The policy term is till age 85 (age next birthday).

GREAT Critical Cover: Top 3 CIS

Be protected against the 3 most common critical illnesses

Apply and get up to a $500 one-time cash rewardFind out more

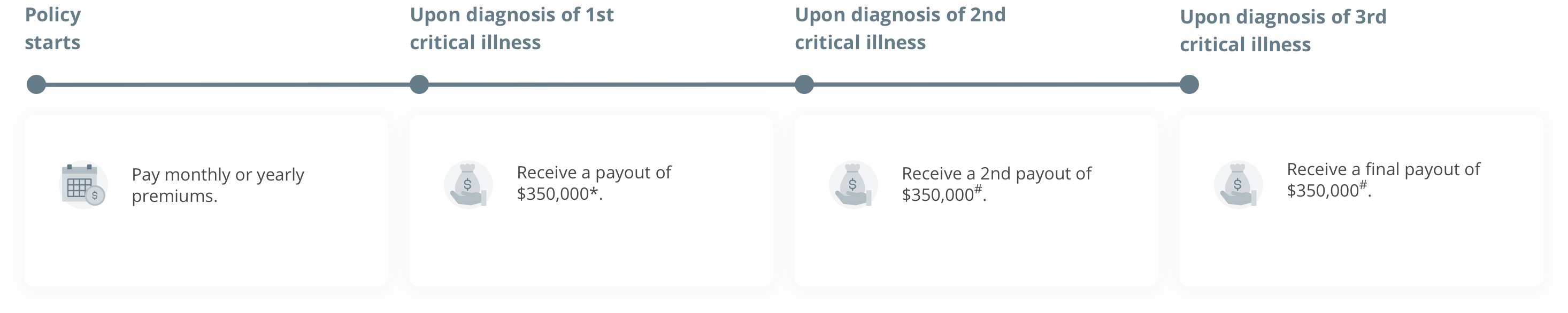

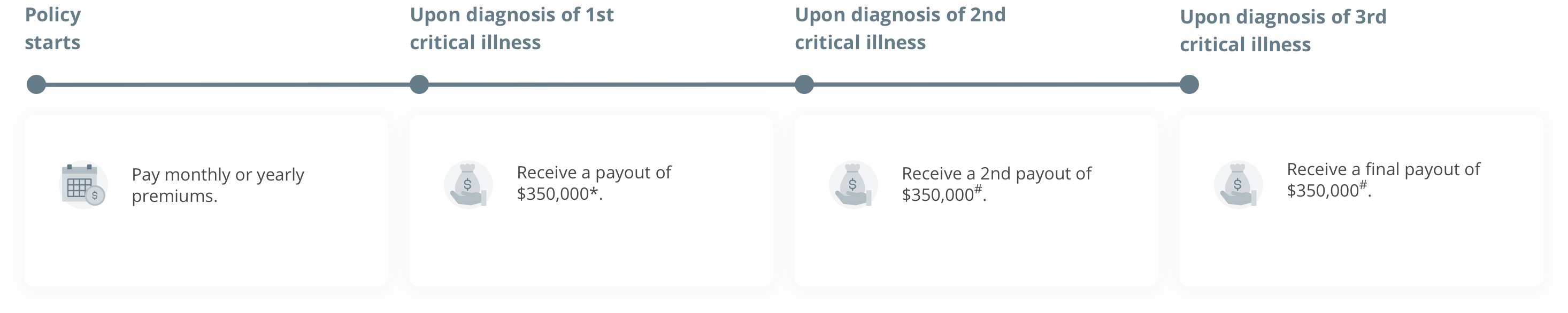

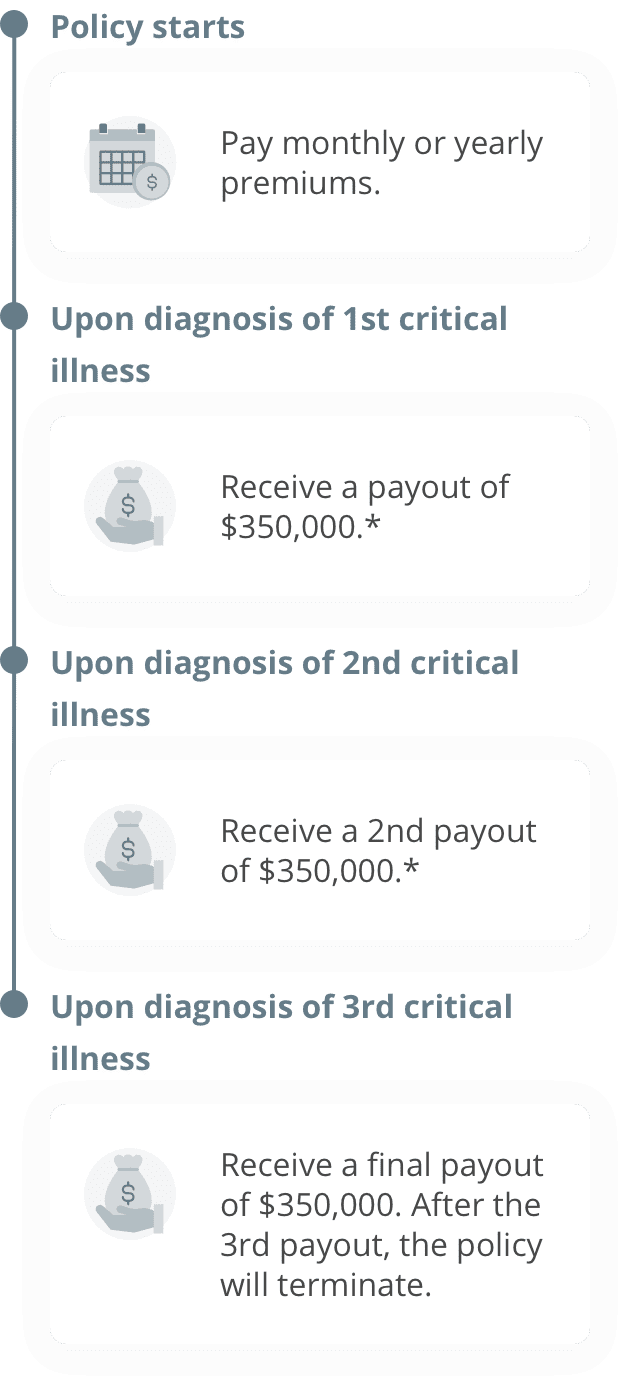

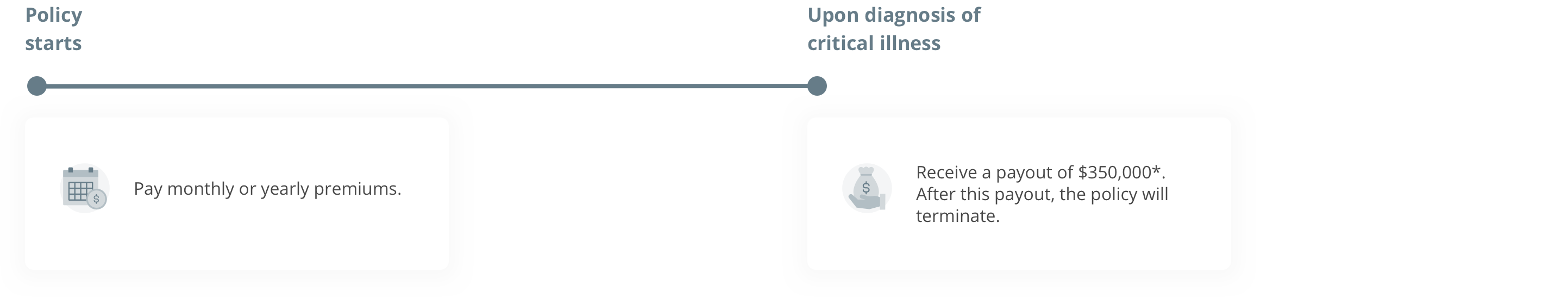

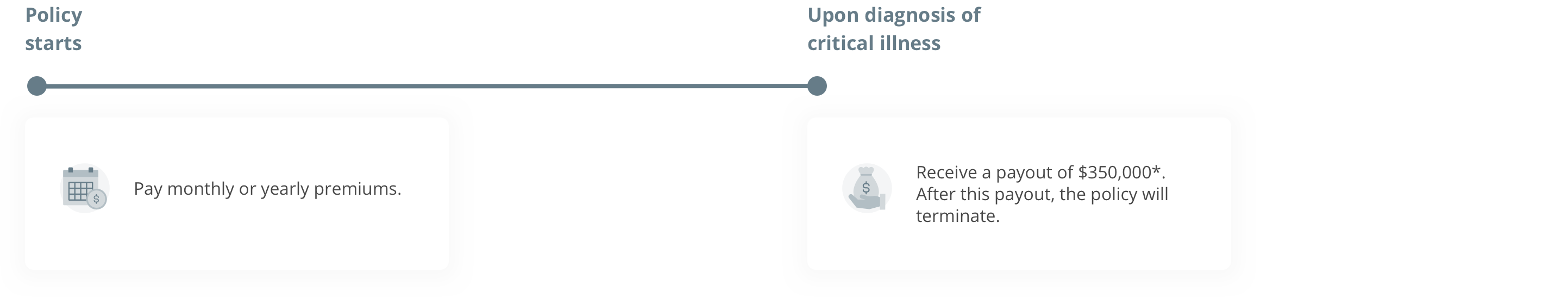

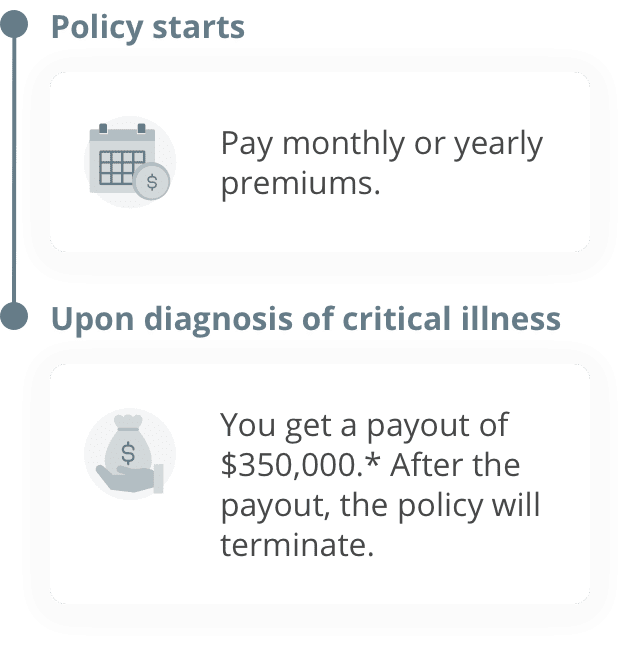

This illustrates a scenario where you have coverage of $350,000.

Disclaimer:

*For cancer and heart attack, there is a waiting period of 90 days (from the inception or reinstatement date of the policy or rider) before you can make a claim.

#Upon diagnosis of 2nd or 3rd critical illnesses.

i) For a different type of critical illness

You can only make the 2nd claim 12 months after making the 1st claim. For example, cancer and heart attack are considered different types of critical illnesses.

ii) For the same type of critical illness

You can only make the 2nd claim 24 months after making the 1st claim. For example, breast cancer and lung cancer are considered the same type of critical illness.

iii) Similar terms apply in the event of a 3rd payout. After the 3rd payout the policy will be terminated.

Disclaimer:

*For cancer and heart attack, there is a waiting period of 90 days (from the inception or reinstatement date of the policy or rider) before you can make a claim.

Find out how much critical illness coverage you need

Get personalised suggestions for each type of coverage on the OCBC app.

I am a

and a

who needs

View your estimated annual premium for the 1st year

The premiums shown below are inclusive of a 10% discount. Please note that you will need to choose 'up to 3 times payout' in the above selection if you wish to add on the optional rider.

Eligibility requirements

19 to 60 years old (age next birthday)

Important notes

GREAT Critical Cover: Top 3 CIs is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As this product has no savings or investment feature, there is no cash value if the policy ends or is terminated prematurely.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies.

All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 1 January 2024.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Common questions

More questions and answersCancer

-

Early stage

- Carcinoma in situ;

- Early Prostate Cancer;

- Early Thyroid Cancer;

- Early Bladder Cancer;

- Early Chronic Lymphocytic Leukemia;

- Neuroendocrine tumours;

- Gastro-Intestinal Stromal tumours; or

- Bone Marrow Malignancies

-

Intermediate stage

Carcinoma in situ of Specified Organs treated with Radical Surgery

-

Critical stage

- Major cancer

Heart attack

-

Early stage

- Cardiac Pacemaker Insertion

- Pericardectomy

-

Intermediate stage

- Cardiac Defibrillator Insertion

- Early Cardiomyopathy

-

Critical stage

- Heart Attack of Specified Severity

Stroke

-

Early stage

- Brain Aneurysm Surgery

- Cerebral Shunt Insertion

-

Intermediate stage

- Carotid Artery Surgery

-

Critical stage

-

Stroke with Permanent Neurological Deficit

-

You are advised to read the policy wording for more details.

Yes. You will receive 100% of the sum assured you have chosen, regardless of the type of critical illness.

The premium will increase each year with age. Find out more in the OCBC app.

Apply for GREAT Critical Cover today and get up to a $500 one-time cash reward

Alternatively, you can get us to contact you.

Do not have the app?

Download on Apple app store

Download on Google Play

Download on AppGallery

Why should I be protected up to 3 times?

Financial impact on you

Critical illness can not only wipe your savings but also your family’s savings. 1 in 3 of critically ill patients incur more than $250,000 in medical and hospitalisation bills.

In addition, you may still need to be accountable for other expenses such as mortgage and family living expenses.

Statistics on being diagnosed for critical illnesses multiple times

Statistics show patients who had their first encounter with cancer, heart attack or stroke might have subsequent diagnoses within 1 to 5 years.

Heart attack

Heart attack patients have:

- 20% chance of getting a second heart attack within 5 years

- a higher risk of a subsequent stroke

Stroke

Stroke patients have:

- 23% chance of getting a second stroke

- 2 times the risk of a heart attack a year after a stroke

Cancer

The recurrence rate for patients of various types of cancers are:

- 75% for Lung cancer

- 33% for Colon cancer

- 30% for Breast cancer

- 25% for Prostate cancer

Sources: Singapore cancer registry, John Hopkins Medicine, American Heart Association, Great Eastern.

Apply via the OCBC app

Open the all new OCBC app > Login > Click on ‘More’ > Under ‘Apply’, click on ‘Insurance’ > Click on ‘GREAT Critical Cover’.

If you are still on the previous version of the app, then click on ‘Insure and stay protected’ after logging in.

You are leaving the OCBC Bank's website to access Great Eastern's website.

By clicking on "Proceed", you acknowledge the following:

- You have chosen not to seek advice on the suitability of this product. You should consider if this product is suitable for your financial circumstances or needs.

Scan to start application:

| Your first annual premium ($) | One-time cash reward ($) |

|---|---|

| Below 500 | — |

| 500 to 799 | 50 |

| 800 to 2,399 | 118 |

| 2,400 to 3,599 | 348 |

| 3,600 to 4,999 | 548 |

| 5,000 to 7,999 | 758 |

| 8,000 to 11,999 | 1,188 |

| 12,000 to 19,999 | 1,788 |

Try it now