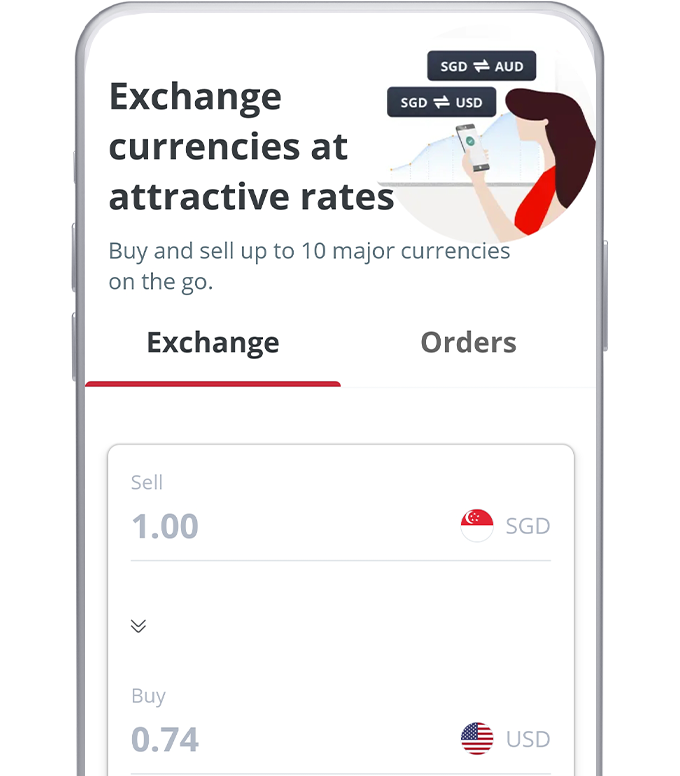

Each debit card can only be linked to one Global Savings Account. Once you link your debit card to a Global Savings Account, you can use it to make purchases in the foreign currencies held in the account.

Learn more about linking a debit card to your Global Savings Account.