A medipreneur is a medical entrepreneur who manages a business providing health and wellness services or products. We help you to run your clinic practice efficiently so that you can focus on your patients.

Run It

Diagnose the vital signs of your healthcare practice with innovative digital solutions. Beyond operating more efficiently and profitably, our digital solutions help you deliver better patient care.

Get dedicated support from OCBC’s Healthcare Specialist Team

Our team of experts understand your unique industry challenges and are here to help you from your first clinic and as you expand both locally and in the region. They can offer you tailored solutions and advice to help your medical practice succeed via banking and beyond banking solutions.

Collect It

Whether it’s collecting payments or paying your medical practice’s bills, give your staff, suppliers and patients a clean bill of health by adopting these innovative and secure digital finance and e-payments solutions.

Speed up payment collection with OCBC OneCollect

Your frontliners can skip the hassle of renting and setting-up point-of-sale equipment with this digital merchant solution that manages transactions easily and collects payments instantly to your business account. Our intuitive app is also integrated with PayNow QR for quick scan-and-pay transactions that saves you merchant commission.

Access a wide range of payment methods with OCBC card terminal

Enjoy preferential pricing when you collect payments from customers using an OCBC card terminal. OCBC card terminals accept the following international payment schemes: VISA, MasterCard, UnionPay, JCB, Alipay+ QR and WeChat Pay QR via physical cards and mobile payments, as well as PayNow QR — all on one terminal.

Moreover, our dedicated support specialist will guide you with your setup.

Subject to terms and conditions, and signing of a Merchant Agreement.

Digitise your payment collections anytime, anywhere

Collect payments from patients using PayNow QR and reconcile data seamlessly with our OCBC API solution. Furthermore, simplify administrative operations with our partner solution so that your staff can stay focused on other important tasks. Speak with our dedicated specialist to find out more.

Conveniently and securely bank cash with Business Deposit Card

No PIN required. No withdrawals and transfers. No balance enquiries allowed. Simply deposit your healthcare practice’s cash takings anytime at an OCBC ATM, skipping the need to queue at branches for cash deposits. This means that your business also saves money with lower fees compared to counter transaction and cash deposit fees at branches.

Grow It

As your healthcare practice grows, we’re here to support you throughout your medipreneur journey. Enjoy a healthy dose of unique opportunities, networking tie-ups, partner benefits and exclusive privileges as part of your relationship with us.

Get the all-in-one Medi Business Account

Get a Medi Business Account† with only a low initial deposit required, and unlimited free FAST & GIRO transactions.

† Subject to bank’s approval.

Gain pre-qualification as an OCBC Premier Banking customer

Get the exclusive Premier Voyage Card, access to premium lifestyle privileges, invites to private wealth seminars by our OCBC Wealth Panel team – our team of top wealth experts from OCBC Group – and your very own personal relationship manager for wealth advisory to help grow your fortune. Committed to your long-term interests and personal goals, our dedicated team will offer you and your wealth the premier treatment.

Access to our dedicated Healthcare Specialist team

Whether you’re a general practitioner, medical specialist, dentist, or allied health practitioner who’s looking to start your own practice or thinking of expanding, our Healthcare Specialists are ready to help you navigate the challenges and address your needs in setting up, day to day operations and financing.

A Plus Physiotherapy

Starting a business during a pandemic wasn’t easy, but with the help of the Healthcare Specialists at OCBC, A Plus Physiotherapy, was ready to operate in two weeks. Find out how our Healthcare Specialists helped to address A Plus Physiotherapy's needs in setting up and running their day to day operations.

Hip & Knee Orthopaedics

Dr Adrian Lau has always desired his own medical practice. Find out how we helped him.

No matter the size or stage of your business, we can support you every step of the way.

Starting a business?

If you are starting your business for the first time, join us as an OCBC Business Banking customer by opening a business account. Or contact our healthcare specialist to help you get started on the right foot and to digitalise your business.

Open a business account

Growing your business?

Whether you are expanding your range of services or your footprint, we offer industry insights and solutions to help you grow and scale. Contact us and our Relationship Manager will be in touch.

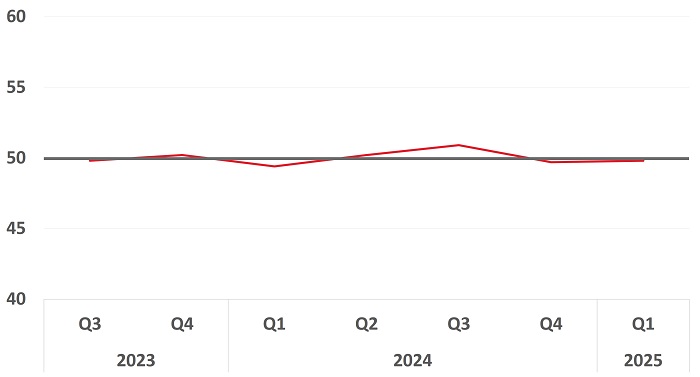

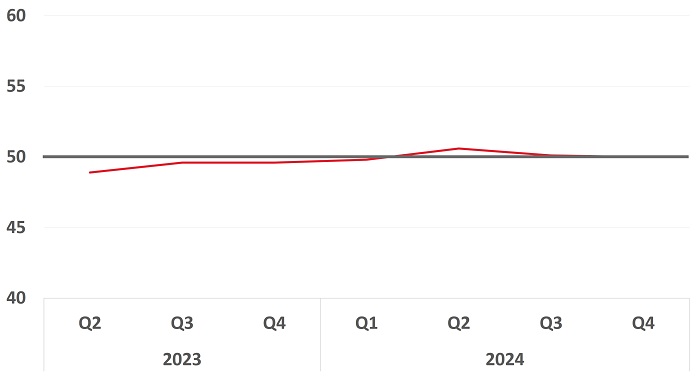

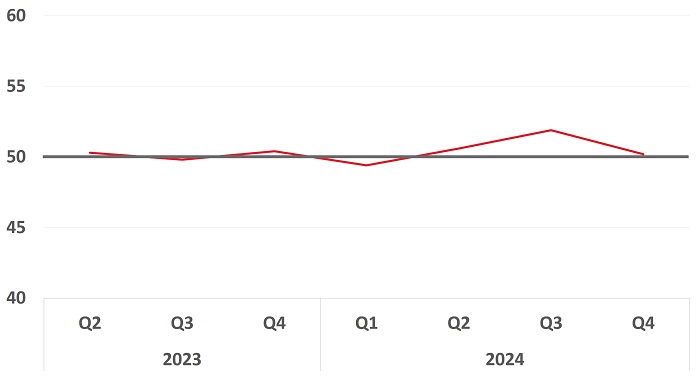

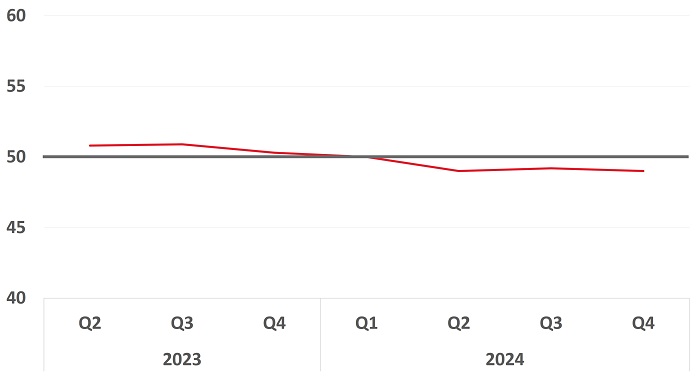

The OCBC SME Index* is a high-frequency index measuring the business health and performance of SMEs across industry value chains, including healtcare.

Whether you are a general practitioner, medical specialist, dentist, or allied health practitioner, you can count on our business solutions and Healthcare Specialist team to provide you with a healthy dose of business insights and support.

*OCBC SME Index is centered on a score of 50, which represents zero change in the inputs from a year ago. A reading above 50 indicates improved activity, while a reading below 50 indicates a deterioration relative to the same period a year ago.