CareShield Life Supplementary Plan: Why We Think Every Working Adult Should Consider Applying For One

CareShield Life Supplementary Plan: Why We Think Every Working Adult Should Consider Applying For One

Singaporeans aged 30 and above can consider getting additional coverage against severe disability through CareShield Life supplementary plans

If you don’t already know, every Singaporean (Singapore citizen and Permanent Resident) who turns 30 will automatically be enrolled in CareShield Life. This took effect from 1 October 2020, and those who are born between 1980 and 1990 have also been automatically enrolled effective from 1 October 2020, or when they turn 30.

CareShield Life replaces ElderShield as our national long-term care insurance scheme. Unlike ElderShield where Singaporeans can opt-out, CareShield Life is compulsory for all Singaporeans, including those with pre-existing illnesses or disabilities, with no option of opting out or being excluded.

Why Was CareShield Life Implemented?

CareShield Life was introduced as a compulsory national long-term care insurance scheme. CareShield Life coverage, which starts from age 30, provides a basic monthly payout that may last up to a lifetime as long as a policyholder is deemed to be unable to perform at least 3 out of 6 Activities of Daily Living (ADLs). These 6 activities are washing, dressing, feeding, toileting, walking or moving around, and transferring.

According to the Ministry of Health, it’s expected that 1 in 2 healthy Singaporeans aged 65 could become severely disabled in their lifetime and would need long-term care. While the median duration for which severely disabled Singapore residents could remain in disability is around 4 years, 3 in 10 would remain in severe disability for 10 years or more – which is why it’s vital for payout duration to be lifelong.

Given such statistics, it is not surprising that the Singapore government believes that having some form of long-term care insurance is important and wants to ensure all Singaporeans, age 30 and above, are covered under CareShield Life. As such, Singaporeans who become severely disabled before the age of 30 would still be included in CareShield Life. They only need to pay a premium upon turning 30 (to qualify for CareShield Life) and will automatically receive monthly CareShield Life payout for up to a lifetime.

While CareShield Life’s monthly payout quantum started at $600 in 2020, the government has previously announced that the payout would increase over the years to keep up with increasing costs of long-term care. This has been fixed at 2% per year from 2020 to 2025.

Is The Basic Payout For CareShield Life Sufficient For Working Adults?

Given that the Singapore government has mandated CareShield Life to be compulsory for all Singaporeans who are born from 1980 onwards once they turn 30, the discussion isn’t about whether CareShield Life is important, but rather, whether the coverage we are getting is enough.

As a compulsory national long-term care insurance scheme, and in order to keep the premiums affordable for all, CareShield Life payouts start from $600 in 2020 and are triggered only upon the inability to perform at least 3 ADLs. This year, the CareShield Life payout is $624 per month for anyone who suffers from at least three out of six ADLs.

In the event of severe disability, we may require long-term care services like rehabilitation, centre-based care, home-based care or nursing care. Depending on the services that are required, this may easily cost us a thousand dollars or more per month. So CareShield Life’s monthly payouts may not be sufficient for us.

Another misconception is that severe disability will only occur to the elderly. Unfortunately, this isn’t always true. An often-overlooked risk is that young, working adults with dependents can also suffer severe disability in the event of an accident. And if that happens, the entire family livelihood will be threatened badly.

Not all disability conditions have the same level of severity. Some disabilities may cause an individual to be unable to perform just 1 ADL. More severe conditions may cause an individual to be unable to perform 3 or more ADLs. For CareShield Life, the criteria to qualify for payouts is the inability to perform 3 or more ADLs.

In our view, CareShield Life payouts should be seen as the minimum amount a person requires if they suffer from severe disability in Singapore. It’s the bare minimum that is needed, rather than what is supposed to be sufficient for everyone. For individuals such as seniors who are no longer working and have a simple lifestyle, CareShield Life payout may still be sufficient for their families to provide basic care for them (e.g. hire a domestic worker)

However, for working adults, it’s unlikely that CareShield Life payouts ($624 per month as of 2022) will be enough if we are severely disabled. This is especially true if we have dependents who are also reliant on us to provide for them.

CareShield Life Supplements Such As GREAT CareShield Gives Us Additional Coverage On Top Of CareShield Life

For those of us who need higher coverage for long-term care and prefer coverage that starts from the inability to perform 1 ADL, we can apply for supplement plans such as GREAT CareShield to give us additional payouts, on top of the basic amount that we receive from CareShield Life.

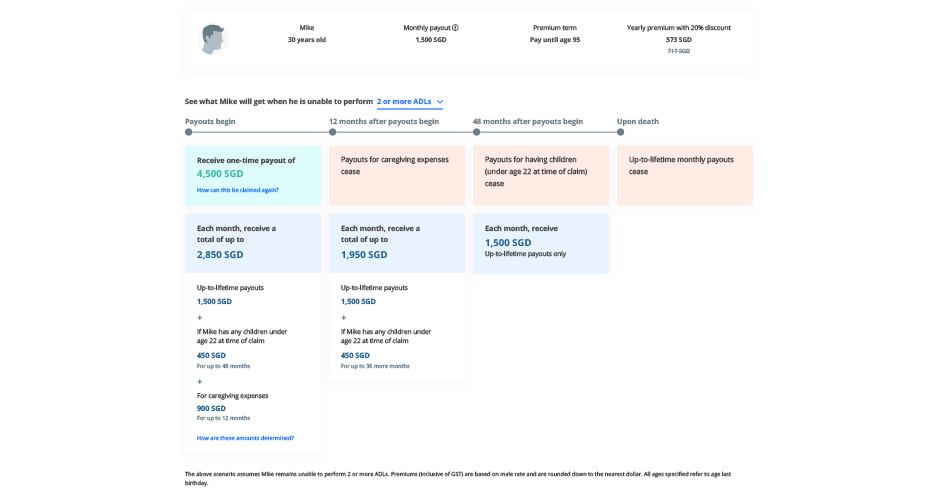

For example, a 30-year-old male who wants a monthly payout of $1,500, on top of their basic CareShield Life payout, can choose to sign up for GREAT CareShield through OCBC.

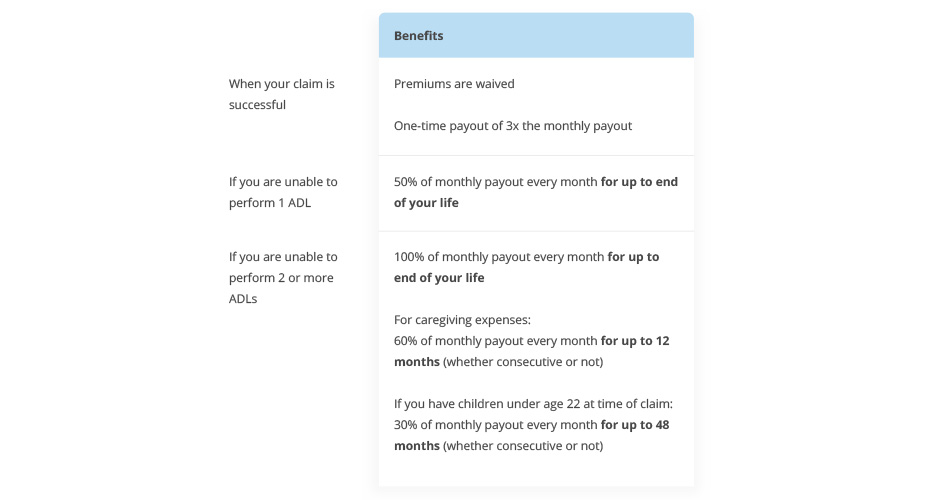

One advantage of GREAT CareShield is that it is the only CareShield Life supplement plan where payouts commence if a policyholder is unable to perform 1 ADL, as opposed to 3 ADLs which is the criteria for CareShield Life.

In the example above, if the policyholder (30-year-old Mike) is unable to perform 2 or more ADLs, the selected monthly payout of $1,500 is paid out. If he is unable to perform 1 ADL, the payout is $750, 50% of the selected monthly payout. All of these payouts are subject to a deferment period of 90 days, and are payable up to a lifetime or till he recovers from the disability.

You can see the benefit illustration below.

Besides being able to enjoy higher payouts with an easier claim eligibility (inability to perform 1 or 2 ADLs), you will also receive a lump sum payout of 3x of your monthly payout. If you are unable to perform 2 or more ADLs, you will also receive additional cash payouts from the Caregiver Benefit (60% of monthly payout) every month for up to 12 months, plus the Dependant Care Benefit (30% of monthly payout) every month for up to 48 months if you have children under age 22 at the time of claim.

We Can Use MediSave Funds To Pay For CareShield Life Supplements

Similar to how many of us would use our MediSave account to pay for our private integrated shield plan, we can use our MediSave account to pay for our CareShield Life Supplement plan, up to a maximum withdrawal amount of $600 each calendar year per insured person.

In our example above, a 30-year-old male who wants a monthly payout of $1,500 will pay a yearly premium of $573 (after a 20% discount). What this means is that the individual does not need to top up any cash for his GREAT CareShield plan if he uses his MediSave funds. Best of all, once the policy is purchased, premiums (inclusive of the 20% discount) do not increase with age throughout the policy term. We can choose between paying our annual premiums up till age 67 or 95.

For some of us working adults, the interest earned on our MediSave funds each year could even be more than enough to pay for our CareShield Life supplement plan premium. For instance, if we have $30,000 in our MediSave today, we will get a minimum of 4% in interest each year, or about $1,200. This could be more than the amount we need to pay for the premium for our CareShield Life supplement plan. Since MediSave primarily serves to take care of our healthcare needs, we can consider using our MediSave savings, or even just the interest we earn on our MediSave savings each year, to pay for our CareShield Life Supplement plans.

Depending on our age and gender, yearly premiums for CareShield Life supplements will vary, with younger individuals enjoying lower rates. Since the rates do not increase with age once we sign up for it, we think it makes sense for any working adult to consider signing up for a CareShield Life supplement plan such as GREAT CareShield as early as possible.

From now till 31 December 2023, you can apply for GREAT CareShield through OCBC Bank or OCBC app and enjoy a 20% discount on your premiums throughout your entire policy term. You can view the pricing for GREAT CareShield on the OCBC website and sign up in less than 10 minutes online. You may also visit any OCBC branch to find out more.

Disclaimer

You can only claim the benefits if you are still unable to perform the ADLs after a 90-day deferment period starting from, and inclusive of, the date of your disability assessment. Premiums are rounded down to the nearest dollar, and are not fixed and may be adjusted by Great Eastern.

Terms and Conditions apply.

GREAT CareShield is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This is only product information provided by OCBC. You may wish to seek advice from a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Get up to 40% off your first-year premium

Alternatively, you can get us to contact you.

Don't have the app?

Download on Apple app store

Download on Google Play

Download on AppGallery

Scan to start application:

You are leaving the OCBC Bank's website to access Great Eastern's website.

By clicking on "Proceed", you acknowledge the following:

- You have chosen not to seek advice on the suitability of this product. You should consider if this product is suitable for your financial circumstances or needs.

Important notes

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person.

GREAT CareShield can only be purchased by CareShield Life or ElderShield policyholders. All Supplements are regulated under the CareShield Life and Long-Term Care Act 2019.

This is only product information provided by us. You may wish to seek advice form a qualified adviser before buying the product. If you choose not to seek advice from a qualified adviser, you should consider whether the product is suitable for you. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. If you decide that the policy is not suitable after purchasing the policy, you may terminate the policy in accordance with the free-look provision, if any, and the insurer may recover from you any expense incurred by the insurer in underwriting the policy.

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).