Achieve financial wellness with your first 3 pay cheques

Achieve financial wellness with your first 3 pay cheques

Congratulations on landing your first job! Now that you have a steady income, find out how you can make the most out of your first three pay cheques with this article:

- First pay cheque: Build an emergency fund

- Second pay cheque: Manage your risks

- Third pay cheque: Start investing

Starting your first full-time job can be a thrilling and life-changing milestone. As a first jobber, what will you do with your first few pay cheques? Treat yourself to an expensive meal? Get your first Chanel bag or Prada wallet?

Being able to handle your money responsibly, alongside your newfound financial independence, is critical in building a solid foundation for yourself, and most importantly, overcoming downturns in life.

Do you invest more than you save?

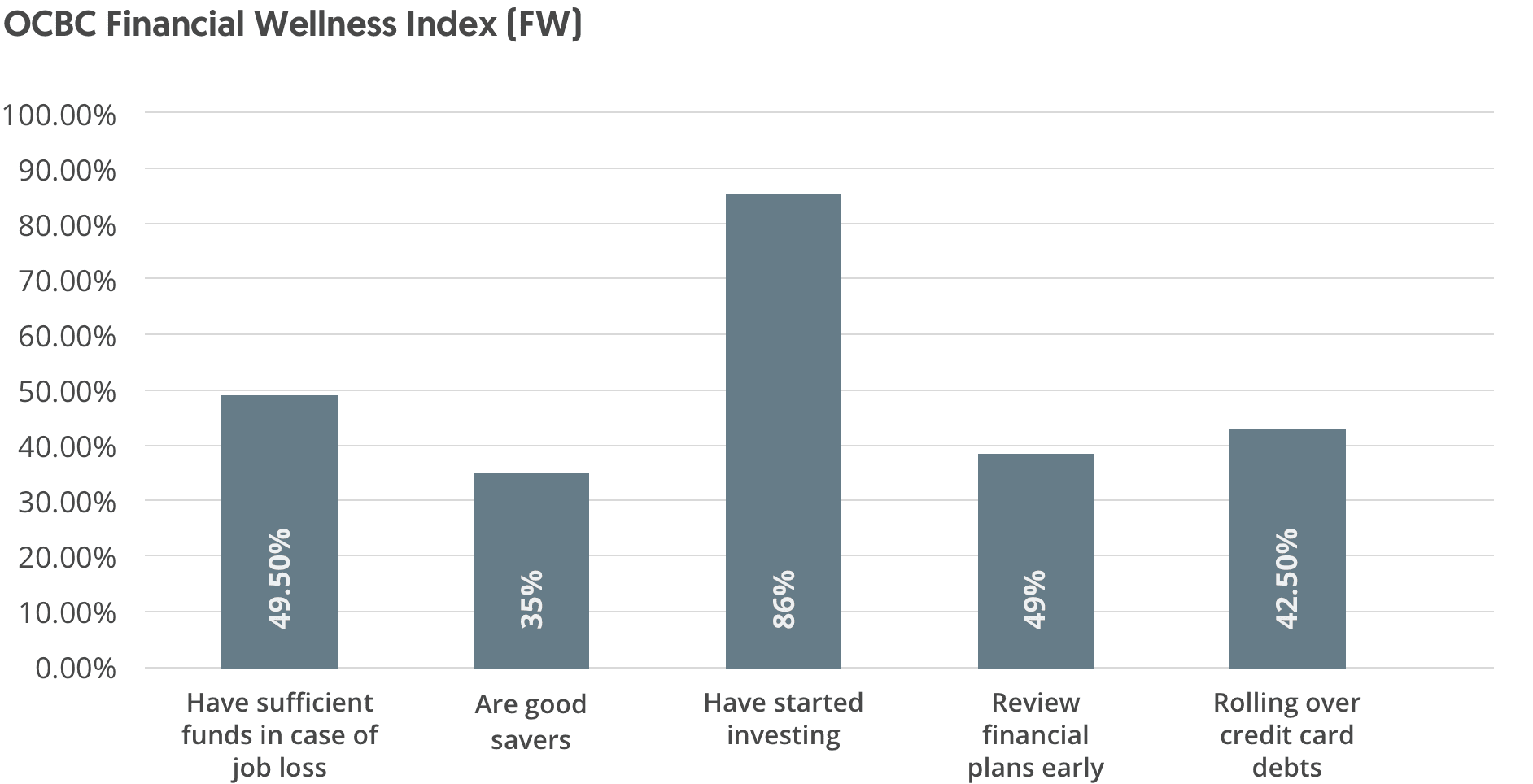

In 2022, OCBC surveyed Singaporeans aged 21 to 29 on key personal finance metrics, including saving, investing and managing debt (Figure 1). While the OCBC Financial Wellness Index survey showed an impressive 86% to have started investing, more effort is needed to encourage saving among this group. Furthermore, an average of only 49.5% have put money aside towards building an emergency fund.

Figure 1: Young Singaporeans aged 21 to 29 prioritise investing over saving

Source: OCBC Financial Wellness Index 2022

These are important gaps to address as saving is a low-risk way of growing your money. Having sufficient money can also provide peace of mind in those moments when you need to bear the cost of unforeseen events. Rather than liquidating your investments (which may lead to losses), you instead pay through your savings.

An emergency fund, as the name suggests, is having sufficient cash set aside for unexpected life events, such as a medical emergency or the financial burden of a sudden job loss. This is a separate pool of money from your savings. Not having an emergency fund can lead you into debt as you may resort to interest-bearing personal loans or credit cards to settle the payments.

How can young Singaporeans like yourself set aside enough money for an emergency? Let us discover and explore how you can use your first three pay cheques to make smart financial decisions when the time comes.

First pay cheque: Build an emergency fund

Your first pay cheque is certainly an exciting moment, but it is also an important moment to strike a balance by making smart financial decisions. Simply put, it is perfectly fine to reward yourself with an expensive treat, but the key here is to not think short term but plan for the longer term. Ensure that you budget your purchases in a sustainable way to avoid diminishing your money at a rate faster than your incoming pay cheques.

A quick and easy way to start is by adopting the golden 50-30-20 rule, which divides your pay cheque into the following:

- 50%: Daily living expenses

- 30%: Entertainment and miscellaneous

- 20%: Personal savings and investment goals

Specifically on savings and investments, you can take the first step in assigning 20% of your first pay cheque towards building an emergency fund. Ideally, grow this fund to cover at least three to six months of your living expenses, in a bid to weather through unexpected downturns.

Rather than simply saving through a regular savings account, explore the use of a high-yield savings account. The 360 Account is a fantastic choice as it allows you to earn up to 4.65% per annum on your first S$100,000 when you credit your salary¹, save² and spend³. There is also the possibility of earning an extra 3% when you purchase eligible insurance and investment products with OCBC Bank.

1 Credit salary of at least S$1,800 through GIRO

2 Increase average daily balance by at least S$500 each month

3 Charge at least S$500 to selected OCBC Credit Cards each month

Second pay cheque: Manage your risks

Next, let’s talk about how you can use your second pay cheque to prepare for any curveballs that life may throw at you.

As we all know, life is unpredictable. Unexpected events can cause a significant blow to your retirement plans. For instance, you were planning to work into your 70s maybe, but a work injury caused you to be bedridden instead. Not only have you lost your source of income, but you also did not get a chance to build a nest egg like you had planned. In addition, there are now massive hospital bills to incur.

It is true when we say we are unable to foresee the future, but one thing we can do is to prepare ourselves for such events.

Think about safeguarding yourself and insuring your loved ones from unforeseen financial obligations. With so many different types of insurance plans out there and a limited budget, how can you get the right coverage and what should you prioritise?

Before diving into the different insurance policies, it is essential to review your existing policies and identify any gaps that may exist.

If you are a Singaporean or Permanent Resident, you are already covered under MediShield Life, which offers basic hospitalisation and surgery coverage. For additional coverage, consider upgrading your MediShield Life plan to Integrated Shield Plans offered by private health insurers. These plans can even be funded using MediSave. Depending on the plan you select, you can then get coverage for higher ward classes, claims and more.

As a first jobber, however, your priorities may be different. While death coverage may not be at the top of your list, you may want to allocate more to critical illness (CI). Just think about it, if any unfortunate event were to happen, you would want to get treated promptly. Being able to take time off work to focus on making a full recovery can make a difference. And this is where CI coverage can give you this option.

Depending on your plan, CI coverage may include:

- Income replacement

- Any remaining out-of-pocket costs

- Payouts for trial of experimental drugs

You may consider the OCBC Great Term Guard (Figure 2), a term insurance plan that provides coverage against death, terminal illness, total & permanent disability (TPD) as well as late-stage CI.

The protection covered under the OCBC Great Term Guard includes:

- Critical illness (includes 53 CI)

- Death or terminal Illness

- Total & permanent disability

Figure 2: OCBC Great Term Guard offers extensive protection with varied coverage to best meet one’s needs

Source: OCBC Wealth Management

Do not think of insurance as a “waste of money”. The OCBC Great Term Guard distinguishes itself from the other comparable policies on the market by offering a complete refund of premiums if no claims are made at the age of 65. Prioritise what is important here, which is your health. Start protecting yourself today.

Third pay cheque: Start investing

Now, a question you may have is, “How can I grow my wealth?”.

Investing is a powerful tool for building long-term wealth, but it can also be intimidating for first-time investors. Technical jargon, alongside the vast variety of investment choices, serve as reasons for resistance to investing. Are you guilty of such procrastination?

A savings account alone is not enough to reach retirement. Rather savings, coupled with investing, help to build your future wealth, beat inflation and preserve your purchasing power.

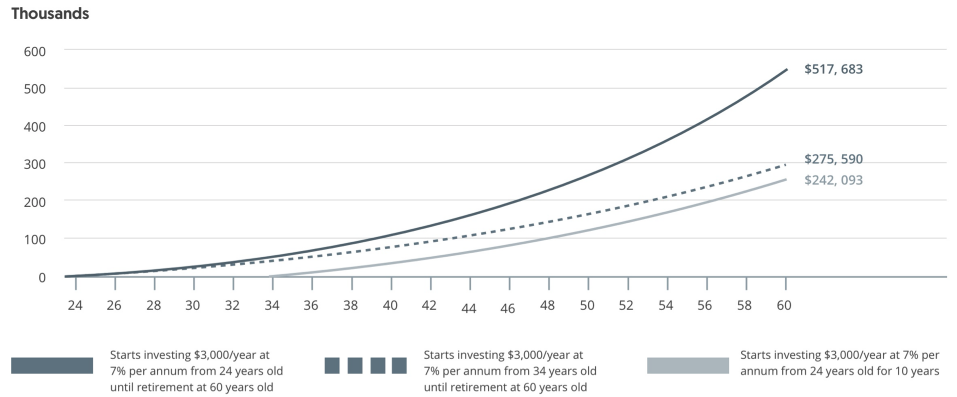

With the power of compounding i.e. multiplying effect (Figure 3), the earlier you start investing, the longer the time horizon you have for your investments to grow.

Figure 3: How to grow your money faster with the power of compounding

Source: OCBC Wealth Management

To kickstart your investment journey, consider using the OCBC RoboInvest platform. Even as a first-time investor, the tested and proven algorithm technology can help you manage your investments and make intelligent and personalised investing suggestions.

With 38 portfolios across 7 markets, the diversified portfolios are designed to reduce risk across different asset classes and investment themes. This ensures that every investor, including yourself, can find an investment that is tailored to your unique risk appetite, needs and wants. Just perfect for first-time investors!

With as little as US$100 per month, here is how the OCBC RoboInvest platform can help you:

- User-friendly and convenient

- Highly interactive

- Hassle-free optimisation

Moving forward, you may want to consider unit trusts too as they give you the flexibility to invest in multiple markets and industries starting from just S$100/month. Aside from achieving portfolio diversification with the top fund ideas curated by experienced OCBC investment experts, you can also get your portfolios taken care of by professional fund managers.

Remember, investing is important at any age and it is never too late to become an investor.

Good job on staying till the end of this article #NewAchievementUnlocked. Feel ready to start? Visit our website or approach your relationship manager to find out more.

General disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

Graphs, charts, formulae and other devices

Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Policy Owners' Protection Scheme

This plan is protected under the Policy Owner's Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Important notice for Insurance

The insurance plans are provided by The Great Eastern Life Assurance Company Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group and Transamerica Life Bermuda Ltd. The insurance plans are not bank deposits and OCBC Bank does not guarantee or have any obligations in connection with it.

You may want to seek advice from a financial adviser before committing to buy the product. If you choose to not seek advice from a financial adviser, you should consider if the product is suitable for you.

Buying a life insurance policy is a long-term commitment. An early termination of the policy usually involves high cost and the surrender value payable may be less than the total premiums paid.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and benefit illustration (available from us) before deciding whether to buy this product. We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies. All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document. This document may be translated into the Chinese language. If there is any difference between the English and Chinese versions, the English version will prevail.

Global Equities Disclaimer

- Dividend growth is not guaranteed, nor are companies in which you invest obliged to pay dividends;

- Companies may go bankrupt rendering the original investment valueless;

- Equity markets may decline in value;

- Corporate earnings and financial markets may be volatile;

- If there is no recognised market for equities, then these may be difficult to sell and accurate information about their value may be hard to obtain;

- Smaller company investments may be difficult to sell if there is little liquidity in the market for such equities and there may be substantial differences between the buying price and the selling price;

- Equities on overseas markets may involve different risks to equities issued in Singapore;

- With regards to investments in overseas companies, foreign exchange rates may move in an unfavourable direction affecting adversely the valuation of investments in base currency terms.

Foreign Currency Disclaimers

- Foreign currency deposits are subject to inherent exchange rate fluctuation that may provide opportunities and risks. Consequently, exchange rate fluctuations may affect the value of your foreign currency investments or deposits.

- Earning on foreign currency investments or deposits may change depending on the exchange rates prevalent at the time of their maturity if you choose to convert.

- Exchange controls may apply to certain foreign currencies from time to time.

- Any pre-termination costs will be taken and deducted from your deposit directly and without notice.

- Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The indicative distribution rate may not be achieved and is not an indication, forecast, or projection of the future performance of the Fund.

For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.