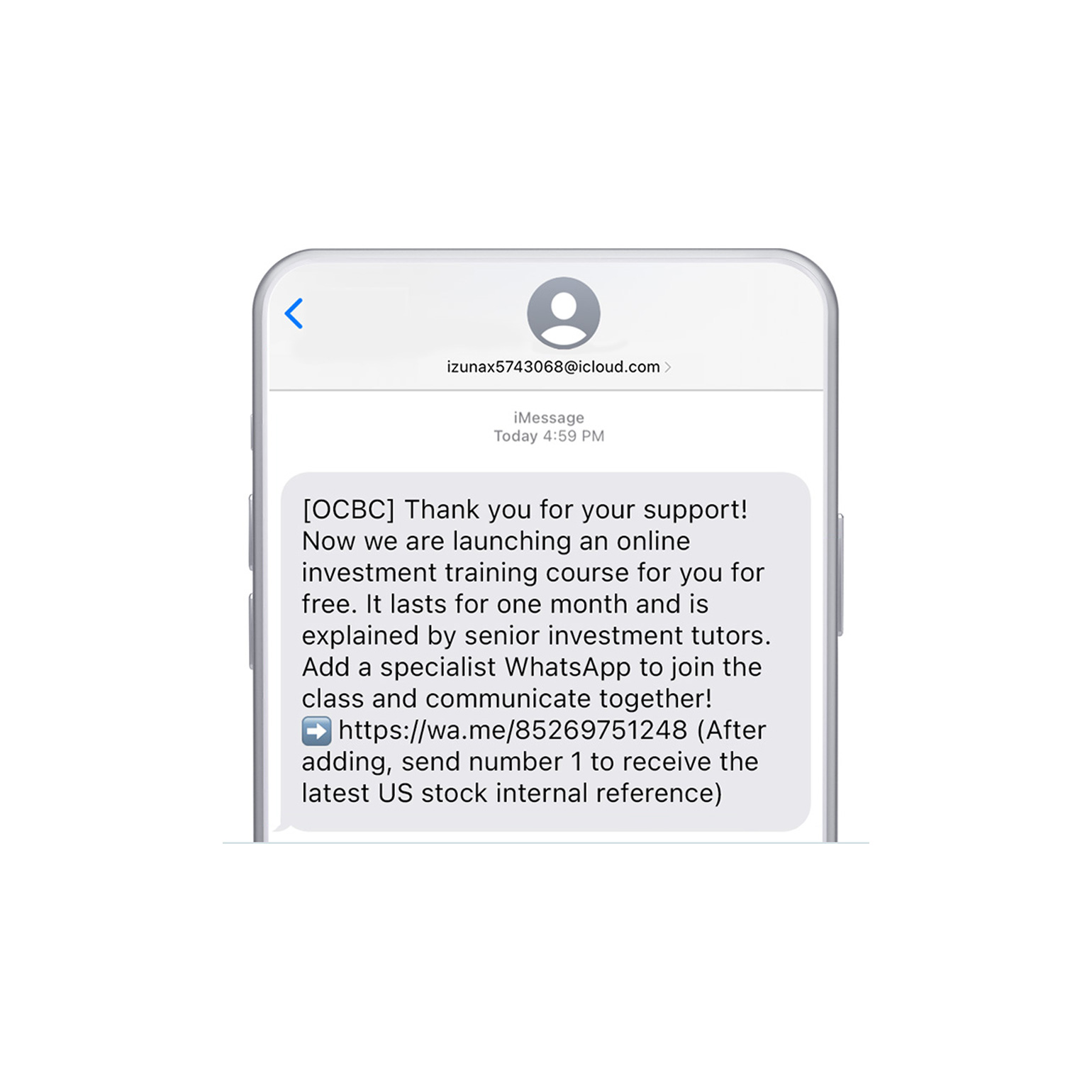

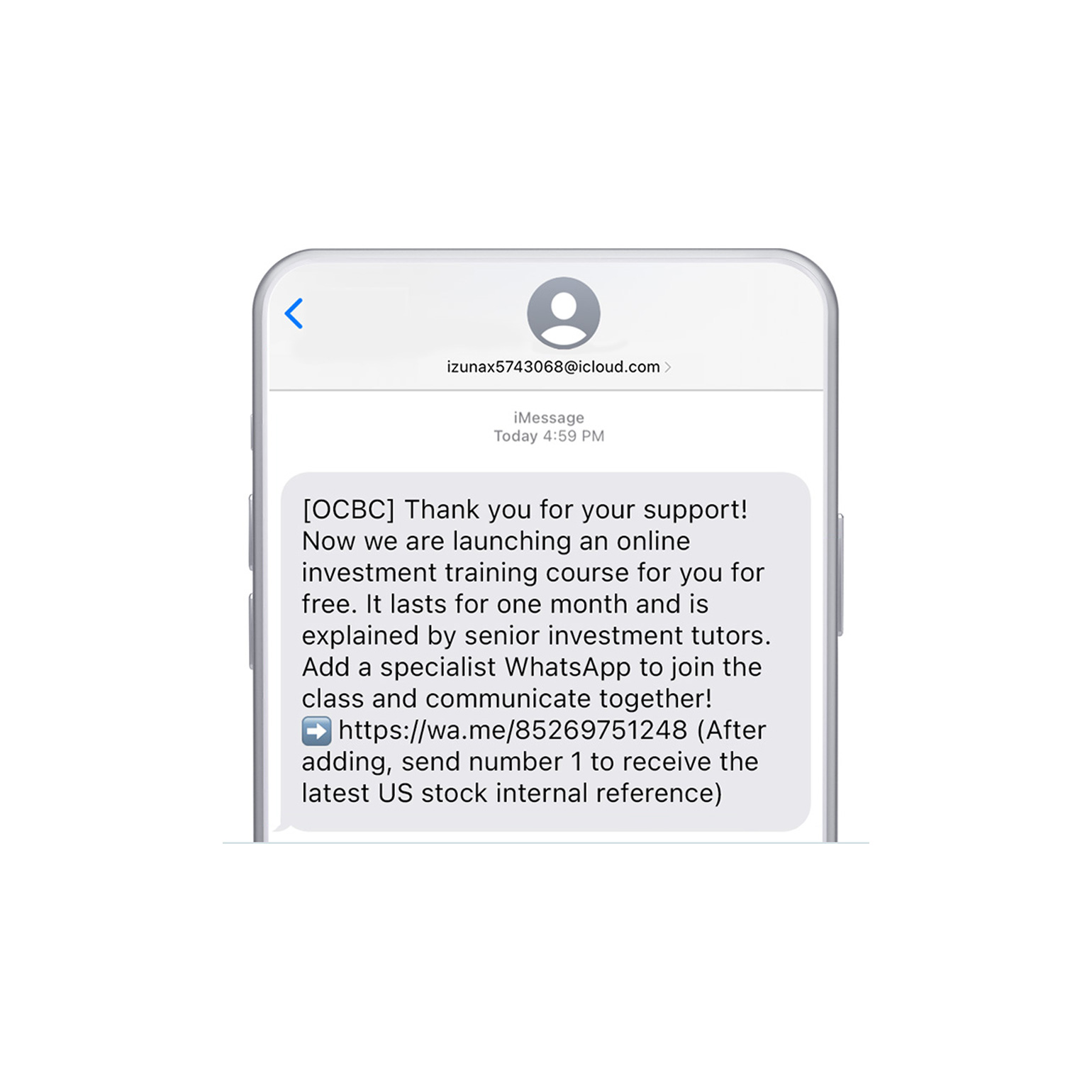

#BeAProAgainstCons with OCBC's security measures and anti-scam tips

Investment scams usually involve individuals who claim to represent legitimate businesses or authorities. They promise their targets investment opportunities that guarantee quick money and/or extraordinary returns at little to no risk.

General Investment Scams

The approach:

Make unsolicited approaches

The scammers will message their targets via social media or messaging platforms (e.g. Facebook, WeChat, Telegram or Line). They will claim to be a stockbroker, financial advisor, portfolio manager or employee of a financial services company.

Make promises of low risk and high returns

They will offer a low-risk, high-return investment opportunity or encourage their target to invest in overseas companies.

Direct targets to sham websites

They may direct their targets to professional-looking websites or resources to back up their claims.

Offer bogus investment opportunities

These usually include high-return investment schemes (e.g. shares, mortgage, or real estate); or options, cryptocurrency or foreign currency trading opportunities.

Sway their targets with persistence

The scammers will usually contact their targets several times. Some targets are eventually persuaded into agreeing to invest.

The fraud:

Steal personal details

Scammers will ask their targets to share personal details (e.g. NRIC numbers or passport details) on the pretext of helping them complete a form for the investment. They will then request that the targets transfer money to banks (often based in China or Hong Kong) and/or pay large sums in administrative and security fees, and taxes.

Ask for money to fulfil non-standard procedures

There have been several cases where scammers – claiming to be from the Hong Kong Monetary Authority or Hong Kong Overseas Control Centre – have asked their targets for a ‘deposit’ before supposed ‘profits’ from investments can be released.

Get victims to help them cover their trail

Scammers may ask their targets to transfer the money into different accounts each time. They may claim that it is for security reasons or because they are an overseas entity – in fact, it is to make their scam harder to detect.

Run Ponzi schemes

Scammers will sometimes ask their targets to download or invest through certain apps, promising quick and high returns. To trick their targets into believing that the scheme is legitimate, they will use money that other people have invested to pay their targets some initial returns. Their early targets – now believing in the scheme – may then be encouraged into persuading friends and family members to invest in the same scheme. The cycle then continues. Eventually, the scammers runs out of money to pay as initial returns or cannot find new targets; they will then disappear with the money they have left. These are known as Ponzi schemes.

Cryptocurrency Scams

The approach:

Make unsolicited approaches

Scammers may reach out to their targets via social media or messaging apps and share about supposed ‘opportunities’ to invest in cryptocurrencies. Although many legitimate businesses trade in cryptocurrencies, cryptocurrencies are highly volatile and tightly regulated in Singapore.

Appeal to targets on many platforms

Cryptocurrency scammers can be very convincing. They will make claims of high returns on social media platforms. They are also increasingly active in advertising on platforms like Discord and Telegram.

Scammers may also impersonate legitimate crypto platforms like Binance and Coinhako via email or SMS, claiming suspicious activity on their targets' accounts. Targets are urged to call fake support hotlines, where they are guided to install a fraudulent app or crypto wallet. In some cases, scammers use WhatsApp calls with screen-sharing to assist in the setup.

The fraud:

Direct targets to bogus trading platforms

Once a target engages with their advertisement, post or message, scammers may direct him/her to a sham online platform through which the target can supposedly trade in cryptocurrency. They may offer to make an trade on their behalf and/or share details of a (bogus) app or website through which the target can trade.

Scammers may also encourage their target to buy cryptocurrency through a fake exchange or ask him/her to send money to a fake company that will supposedly do so on his/her behalf.

Scammers impersonating legitimate trading platforms may trick victims into transferring virtual assets to fake wallets or revealing login credentials, claiming it’s for “security purposes”.

Promote fake success stories

To get their victim to invest more, they will create and show fake data on their victim’s supposed profits or losses (e.g. using custom MetaTrader platforms).

Disappear without a trace

Victims of such scams will eventually realise that they are unable to withdraw any money via the bogus trading platform. The scammers, upon being contacted, will make excuses for the delays in withdrawal, ban the victim from the bogus platform or shut the platform down entirely. They will then disappear – and so will the victims’ money.

Romance Baiting

The approach:

Target people searching for a genuine connection

Some investment scammers will take their scam step further and impersonate a member of their target’s opposite sex to get close to him/her. They may set up fake dating profiles and/or contact their target via dating sites, apps and social media.

Take conversations off-platform quickly

They will generally ask to take the conversation to a messaging app like WhatsApp or WeChat where they can exchange encrypted messages. They will claim it is because such messaging apps are more private; in reality, it is because it becomes harder for the authorities to track them.

The fraud:

Use fake expressions of love to present their scam

Scammers will try to gain their target’s trust by doing things like expressing strong feelings in a short period of time and sharing (untrue) private details. Once they believe they have gained the target’s trust, they will present them with an ‘unmissable’ investment opportunity.

Claim returns that do not exist

They will claim to have personally benefited from the investment opportunity and invite their target to start by transferring small amounts of money to them for the investment. They may share some quick ‘returns’ to encourage their target to invest even larger sums of money.

Disappear without a trace

Once the target runs out of money to invest or decides he/she wants to withdraw some funds, the scammer will stop all communications and disappear with the money.

-

Spot the signs

If something seems good to be true, it almost always is. Any promise of guaranteed returns should be treated as a warning sign.

-

Be sceptical

Be wary of strangers who contact you out of the blue and individuals who pressure you into acting on their advice or promises to make you rich.

Never take investment advice from strangers you meet on social media or dating apps. Ignore their unsolicited approaches and advice.

-

Seek advice from an independent professional

Investment scams can be hard to spot; before you invest, make sure to seek independent legal or financial advice from licensed professionals.

-

Do your research

Even if you believe you are investing in a reputable company, ask a financial or legal advisor to review any materials they provide beforehand. Scammers often impersonate real companies and may share professional-looking sales materials and websites with you.

Do a thorough check on the company and its representatives using resources such as the Monetary Authority of Singapore (MAS)’s Financial Institution's Directory, Register of Representatives and the Investor Alert List. You can find these at the MAS website.

When dealing with unregulated entities, you will have little recourse if things go wrong. If an entity is based outside of Singapore, check if it is regulated with the relevant overseas authority.

Do an online search for the company or individual’s name and add the words ‘review’, ‘complaint’ or ‘scam’ to learn about other people’s experiences with them.

-

Do not give in to pressure

Do not allow yourself to be pressured into making decisions related to investing on the spot. Always take the time to understand what you are investing in and know that high returns come with high risks.

-

Protect your money

Do not transfer money or digital currencies to anyone you have only met online or into investment opportunities that they introduce to you.

-

Protect your details

Never provide your personal details (e.g. NRIC, passport details or contact details) or banking information (e.g. account number or credit card details) to anyone you do not know well.