If you are using OCBC app, you need to complete PayNow transfer to get your PayNow daily limit changed.

PayNow with OCBC

Sending and receiving money has never been easier

Transfer and receive money instantly and securely.

Make even bigger transfers with the new and improved PayNow daily transfer limit. You can now transfer up to S$200,000 if you’re a Personal Banking customer, and S$300,000 if you’re a Premier Banking customer.

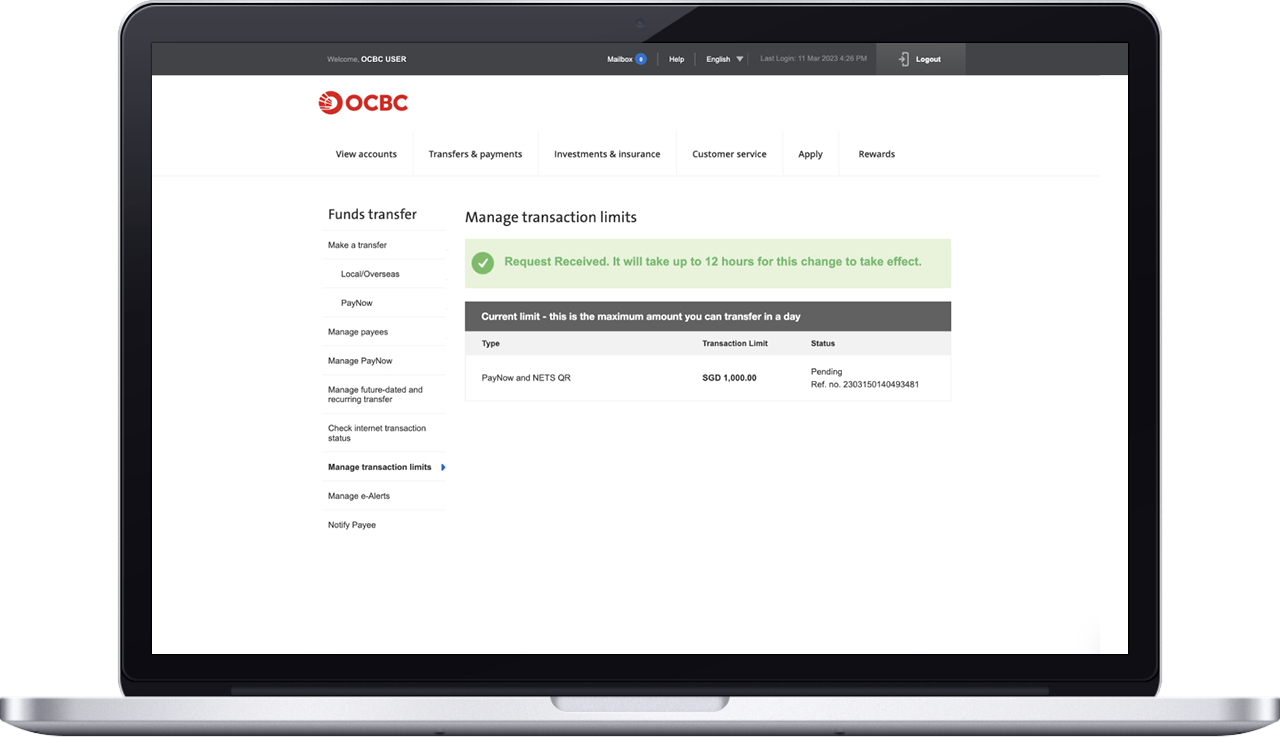

From 18 March 2022, when you add a new payee, increase a limit or change your mobile number/email address, it will take at least 12 hours for the change to take effect.

Be amongst the first to receive government payouts such as GST vouchers and Assurance Package

Receive your insurance payouts instantly to your bank account

For those above 55 years old, get your CPF savings withdrawals credited directly into your account, as often as you need

Make secure transfers

Receive immediate transfers

No need to give out your bank account number to receive payments

Generate your own QR code without sharing your mobile number to receive payments

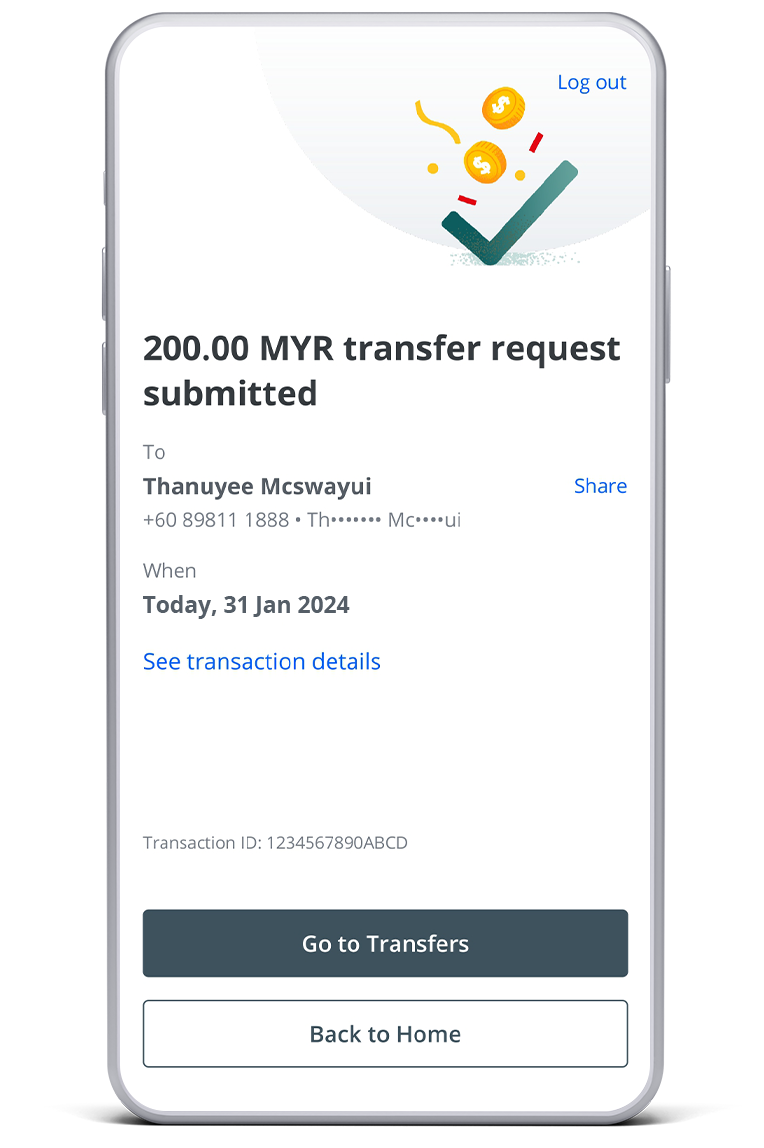

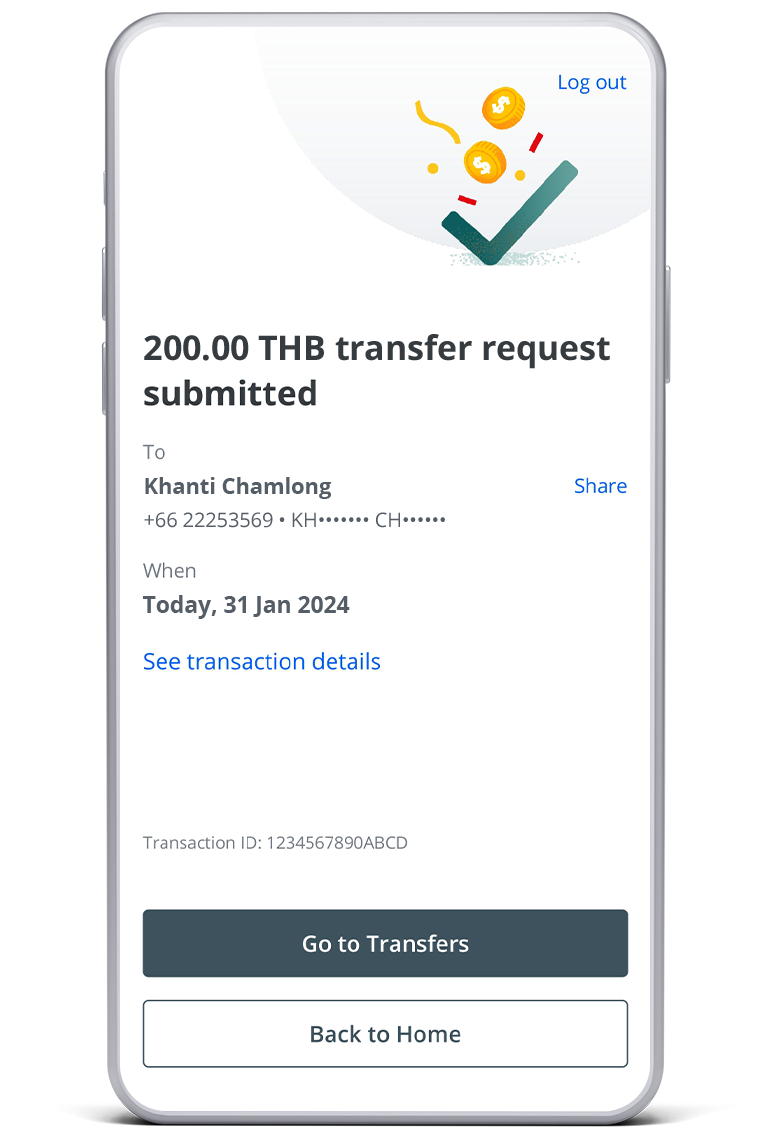

Send money anytime to family and friends in Malaysia and Thailand via their mobile number registered on DuitNow and PromptPay respectively.

Convenient overseas transfers in Malaysia with PayNow-DuitNow

To transfer funds to a family or friend in Malaysia, the recipient must register for DuitNow with one of the Malaysian banks participating in the PayNow-DuitNow service.

View our Frequently Asked Questions for PayNow-DuitNow service for more details.

Convenient overseas transfers in Thailand with PayNow-PromptPay

To transfer funds to a family or friend in Thailand, the recipient must register for PromptPay with one of the Thai banks participating in the PayNow-PromptPay service.

View our Frequently Asked Questions for PayNow-PromptPay service for more details.

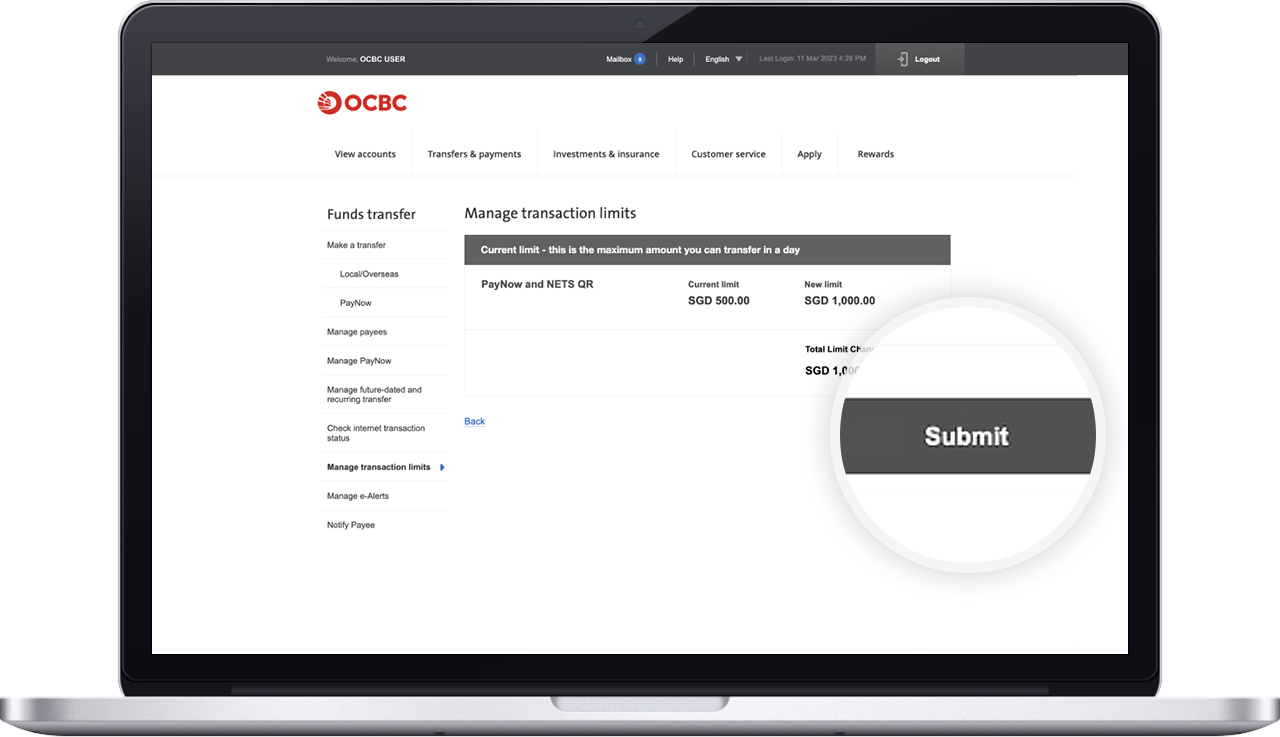

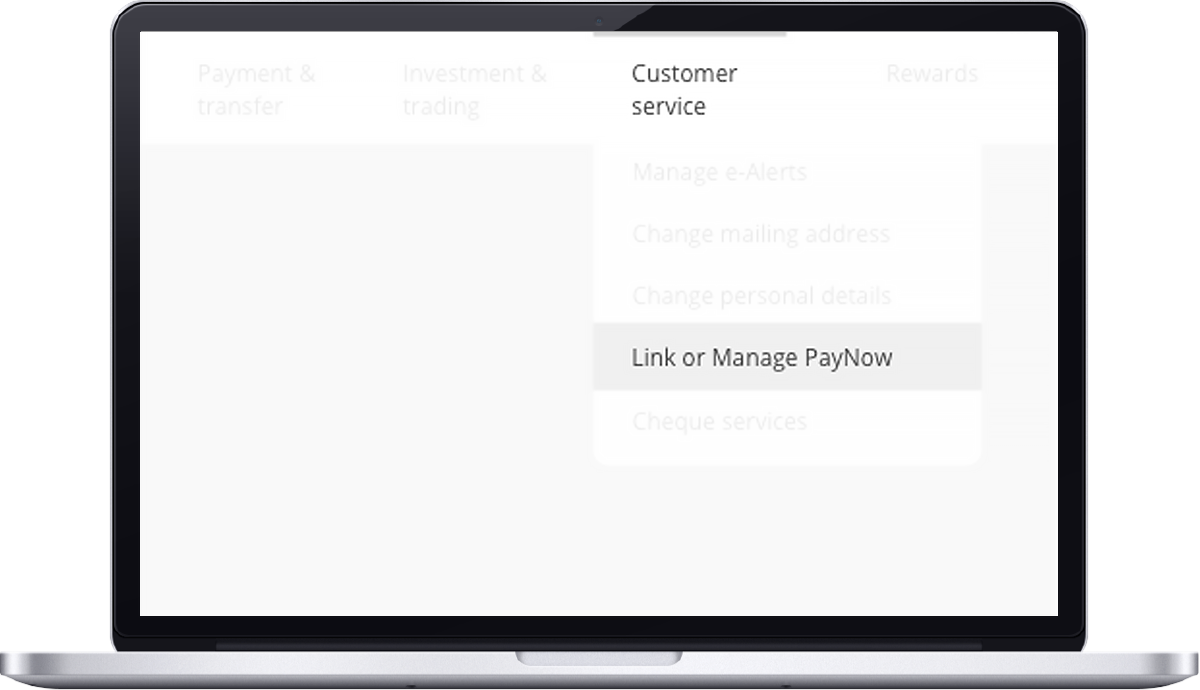

Increase your daily transfer limit via OCBC app or Online Banking

You can also increase your limit when you transfer an amount higher than your current limit.

*Up to S$300,000 daily limit for Premier customers

Please note: Only one transaction signing is required to authorise both your PayNow daily limit update and transfers over the authorised limit.

Using PayNow for your business?

Find out how you can enhance your business transaction with PayNow.

Terms and conditions

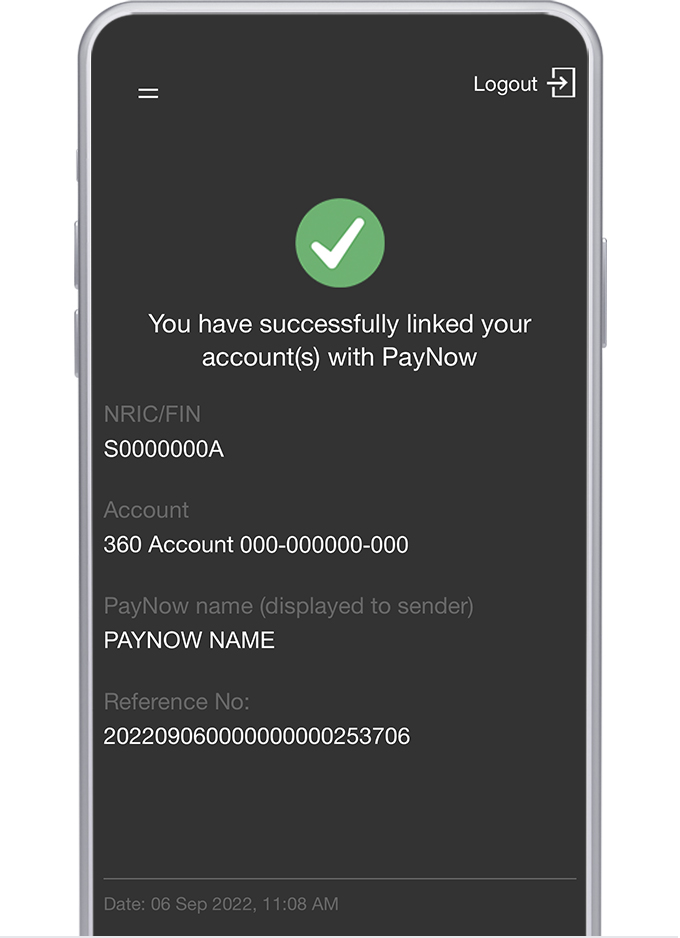

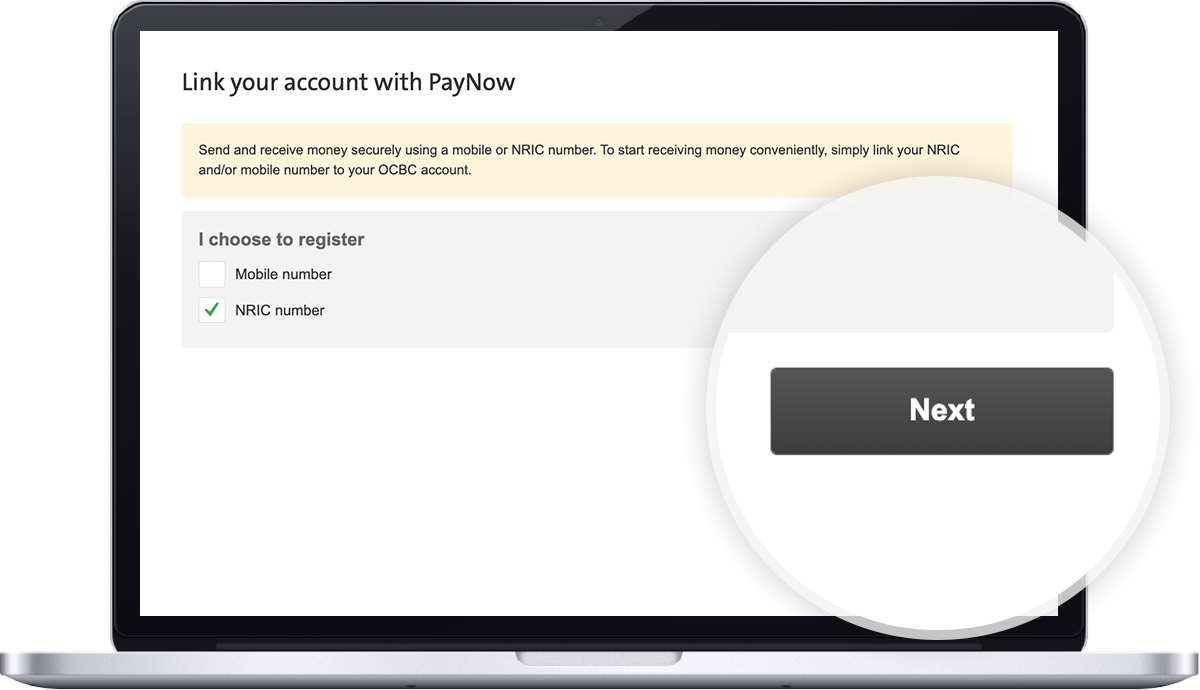

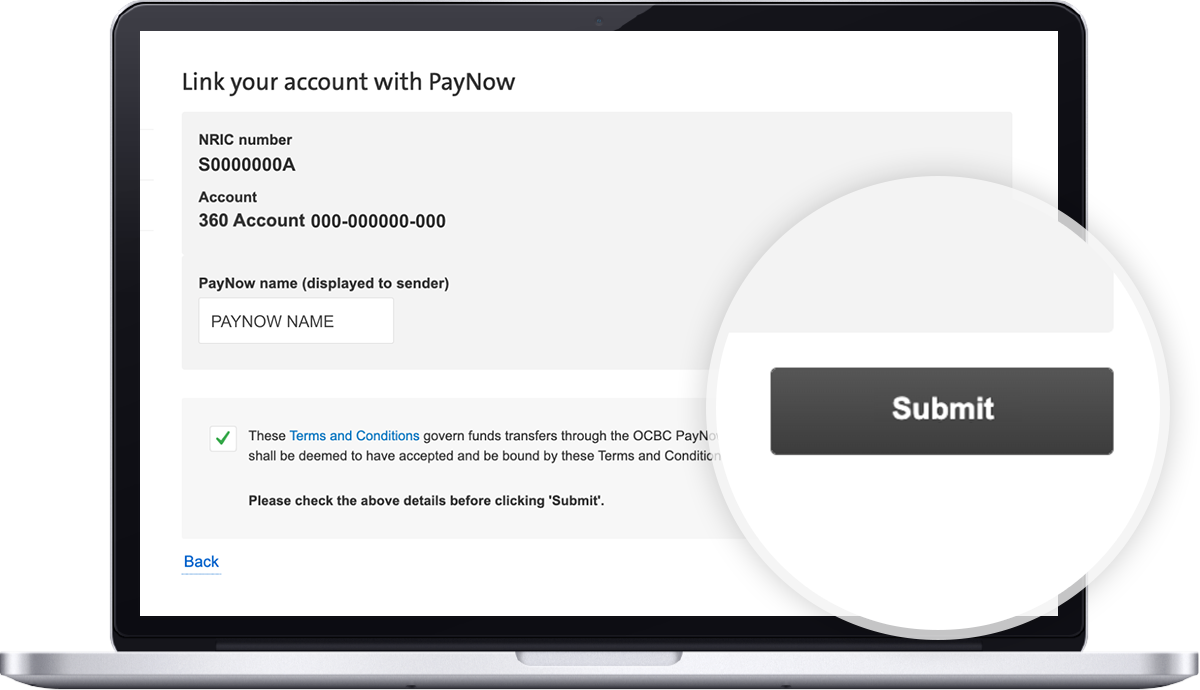

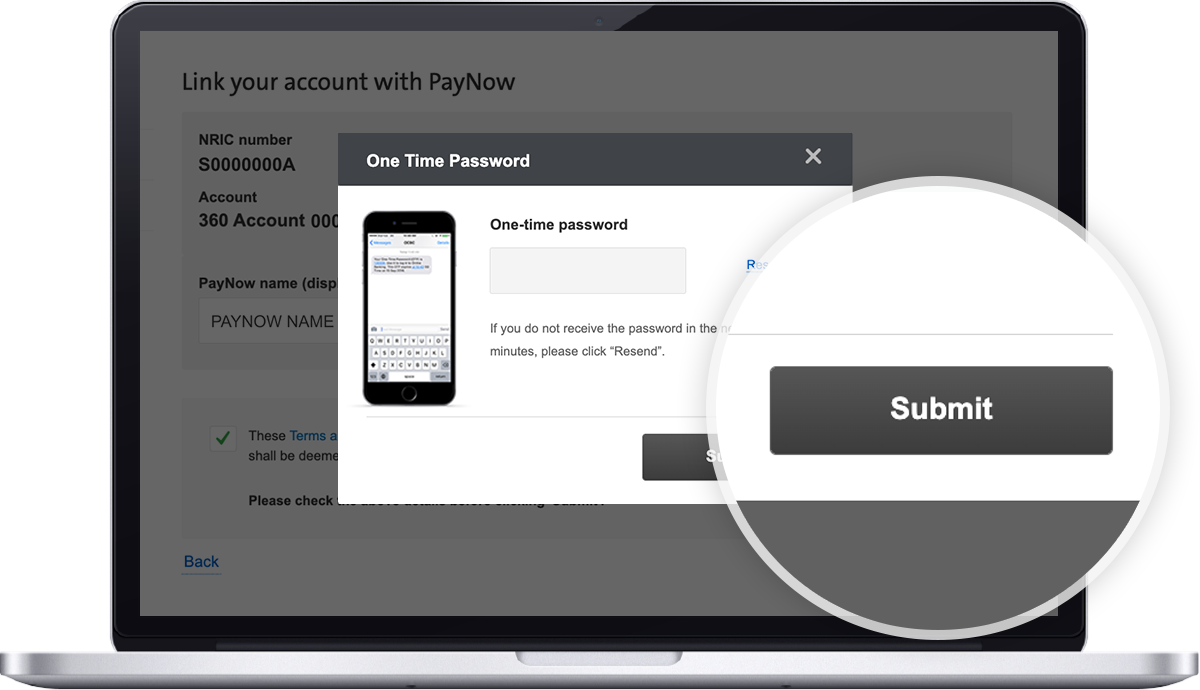

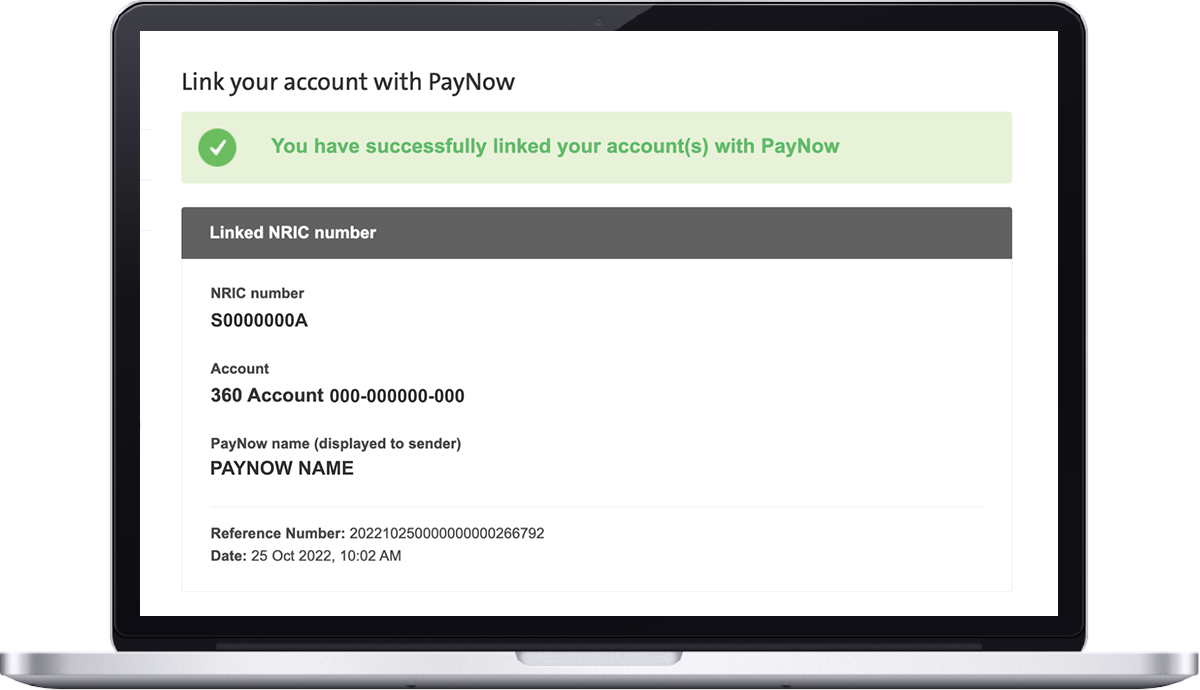

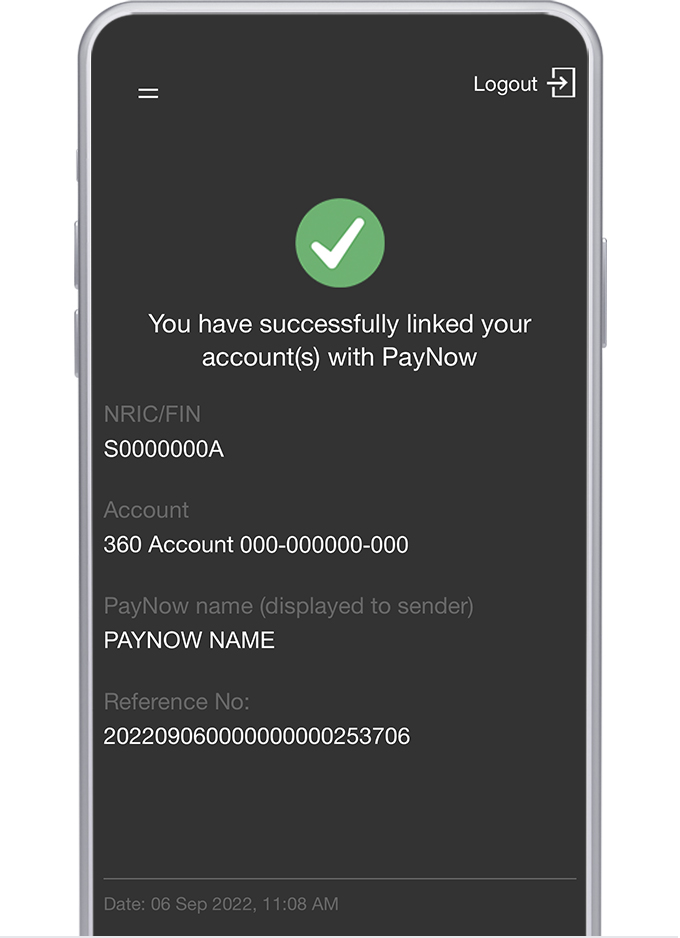

Register for PayNow with OCBC

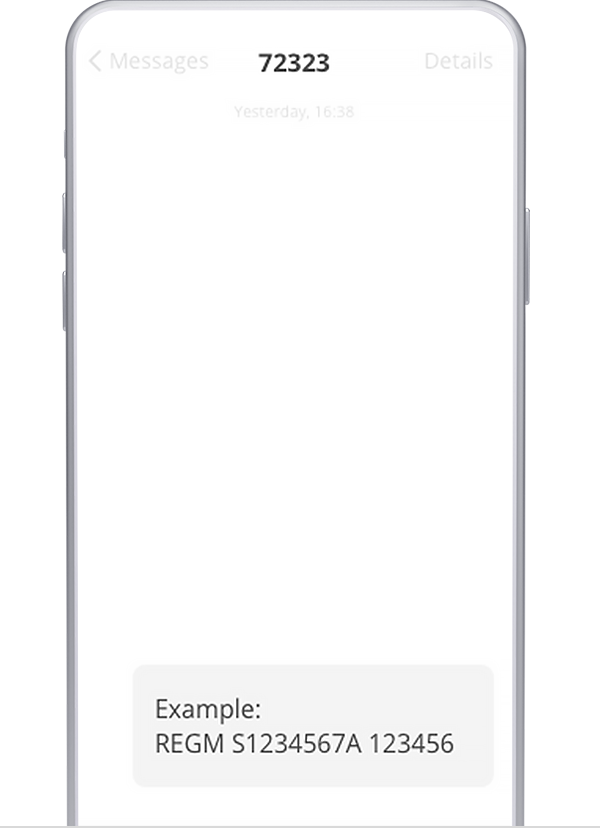

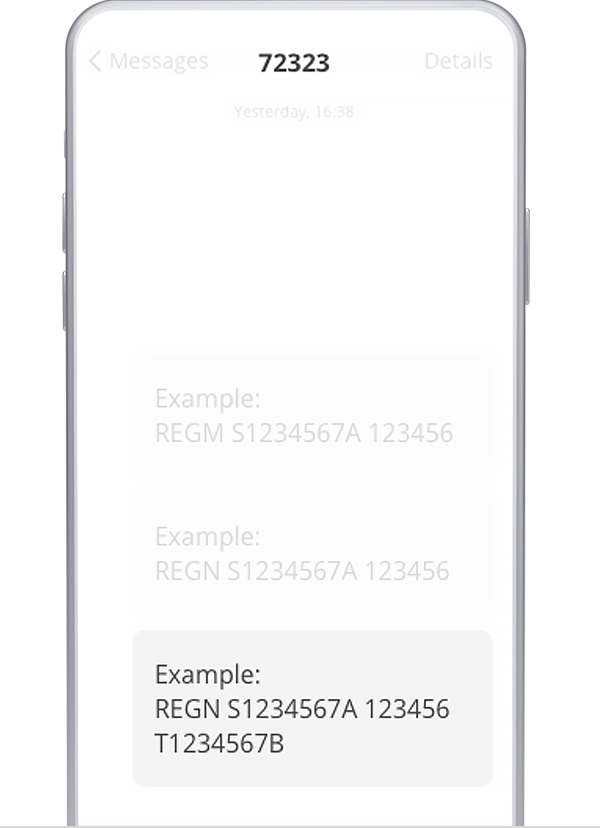

or SMS to 72323 using the following format.

Common questions

More questions and answersNo, the maximum daily limit for unregistered PayNow account using the passcode remains unchanged at 1,000 SGD. Only transfer made to a registered PayNow user can be more than 5,000 SGD daily.

The transaction limit refers to the maximum amount you can send daily. The authorised limit refers to the amount above which you will need to have the transaction authorized either via OneToken, an SMS OTP or your digital banking hardware token.

No, your authorised limit remains unchanged at 200 SGD.

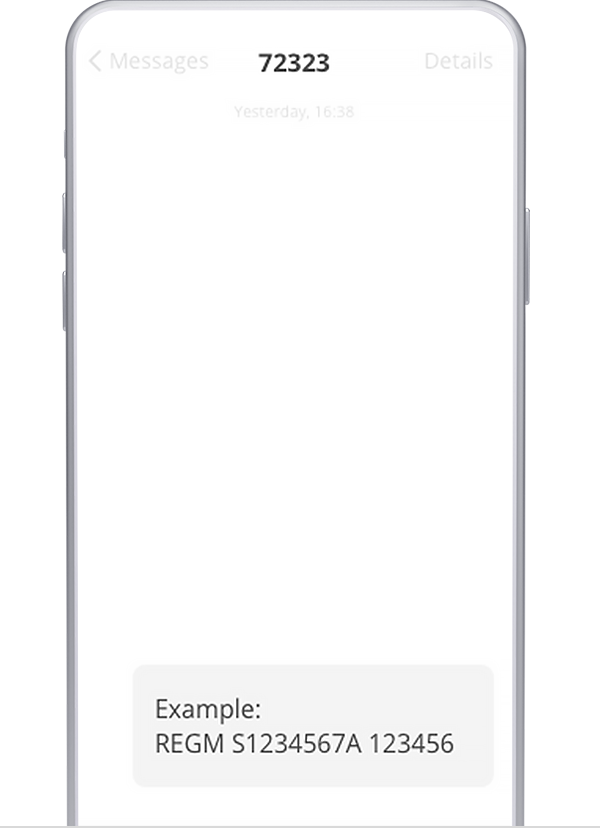

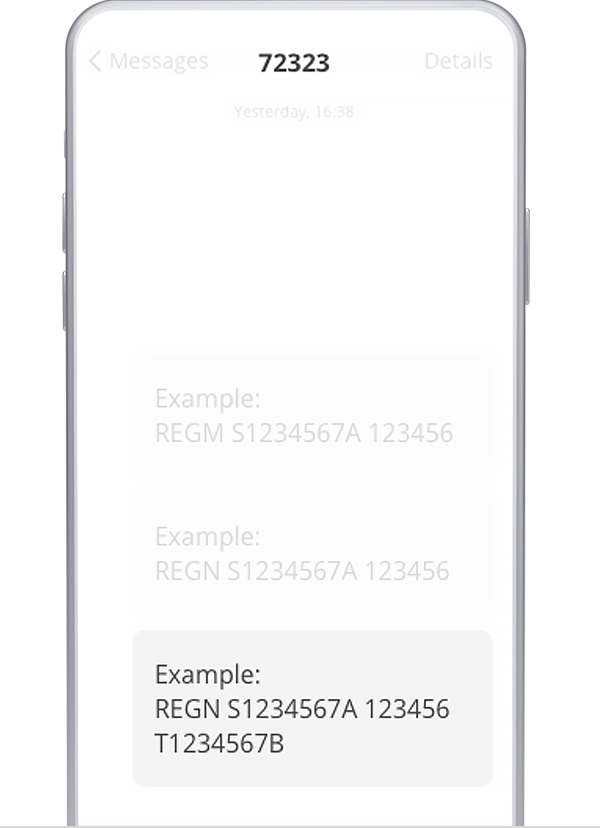

Simply copy one of the following formats and SMS to 72323:

Register your Mobile Number:

REGM <space> NRIC <space> last 6 digits of account number

Example: REGM S1234567A 123456

Register your NRIC:

REGN <space> NRIC <space> last 6 digits of account number

Example: REGN S1234567A 123456