#BeAProAgainstCons with OCBC's security measures and anti-scam tips

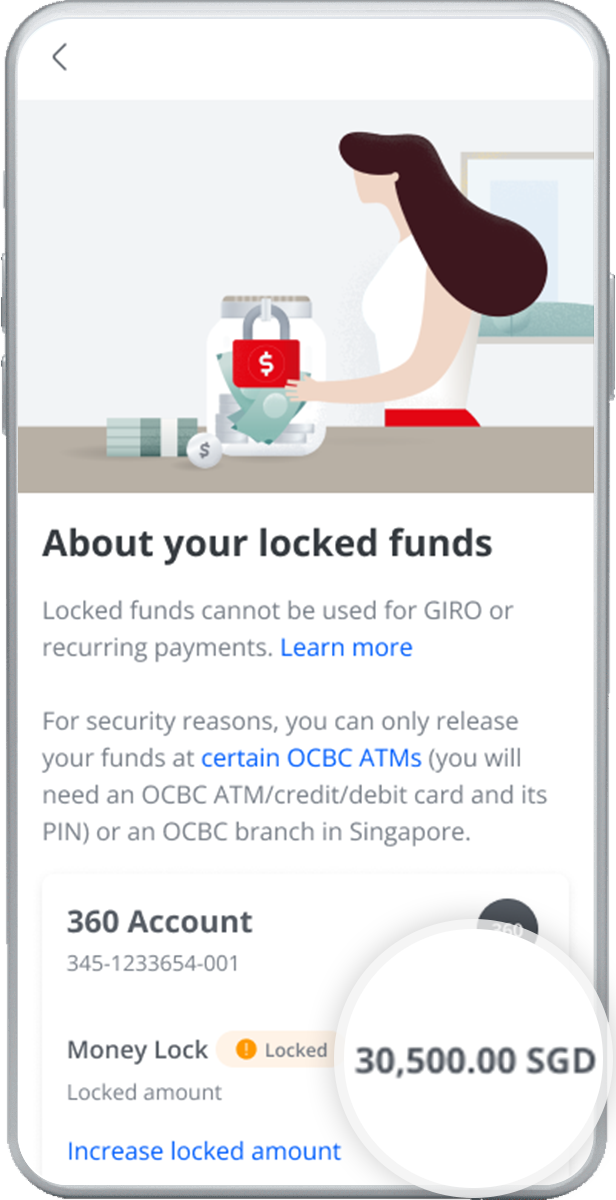

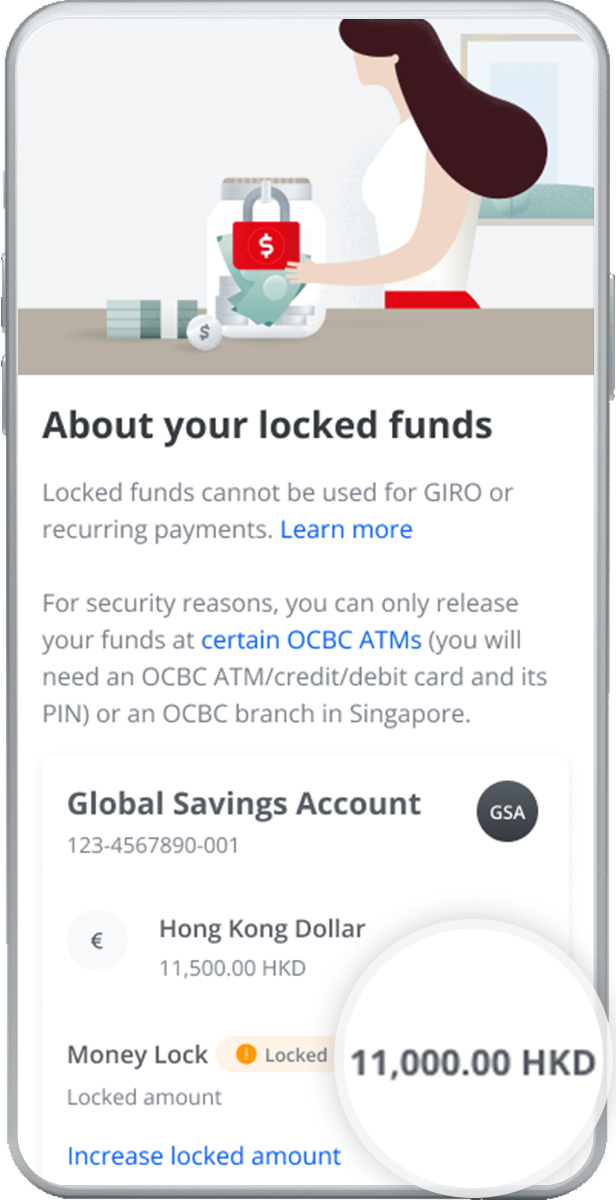

OCBC Money Lock is our latest anti-scam security feature designed to help you better protect your funds. In addition to locking the funds in your current/savings account(s), you can lock your Time Deposit account(s) to prevent changes to maturity instructions - or any unauthorised withdrawals before each placement matures - from being made via the OCBC app*.

By locking the funds in your current/savings account(s) and securing your Time Deposit account(s), you are adding an extra layer of protection against scams. For your security, your funds can only be released, or your account(s) unlocked, after we verify your identity.

* If your Time Deposit account is unlocked, you can manage the placements made under it (e.g. withdraw your funds before maturity and change the maturity instructions) via the OCBC app. You cannot manage your placements via OCBC Internet Banking, whether your account is locked or not.

Money Lock on the go

Use the OCBC app or Internet Banking to lock:

- Funds in your current and/or savings account(s) or increase the locked amount

- Your Time Deposit account(s)

Greater peace of mind

Funds in your current/savings account(s) can only be released, or your Time Deposit account(s) unlocked, after we verify your identity. This means that, even in the unlikely event where a scammer gains digital access to your account(s), your locked funds will remain safe.

Learn more about releasing the funds in your current/savings account or unlocking your Time Deposit account.

No impact on your account benefits

Even if you lock the funds in your current/savings account(s), they will still stay in your account(s) and count towards the account balance. This means you will continue to enjoy the account benefits, such as the earning of interest.

If you lock your Time Deposit account, you will continue to earn interest as well. However, you will not be able to withdraw your funds before each placement matures or change the maturity instructions until your account is unlocked.

Funds can be locked via the OCBC app or Internet Banking. They will be kept safe until you are ready to release them. Please take the steps below to lock your funds via the OCBC app.

As you cannot use locked funds for GIRO, scheduled or recurring payments, or to pay account fees, do keep enough available balance to avoid late fees and charges. Certain transactions (e.g. fees for unsuccessful GIRO deductions and SimplyGo payments) may still be deducted if needed.

How to

for

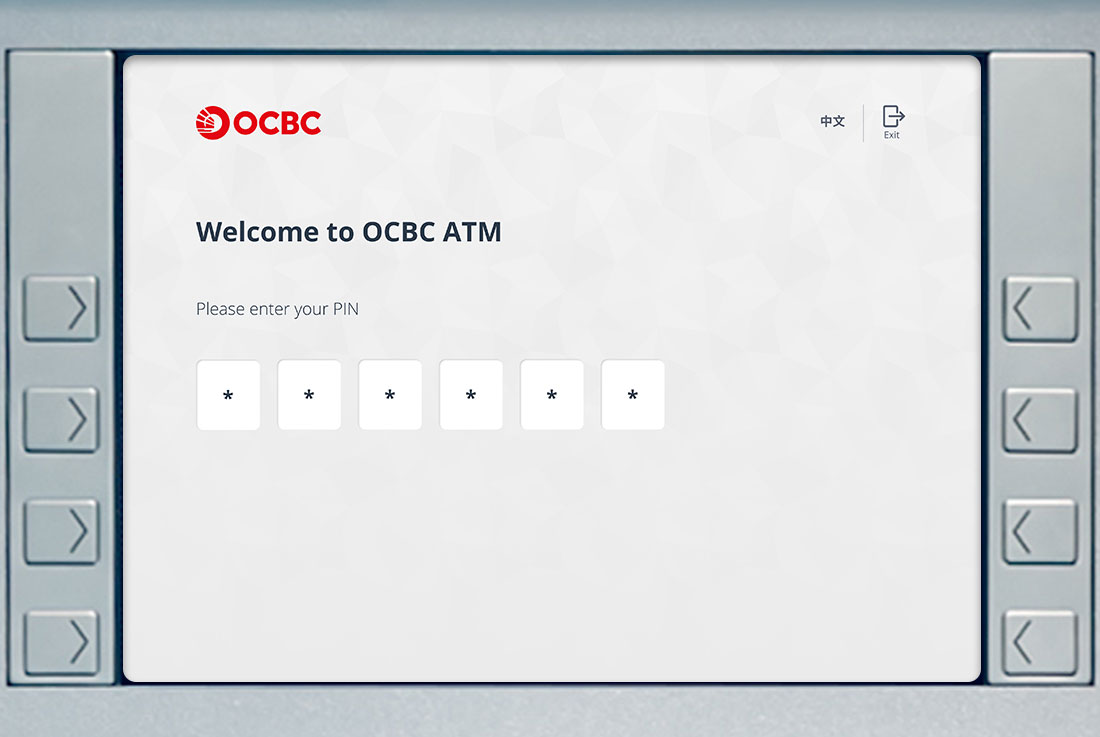

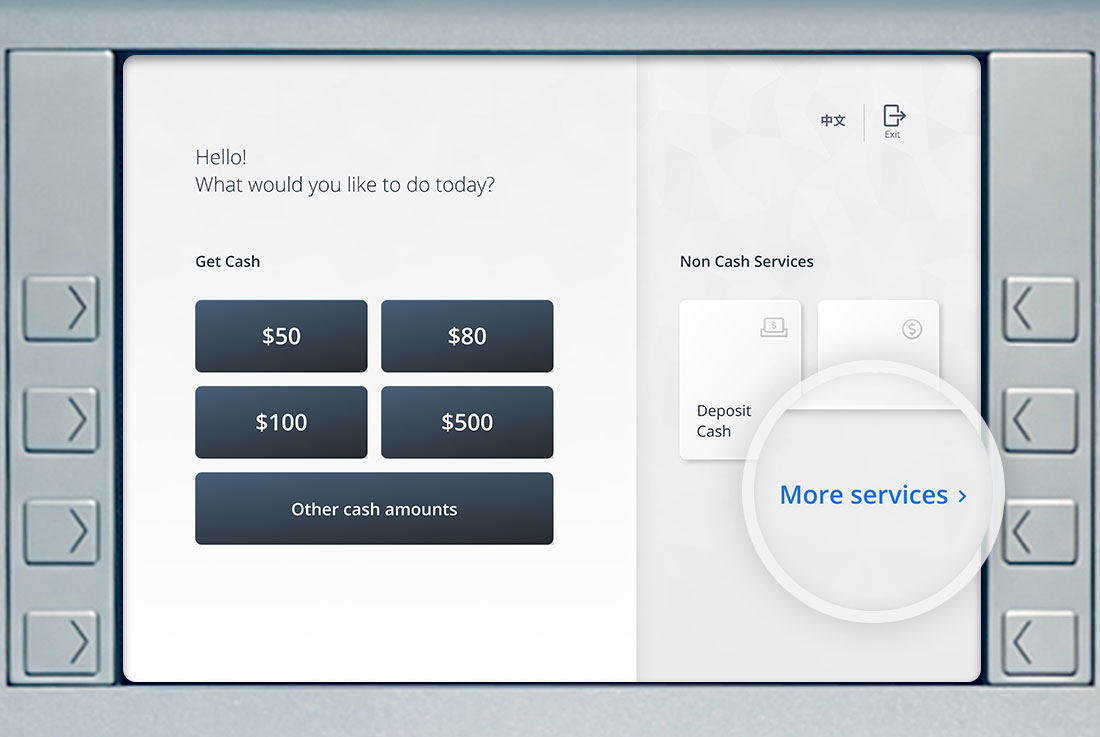

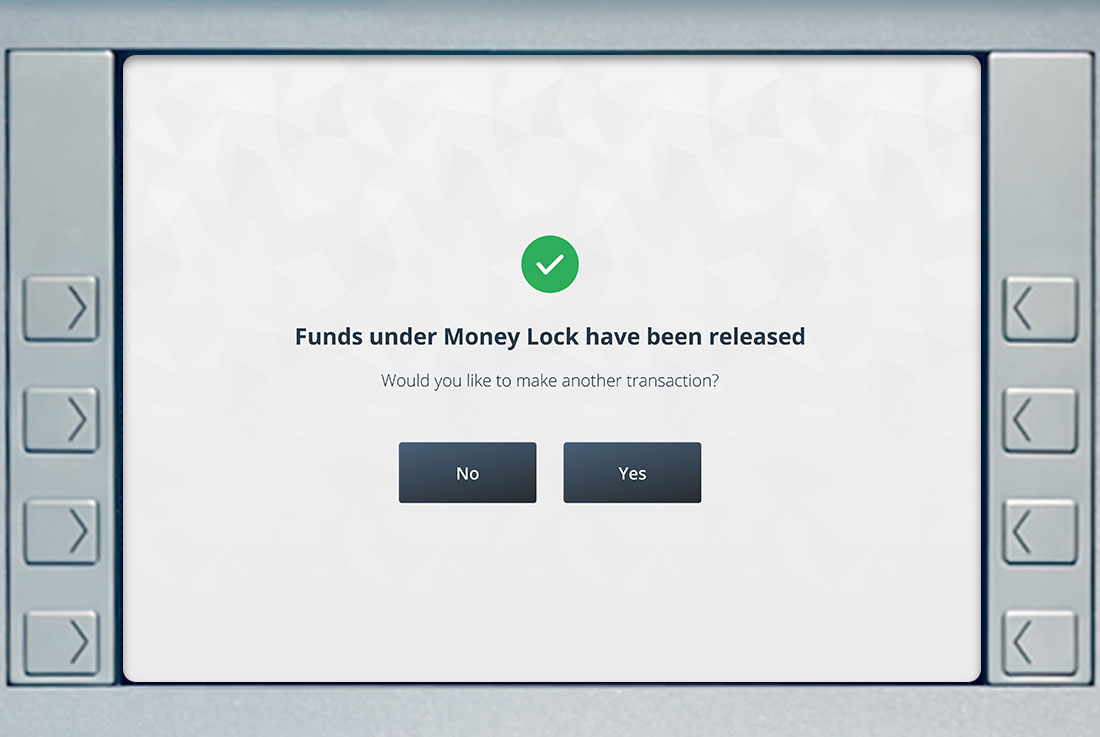

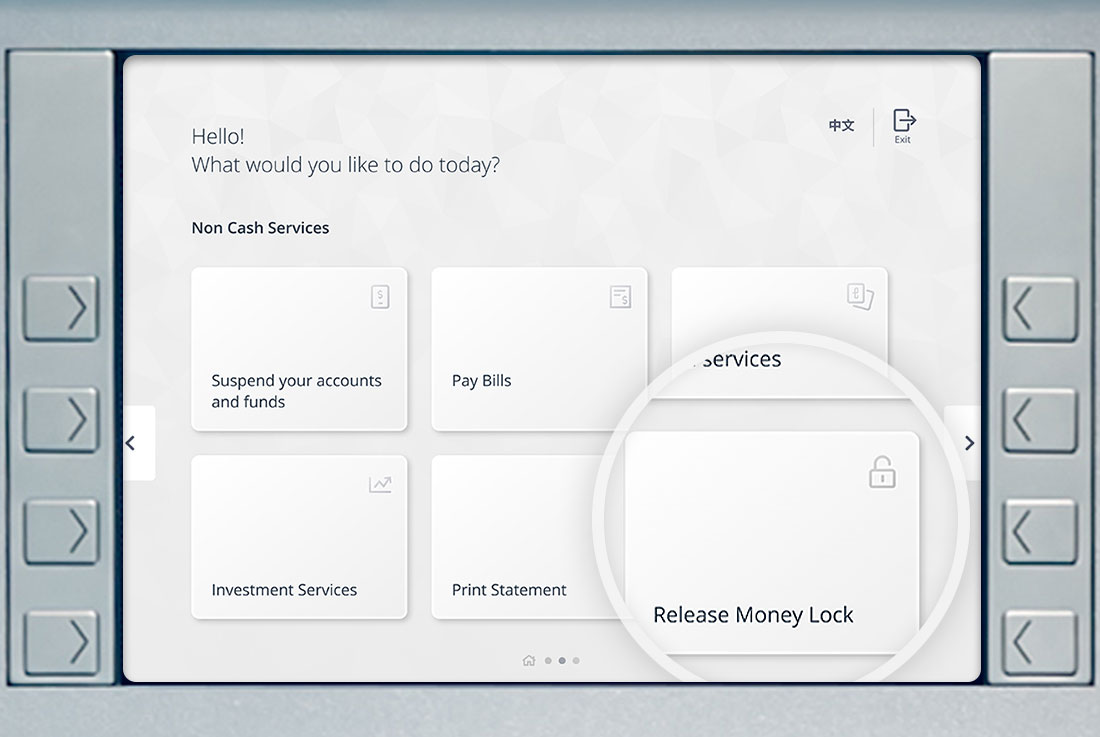

For your security, your funds can only be released in person or after we verify your identity through a phone call.

For OCBC Singapore customers living in Singapore

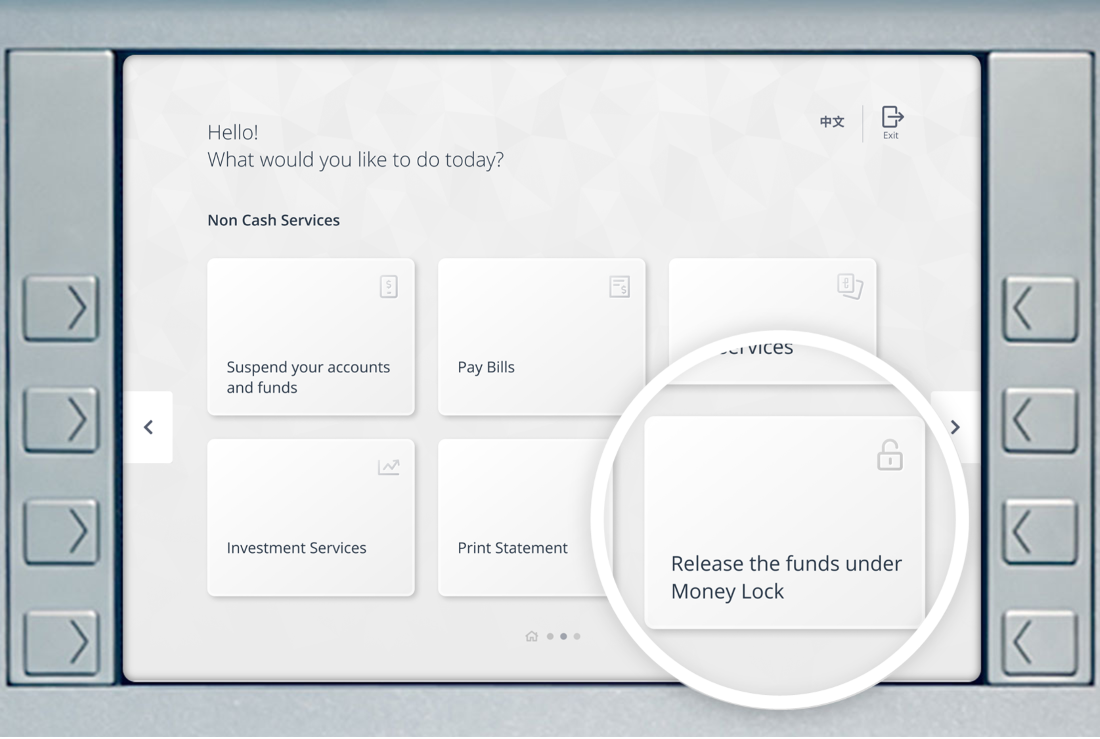

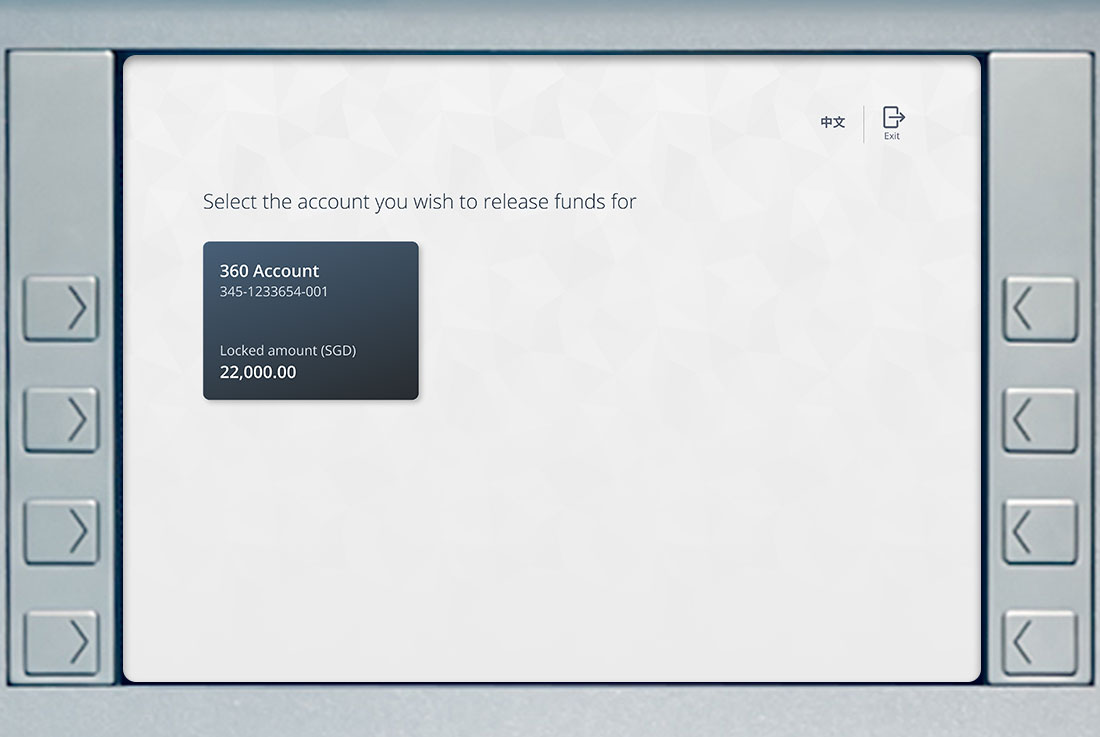

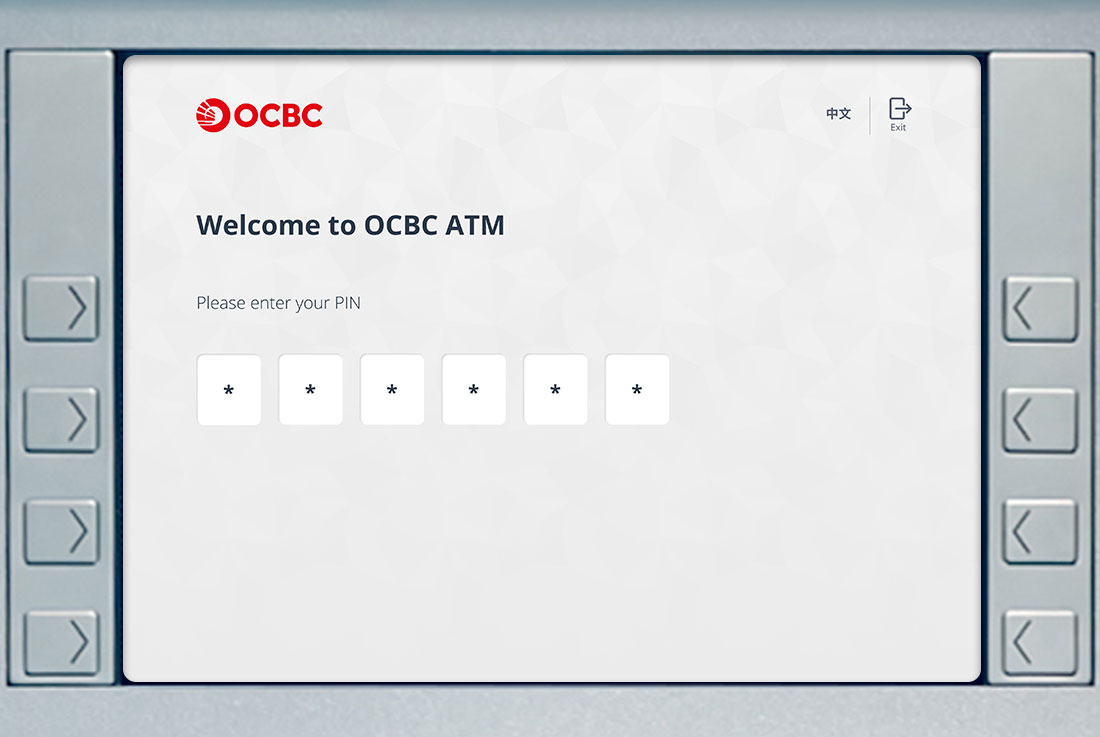

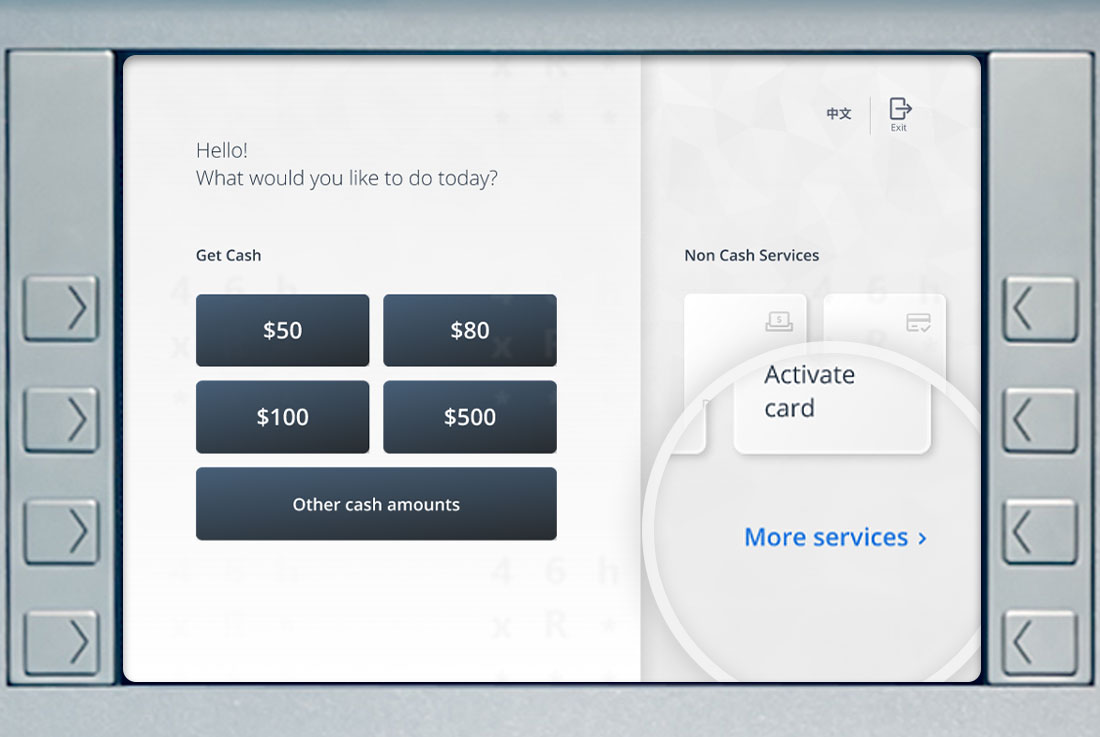

You can instantly release your funds at any OCBC ATMs, New ATMs and Service Kiosks (you will need an OCBC ATM/credit/debit card and its PIN) – choose this option to skip the queue – or an OCBC branch.

For OCBC Singapore customers living overseas

You can release your funds by submitting a request via the Secured Mailbox in the OCBC app or Internet Banking. We will be in touch within 4 working days.

Because locked funds cannot be released via digital channels, cybercriminals cannot get to them even if they gain digital access (e.g. through malware attacks) to your account(s). It is much harder for cybercriminals to gain access your account(s) and funds through physical methods like visiting an OCBC branch or ATM.

How to release my funds if I live

How to

your Time Deposit account via the OCBC appaccount

-

When your funds are locked, you cannot use them for:

- New or existing payment arrangements (e.g. GIRO, standing instructions or future-dated transfers)

- Transfers to another OCBC account

- Transfers to another bank’s account (e.g. local and overseas transfers)

- Bill or credit card payments

- Fixed deposit placements or investments

- Insurance purchases or payments

- Loan or tax repayments

- ATM withdrawals or transfers

You may not access your locked funds until you release them. Do keep enough available balance to avoid late fees and charges. Certain transactions (e.g. fees for unsuccessful GIRO deductions and SimplyGo payments) may still be deducted if needed.

-

If you are an OCBC Singapore customer living in Singapore, you can release your funds at any local OCBC ATMs, New ATMs, Service Kiosks, or an OCBC branch. You will need an ATM/ debit/credit card and its PIN.

- Damaged or lost your card? Request for a replacement card via ‘Card services’ in the OCBC app. The card will be mailed to the address in our records within 5 working days. Please follow this step-by-step guide to request a replacement card via the OCBC app.

- Do not have an OCBC card? Apply for:

- A credit card via the ‘Apply’ feature in the OCBC app, Internet Banking or on our website; or

- A debit card via the ‘Apply’ feature in OCBC Internet Banking or on our website.

- Forgot your card's PIN? Reset it:

- Via the OCBC app: Log in to the OCBC app > Tap on 'More' at bottom right > Card Services > Reset card PIN

- Via OCBC Internet Banking: Log in to OCBC Internet Banking > Customer Service > Card services > Reset card PIN

To avoid any inconvenience when you need to release (i.e. access) your funds, please check that your card and its PIN are still valid before locking your funds.

-

You cannot release your funds at an OCBC ATM or branch overseas.

If you are an OCBC Singapore customer living in Singapore, you can only release your funds at all local OCBC ATMs, New ATMs and Service Kiosks, or at an OCBC branch. For your convenience, if you have plans to go overseas and may need to access your locked funds during that period, we encourage you to release your funds at an OCBC ATM before leaving.

If you are an OCBC Singapore customer living overseas, please submit a request to release your funds via Secured Mailbox in the OCBC app or Internet Banking. We will be in touch within 4 working days.

-

Locked funds have to be released in full.

You cannot partially release your locked funds. You must first release the full amount and then submit a request to lock a new amount via the OCBC app or Internet Banking.

-

Which OCBC ATMs, New ATMs and Service Kiosks can I visit to release my funds?

You may release your funds at any OCBC ATM, New ATM or Service Kiosk. Locate the nearest ATM here.

-

Can I use OCBC Money Lock to lock all types of Time Deposit accounts?

No. Foreign Currency Time Deposit accounts and joint Time Deposit accounts where all account holders must jointly perform any action cannot be locked.

-

Does locking my Time Deposit account only protect placements I make after I lock it? Will placements I made in the past also be protected?

Once a Time Deposit account is locked, all placements made under the account will be locked, including existing placements made before the account was locked. Any placements made in the future under your locked Time Deposit account will also automatically be locked.

-

If my Time Deposit placement matures and the funds are credited to my selected current or savings account, will these funds remain locked?

No. Once your placement matures, your funds will be – if you have instructed us to – withdrawn from your Time Deposit account and deposited in the account you specified. These funds will not automatically be locked. You may choose to lock them for extra layer of protection against scams.

-

Can I visit an OCBC branch to withdraw funds before maturity or change the maturity instructions for placements made under my locked Time Deposit account?

Yes. You can make any request or transaction involving your Time Deposit account at an OCBC branch, even if the account is locked.

Locking a Time Deposit account only makes it impossible for you to withdraw funds before each placement matures or change the maturity instructions via the OCBC app. This is to prevent unauthorised access to your funds even in the unlikely event that a scammer gains unauthorised digital access to your account.