-

Step 1: Sign up for a Digital Banking account

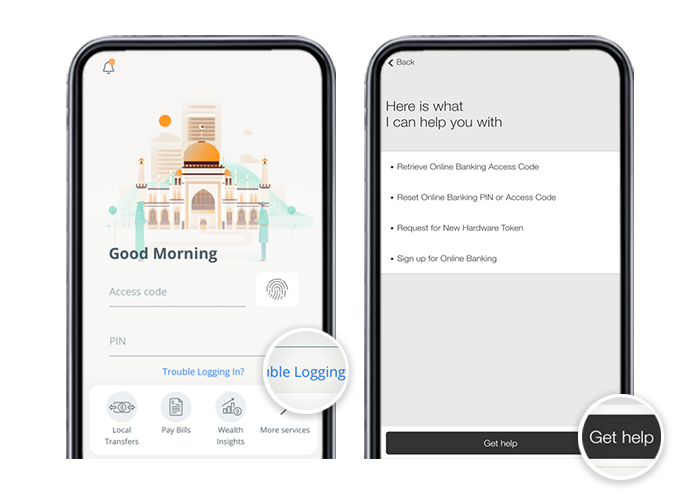

On mobile app

Tap on "Trouble Logging in?" and select "Get help".

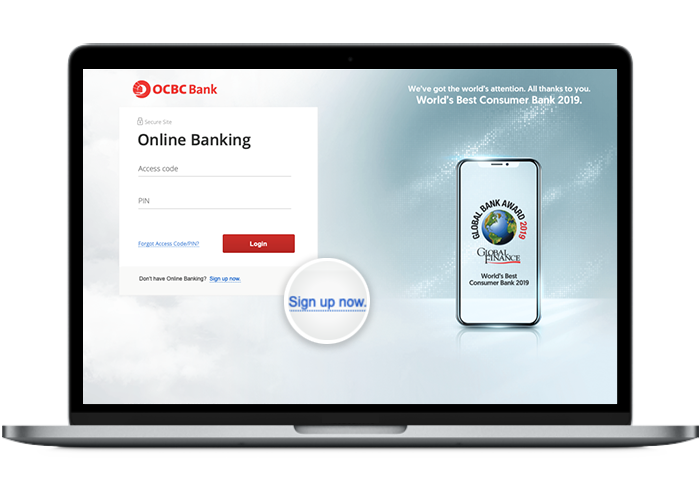

On desktop

Click on "Sign up now".

-

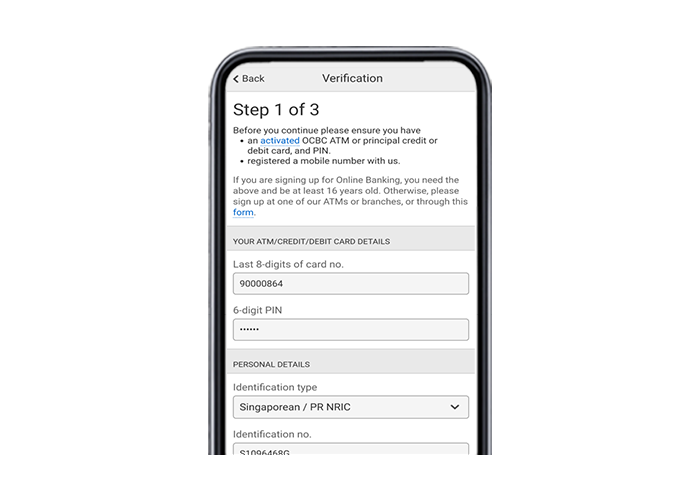

Step 2: Fill in your ATM/credit/debit card details (Last 8 digits of card no. & 6-digit PIN)

On mobile app

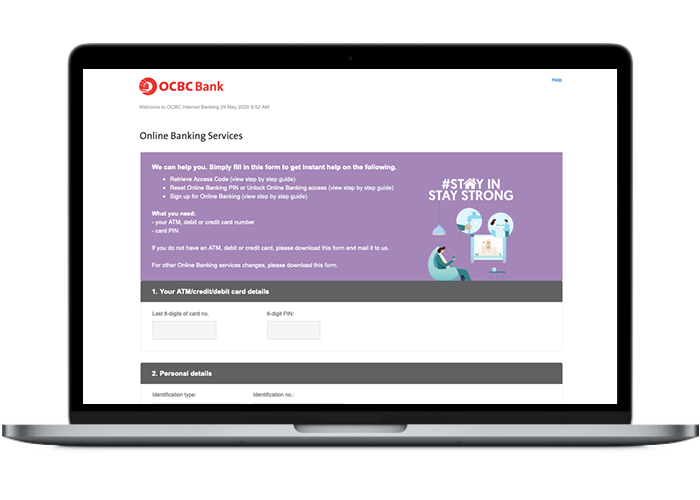

On desktop

-

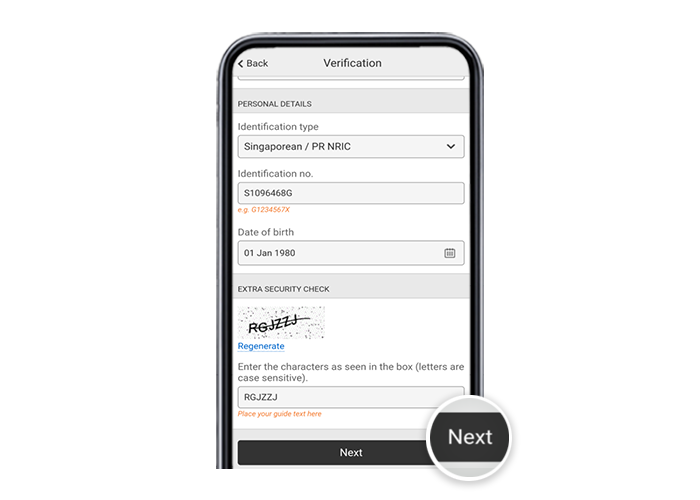

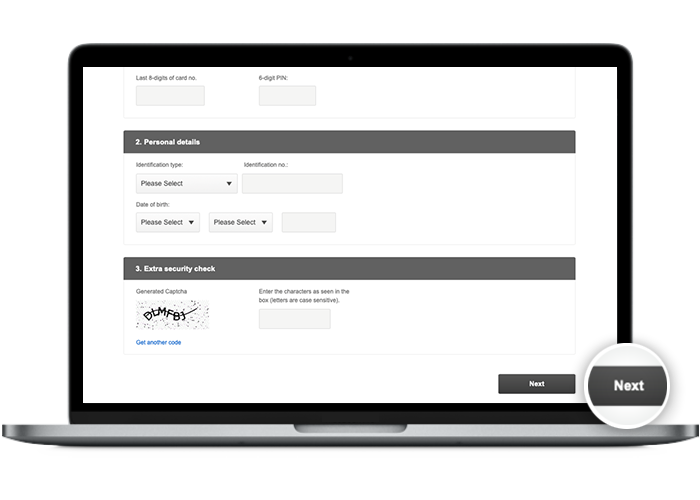

Step 3: Fill in your personal details, enter the generated captcha and tap on "Next"

On mobile app

Fill in your Identification type, Identification no. & Date of Birth.

On desktop

Fill in your Identification type, Identification no. & Date of Birth.

-

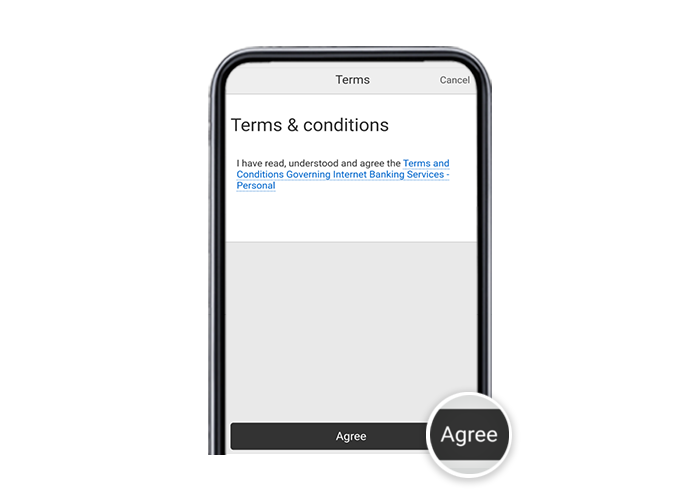

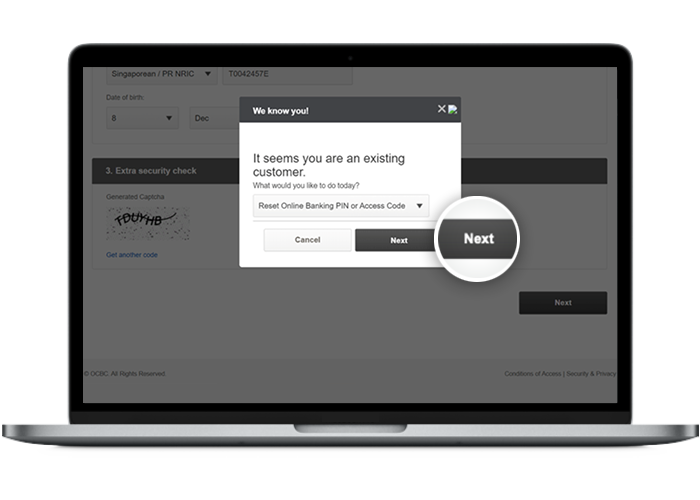

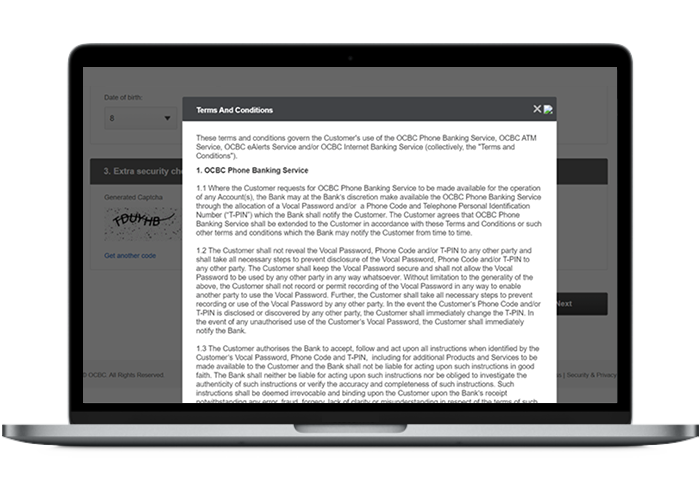

Step 4: Accept the Terms & conditions / Reset your Online Banking PIN or Access Code

On mobile app

Tap on "Agree" to accept the Terms & conditions.

On desktop

Under the drop down menu, select “Reset Online Banking PIN or Access Code” and click on "Next".

-

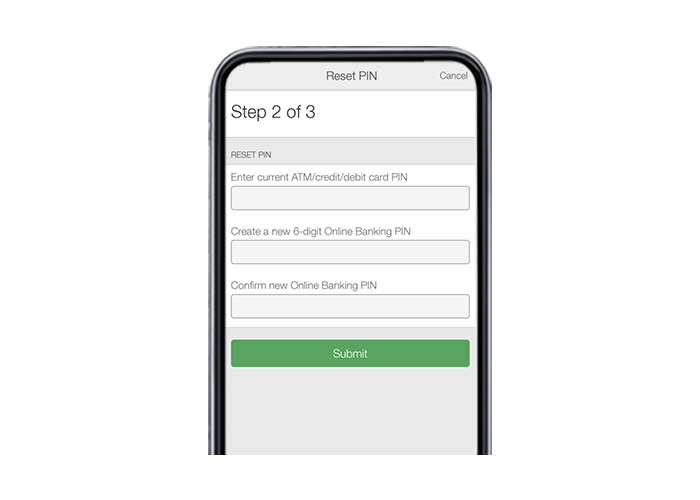

Step 5: Create and confirm your new Online Banking PIN / Accept the Terms and conditions

On mobile app

Enter your current ATM/credit/debit card PIN, create and confirm your new 6-digit Online Banking PIN and tap on "Submit".

On desktop

Click on "Accept" to accept the terms and conditions governing the use of OCBC Internet Banking Service.

-

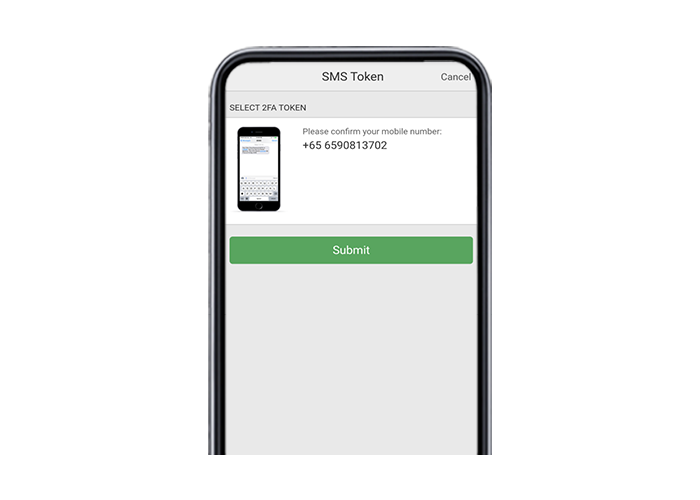

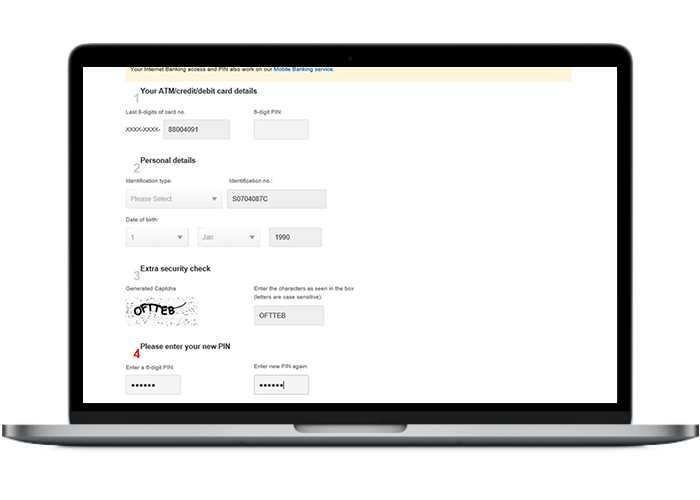

Step 6: Tap on “Submit” to confirm your mobile no. / Create your new PIN on desktop

On mobile app

On desktop

Enter your personal details and New PIN before clicking submitting them for account registration.

-

Step 7: And you’re done!

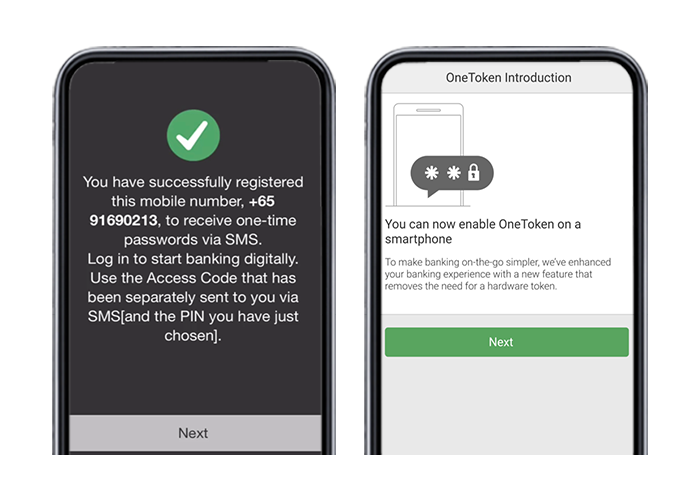

On mobile app

You have successfully registered for SMS OTP. Tap on "Next" to proceed to set up OneToken.

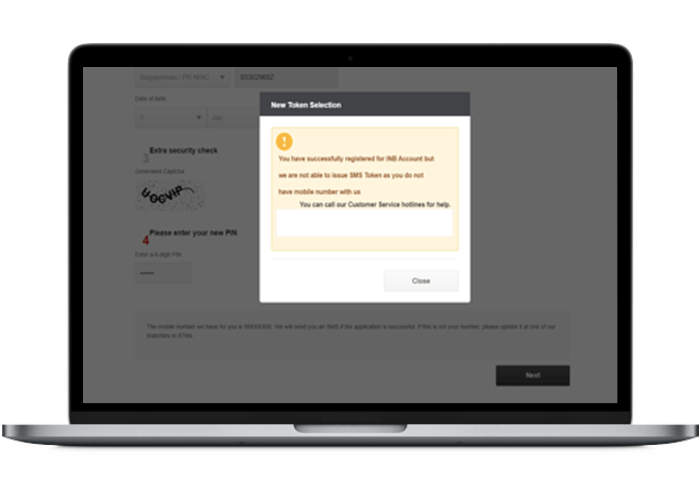

On desktop

Scam tactics are constantly evolving. To #BeAProAgainstCons, learn more about the tell-tale signs of different scams and the security features we have designed to protect you.

Read our security advisories to stay up to date on our latest scam alerts and anti-scam tips.