-

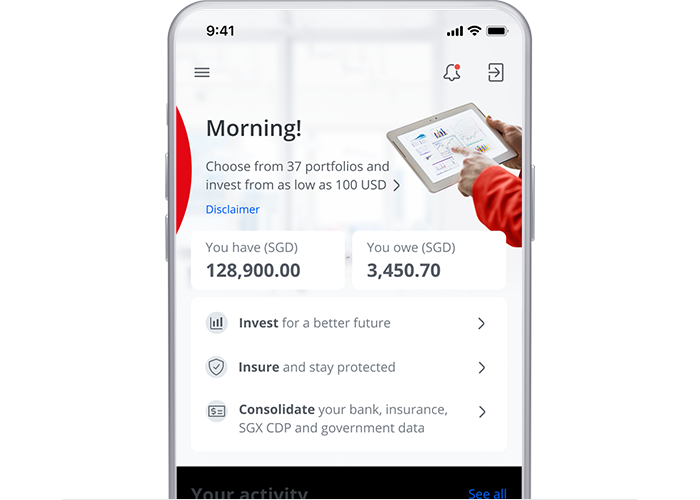

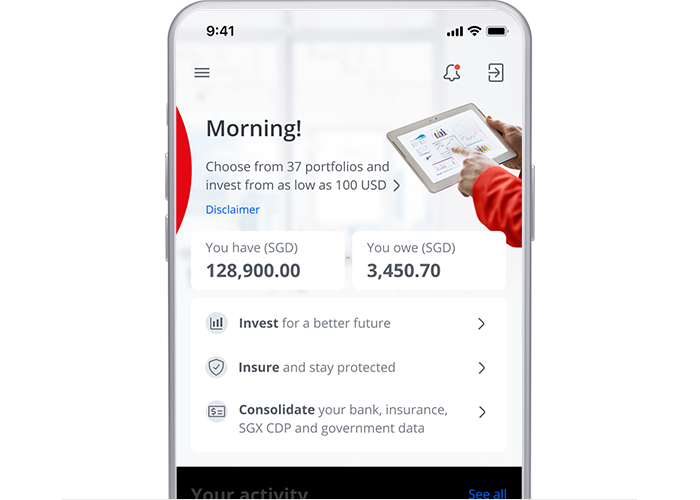

OCBC OneTouch™

OCBC OneTouch™ allows OCBC customers to use fingerprint recognition to easily and securely access their account information and banking services in the OCBC Digital app.

The feature is available on Touch ID-enabled Apple iPhones running on iOS 8 and above and other Bank-designated devices with the fingerprint recognition feature of Google Android version 4.4.2 and above.

OCBC OneTouch™ uses your unique fingerprint pattern, registered and stored solely on your mobile devices as a secure source of identification and login authentication. For added security, each user can only activate OCBC OneLook™ on one mobile phone at any point in time and jailbroken mobile devices are not supported.

-

How to activate OCBC OneTouch™

Step 1: Open the OCBC Digital app, tap on “Login”, then tap on the Fingerprint ID icon

On OCBC Digital app:

Step 2: Read and agree to the terms and conditions, then tap on "Activate OCBC OneTouch™”

On OCBC Digital app:

Step 3: Enter your Access Code and PIN, then tap “Next”

On OCBC Digital app:

Step 4: And that is it! You will receive a confirmation message via SMS. OCBC OneTouch™ will be activated and you will be automatically logged in.

On OCBC Digital app:

-

OCBC OneLook™

OCBC OneLook™ allows OCBC customers to use facial recognition to easily and securely access their account information and banking services in the OCBC Digital app.

The feature is available on Face ID-enabled Apple iPhones running on iOS 11 and above.

OCBC OneLook™ uses your unique face, registered and stored solely on your mobile device, as a secure source of identification and login authentication. For added security, each user can only activate OCBC OneLook™ on one mobile phone at any point in time and jailbroken mobile devices are not supported.

To get started, you need to perform a one-time activation in the OCBC Digital app using your online banking Access Code and PIN.

-

How to activate OCBC OneLook™

Step 1: Open the OCBC Digital app, tap on “Login”, then tap on the Face ID icon

On OCBC Digital app:

Step 2: Read and agree to the terms and conditions, then tap on "Activate OCBC OneLook™"

On OCBC Digital app:

Step 3: Enter your Access Code and PIN, then tap "Next"

On OCBC Digital app:

Step 4: And that is it! You will receive a confirmation message via SMS. OCBC OneLook™ will be activated and you will be automatically logged in.

On OCBC Digital app:

To get started, you need to perform a one-time activation in the OCBC Digital app using your online banking Access Code and PIN.

-

Prefer to login using your online banking Access Code and PIN instead?

If you opt not to use biometric authentication, you may customise your OCBC Digital Access Code and/or PIN to your preference.

Learn how to customise your Access Code.

Are you a Singpass login user? Then follow the steps below:

Step 1: Log in with Singpass

On mobile app

On desktop

Log in with Singpass and authorise login using OCBC OneToken with your mobile device.

Step 2: Select "Online Banking Settings" and navigate to "Change Access Code"

On mobile app

Tap on the top left menu bar and go to “Profile & Settings”. Select “Online Banking Settings”, then “Change Access Code”.

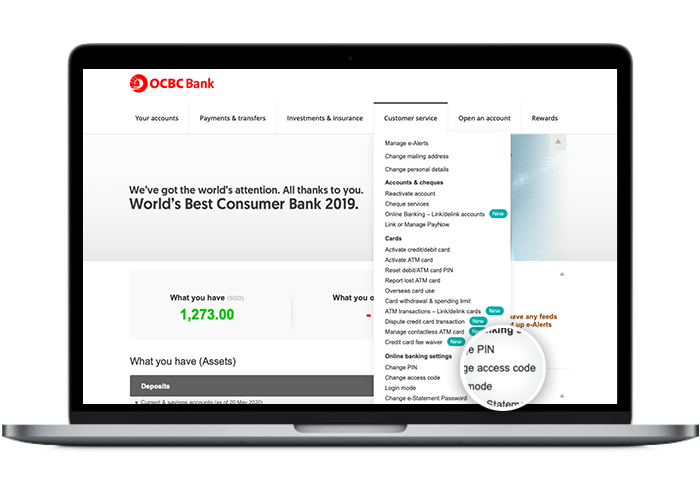

On desktop

Click on “Customer service”. Under “Online banking settings”, select “Change PIN” or “Change access code”.

Step 3: Enter your new Access Code/PIN and submit it. You’re done!

On mobile app

Enter your new Access Code. Tap on “Submit”, and you’re done!

On desktop

Enter your new Access Code/PIN. Click “Submit”, and you’re done!

Can’t activate OCBC OneLook™ or OneTouch™ because you have forgotten your log in details?

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.