-

Step 1: Log in with your access code and PIN or fingerprint ID

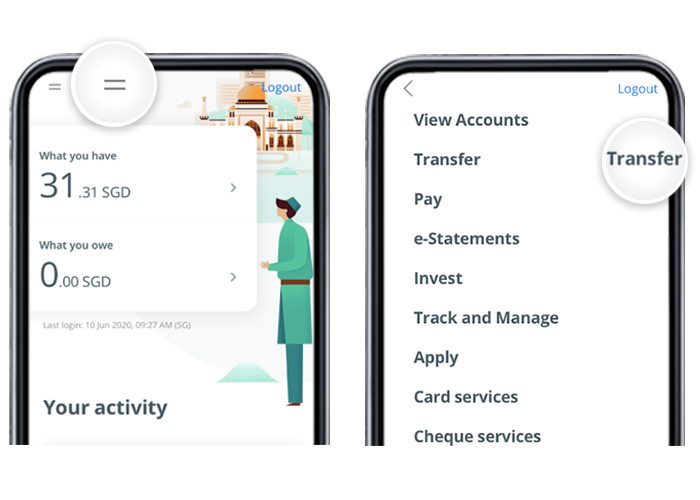

On mobile app

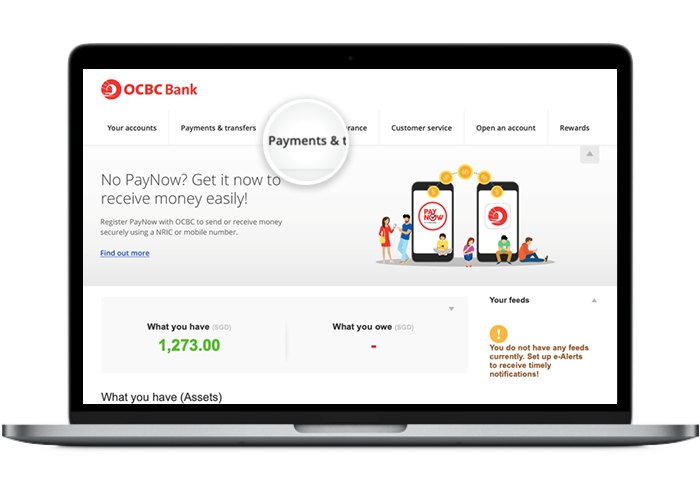

On desktop

-

Step 2: Navigate to "Payments and transfers"

On mobile app

Tap on the menu bar on the top left.

Tap on "Transfer".

On desktop

Click on "Payments and transfers".

-

Step 3: Select the type of payment/transfer to make

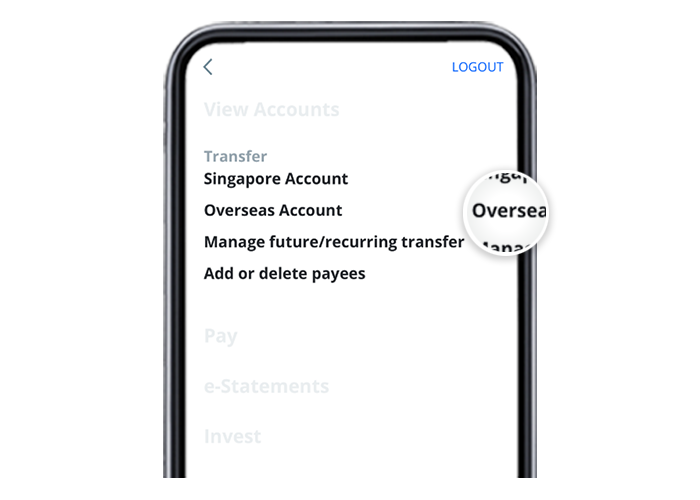

On mobile app

Tap on "Overseas Account".

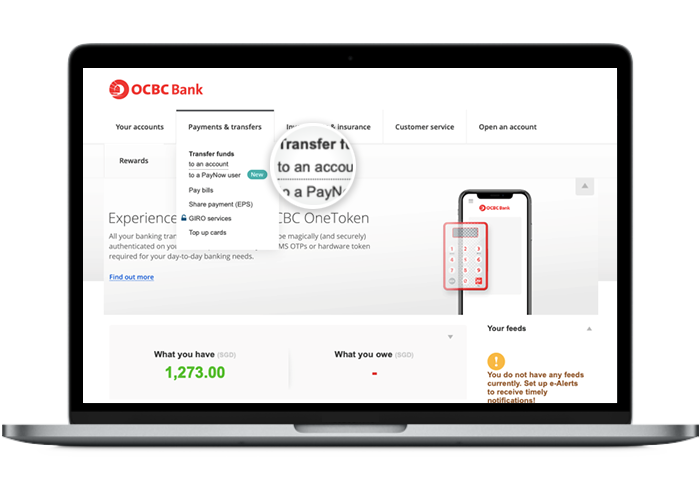

On desktop

Click on "to an account".

-

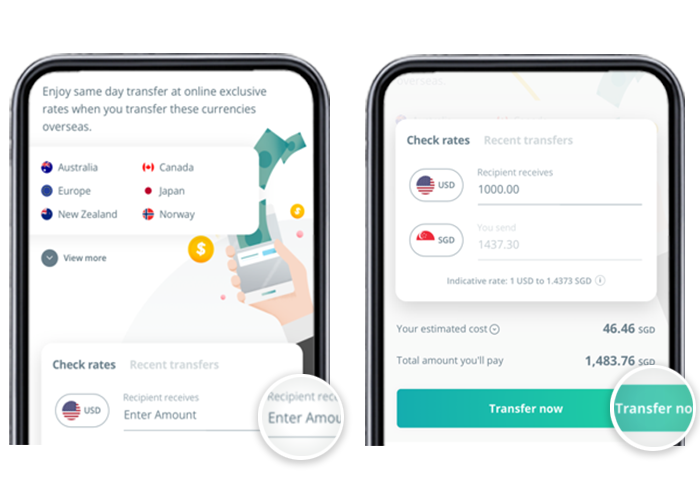

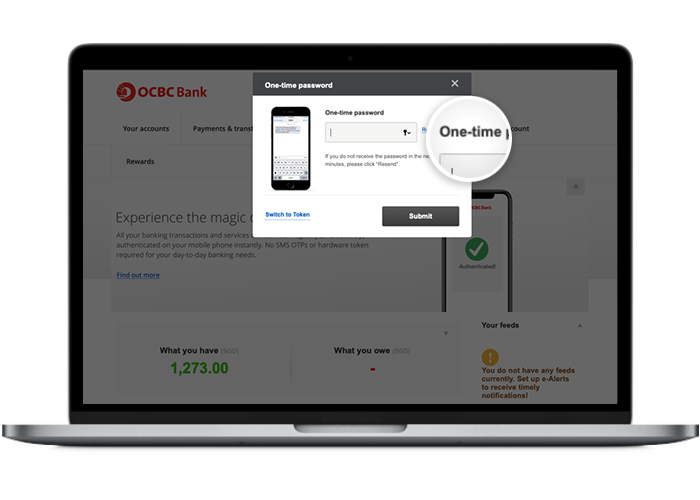

Step 4: Set up the transfer amount on mobile / Authenticate action with your One-time password on desktop

On mobile app

Select the currency and enter the transfer amount.

Review the rate and tap on "Transfer now".

On desktop

Enter and submit the One-time password sent to you via SMS.

-

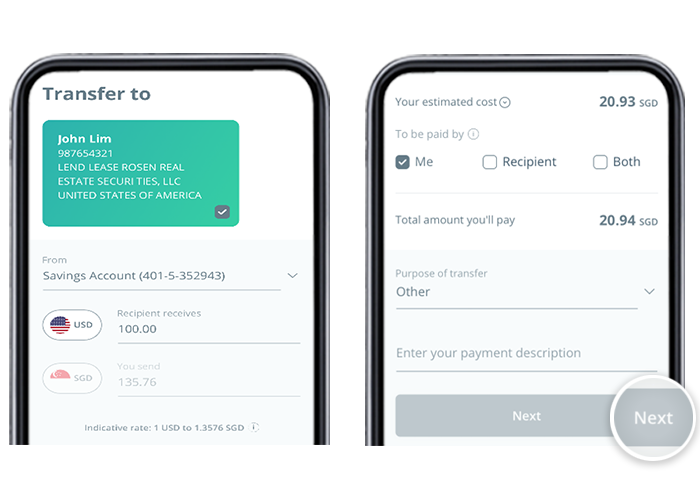

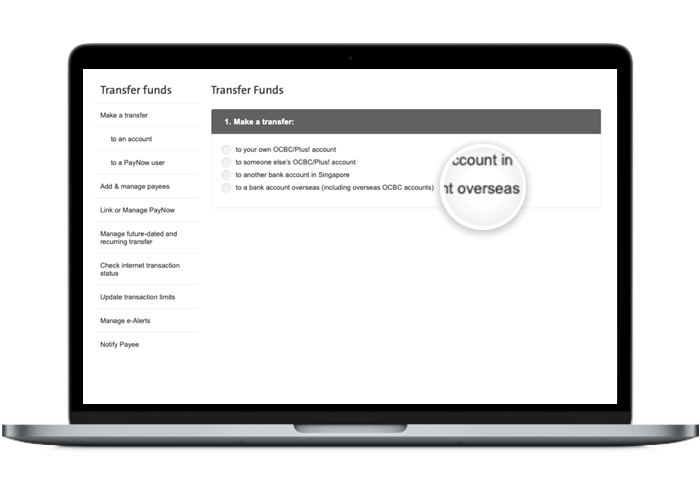

Step 5: Select your payee on mobile / Select the type of account to transfer to on desktop

On mobile app

Select the payee and choose your account to make the transfer from.

Enter the payment description and tap on "Next".

On desktop

Click on "to a bank account overseas (including overseas OCBC accounts)".

-

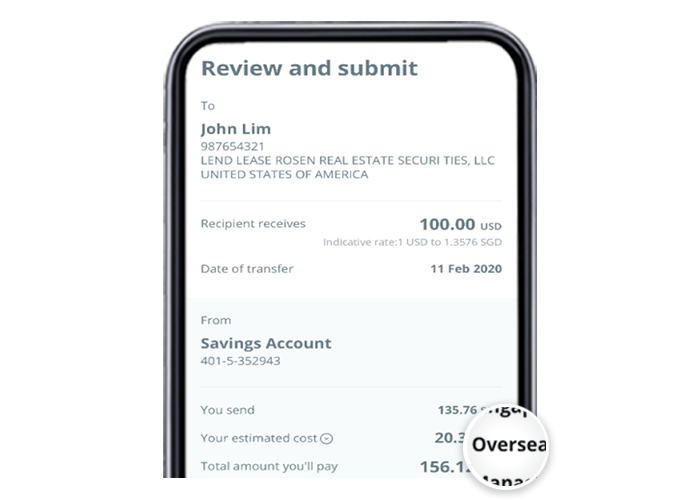

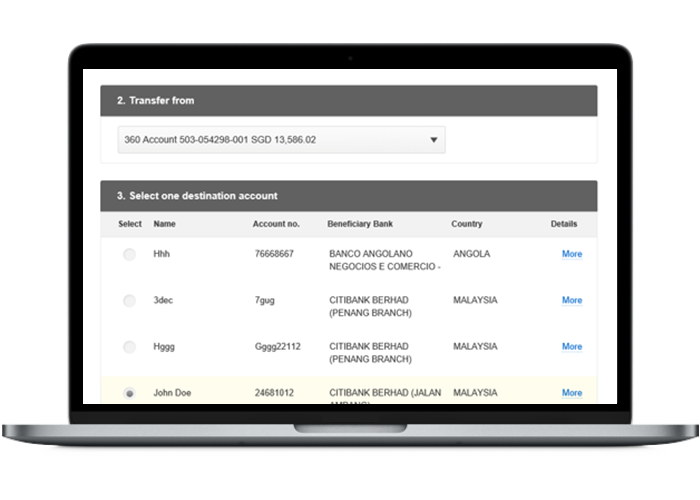

Step 6: Confirm your payment on mobile / Select the debiting and crediting accounts on desktop

On mobile app

Review your payment details before tapping on "Confirm".

On desktop

Select the account to make your transfer from as well as the destination account.

-

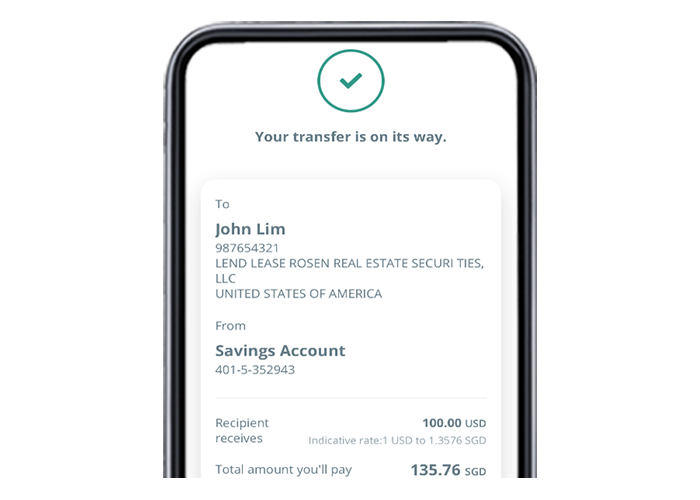

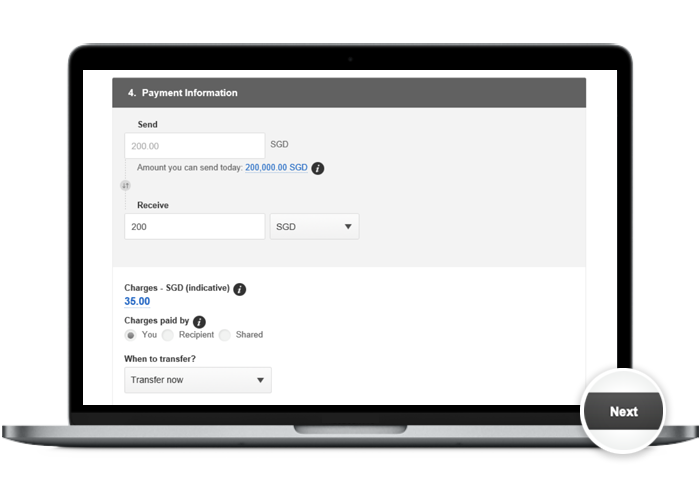

Step 7: And you’re done on mobile! / Fill in the payment details on desktop

On mobile app

Fill in the account number and payment limit.

Agree to the Terms and Conditions, and you’re done!

On desktop

Fill in all the required payment information and click on "Next".

-

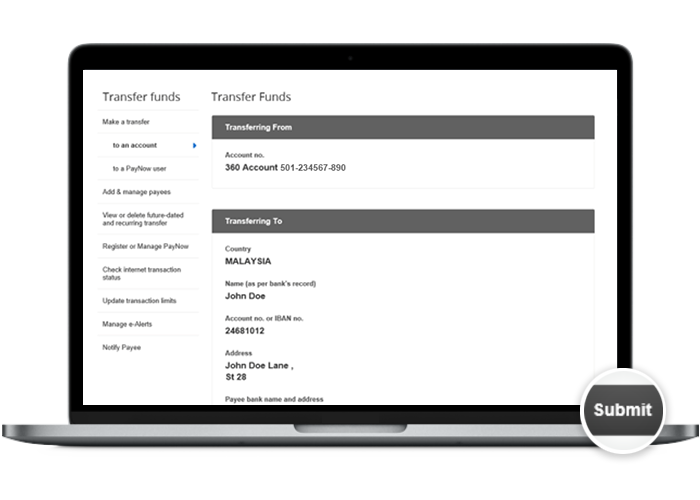

Step 8: Review the transfer details and click on "Submit"

On desktop

-

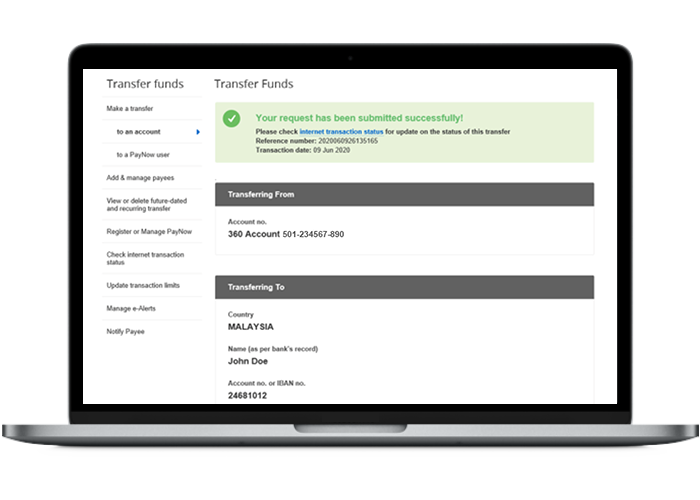

Step 9: And you’re done on desktop!

On desktop

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.