#BeAProAgainstCons with OCBC's security measures and anti-scam tips

Increasingly prevalent, job scams involve scammers that try to trick their targets into handing over money, or personal and financial details. They do so through unsolicited offers that promise low effort yet high-paying jobs or ‘guaranteed’ ways of generating fast income.

Job scams come in many forms and can include:

Agent job scams

-

Employ targets as agents of a fake company

One common job scam involves ‘employers’ that hire targets to act as agents for a company. They will ask to use the target’s bank account to receive and transfer money to another, foreign company via online banking or money transfer services (e.g. Western Union or MoneyGram). In exchange, the target will get a commission for each transfer. This is likely money laundering in action.

Affiliate marketing scams

-

Get targets to perform simple tasks online

Targets may receive unsolicited messages or come across advertisements promoting highly paid part-time affiliate marketing jobs that involve scammers claiming to pay a commission to users for boosting viewership of social media posts and videos by liking these posts, or reviewing hotels and restaurants. To perform these jobs and earn commissions, targets are asked to sign up for accounts on websites or apps provided by the scammers, where they purportedly offer packages for jobs with varying commissions paid per task.

Targets are instructed to sign up for these packages by making upfront payments to unknown bank accounts before they can start the job to earn commissions. Following which, once the ‘job’ starts, scammers may try to convince victims that they are doing legitimate work by paying out smaller commissions, before eventually stopping and disappearing with their victim’s money. -

Ask targets to pay for products

Targets are approached to become sellers or service providers for scammers posing as a legitimate company or as representatives of a credible seller. The scammers will ask targets to pay for products in advance – supposedly to help improve sales. -

Make false promises of refunds

Targets are promised a full refund from their purchases – on top of an attractive commission. To build trust, targets will be duly compensated for the first few purchases. However, they will be asked to pay for increasingly expensive items or asked to recruit others to increase their commissions. The scammers will eventually stop compensating the targets once large sums of money have been spent. They will disappear with the victims’ money. -

Offer fake assembly job

Scammers, posing as an ‘employer’, may hire targets to assemble products using materials they have to buy from the ‘employer’. To get the job, targets will be asked to buy a starter kit or these materials in advance. Targets may then not receive any materials; if they do, the materials may not be what was promised and could include instructions to recruit others in exchange for a commission. - In some instances, once the target has completed the work, the ‘employer’ will make excuses to refuse paying for some, or all of, the work.

Male social escort job scams

- Scammers may ask for fees (e.g. registration fee) before they will supposedly introduce their targets to wealthy female clients. Targets will never be introduced to any such client.

Tactics may vary by job scam type. Some common tactics are provided below.

The approach:

Make promises of lucrative rewards for minimal effort

Targets are usually contacted by individuals and given details on attractive, commission-based jobs that promise high returns for minimal effort. Such fake job opportunities may also appear on social media or classified ad websites. They may sometimes come with vague job descriptions that would not typically appear on genuine employers’ channels.

Make unsolicited contact via social media and messaging apps

Scammers will approach targets via social media and messaging apps like WhatsApp or Telegram with unsolicited job offers. They will claim to be from legitimate recruitment companies or recruiting for credible organisations.

The fraud:

Deceive the target as a ‘group’

After convincing their target to learn more about the job offer, the scammers may add their target to WhatsApp or Telegram groups. There, accomplices – or the original scammers, using multiple devices/accounts – will pose as people who have purportedly benefited from the opportunity. They will share fake testimonials (e.g. that the job is easy and makes them a lot of money) and praise the fake job opportunity to make it appear legitimate.

Steal personal and banking details, or ask for recruitment fees

Once a target has been persuaded to accept the fake job offer, the scammers may ask him/her to open an account through an unverified app or website. This account opening process would require the target to enter their personal and banking information, which the scammers then steal to commit fraud and theft.

Scammers may also ask for payment to cover certain fees (e.g. administrative or recruitment fees) before allowing the target to start work. They then disappear with this money.

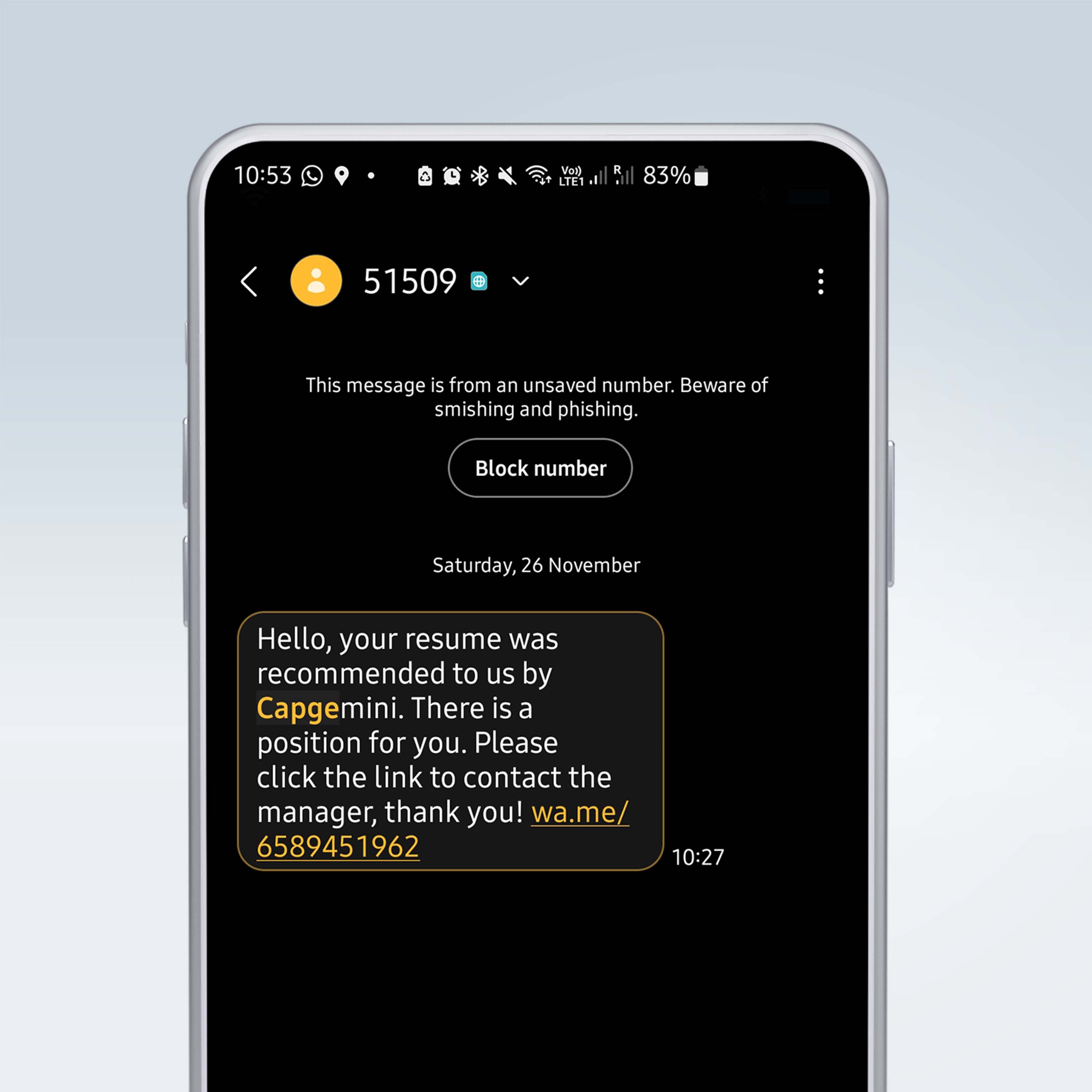

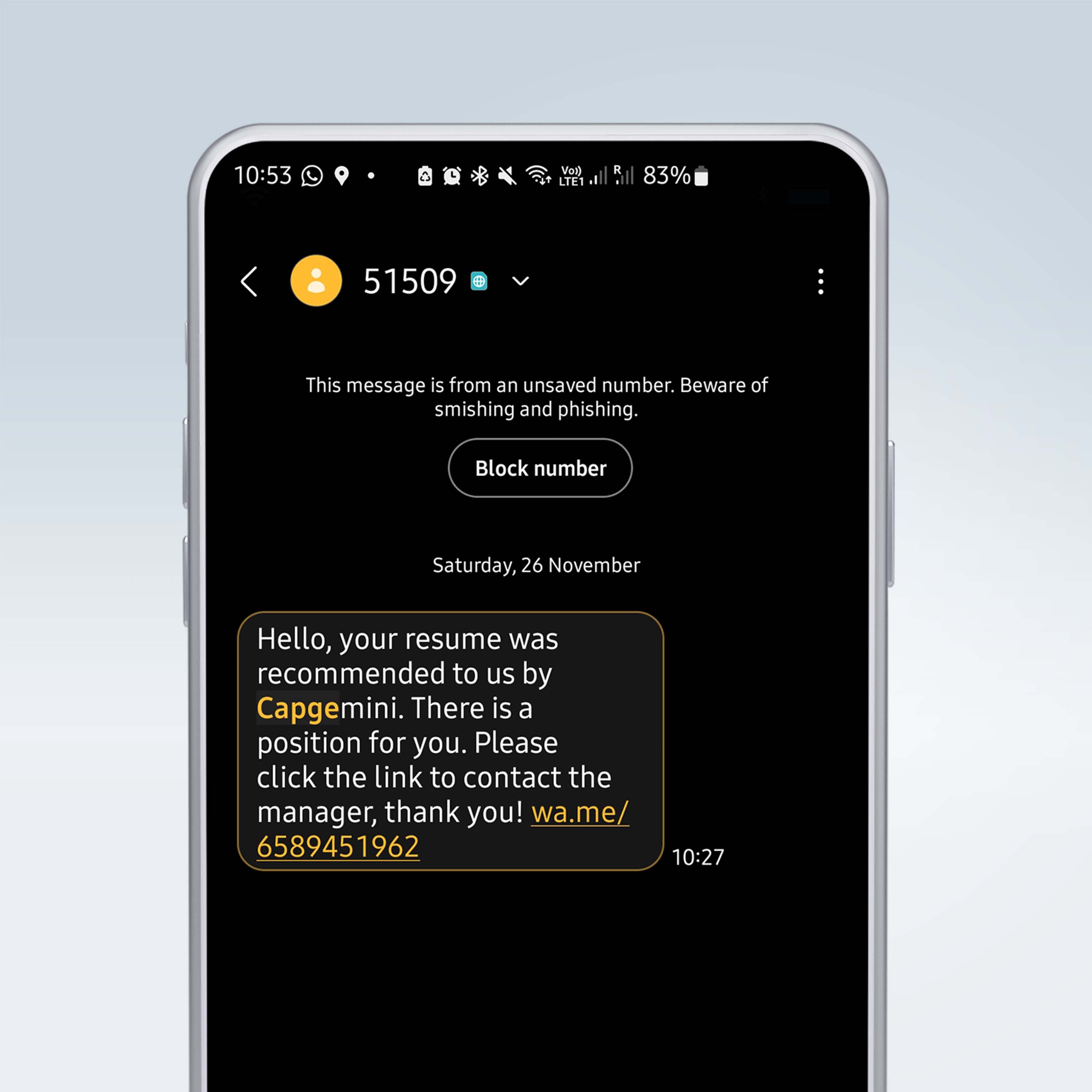

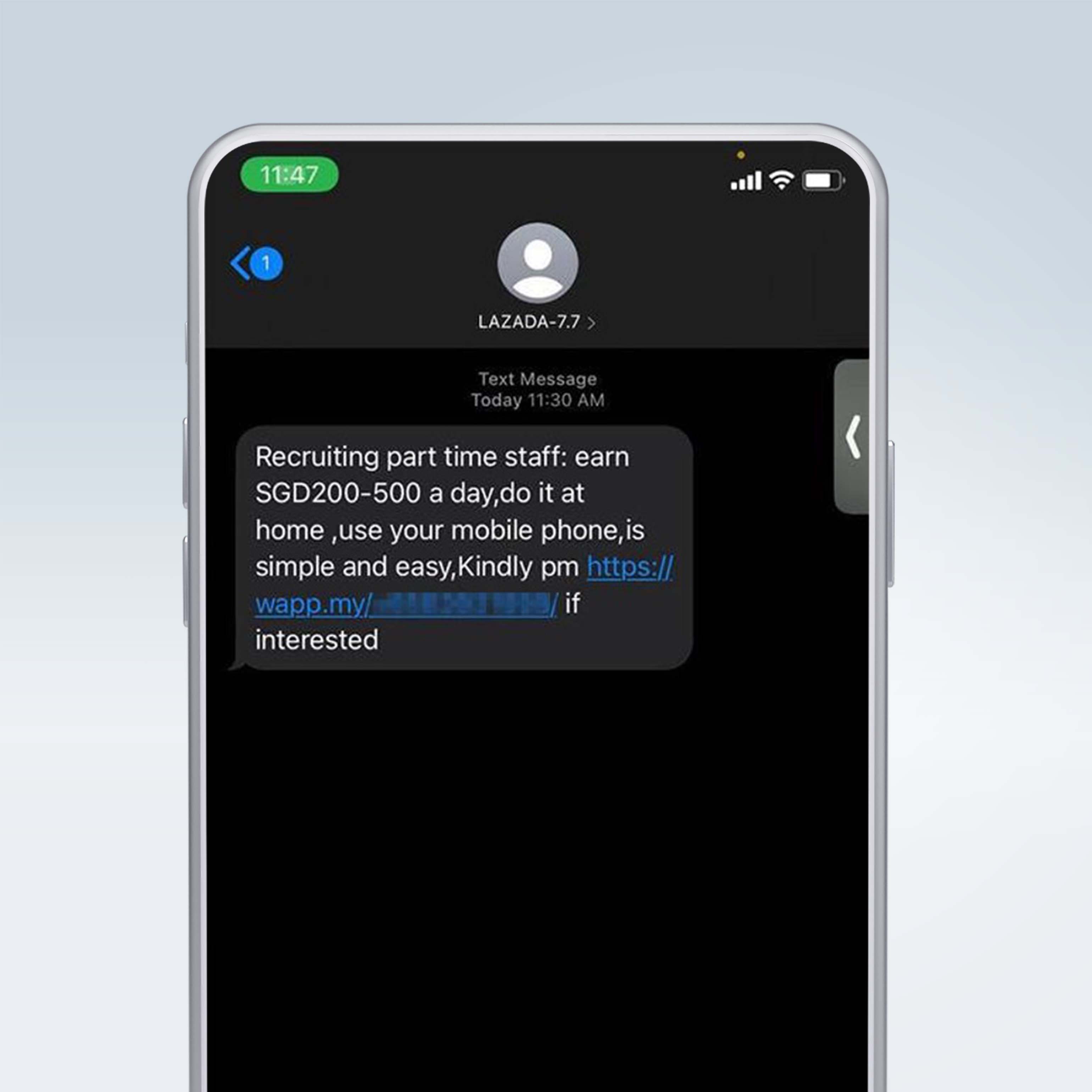

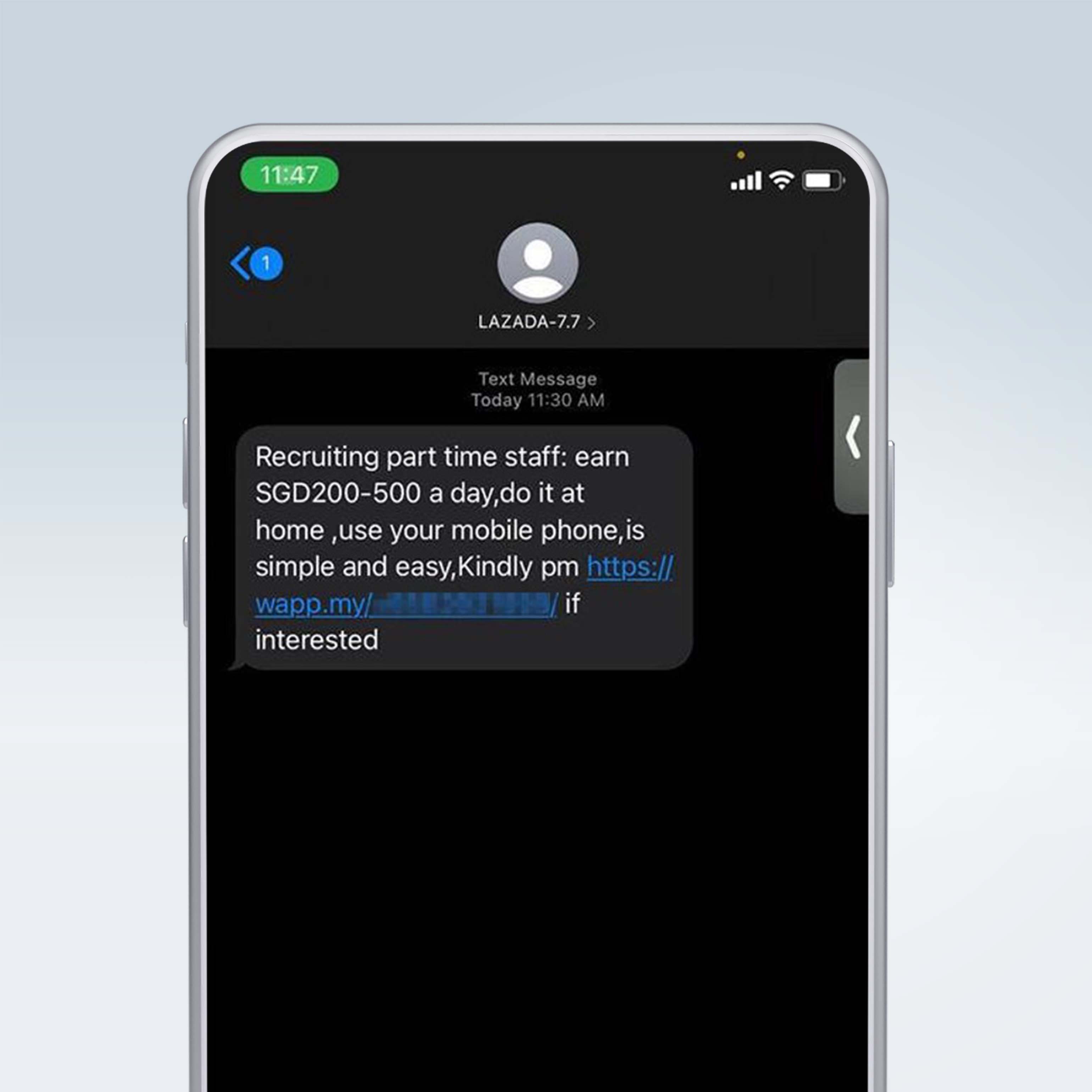

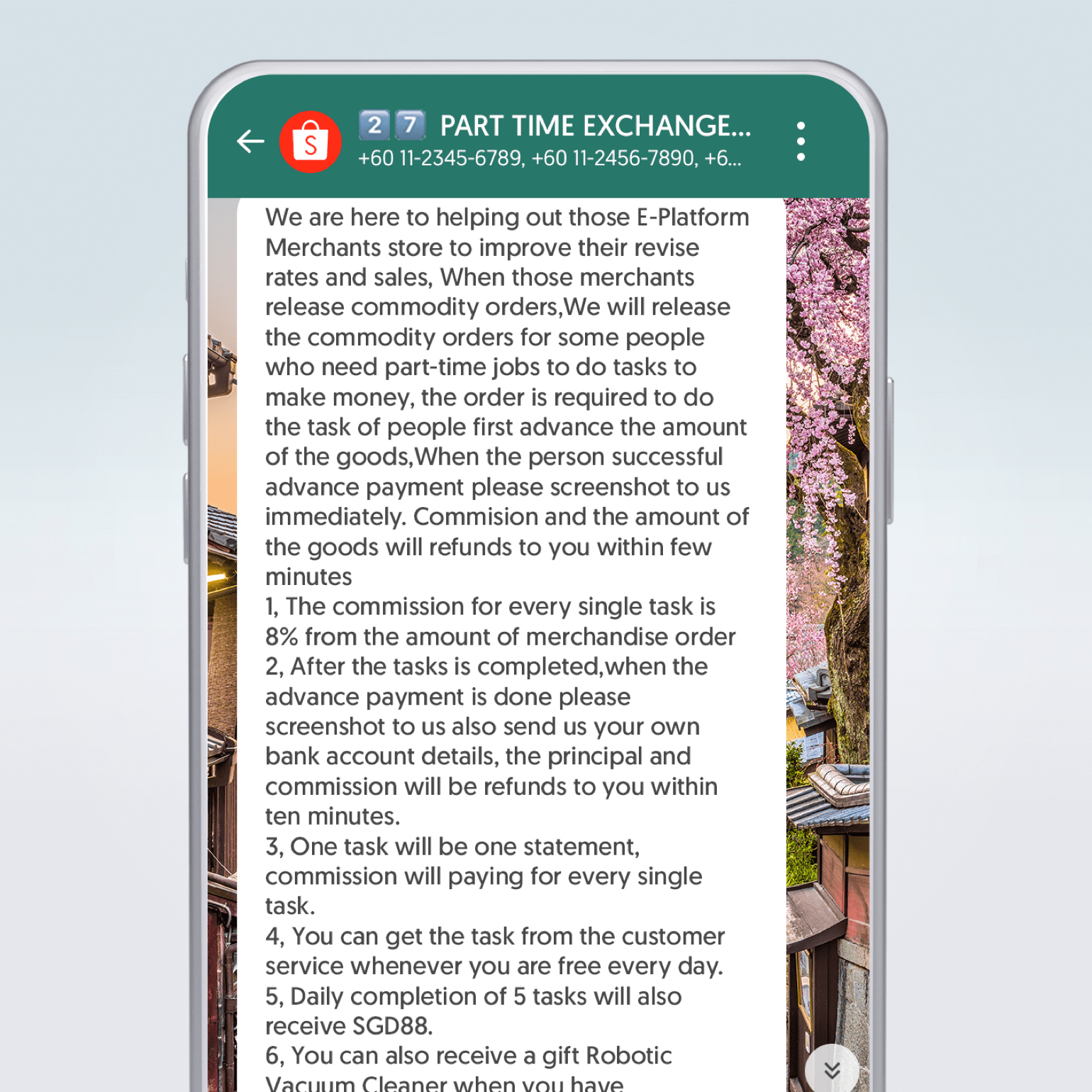

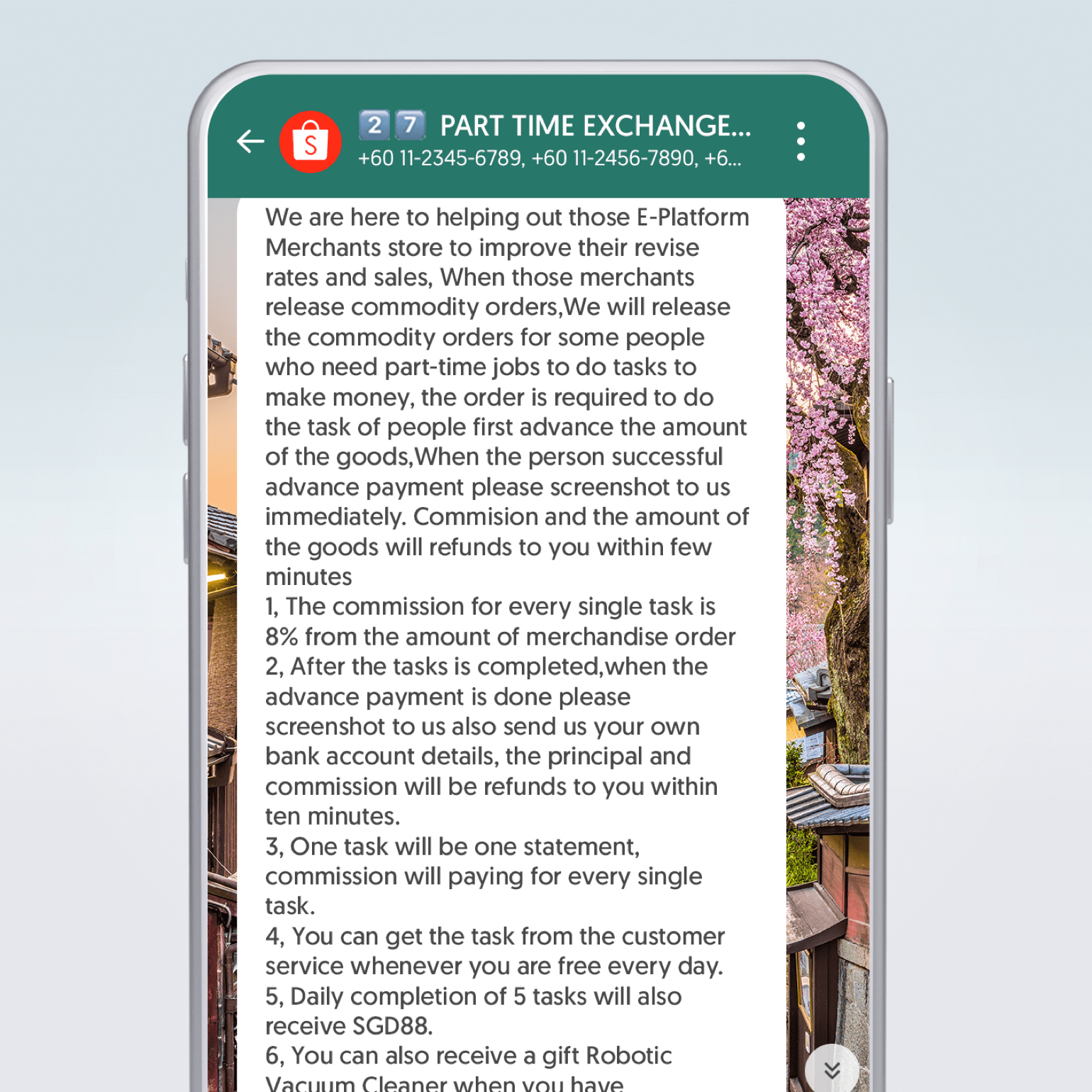

How a job scam might look

Here is an example of what a job scammer might send you.

Offer part-time jobs via messaging apps

Targets receive unsolicited messages offering part-time job opportunities via messaging apps (e.g. WhatsApp). These may come from seemingly legitimate companies or recruiters. They may be poorly written or sent from an unknown or unverifiable number; often, they do not provide a way for targets to verify that the ‘opportunity’ is real.

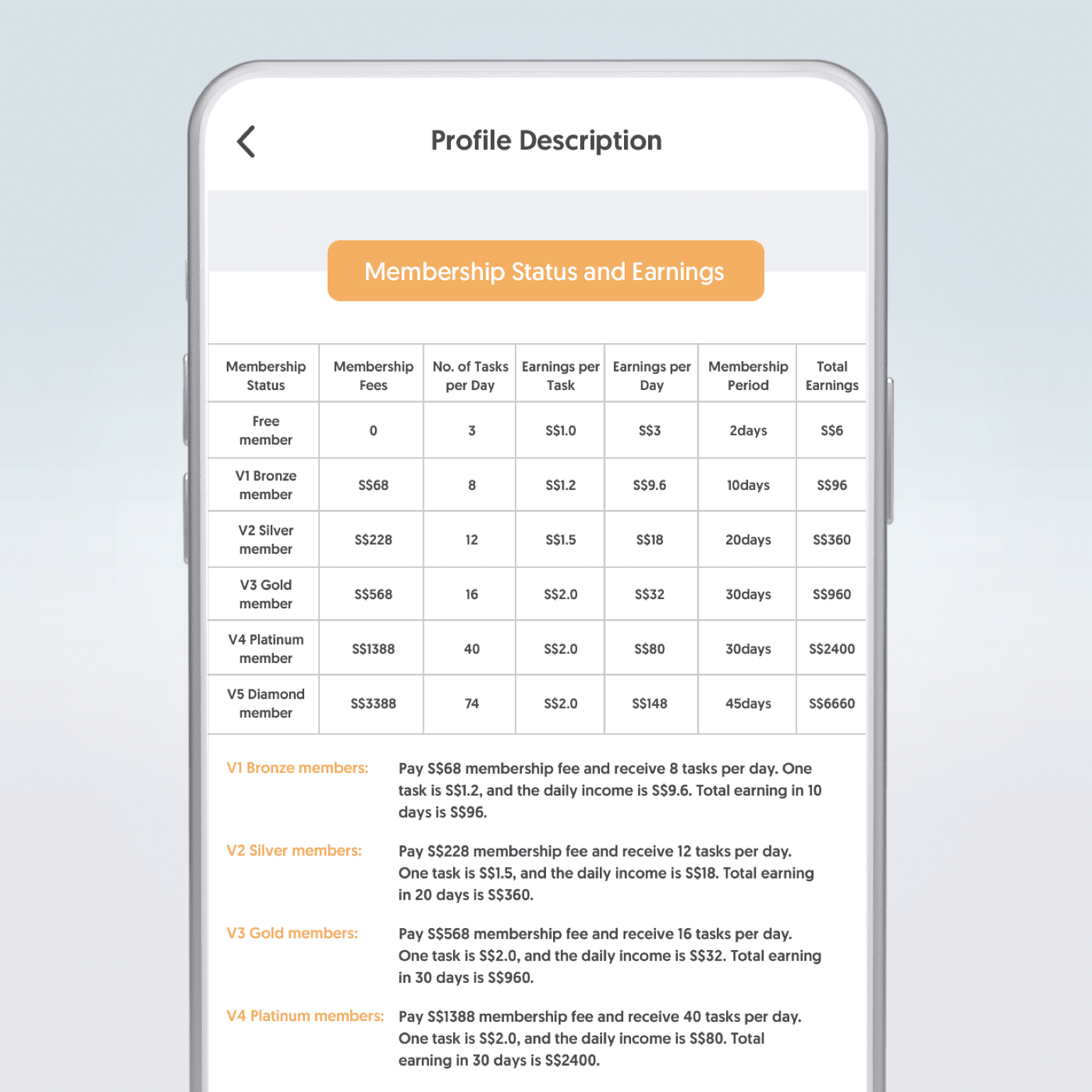

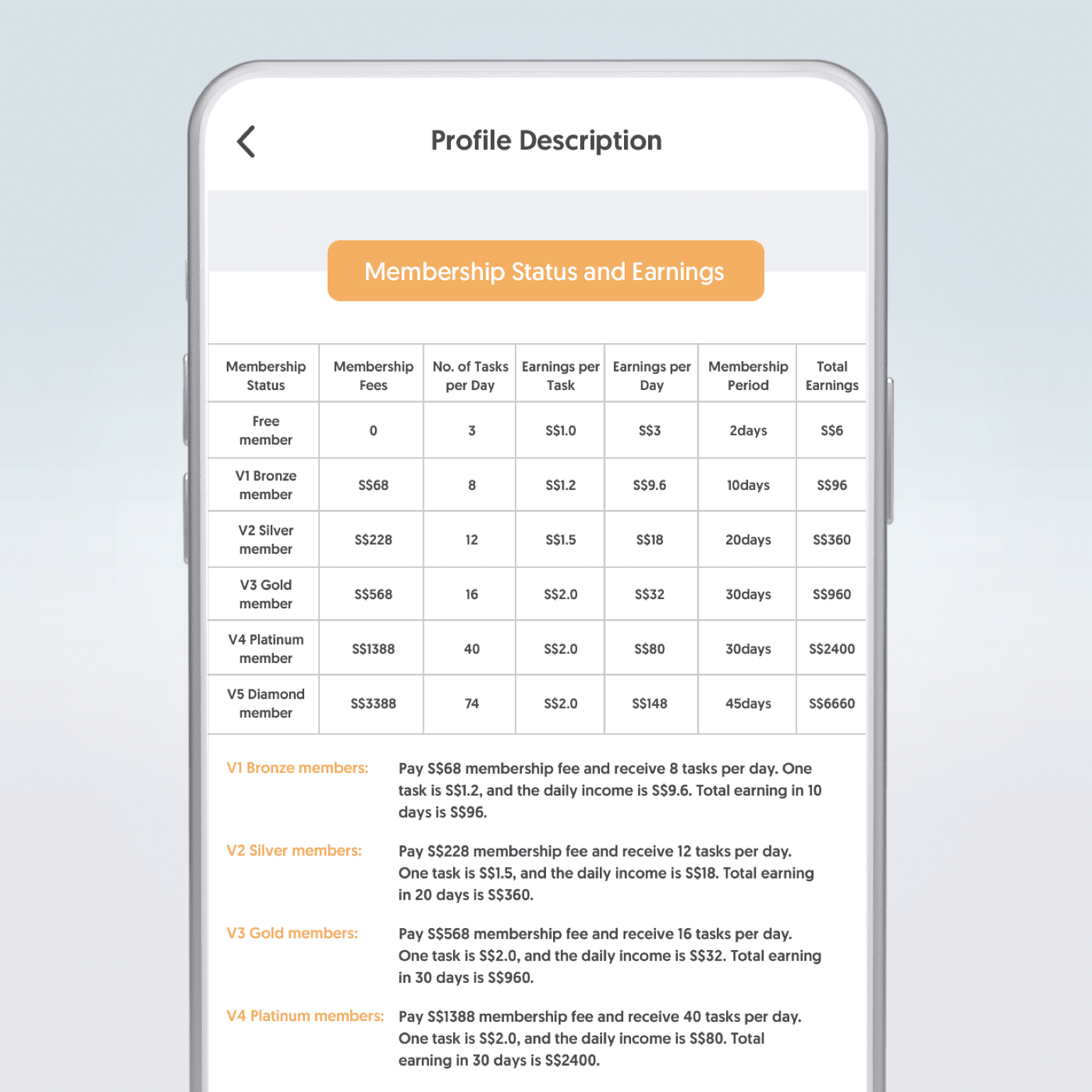

Offer ‘tiered job packages’

Commission-based job scammers invite their targets to perform simple tasks online. The targets will often be linked to a website that they are required to sign up at to gain access to these tasks. Such tasks are often part of a ‘tiered membership package’ – supposedly, the more money the target invests upfront, the higher their potential earnings will be. Once they pocket their targets’ money, scammers will leave their targets with no job or refund.

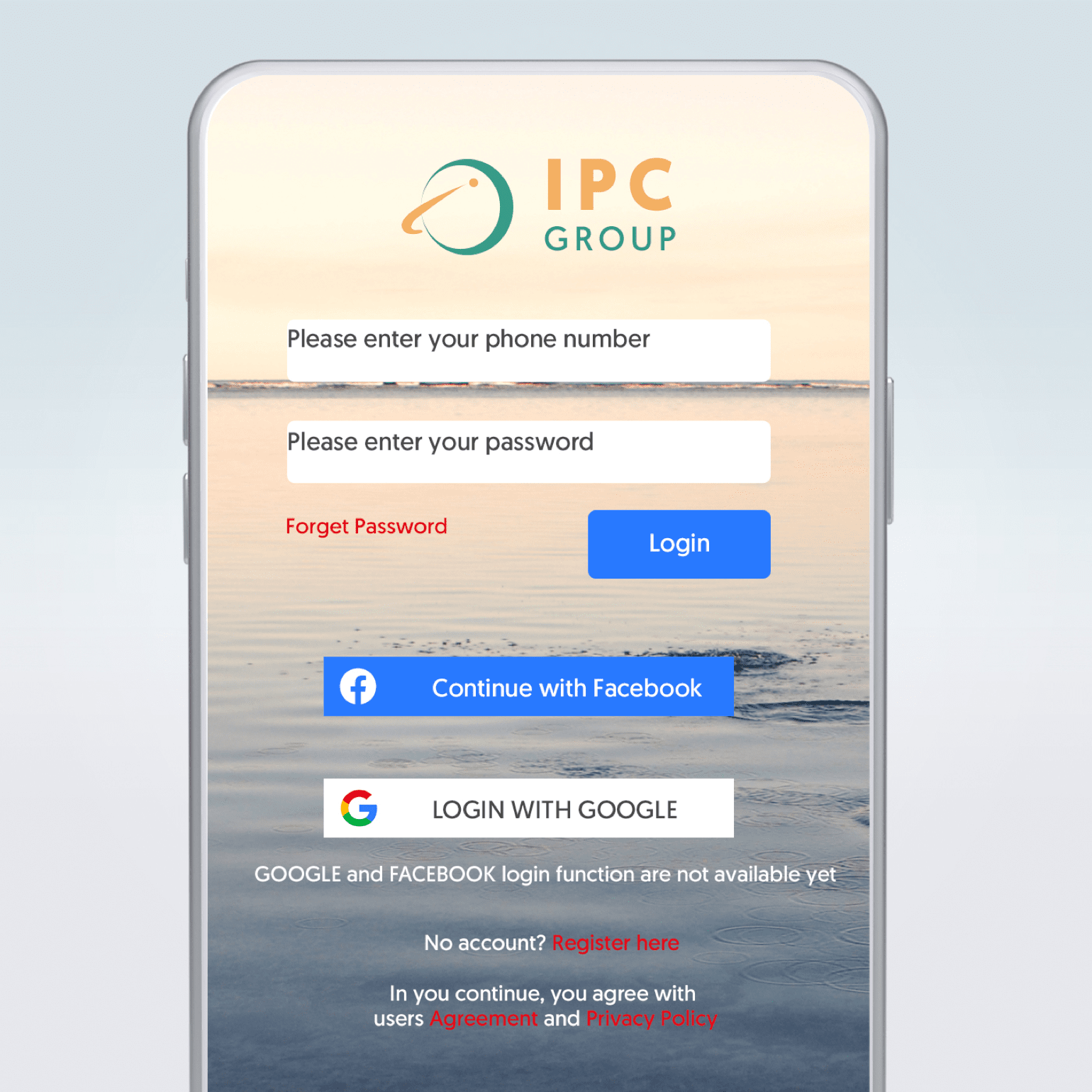

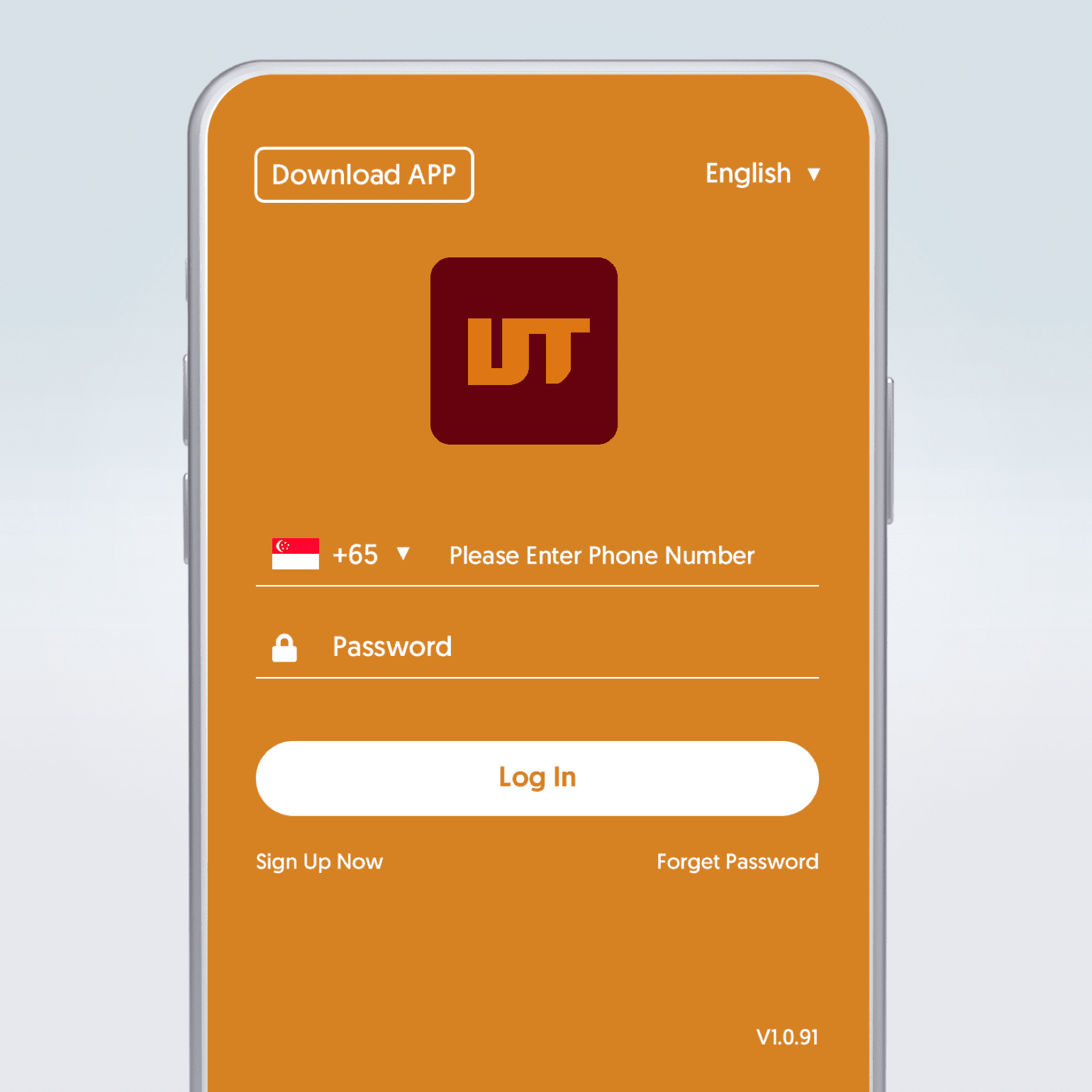

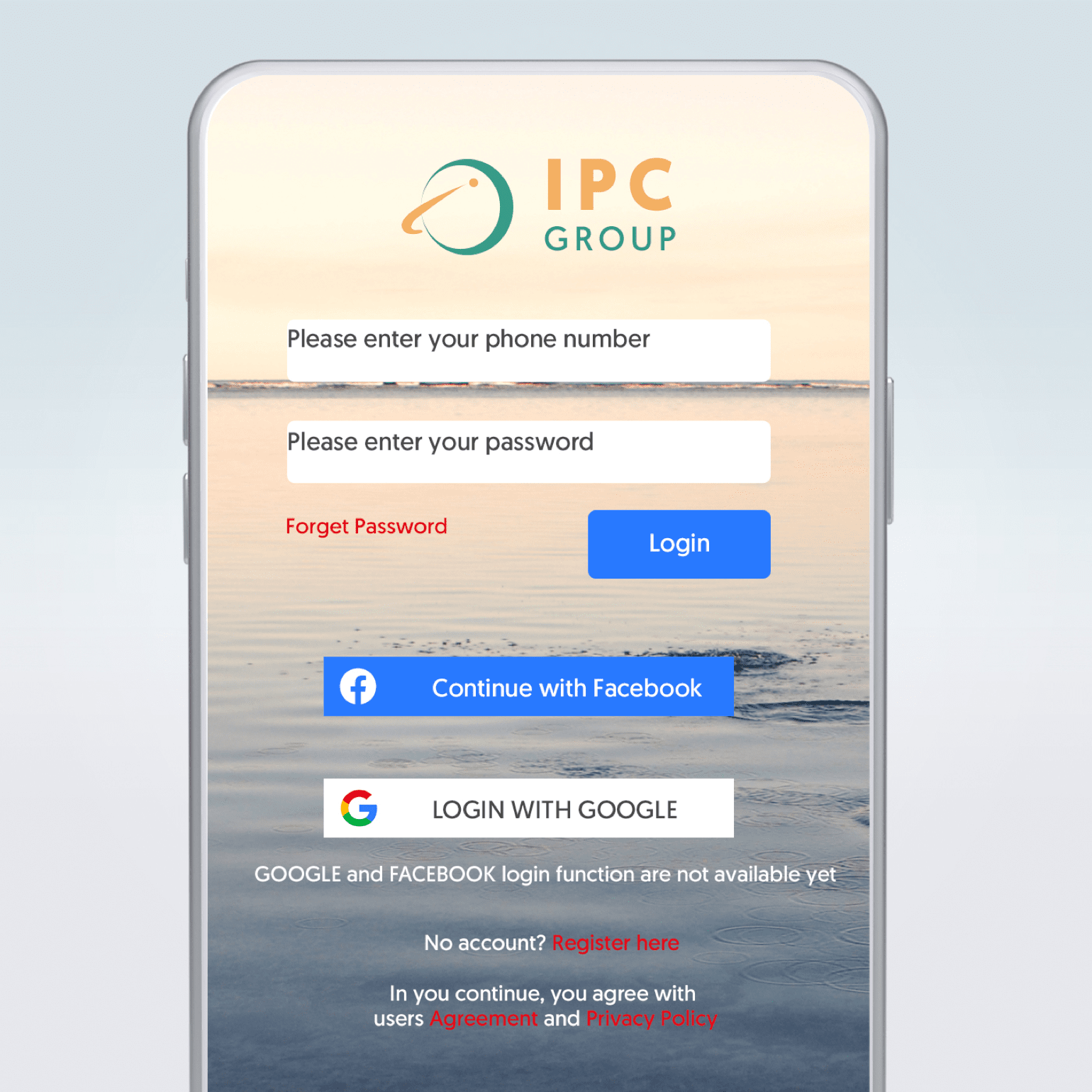

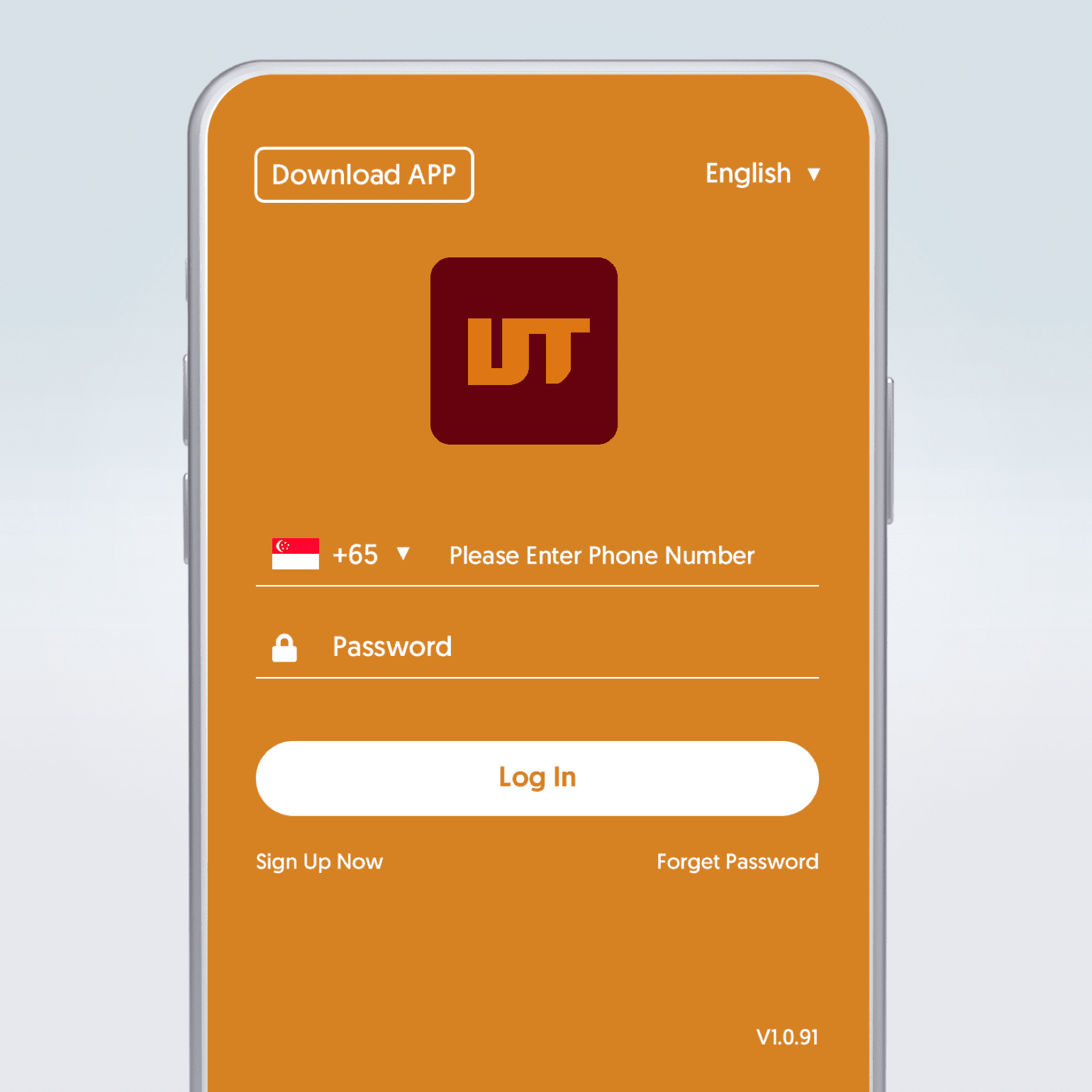

Trick targets into visiting spoofed login pages

Scammers may create login pages that mimic the look and feel of websites belonging to legitimate organisations or reputable job search platforms. This is to trick their targets into entering their login credentials. The stolen information will then be used for identity theft or other fraudulent activities.

Steal personal data through fake apps or platforms

Targets may be lured into creating accounts on platforms of unknown origin, or downloading apps from unknown sources. During this process, they will be asked for unnecessary permissions or personal data access. Legitimate apps and websites typically do not require access to such data.

-

Spot the signs

Do not accept dubious or unsolicited job offers that offer lucrative rewards for little effort. These are usually scams.

-

Be sceptical

Be suspicious of vague job descriptions, unsolicited ‘work from home’ opportunities or job offers, and ‘employers’ or ‘recruiters’ who do not use an email address tied to an organisation.

Be wary of communications that do not address you by name or which do not include a street address (only an email address or a PO box).

-

Do not act

Do not pay to receive more information or materials about a job offer or job.

Do not pay to secure a job offer. No legitimate organisation will ask you to pay to secure a job offer or require you to sign up for a paid membership before you can start work.

Do not apply for a job that requires you to download and create an account on unverified apps from unknown sources.

-

Do your research

Stay away from employers that do not have a street address and a registered company number that you can verify as being legitimate – they can be difficult to trace if you do run into any issues with them. If you have an unsolicited job offer that appears to be from a legitimate company, make sure to verify its legitimacy with the hiring company directly (e.g. through the recruitment section on their website or by contacting their Human Resources department).

-

Keep your details secure

Never give out your Online Banking login credentials, card details or One-Time Passwords (OTPs) to anyone.

-

Protect your account(s)

Do not transfer money to or agree to receive money from people you do not know. Be responsible for all transactions carried out under your account(s) and do not allow your ‘employers’ to use your account(s) to make transactions. You could be laundering money for criminals – a criminal offense that carries a hefty fine of up to S$500,000 and prison time of up to 10 years.

-

Be alert

Get transaction notifications via SMS, email, or push notification (e-Alerts).To change the threshold limits for when you receive e-Alerts, go to OCBC Internet Banking > Customer service > Manage e-Alerts.

Always read your notifications carefully and call us immediately if the transactions shown are not made by you.

-

Protect your phone

If you have an iOS device, consider downloading the ScamShield app – it blocks unsolicited messages and calls. Visit www.scamshield.org.sg to find out more.