Turn your invoices into cash. Get paid in a flash.

Borrow and pay only for what you use at 0.6% per month.

Get paid faster

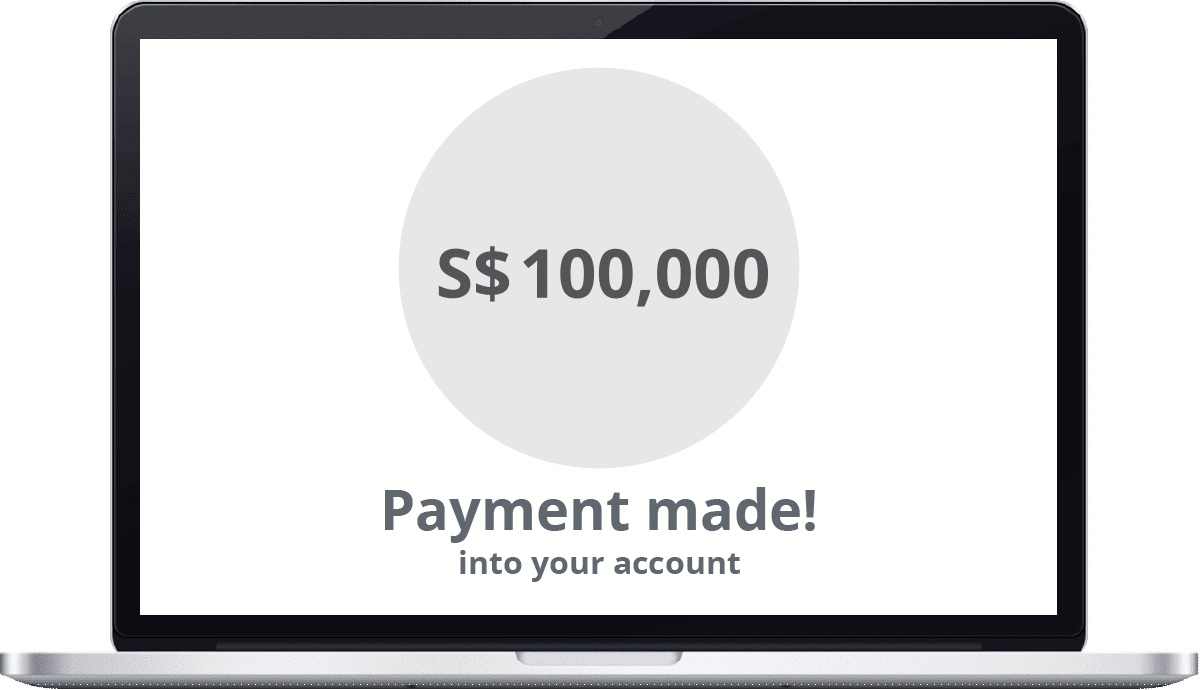

Receive payments immediately instead of waiting up to 30, 60, 90, or even 120 days.

Receive payments immediately instead of waiting up to 30, 60, 90, or even 120 days.

Improve cash flow

Receive your funds within 1 working day.

Receive your funds within 1 working day.

Save costs

Pay interest only for the amount you use

Pay interest only for the amount you use

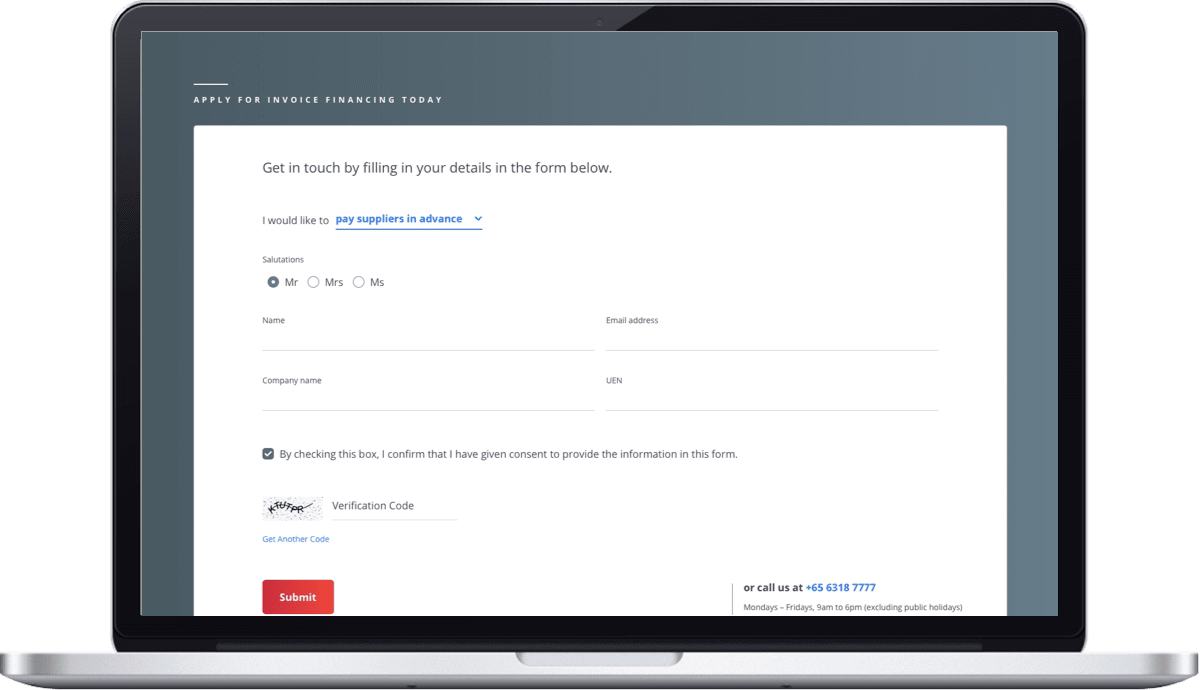

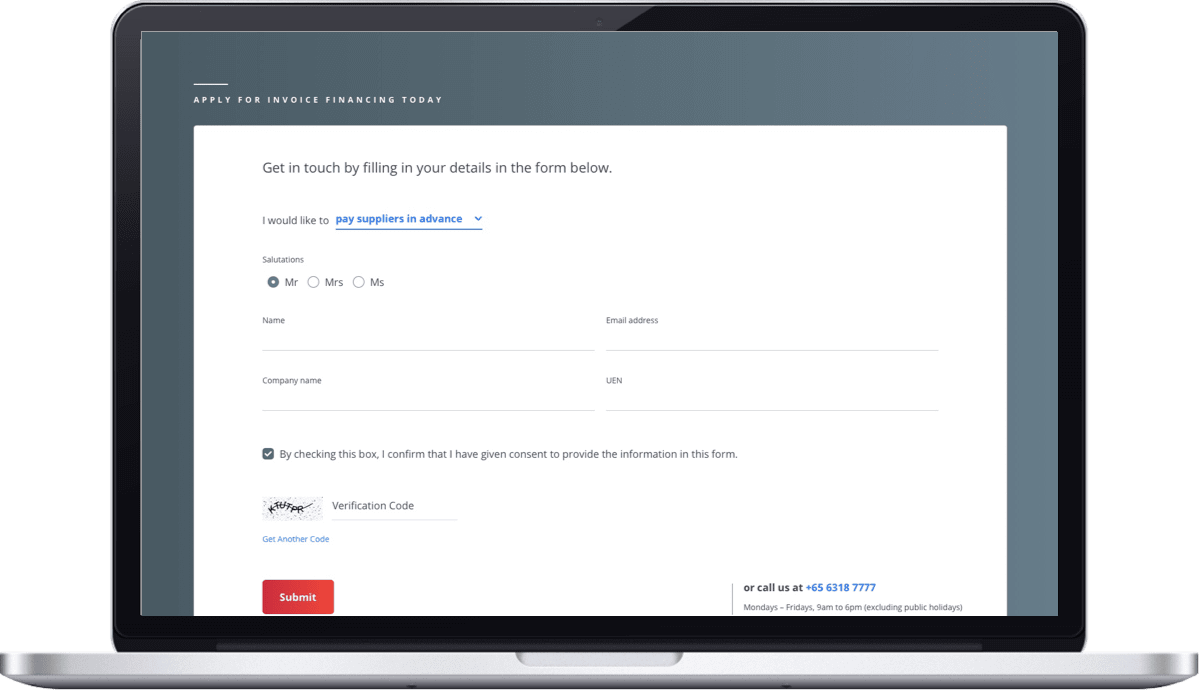

I would like to

I would like to

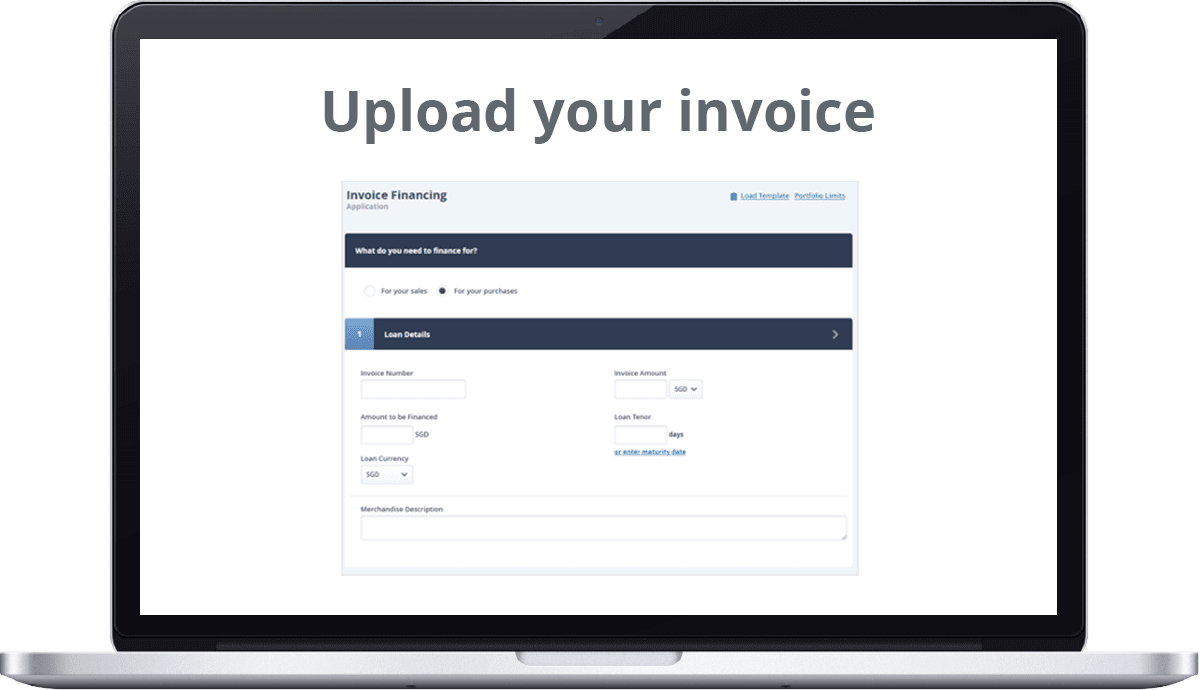

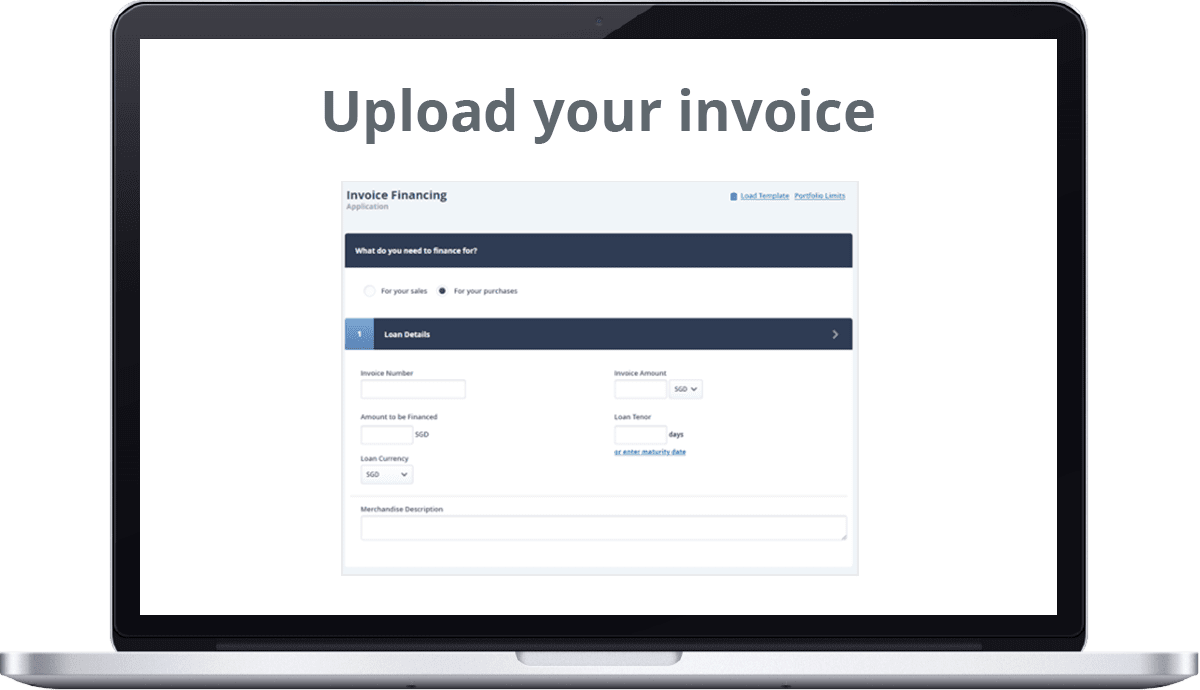

Don't let payment terms stop you. Let us pay you first.

Unlock cash from your unpaid invoices so that you can grow and scale your business.

*Applicable for invoices uploaded before 4:30pm

Build better relationships. Pay your suppliers right on time.

Let us pay for your invoices first, so you can buy inventory or complete customer orders with the extra cash.

Check how much it costs to get the funds you need.

Disclaimer / Important Notice

The figures generated by this calculator are intended as a guide only, based on information that you provide. This shall not, and is not intended to, constitute a commitment that rates offered to you will necessarily be better than those generated by the calculator, and, in particular, is not a commitment to provide any financing. Rates will be determined according to, among other things, our analysis of your risk profile. Any financing is subject to terms and conditions.

Short-term Financing for quick wins

- Receive payments immediately for essential purchases to complete customer orders

- Access more cash as your business turnover grows

- Manage seasonal demand

- Fulfill your invoice payment terms, lengthy delivery or project completion schedules

- Improve cash flow and plan ahead with confidence

What does it take to achieve the goal of being a leader in the activewear scene in Asia?

For Kydra, it’s about having the right financing — enabling them to meet surges in demand and bridging their short-term cash flow gap.

or call us at +65 6318 7777

Mondays - Fridays, 9am to 6pm (excluding public holidays)

Common questions

See all questionsYour business has to be ACRA-registered and in operations for at least 2 years. Businesses with less than 2 years of operations can still apply and applications will be considered on a case-by-case basis. Latest year of company financials and 2 years of your guarantor’s NOA are required.

There is no minimum amount for each drawdown. Your business has the flexibility to finance invoices as and when you need to. A fee will be charged for late payments and if the prepaid amount is USD500,000 and above.

No, they will not be aware that OCBC finances your purchases or sales.