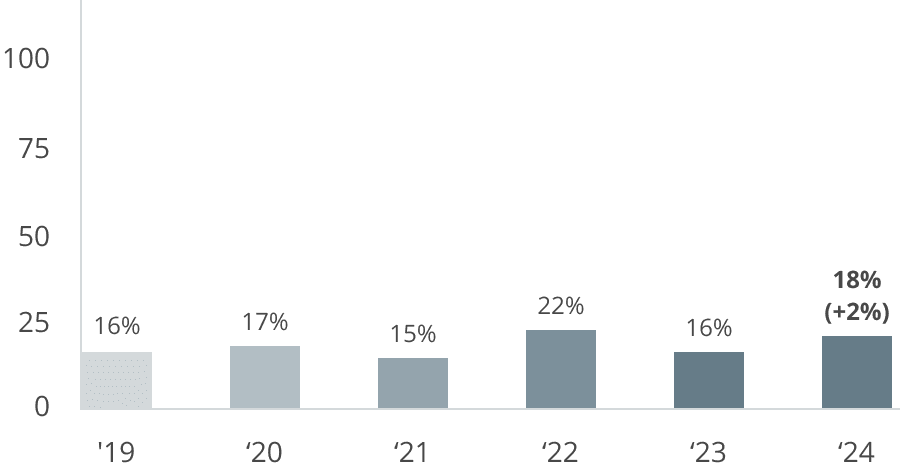

Singaporeans who have saved at least 6 months of their monthly salary

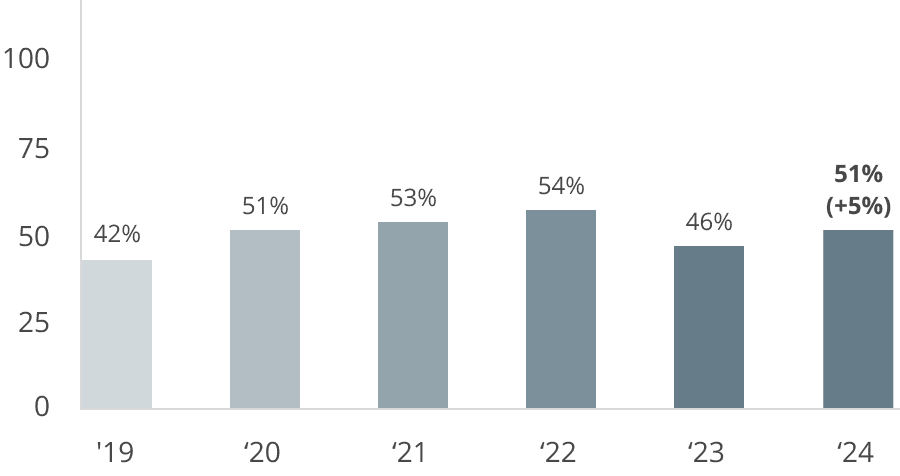

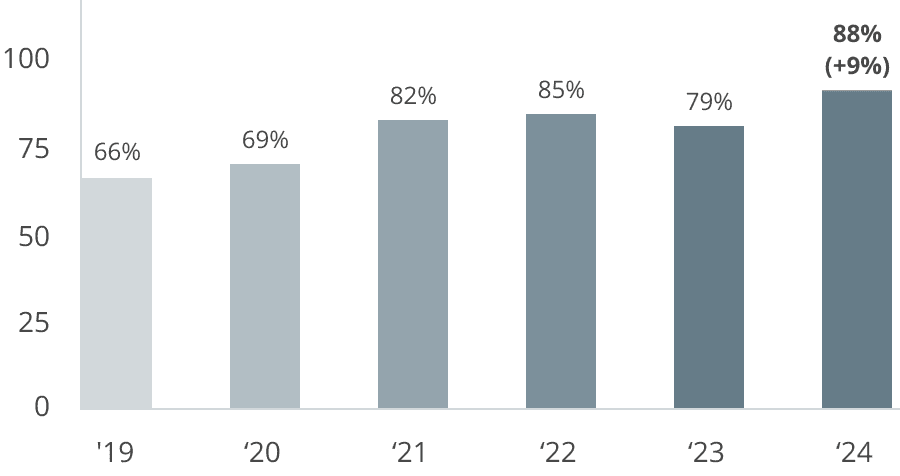

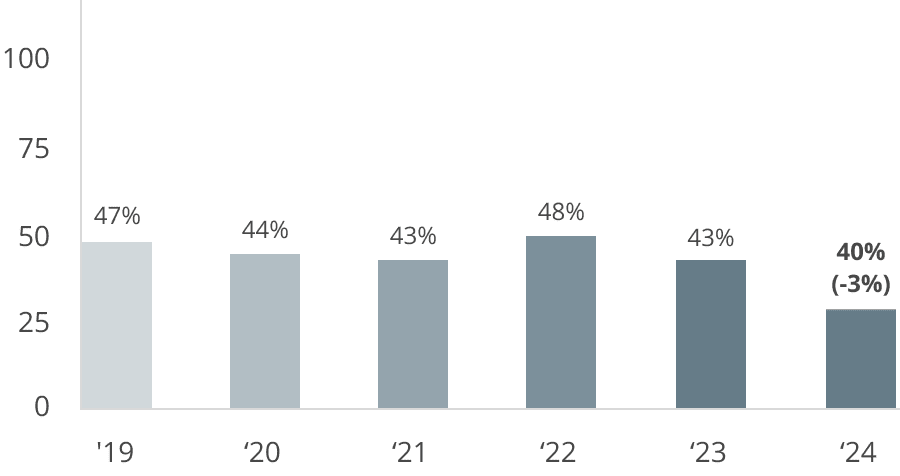

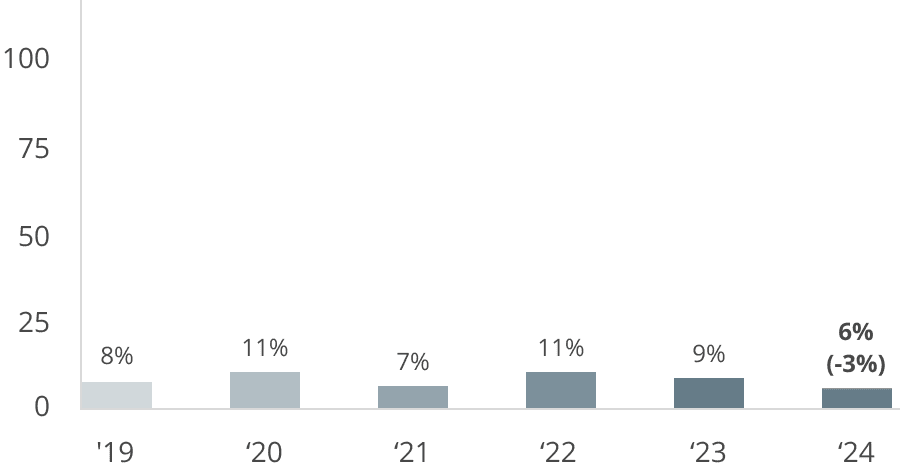

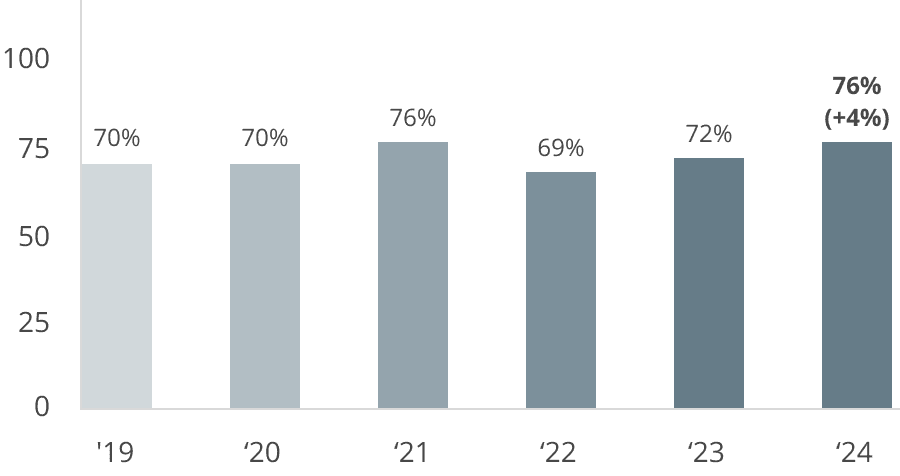

Singaporeans who are on track with their retirement plans

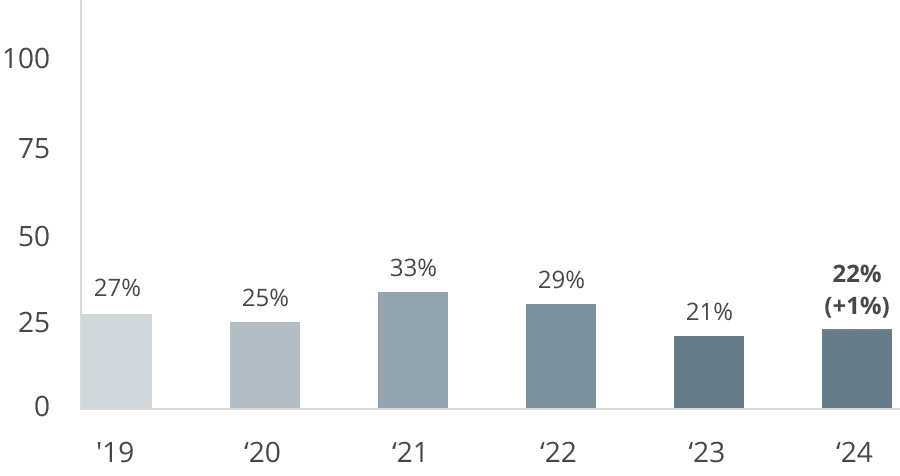

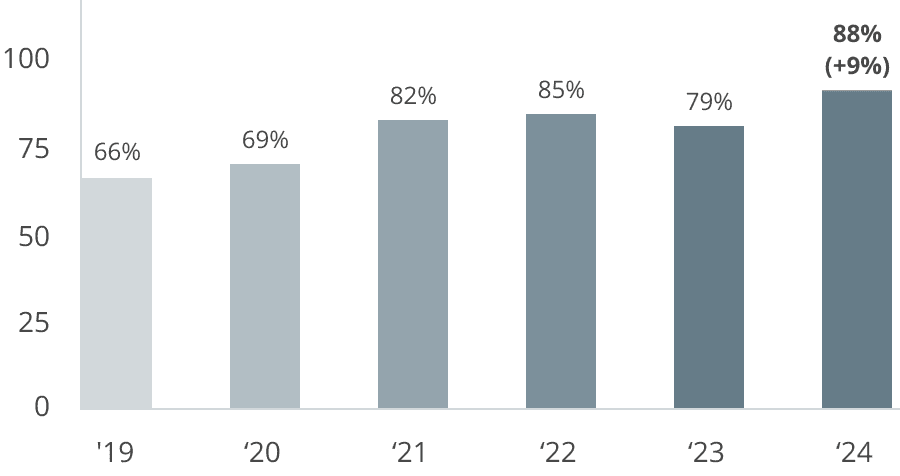

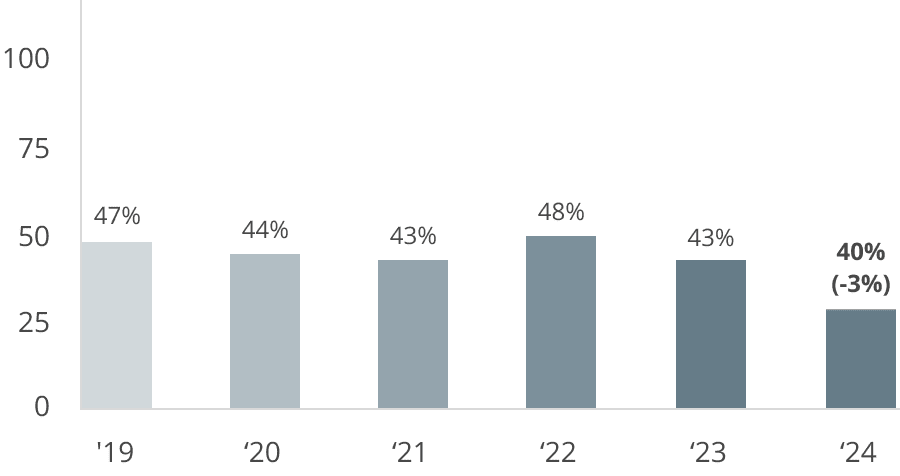

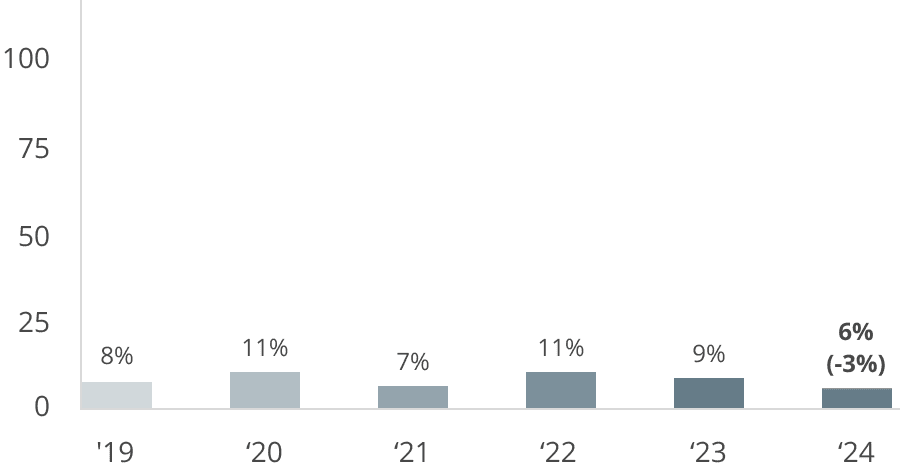

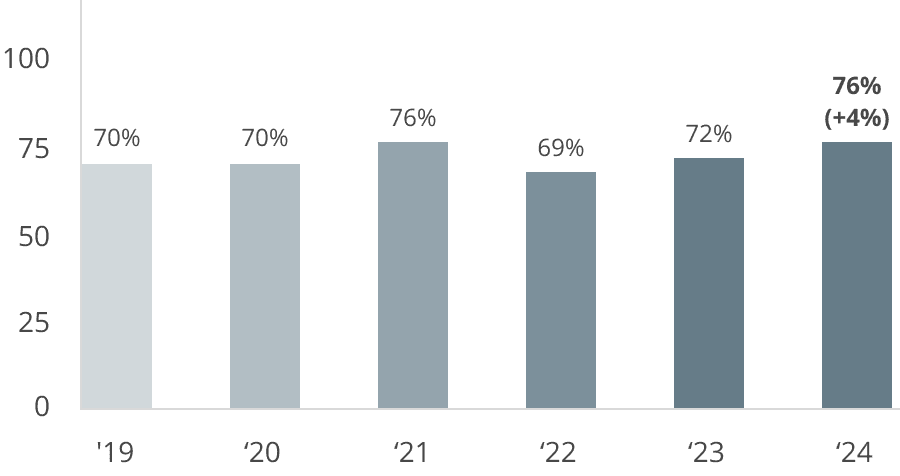

Singaporeans who have investments

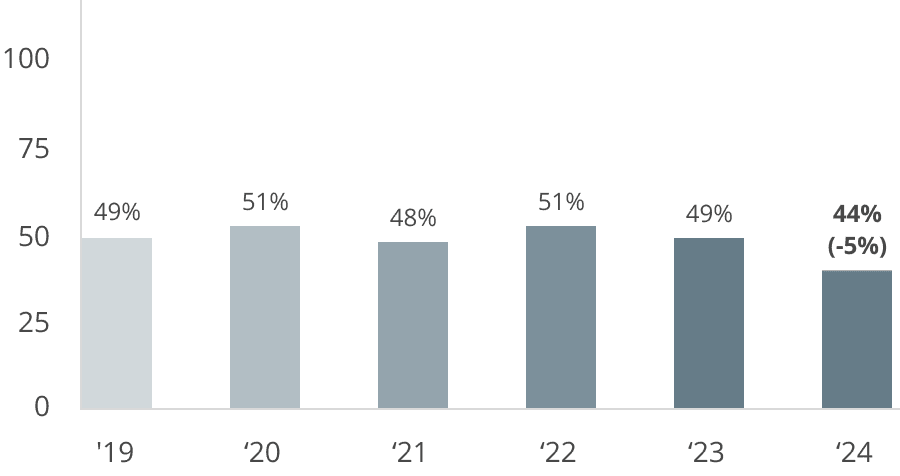

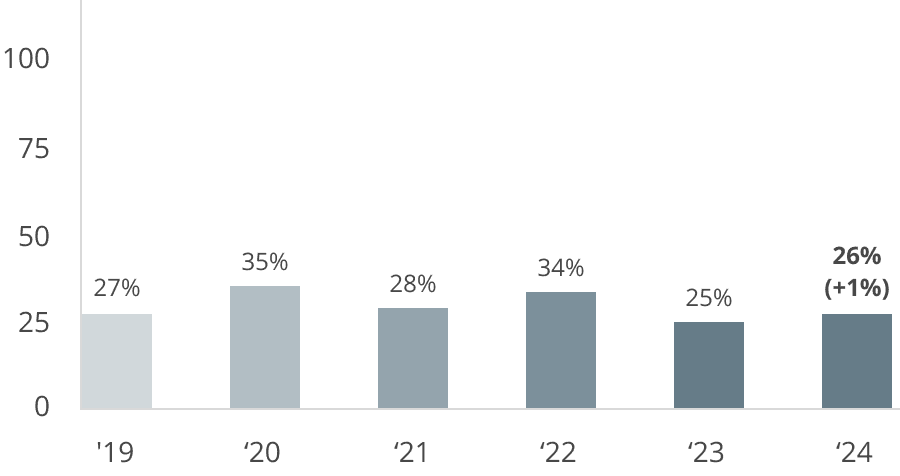

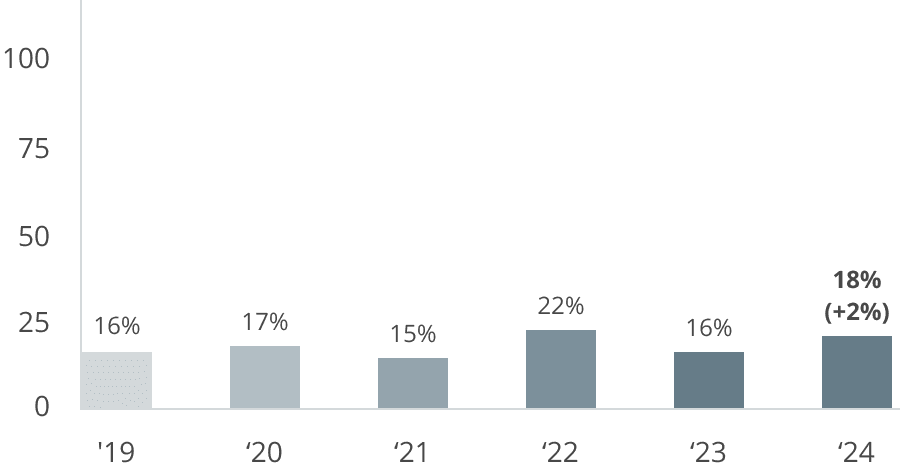

Singaporeans who do annual regular reviews of their plans

Singaporeans who often gamble more than they can afford to lose

Investors who excessively speculate for quick gains

Singaporeans who often borrow money from their family or friends

Singaporeans who spend beyond their means to keep up with their peers

Singaporeans with no unsecured debt

We developed a condensed version of the Financial Wellness Index survey. Curious to know where you stand?

Asses your financial wellness

Get insights into your overall financial health and find out how you fare among your peers.

Plan with OCBC Digital

Scan the QR code to open the app.