#BeAProAgainstCons with OCBC's security measures and anti-scam tips

The authorisation limit refers to the amount which you can pay or transfer before being asked to authorise transactions such as FAST/PayNow transfers, bill payments or online purchases (e.g. NETS QR, eNETS), using a fully activated OCBC OneToken or hardware token. It applies to each transaction you make and differs by transaction type.

Gives you an extra layer of protection

Authorisation limits give you an extra layer of protection for high-risk transactions made using your account, as these will require the additional authentication via a fully activated OCBC OneToken or hardware token.

Lets you verify transactions in real time

Authorisation limits allow you to verify the accuracy of the value of your transactions in real time, ensuring you are being debited the correct amount (e.g. for eNETS) if such payments are above the limit set.

Fixed for your safety

Authorisation limits are fixed and, for your safety, cannot be changed. This added protection is designed to mitigate the financial damage scammers may inflict in the unlikely event they gain unauthorised access to your account(s).

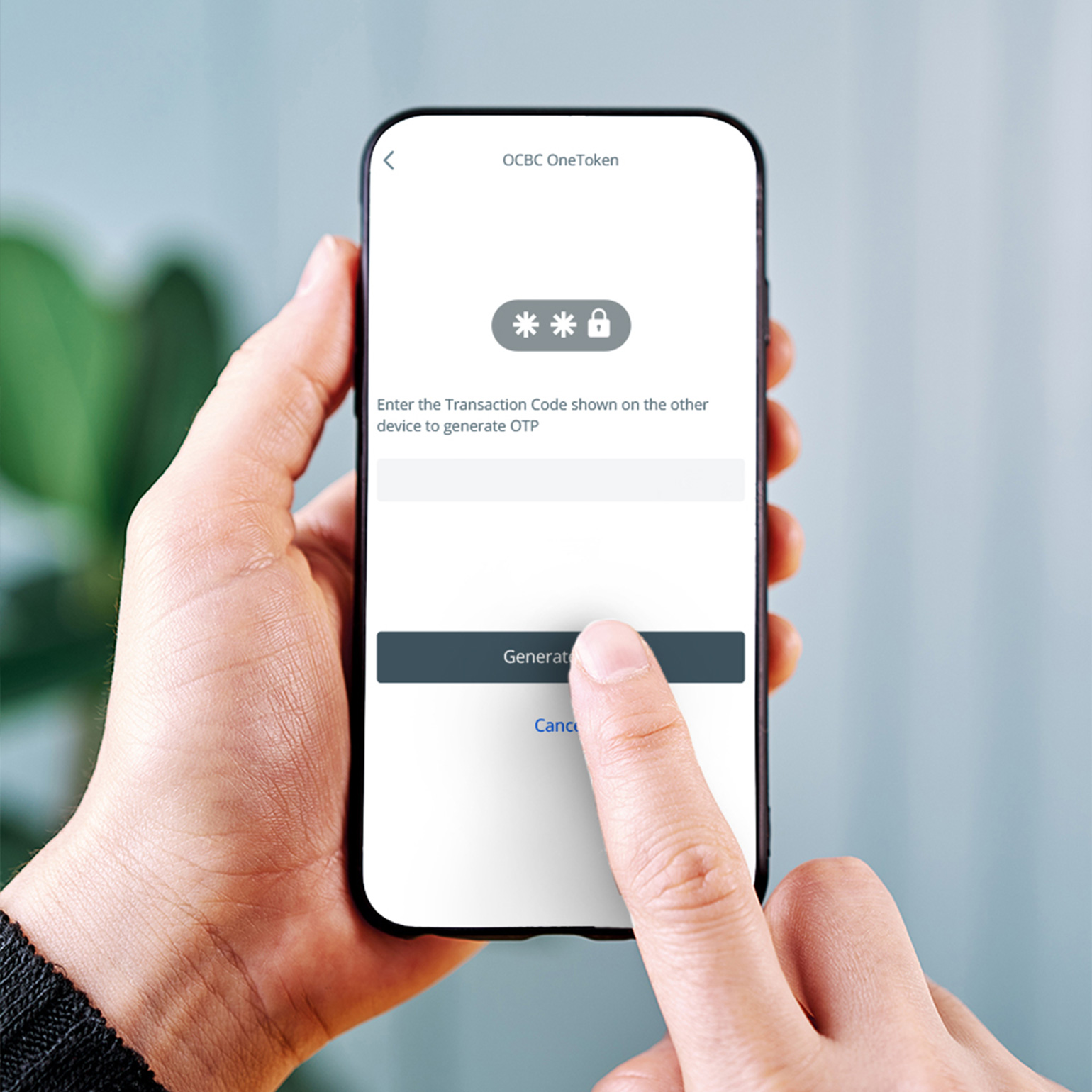

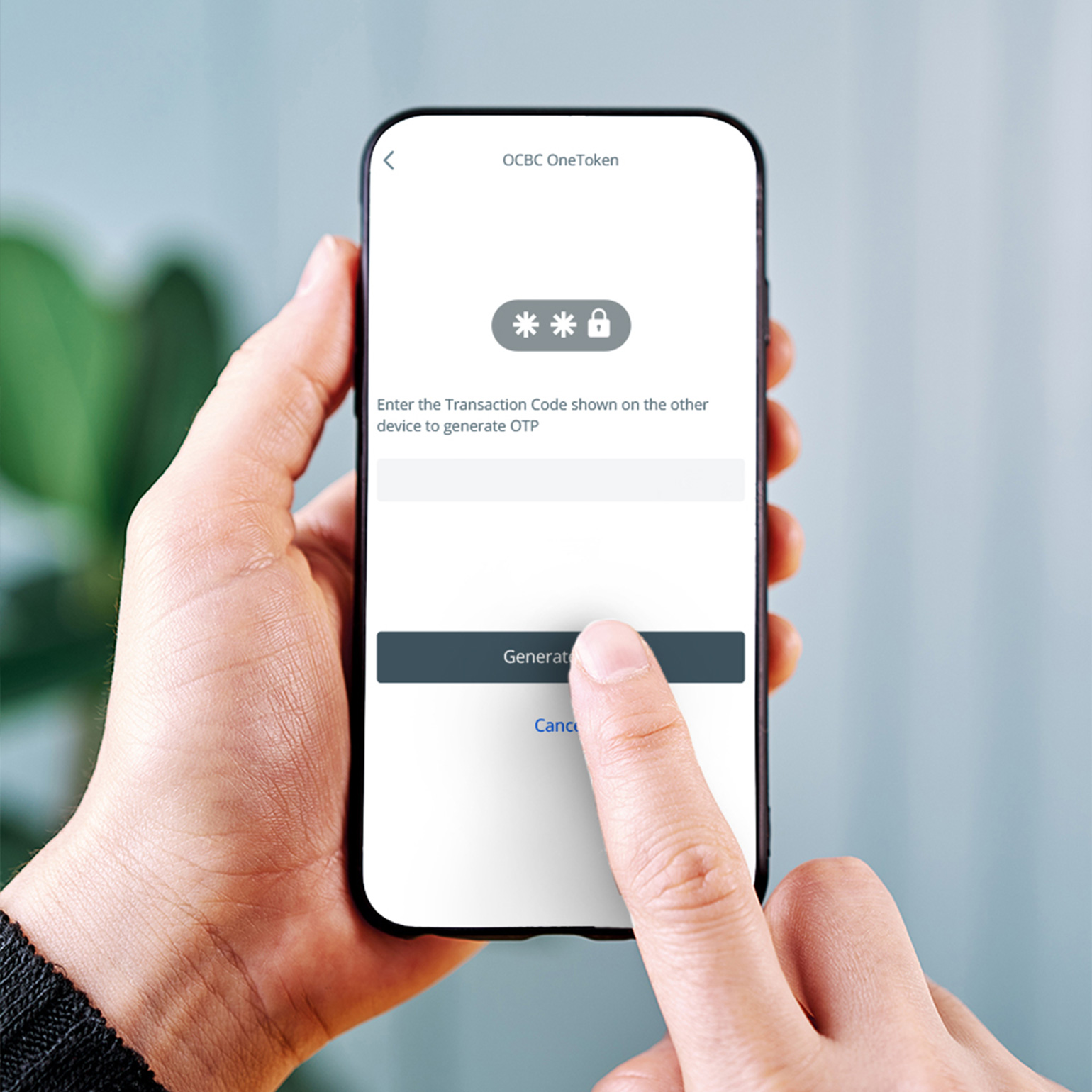

You can authorise your transactions easily using your fully activated OCBC OneToken via the OCBC app or hardware token.

FAQs on authorisation limits

Learn more about the OCBC OneToken