#BeAProAgainstCons with OCBC – empowering you to bank safely and securely

Think that call is real? Think again.

12 June 2025

Scammers continue to employ increasingly hard-to-detect methods of trickery.

In this edition of ‘Be A Pro Against Cons with OCBC’, we shed light on two kinds of impersonation scams that are on the rise: One feigns escalation of an ‘issue with your account’ by transferring your call to a fake officer, and the other involves deepfakes (highly realistic fake videos, audio, and images) of trusted individuals. Both kinds exploit your sense of fear or urgency to con you into taking action.

Remember, the Monetary Authority of Singapore (MAS), police and banks will never ask you to transfer money or disclose your online banking credentials. If you are unsure whether something is a scam, call the 24-hour ScamShield Helpline at 1799 to check.

WATCH OUT FOR THESE SCAMS

Bogus investigations and call transfers

Scammers may pose as bank staff and claim that suspicious transactions were made using your account. If you deny involvement, they will ‘escalate’ the situation by transferring your call – to another scammer!

The second scammer, in the guise of a police or government (e.g. MAS) officer, may claim that your account is linked to criminal activity and pressure you to disclose personal details, transfer money or even withdraw cash to assist with the ‘investigation’ you are supposedly under.

Victims often comply out of fear – only to realise they have been scammed when the callers disappear.

Red flags to watch for:

- Your call with ‘bank staff’ is transferred to a ‘government officer’.

- You are asked for payment or to share personal information.

- You are asked to share your screen or make payments over the phone.

- The caller uses threats of arrest, penalties or legal action to force compliance.

- The voice or video seems unnatural – the scammers may be using Artificial Intelligence (AI).

How to protect yourself:

Take steps to protect yourself and your loved ones.

Know what banks will not do

Banks will never ask you to transfer money, disclose online banking credentials or install apps from non-official sources. They will not transfer your call to the police or government officers.

Do not be taken in by familiarity

Scammers may use your name or personal information to sound legitimate.

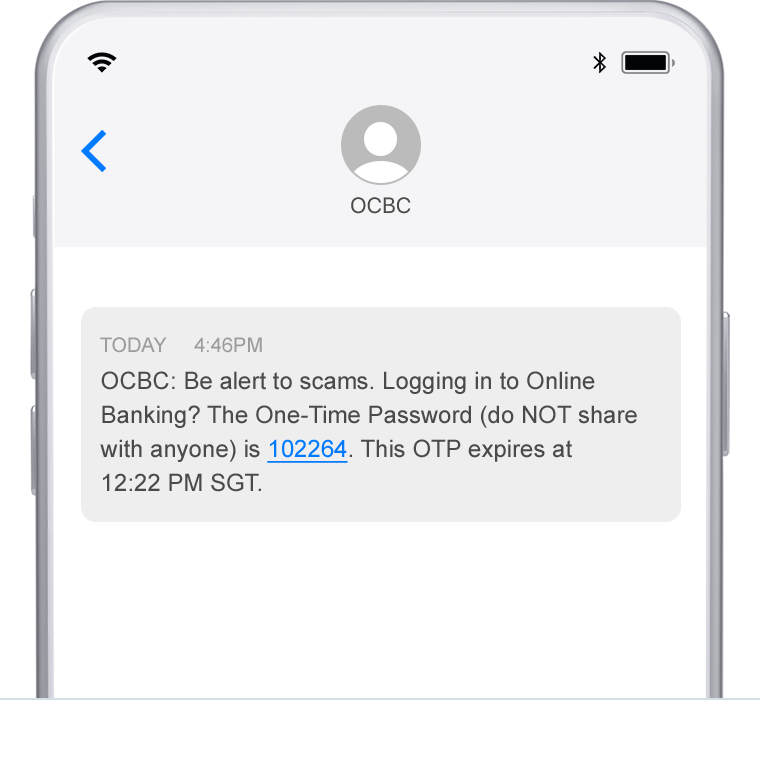

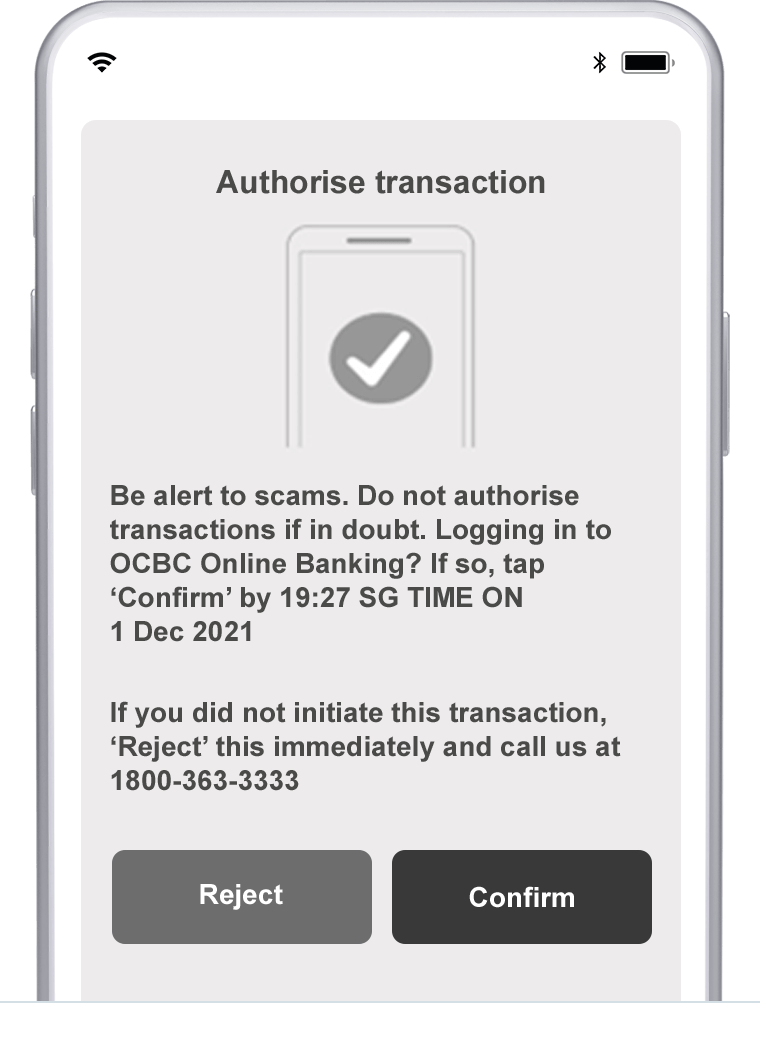

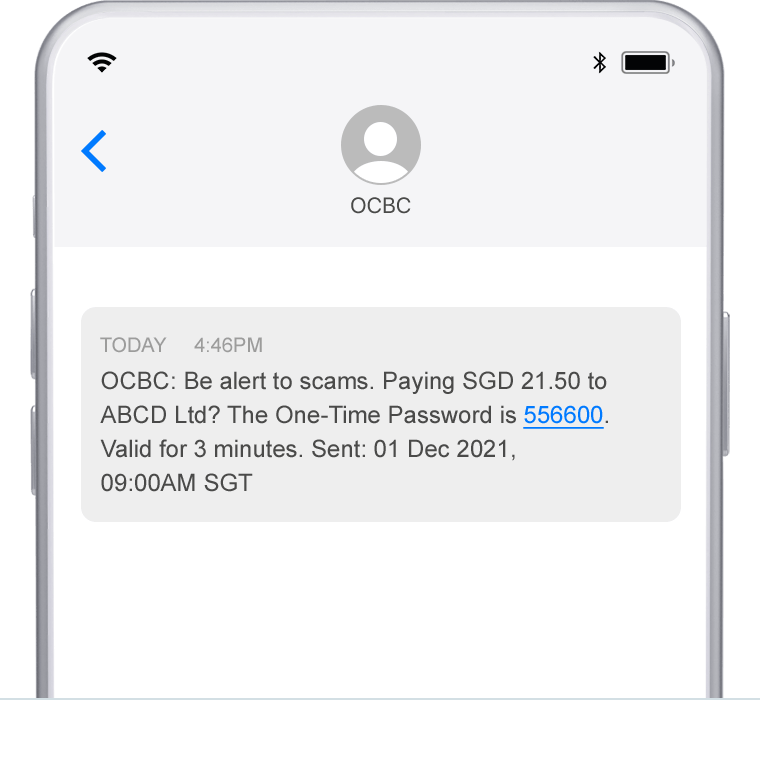

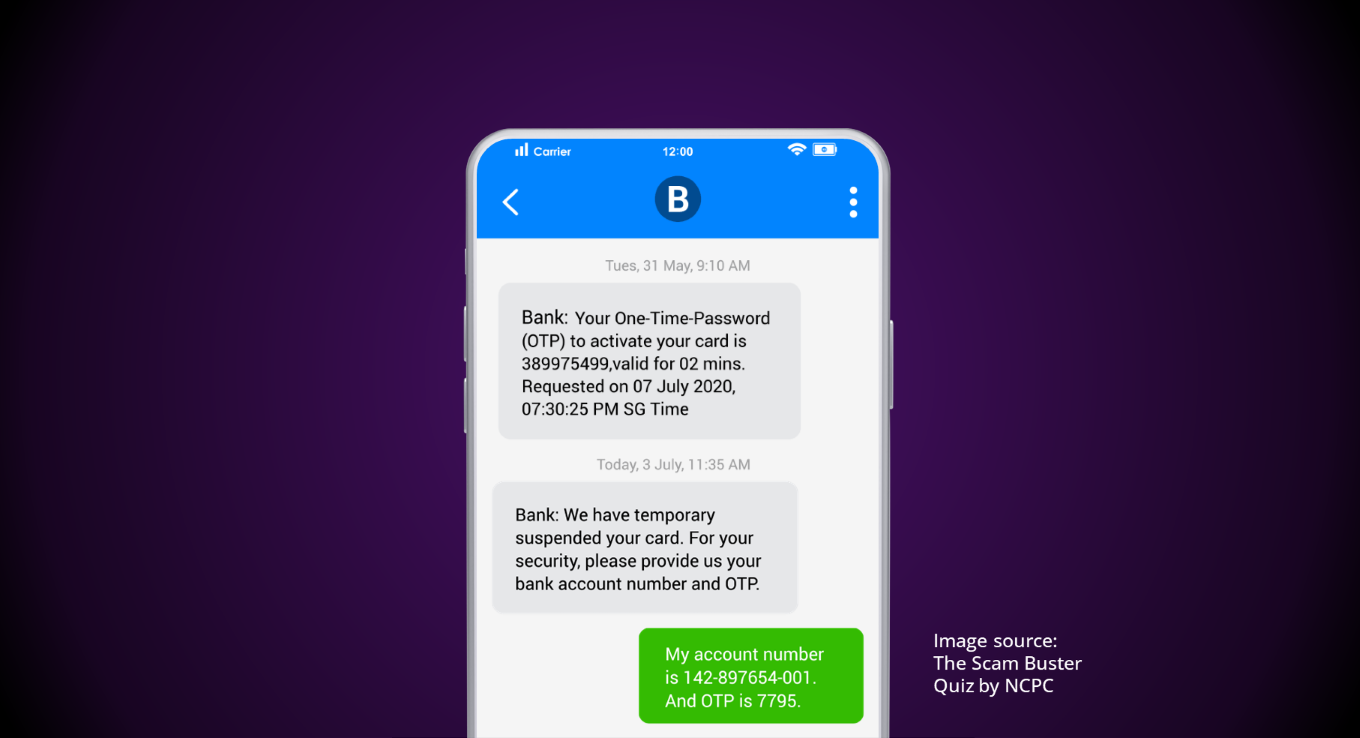

Read carefully before you tap

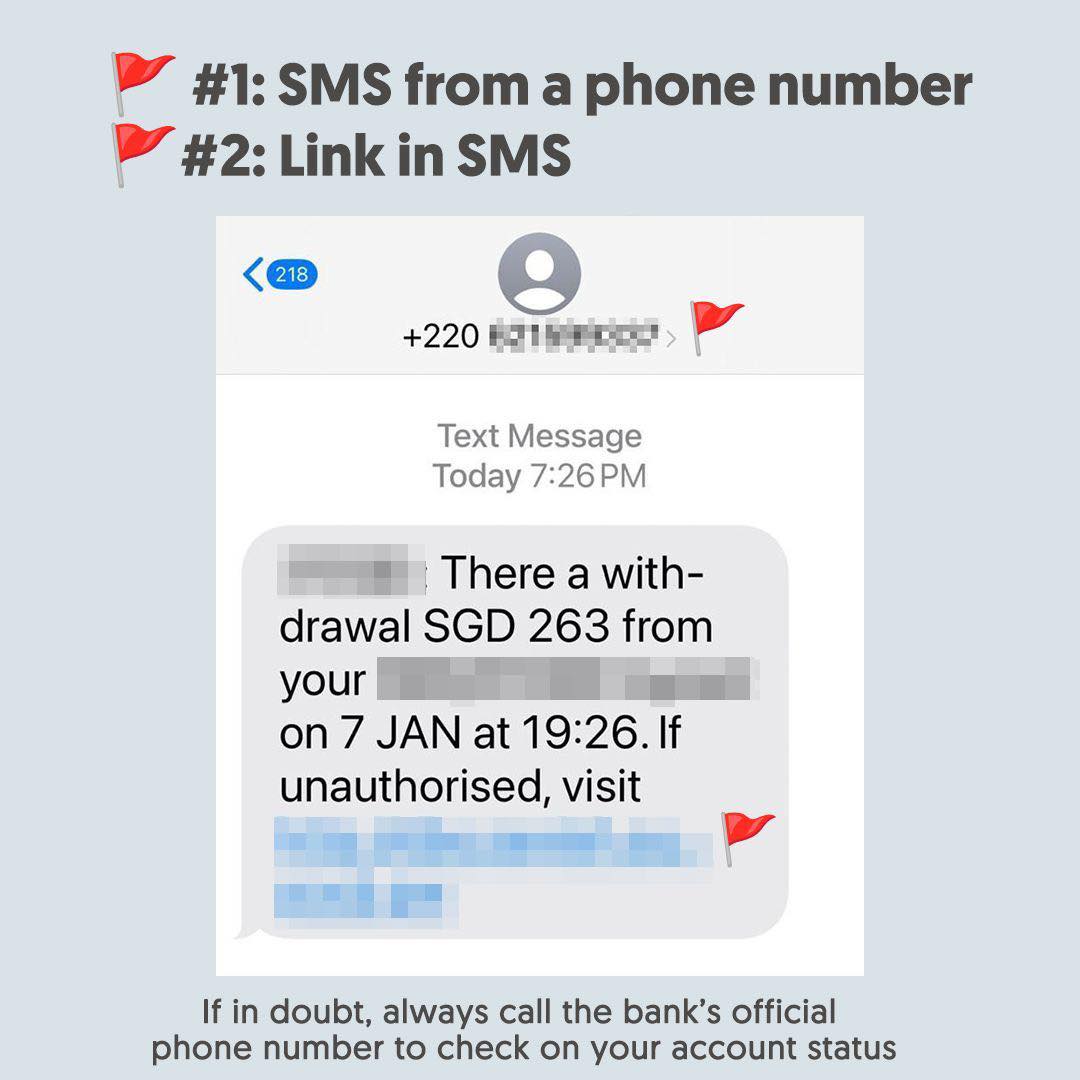

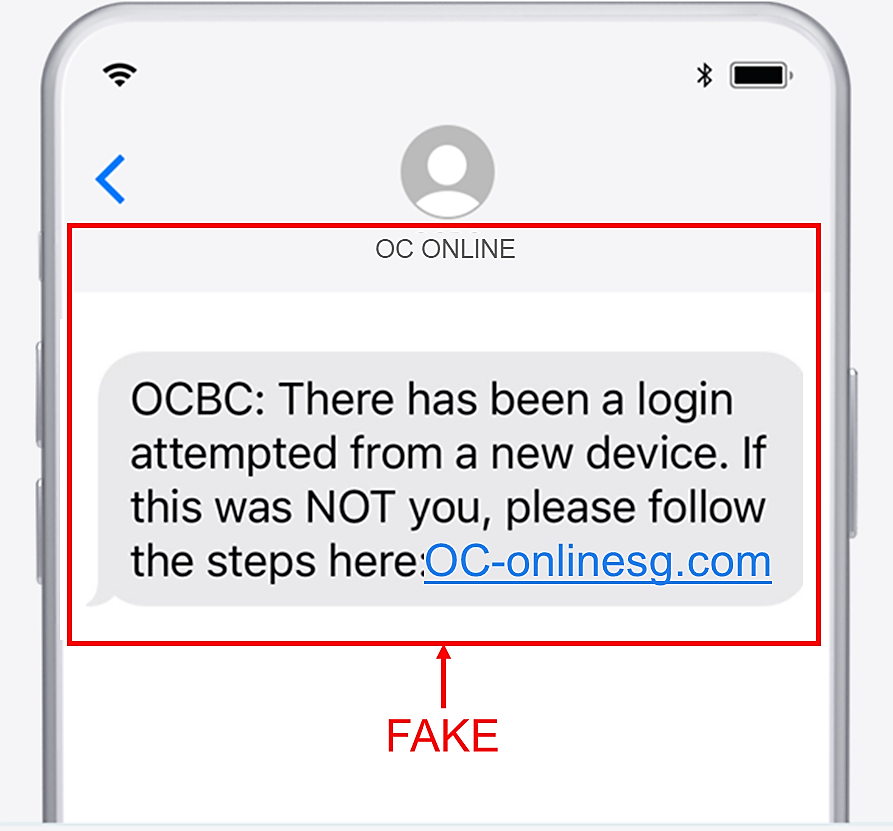

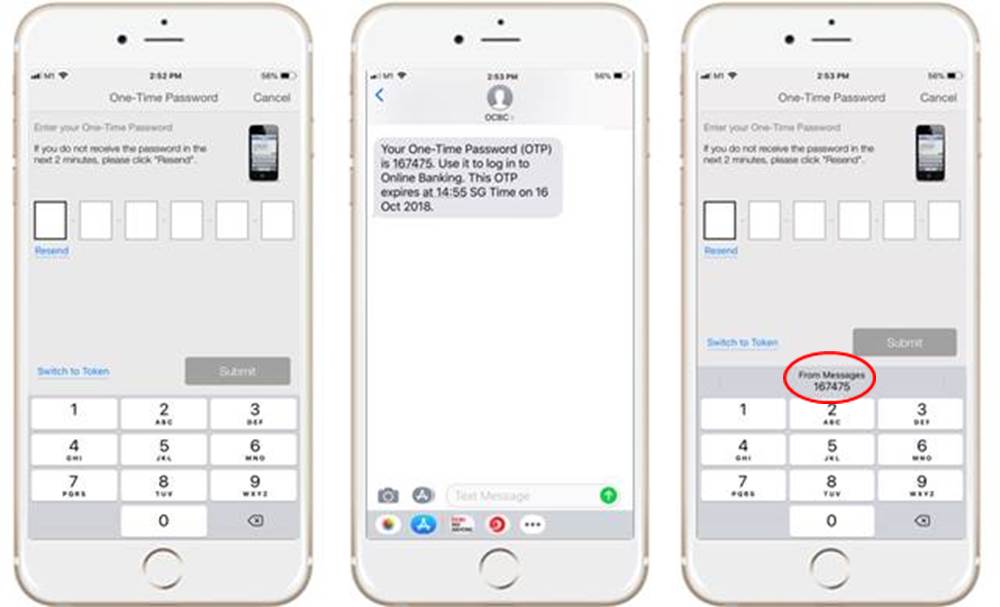

Only approve digital token requests initiated by you and check that SMS notifications are sent from the bank’s official sender ID, not a mobile number.

Know what banks will not do

Banks will never ask you to transfer money, disclose online banking credentials or install apps from non-official sources. They will not transfer your call to the police or government officers.

Do not be taken in by familiarity

Scammers may use your name or personal information to sound legitimate.

Read carefully before you tap

Only approve digital token requests initiated by you and check that SMS notifications are sent from the bank’s official sender ID, not a mobile number.

Deepfake calls

Scammers are using advanced AI tools to create highly realistic fake videos, audio, and images – known as deepfakes – to impersonate trusted individuals. You may get a voice or video call that appears to come from a senior executive, government (such as police or MAS) officer, or even someone you know.

These deepfakes may look and sound like the impersonated individual and often reference personal or company-specific details to gain your trust. Once credibility is established, scammers may:

- Apply psychological pressure: They may ask you for urgent fund transfers or sensitive information, or request that you download files or apps from unofficial sources.

- Exploit trust and a false sense of urgency: They may dangle fake investment opportunities that you supposedly cannot pass up (these often come with urgent deadlines); or request your immediate help or cash, citing a fake emergency.

REMEMBER THESE ANTI-SCAM TIPS

Take steps to protect yourself and your loved ones.

Pause and assess

Is the message creating fear or urgency? Is the request unusual, secretive or out of character for the sender?

Verify independently

Contact the person or organisation using their official contact details in the public domain, not those provided in the call.

Look for signs of deepfakes

Watch for unnatural facial expressions or distorted video/audio quality (e.g. robotic voices, lips not matching sounds, inconsistent lighting and skin texture).

Enable Two-Factor Authentication (2FA)

Use 2FA to prevent hackers from taking control of your accounts on social media and messaging applications, and spreading fake posts in your name.

Pause and assess

Is the message creating fear or urgency? Is the request unusual, secretive or out of character for the sender?

Verify independently

Contact the person or organisation using their official contact details in the public domain, not those provided in the call.

Look for signs of deepfakes

Watch for unnatural facial expressions or distorted video/audio quality (e.g. robotic voices, lips not matching sounds, inconsistent lighting and skin texture).

Enable Two-Factor Authentication (2FA)

Use 2FA to prevent hackers from taking control of your accounts on social media and messaging applications, and spreading fake posts in your name.

Learn more about other common scams

STAY SAFE WITH OCBC

Have a look at our security measures that help you bank confidently and #BeAProAgainstCons.

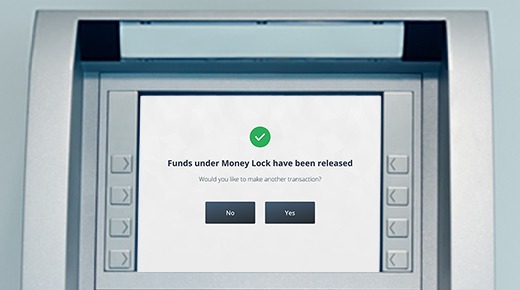

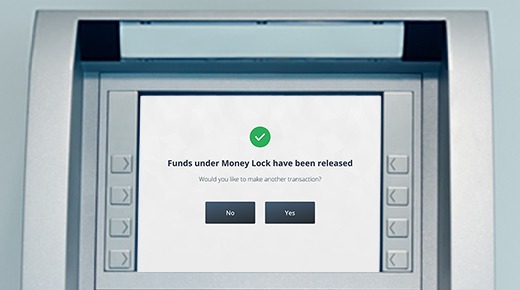

OCBC Money Lock

This helps you lock the funds in your current, savings and/or Time Deposit account(s). The locked funds can only be released at an OCBC ATM, Service Kiosk or branch.

OCBC Kill Switch

If you suspect that your banking or card details have been compromised, you can take immediate action by activating OCBC Kill Switch via the OCBC app, at certain OCBC ATMs or by calling our Personal Banking hotline (OCBC website > Contact us > Press ‘8’). This prevents access to your accounts and cards.

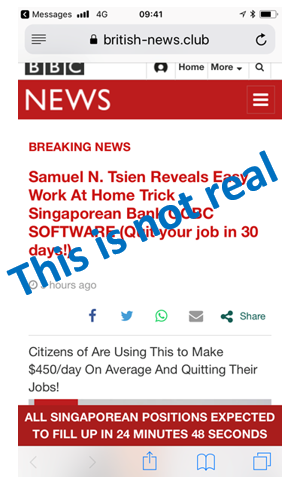

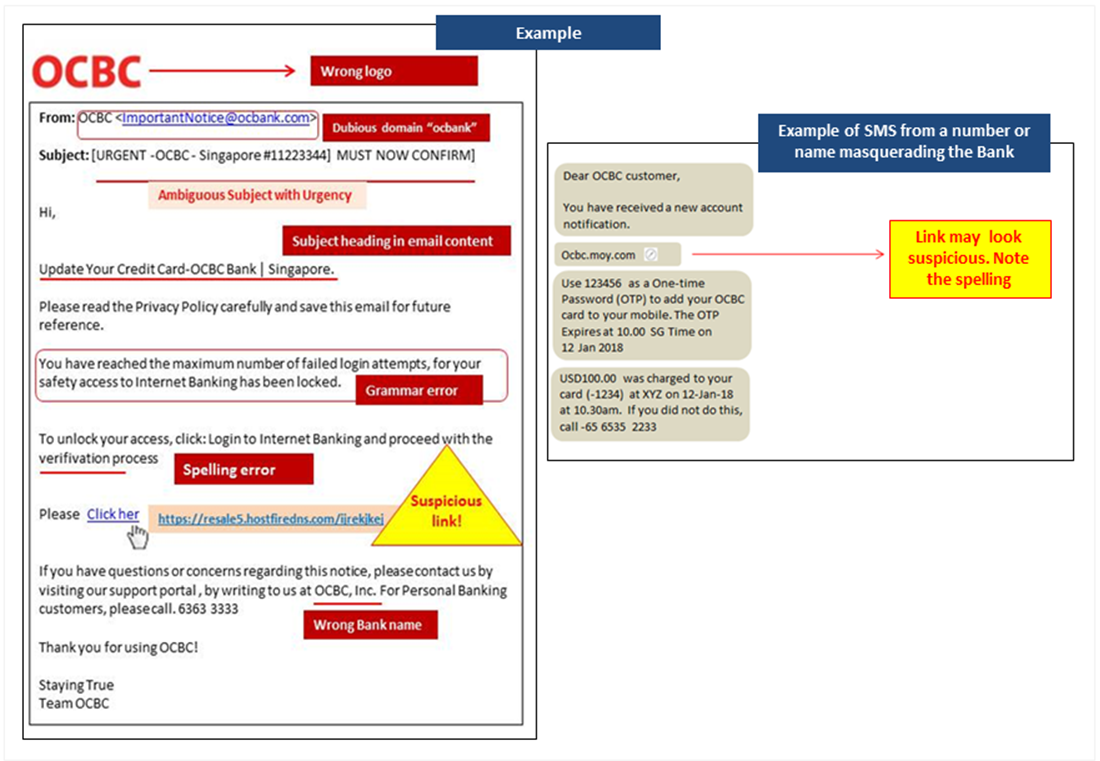

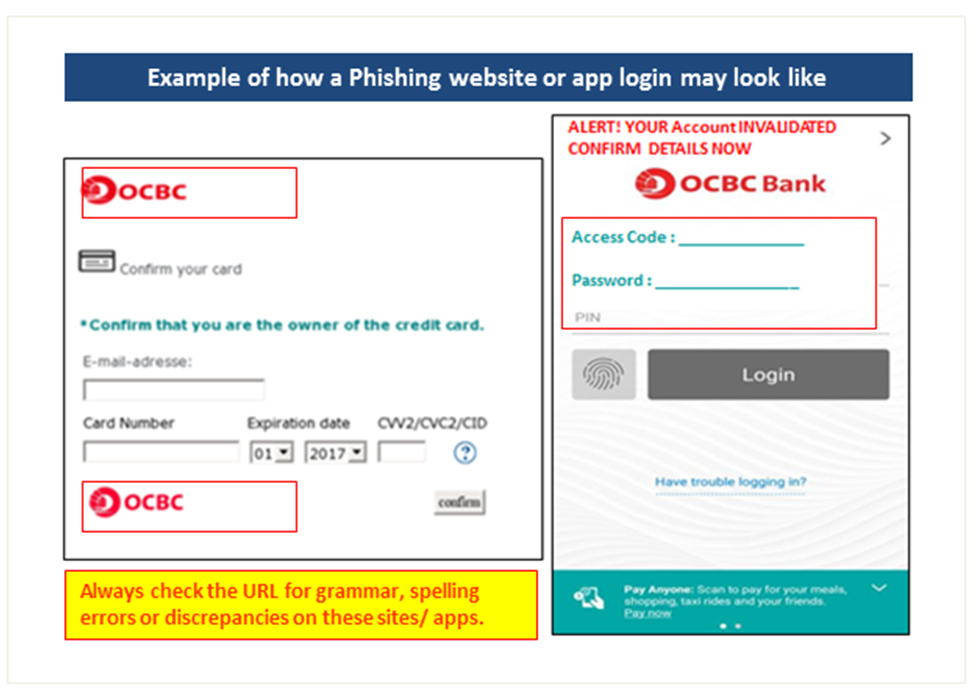

Do not be taken in by phishing and fake friend scams

25 February 2025

As scam tactics become more sophisticated, it is easy to let scammers catch you off guard. Often, they will try to gain your trust by convincing you that they are people you know or from trusted organisations.

Stay vigilant – you do not have to fall for their tactics. Read on to learn how you can protect yourself.

WATCH OUT FOR THESE SCAMS

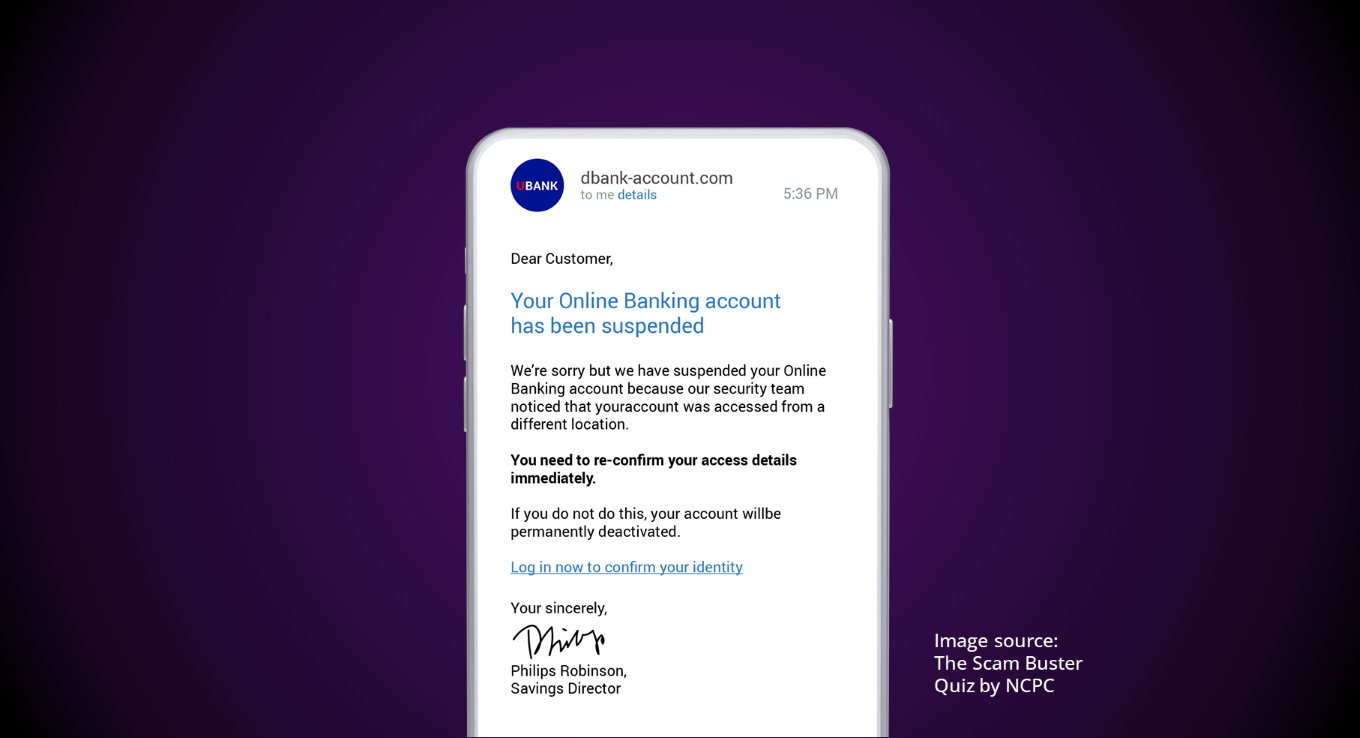

Phishing scam

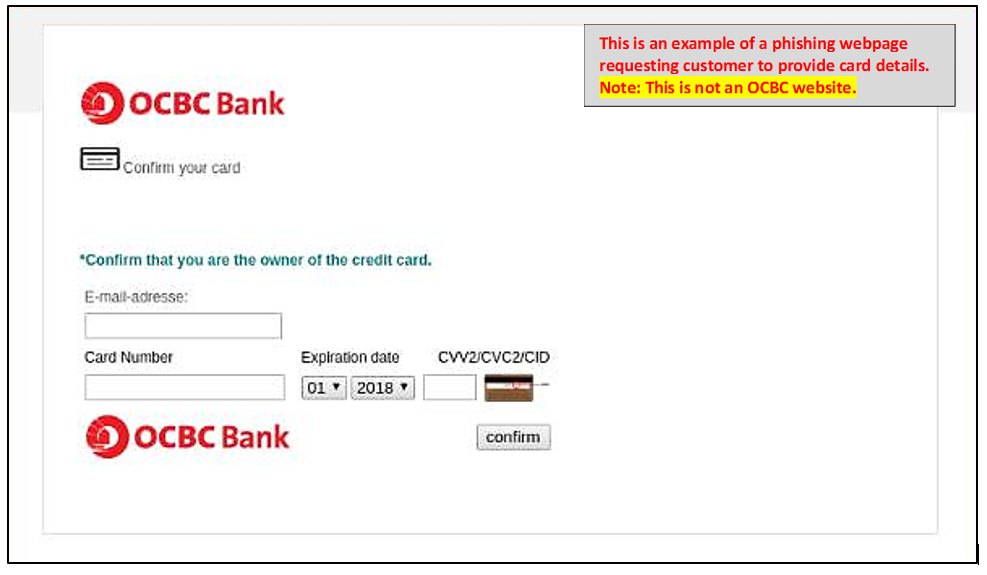

In a phishing scam, a target comes across an advertisement – put up by what he/she thinks is a legitimate entity, like a government organisation or bank – on websites or social media platforms like Carousell, Facebook or TikTok. These ads often display offers that are too good to be true. Enticed, the target gets in touch with the scammer using the contact details provided in the ad. The scammer will then send the target a link (usually via messaging platforms like WhatsApp, Telegram or SMS) and request that the target enters his/her banking credentials at that website.

The site is actually a spoofed one that is designed to appear legitimate; in fact, the scammer uses it to steal the target’s information. The target only realises that he/she has been scammed when unauthorised transactions are made using his/her bank accounts.

Fake friend scam

Got a call from an unknown number – and had the other party ask you to guess who he/she is? This is how ‘fake friend’ scammers lure targets into their traps. Once the target suggests a name, the scammer will assume that identity and ask the target to replace his/her number in the target’s contact list. At other times, such scammers may pretend to be a long-lost friend and ask for urgent financial assistance.

Learn more about other common scams

WAYS TO PROTECT YOURSELF

Scammers prey on their targets’ emotions. They may try to intimidate, create false urgency or make you feel like you are missing out. Be vigilant and adopt protective measures.

| Got an unsolicited direct message – or one where the sender claims to know you – via social media? | Always verify the identity of the sender. If the sender is purportedly an organisation, call their hotline number to check. If in doubt, get a second opinion from a trusted friend or family member. |

| Came across an online deal that seems too good to be true? |

Always check the credibility of online sellers by reading reviews of their services. Make purchases only from reputable merchants. |

| Received a link from a seller through a social messaging platform, and asked to access it to share sensitive information or make payment? |

Do not key in your banking credentials into – or make payment through – unverified webpages. These include webpages that you access through links sent to you via social messaging platforms (e.g. WhatsApp, Telegram). |

| Prompted to authorise a suspicious payment or received a transaction notification for a purchase you did not make? |

|

#BEAPROAGAINSTCONS WITH OCBC

Have a look at our security measures that help you bank safely and confidently:

12-hour cooling period for key account changes

When you activate OCBC OneToken, our digital banking token, you will need to wait 12 hours before key account changes (e.g. adding of payees or changing of contact details) can be made. This cooling period is meant to protect you from scammers seeking to make unauthorised transactions using your account(s).

OCBC Money Lock

You can use our Money Lock feature to lock the funds in your current, savings and/or Time Deposit account(s). The locked funds can only be unlocked via ATMs, Service Kiosks or at an OCBC Branch.

OCBC Kill Switch

If you suspect that your banking credentials have been compromised, you can take immediate action by activating OCBC Kill Switch via the OCBC app, at certain OCBC ATMs or by calling our Personal Banking hotline (OCBC website > Contact us > Press ‘8’). This prevents access to all your accounts and cards.

Fraud surveillance system

Our fraud surveillance system allows us to look out for unauthorised activities and safeguard you against them. We will continuously enhance it with additional security measures to better protect your funds.

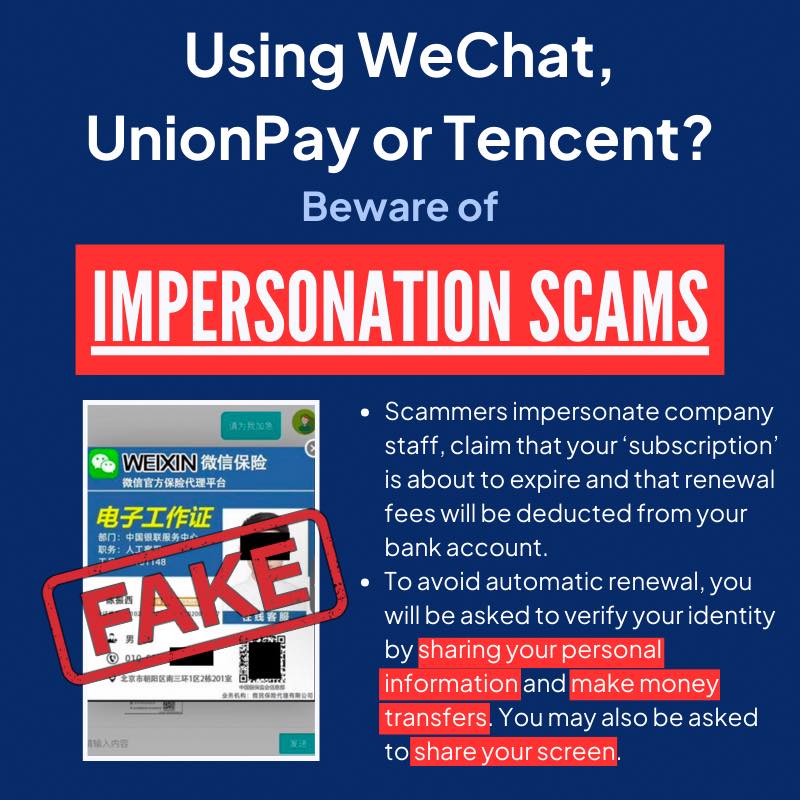

Security advisory: Watch out for impersonators and unsolicited payment requests

17 January 2025

As the festive season continues, impersonation scams in various forms are on the rise. Don’t fall victim to these deceitful tactics! Always confirm the identity of the caller and verify the legitimacy of any calls claiming to be from banks, organisations, or reputable companies. Protect yourself and your loved ones by staying informed.

Please see the following messages from the Singapore Police Force:

Source: Singapore Police Force

For more details, view the Singapore Police Force's advisory on the impersonation scam variation featuring impersonation of Chinese companies.

How to identify sneaky 'sellers' who are out to scam

4 November 2024

Do not let scammers pull the wool over your eyes. They prey on unsuspecting shoppers with deals that sound too good to be true.

From posing as sellers on social media platforms to sending you fake parcel delivery notifications, scammers on online shopping sites can cost you dearly.

Read on to learn how you can shop smart and protect yourself from common shopping scams.

WATCH OUT FOR THESE SCAMS

Here are 3 common types of online shopping scams. See how they work and how to protect yourself from them.

E-commerce scam

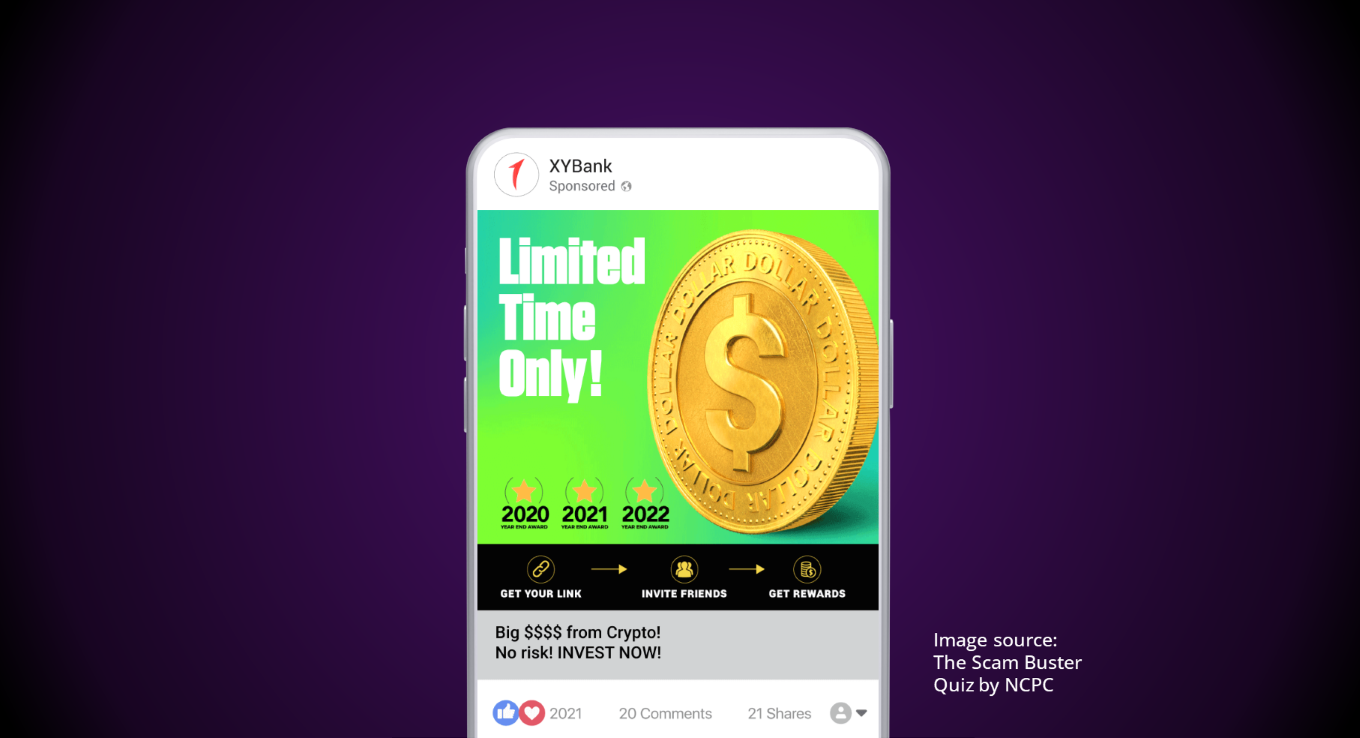

- When browsing online platforms like Carousell and Facebook, you come across an ad for a deal that sounds too good to be true or a limited-time offer (e.g. for personal accessories and electronics).

- After indicating that you want to make a purchase, you are asked to make a funds transfer to the ‘seller’s’ bank account.

- Once you do so, the ‘seller’ disappears and the product never arrives or turns out to be a fake. As payment was not made via the e-commerce platform, you are left with no way to recover your funds.

Online marketplace phishing scam

- You come across an ad or sponsored post promoting heavily discounted items on an online platform like Carousell, Facebook Marketplace, Instagram or TikTok.

- When you access the link provided in the post to make the purchase, you are taken to a separate website where you are asked to enter your banking credentials or card details. Alternatively, you may be taken to a messaging app (e.g. WhatsApp or Telegram). The scammer then asks you to access a link to place a deposit or make payment (including for customs fees/delivery charges).

- The website you are taken to is actually a spoofed one that is designed to appear legitimate. The scammer uses the site to steal your banking credentials or card details.

Parcel delivery phishing scam

- A scammer, posing as a member of logistics company like SingPost, sends you a message claiming that the delivery of your parcel has failed or that your parcel is held at customs.

- You are asked to access a link – which takes you to a spoofed website – to supposedly confirm your mailing address and make a small payment so the company can release your parcel for delivery.

- After entering your banking credentials or card details for payment, you later discover that unauthorised transactions have been made using your card.

Learn more about other common scams

HOW TO PROTECT YOURSELF FROM ONLINE SHOPPING SCAMS

| Found a deal that seems too good to be true? | Always check the credibility of online sellers by reading reviews. Only make purchases from reputable merchants. |

| Received a link from a seller through a social messaging platform and asked to access it to share sensitive information or make payment? |

|

| Asked to place a deposit for a purchase? | Avoid placing deposits. If it is necessary to make payment in advance, use the platform’s secured payment options. If possible, choose an arrangement that only releases your payment to the seller after you have received your item. |

| Prompted to authorise a payment using your digital token or SMS One-Time Password? | Check all authorisation requests before you approve them. |

| Asked to make payment for failed delivery or a parcel held at customs? | Be cautious when you are asked to pay an additional fee due to failed delivery or your parcel being held at customs. |

STAY SAFE WITH OCBC

Have a look at our security measures that help you bank confidently and #BeAProAgainstCons.

OCBC Money Lock

This helps you lock the funds in your current, savings and/or Time Deposit account(s). The locked funds can only be released at an OCBC ATM, Service Kiosk or branch.

OCBC Kill Switch

If you suspect that your banking or card details have been compromised, you can take immediate action by activating OCBC Kill Switch via the OCBC app, at certain OCBC ATMs or by calling our Personal Banking hotline (OCBC website > Contact us > Press ‘8’). This prevents access to your accounts and cards.

Beware of fake ads that appear on social media platforms!

10 October 2024

People have reported fake advertisements – promoting enticing food offers or products – making the rounds on social media. The scammers’ goal is to deposit malware on your devices!

With year-end sales coming up, be extra vigilant in safeguarding your funds. Scroll for more about the scammer’s modus operandi and the steps you can take to keep your bank account(s) safe.

TYPICAL MODUS OPERANDI

An enticing ad is first placed on a social media platform, with a link that takes the target to a messaging app like WhatsApp.

Using social engineering tactics, the target is persuaded to launch Google Play Store app and deactivate “Google Play Protect” security feature on his or her mobile device.

Once this happens, malicious Android Application Packages (APKs) may not be detected. The target is convinced to download a malware-laced app via such an APK (which includes granting the app accessibility permission), allegedly to enable payment for purchase or delivery fee.

The app requests the target’s personal details and banking credentials; a legitimate remote-control app is subsequently downloaded from the Google Play Store – allowing the scammer to control the device.

The scammer now accesses the target’s online banking account using the remote-control app and performs unauthorised transactions.

PROTECT YOURSELF FROM MALWARE

Malware is a type of malicious software that scammers use to infect computers and mobile devices in order to carry out criminal activities. Once infected, the devices can be accessed remotely by scammers. Confidential data like your login credentials may be stolen.

Warning Signs

- You are asked to install apps via links or attachments from unknown sources (e.g. social media or messaging platforms).

- You are asked to download additional apps or allow accessibility permissions.

Security Tips

- Do not disable “Google Play Protect” security function on any of your devices.

- When installing apps, review the permissions that are requested and ensure they are genuinely necessary.

- Avoid installing software or running programmes from unknown sources.

- Never store your online banking login credentials in your web browsers or devices.

- Use trusted anti-virus solutions to keep your devices secure.

- Check the details of your transactions carefully and read the notifications we send you. Notify us immediately if you see a transaction you did not make.

OUR SECURITY FEATURES

You may use these enhanced security features to further safeguard your accounts.

OCBC Money Lock

This helps you lock the funds in your current, savings or Time Deposit account(s). The locked funds can only be released at an OCBC ATM, Service Kiosk or branch.

OCBC Kill Switch

If you suspect that your device has been hacked, you can take immediate action by activating OCBC Kill Switch via the OCBC app, at certain OCBC ATMs or by calling our Personal Banking hotline (OCBC website > Contact us > Press ‘8’). This prevents access to your accounts and cards.

Time to unmask impersonators who are out to scam

20 August 2024 (Last updated 12 November 2024)

Do not let scammers succeed in using fake identities – whether they claim to be bank officers or government officials, long-lost friends or employees of certain companies. Take charge of your security and stay one step ahead of those who seek to deceive you. Read on to arm yourself with knowledge against impersonation scams.

WATCH OUT FOR THESE SCAMS

Here are 3 common types of impersonation scams. Learn how to protect yourself from them.

Fake bank officers/government officials

Scammers impersonating bank officers or government officials will, through unsolicited calls, falsely accuse their targets of engaging in criminal activities. Under false pretenses (such as “to help with investigations”), they may demand that their targets send them money, provide them with banking details, or, when impersonating a bank officer, they may pretend to transfer the call to another party outside of the bank (such as the Police or other government officials).

Fake friends

Got a call from an unknown number – and had the other party ask you to guess who he/she is? This is how ‘fake friend’ scammers lure targets into their traps. Once the target suggests a name, the scammer will assume that identity and ask the target to replace his/her number in the target’s contact list. At other times, such scammers may pretend to be a long-lost friend and ask for urgent financial assistance.

Fake tech vendors/telco staff

A target of such ‘tech scams’ will receive a pop-up message stating that his/her device has been compromised, alongside a number that he/she should supposedly call for help. Scammers posing as tech vendors or telco staff will then direct the target to download remote control applications that grant them control over the target’s device. The scammers will then trick the target into logging in to his/her online banking account. Once the target has done so, the scammers will access the target’s device and make unauthorised transactions using his/her bank account.

Learn more about other common scams

HERE’S HOW YOU CAN PROTECT YOURSELF

| Got a call from someone claiming to be a bank officer or government official, long-lost friend or employee of certain companies? Did he/she ask for money? |

|

| Got an email/SMS that contains one or more links? Does it urge you to make payment or provide banking credentials? | Banks will never send you SMSes or emails with clickable links. Do not click on such links. |

| Got an unsolicited direct message – or one from someone who claims to know you – via social media? |

|

| Got an error message on your device – supposedly because of a technical issue? Does that message urge you to call a contact number shown on it? | Do not call numbers shown in such error messages. Instead, verify the authenticity of the error message by contacting the company using the contact number listed on its official website. |

STAY SAFE WITH OCBC

Have a look at our security measures that help you bank confidently and #BeAProAgainstCons.

OCBC Money Lock

Add an extra layer of protection against scams by locking the funds in your current/savings account(s) and securing your Time Deposit account(s). For your security, your funds can only be released, or your account(s) unlocked, after we verify your identity.

OCBC Kill Switch

Suspect your banking and/or card details have been compromised? Block access to your account(s) and card(s) by immediately activating OCBC Kill Switch. Do this via the OCBC Digital app, at certain OCBC ATMs or by calling our Personal Banking hotline (OCBC website > Contact us > Press ‘8’).

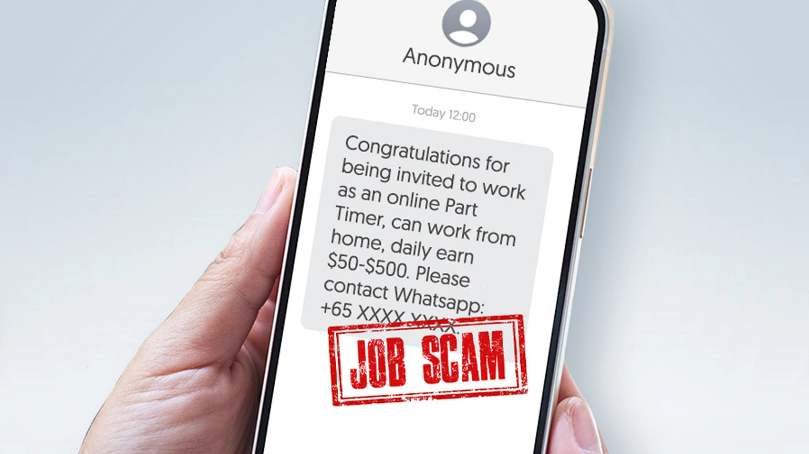

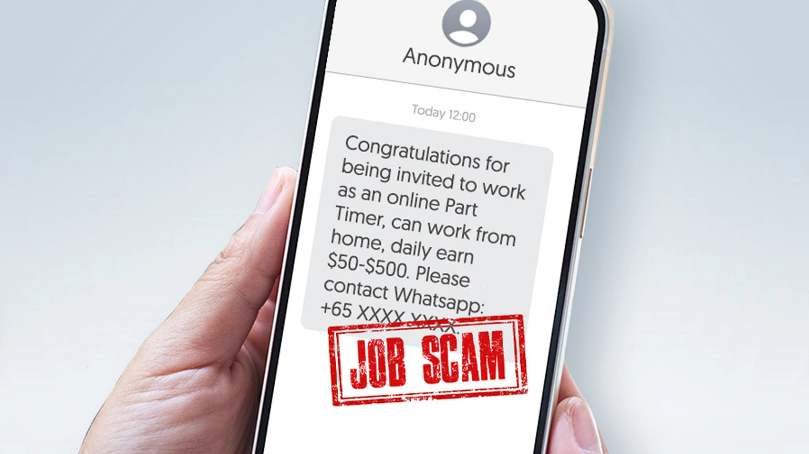

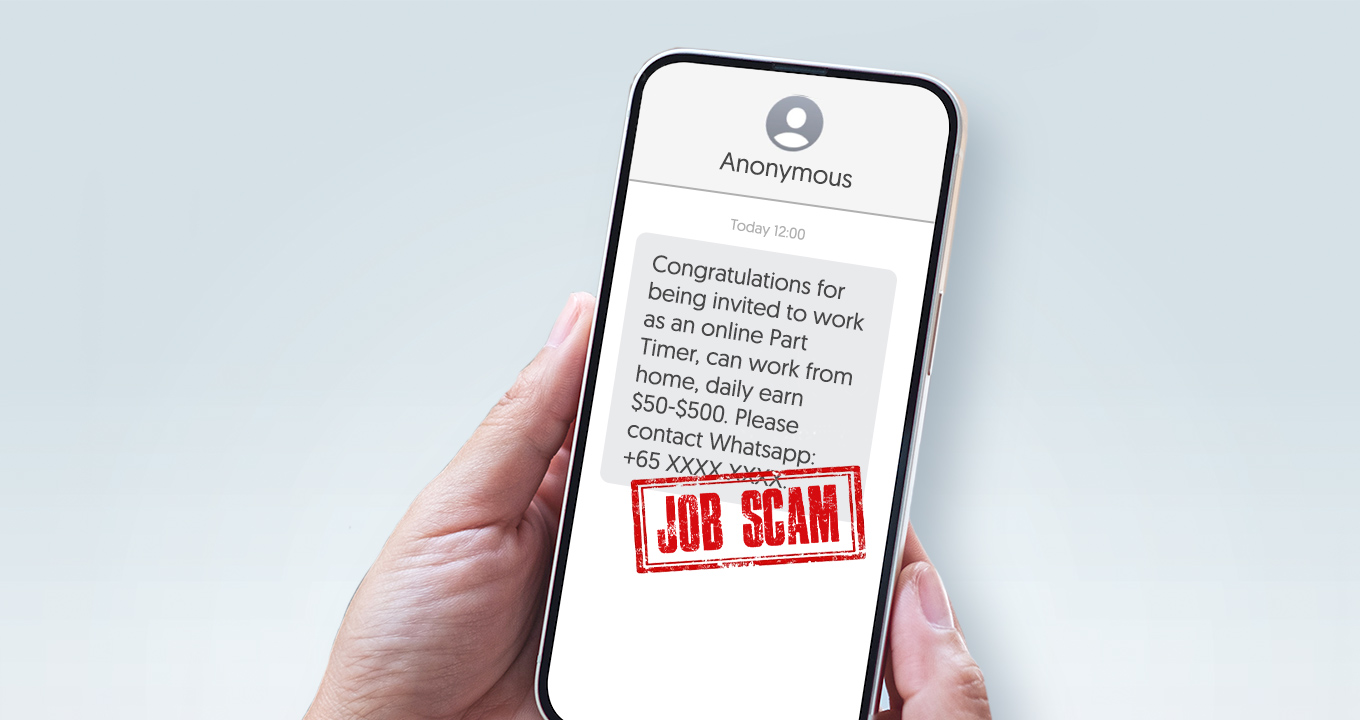

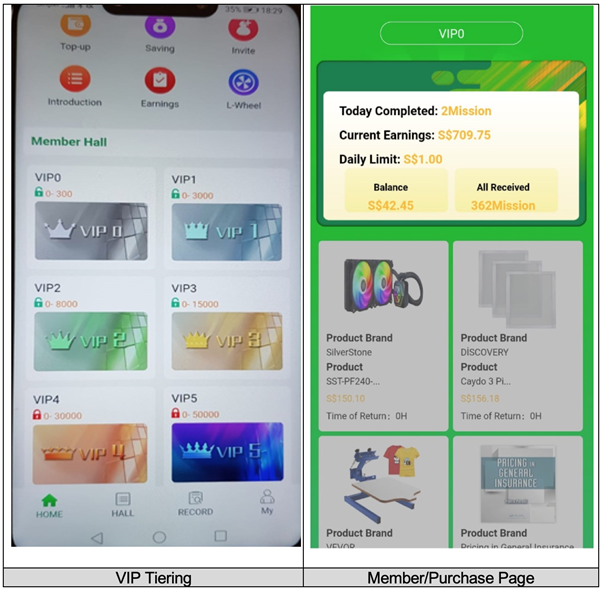

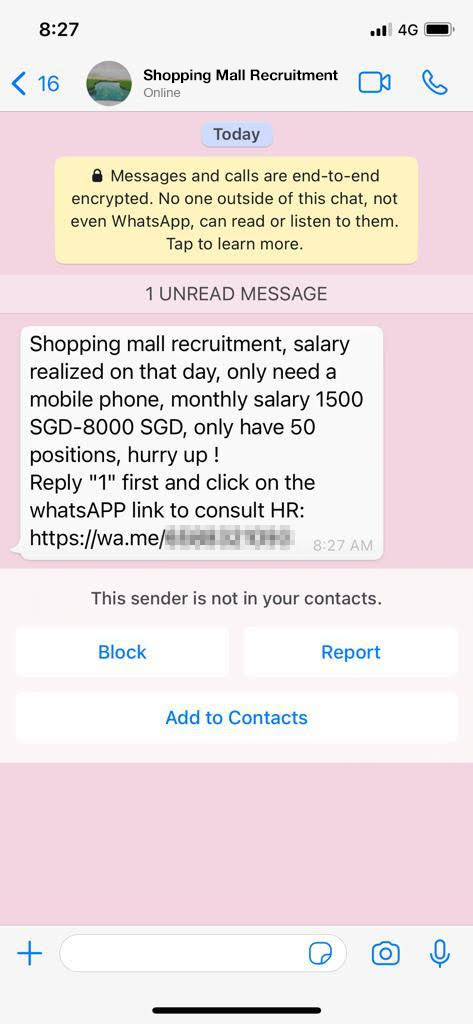

Protect your funds from job and tech support scams

24 May 2024

Got a lucrative job offer that sounds too good to be true? Saw a mysterious pop-up message telling you to call a number as your device has been compromised? These are common scam tactics that you should be cautious of.

Let us work together to stay one step ahead of scammers. Read the tips below to protect yourself from job and tech support scams.

WATCH OUT FOR THESE SCAMS

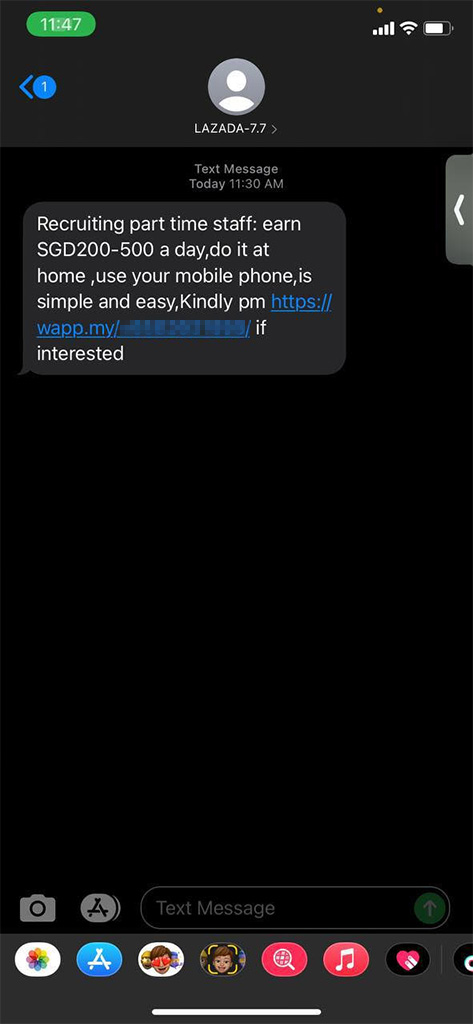

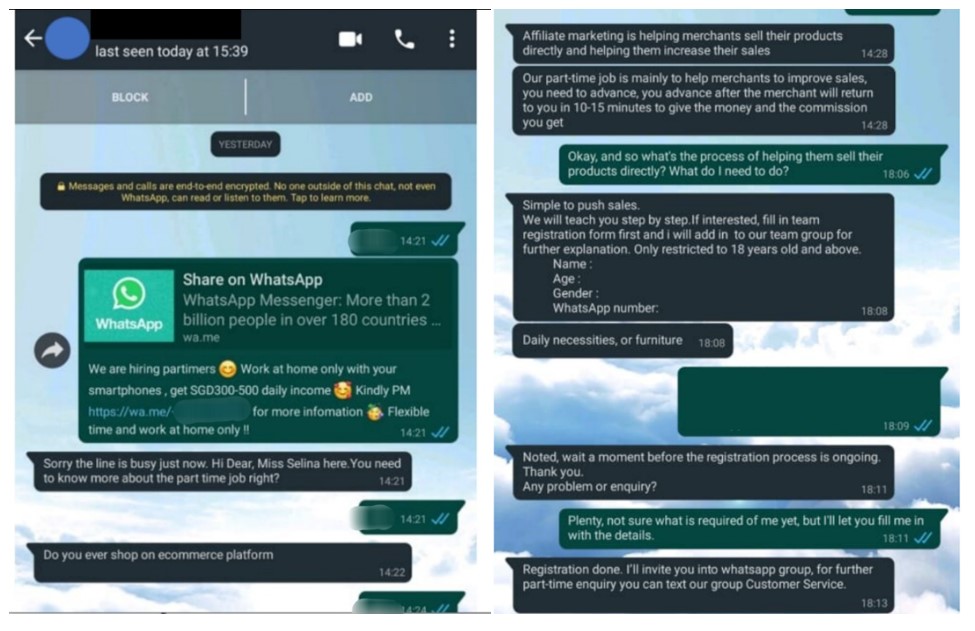

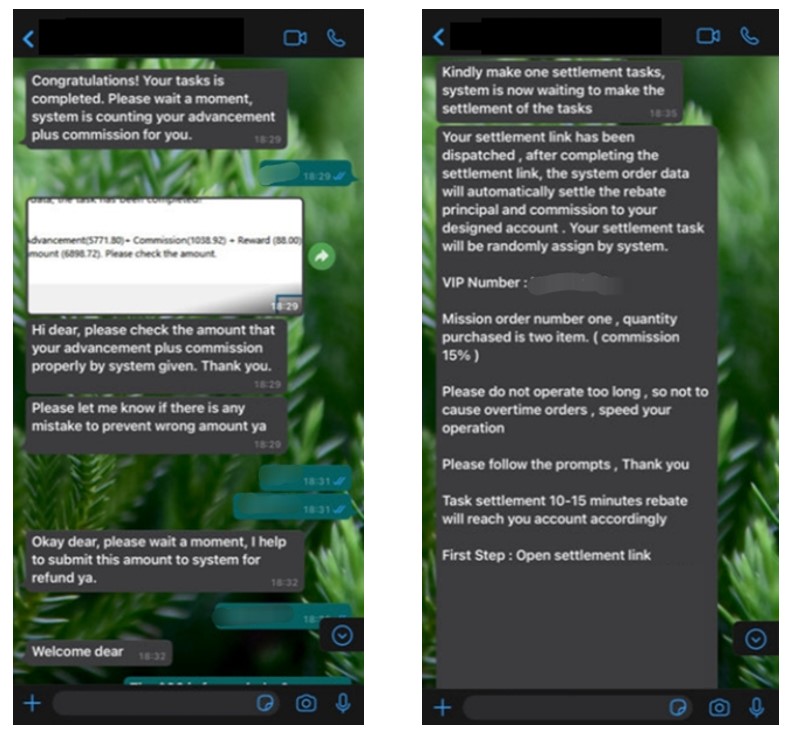

Job scams

The approach: A scammer sends a target an unsolicited job offer via a messaging platform like WhatsApp or Telegram. The scammer claims to be from a legitimate recruitment agency or is recruiting for a credible organisation.

The scam: In exchange for commission, the target is asked to perform simple tasks online, such as completing surveys, giving reviews or liking social media posts. To gain the target’s trust, the scammer may initially give a small sum of money for completing the tasks. The scammer then requests money – or personal and banking details – in exchange for ‘unlocking’ access to higher paying tasks. After receiving the money or personal and banking details, the scammer disappears.

How to protect yourself:

- Do not accept dubious or unsolicited job offers that offer lucrative rewards for little effort

- Verify the legitimacy of any unsolicited job offer with the hiring company directly (e.g. check the recruitment page on their website or contact their Human Resources department)

- Do not pay to secure a job offer – legitimate companies never ask for this

Tech support scams

The approach: A target gets a pop-up message on his/her device claiming that the device has been compromised or has a software issue.

The scam: The message asks the target to contact a ‘tech support’ hotline to fix the issue. The hotline is actually manned by scammers, who will try to trick the target into revealing sensitive information. The target could also be asked to access websites or download files that give the scammer control of the target’s device, including banking apps. The scammer then steals money or makes fraudulent transactions using the target’s account(s).

How to protect yourself:

- Do not contact tech support via hotlines or email addresses that appear in pop-up messages which claim your device has been compromised. Legitimate tech companies will never send you such messages. If your device has any issues, search for the company’s hotline or email address via their website

- Regularly scan your device using antivirus software

- Never share your banking details with anyone

Learn more about other common scams

STAY SAFE WITH OCBC

Have a look at our security measures that help you bank confidently and #BeAProAgainstCons.

OCBC Money Lock

Add an extra layer of protection against scams by locking the funds in your current/savings account(s) and securing your Time Deposit account(s). For your security, your funds can only be released, or your account(s) unlocked, after we verify your identity.

OCBC OneToken

Choose OCBC OneToken over hardware token. You can easily activate OCBC OneToken using an SMS One-Time Password (OTP) and your 6-digit card PIN. Twelve hours later, start transacting seamlessly and securely via the OCBC Digital app.

Daily transaction limit

Set your preferred daily transaction limit so that large sums of money cannot leave your account(s) without your knowledge and authorisation.

OCBC Kill Switch

If you suspect that any of your accounts or devices have been compromised, take immediate action by activating OCBC Kill Switch (call our Personal Banking hotline and press ‘8’). This prevents access to your account(s) and card(s).

Learn more about our security measures

REMEMBER THESE ANTI-SCAM TIPS

Take steps to protect yourself and your loved ones.

Never share your banking credentials such as Access Code, PIN and OTPs with anyone

Received a suspicious call? Verify the legitimacy of the caller and company from their official website before providing any personal information

Targeted by a scam? Report it to the authorities and spread the word to help prevent others from falling victim to similar scams

Never share your banking credentials with anyone

Always check that the websites you browse are official ones

Ensure that your contact details are up to date in our records so you can receive timely banking alerts

Learn how to spot and stop common scams

22 February 2024

Protect your hard-earned money from scams! Equip yourself with the knowledge to spot and stop scams like a pro.

Not sure where to start? Read the tips below to protect yourself from 3 common scams – malware, phishing and government impersonation.

WATCH OUT FOR THESE SCAMS

Here are 3 scams you should know about and the ways to protect yourself from them.

Malware threats

Malware is a type of malicious software that scammers use to infect computers and mobile devices in order to carry out criminal activities. Once infected, the devices can be accessed remotely by scammers and confidential data like your login credentials may be stolen.

How to protect yourself:

- Avoid installing software or running programs from unknown sources

- Do not open attachments and links – or scan QR codes – from unsolicited emails and Whatsapp messages, and social media platforms

- Keep your devices secure by using trusted anti-virus solutions

- Never store your online banking login credentials in your web browsers or devices

Phishing scams

Phishing scams are those where scammers trick you into sharing confidential information by pretending to be someone they are not or offering something in exchange.

How to protect yourself:

- Be sceptical of deals that seem too good to be true

- Do not provide your personal and/or banking details when prompted by unverified websites

- Enable transaction alerts for your bank account(s) and credit card(s)

Government impersonation

Beware of scammers posing as government officials, such as police officers and court officials. They often use scare tactics to convince you into disclosing your personal details.

How to protect yourself:

- Do not give in to pressure and let fear rush you into making hasty decisions

- End a call immediately if the caller is unable to properly identify himself/herself

- Always verify the authenticity of any information shared with you, or requests made to you, by contacting the organisation through their official website or hotline

Learn more about other common scams

STAY SAFE WITH OCBC

Have a look at our security measures that help you bank confidently and #BeAProAgainstCons.

OCBC Money Lock

Add an extra layer of protection against scams by locking the funds in your current/savings account(s) and securing your Time Deposit account(s). For your security, your funds can only be released, or your account(s) unlocked, after we verify your identity.

Cooling-off periods

A 12-hour cooling period is applied to certain requests like the activation of OCBC OneToken. If an unauthorised request has been made (suggesting a potential scam), you will have more time to respond.

Daily transaction limit

Set your preferred daily transaction limit so that large sums of money cannot leave your account(s) without your knowledge and authorisation.

OCBC Kill Switch

If you suspect that your device has been compromised, you can take immediate action by activating OCBC Kill Switch via the OCBC Digital app. This prevents access to your account(s) and card(s).

Learn more about our security measures

REMEMBER THESE ANTI-SCAM TIPS

Take steps to protect yourself and your loved ones.

Never share your banking credentials with anyone

Always check that the websites you browse are official ones

Ensure that your contact details are up to date in our records so you can receive timely banking alerts

Never share your banking credentials with anyone

Always check that the websites you browse are official ones

Ensure that your contact details are up to date in our records so you can receive timely banking alerts

Protect yourself from scams this Chinese New Year

Browsing online marketplaces and social media platforms for Chinese New Year offers? Stay alert. Do not fall prey to scammers who are out in full force to entice victims with seemingly attractive deals.

Before making a purchase, consider these five questions:

- Is the ‘deal’ too good to be true – priced way below market rates and/or disguised as a limited time only offer?

- Did you see the ‘deal’ on an unverified site, or get it – unsolicited – from an unfamiliar email address or mobile number?

- Did the seller ask to take your conversation off the online shopping platform?

- Were you asked to download an app to your mobile phone to complete the purchase or to make payment?

- Were you pressured to make payment to strangers, or place a small deposit, because the ‘deal’ is time-sensitive/‘stocks’ are limited?

Answered ‘yes’ to any of the questions above? Beware – it is likely a scam.

Three golden rules to protect yourself

Here is how you can prevent yourself from falling prey to scammers:

- Always verify the authenticity of offers. Make sure you are on a legitimate website and not a lookalike.

- NEVER reveal your Online Banking login credentials or card details to anyone.

- NEVER click on links that you see in pop-up advertisements – or those in emails/messages that urge you to install apps to make payment. You may inadvertently download malware apps onto your phone.

Let our Safety and Security information hub be your one-stop guide to banking safely online.

Wish to report possible fraud? Call our Personal Banking hotline at +65 6363 3333, then press 8. If you are in the queue to be served by a Customer Service Executive, you may choose to activate our emergency kill switch – also available via the OCBC Digital app and at selected OCBC ATMs – to protect your account(s).

To secure excess funds, consider using OCBC Money Lock – available via OCBC Internet Banking and the OCBC Digital app.

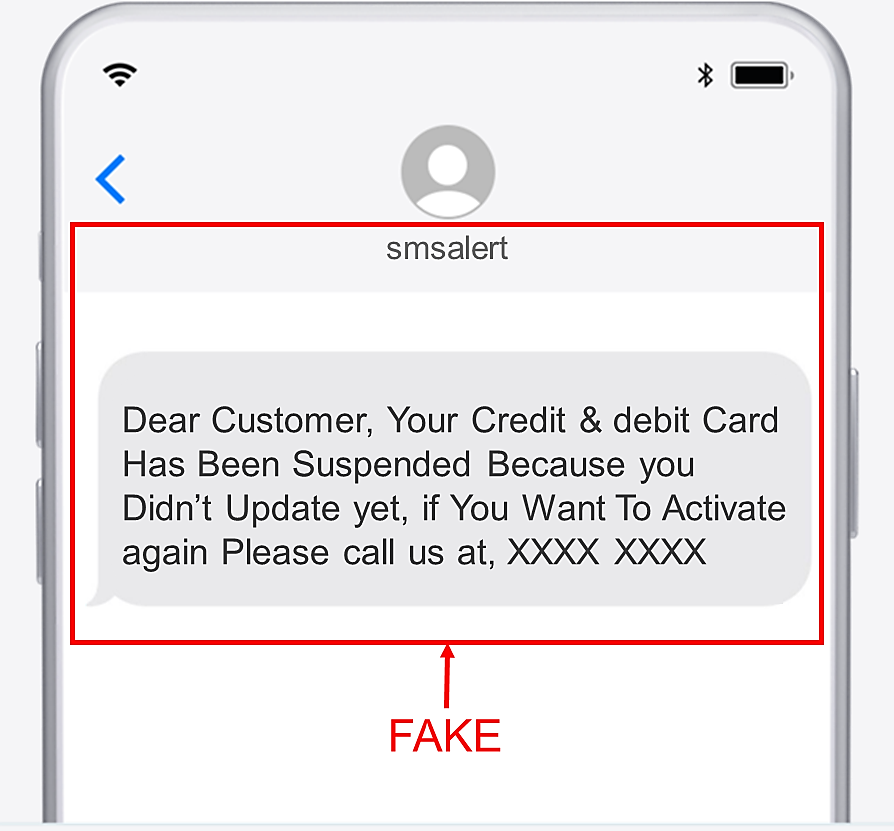

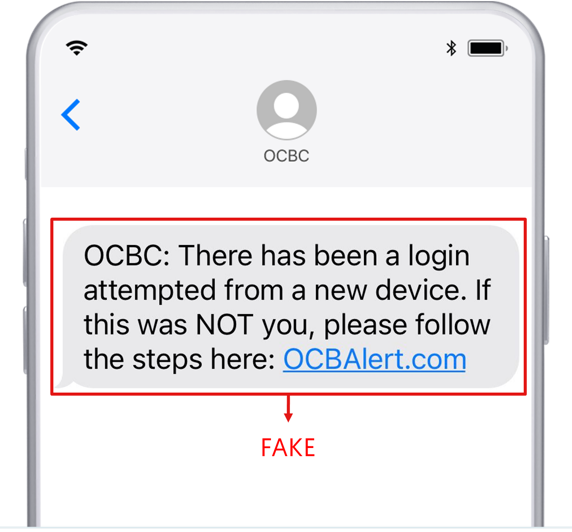

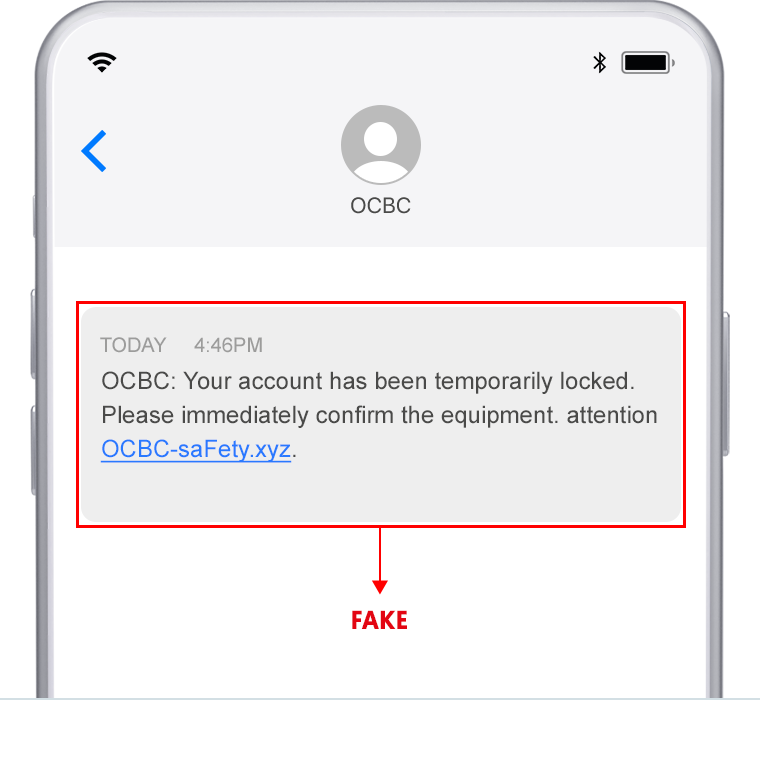

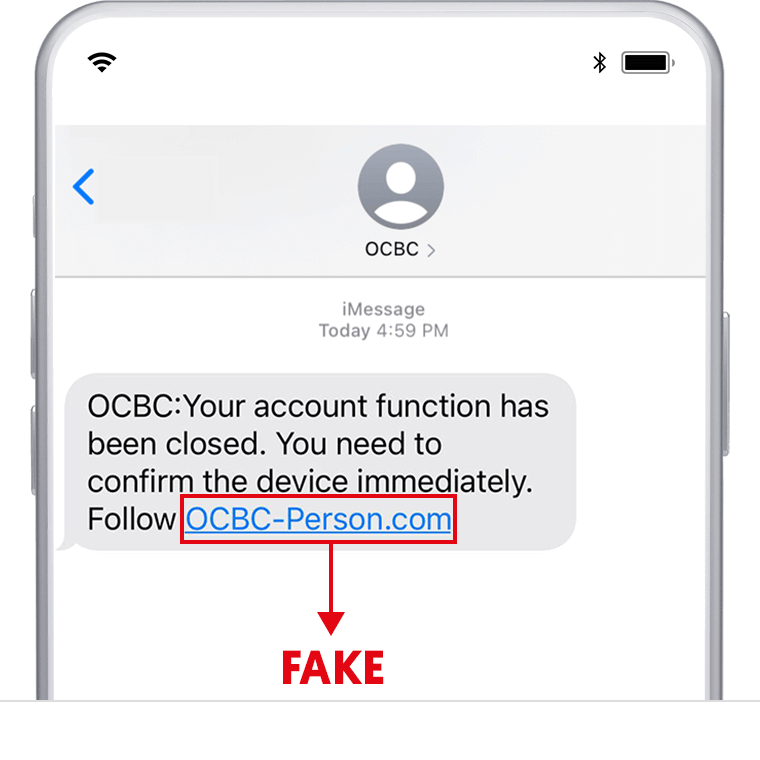

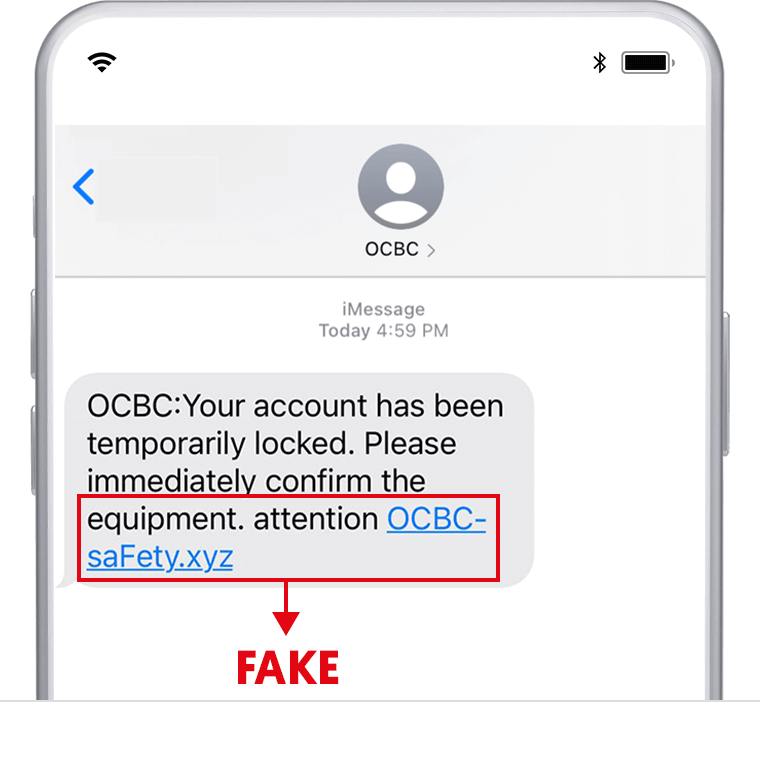

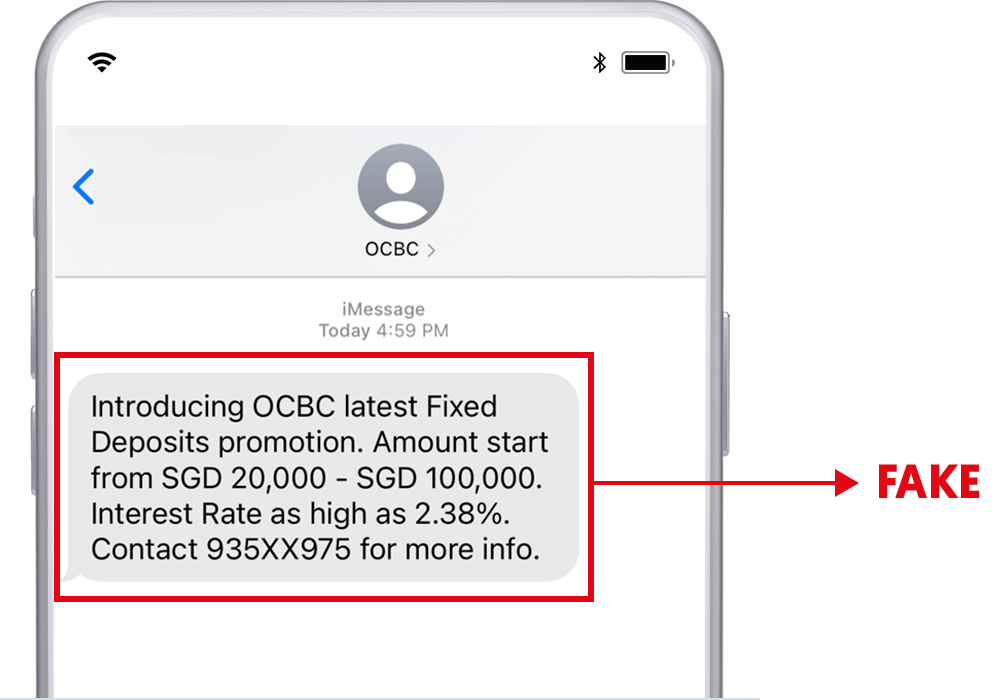

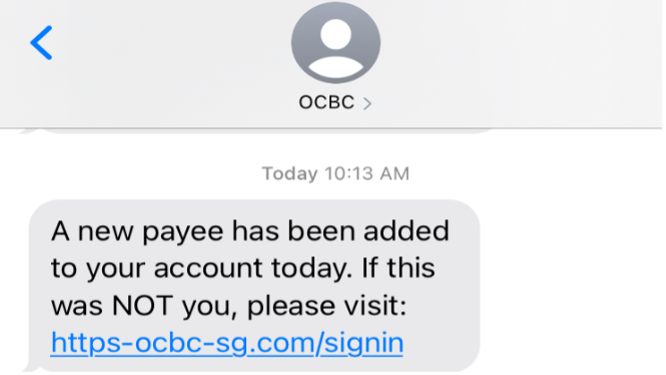

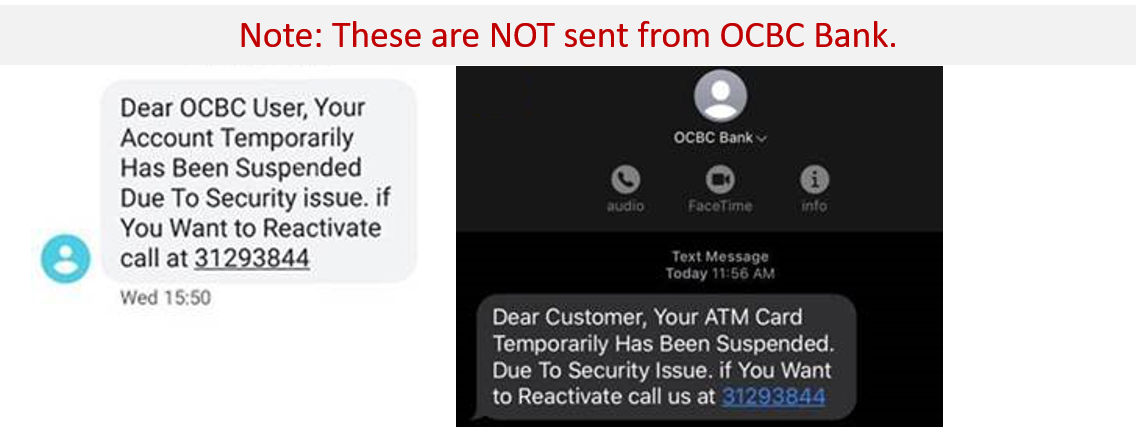

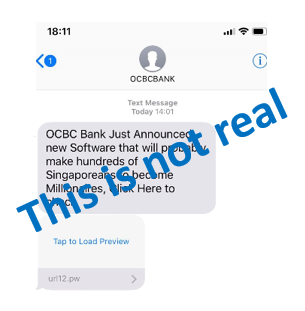

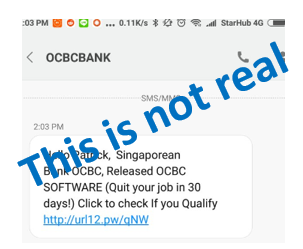

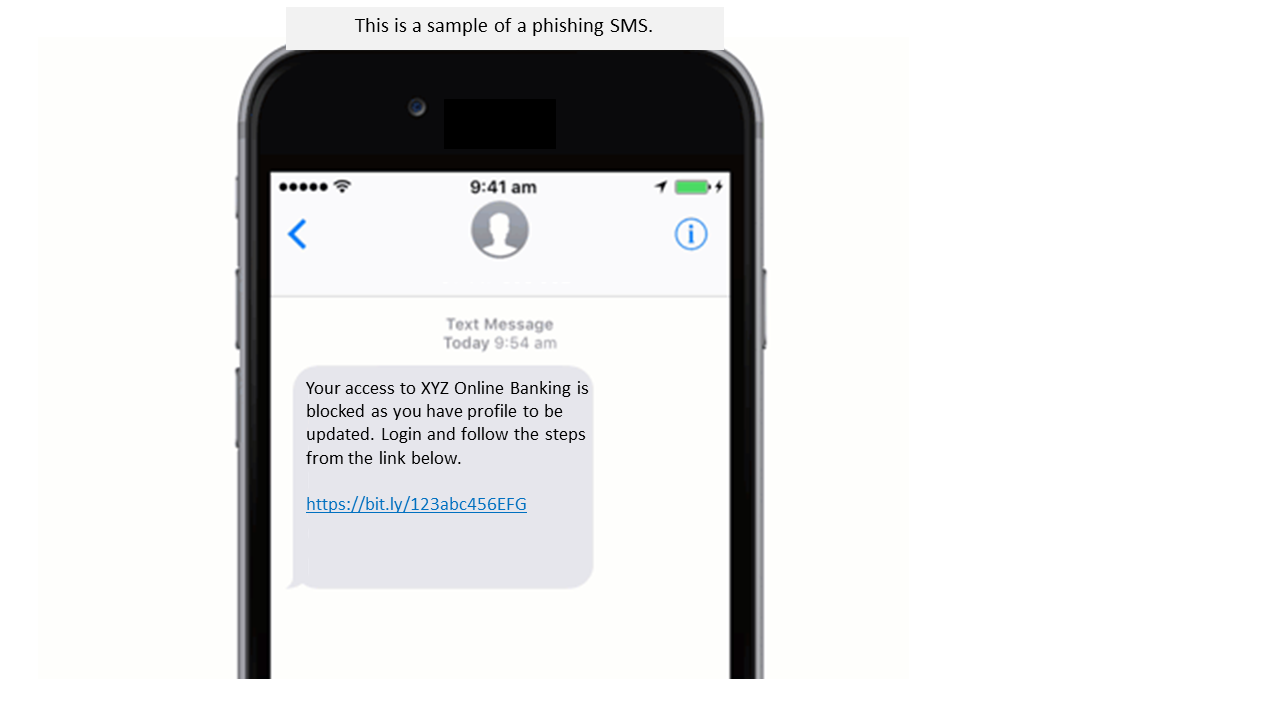

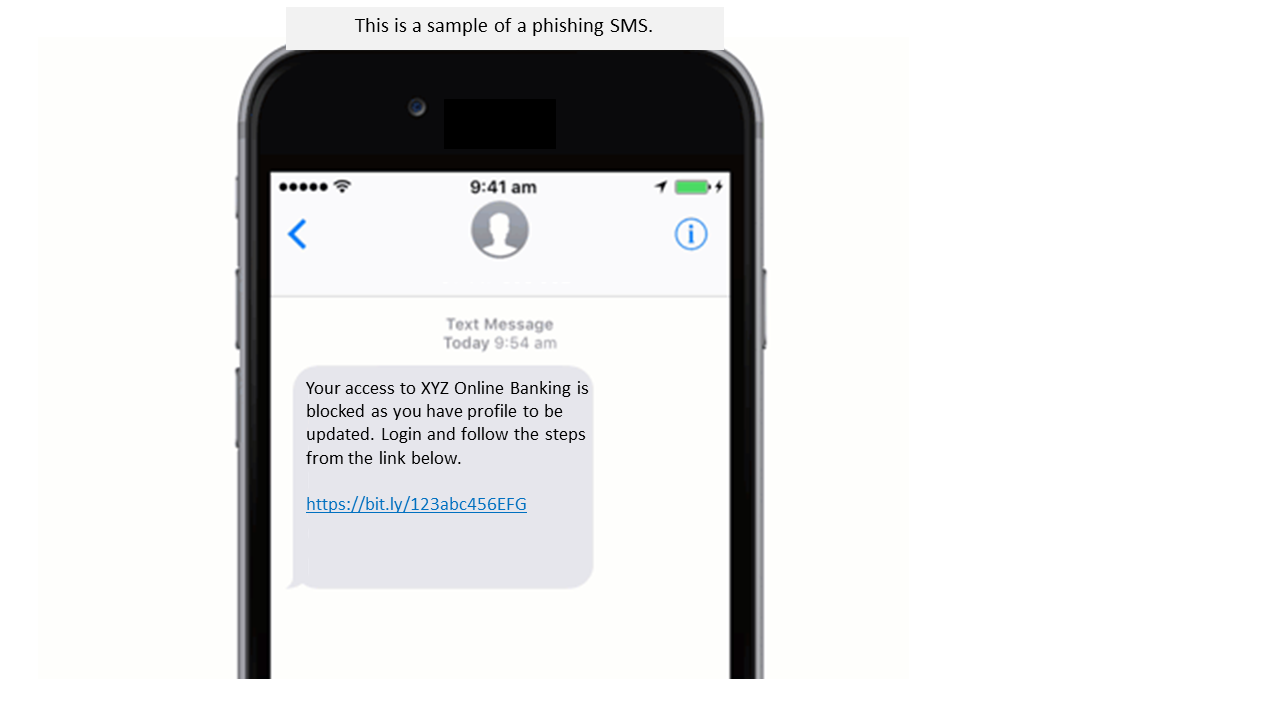

Caution: Stay alert from scam SMSes posing as OCBC

Please note that official OCBC SMSes will always come from "OCBC" and "OCBC Bank" and we will never include links in our SMSes.

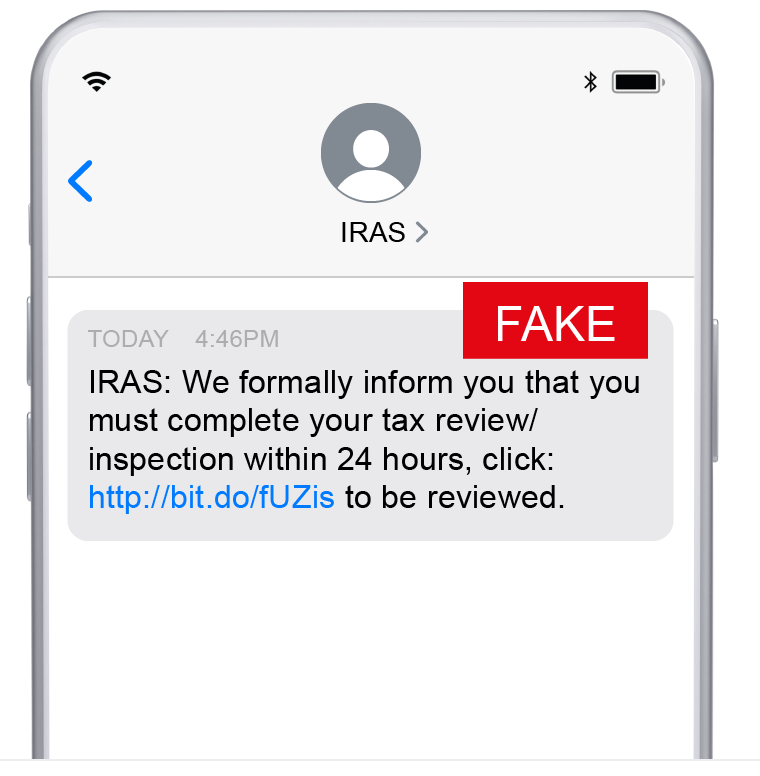

Sample of a scam SMS as follows:

Always remember:

- Never click on links in SMSes or emails that claim to be from OCBC

- Never provide your Access Code, PIN, card details or OTP (One-Time Password) to anyone or key such information into unverified webpages;

- To log in, always use OCBC’s official mobile banking app or go to the OCBC website > Login > Personal Banking (type the URL directly into your browser); and

- OCBC employees will never ask you to reveal your PIN/OTP or transfer funds to personal accounts

We have availed a dedicated option for customers calling our hotline – 6363 3333 – to report possible fraud (just press 9).

Be careful of who you trust

12 January 2024

Received a suspicious call from someone claiming to be an acquaintance or relative? Did a love interest you met online ask you for money? Scammers may be trying to prey on your trust. Do not let your guard down.

Join us and the National Crime Prevention Council (NCPC) to ACT Against Scams by remembering three simple steps: Add, Check, Tell.

COMMON THREATS

Here are two types of scams that aim to take advantage of your vulnerabilities. Be on your guard if you spot these signs:

Impersonation scams

How scammers may approach you:

You may be contacted by someone claiming to be from a reputable entity (e.g. government agency, bank, telco, postal delivery company or merchant), or a long lost friend or family member. In the latter case, they may even sound similar to that friend or family member. After making some conversation, imposters may ask you for money or for your personal banking details to resolve what they claim is an important issue. Their real intent, however, is to steal your money or identity.

Watch out for these tactics:

- Using compromised or spoofed accounts to impersonate your friends on social media or messaging apps (e.g. WhatsApp), imposters may ask for your personal or banking details, or request that you send them money (this may be under the guise of helping to sign you up for attractive contests or investment opportunities). You might later discover that fraudulent transactions have been made from your bank accounts.

- You receive a call from an unknown caller claiming to be an acquaintance or relative. He/she may use vague details about themselves and your supposed relationship to trick you into believing them. Such imposters may claim to be in need of urgent financial help (e.g. in a supposedly urgent or life-threatening situation) so that they can persuade you into sending money to help them.

- You get a call from someone – seemingly a bank representative – who asks you to address certain account or card transaction issues by first giving them your personal and/or bank account details. This is a ploy to get you to give him/her confidential information.

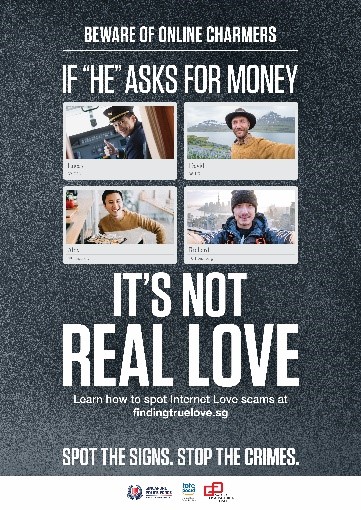

Internet love scams

How scammers may approach you:

Love scammers may reach out to you through online dating sites or social media. They often create attractive fake profiles to capture attention and use emotional tactics to gain trust. Eventually, they will demand ‘proof of affection’, often in the form of money, gifts or personal details.

Watch out for these tactics:

- They may claim to have developed feelings for you in a short period of time. To gain your interest and trust quickly, they may shower you with loving words or small gifts.

- They may share elaborate tales of misfortune to gain sympathy, then ask for money to get them through supposed hard times or a personal emergency. Often, inconsistencies appear in their stories over time.

- They may request a large sum at once or several payments over longer periods of time, promising to pay it all back. However, they will constantly make excuses for not returning the money – and eventually disappear.

‘TELL’ WITH OCBC AND NCPC

Take steps to protect yourself and your loved ones.

Inform the authorities if you encounter scams. The more quickly scams are reported, the more quickly the authorities can take action to prevent more people from falling prey to scams.

Always verify the authenticity of any information or request you get from entities that ask for your personal details or contact you unsolicited. To do so, contact the organisation or individual directly (e.g. via their website, email address, app, hotline or phone number). If in doubt, get a second opinion from a trusted friend or family member.

If you encounter potential scammers on social media or dating sites and apps, block and report them to the platforms involved. You can also report them anonymously via the chat feature on the Scam Alert website. Share your experience with friends and family to educate them.

If you – or people you know – are in an online ‘relationship’ with someone but are suspicious of their intentions, turn to trusted friends or family members for a second opinion.

If anyone, including an prospective partner you met online, requests money for investment, be alert and conduct your due diligence. Never send money to someone you have not met in person. When uncertain, seek advice from a friend or family member.

Download the ScamShield app by NCPC to report any scam calls and messages you may receive. Be wary of unusual requests received over WhatsApp, even if they were sent by your WhatsApp contacts.

Share the latest scam news and trends with your friends and family so that they do not become victims of scams.

Inform the authorities if you encounter scams. The more quickly scams are reported, the more quickly the authorities can take action to prevent more people from falling prey to scams.

Always verify the authenticity of any information or request you get from entities that ask for your personal details or contact you unsolicited. To do so, contact the organisation or individual directly (e.g. via their website, email address, app, hotline or phone number). If in doubt, get a second opinion from a trusted friend or family member.

If you encounter potential scammers on social media or dating sites and apps, block and report them to the platforms involved. You can also report them anonymously via the chat feature on the Scam Alert website. Share your experience with friends and family to educate them.

If you – or people you know – are in an online ‘relationship’ with someone but are suspicious of their intentions, turn to trusted friends or family members for a second opinion.

If anyone, including an prospective partner you met online, requests money for investment, be alert and conduct your due diligence. Never send money to someone you have not met in person. When uncertain, seek advice from a friend or family member.

Download the ScamShield app by NCPC to report any scam calls and messages you may receive. Be wary of unusual requests received over WhatsApp, even if they were sent by your WhatsApp contacts.

Share the latest scam news and trends with your friends and family so that they do not become victims of scams.

Explore other solutions OCBC has designed to safeguard your banking experience at: How to bank safely and securely.

ALWAYS REMEMBER TO ‘ACT’

Organised by the NCPC, the ACT Against Scams campaign aims to educate the public on how to prevent, spot and stop scams.

ADD

Install security tools like antivirus software to be better protected online.

CHECK

Look out for potential scam signs by verifying information with trusted sources.

TELL

If you encounter any scams, inform the authorities and let others know promptly.

ADD

Install security tools like antivirus software to be better protected online.

CHECK

Look out for potential scam signs by verifying information with trusted sources.

TELL

If you encounter any scams, inform the authorities and let others know promptly.

Learn more about ACT on the NCPC website.

If you believe you have fallen prey to a scam, please visit any OCBC branch. Alternatively, call our Personal Banking hotline on +65 6363 3333, then press 8 to report the scam. If you are in the queue to be served by a Customer Service Executive, you may choose to activate our emergency kill switch – also available via the OCBC Digital App and at selected OCBC ATMs – to protect your account(s).

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Do not inadvertently become an accomplice to criminal activity

1 January 2024

We wish to remind customers not to let third parties misuse their accounts as this could lead to criminal prosecution.

The Singapore Police Force has observed a trend of individuals who act as ‘money mules’ for crooks, or who sell their banking details or Singpass credentials.

If you do this, you would be smoothing the way for scammers’ criminal behaviour and helping them move criminal proceeds. You could also be held criminally liable under the 2023 amendments to the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA) and Computer Misuse Act (CMA).

Acting as money mules and selling banking details/Singpass credentials

Money mules are individuals who allow criminals to control their bank or payment accounts, or who use their accounts to receive or transfer funds under criminals’ instructions.

Some individuals sell their banking details or Singpass credentials to criminals, who then use these details for illegal activities like money laundering.

Although criminals may offer you a lot of money for your personal information, stay away from making such deals with them. Doing so could be a criminal offence – for example, selling Singpass credentials is strictly prohibited by the Singapore Government – and/or be in breach of OCBC’s Terms and Conditions.

If you are found guilty of any of the above, you may be liable for a fine, imprisonment or both.

For details, read the SPF advisory on CDSA and CMA Bill Amendments.

What to do if you wish to report your account?

If you have performed any of the above activities and wish to stop your account(s) from further being misused, please visit any OCBC branch. Alternatively, you may activate our emergency kill switch, available via the OCBC Digital app and at selected OCBC ATMs.

Do make a police report immediately as well.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Sounds too good to be true? It could be a scam.

8 September 2023

Came across an advvertisement that offered an unbelievably good deal? Did a job offer – promising lucrative commissions – suddenly fall into your lap? If something sounds too good to be true, it likely is.

Learn to identify the tricks used by scammers. Join us and the National Crime Prevention Council (NCPC) to ACT Against Scams by remembering three simple steps: Add, Check, Tell.

COMMON THREATS

Here are two types of scams that aim to expose your vulnerabilities:

Investment scams

How scammers may approach you:

Individuals claiming to represent stockbrokers, banks or financial companies may approach you with unsolicited investment opportunities. They may promise quick money and/or extraordinary returns at little to no risk. Such scammers often offer time-limited deals and gifts, or rebates, to pressure you into acting quickly. They may – in attempts to persuade you to invest in their bogus opportunities – repeatedly send you messages via social media or messaging apps.

Watch out for these tactics:

- If you express interest in the investment, the scammer will ask you to give them your personal information/bank account details, and/or install a fake investment app. They will claim that you need to do so to open an investment account.

- You may be asked to visit professional-looking websites – complete with fake client testimonials and case studies used to support the scammer’s false claims.

- The scammer may ask you to send money to a non-business account, supposedly to pay an ‘initial fee’ and for the investment. Later, when you try to withdraw your returns or initial investment amount, you may realise that the scammer has disappeared with your money.

Job scams

How scammers may approach you:

Scammers may approach you with unsolicited offers that promise low-effort, high-paying jobs; or ‘guaranteed’ ways of generating fast income. If you do express interest, they will try to get you to hand over your money, personal information and/or bank account details, which they then use to commit fraud and theft.

Watch out for these tactics:

- You receive, via messaging apps, unsolicited messages offering part-time job opportunities from seemingly legitimate companies or recruiters. These messages are typically poorly written or sent from an unknown or unverifiable number.

- You are added to a group chat where multiple people – possibly the scammer(s) using multiple accounts – share fake testimonials to drum up interest in the job opportunity.

- You are directed to a website/app and asked to enter your personal information/banking etails to access a job opportunity. Any details you enter may be stolen to commit fraud.

- Scammers may offer you a commission for performing simple tasks – reviewing restaurants or completing simple surveys, for example – through messaging platforms like WhatsApp or Telegram. To gain your trust, they may initially pay you a small commission for each task you do. However, they will eventually ask you send them increasingly large sums of money to continue accessing the tasks. They will then vanish with the cash.

‘CHECK’ WITH OCBC AND NCPC

Adopt these security measures to safeguard your online experience:

Only download apps from official stores like the App Store (for iOS) or Google Play Store (for Android) and review the permissions that are requested. Make sure they are genuinely necessary.

Keep your devices secure and up to date by enabling automatic updates and installing anti-virus software on your phone, computer and other devices with Internet access.

Always check that the websites you browse are official ones. Do not let your web browser or devices store your login credentials.

Conduct your investment dealings exclusively with companies licensed by the Monetary Authority of Singapore (MAS). Always do a thorough check on companies and their representatives using resources such as the Financial Institutions Directory, Register of Representatives or Investor Alert List (available on the MAS website). If a company is based outside of Singapore, check if it is licensed with the relevant overseas authority.

Never give out your Online Banking login credentials, card details or One-Time Passwords (OTPs) to anyone.

Do not transfer money to or agree to receive money from people you do not know. Be responsible for all transactions made under your account(s) and do not let third parties use your account(s) to make transactions.

Explore other solutions OCBC has designed to safeguard your banking experience at: How to bank safely and securely.

ALWAYS REMEMBER TO ‘ACT’

Organised by the NCPC, the ACT Against Scams campaign aims to educate the public on how to prevent, spot and stop scams.

ADD

Instal security tools like antivirus software to be better protected online.

CHECK

Look out for potential scam signs by verifying information with trusted sources.

TELL

If you encounter any scams, inform the authorities and let others know promptly.

Learn more about ACT on the NCPC website.

If you believe you have fallen prey to a scam, please visit any OCBC branch. Alternatively, call our Personal Banking hotline on +65 6363 3333, then press 8 to report the scam. If you are in the queue to be served by a Customer Service Executive, you may choose to activate our emergency kill switch – also available via the OCBC Digital App and at selected OCBC ATMs – to protect your account(s).

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Be alert to scams that use fear tactics

19 June 2023

Is someone telling you that, to avoid serious consequences, you must reveal your banking details or personal information? Creating a sense of fear and urgency like this is a common tactic used by scammers to make it harder for their targets to think critically and take precautions.

Be wary – even if the caller claims to be from a government agency or a reputable business.

Learn how to spot such fear tactics. Join us and the National Crime Prevention Council (NCPC) to ACT Against Scams by remembering three simple steps: Add, Check, Tell.

COMMON THREATS

In our previous security advisory (available below), we learnt how to ACT against the dangers of malware, phishing and impersonation scams. Now, let us learn about:

Government official impersonation scams

How scammers may approach you:

Scammers might contact you claiming to be government officers investigating an alleged offence you have committed in Singapore or overseas. To gain your trust, they may even use a real officer’s name. Their aim in leveraging the authority and reputation of the officer is to stop you from questioning their demands.

Watch out for these tactics:

- Using the threat of legal action or arrest, they will try to manipulate you into revealing personal details. They may claim that they need such details before they can tell you more about the (fake) investigation that they are conducting.

- They may also ask you to visit websites that would, under the guise of ‘verifying your identity’, prompt you to scan a Singpass QR code or enter your online banking details. Your details would then be stolen and used for fraudulent activities.

Learn more about Impersonation Scams.

Tech support scams

How scammers may approach you:

Impersonating employees from legitimate companies, scammers may call you – or scare you into calling them with website pop-ups made to look like warnings from your device or anti-virus software. They often claim that there is a software, online account or Wi-Fi issue that requires your immediate attention. Their goal? To create anxiety so that you will act hastily without confirming the legitimacy of their claims. .

Watch out for these tactics:

- They may threaten to suspend your account unless you provide them with sensitive information or make an immediate payment to ‘fix’ the issue. They may ask you to share personal and banking details via a spoofed website/email address made to look like it belongs to a legitimate company or government agency.

- Others may claim that your device or Wi-Fi network has been hacked and/or fraudulent transactions were made in your name. Under the guise of diagnosing the issue, they may ask you to download a remote access application (which would give them access to your device) and have you log in to your online banking account or share sensitive information (e.g. card details or One-Time Passwords).

‘ADD’ WITH OCBC AND NCPC

Adopt these security measures to safeguard your online experience:

Be very wary of messages containing links or attachments that prompt downloads. Only download apps from the App Store (for iOS) or Google Play Store (for Android).

Download the ScamShield app by NCPC. ScamShield can block scam calls and detect scam SMSes.

Instal anti-virus software and malware removal tools on your phone, computer and other devices with Internet access; and enable automatic updates. Look for software with features that help identify and block fraudulent pop-up ads. When installing apps, review the permissions that are requested to ensure they are necessary.

Enable biometric authentication for your devices and apps (where available) and two-factor authentication (2FA) for any online accounts you have.

Enable OCBC OneToken so you can log in to your online banking account and authorise transactions securely.

Opt for e-Statements to closely keep track of all your transactions via OCBC Internet Banking or the OCBC Digital app.

Explore other solutions OCBC has designed to safeguard your banking experience at: How to bank safely and securely.

ALWAYS REMEMBER TO ‘ACT’

Organised by the NCPC, the ACT Against Scams campaign aims to educate the public on how to prevent, spot and stop scams.

ADD

Instal security tools like antivirus software to be better protected online.

CHECK

Look out for potential scam signs by verifying information with trusted sources.

TELL

If you encounter any scams, inform the authorities and let others know promptly.

Learn more about ACT on the NCPC website.

If you believe you have fallen prey to such scams or that your OCBC account details/funds may be, or may have been, compromised, please call our Personal Banking hotline for assistance. Press 9 to report fraud or 8 to temporarily freeze all your accounts and cards.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Be ready to ACT Against Scams!

20 March 2023

Safeguard your financial security and well-being

Last year saw a spike in the number of scams reported in Singapore. Millions of dollars have been lost to scams, with younger adults particularly affected by job and e-commerce scams, and seniors increasingly targeted by fake friend calls, investment, and phishing scams.

So how can you avoid falling prey to scams?

Join us and the National Crime Prevention Council (NCPC) to ACT against scams. By remembering just 3 simple steps – Add, Check, Tell, we will be better equipped to protect ourselves and our loved ones.

WHAT IS ACT?

Organised by the NCPC, the ACT Against Scams campaign aims to educate the public on how to prevent, spot and stop scams.

ADD

Install security tools (e.g. antivirus software) on your devices and adopt security features (e.g. biometric authentication) that enhance your online protection.

CHECK

Be vigilant and on the lookout for scam signs. Always check and verify information you receive, or are asked to share, with trusted sources.

TELL

Inform the authorities, bank and your friends, family, and community about scam encounters promptly.

Learn more about ACT on the NCPC website.

Read about how we can all “ACT Against Scams” in the Scaminar 2023 keynote address by the Ministry of Home Affairs.

COMMON THREATS

Be better prepared to ACT by learning more about the following threats:

Phishing scams

Phishing scammers may approach via email, SMS or social media pretending to be from a legitimate organisation and often offer something that is not real (like a reward) or use fear tactics (like demanding immediate action to resolve a fictitious issue) to trick victims into disclosing confidential information (e.g. their NRIC number, card details, online banking or Singpass credentials). Learn more about Phishing Scams.

Malware

Malware is a type of malicious software that cybercriminals use to infect their target's computers and mobile devices to perform criminal activities, such as stealing confidential data, gaining remote control over the compromised device and data, and spying on a person’s online activities. Learn more about Malware.

Impersonation scams

Impersonators will contact their targets claiming to be a member of a legitimate business, bank, or government official, and use fear tactics to try and convince them to reveal personal details which they then use to commit fraud. Learn more about Impersonation Scams.

Learn about the above and other common threats.

‘ADD’ WITH OCBC

Adopt the following security measures by OCBC to safeguard your banking experience:

Transaction Alerts

Set up e-alerts to receive timely notifications related to your account(s) and banking activities.

Transaction Limits

Customise your daily transaction limits according to your needs to better secure your funds.

E-Statements

Opt for e-Statements to closely keep track of all your transactions via Internet Banking or the OCBC Digital app.

For an extra layer of protection, download the ScamShield app by the NCPC to block scam calls and detect scam SMSes.

Learn how to make use of these features and explore other solutions OCBC has designed to safeguard your banking experience at: How to bank safely and securely.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Protect yourself against malware

Look out – especially if you have an Android device.

New variants of Android malware (‘malicious software’) allow scammers to control your device remotely or steal sensitive information like login credentials or card details. This means that scammers can log in to your account and make fraudulent transactions or transfers without your knowledge.

Android malware may be found in apps available in the Google Play Store. They could also be disguised as ‘helpful apps’ in Android Package Kit (APK) files that you may be tricked into downloading. By downloading them or giving access to certain functions, you may unwittingly allow scammers to take control of your device.

The Police and the Cyber Security Agency of Singapore have released an advisory on malware. Read more.

Here is how you can protect yourself against malware:

- Only download apps from the App Store (for iOS) or Google Play Store (for Android).

- Do not download apps (e.g. email attachments, pop-up advertisements or links coming from unsolicited emails, messages or social media posts) without verifying the authenticity and source.

- When installing apps, review the permissions that are requested. Make sure they are genuinely necessary. Asked to download additional apps? Be very wary.

- Install anti-virus software and malware removal tools on phones, computers and devices with Internet access.

- Always get the latest versions of your devices’ operating systems and applications – the latest security patches will address security vulnerabilities. Enable automatic updates so your devices are protected.

- Check transaction details carefully and read the notifications we send you. Notify us immediately if you receive alerts for transactions you did not make.

If you believe you have fallen prey to a scam, please visit any OCBC branch. Alternatively, call our Personal Banking hotline at 1800 363 3333 (+65 6363 3333 if you are overseas), then press 8 to report the scam. If you are in the queue to be served by a Customer Service Executive, you may choose to activate our emergency kill switch – also available via the OCBC Digital app and at selected OCBC ATMs – to protect your account(s).

As scams constantly evolve, please stay vigilant at all times.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Be wary of scammers this festive season

19 December 2022

’Tis the season to be vigilant

The festive season will see a surge in scams. Let our new Safety and Security information hub be your one-stop guide to banking safely online. Learn about the safeguards we have that protect you when you bank online.

PROTECT YOURSELF FROM SCAMMERS

Do you know which types of scams are most prevalent in Singapore? So you can better protect yourself, familiarize yourself with scam tactics – and what to do when you encounter a scam – on the Safety and Security information hub.

e-Commerce scams

Stay safe online. Read our response to the top questions about e-Commerce scams:

- What e-Commerce scams are and how such scammers operate

- How to avoid becoming a victim

- What to do if you have been scammed

Job scams

Got a lucrative job opportunity that requires no job experience? Learn the tactics scammers use to prey on your aspirations.

Impersonation scams

Learn how to spot impersonators who may approach you by claiming to be from a legitimate business or the local government.

Spot the scams

Stay safe this festive season by learning more about these and other prevalent scams in Singapore (e.g. phishing scams, loan scams and love scams).

BANK SAFELY AND SECURELY

Explore the Safety and Security information hub to discover the measures that we have in place to help you bank safety. Learn how to get help to resolve your concerns and read about:

How to get started with online banking

Take the first steps towards a safe and secure online banking experience. Learn how to set up the OCBC OneToken, activate the biometric login feature and set limits for your transactions.

How we protect you

Explore the security features and measures that we have designed to safeguard your account(s), such as the OCBC Kill Switch which you can use to temporarily freeze your accounts and cards to stop fraudsters.

Security advisories

Stay on top of evolving fraud and cyber threats. Learn how to better protect yourself and read more about the latest measures we have implemented for your protection on this page.

Always remember. Never reveal your card details, online banking login credentials or One-Time Passwords (OTPs) to anyone. Learn to bank safely and securely.

Got a call from someone claiming to be from OCBC? Beware

09 November 2022

Several customers have reported receiving calls from scammers claiming to be from OCBC.

Be on your guard. Calls that are not from us have these tell-tale signs:

- The caller might ask you to reveal your Online Banking login credentials, card details, PIN and/or your One-Time Password (OTP) on the pretext of helping you solve ‘issues’ with your account or card. This is a trap: They will use these details to take over your account.

- The caller might also transfer the call to another scammer impersonating a government official or police officer, who will then request that you transfer money to them – supposedly to ‘resolve the issues’ with your account or card, or to ‘solve a crime’.

Beware of such calls. They are NOT from us.

How to protect yourself:

- Be wary of calls with the ‘+’ prefix, especially when you are not expecting an international call. Always verify the identity of the person(s) and the organisation(s) by calling their hotline numbers.

- Do not provide your Access Code, PIN, card details or OTP to anyone. OCBC employees will never ask you to reveal your PIN/OTP or transfer funds to personal accounts.

- Do not call any numbers or click on any links in SMSes. We will never send you SMSes or emails with clickable URLs.

- Read the notifications we send you carefully and alert us if any transaction was not made by you.

- Never authorise a transaction or login unless you know its purpose.

If you believe you have fallen prey to a scam, please visit any OCBC Bank branch or call our Personal Banking hotline at 6363 3333 (or +65 6363 3333 if you are overseas) and press 9 to report fraud. To temporarily freeze all your accounts, you can activate the emergency kill switch via the OCBC Digital app, selected OCBC ATMs or our hotline (press 8).

As scams constantly evolve, please stay vigilant at all times.

Visit ScamAlert.sg to learn how to spot scams and test how alert you are by taking the National Crime Prevention Council’s (NCPC) Scam Buster Quiz.

By visiting the above URL, you will be redirected to the NCPC website.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

When deals sound too good to be true

08 November 2022

Tempted by an online offer or advertisement shouting a fantastic deal or product that is way below market price? Did the e-commerce merchant or social media seller insist on your making a bank transfer instead of using the online platform’s secure payment option?

Beware of e-commerce and social media advertisement scams as you browse online marketplaces and social media accounts. Some advertisements may even claim that they are offering deals from the Bank. They are not.

The Singapore Police Force reported that 2,707 people fell victim to e-commerce scams in 2021. Do not be the next victim.

Read on for tell-tale signs of e-commerce scams and how to protect yourself.

![]() E-commerce or social media advertisement scams prey on your fear of losing out on a fantastic deal

E-commerce or social media advertisement scams prey on your fear of losing out on a fantastic deal

Here is how they may prey on you:

- What they will steal: Your money, digital banking login credentials and card details.

- Where:Through online marketplaces or social media accounts.

-

How: Scammers may tempt you with deals or products that are way below the market price or disguised as limited time-only or flash deals. They will ask you to make bank transfers instead of using the platform’s payment options.

In some cases, after clicking on a social media advertisement, you will be brought to a website and asked to key in your contact details so a ‘representative’ can contact you. In other cases, you may be asked by a ‘representative’ from a postal or delivery company to click on a URL and provide your card details to resolve issues with your parcel.

![]() How to protect yourself

How to protect yourself

- Beware of deals that sound too good to be true. Always check the credibility of online sellers by reading reviews of their services. As far as possible, purchase only from reputable merchants.

- Avoid making payments or deposits in advance. If an advance payment is required, use the shopping platform’s secured payment option or arrangement that releases payment to the seller only when you receive the item.

- Do not provide your Access Code, PIN, card details or One-Time Password to anyone. Do not key such information into unverified webpages.

- Never authorise a transaction or login unless you know its purpose.

- Always read your bank notifications carefully and notify us immediately if the transactions are not performed by you.

If you believe you have fallen prey to a scam, please visit any OCBC Bank branch or call our Personal Banking hotline at 6363 3333 (or +65 6363 3333 if you are overseas) and press 9 to report fraud. To temporarily freeze all your accounts, you can activate the emergency kill switch via the OCBC Digital app, selected OCBC ATMs or our hotline (press 8).

Be vigilant. Protect yourself from scams.

Visit ScamAlert.sg to learn how to spot scams and test how alert you are by taking the National Crime Prevention Council’s (NCPC) Scam Buster Quiz.

By visiting the above URL, you will be redirected to the NCPC website.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

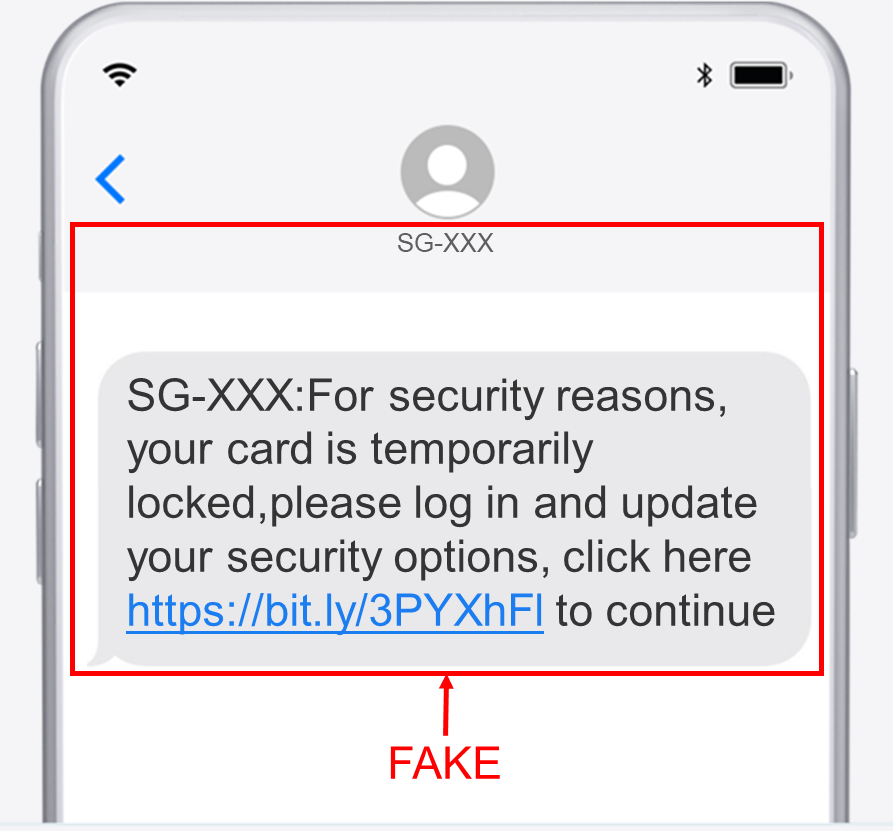

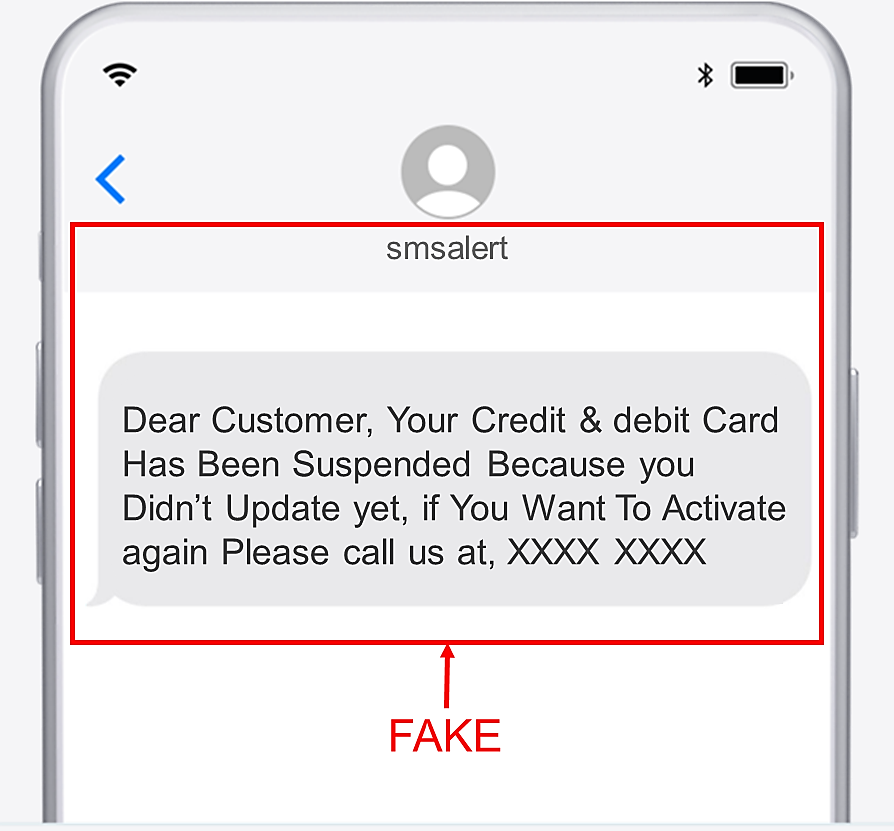

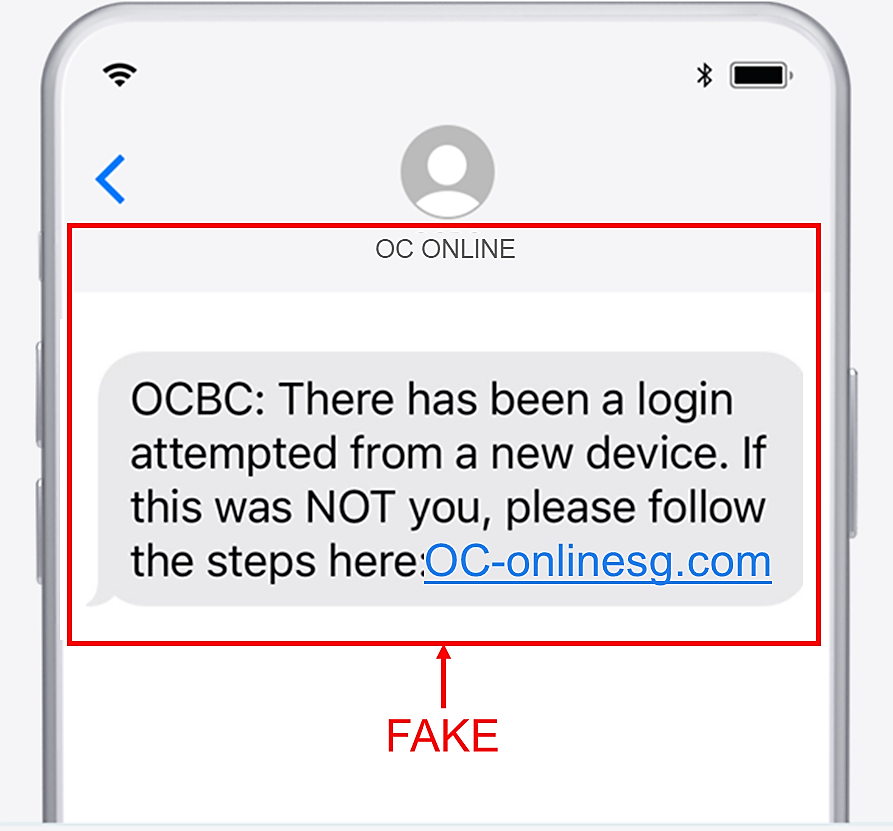

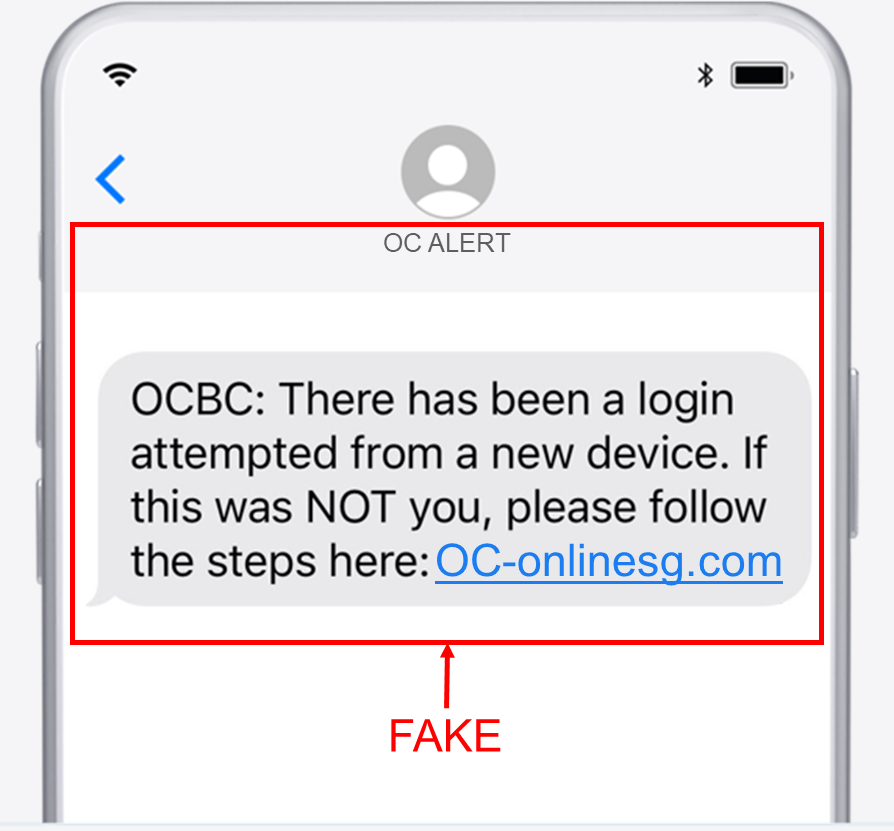

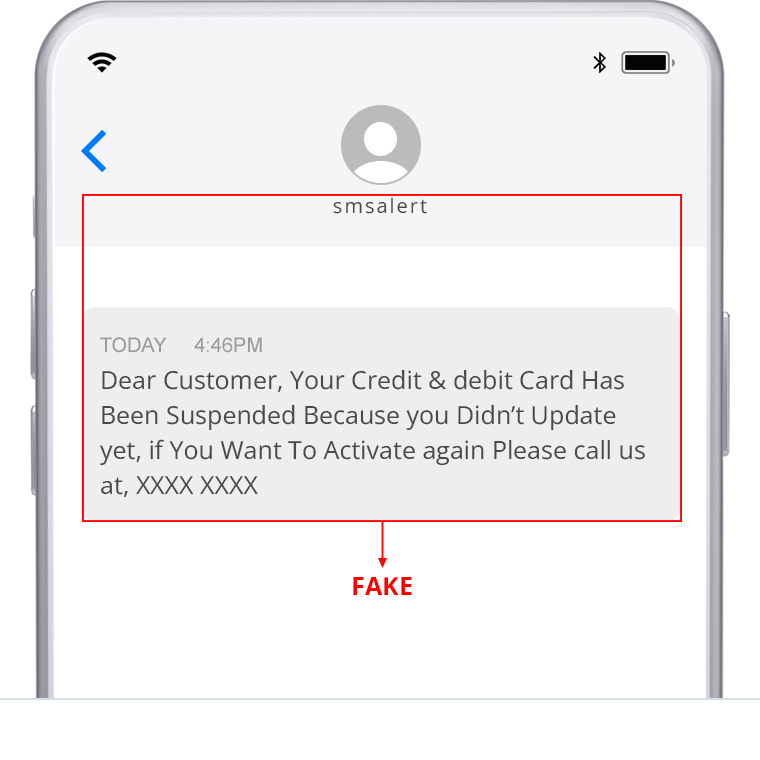

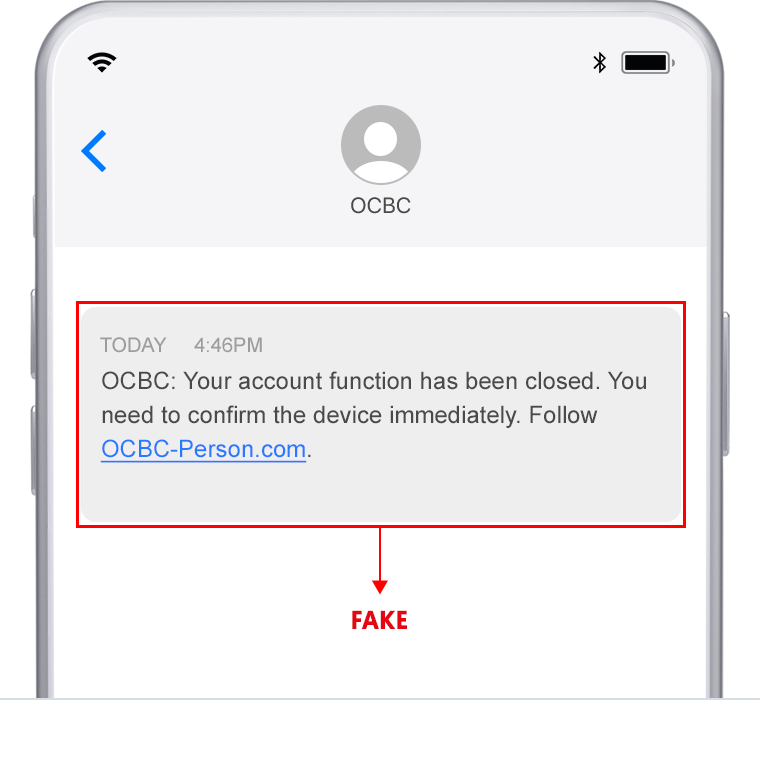

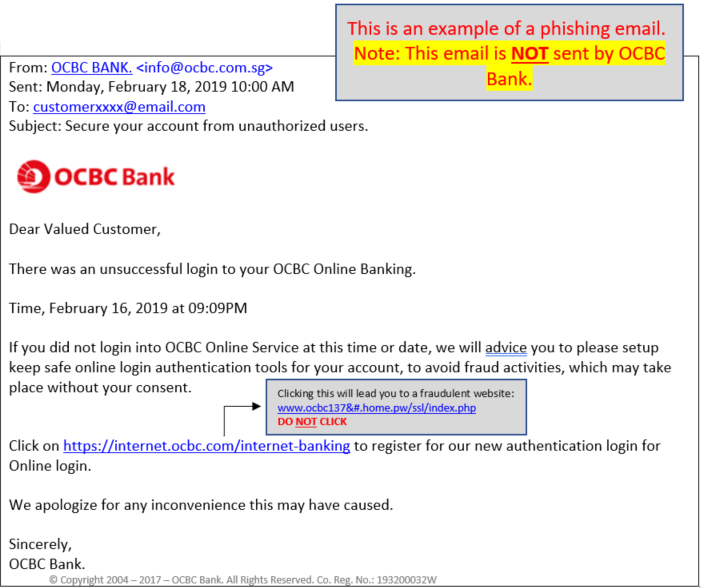

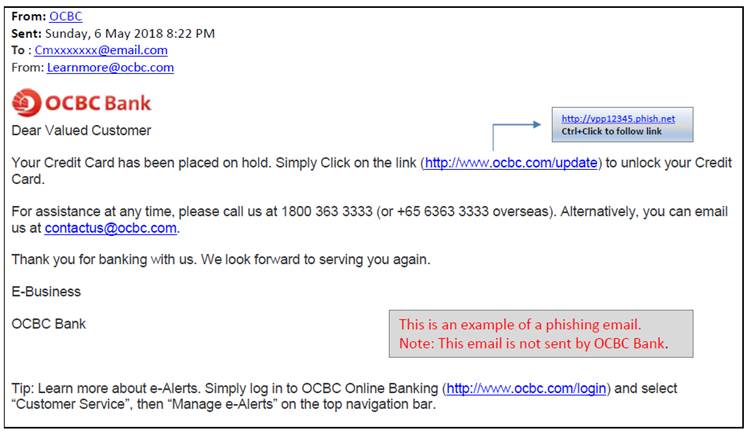

Phishing scams involving banks are on the rise again

19 October 2022

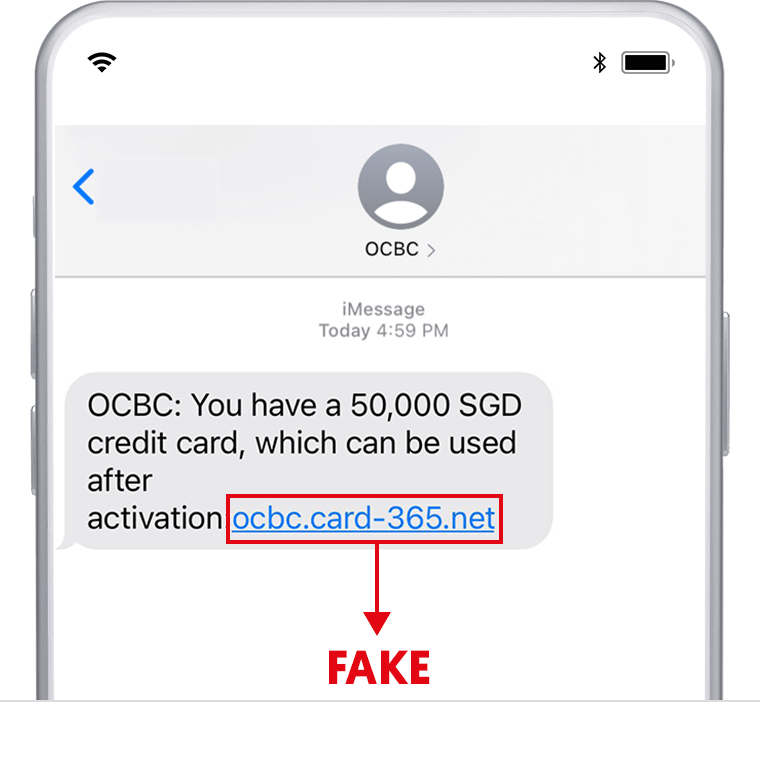

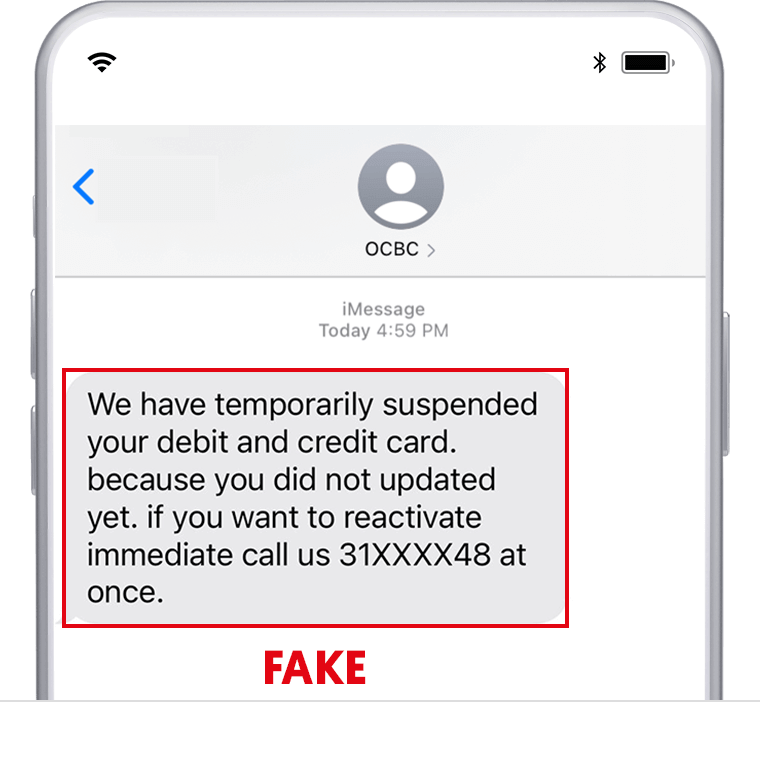

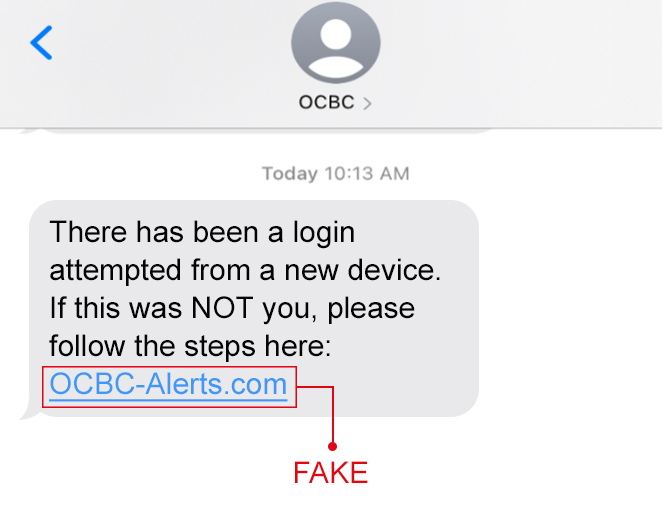

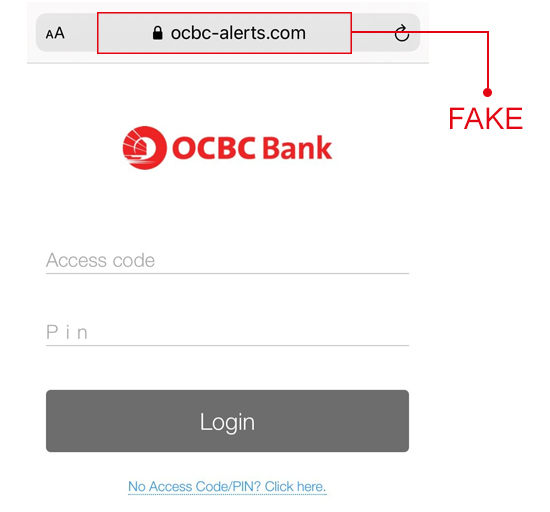

The police have observed another surge of phishing scams involving scammers who impersonate banks and target victims through SMS.

Beware of SMSes that ask you to call a hotline or click on a URL to resolve an issue involving your bank account or credit card.

- If you call the hotline, you will be asked to provide your personal and banking details (supposedly to verify your identity), followed by your One-Time Password (OTP).

- If you click on the URL, you will be taken to a website controlled by the scammers and asked to provide your online banking login credentials, card details or OTPs.

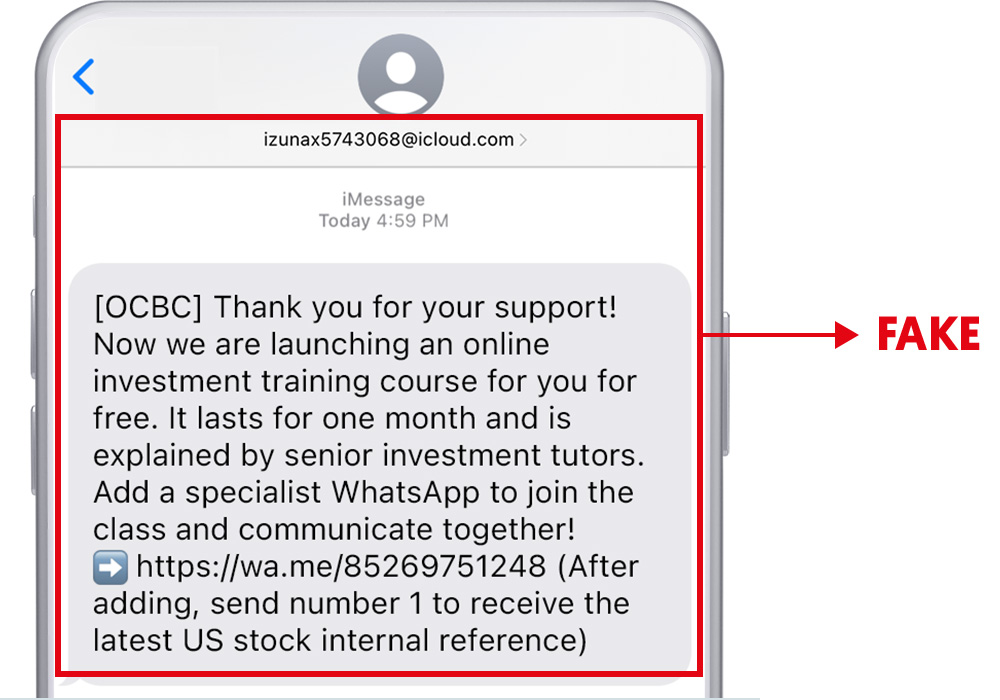

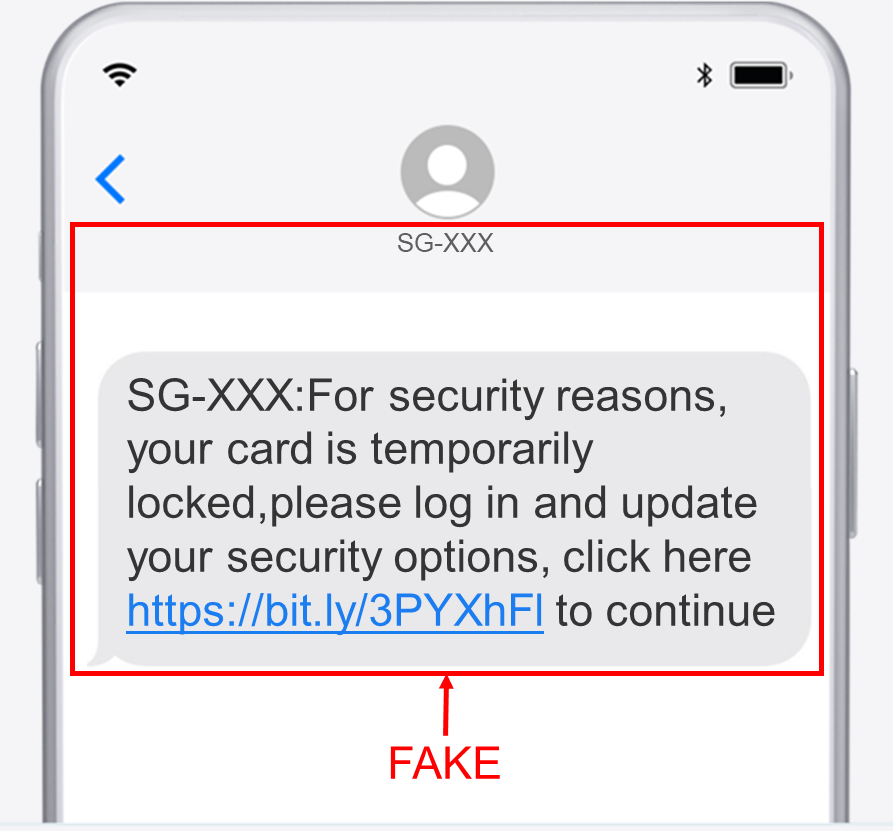

Here are samples of such phishing SMSes:

Read the police advisory on the resurgence of bank phishing scams here.

How to protect yourself:

- Do not call any numbers or click on any links in SMSes. We will never send an SMS to inform you about login issues, account closures or your being locked out of your account.

- Do not provide your Access Code, PIN, card details or OTP to anyone. OCBC employees will never ask you to reveal your PIN/OTP or transfer funds to personal accounts.

- Do not key such information into unverified webpages. We will never send you any SMSes or emails with clickable URLs.

- Use only the official OCBC Digital mobile banking app or go to the OCBC website > Login > Personal Banking.

- If you believe you have fallen prey to a scam, please visit any OCBC Bank branch or call our Personal Banking hotline at 6363 3333 (or +65 6363 3333 if you are overseas) and press 8 to report fraud. To temporarily freeze all your accounts, you can activate the emergency kill switch via the OCBC Digital app, selected OCBC ATMs or our hotline (press 8).

As scams constantly evolve, we must keep ourselves updated on the latest trends and be alert to the signs to look out for.

Visit ScamAlert.sg to learn how to spot scams and test how alert you are by taking the National Crime Prevention Council’s (NCPC) Scam Buster Quiz.

By visiting the above URL, you will be redirected to the NCPC website.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

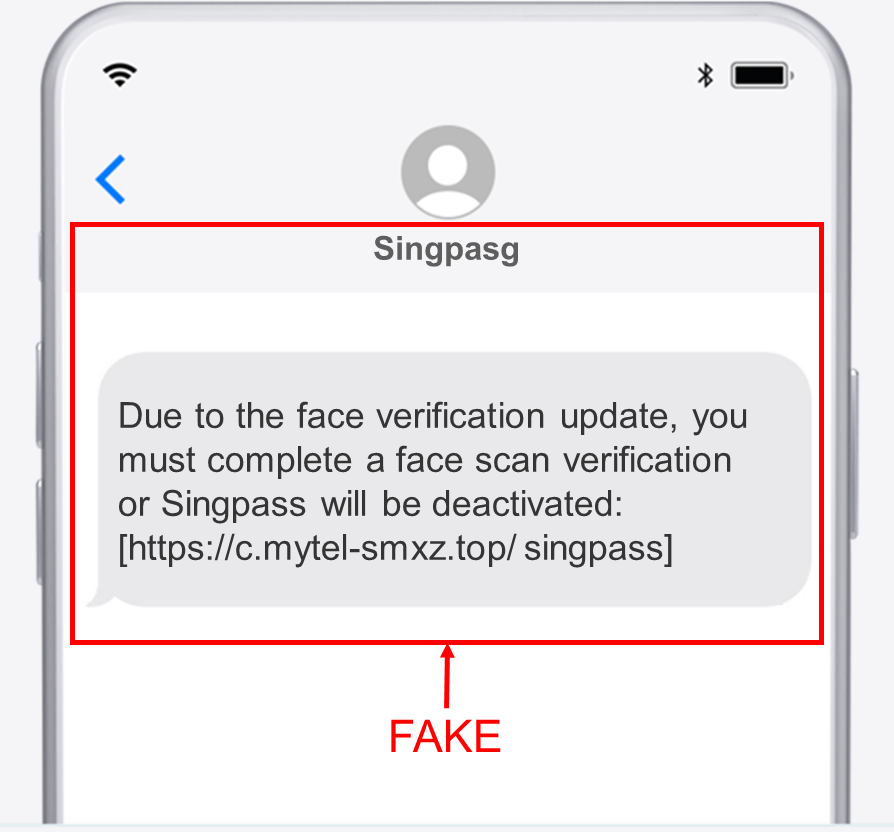

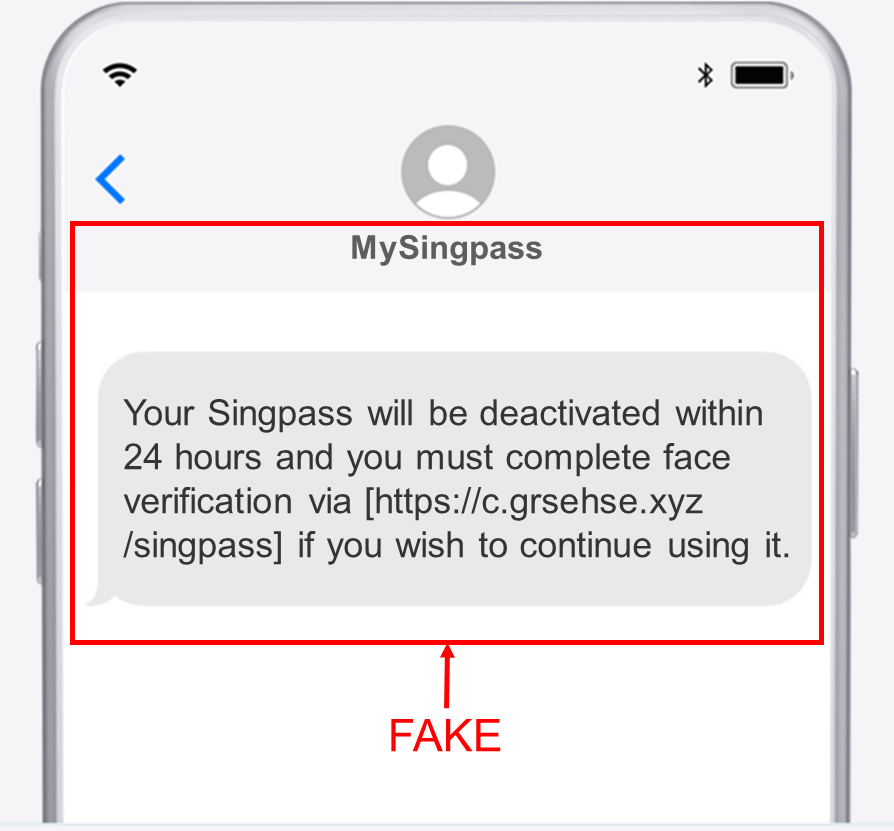

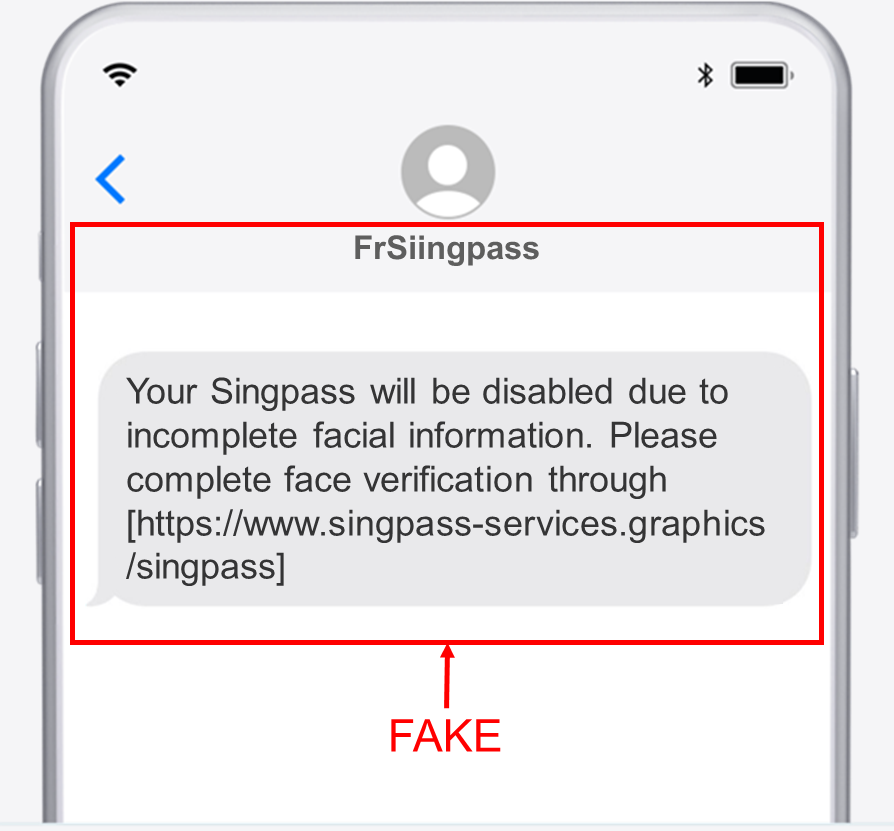

Protect your Singpass login credentials

7 October 2022

Scammers are now sending phishing SMSes to obtain your Singpass login credentials.

If you click on the links in such SMSes, you will be taken to a spoofed Singpass login page and asked to key in your Singpass ID and password.

Thereafter, you will be directed to a spoofed bank login page and prompted to enter your Online Banking credentials and One-Time Password (OTP). The scammers will then use these to fraudulently apply for credit cards or open bank accounts.

Please take heed when asked for your Singpass login credentials. Do not let your guard down.

Read the police advisory on phishing scams that target your Singpass login credentials here

To protect yourself, keep these tips in mind:

- Singpass is your digital identity. Treat it with care as your Singpass login credentials can be used to access thousands of services, including applying for credit cards or opening bank accounts.

- Do only scan the Singpass QR code on the website of the digital service that you wish to access or tap the Singpass QR code on the app of the digital service.

- DO NOT key any personal information into unverified webpages.

- If you believe you have fallen prey to a scam, please visit any OCBC Bank branch or call our Personal Banking hotline at 6363 3333 (or +65 6363 3333 if you are overseas) and press 9 to report fraud. To temporarily freeze all your accounts, you can activate the emergency kill switch via the OCBC Digital app, selected OCBC ATMs or our hotline (press 8).

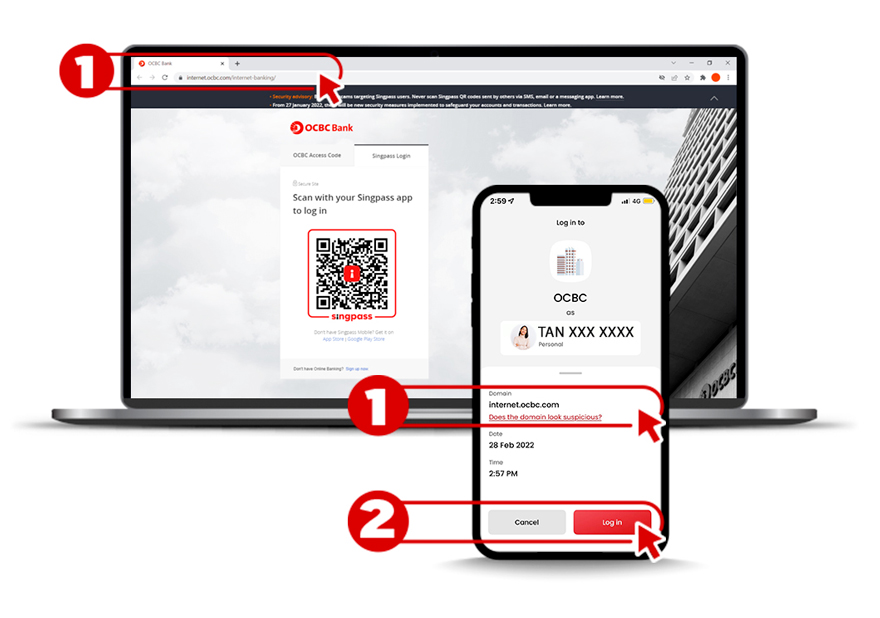

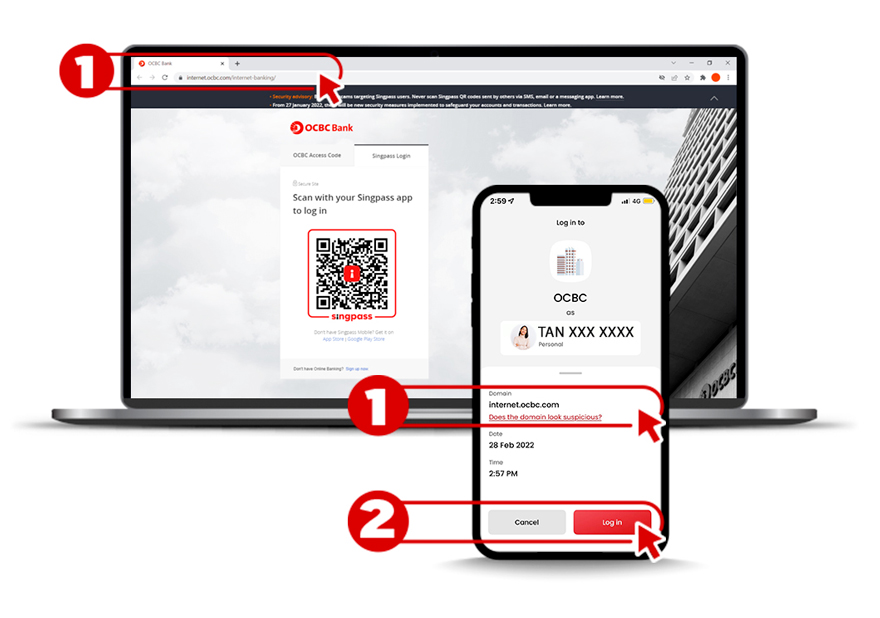

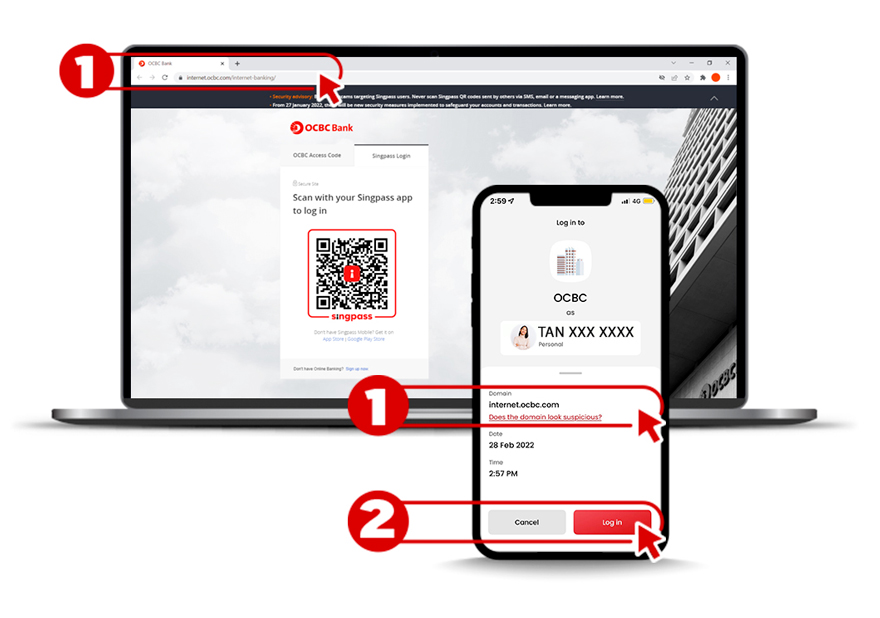

Logging in to OCBC Internet Banking by scanning a Singpass QR code?

| Always check and ensure that the OCBC URL shown in your Singpass app matches the URL on your browser. | |

| OCBC URL: internet.ocbc.com | |

| Ensure that the login or transaction request was initiated by you before tapping the ‘Log In’ button on your Singpass app. |

As scams constantly evolve, we must keep ourselves updated on the latest trends and be alert to the signs to look out for.

Visit ScamAlert.sg to learn how to spot scams and test how alert you are by taking the National Crime Prevention Council’s (NCPC) Scam Buster Quiz.

By visiting the above URL, you will be redirected to the NCPC website.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Do your part in keeping scammers away

23 September 2022

We have robust controls in place – two-factor authentication and One-Time Passwords – to safeguard your accounts and transactions. But these measures alone are not enough as scammers are continually devising ways to trick you into giving away your Online Banking login credentials and card details.

These can range from email spoofing and phishing to posing as merchants or companies asking you to open accounts with them.

Always review your transaction details and notify us immediately if you see any suspicious activity in your account(s).

Read on for the ways to protect yourself from scams.

How to protect yourself from scams

-

Update your mobile number and email address with us to receive e-Alerts and One-Time Passwords (OTPs)

e-Alerts notify you of transactions made using your account so you can inform us quickly if they were not made by you.

OTPs are sent via email or SMS as an extra layer of protection before you can perform certain ‘high-risk’ transactions.

Hence, it is crucial for you to ensure your contact details are updated with us.

Here is how you can update them:

-

OCBC Internet Banking

Log in > Customer service > Change personal details

-

OCBC Digital app

Log in > Menu > Profile & Settings > Update phone number/email

Remember, we will never send you SMSes to inform you about login issues, account closures or your being locked out of your account. Received SMSes or emails with clickable URLs? They are not from us.

-

-

Read your letters and statements

Do not ignore documents – e.g. letters and statements – that we send you. Read them carefully and inform us if you see any unfamiliar transactions.

Here is how you can view your documents:

-

OCBC Internet Banking

Log in > Your accounts > Documents

-

OCBC Digital app

Log in > Tap on the left menu bar > Documents

To protect your account details, you will be asked – before you can access the documents – to enter an 11-character alphanumeric password (case-sensitive) in the following format:

-

-

Get in touch immediately if needed

If you believe you have fallen prey to a scam, call our Personal Banking hotline hotline at 6363 3333 or (+65 6363 3333 if you are overseas) for assistance. Press 9 to report fraud or 8 to temporarily freeze all your accounts and cards.

Visit ScamAlert.sg to learn how to spot scams and test how alert you are by taking the National Crime Prevention Council’s (NCPC) Scam Buster Quiz.

By visiting the above URL, you will be redirected to the NCPC website.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Time to update the software version for your device/browser

Apple Inc. released an important security update for iOS devices recently. This update will fix a security flaw that allows hackers to take control of iOS devices and access data stored within.

Google has also advised users to download the latest update for their Chrome browser to fix a security flaw, where a feature in the browser allows applications and web services to be launched directly from a webpage.

Read more on Apple’s software update here and Google’s Chrome browser security update here.

We urge you to update your devices and Chrome browser with the latest software as soon as possible. Subsequently, do update your software regularly for better security.

How to update the software

iOS device

Visit Apple’s website for details or take the following steps:

|

|

|

Android device

Visit Android’s website for details or take the following steps:

|

|

|

Google’s Chrome browser

Check if the latest version has already been updated automatically by taking the following steps:

- Click on the three dots at the top right corner of the browser

- Select ‘Help'

- Select ‘About Chrome’

- Click on ‘Update Google Chrome’ button if the browser has not been updated with the latest patch

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

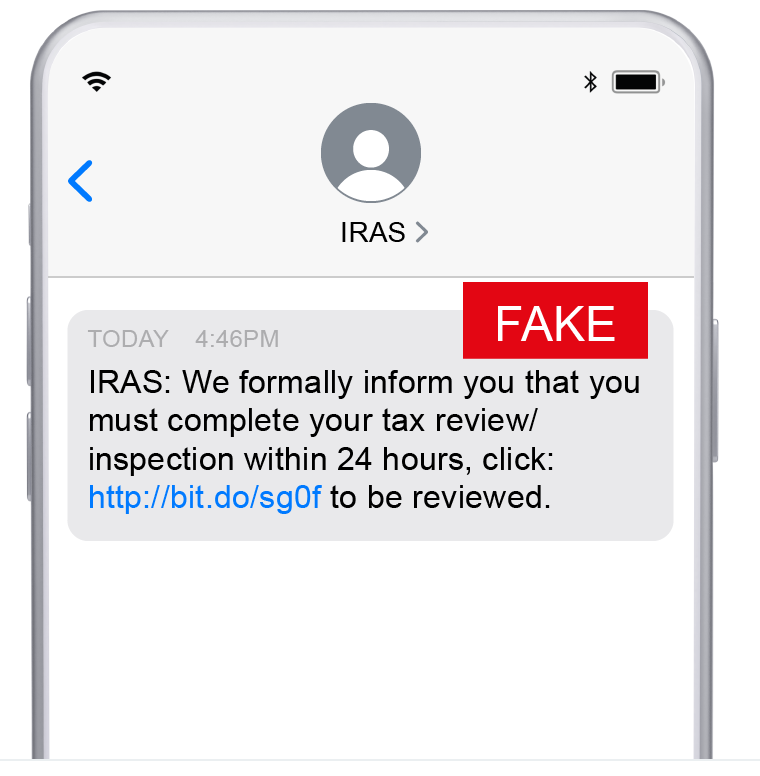

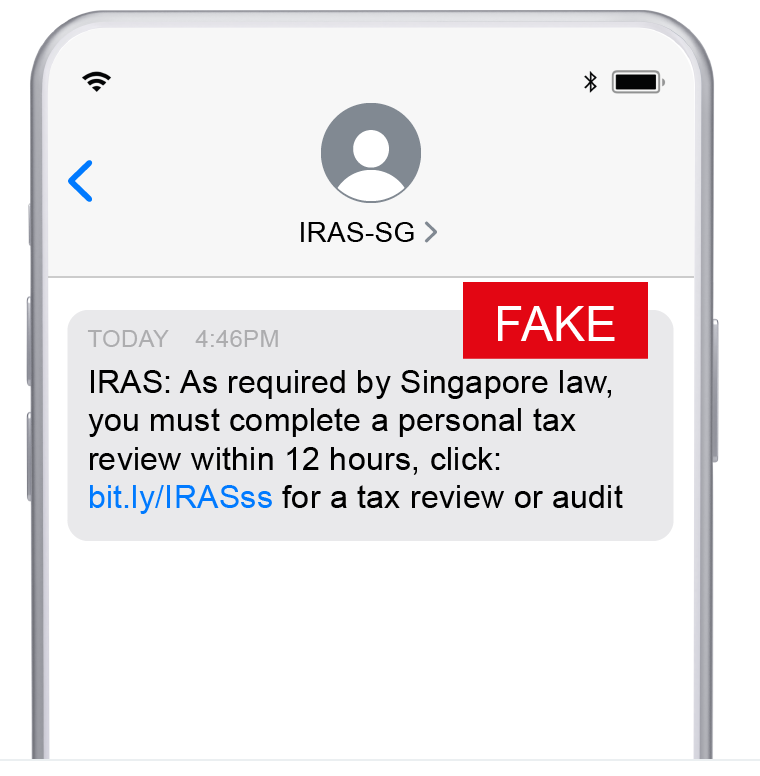

Protect your Singpass details

17 August 2022

Do be extra alert if asked for your Singpass details. Scammers are now trying to obtain Singpass details through phishing SMSes claiming to be from government agencies such as IRAS.

Upon clicking on the link in such SMSes, victims will be directed to a spoofed Singpass login page and asked to key in their Singpass ID and password.

Thereafter, victims are redirected to a spoofed bank login page where they are prompted to enter their Online Banking credentials and One-Time Password (OTP). These will be used to apply for credit cards or open bank accounts.

Here are samples of such phishing SMSes:

Read the police advisory on phishing scams involving IRAS and Singpass here.

How to protect yourself:

- Singpass is your digital identity. Treat it with care as your Singpass login credentials can be used to access thousands of services, including applying for credit cards or opening bank accounts.

- Do only scan the Singpass QR code on the website of the digital service that you wish to access or tap the Singpass QR code on the app of the digital service.

- DO NOT key any personal information into unverified webpages.

- If you suspect that you have been scammed, call our hotline at 1800 363 3333 and press ‘9’ to report a case or ‘8’ to activate the ‘kill switch’ feature, which will temporarily suspend all your accounts.

Want to log in to OCBC Internet Banking by scanning a Singpass QR code?

| Always check and ensure that the OCBC URL shown in your Singpass app matches the URL on your browser. | |

| OCBC URL: internet.ocbc.com | |