#BeAProAgainstCons with OCBC's security measures and anti-scam tips

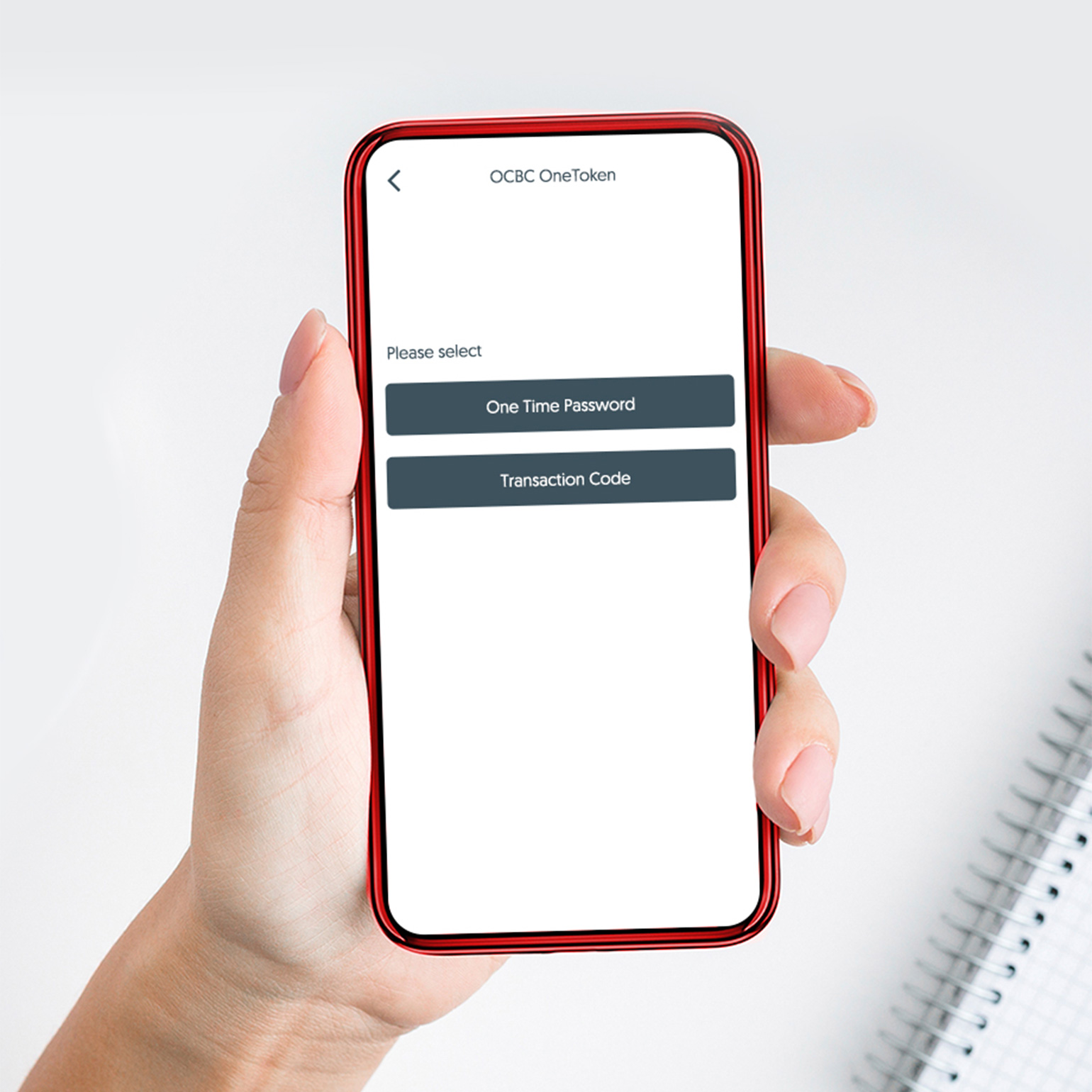

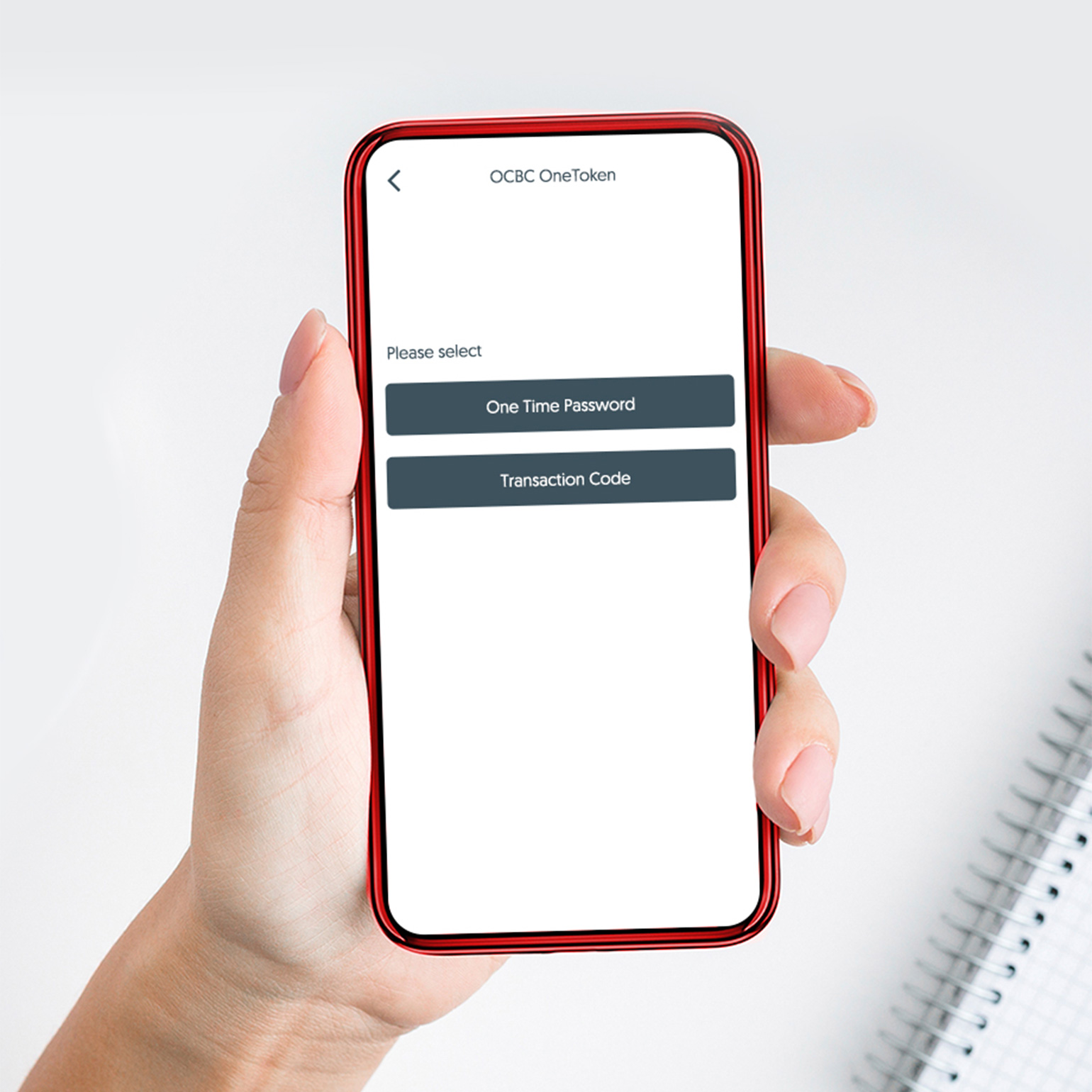

OCBC OneToken is a digital token installed as part of the OCBC app on your mobile device. With OCBC OneToken, you can easily authorise high-risk banking transactions securely on your device.

OCBC OneToken is an alternative to the hardware token or SMS token that can be used to authorise certain transactions, including those made via OCBC Internet Banking or the OCBC app.

Gives you two layers of security

OCBC OneToken is securely integrated within the OCBC app, which itself can be accessed only after your identity has been verified (i.e. via Access Code and PIN, OCBC OneTouchTM or OCBC OneLookTM). Two layers of security gives you added peace of mind.

Requires your authorisation for high-risk transactions

OCBC OneToken lets you perform transactions seamlessly and securely. It assures you that no high-risk transactions can take place without the extra step of authorisation.

Mitigates losses should your accounts be compromised

OCBC OneToken is required to authorise transactions above the authorisation limits set by us. It provides assurance that, should your accounts ever be compromised, criminals will not be able to use it to make large sum payments.

- Activate OCBC OneToken as soon as you download the OCBC app. You can do so by using SMS OTP and email OTP, Token Key, or a hardware token.

- When you use OCBC OneToken, make sure you read the push notifications we send you carefully. Do not provide OCBC OneToken authorisation without knowing the purpose of the transaction or login.

- Protect your device with a strong password to keep it secure and enrol only your own biometrics (face or fingerprint) on it. This protects access to the device on which OCBC OneToken resides.