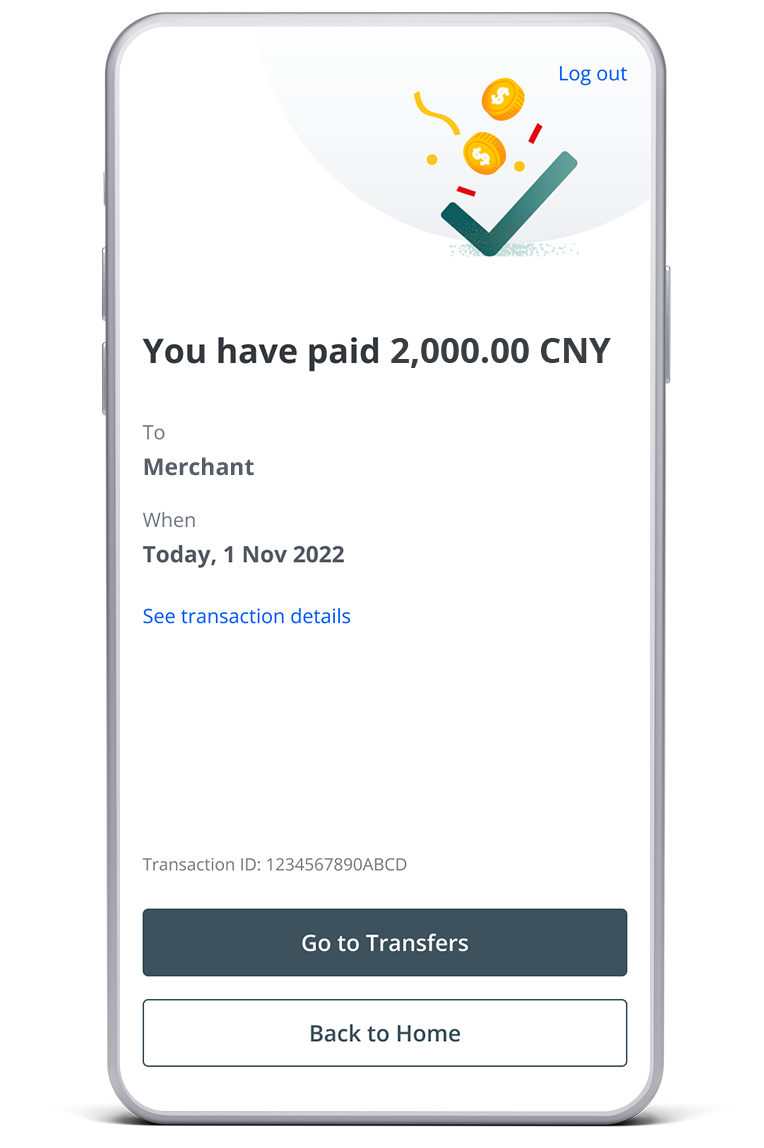

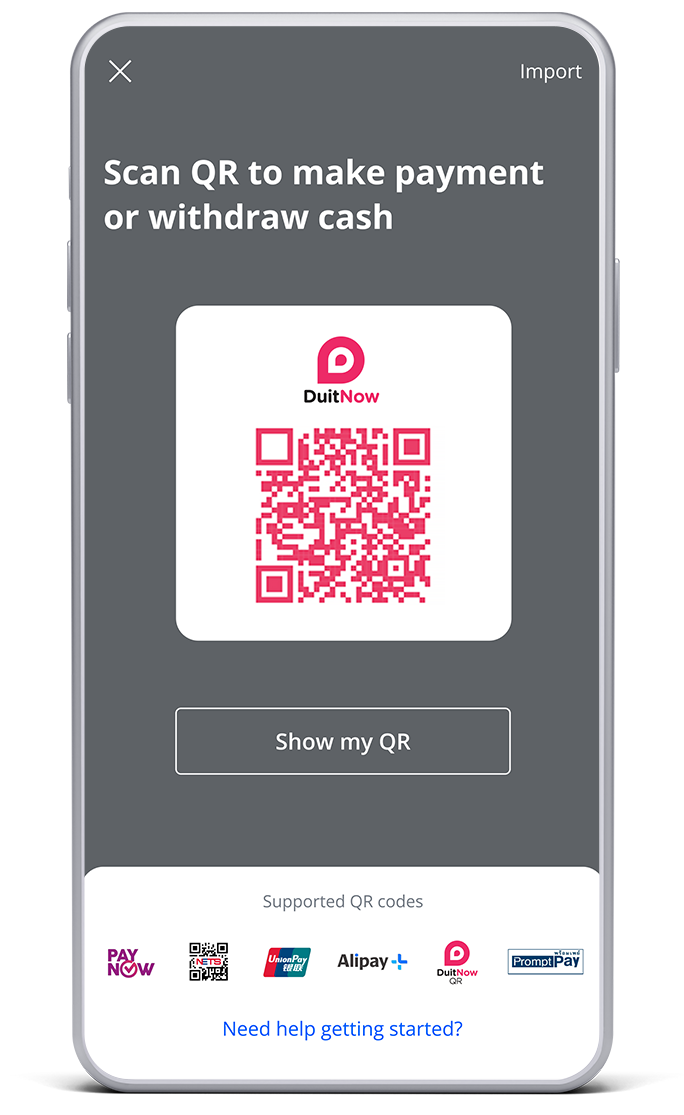

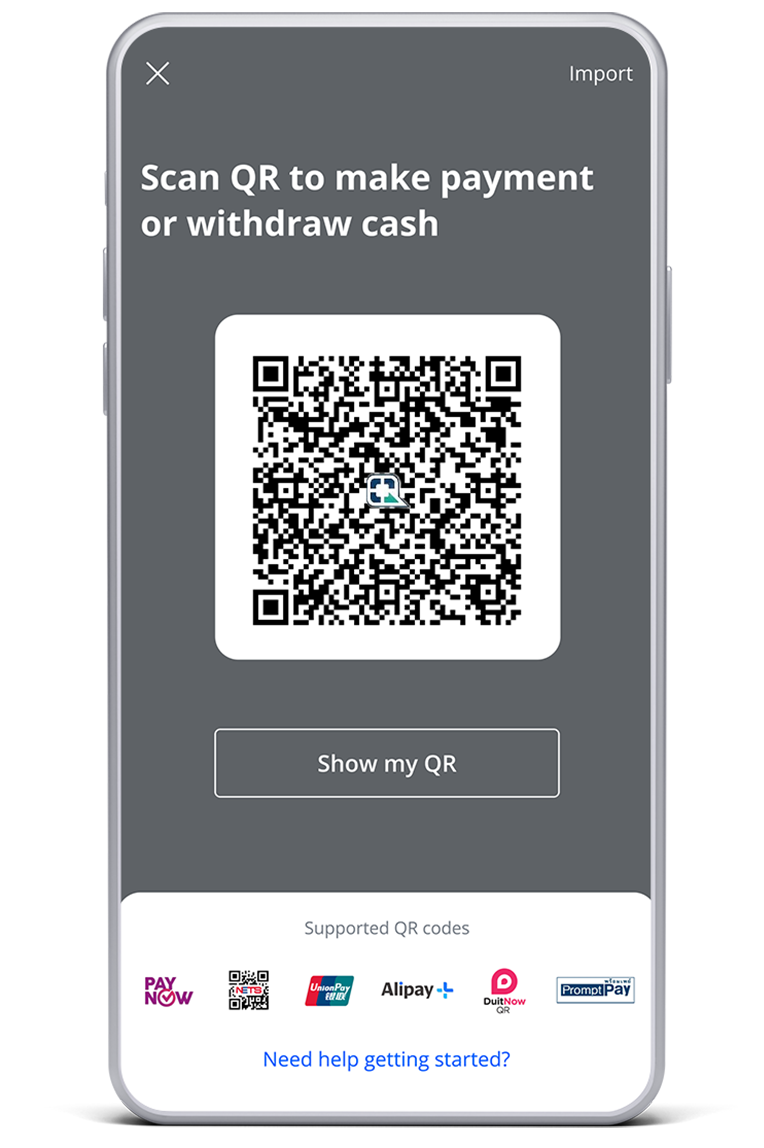

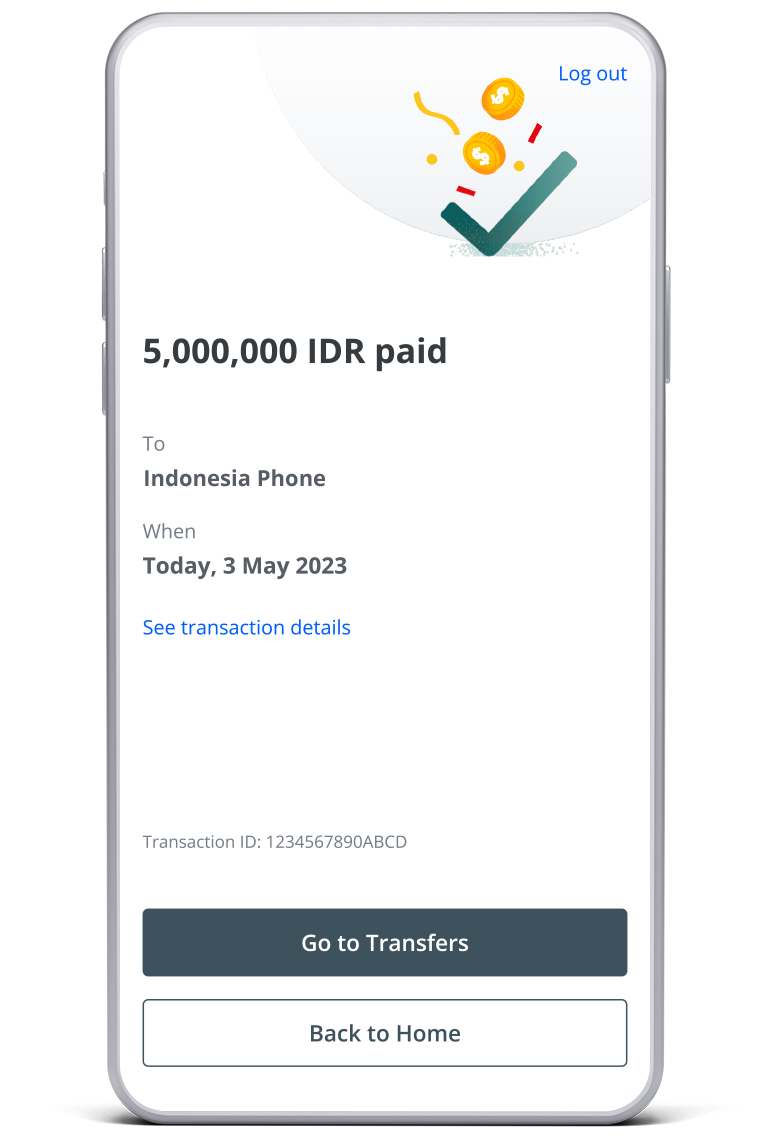

Alipay+ QR is accepted in over 40 destinations worldwide, such as China, Malaysia, South Korea, Japan, United States and more, with a daily transaction limit of S$3,000.

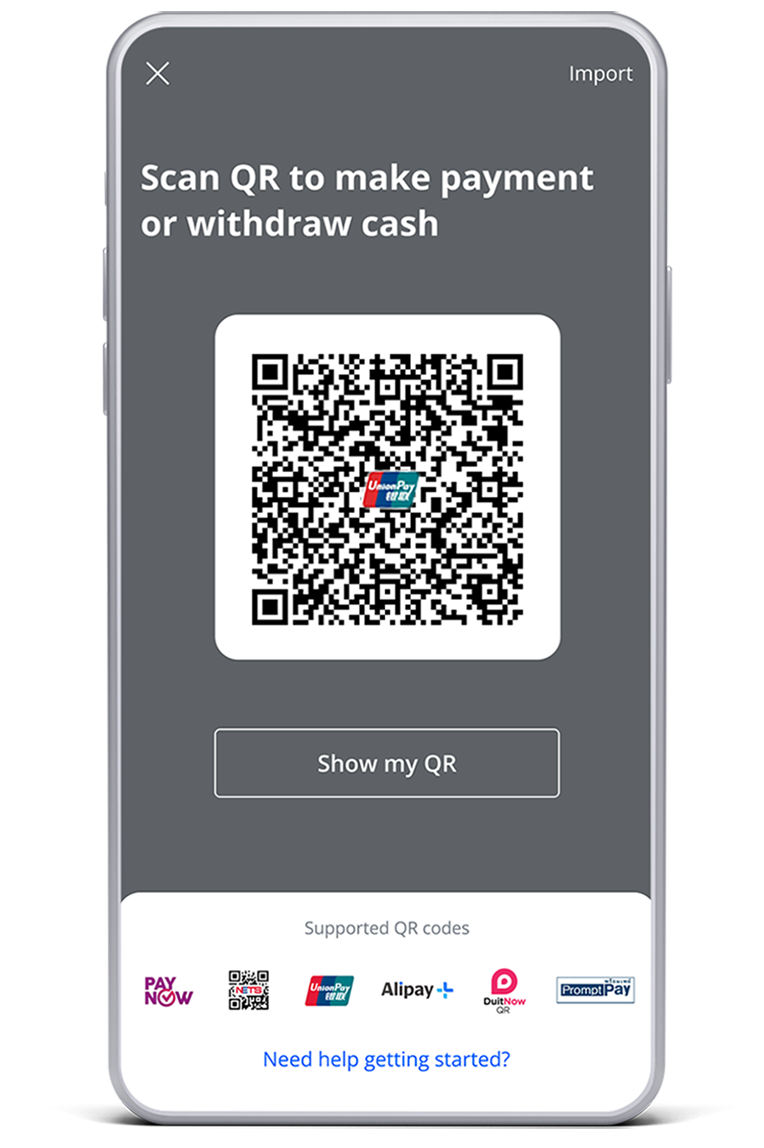

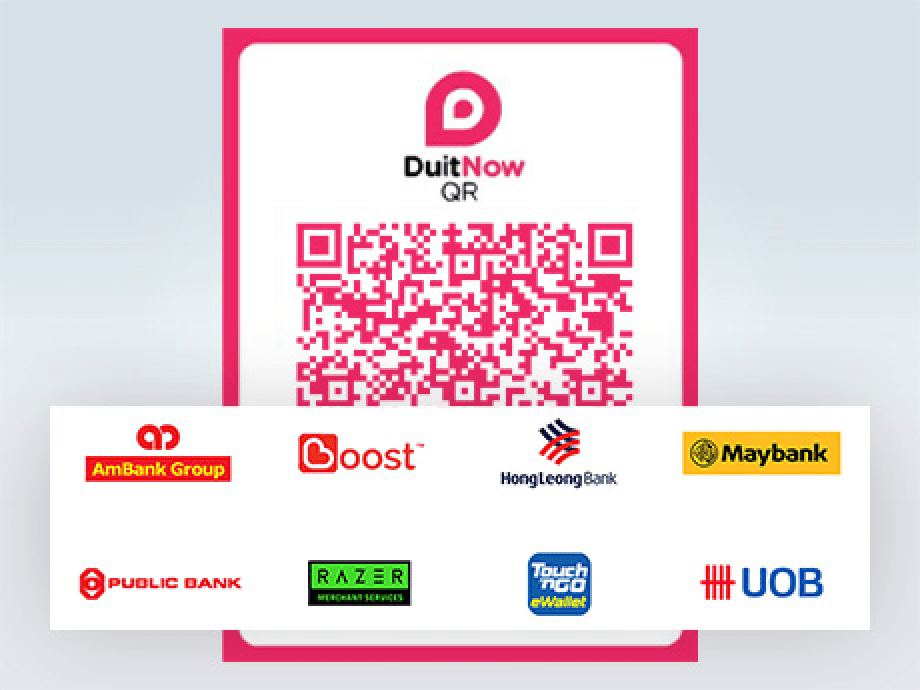

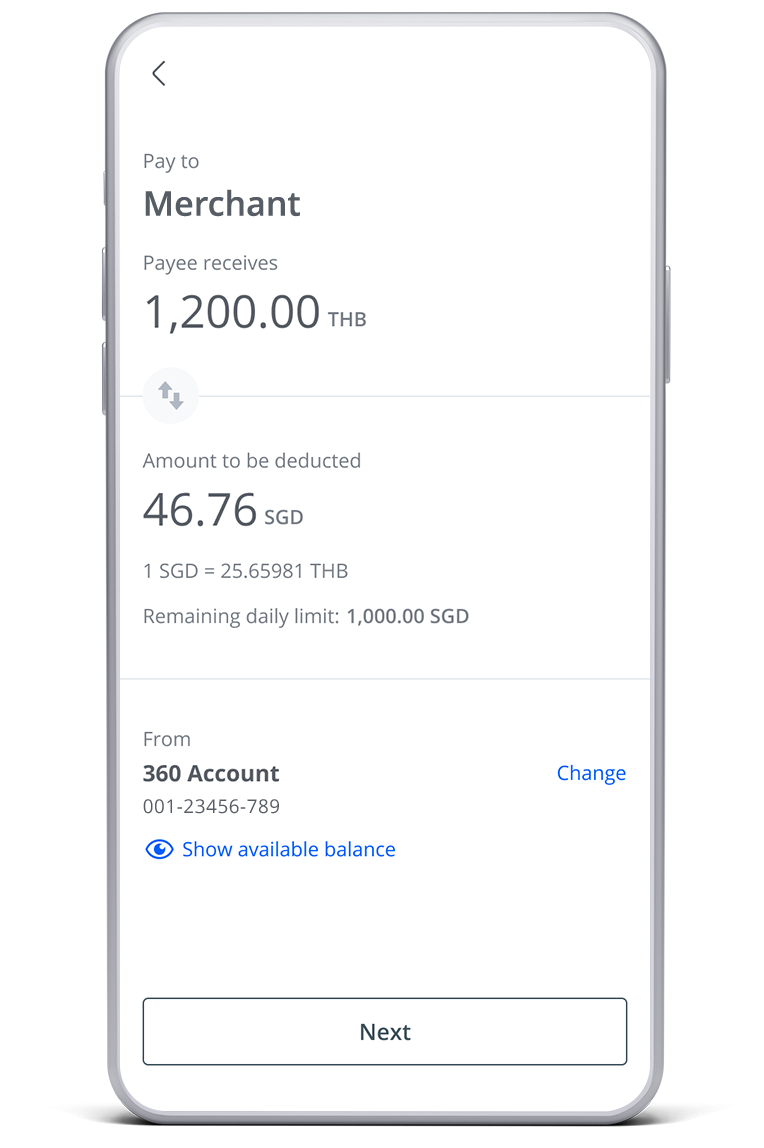

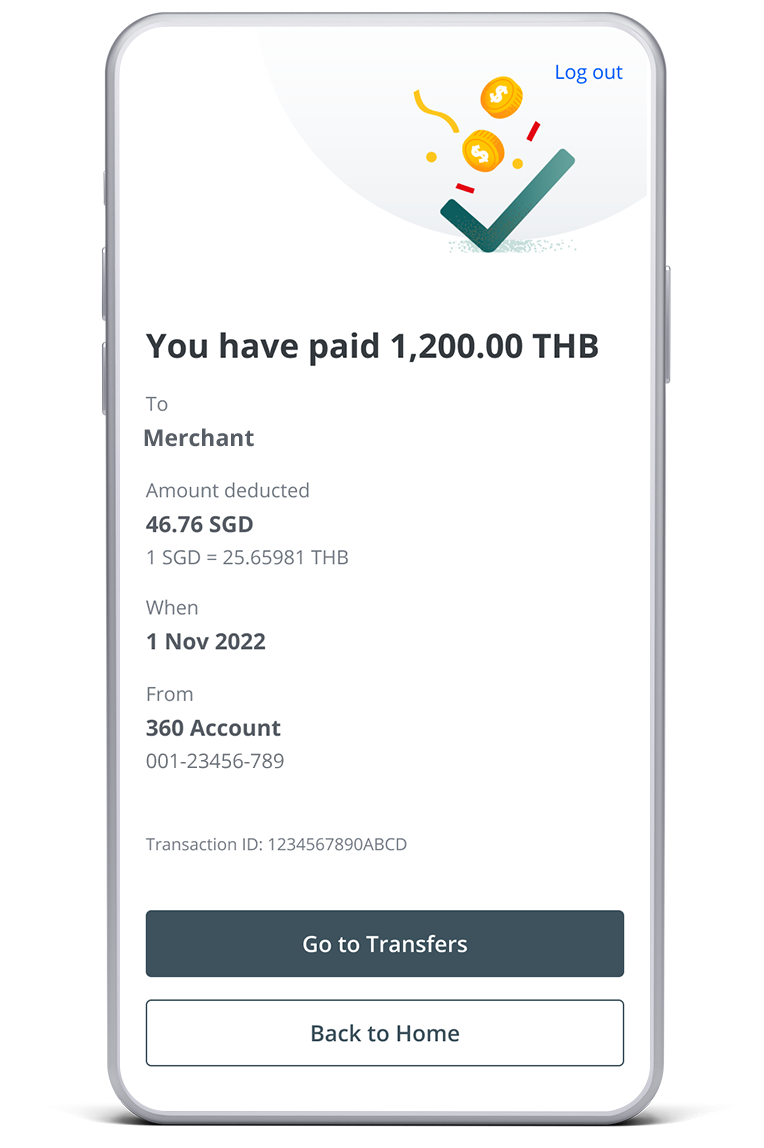

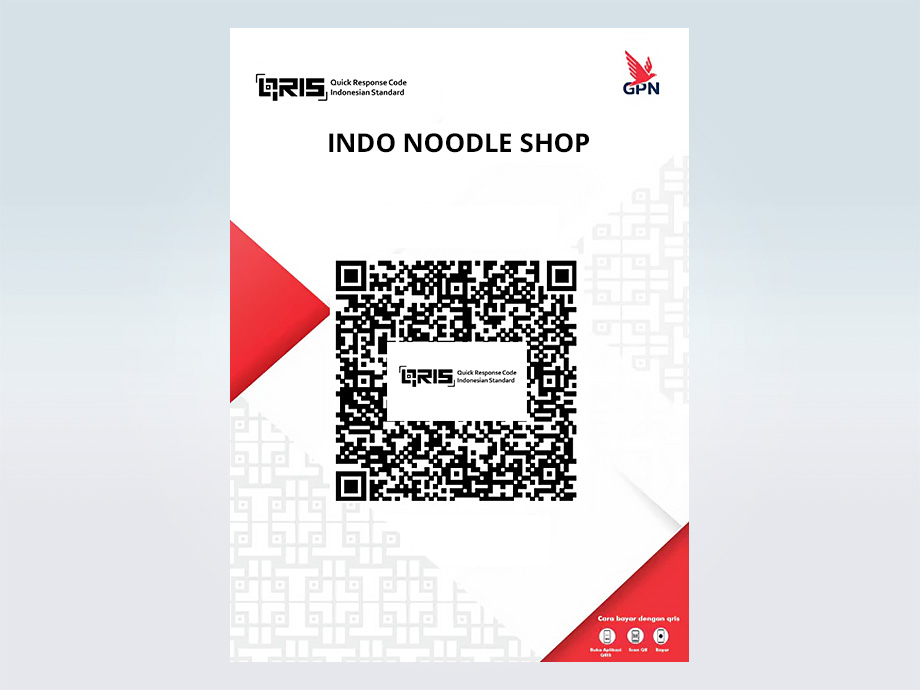

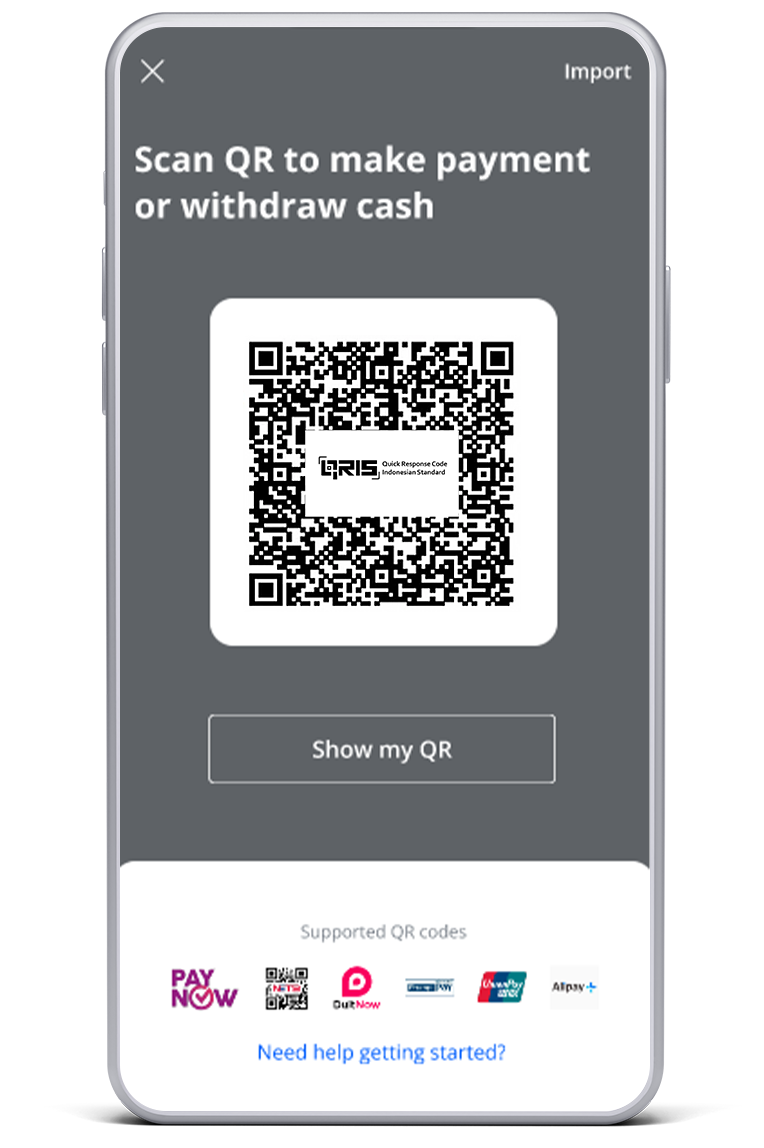

Look out for the Alipay+ QR code at the merchant’s counter.

View our frequently asked questions.