-

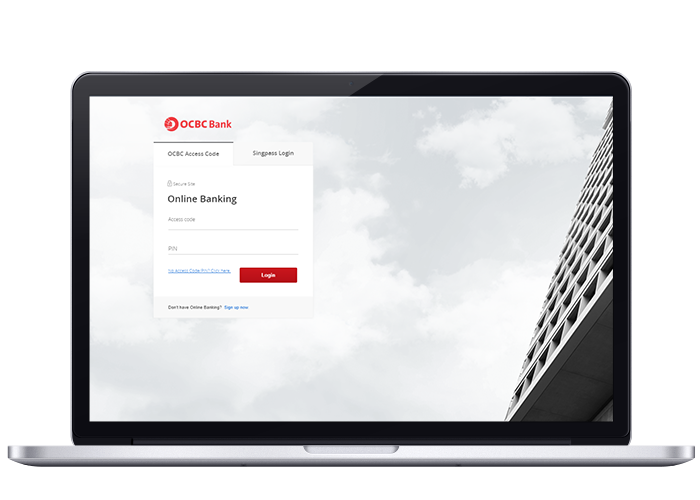

Step 1: Login using an access code PIN, fingerprint ID, or Singpass

OCBC app

Tap on the “More” icon in the bottom navigation bar and tap on “Documents- Statements & Letters”

OCBC Internet Banking

Log in with your Access Code and PIN

-

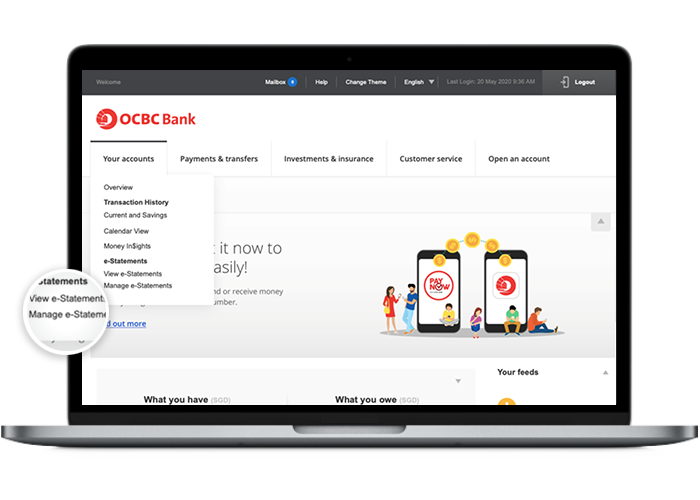

Step 2: Choose ‘Manage Documents’

OCBC app

Toggle on if you wish to receive digital statements (instead of hardcopy statements) for each of the respective account(s) and credit card(s).

OCBC Internet Banking

Click ‘Your accounts’ > ‘Documents’ > ‘Manage Documents’

-

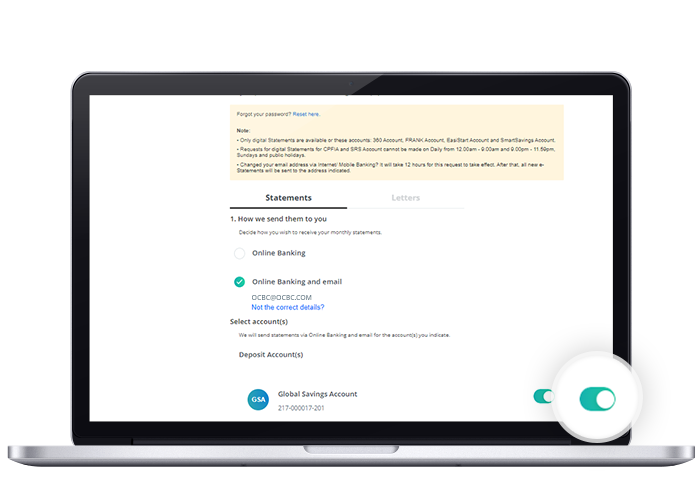

Step 3: Choose your preferred way of getting Statements for each account

OCBC app

Select only the account(s) you wish to apply the change to and tap on the circle next to the option you prefer

OCBC Internet Banking

Select only the account(s) you wish to apply the change to and tap on the circle next to the option you prefer

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.