| Why it matters |

| CareShield Life's coverage is only applicable for severe disability. |

| 57% of GREAT CareShield claimants are under the age of 502. |

| Payouts are in cash so that you and your caregiver have the flexibility to decide on your desired care arrangements (e.g. home care or nursing home care, dependent living expenses etc). |

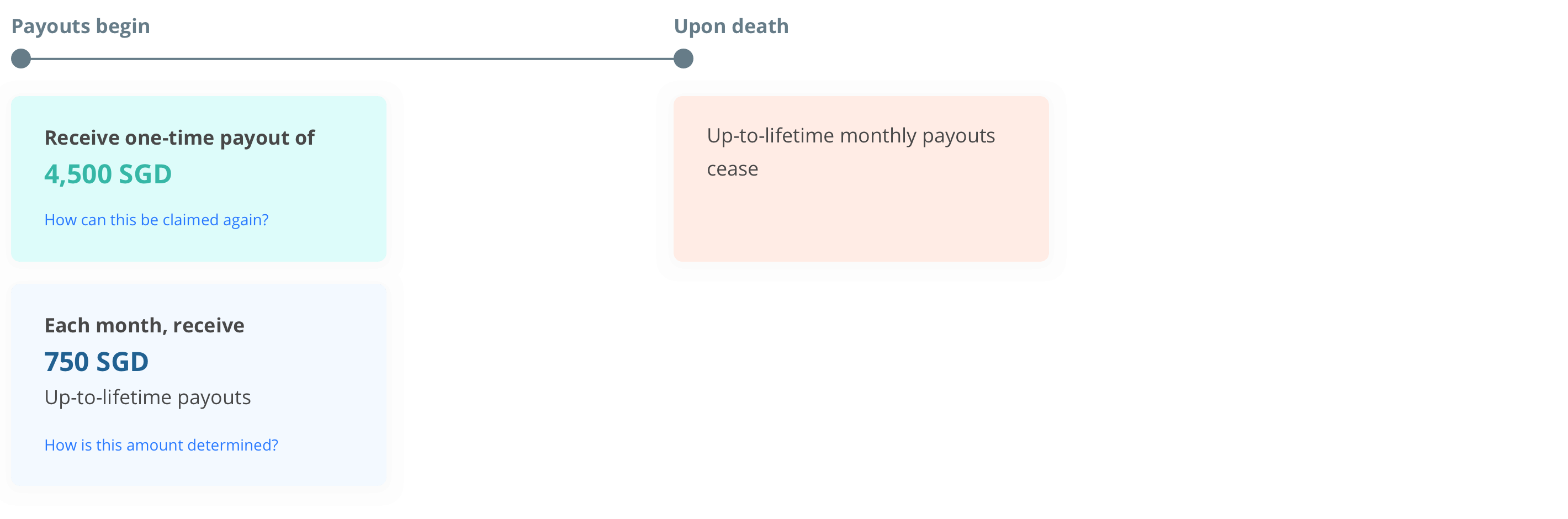

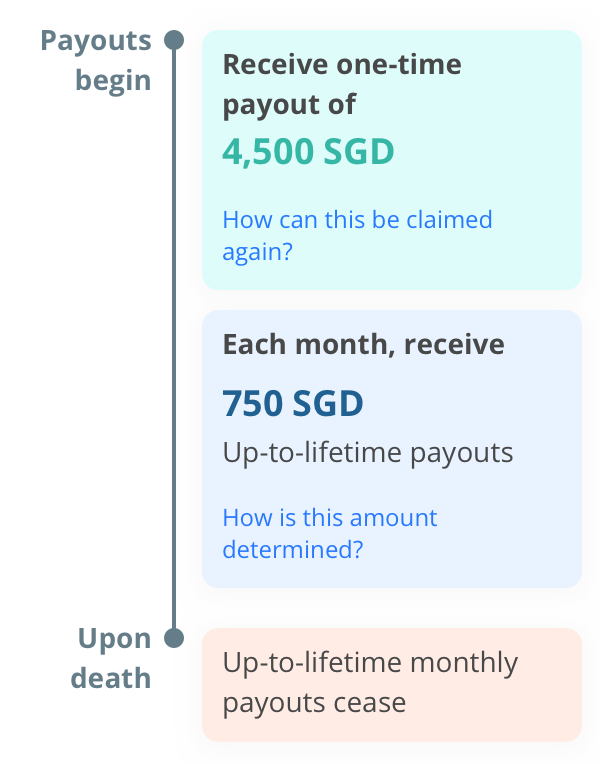

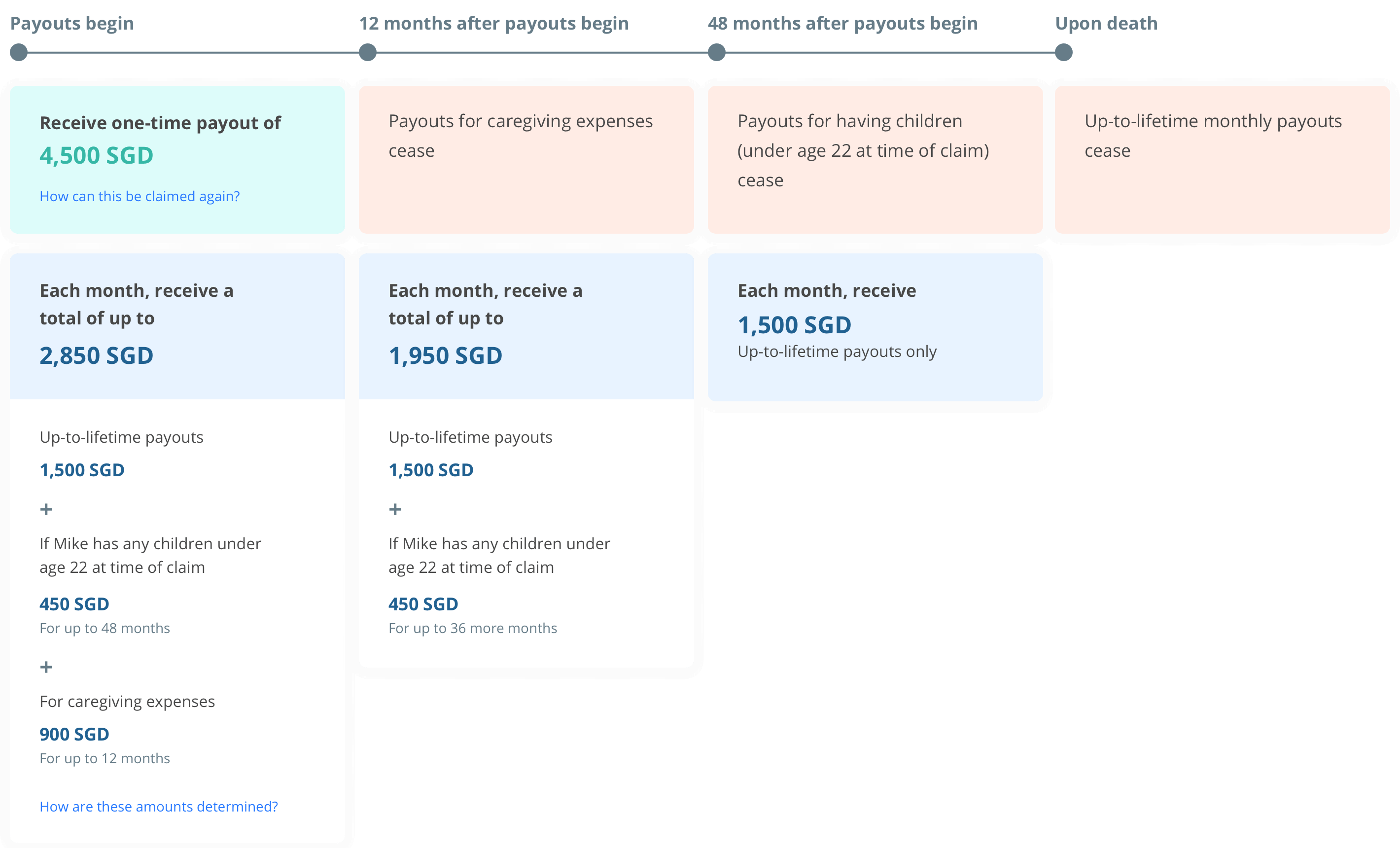

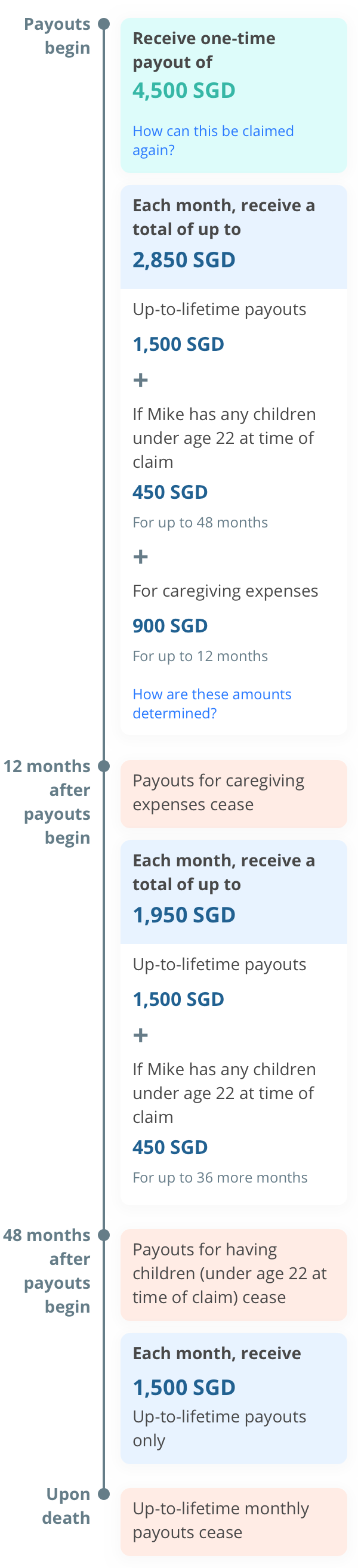

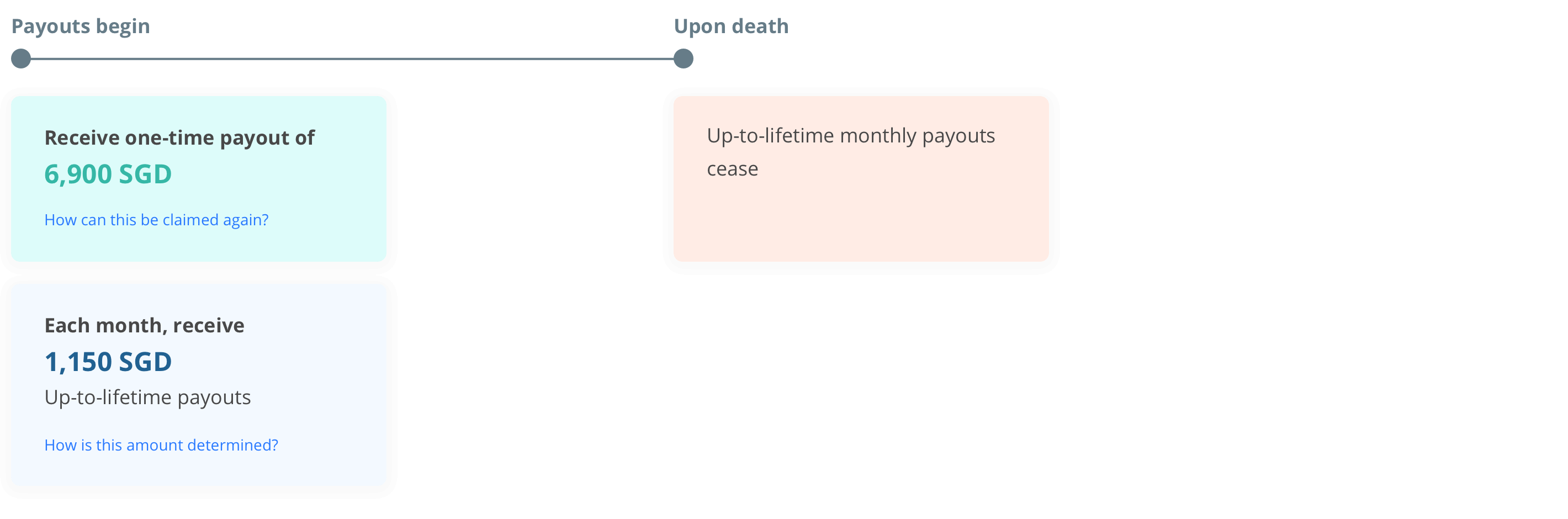

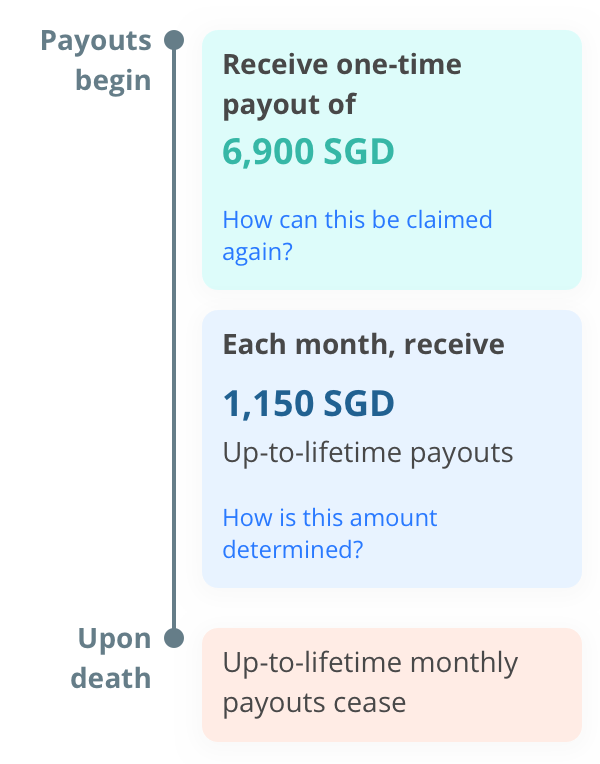

| Receive monthly payouts1 and a lump sum Initial Benefit3 of up to S$15,000 to support your daily expenses and long-term care. Your future premiums will also be waived4. |

| Average disability based on home caregiving with a domestic helper is at least S$4,000/month5. |

| Recovering from a disability may take time, and it comes with long-term medical and caregiving expenses. So having the assurance of cash payouts is important. |

| 28% of GREAT CareShield claims result from the inability to perform 1 ADL.2 |

| GREAT CareShield can be paid with your MediSave funds, up to a limit of S$600 per calendar year per insured person. Premium rates will not increase with age7. |

| Get protected as early as possible. Apply easily and directly via the OCBC app. |