- Seamless banking experience anytime, anywhere: Never have to carry a hardware token around or worry about misplacing it. Use just your mobile device to authorise the transactions you make.

- Fuss-free activation: Activating OCBC OneToken only requires a few taps on the OCBC app. With it, you do not need to wait for a hardware token to be mailed to you to start authorising online transactions.

- Enhanced security: OCBC OneToken is securely integrated into your OCBC app. It is protected by your mobile device’s screen lock and the security measures that are built into the OCBC app.

- Planet-friendly choice: Do your part for the environment. Hardware tokens need to be replaced every few years as their batteries die or newer versions are released. By using a digital token, you will reduce e-waste and the carbon footprint involved in the manufacturing and shipping of hardware tokens.

Use OCBC OneToken (digital token) for a seamless and secure banking experience

Switch to OCBC OneToken to enjoy hassle-free banking.

OCBC OneToken is a digital token that can be used to authenticate and authorise transactions made via the OCBC app or Internet Banking, and certain online card payments. It is securely integrated into the OCBC app on your mobile device.

You can use OCBC OneToken – instead of hardware tokens or SMS One-Time Passwords (OTPs) – to protect yourself against unauthorised digital transactions.

Alternatively, you can activate OCBC OneToken using SMS OTP and Token Key or your existing physical hardware token.

Please refer to our FAQs if you need help.

View our Help & Support page for more information on how to authorise online transactions using OCBC OneToken.

Disclaimers

We advise you to stay vigilant and secure your mobile device using biometric authentication.

Alternatively, use a strong password, PIN or other security mechanism to prevent unauthorised use of your mobile device. To further protect yourself, enable biometric authentication for the OCBC app and customise your Access Code and PIN.

Forgot Access Code/PIN? Reset instantly.

Yes, OCBC OneToken is securely integrated into the OCBC app on your mobile device. Security can be further enhanced by your device's screen lock (e.g. biometric or PIN).

You may still do so, depending on the type of transaction you make.

- Transactions made via the OCBC app or Internet Banking: No. Once you have activated your OCBC OneToken on your mobile device, you will not be able to use your hardware token or SMS OTPs to authorise such transactions.

- Transactions made via Phone Banking or SMS Banking: SMS OTPs may still be used to authorise such transactions.

- Online card transactions: SMS OTPs may still be required by some online merchants.

If you are an iOCBC user, you can continue to use your hardware token to access your iOCBC account.

First, please ensure your mobile device is connected to the Internet. Do also check that you have allowed push notifications for the OCBC app and that you have enabled push notifications via the app.

To allow push notifications to be sent via the app

- For iOS devices:

- Step 1: Access Settings > Select Notifications

- Step 2: Select ‘OCBC app’ > Turn on Notifications

- For Android devices:

- Step 1: Access Settings > Select Apps & Notifications

- Step 2: Select Notifications > Select App Notifications

- Step 3: Select OCBC app > Turn on Notifications

To enable push notifications

- Step 1: Launch the OCBC app

- Step 2: Tap on the bell icon (at top right)

- Step 3: Tap on the gear icon (at top right) to view Settings

- Step 4: Toggle on ‘Receive reminders and alerts’

For details, refer to our FAQs.

Next, please note that you will not receive push notifications for transactions made via the OCBC app as they are authorised in the background.

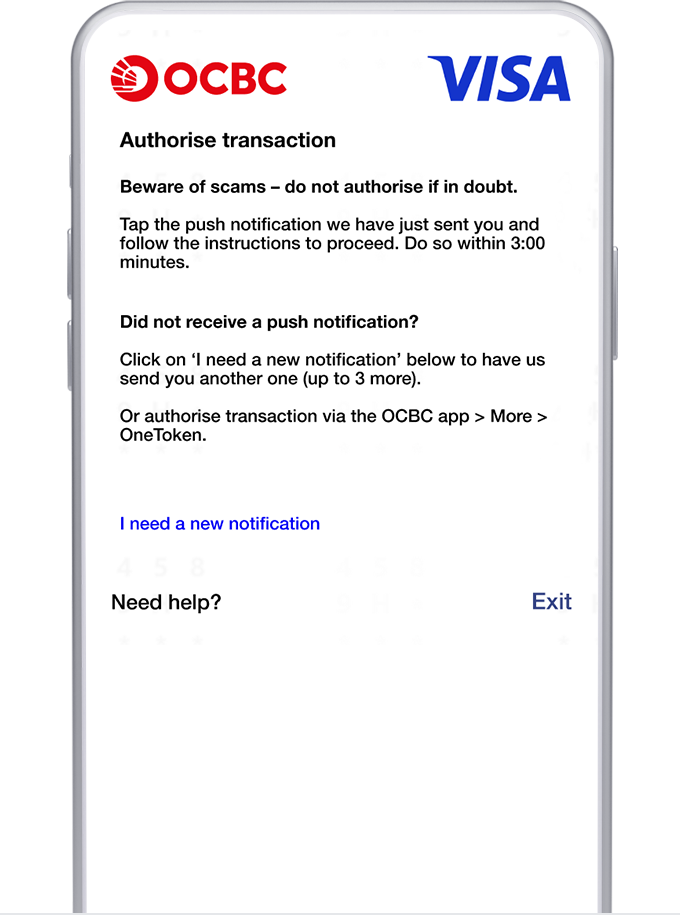

If you do not receive a push notification for your OCBC Internet Banking or online card transaction, you can take these steps to authorise your transaction:

- Step 1: Submit your transaction request

- Step 2: An authorisation prompt will be shown on the screen

- Step 3: Launch the OCBC app on your mobile device > Tap on ‘More’ (bottom right-hand corner of the screen) > ‘OneToken’. A prompt titled ‘Authorise Transaction’ or ‘Authorise login’ should appear*

- Step 4: Tap ‘Confirm’ to authorise your transaction

- Step 5: Return to your browser

*If you do not see it, please return to your browser to request a new push notification.

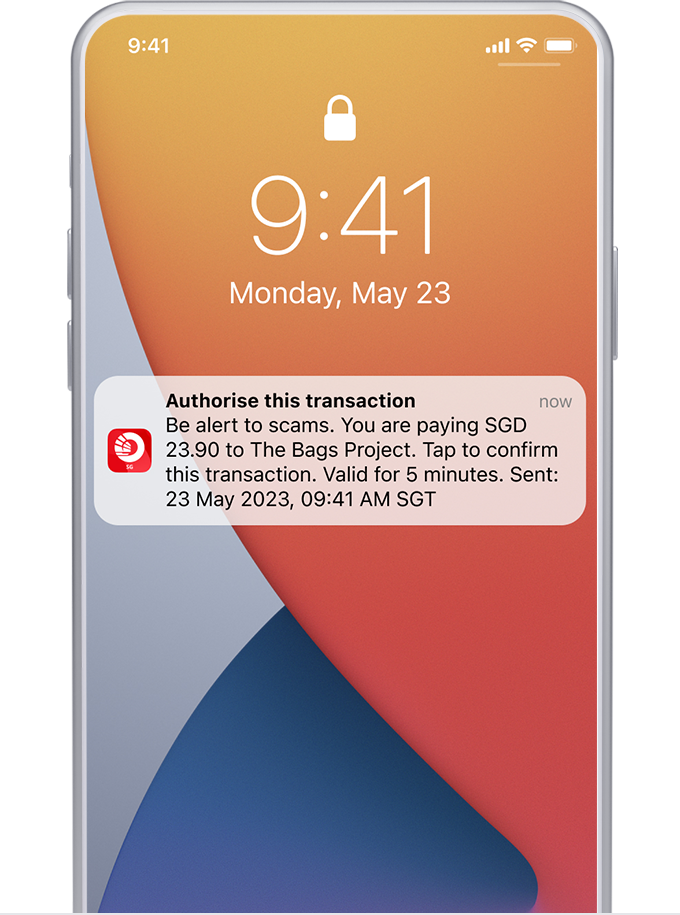

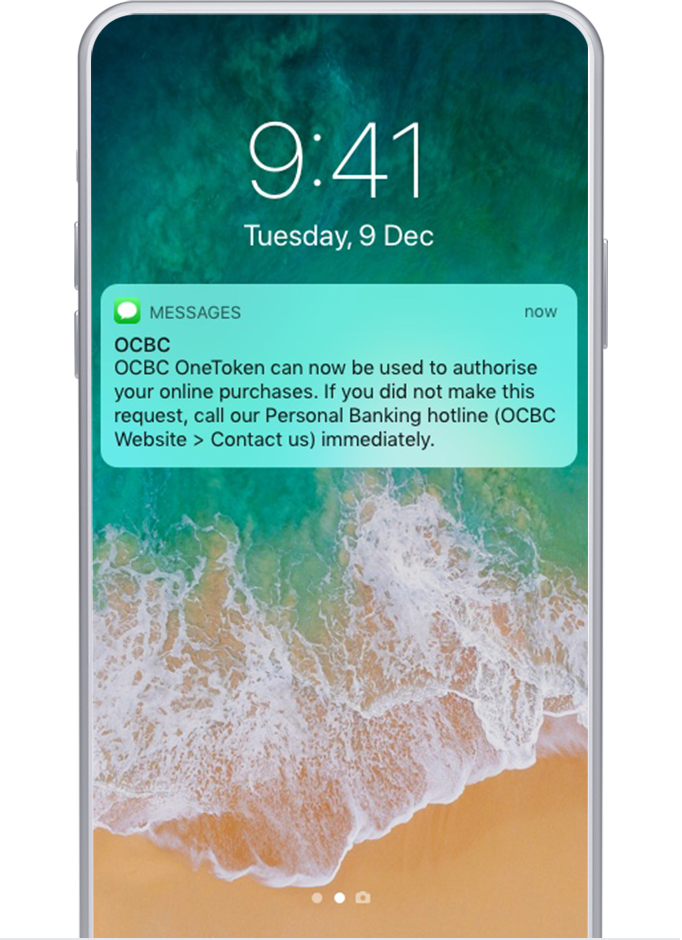

Authorise transactions with just a tap

When you login or perform a transaction on your desktop, you will receive a notification on your mobile phone prompting you to authorise the action. Simply tap on the notification and it’s approved!

Notifications for the OCBC app must be enabled on your mobile device for this purpose. Learn more

High risk transactions include:

- Adding a new payee*

- Adding credit cards from other banks

- Making funds transfer

- Changing transaction/daily/authorisation/withdrawal/ funds transfer limits*

- Changing credit and spending limits on your cards

- Updating personal particulars*

- Changing online banking PIN

*For your security, to access services like adding payees, changing transaction limits and updating personal details, you must wait up to 12 hours for OCBC OneToken to be fully activated.