Mind the gap – manage rising healthcare costs with the right tools

Mind the gap – manage rising healthcare costs with the right tools

Key takeaways

- 1 in 4 Singaporeans aged 40 and above has at least one chronic disease.

- Singaporeans have a critical illness protection gap of S$256,8001.

- As the cost of medical treatment continues to rise in Singapore, it is increasingly important to ensure that you have sufficient coverage in the event of a critical illness.

The ageing population in Singapore, unhealthy diets and lack of physical activity have contributed to the increased prevalence of chronic diseases. 1 in 4 Singaporeans aged 40 and above has at least one chronic disease2 such as diabetes, high blood pressure, high blood cholesterol and stroke.

Chronic diseases typically require ongoing medical care. These conditions can significantly impact a person’s health, quality of life, and may add to the financial burden due to the cost of medical treatment, medications and other related expenses.

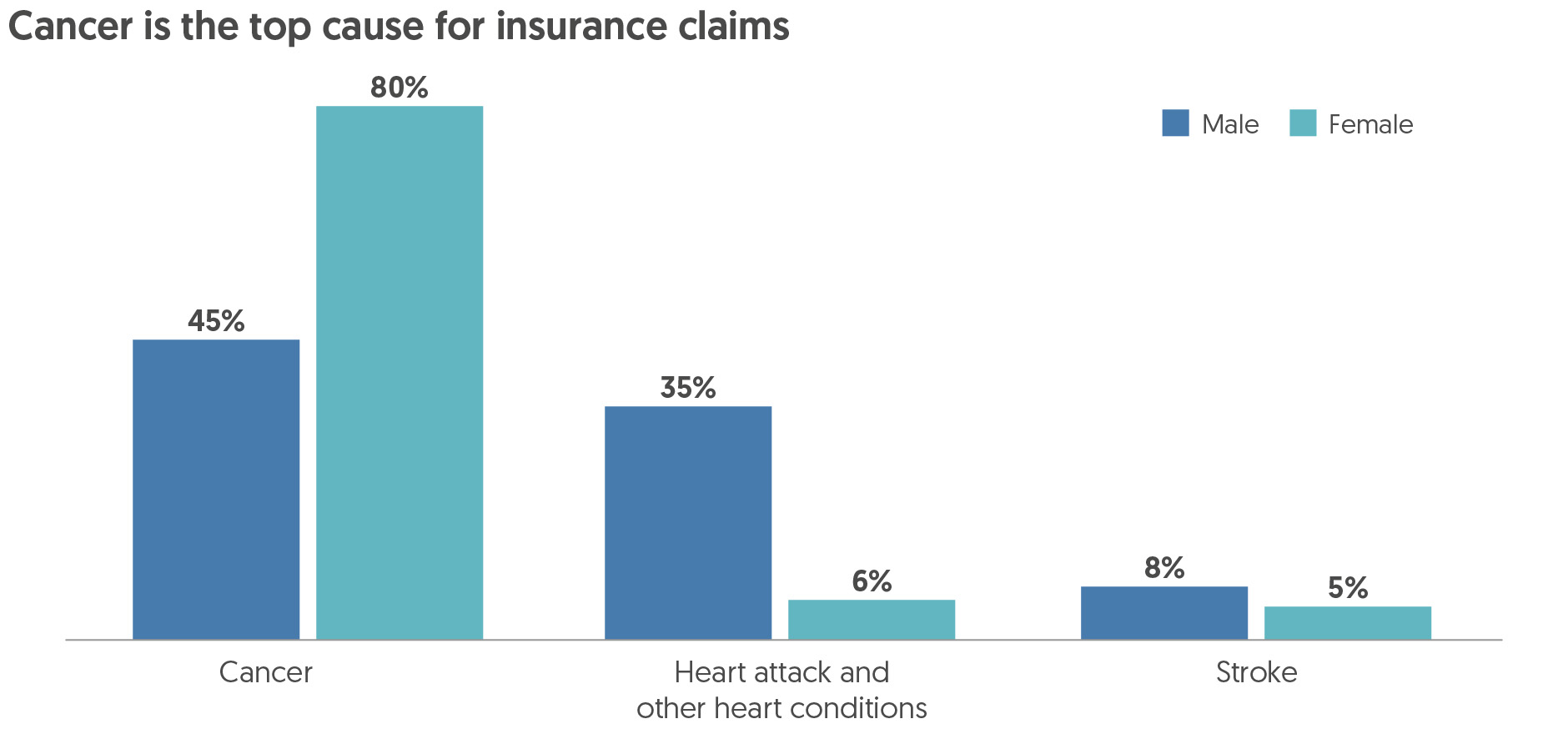

Figure 1: 90% of all major critical illness claims are due to cancer, heart disease or stroke.

Source: The Gen Re dread disease survey – key takeaways for Singapore market, Gen Re (retrieved on 11 February 2023).

Figure 2: The number of Singaporeans diagnosed with critical illnesses is concerning. It is important to safeguard one’s physical and financial health.

- Heart disease

- Stroke

| Cancer | Heart disease | Stroke |

|---|

|

|

|||||||||||||||||||||

Sources: Why some cancers come back, Cancer Research UK (retrieved on 12 February 2023). Common types of cancer, Singapore Cancer Society (retrieved on 7 February 2023). Dangers of life-threatening second heart attack may be highest soon after the first, Self-monitoring after a heart attack, Singapore Heart Foundation (retrieved on 14 February 2023). Heart disease statistics, Singapore Heart Foundation (retrieved on 7 February 2023). Secondary stroke prevention checklist, American Stroke Association (retrieved on 7 February 2023). Singapore stroke registry annual report 2020, National Registry of Diseases Office (released on October 2022). Singapore myocardial infarction registry annual report 2020, National Registry of Diseases Office (released on August 2022). Singapore cancer registry annual report 2020, National Registry of Diseases Office (released on December 2022).

Figure 3: Singaporeans should be financially prepared for the rising cost of medical treatment.

Source: Singaporeans living longer, but need to shorten years spent in ill health, Today Online, 10 September 2017.

Coverage you need

This has prompted the Life Insurance Association Singapore (LIA) to recommend individuals to have a minimum coverage that covers five years of expenses against critical illnesses. The suggested five-year timeframe is the average recovery time for a major illness. Having sufficient coverage ensures the patient’s family needs and expenses continue to be well taken care of during the recovery period, thus allowing the patient to focus on getting well.

Figure 4: Singaporeans’ critical illness protection are still way below LIA’s recommended amount.

- Coverage amount

| Coverage amount |

|---|

|

|

Source: 2017 protection gap study, 26 April 2018 – Singapore, Life Insurance Association Singapore

Singapore’s national healthcare schemes

45% of the Singaporeans who have no critical illness plan assume that their existing health insurance plans from national healthcare schemes such as MediSave, MediShield Life and Integrated Shield Plan are sufficient3.

Figure 5: Singapore’s national healthcare schemes provide coverage for a wide range of healthcare services, but they may not cover all the costs associated with a critical illness.

- MediSave

- MediShield Life

- Integrated Shield Plan (IP)

- Critical illness insurance

| Types of health insurance plans |

Benefits |

| MediSave |

|

| MediShield Life |

|

| Integrated Shield Plan (IP) |

|

| Critical illness insurance |

|

| Types of health insurance plans |

| MediSave |

| MediShield Life |

| Integrated Shield Plan (IP) |

| Critical illness insurance |

Source: Healthcare financing, Central Provident Board (retrieved on 11 February 2023).

Protection gap exists

According to a survey conducted by Great Eastern Life in December 2020, Singaporeans are worried about expensive medical bills and loss of income3 when they are unwell and unable to work during the recovery period.

Figure 6: Financial burden and the potential relapses are among the concerns of critical illness patients.

| 50% Over 50% of the patients depend on insurance payouts to manage their financial expenses |

S$250,000 1 in 3 patients incur more than S$250,000 in medical and hospitalisation bills |

No income 2 in 5 patients have no income for at least 12 months when they are recuperating |

| 3 in 4 3 in 4 patients are willing to pay higher premiums for protection against various critical illnesses or relapses |

80% Over 80% of the patients regretted not getting more coverage |

50% Over 50% of the patients believe that they will have multiple occurrences of critical illnesses |

Source: Great Eastern survey on critical illness, Great Eastern Life (retrieved on 11 February 2023).

Proactive approach

With medical advancement making rapid and continued progress with new diagnostic and treatment methods, more critical illnesses are becoming preventable and treatable. A government-led health promotion programme, Screen for Life (SFL), launched in 2017 to encourage regular health screenings and the early detection and prevention of chronic illnesses like cancer, cardiovascular diseases and diabetes.

SLF’s initiative has successfully promoted a proactive approach to health and well-being among Singaporeans. As a result of regular health screenings, more cases of early detection of health conditions have been diagnosed, increasing the incidence of critical diseases. This in turn has reduced the mortality rates as early treatments can improve the chances of recovery.

Figure 7: Early treatments have proven to significantly lower mortality rates for the majority of critical illnesses.

- Heart disease

- Stroke

| Cancer | Heart disease | Stroke |

|---|

|

|

Source: Singapore stroke registry annual report 2020, National Registry of Diseases Office (released on October 2022). Singapore myocardial infarction registry annual report 2020, National Registry of Diseases Office (released on August 2022). Singapore cancer registry annual report 2020, National Registry of Diseases Office (released on December 2022).

The cost of medical treatment

The ageing population, medical advancements and higher operating costs are the key contributors to rising healthcare costs in Singapore4.

A cancer patient typically pays a few hundred dollars a month for traditional cancer drugs. In the age of medical advancements, a newer treatment such as immunotherapy can result in a monthly bill exceeding S$5,000. In 2019 alone, Singapore spent S$375 million on cancer drugs and the cost is likely to go up to S$2.7 billion5 by 2030 if the current trajectory continues.

Chronic illnesses are long-term health conditions that often require ongoing medical care and treatments hence patients with chronic illnesses are likely to spend more on healthcare. The cost of medical treatment is not the only financial burden patients face. They may also have to deal with loss of income while unwell and unable to work, on top of the expenses for daily living.

Around 20% of the health-insurance related complaints in the past three years were about unsuccessful insurance claims which were mainly due to treatments not being covered by the policy contract, claims exceeding the claim limit, claims made after the policy had lapse or not being able to provide the supporting documents needed for the insurer to evaluate the claim application6.

Therefore, it is important to ensure that your policy is up to date and any changes in your life or health have been taken into consideration. The amount of coverage should be reviewed periodically to make sure that it is enough to cover the medical expenses, loss of income and other costs associated with critical illnesses.

Knowing that you have the adequate protection in the event of a serious medical diagnosis, you and your family do not have to face unexpected financial expenses and thus allowing you to focus on your recovery.

GREAT Critical Cover: Top 3 CIs is a critical illness plan which one can consider to get protected for all stages of the 3 most common critical illnesses in Singapore – cancer, heart attack, and stroke.

Secure the peace of mind you need with 100% payout upon diagnosis. This can be used to defray living expenses , loss of income or medical bills during your recovery period. Add on an optional rider to be protected up to 3 times your coverage amount in the event of multiple diagnoses.

Choose from 3 coverage amounts of S$100,000, S$200,000 or S$350,000, and check your premiums via OCBC app today.

Alternatively, speak to an OCBC Personal Financial Consultant today to give you and your family a peace of mind in case of the unexpected.

Discover more articles about financial planning for all ages.

Apply for GREAT Critical Cover today and get up to $1,200 one-time cash reward

Alternatively, you can get us to contact you.

Do not have the app?

Download on Apple app store

Download on Google Play

Download on AppGallery

General Disclaimer

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

Information presented as at 1 January 2024.

References

- 2017 protection gap study – Singapore, 26 April 2018, Life Insurance Association Singapore.

- Chronic diseases – A Growing Problem in Workplace, Health Promotion Board (retrieved on 11 February 2023).

- Great Eastern survey on critical illness, Great Eastern Holdings Limited (retrieved on 11 February 2023).

- Ageing population, medical advancements among factors that contribute to rising healthcare cost: Koh Poh Koon, 2 November 2020, CNA.

- Why S'pore spends so much on cancer treatment and how MediShield Life changes aim to tackle this, 18 August 2021, The Straits Times.

- MAS clarifies grounds for claims rejection, 13 January 2022, Insurance Business Asia.

Sources

- The Gen Re dread disease survey – key takeaways for Singapore market, Gen Re (retrieved on 11 February 2023).

- Why some cancers come back, Cancer Research UK (retrieved on 12 February 2023).

- Common types of cancer, Singapore Cancer Society (retrieved on 7 February 2023).

- Dangers of life-threatening second heart attack may be highest soon after the first, American Heart Association (retrieved on 07 February 2023).

- Heart disease statistics, Singapore Heart Foundation (retrieved on 7 February 2023).

- Secondary stroke prevention checklist, American Stroke Association (retrieved on 7 February 2023).

- Singapore stroke registry annual report 2020, National Registry of Diseases Office (released on October 2022).

- Singapore myocardial infarction registry annual report 2020, National Registry of Diseases Office (released on August 2022).

- Singapore cancer registry annual report 2020, National Registry of Diseases Office (released on December 2022).

- Singaporeans living longer, but need to shorten years spent in ill health, 10 September 2017, Today.

- 2017 protection gap study – Singapore, 26 April 2018, Life Insurance Association Singapore.

- Healthcare financing, Central Provident Board (retrieved on 11 February 2023).

- Self-monitoring after a heart attack, Singapore Heart Foundation (retrieved on 14 February 2023).

Policy Owner’s Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Important notes for GREAT Critical Cover

GREAT Critical Cover: Top 3 CIs is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As this product has no savings or investment feature, there is no cash value if the policy ends or is terminated prematurely.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies.

All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 7 July 2023.

Scan to start application:

You are leaving the OCBC Bank's website to access Great Eastern's website.

By clicking on "Proceed", you acknowledge the following:

- You have chosen not to seek advice on the suitability of this product. You should consider if this product is suitable for your financial circumstances or needs.

Apply via the OCBC app

Open the all new OCBC app > Login > Click on ‘More’ > Under ‘Apply’, click on ‘Insurance’ > Click on ‘GREAT Critical Cover’.

If you are still on the previous version of the app, then click on ‘Insure and stay protected’ after logging in.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).