Help And Support

Loans - Transition of Benchmark Rates (English)

-

For more information on SIBOR FAQ in Chinese:

Please visit this website.

-

What is SORA (Singapore Overnight Rate Average)?

SORA has replaced the Singapore Interbank Offered Rate (SIBOR) and Swap Offer Rate (SOR) as the key interest rate benchmark for Singapore dollar (S$) interest rate contracts.

SORA is calculated and administered by the Monetary Authority of Singapore (MAS). It is published as a daily rate and a series of 1-month, 3-month and 6-month compounded rates on the MAS website. The Compounded SORA rates are calculated as the compounded average of daily SORA readings over the relevant 1-month, 3-month or 6-month periods before each publication date, reducing the effects of rate volatility.

SORA is a robust and transparent benchmark anchored on actual market transactions and underpinned by a deep and liquid overnight interbank funding market. It is determined based on the volume-weighted average rate of borrowing transactions in the unsecured overnight interbank Singapore dollar cash market in Singapore between 8am and 6.15pm.

-

Can I choose to retain my property loan referencing SIBOR, and not switch out of it?

As SIBOR will be discontinued after 31 December 2024, you are strongly encouraged to contact us early to explore the available options:

- Option 1: Any prevailing property loan package offered by us

- Option 2: SORA Conversion Package (SCP) at the spot-spread

- Option 3: Wait for automatic conversion to the SCP in June 2024 at the historical median spread

If you do not switch out your SIBOR-based property loan to an alternative loan package by 30 April 2024, we will automatically convert it to the SCP at the historical median spread in June 2024, 6 months ahead of the discontinuation of SIBOR (i.e. Option 3). This is to allow time for an orderly transition out of SIBOR loans by banks and customers and to ensure that all outstanding SIBOR loans are converted before SIBOR is discontinued.

-

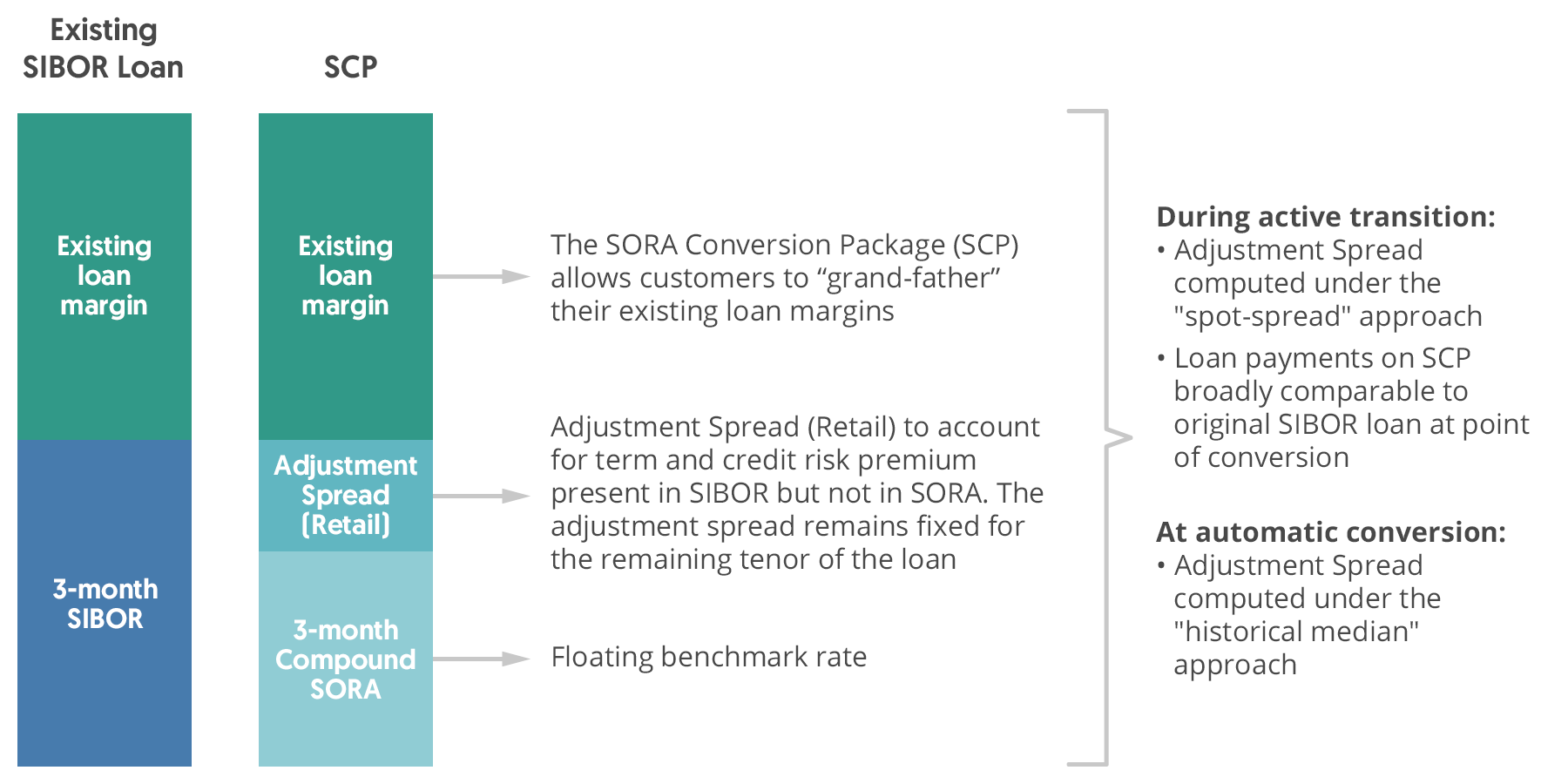

What is the SORA Conversion Package?

Banks are offering customers with existing SIBOR loans a switch to the SORA Conversion Package at no additional fees and no additional lock-in period.

The SCP seeks to directly convert your existing SIBOR-based loan to a SORA-based loan. The key components of the SCP are:

- Your existing SIBOR loan margin will remain unchanged;

- 3-month Compounded SORA is a floating interest rate benchmark published by MAS (see Q1);

- An adjustment spread will be added to account for the difference between SIBOR and the 3-month Compounded SORA.

Diagram 1: Illustration of the SORA Conversion Package (SCP)

You should note that there are differences in the computation of the adjustment spread, depending on the timing of your transition.

- Active Transition Phase (1 September 2023 to 30 April 2024)

- Automatic Conversion Phase (in June 2024)

The interest on your loan will be calculated based on:

3-month Compounded SORA + Your existing SIBOR loan margin + Adjustment Spread (spot-spread)

where the Adjustment Spread (spot-spread) is computed as the average difference between applicable SIBOR and 3-month Compounded SORA in the preceding three-month period1. The Adjustment Spread (spot-spread) is floored at zero.

The Adjustment Spread (spot-spread) is published by ABS Benchmarks Administration Co (ABS Co) on the first working day of each month2 and will apply for customers transitioning to the SCP in that particular month. For example: The spot-spread published on 1 December 2023 will be used for customers who actively transition to the SCP in December 2023. After the transition, the adjustment spread remains fixed in your loan for the remaining tenor of the loan.

The interest on your loan will be calculated based on:

3-month Compounded SORA + Your existing SIBOR loan margin + Adjustment Spread (historical median)

where the Adjustment Spread (historical median) is computed as the historical median between the applicable SIBOR and 3-month Compounded SORA over the period of 30 June 2018 to 30 June 2023.

1-month SIBOR to 3-month

Compounded SORA3-month SIBOR to 3-month

Compounded SORAAdjustment spread (4 decimal places) 0.2426% 0.3571% 1For example, if your existing loan reference is 1-month SIBOR, the Adjustment Spread (spot-spread) is the average difference between 1-month SIBOR and 3-month Compounded SORA in the preceding three-month period.

-

Why is there an adjustment spread in the SORA Conversion Package?

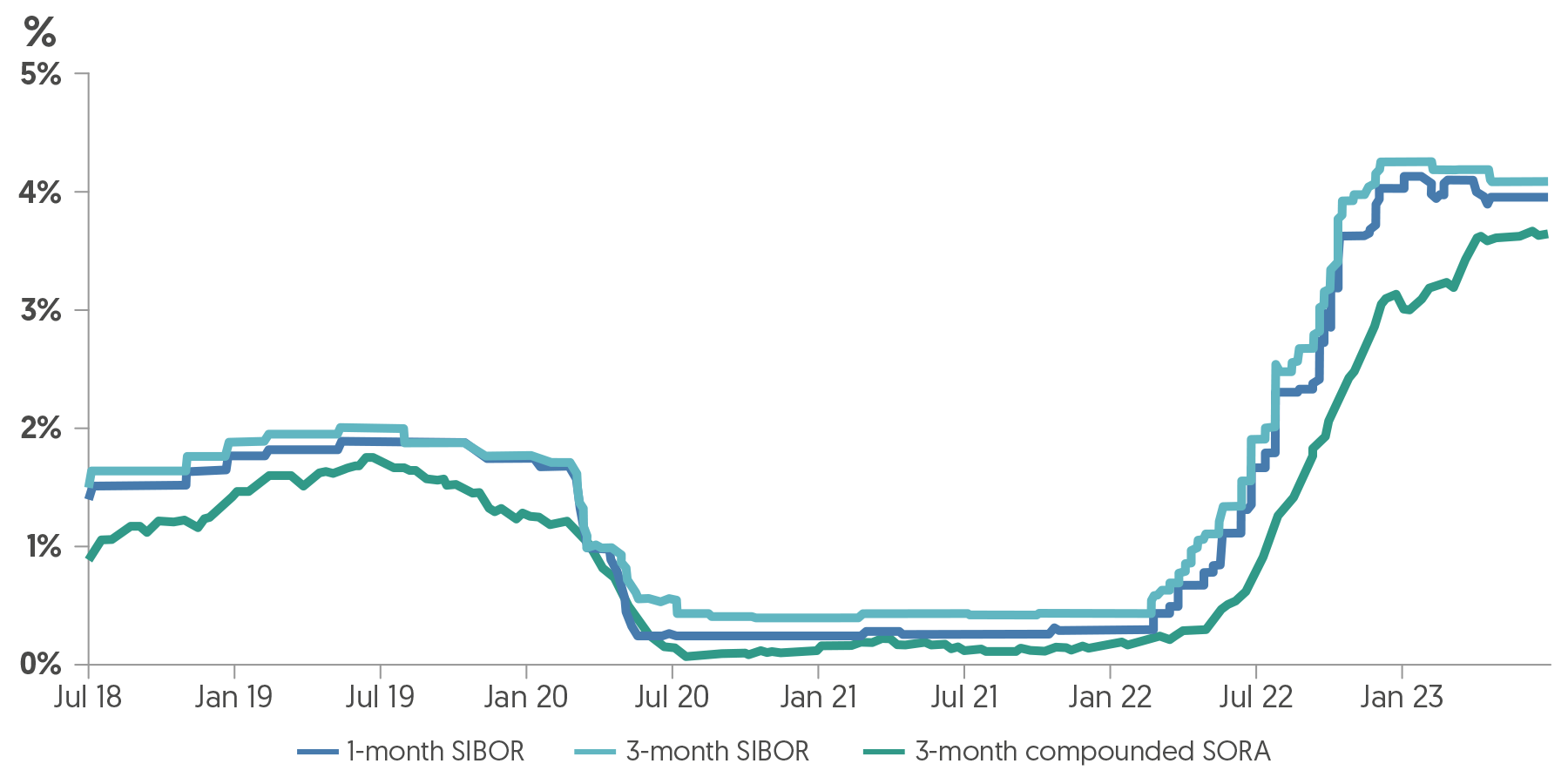

An adjustment spread is necessary when converting a SIBOR loan to a 3-month Compounded SORA reference because of inherent differences between SIBOR and compounded SORA. The adjustment spread accounts for differences in the level of SIBOR and 3-month Compounded SORA; this maintains parity when you switch from SIBOR to 3-month Compounded SORA.

SIBOR represents unsecured term (1-month or 3-month) lending rates. It includes term and credit risk premiums that account for the uncertainty in the level of interest rates over a future period as well as the risk of providing unsecured credit over a 1-month or 3-month period. In contrast, SORA and compounded SORA represent overnight lending rates and exclude such term and credit risks.

Consequently, as reflected in Diagram 2 below, 3-month Compounded SORA has also typically been significantly lower than 1-month and 3-month SIBOR.

Diagram 2: Historical comparison of 1-month SIBOR, 3-month SIBOR and 3-month Compounded SORA

-

Why is there a different approach in Adjustment Spread (retail) between the Active Transition Phase and Automatic Conversion Phase?

The Steering Committee for SOR & SIBOR Transition (SC-STS) has recommended that the spot-spread approach (floored at zero) be applied to the SCP during the period of active transition, and the 5-year historical median, at automatic conversion. This approach has the following benefits:

- Provides customers with choice during the period of active transition: Customers can choose the spot-spread (potentially allowing them to lock in favourable spreads should spot-spreads be low); switch to banks’ prevailing package; or do nothing and have their packages be automatically converted in June 2024 at the 5-year historical median spread.

- Provides customers with certainty on automatic conversion outcome: As the 5-year historical median has been set and fixed upfront, customers would be made aware early of the adjustment spread that would apply should they do nothing and have their packages automatically converted in June 2024, in accordance with the industry timeline. On a month-to-month basis, customers would be able to compare among (i) the bank’s prevailing packages, (ii) the month’s spot-spread that would apply during the active transition period, and (iii) the 5-year historical median that would apply at automatic conversion. This would help customers make an informed decision on whether they should actively transition in that month.

Given these benefits, the approach of offering customers three options for transitioning of SIBOR retail loans was also supported by respondents to the SC-STS consultation on adjustment spreads for the conversion of legacy SIBOR loans to SORA3.

3See SC-STS’ Response to Consultation Feedback and Final Recommendations for Adjustment Spread for the Conversion of SIBOR Loans to SORA (30 June 2023) at http://abs.org.sg/docs/library/response-to-feedback-on-consultation-on-adjustment-spreads-for-the-conversion-of-legacy-sibor-loans-to-sora.pdf

-

Why is the 5-year historical median spread between SIBOR and Compounded SORA used as the applicable adjustment spread for the automatic conversion of SIBOR loans?

The 5-year historical median spread – rather than the spot-spread – is used for the automatic conversion of SIBOR loans as it can be determined beforehand. This provides customers with early certainty on the terms of automatic conversion that will apply to their loan should they do nothing and have their packages be converted in June 2024.

The 5-year historical median spread is a fair estimate of the average spread between SIBOR and Compounded SORA: A 5-year period is sufficiently long to smooth out the effects of idiosyncratic market events over past years and reasonably estimates where spreads could converge towards in the long run. The use of a 5-year historical median spread is also aligned to international convention adopted for the transition of similar interest rate contracts, as well as the transition of SIBOR and SOR wholesale contracts. It was supported by respondents to the SC-STS consultation on adjustment spreads for the conversion of legacy SIBOR loans to SORA.

-

Will the Adjustment Spread change throughout the tenor of my loan?

The Adjustment Spread that is applied by us in the SCP, as would be stated in the contract agreement, will stay the same for the remaining tenor of your loan. There will not be any change, even though the Adjustment Spread (spot-spread) published by the ABS Co in subsequent months may move higher or lower due to fluctuations that are inherent in floating interest rates.

You can refer to the ABS Co’s website for the prevailing Adjustment Spread (spot-spread) that will be applied in the SORA Conversion Package at the point where you switch your loan.

-

How will my interest payments change throughout the tenor of my loan?

If you have switched to the SCP at the Adjustment Spread (spot-spread) of 0.3012%:

- The adjustment spread of 0.3012% will remain unchanged throughout the tenor of your loan.

- If your loan has a step-up tier rate, the loan after switching to the SCP will similarly have a step-up tier rate.

Current SIBOR package SORA Conversion Package Year 2023: 3-month SIBOR + 1.00% Year 2023: 3-month Compounded SORA + 1.00% + 0.3012% Year 2024: 3-month SIBOR + 1.20% Year 2024: 3-month Compounded SORA + 1.20% + 0.3012% Year 2025 onwards: 3-month SIBOR + 1.50% Year 2025 onwards: 3-month Compounded SORA + 1.50% + 0.3012% -

My loan is currently on fixed rate and will only change to a SIBOR reference rate after the fixed tenor ends. How will the transition affect my loan?

Your loan will remain on fixed rate until the fixed tenor ends. You can decide if you wish to switch to a prevailing property loan package offered by us or switch the floating part of your loan (e.g. your loan might reference SIBOR in the fourth year, after the fixed rate period ends) to the SCP.

If you decide to switch to a prevailing property loan package offered by us, no administrative or prepayment fee will be charged for the conversion. A lock-in period may apply depending on the package you choose.

If you decide to switch to the SCP and you apply during the active transition period to have your package switched to the SCP, the SCP with an Adjustment Spread (spot-spread) will apply after the end of the fixed tenor.

Otherwise, if you wait to have your package automatically switched to the SCP, the SCP with an Adjustment Spread (historical median) will apply after the end of the fixed tenor.

-

How do I decide which is the “best package” for me?

There is no “best package” as everyone’s financing needs and preferences differ. As such, we encourage you to contact us early to discuss your options.

You may wish to consider these factors when making your decision:

- Comparison of the Adjustment Spread (retail): In deciding whether to switch to the SCP during active transition (between 1 September 2023 to 30 April 2024) or to wait for automatic conversion to the SCP (in June 2024), you may wish to compare the adjustment spread that would apply to your loan.

- The adjustment spread at automatic conversion is known upfront:

- The Adjustment Spreads (historical median) below will apply for customers switching to the SCP in June 2024 from a 1-month SIBOR and/or a 3-month SIBOR loan respectively:

1-month SIBOR to 3-month

Compounded SORA3-month SIBOR to 3-month

Compounded SORAApplied in June 2024 0.2426% 0.3571%

- The Adjustment Spreads (historical median) below will apply for customers switching to the SCP in June 2024 from a 1-month SIBOR and/or a 3-month SIBOR loan respectively:

- The adjustment spread at automatic conversion is known upfront:

- The adjustment spread during active transition is published for the current period, but unknown for future periods:

- ABS Co will publish the Adjustment Spreads (spot-spread) on the first Singapore working day of each month. The Adjustment Spreads (spot-spread) will apply for customers switching to the SCP during the active transition phase from a 1-month SIBOR and/or a 3-month SIBOR loan respectively.

- The published Adjustment Spreads (spot-spread) at the start of each month will be used for customers who apply to actively transition to the SCP that month.

1-month SIBOR to 3-month

Compounded SORA3-month SIBOR to 3-month

Compounded SORA4 September 2023 [To be published by ABS Co] [To be published by ABS Co] 2 October 2023 [To be published by ABS Co] [To be published by ABS Co] 1 November 2023 [To be published by ABS Co] [To be published by ABS Co] 1 December 2023 [To be published by ABS Co] [To be published by ABS Co] 2 January 2024 [To be published by ABS Co] [To be published by ABS Co] 1 February 2024 [To be published by ABS Co] [To be published by ABS Co] 1 March 2024 [To be published by ABS Co] [To be published by ABS Co] 1 April 2024 [To be published by ABS Co] [To be published by ABS Co]

- The earlier you think about your options, the better.Starting early will give you a wider range of options in terms of when and at what spreads you can transition your loan to.

- All-in interest rate: In addition to the adjustment spread, you may wish to compare the all-in interest rate which you are currently paying on your existing SIBOR loan and the all-in interest rate of the alternative loan packages offered by us.

- For example, the all-in interest rate would comprise the following:

- For existing SIBOR loan: (i) the SIBOR reference rate (which is a floating rate) and (ii) your existing loan margin.

- For SCP: (i) the 3-month Compounded SORA reference rate (which is a floating rate), (ii) your existing loan margin, and (iii) the applicable Adjustment Spread (retail).

- For prevailing packages: Varies across different packages.

- The comparison of all-in interest rate is particularly important for customers who are thinking of switching to banks’ prevailing packages. Unlike the SCP, which allows customers to retain their existing loan margin, this may not happen under banks’ prevailing packages.

- For a customer whose loan margin on their existing SIBOR loan is low, the all-in interest rate of the SCP could be lower than the prevailing loan packages, as the SCP will allow the customer to retain the existing low loan margin.

- Conversely, for a customer whose loan margin on their existing SIBOR loan is high, the all-in interest rate on the prevailing loan packages may be more attractive.

- For example, the all-in interest rate would comprise the following:

- Financing preferences: You may wish to consider your financing preferences when deciding between the prevailing packages offered by us, which may include both fixed and floating rate packages. For example, if you prefer certainty in interest rate payments, you may like a fixed rate package better. As prevailing packages would come with different terms and conditions (e.g. lock-in periods), you may also wish to take them into consideration in your decision.

Once again, we encourage you to speak to us early. We will be able to provide more advice.

Choose a loan now that’s suitable for you.

- Comparison of the Adjustment Spread (retail): In deciding whether to switch to the SCP during active transition (between 1 September 2023 to 30 April 2024) or to wait for automatic conversion to the SCP (in June 2024), you may wish to compare the adjustment spread that would apply to your loan.

-

How do I switch to the SCP or another loan package?

Complete and submit the form at www.ocbc.com/HLREPRICING to do so.

-

Will I be charged any fees for making a switch now?

There are no fees for switching out of your SIBOR-based loan to the SCP or any prevailing packages offered by us. However, fees will apply according to the terms of your existing loan package should you decide to refinance your loan with another financial institution.

For specific scenarios, please see further details below.

Scenario Fees that may apply Your loan is out of the lock-in period and not bound by any subsidies (such as legal or valuation subsidies). A one-time fee-free switch to prevailing packages or SCP is provided. Your loan is still within the clawback period for subsidies e.g. within 3 years from date of loan disbursement. A one-time fee-free switch to prevailing packages or SCP is provided.

You need not repay the subsidies received under your current loan when switching to any prevailing packages or SCP. However, the clawback period of your subsidies will be carried through to your repriced loan. If you decide to redeem your loan, the clawback of all subsidies will apply.

If the prevailing loan package comes with a separate clawback period (e.g. 3 years), this will run concurrently with the clawback period that was ported over from the SIBOR loan (e.g. 1 year).

Please note that the clawback period is independent from the lock-in period of the new loan, i.e. they do not affect each other.

Your loan is still within the lock-in period subject to redemption fees e.g. within 3 years from date of loan disbursement. A one-time fee-free switch to prevailing packages or SCP is provided.

There will be no prepayment fees charged if you switch to any prevailing packages or the SCP. However, if you decide to redeem your loan, a prepayment fee will apply (if any).

There will be no change to the remaining period of your lock-in if you decide to switch to the SCP. However, if you decide to switch to a prevailing loan package which comes with a fresh lock-in period (e.g. 3 years), you will be subject to this fresh lock-in period, even if you are still within the lock-in period of your SIBOR loan package. For example, if you have a year left in the lock-in period for your SIBOR loan and the lock-in period of the prevailing loan package is 2 years, the new lock-in period of 2 years would apply.

Please note that the lock-in period is independent from the clawback period of the new loan, i.e. they do not affect each other.

Your loan is still undisbursed/partially disbursed. A one-time fee-free switch to prevailing packages or SCP is provided.

There will be no prepayment or cancellation fee charged for this switch. However, these fees will apply if you decide to redeem your loan.

There will be no change to the remaining period of your lock-in if you decide to switch to the SCP. However, if you decide to switch to a prevailing loan package that comes with a fresh lock-in period (e.g. 3 years), you will be subject to this fresh lock-in period even if you are still within your SIBOR loan lock-in period. For example, if you have a year left in the lock-in period for your SIBOR loan and the lock-in period of the prevailing loan package is 2 years, the new lock-in period of 2 years would apply.

Your loan is currently on fixed rate and will only be changed to a SIBOR reference rate after the fixed tenor ends. A one-time fee-free switch to prevailing packages or SCP is provided.

There will be no prepayment or cancellation fee charged for this switch. However, these fees will apply if you decide to redeem your loan.

There will be no change to the remaining period of your lock-in if you decide to switch to the SCP and the SCP will apply after the end of your fixed rate tenor on the SIBOR-based part of your loan.

For example, if you have a year left in the lock-in period for your fixed rate loan:

- The fixed rate will continue to apply for the 1-year lock-in period.

- The SCP will apply after the end of the 1-year lock-in period.

However, if you decide to switch to a prevailing loan package which comes with a fresh lock-in period (e.g. 3 years), you will be subject to this fresh lock-in period, even if you are still within the lock-in period of your existing loan package.

For example, if you have a year left in the lock-in period for your existing loan and the lock-in period of the prevailing loan package is 2 years, the new lock-in period of 2 years would apply.

-

Will I be subject to a fresh lock-in period if I switch to any prevailing package offered by the Bank?

If you switch to any of our prevailing packages, you may be subject to the terms and conditions of that prevailing package, including a fresh lock-in period.

-

Will I be subject to recomputation of the Total Debt Servicing Ratio (TDSR), Loan-To-Value (LTV), and Mortgage Servicing Ratio (MSR) requirements when I switch from my SIBOR loan to an alternate package offered by the same bank?

As the need to replace the SIBOR-based property loan with an alternative loan package is necessitated by the discontinuation of SIBOR on 31 December 2024, MAS will not require financial institutions to re-compute the TDSR, LTV, and MSR requirements for affected customers, including investment property loan borrowers, making the switch with the same financial institution. This is a one-time exception as part of the industry-wide exercise to facilitate customers’ switch to alternative loan packages offered by the same bank and extends to customers utilising the one-time fee-free switch from the SCP to a prevailing package of the bank.

If you initiate a refinancing of your property loan with another financial institution, you will be subject to the prevailing property loan rules (e.g. TDSR, LTV, and MSR). However, you should check with that financial institution if you are eligible for any of the existing exemptions that are provided. For example, currently, borrowers are exempted from TDSR when refinancing their owner-occupied housing loans.

-

Will I be subject to recomputation of TDSR if I switch to a prevailing loan package and, at the same time: (1) Apply for a (new or additional) mortgage withdrawal loan, and/or (2) Request that the loan tenor be extended?

For requests other than the switching out of your SIBOR-based loan to a prevailing loan package, you would be subject to credit assessment; the recomputation of TDSR will apply. We recommend that you speak with us if you have requests beyond package switching.