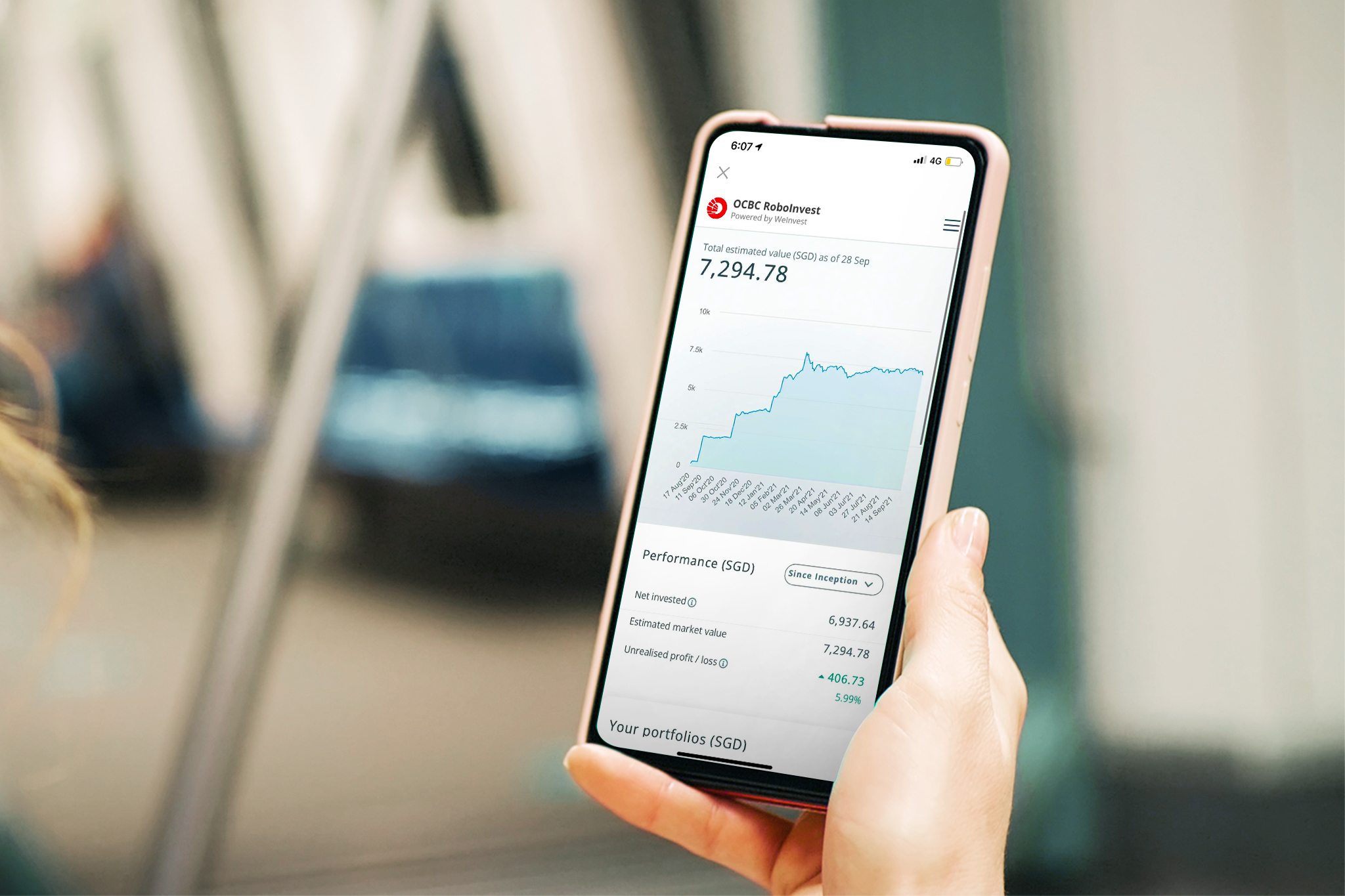

RoboInvest is a digital investment platform based on tested and proven algorithm technology to help investors make intelligent investment decisions, without the hassle of monitoring your portfolios.

Why choose OCBC RoboInvest for investments?

OCBC RoboInvest brings you the best elements of a high-end investing service, without the lock in of a high investment amount and excessive management fee typically associated with this service. You will experience:

- Access to local and global products

- Automated Portfolio Management Service

- Bank-grade secure interface

- Online access to your portfolio anytime

What’s the difference between OCBC RoboInvest’s service and an online broker’s service?

OCBC RoboInvest manages the investment portfolios you have invested in with automated periodic rebalancing, while you can sit back and track your accounts 24/7 to watch your investment grow.

Why choose to invest with OCBC RoboInvest instead of keeping money in the bank?

Keeping money in your bank savings account only earns the interest rate on your deposits. With OCBC RoboInvest, your money can be invested in model portfolios according to your risk tolerance, thus possibly having a higher return in the long term.

What’s the eligibility criteria to use this service?

- At least 18 years of age

- Non-US citizen

- Non-UK resident

- Non-EU resident

- People not residing in Russia, Belarus, or within the EEA

- Have an existing OCBC Current or Savings account with Online Banking access

Is this a service provided by OCBC? Why is there a “powered by WeInvest” label on the platform?

OCBC RoboInvest is a collaboration between OCBC and a Fintech firm Planar Investments Pte Ltd (WeInvest). This brand new platform is developed and supported by WeInvest, with customised screens and investment flow for OCBC. And we are bringing this investment service exclusively to OCBC customers!

Do I always have to go through OCBC Internet Banking to gain access to OCBC RoboInvest?

Yes. You can access RoboInvest after logging into OCBC internet banking or mobile banking

Who can I contact if I encounter issues with the platform or have queries on my investments?

Please contact the email support ID Support@OCBCRoboInvest.com. Our Fintech partner WeInvest supporting the platform will be able to assist you further. Typically, a response can be expected within the next business day.

What is the difference between OCBC RoboInvest’s service and OCBC Blue Chip Investment Plan (BCIP)?

OCBC’s Blue Chip Investment Plan (“BCIP”) aims to allow users to invest simply and gain exposure to the stock market. BCIP customers can select up to 20 share counters or ETF counters on the Straits Times Index for regular investment from as low as S$100. BCIP adopts the concept of Dollar Cost Averaging and customers can invest a chosen amount into their selected counters comfortably each month without timing the market. OCBC RoboInvest however, aims to provide customers with an easy way to steer their portfolio towards the strategy of their choice by following one preformulated strategies. By doing so, customers can gain exposure to Exchange-Traded Funds (“ETF”) and Equities, in Singapore and overseas markets. Unlike the BCIP, RoboInvest is not a regular savings plan and customers can curate the timing of investing their funds.