-

Overseas Cheque Clearing accepts only 3 currencies from 15 March 2026

From 15 March 2026, we only accept 3 currencies (USD, MYR, and HKD) for Overseas Cheque Clearing. We encourage you to receive payments via Telegraphic Transfer (TT).

We will be updating the following pricing guides and make them available at Help & Support – Fees & Charges | OCBC Business Banking SG from 15 March 2026:

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Discontinuation of OCBC Big Disposable Bag from 1 February 2026

We are discontinuing the sale of OCBC Big Disposable Bag effective from 1 February 2026. You may continue to use the OCBC Small Disposable Bag or Reusable Bag to deposit your cash into our account.

We will be updating the following pricing guides and make them available at Help & Support – Fees & Charges | OCBC Business Banking SG from 31 January 2026:

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Business Deposit Card fees waiver extended to 31 December 2026

We will be extending the fees waiver for our Business Deposit Card for issuance and replacement from 31 December 2025 to 31 December 2026.

Description Card Issuance / Replacement Charges Card issuance S$5 per card (Promotion extended: Free application before 31 December 2026) Replacement of card due to lost/stolen/damaged card S$5 per card (Promotion extended: Free application before 31 December 2026)

We will be updating the following pricing guides to reflect the above changes and make them available at Help & Support – Fees & Charges | OCBC Business Banking SG from 31 December 2025:- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Extension of PayNow Fee Waivers to 31 December 2028

We will be extending our PayNow fee waivers from 31 December 2025 to 31 December 2028.

Description Charges To receive money through PayNow Per transaction: S$0.20

(Promotion extended: Free till 31 December 2028)

The Bank reserves the right to impose charges of S$0.20 for certain use cases and industries.To make payment through PayNow Per transaction:

· Applicable GIRO or FAST transaction fee

· S$0.20 lookup fee* (Promotion extended: Free till 31 December 2028)

*To check if recipient has registered for PayNow

We will be amending the pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 31 December 2025:· Business Banking Pricing Guide

· Corporate & Institutional Banking Pricing Guide

· Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Discontinuation of Singapore Dollar (SGD) corporate cheque books, bulk cheque services and cheque self-printing services, effective 1 January 2026

From 1 January 2026, we will no longer provide SGD corporate cheque books, bulk cheque services and cheque self-printing services.

We encourage you to utilise our digital payment services, such as FAST and GIRO, for fast and secure local transfers.

Further information regarding this industry-wide measure can be found in the Monetary Authority of Singapore (MAS) Consultation Paper and MAS Press Release.

This message contains links to third-party websites. By accessing any such websites, you agree to our terms of use.

Thank you for banking with us.

-

Changes involving the issuance of demand drafts from 1 October 2025

From 1 October 2025, we will no longer issue demand drafts in currencies other than USD. We will also discontinue over-the-counter issuance of USD demand drafts at all branches except OCBC Centre Branch. Please use alternative methods (e.g. Telegraphic Transfer) to send funds overseas.

We will continue to honour all OCBC-issued demand drafts after 1 October 2025, as long as they are deposited within 6 months of the date of issue.

Thank you for banking with us.

-

Changes to OCBC Business Account Terms and Conditions from 1 October 2025

On 1 October 2025, we will revise the OCBC Business Account Terms and Conditions to provide greater clarity on our QR code collection services. The new clauses are:

- Clause 12: TERMS AND CONDITIONS GOVERNING API LINKAGE

- Clause 13: PAYMENT RAIL LINKAGE

- Clause 21: SPECIFIC TERMS APPLICABLE TO WEIXIN PAY PAYMENTS

- Clause 22: SPECIFIC TERMS APPLICABLE TO SHOPEEPAY PAYMENTS

- Clause 23: SPECIFIC TERMS APPLICABLE TO UNIONPAY PAYMENTS

The revised OCBC Business Account Terms and Conditions will be available at https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/business-account-terms-and-conditions-effective1oct25.pdf from 29 August 2025.

Thank you for banking with us.

-

Overseas clearing of AUD cheques to be discontinued

Currently, the AUD cheques we receive are cleared overseas rather than in Singapore. We wish to inform you that we will no longer accept such AUD cheques from 15 September 2025. Please advise your payers to use alternatives like Telegraphic Transfers.

Thank you for banking with us.

-

Update on Business Cards Provisioning Requirements

With effect from 9 September 2025, customers will be required to enable the Mobile Wallets feature in either OCBC Velocity or the OCBC Business Mobile App before they can provision their Business Cards onto mobile wallets.

Guides on how to provision the respective Business Cards onto mobile wallets will be available in the links below upon launch.Business Debit Card : https://www.ocbc.com/business-banking/smes/transactions/business-debit-card

Business Credit Card : https://www.ocbc.com/business-banking/smes/transactions/business-credit-card

Thank you for banking with us.

-

Revisions to Connectivity Channels Terms and Conditions

On 1 September 2025, we will revise the following clauses in the Connectivity Channels Terms and Conditions to specify that they will apply in countries other than Singapore:

- Clause 3.2 of Section 3, ‘Access Credentials’

- Clause 5.1 (a) of Section 5, ‘Consent for Disclosure, Etc’

- Clauses 13.11, 13.12 (new clause related to dispute resolution) and 13.22 of Section 13, ‘General’

The revised version of the Connectivity Channels Terms and Conditions will be available at https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/forms/ebanking/connectivity-channels-terms-and-conditions-effective1sep25.pdf from 1 August 2025.

Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions and pricing guides from 28 July 2025

On 28 July 2025, we will revise our OCBC Business Account Terms and Conditions and pricing guides. These revisions include:

OCBC Business Account Terms and Conditions

We will add a new Clause 15 under the ‘Singapore Product Addendum’ section, which details the Terms and Conditions governing the Electronic Deferred Payment Scheme.

The revised OCBC Business Account Terms and Conditions will be available at https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/business_account_terms_and_conditions.pdf.

Pricing Guides

We will revise the following pricing guides to include the charges applicable to the Electronic Deferred Payment Scheme:

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

The new Electronic Deferred Payment (EDP) charges are set out in the table below.

Description Charges EDP and EDP+ creation Waived EDP and EDP+ cancellation The revised Pricing Guides will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 28 July 2025.

Thank you for banking with us.

-

Revisions to the Cash-backed Banker’s Guarantee Application Form with effect from 25 June 2025 (inclusive of this date)

With effect from 25 June 2025, the Cash-backed Banker’s Guarantee Application Form will be updated.

Please download the latest application forms from https://www.ocbc.com/business-banking/help-and-support/trade#section-guarantee. Please note that the old application forms will no longer be accepted after 25 July 2025.

Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 May 2025 (inclusive of this date)

The OCBC Business Account Terms and Conditions will be amended with effect from 1 May 2025 (inclusive of this date).

The amendments can be found in the following:

(i) Section C: Definitions and Interpretation

Clause 1.1

(ii) Singapore Product Addendum:

Clauses 14, 15.1

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business-account-terms-and-conditions-effective1May25.pdf from 1 April 2025 (inclusive of this date).

Thank you for banking with us.

-

Revisions to pricing guides with effect from 1 April 2025 (inclusive of this date)

Please note that we will be making the following amendments from 1 April 2025 (inclusive of this date):

(i) Revision to urgent cheque image retrieval feeCurrent New **For each urgent cheque image retrieval (within 7 business days), an additional charge of S$21.40 (inclusive of GST) will be levied. **For each urgent cheque image retrieval (within 7 business days), an additional charge of S$21.80 (inclusive of GST) will be levied.

(ii) Removal of outdated fees for Cheque Image Retrieval, Document/Statement Retrieval Charges and Letter of Reference/Foreign Endorsement(loan-related)

(iii) Formatting changes for Tracers/Investigations fees for clarity under “Amendments/Cancellations/Investigations/Tracers” section

We will be amending the pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG with effect from 1 April 2025 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Update to Cash-backed Banker’s Guarantee Application Form

With effect from 31 January 2025, the Cash-backed Banker’s Guarantee Application Form will be updated, and a new Cash-backed Banker’s Guarantee Amendment Form will be made available.

Please download the latest application forms from https://www.ocbc.com/business-banking/help-and-support/trade. Please note that old application forms will no longer be accepted after 28 February 2025.Please also note that with effect from 1 March 2025, a processing fee of SGD100 is applicable for applications submitted via email or in hard copy. This fee will be waived if you submit your application online through OCBC Velocity > Trade Finance > Cash-backed Banker’s Guarantee > New Application.

Kindly contact our Business Banking Service Manager through the Hotline at (65) 6538 1111 if you have further queries.

Thank you for banking with us. We look forward to your continued support.

-

Revisions to OCBC Business Debit Card Agreement with effect from 10 Feb 2025 (inclusive of this date)

The OCBC Business Debit Card Agreement will be amended with effect from 10 February 2025 (inclusive of this date).

The amendments can be found in the following:

(i) Section 2. Card and PIN- Clause 2.1

(ii) Section 7. Loss/theft/misuse of Card/disclosure of PIN

- Clause 7.3. Liability for lost/stolen Cards

(iii) Section 13. Disclosure of Information

- Clause 13.1: Parties to whom disclosure may be made

- Clause 13.3: Additional rights

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/forms/ocbc%20business%20card/bdc-cardmember-agreement-Feb25.pdf from 10 January 2025 (inclusive of this date).Thank you for banking with us.

- Clause 2.1

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 January 2025 (inclusive of this date)

Further to the notice published on 27 November 2024 and 12 December 2024 on Revisions to OCBC Business Account Terms and Conditions, we will be making additional amendments to the Business Account Terms and Conditions with effect from 1 January 2025 (inclusive of this date):

The amendments are as follows:

(i) Singapore Product Addendum:

- Corresponding Chinese Language for Clauses 11A & 11B

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business-account-terms-and-conditions-effective1Jan25-updated.pdf from 12 December 2024 (inclusive of this date).The OCBC Business Account Terms and Conditions will be amended with effect from 1 January 2025 (incusive of this date).

Thank you for banking with us.

- Corresponding Chinese Language for Clauses 11A & 11B

-

Revisions to OCBC Business Account Terms and Conditions with effect from 16 December 2024 (inclusive of this date)

The OCBC Business Account Terms and Conditions will be amended with effect from 16 December 2024 (inclusive of this date).

The amendment can be found in the following:

- Singapore Local Addendum:

A notice regarding E-Payments User Protection Guidelines has been included.

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business-account-terms-and-conditions-effective16Dec24.pdf from 12 December 2024 (inclusive of this date).

Thank you for banking with us.

- Singapore Local Addendum:

-

Update to descriptions for PayNow transactions in our statements and SWIFT messages

We refer to our notices of 30 September 2024 and 28 October 2024 regarding an update to descriptions for PayNow transactions in our statements and SWIFT messages (MT940, MT942, MT900 and MT910).

The revised descriptions will apply to transactions posted on and after 8 December 2024.

If you are currently using our statements and/or SWIFT messages for auto-reconciliation purposes, you may wish to update your system on 8 December 2024.

The revised descriptions are as follows:Transaction type

Statements

MT940 and MT942 messages (tag: 86)

MT900 and MT910 messages (tag: 20)

Non-Payroll Line 2: Purpose code <space> S$ <space> Debtor/Creditor name1

Line 4: PayNow:<space> Payment details/End-to-end ID 2

Example

FAST PAYMENT

OTHR S$ JOHN TAN

INVOICE NO TT34

PayNow: PAYMENT OF INVOICE NO TT34

Line 4: PayNow:<space> Payment details/End-to-end ID 2

Line 2: Purpose code <space> S <space> <space> Debtor/Creditor name1

Example

:86:FAST PAYMENT

OTHR S JOHN TAN

INVOICE NO TT34

PayNow: PAYMENT OF INVOICE NO TT34Purpose code <space> S <space> <space> Debtor/Creditor name3

Example

:20:OTHR S JOHN TAN

Payroll Line 4: PayNow:<space> Payment details/End-to-end ID 2

ExampleFAST PAYMENT

SALA PAYROLL

PAYROLL REF TC60

PayNow: PAYROLL FOR AUGUST 2024Line 4: PayNow:<space> Payment details/End-to-end ID 2

Example:86:FAST PAYMENT

SALA PAYROLL

PAYROLL REF TC60

PayNow: PAYROLL FOR AUGUST 2024

This will remain unchanged.

Example:20:SALA PAYROLL

1 Only the first 11 characters (including spaces) will be shown in the statement/SWIFT message

2 Only the first 26 characters (including spaces) will be shown in the statement/SWIFT message

3 Only the first 8 characters (including spaces) will be shown in the statement/SWIFT messageIf you have any questions, please call our Business Banking hotline: OCBC website > Contact us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 January 2025 (inclusive of this date)

The OCBC Business Account Terms and Conditions will be amended with effect from 1 January 2025 (inclusive of this date).

The amendments are as follow:

(i) Singapore Product Addendum:- Clause 1: TIME DEPOSITS

Added new clause 1.2

Amended clause 1.5 (previously clause 1.4) - Clause 11: TERMS AND CONDITIONS GOVERNING OCBC ONECOLLECT

Added new clauses

11A. SPECIFIC TERMS APPLICABLE TO ALIPAY PAYMENTS

11B. SPECIFIC TERMS APPLICABLE TO DUITNOW QR PAYMENTS

(ii) Amended minor typographical and numbering errors.

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1Jan25.pdf from 29 November 2024 (inclusive of this date).

Thank you for banking with us.

- Clause 1: TIME DEPOSITS

-

New collection modes on OCBC OneCollect

With effect from 1 January 2025 (inclusive of this date), we will be making Alipay+ and DuitNow QR available as new QR collection modes on OCBC OneCollect.

Please note that we will be amending the following pricing guides to reflect the charges for this new QR collection mode i.e. Alipay+ and DuitNow QR and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 January 2025 (inclusive of this date):- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

Description Current Charges Updated Charges

[with effect from 1 January 2025 (inclusive of this date)]OCBC OneCollect - PayNow – 0.25% of the total funds collected, deducted on a monthly basis. First 3 months of fees are waived.

- UnionPay – 1.50% of the total funds collected per day, deducted on a daily basis.

- ShopeePay – 1.50% of the total funds collected per day, deducted on a daily basis.

- WeChat Pay – 1.50% of the total funds collected per day, deducted on a daily basis.

- PayNow – 0.25% of the total funds collected, deducted on a monthly basis. First 3 months of fees are waived.

- UnionPay – 1.50% of the total funds collected per day, deducted on a daily basis.

- ShopeePay – 1.50% of the total funds collected per day, deducted on a daily basis.

- WeChat Pay – 1.50% of the total funds collected per day, deducted on a daily basis.

- Alipay+* – 1.50% of the total funds collected per day, deducted on a daily basis.

- DuitNow QR* – 1.50% of the total funds collected per day, deducted on a daily basis.

-

Commencement of charging from the first transaction for all Singapore Dollar Business Accounts for certain over the counter branch transactions

Starting from January 1, 2025, we will begin charging all Singapore Dollar Business Accounts for specific over-the-counter branch transactions, including cash deposits (including bulk cash deposits), cash withdrawals, and cash cheque encashments.

Please refer to our Business Banking Pricing Guide available at Help & Support – Fees & Charges | OCBC Business Banking SG.

Thank you for banking with us.

-

Revision to FAST and GIRO Charges for Business Growth Account from 1 January 2025

From 1 January 2025 (inclusive of this date), we will be revising the number of free FAST payment and GIRO transactions to 80 per month, respectively, for Business Growth Account.

Thank you for banking with us.

-

Revisions to OCBC Business Debit Card Agreement with effect from 11 December 2024 (inclusive of this date)

The OCBC Business Debit Card Agreement will be amended with effect from 11 December 2024 (inclusive of this date).

The amendments can be found in the following:

- Section 13: Disclosure of information

- Clause 13.3

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/forms/ocbc%20business%20card/bdc-cardmember-agreement-dec24.pdf from 11 November 2024 (inclusive of this date).

Thank you for banking with us.

-

Revision of terms and conditions for trade finance applications with effect from 6 November 2024

Effective 6 November 2024, we will be revising the terms and conditions for trade finance applications.

Please download the latest application forms with the revised terms and conditions from https://www.ocbc.com/business-banking/help-and-support/trade, starting 6 November 2024. Old application forms will no longer be accepted after 11 December 2024.

Please contact our Trade Finance service staff through the Trade Hotline at (65) 6318 7777 if you have further queries.

Thank you for banking with us. We look forward to your continued support.

-

Commencement of charging from the first transaction for Foreign Business Accounts for certain over the counter branch transactions

Please refer to the table below on the changes effective from 5 December 2024 (inclusive of this date):

Product Description Current New Over the counter branch transaction charges

[Chargeable transactions are cash deposits (including bulk cash deposits), cash withdrawal and cash cheque encashment.]

- First 3 transactions per month: FREE

(The transactions are calculated on an aggregate basis for all your bank accounts under the same customer name.)

- 4th transaction onwards: S$20 per transactionS$20 per transaction

We will be amending the pricing guide to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 5 December 2024 (inclusive of this date):- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Revision of Cash Deposit charges with effect from 1 December 2024

Please refer to the table below on the changes effective from 1 December 2024 (inclusive of this date):

Product Description Current New Cash Deposit charges First S$20,000 per day - free; every subsequent S$10,000 (or less) - S$10. First S$20,000 per day - free; every subsequent S$10,000 (or less) - S$20.

We will be amending the pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 December 2024 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Revisions to Connectivity Channels Terms and Conditions with effect from 1 December 2024 (inclusive of this date)

The Connectivity Channels Terms and Conditions will be amended with effect from 1 December 2024 (inclusive of this date).

The amendments can be found in the following:

(i) Section 2: Authorisation and Instructions

Clause 2.4

(ii) Section 5: Consent for Disclosure, Etc

Clause 5.1

(iii) Section 13: General

Clause 13.17

(iv) Section 14: Definitions and Interpretation

Clause 14.1The revised version of the Connectivity Channels Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/eBanking/connectivity-channels-terms-and-conditions-effective1Dec24.pdf.

Thank you for banking with us.

-

Revisions to Corporate API/SDK Terms of Use with effect from 1 December 2024 (inclusive of this date)

The Corporate API/SDK Terms of Use will be amended with effect from 1 December 2024 (inclusive of this date).

The amendments can be found in the following:

(i) Part 4: General Terms

Clause 13.7

The revised version of the Corporate API/SDK Terms of Use will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/eBanking/corporate-api-service-terms-of-use-effective1Dec24.pdf from 1 November 2024 (inclusive of this date).Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 December 2024 (inclusive of this date)

The OCBC Business Account Terms and Conditions will be amended with effect from 1 December 2024 (inclusive of this date).

The amendments can be found in the following:

(i) Section A: General Terms and Conditions

Clauses 11.1, 15.21

(ii) Section C: Definitions and Interpretation

Clause 1.1

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business-account-terms-and-conditions-effective1Dec24.pdf from 1 November 2024 (inclusive of this date).Thank you for banking with us.

-

Postponed: Update to descriptions for PayNow transactions in statements and SWIFT messages

We refer to the notice we posted on 30 September 2024 regarding an update to descriptions for PayNow transactions in our statements and SWIFT messages.

The update has been postponed; we will post a further notice and send affected customers an email once a new date is confirmed.

If you have any questions, please call our Business Banking hotline: OCBC website > Contact us.

We are sorry for any inconvenience caused.

Thank you.

-

Update to descriptions for PayNow transactions in our statements and SWIFT messages

Dear Valued Customer

We wish to inform you that we will be updating the formats of descriptions for PayNow transactions in our statements and SWIFT messages (MT940, MT942, MT900 and MT910).

This change will apply to transactions posted on and from 27 October 2024.

If you are currently using our statements and/or SWIFT messages for auto-reconciliation purposes, you may wish to update your system on 27 October 2024.

The descriptions for PayNow transactions will be updated to the following formats:Transaction type

Statements

MT940 and MT942 messages (tag: 86)

MT900 and MT910 messages (tag: 20)

Non-Payroll Line 2: Purpose code <space> S$ <space> Debtor/Creditor name1

Line 4: PayNow:<space> Payment details/End-to-end ID 2

Example

FAST PAYMENT

OTHR S$ JOHN TAN

INVOICE NO TT34

PayNow: PAYMENT OF INVOICE NO TT34

Line 4: PayNow:<space> Payment details/End-to-end ID 2

Line 2: Purpose code <space> S <space> <space> Debtor/Creditor name1

Example

:86:FAST PAYMENT

OTHR S JOHN TAN

INVOICE NO TT34

PayNow: PAYMENT OF INVOICE NO TT34Purpose code <space> S <space> <space> Debtor/Creditor name3

Example

:20:OTHR S JOHN TAN

Payroll Line 4: PayNow:<space> Payment details/End-to-end ID 2

ExampleFAST PAYMENT

SALA PAYROLL

PAYROLL REF TC60

PayNow: PAYROLL FOR AUGUST 2024Line 4: PayNow:<space> Payment details/End-to-end ID 2

Example:86:FAST PAYMENT

SALA PAYROLL

PAYROLL REF TC60

PayNow: PAYROLL FOR AUGUST 2024

This will remain unchanged.

Example:20:SALA PAYROLL

1 Only the first 11 characters (including spaces) will be shown in the statement/SWIFT message

2 Only the first 26 characters (including spaces) will be shown in the statement/SWIFT message

3 Only the first 8 characters (including spaces) will be shown in the statement/SWIFT messageIf you have any questions, please call our Business Banking hotline: OCBC website > Contact us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 October 2024 (inclusive of this date)

Dear Valued Corporate Customer,

The OCBC Business Account Terms and Conditions will be amended with effect from 1 October 2024 (inclusive of this date).

The amendments can be found in the following:

- Singapore Product Addendum:

Clauses 13.1, 13.2, 13.3, 13.4, 13.5, 13.6, 13.7, 13.8, 13.9, 13.10, 13.11, 13.12, 14.1

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1Oct24.pdf from 23 September 2024 (inclusive of this date).

Thank you for banking with us.

-

Commencement of charging from the first transaction for Business Entrepreneur Account Plus for certain over the counter branch transactions

Dear Valued Corporate Customers,

Please refer to the table below on the changes effective from 1 October 2024 (inclusive of this date):

Product Description Current New Over the counter branch transaction charges

[Chargeable transactions are cash deposits (including bulk cash deposits), cash withdrawal and cash cheque encashment.]

Business Entrepreneur Account Plus:

- First 3 transactions per month: FREE

- 4th transaction onwards: S$20 per transaction(The transactions are calculated on an aggregate basis for all your bank accounts under the same customer name.)

Business Entrepreneur Account Plus:

S$20 per transaction

We will be amending the pricing guide to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 October 2024 (inclusive of this date):

- Business Banking Pricing Guide

Thank you for banking with us.

-

New collection mode on OCBC OneCollect

Dear Valued Corporate Customers,

With effect from 15 July 2024 (inclusive of this date), we will be making WeChat Pay available as a new QR collection mode on OCBC OneCollect.

Please note that we will be amending the following pricing guides to reflect the charges for this new QR collection mode i.e. WeChat Pay and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 15 July 2024 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

Description Current Charges Updated Charges

[with effect from 15 July 2024 (inclusive of this date)]OCBC OneCollect 1) PayNow - 0.25% of the total funds collected, deducted on monthly basis.

2) UnionPay – 1.50% of the total funds collected per day, deducted on a daily basis.

1) PayNow - 0.25% of the total funds collected, deducted on monthly basis.

2) UnionPay – 1.50% of the total funds collected per day, deducted on a daily basis.

3) ShopeePay* – 1.50% of the total funds collected per day, deducted on a daily basis.

4) WeChat Pay* – 1.50% of the total funds collected per day, deducted on a daily basis.

*Transaction charges for ShopeePay and WeChat Pay are waived until 30 September 2024.

Thank you for banking with us.

-

Revisions to OCBC Terms & Conditions governing Business Loans with effect from 15 July 2024

Dear Valued Corporate Customer,

With effect from 15 July 2024, there will be revisions to the OCBC Business Loans Terms and Conditions.

- New clause 17: Pre-Approved Loans

The revised version of the OCBC Terms & Conditions governing Business Loans will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/loans/terms-and-condition-governing-business-loans.pdf from 5 July 2024.

Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 August 2024 (inclusive of this date)

Dear Valued Corporate Customer,

The OCBC Business Account Terms and Conditions will be amended to reflect the new names of Singapore legislation with effect from 1 August 2024 (inclusive of this date).

The amendments can be found in the following:

Singapore Local Addendum:

Clauses 4.1 (a), 6.3, 6.7, 7.1Singapore Product Addendum:

Clauses 12.22, 12.41, 14.1

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1Aug24.pdf from 1 July 2024 (inclusive of this date).Thank you for banking with us.

-

New collection mode on OCBC OneCollect

Dear Valued Corporate Customers,

With effect from 27 June 2024 (inclusive of this date), we will be making ShopeePay available as a new QR collection mode on OCBC OneCollect.

Please note that we will be amending the following pricing guides to reflect the charges for this new QR collection mode i.e. ShopeePay and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 27 June 2024 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

Description Current Charges Updated Charges

[with effect from 27 June 2024 (inclusive of this date)]OCBC OneCollect 1) PayNow - 0.25% of the total funds collected, deducted on monthly basis.

2) UnionPay – 1.50% of the total funds collected per day, deducted on a daily basis.

1) PayNow - 0.25% of the total funds collected, deducted on monthly basis.

2) UnionPay – 1.50% of the total funds collected per day, deducted on a daily basis.

3) ShopeePay – 1.50% of the total funds collected per day, deducted on a daily basis. Waiver until 31 August 2024.

Thank you for banking with us.

-

Revision to GIRO Charges for Business Entrepreneur Account Plus from 1 July 2024

Dear Valued Corporate Customers,

From 1 July 2024 (inclusive of this date), we will be revising GIRO charges for Outward GIRO as follows:Current Charges

(until 30 June 2024)New Charges

(from 1 July 2024)Outward GIRO S$0.10 per item requested via OCBC Velocity.

Standard charges apply. Please refer to Transaction Charges.

Thank you for banking with us.

-

Revision to GIRO Charges for Business 8 Account from 1 July 2024

Dear Valued Corporate Customers,

From 1 July 2024 (inclusive of this date), we will be revising GIRO charges for Outward GIRO as follows:Current Charges

(until 30 June 2024)New Charges

(from 1 July 2024)Outward GIRO S$0.08 per item

Standard charges apply. Please refer to Transaction Charges.

Thank you for banking with us.

-

Revision to GIRO Charges for Business Privilege Account from 1 July 2024

Dear Valued Corporate Customers,

From 1 July 2024 (inclusive of this date), we will be revising GIRO charges Outward GIRO as follows:Current Charges

(until 30 June 2024)New Charges

(from 1 July 2024)Outward GIRO S$0.10 per item requested via OCBC Velocity

S$0.20 per item requested via other channels.

Standard charges apply. Please refer to Transaction Charges.

Thank you for banking with us.

-

Discontinuation of INR Demand Draft Issuance with effect from 1 July 2024

Dear Valued Corporate Customers,

With effect from 1 July 2024, we will no longer offer INR demand draft issuance. Please pay via other alternatives such as telegraphic transfer.

Please remind your beneficiaries to deposit their OCBC-issued INR demand drafts within 6 months from issuing date.

Thank you for banking with us.

-

Discontinuation of Hong Kong Dollar payment via International Automated Clearing House (IACH)

Dear Valued Corporate Customers,

With effect from 17 June 2024, Hong Kong Dollar (HKD) payment via International Automated Clearing House (IACH) will no longer be offered due to a local market change relating to the payment clearing scheme in Hong Kong.

Overseas remittances in HKD may still be effected via Outward Telegraphic Transfer.

Thank you for banking with us.

-

Removal of Charges for JPY Business Accounts from 1 June 2024 (inclusive of this date)

Dear Valued Corporate Customers,

With effect from 1 June 2024 (inclusive of this date), the service charge for JPY Business Accounts will be removed.

Please note that we will be amending the following pricing guides to reflect the change which is set out above and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 June 2024 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate and Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Implementation of USD Cheque Issuance and Deposit Fees from 1 April 2024

Dear Valued Corporate Customers,

From 1 April 2024 (inclusive of this date), we will be implementing a USD Cheque Issuance and USD Cheque Deposit fee of US$1 /cheque in line with an industry-wide measure to better reflect increasing cheque processing costs.

Please refer to the table below.

ChequesCurrent Charges

(until 31 March 2024)New Charges

(from 1 April 2024)USD Cheque Clearing (Issuance) Fee No charge US$1/Cheque USD Cheque Deposit Fee No charge US$1/Cheque

For more information on this industry-wide measure, please refer to the MAS announcement at:

We encourage you to adopt electronic payment methods such as Telegraphic Transfers for your USD payments.

Please also note that we will be amending the following pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 April 2024 (inclusive of this date).

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us. -

Revision to Cashier’s Order fee from 1 April 2024

Dear Valued Corporate Customers,

From 1 April 2024 (inclusive of this date), we will be revising the Cashier’s Order fee for Cashier’s Orders requested through digital channels (OCBC Velocity or Host-to-Host) or hardcopy application (OCBC Branches or mailed-in).

Please refer to the table below.

Cashier's OrderAccount Holder Current Charges

(until 31 March 2024)New Charges

(from 1 April 2024)Payable to Own Name/Third Party S$5 /Cashier’s Order S$15 /Cashier’s Order

Please also note that we will be amending the following pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 April 2024 (inclusive of this date).

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us. -

Revision to Branch / Manual Instruction charges for Outward Remittance – Telegraphic Transfer and Internal Funds Transfer from 1 April 2024

Dear Valued Corporate Customers,

From 1 April 2024 (inclusive of this date), we will be revising the Outward Remittances Telegraphic Transfer cable fee and Internal Funds Transfer fee, which are requested through branch / manual instruction.

Please refer to the table below.

Outward Remittances - Telegraphic TransferAccount Holder Current Cable Charge

(until 31 March 2024)New Cable Charge

(from 1 April 2024)Debit from SGD Accounts S$35 S$40 Debit from Foreign Currency Account without Foreign Exchange S$35 S$40 Debit from Foreign Currency Account with Foreign Exchange S$35 S$40

Internal Funds Transfer

Account Holder Current Cable Charge

(until 31 March 2024)New Cable Charge

(from 1 April 2024)For funds transfer within OCBC Singapore accounts S$5 S$15

For the avoidance of doubt, there are no changes to:

(a) fees and charges for OCBC Velocity (Business Internet Banking), OCBC Business app, Host-to-Host, or API instructions;

(b) the Branch / Manual Instruction fees and charges where the account holder is "Withdrawal from Foreign Currency Time Deposits"; and(c) the Agent Fee for all types of account holders for Outward Remittances - Telegraphic Transfer.

(d) fees and charges for OCBC Velocity (Business Internet Banking) for Internal Funds Transfer.Please also note that we will be amending the following pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 April 2024 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate and Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 April 2024

Dear Valued Corporate Customer,

The OCBC Business Account Terms and Conditions will be amended with effect from 1 April 2024.

The amendment can be found in the following:

(i) Singapore Local Addendum: Clause 6.2

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1Apr24.pdf from 1 March 2024.

Thank you for banking with us.

-

Discontinuation of Offsite Quick Cheque Deposit Box Service from 5 March 2024, 3:30pm

Dear Valued Corporate Customer,

Our Offsite Quick Cheque Deposit Box service at various locations will be discontinued from 5 March 2024, 3.30pm.

You may visit our nearest full-service branch for your cheque deposit and other banking needs.

S/No. Offsite Quick Cheque Deposit Box Service Location Last Cheque Collection Nearest Full-service OCBC Branch 1 Shell Boon Lay 5 March 2024, 3:30pm Jurong Point 2 Shell Paya Lebar (Macpherson) 5 March 2024, 3:30pm Paya Lebar Square 3 Shell Paya Lebar (PIE) 5 March 2024, 3:30pm Paya Lebar Square 4 Shell Pasir Ris 5 March 2024, 3:30pm White Sands 5 Shell Woodlands 5 March 2024, 3:30pm Causeway Point 6 Midview City 13 March 2024, 3:30pm Thomson 7 Ruby Industrial Complex 30 April 2024, 3:30pm Paya Lebar Square 8 Shun Li Industrial Park 30 April 2024, 3:30pm Bedok 9 Ubi Techpark 30 April 2024, 3:30pm Paya Lebar Square 10 8@TradeHub21 30 April 2024, 3:30pm Jurong East

We apologise for any inconvenience caused and appreciate your kind understanding.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 March 2024

Dear Valued Corporate Customer,

The OCBC Business Account Terms and Conditions will be amended with effect from 1 March 2024.

The amendments can be found in the following:

(i) Section A: General Terms and Conditions

Clauses 3.4, 8.2, 8.3, 8.4, 11.1, 11.2, 12.1, 13.1, 14.1, 14.2, 15.6, 15.13

(ii) Section B: Terms & Conditions Governing Electronic Services

Clauses 2.1, 3, 4, 5, 6, 7, 8, 9

(iii) Section C: Definitions and Interpretation

Clauses 1.1, 2.2

(iv) Singapore Local Addendum:

Clauses 5, 6, 7

(v) Singapore Product Addendum:

Clauses 8.22, 11.4, 11.13, 11.14, 12, 13.5, 13.9, 14.1The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1Mar24.pdf from 1 February 2024.

Thank you for banking with us.

-

Revision to Annual Service Fees for OCBC credit cards

From 1 January 2024, we will be revising the Annual Service Fees for the OCBC Business Credit Card and OCBC Corporate Credit Card.

Till 31 December 2023

From 1 January 2024

Annual Service Fee (inclusive of GST)

OCBC Corporate Credit Card

$100.00

$109.00

OCBC Business Credit Card

$194.40

$196.20

-

Revision of the prices of our Reusable Bag and Security Tag

Dear Valued Corporate Customers,

There will be a revision of the prices of our Reusable Bag and Security Tag, effective 1 January 2024 (inclusive of this date).

Product Description

Current Price

(Inclusive of GST)Revised Price

(Inclusive of GST)Reusable Bag

S$56.00

S$70.00

Security Tag

S$0.11

S$0.14

Please also note that we will be amending the following pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support – Fees & Charges | OCBC Business Banking SG from 1 January 2024 (inclusive of this date):

- Business Banking Pricing Guide

- Corporate and Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Discontinuation of Offsite Quick Cheque Deposit Box Service at Caltex Jalan Bukit Merah on 29 Dec 2023, 3:30pm

Dear Valued Corporate Customer,

Our Offsite Quick Cheque Deposit service will be discontinued on 29 Dec 2023.

The last collection of cheques will be on 29 Dec 2023 at 3:30pm.

Your cheque deposit and other banking needs will continue to be served by the nearest full-service branch at:

Tiong Bahru Plaza Branch

302 Tiong Bahru Road

#01-125/126 Tiong Bahru Plaza

Singapore 168732We apologise for any inconvenience caused and appreciate your kind understanding.

-

Revisions to Outward Remittances – Telegraphic Transfer Fees and Charges

Dear Valued Corporate Customers,

From 1 December 2023 (inclusive of this date), we will be making the following changes in respect of outward remittances via telegraphic transfer, which are requested through OCBC Velocity (Business Internet Banking), Host-to-Host or API:

(a) reducing the commission for Outward Remittances – Telegraphic Transfer to SGD30.00;

(b) waiving the Commission-in-lieu-of exchange as well as Cable Charge

for the following types of account holders:

(a) Debit from SGD Accounts;

(b) Debit from Foreign Currency Account without Foreign Exchange; and

(c) Debit from Foreign Currency Account with Foreign Exchange.

Please refer to the table below.

For the avoidance of doubt, there are no changes to:

(a) the Cable Charge for branch / manual instruction;

(b) the Agent Fee for all types of account holders; and

(c) all Outward Remittances - Telegraphic Transfer fees and charges where the account holder is "Withdrawal from Foreign Currency Time Deposits".

Telegraphic Transfer Current Fees/Charges New Fees/Charges (until 30 November 2023) (from 1 December 2023) Account Holder Commission Commission-in-lieu of exchange1 Cable Charge Commission Commission-in-lieu of exchange Cable Charge OCBC Velocity (Business Internet Banking) OCBC Velocity (Business Internet Banking), Host-to-Host and API Debit from SGD Accounts Same/Third Party: 1/8% commission (min S$10, max S$100) N.A. Flat fee of S$25 Flat fee of S$30 Waived Waived Debit from Foreign Currency Account without Foreign Exchange Same/Third Party: 1/8% commission (min S$10, max S$120) 1/8% commission-in lieu of exchange1 (min S$25, max S$120) Debit from Foreign Currency Account with Foreign Exchange Same/Third Party: 1/8% commission (min S$10, max S$100) N.A. 1 Commission-in-lieu of exchange is applicable when there is no foreign exchange involved.

Please also note that we will be amending the following pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support - Fees & Charges | OCBC Business Banking SG from 1 December 2023:

Business Banking Pricing Guide

Corporate & Institutional Banking Pricing Guide

Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Discontinuation of EUR Demand Draft Issuance with effect from 18 November 2023

Dear Valued Corporate Customers,

With effect from 18 November 2023, we will no longer offer EUR demand draft issuance. Please pay via other alternatives such as telegraphic transfer.

Please remind your beneficiaries to deposit their OCBC-issued EUR demand drafts within 6 months from issuing date.

-

Revision of coins charges

Dear Valued Corporate Customers,

We will be revising the charges for coin deposit/withdrawal and exchange services which are performed at Teller Counter at our branches from 1 September 2023 (inclusive of this date).

Description

Current Charges

(until 31 August 2023)

New Charges

(from 1 September 2023)Coin Deposit

S$1.50 for every 100 coins deposited or part thereof

S$2.00 for every 100 coins deposited or part thereof

Coin Withdrawal

S$1.50 for every S$50 withdrawn or part thereof

S$2.00 for every S$50 withdrawn or part thereof

Coin Exchange

S$1.50 for every S$50 exchanged or part thereof

S$2.00 for every S$50 exchanged or part thereof

Please also note that we will be amending the following pricing guides to reflect the above changes and the amended versions of the same will be available at Help & Support - Fees & Charges | OCBC Business Banking SG from 1 September 2023:

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions with effect from 1 September 2023

Dear Valued Corporate Customer,

The OCBC Business Account Terms and Conditions will be amended with effect from 1 September 2023.

The amendments can be found in the following:

(i)Singapore Local Addendum:

Clauses 1.3, 3.3, 5.1

(ii)Singapore Product Addendum:

Clauses 8.16, 9.24, 11.11, 11.13, 11.14, 12.11, 13.0 - 13.9, 14.1The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1Sep23.pdf from 1 August 2023.

Thank you for banking with us.

-

SGD Cheque Book and SGD Cheque Pricing changes from 3 July 2023

Dear Valued Corporate Customers,

In line with Singapore’s Smart Nation vision to be cheque-free, we will be implementing the following SGD cheque related changes from 3 July 2023.

- Implementation of SGD Cheque Deposit Fee of SGD 0.75/cheque

- Implementation of SGD Cheque Book Issuance Fee of SGD 25/cheque book for:

- Newly opened Business Growth Account, Business Entrepreneur Account Plus and Business Foreign Account accounts (from first cheque book onwards)

- Existing Business Entrepreneur Account Plus and Business Foreign Account accounts (for subsequent cheque books)

- Cessation of auto cheque book issuance for newly opened Business Growth Account, Business Entrepreneur Account Plus and Business Foreign Account accounts. Customers may request for cheque book by contacting our Business Banking Service Managers at +65 6538 1111, or submitting a Request for Corporate Cheque Book form, a copy of which is available at http://www.ocbc.com/business-banking/Forms.html under the Account Activities category.

Note: For existing Business Growth Account, Business Entrepreneur Account Plus and Business Foreign Account accounts, subsequent cheque book will be auto issued when your existing cheque book is about to be used up and is chargeable at SGD 25/cheque book. If you would like to cease auto cheque book issuance for your existing accounts, please submit a Request for Corporate Cheque Book form (indicate under the OTHER REQUEST section) before 3 July 2023. Otherwise, you are deemed to have consented to auto-issuance of subsequent cheque books at a charge of SGD 25/cheque book.

We encourage you to adopt electronic payment methods such as GIRO, FAST and Paynow.

Please also note that we will be amending our pricing guides to reflect the above changes.

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

-

Hardcopy Account Statements to be stopped after May 2023

Dear Valued Corporate Customer,

As part of the Bank’s effort to go paperless, you can now download your

e-Statement from Velocity. We will stop sending hardcopy month end account

statements to clients on Standard and Classic Velocity Service Packages after the

May 2023 month end statement. To learn more about corporate eStatement, please

visit: www.ocbc.com/business-banking/help-and-support/account-details/e-statements

-

Discontinuation of Offsite Quick Cheque Deposit Box Service at Esso Ang Mo Kio on 30 May 2023, 3:30pm

Dear Valued Corporate Customer,

With the closure of the Esso petrol station at 3551 Ang Mo Kio Ave 3, our Offsite Quick Cheque Deposit service will be discontinued.

The last collection of cheques will be on 30 May 2023 at 3:30pm.

Your cheque deposit and other banking needs will continue to be served by the nearest full-service branch at:

Ang Mo Kio Central Branch

53 Ang Mo Kio Ave 3

#B1-32/33 AMK Hub

Singapore 569933

We apologise for any inconvenience caused and appreciate your kind understanding.

-

Revisions to OCBC Business Account Terms and Conditions from 1 April 2023

Dear Valued Corporate Customer,

The OCBC Business Account Terms and Conditions will be amended with effect from 1 April 2023.

The amendments can be found in Section A: General Terms and Conditions:

- New Clauses 9.8A, 10.4A, 15.25

- Amended Clauses 10.8, 14.1, 15.12

Section C: Definitions and Interpretation:

- Amended Clauses 1.1

Singapore Local Addendum:

- Removed Clauses 5.8 to 5.10

- Amended Clauses 6.1

Singapore Product Addendum:

- Amended Clauses 1.2, 15.1

- New Clauses 14.0 – 14.9

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/PDF/business_account_terms_and_conditions_effective1april23.pdf from 1 March 2023.

Thank you for banking with us.

-

GST Rate Change for 2023 & 2024

Dear Valued Customers,

In the Singapore Budget 2022, the Minister for Finance announced that the GST rate will be increased from:

- 7% to 8% with effect from 1 January 2023; and

- 8% to 9% with effective 1 January 2024.

Please refer to the table below which sets out the existing and new fees and charges, for 3 of our products and services which are affected by these changes:

Products/Services

Charges

Cheque Image Retrieval

Existing charges until 31 December 2022 (inclusive of this date)

S$21.40 (inclusive of GST) for retrievals of cheques cleared less than 1 year ago.

S$32.10 (inclusive of GST) for retrievals of cheques cleared between 1 to 3 years ago.

S$53.50 (inclusive of GST) for retrievals of cheques cleared more than 3 years ago.

New charges with effect from (“wef”) 1 January 2023

S$21.60 (inclusive of GST) for retrievals of cheques cleared less than 1 year ago.

S$32.40 (inclusive of GST) for retrievals of cheques cleared between 1 to 3 years ago.

S$54.00 (inclusive of GST) for retrievals of cheques cleared more than 3 years ago.

New charges wef 1 January 2024

S$21.80 (inclusive of GST) for retrievals of cheques cleared less than 1 year ago.

S$32.70 (inclusive of GST) for retrievals of cheques cleared between 1 to 3 years ago.

S$54.50 (inclusive of GST) for retrievals of cheques cleared more than 3 years ago.

Document / Statement Retrieval Charges (for each monthly Statement)

Existing charges until 31 December 2022 (inclusive of this date)

Borrowing Customer

Free for the current and previous month (statement only)

S$21.40 (inclusive of GST) for retrievals of less than 1 year ago.

S$32.10 (inclusive of GST) for retrievals between 1 to 3 years ago.

S$53.50 (inclusive of GST) for retrievals of more than 3 years ago.

New charges wef 1 January 2023

Borrowing Customer

Free for the current and previous month (statement only)

S$21.60 (inclusive of GST) for retrievals of less than 1 year ago.

S$32.40 (inclusive of GST) for retrievals between 1 to 3 years ago.

S$54.00 (inclusive of GST) for retrievals of more than 3 years ago.

New charges wef 1 January 2024

Borrowing Customer

Free for the current and previous month (statement only)

S$21.80 (inclusive of GST) for retrievals of less than 1 year ago.

S$32.70 (inclusive of GST) for retrievals between 1 to 3 years ago.

S$54.50 (inclusive of GST) for retrievals of more than 3 years ago.

.

Products/Services

Charges

Letter of Reference/Foreign Endorsement

(loan-related)Existing charges until 31 December 2022 (inclusive of this date)

S$32.10 per letter (inclusive of GST)

New charges wef 1 January 2023

S$32.40 per letter (inclusive of GST)

New charges wef 1 January 2024

S$32.70 per letter (inclusive of GST)

Please also note that we will be amending the following documents to reflect the new fees and charges which are set out in the table above:

- Business Banking Pricing Guide

- Corporate & Institutional Banking Pricing Guide

- Foreign Business Account Pricing Guide

For more information on the GST rate increase, please refer to IRAS’s website (https://www.iras.gov.sg).

-

OCBC Anti-Money Laundering / Countering the Financing of Terrorism & Sanction Notice

Dear Valued Corporate Customers,

As a global financial hub, Singapore is exposed to money laundering, terrorist financing and proliferation financing (collectively, Financial Crime) risks. The potential social and economic damage brought by these illicit activities to Singapore and the international financial markets is immense and severe. This is because such activities may involve drug dealings, illegal arms dealings, extortion, kidnapping, corruption, tax evasion, unlicensed money lending, terrorism activities and other serious crimes. These will not only lead to an increase in crime, but also bring harm to legitimate businesses.

OCBC Group – i.e. OCBC Bank and its subsidiaries, branches in and outside Singapore – are committed to complying with the sanctions laws and regulations issued by the Singapore Government including the Monetary Authority of Singapore, the United Nations Security Council, the European Union, United States Treasury Department’s Office of Foreign Assets Control and the United Kingdom’s Office of Financial Sanctions Implementation of HM Treasury as well as the applicable laws and regulations of the jurisdictions in which we operate. OCBC Group does not establish business relationships or transact with sanctioned individuals, entities, sanctioned countries or territories (such as North Korea, Iran, Syria, Cuba, Crimea, Donetsk, Luhansk, Kherson and Zaporizhzhia)1 , where such relationships or transactions are non-compliant with the above sanctions laws and regulations, or are against the OCBC Group’s internal AML/CFT and sanctions risk policies.

This means that we will proactively take measures to combat financial crime in order to safeguard the Group as well as our customers’ business reputation, assets and interests. Such measures may include:

• Monitoring and analysing your account activities;

• Contacting you for additional information as and when necessary, where such information is not available from our monitoring and analysis, to ensure compliance with applicable laws, regulations and policies;

• Rejecting or blocking transactions that are not permitted by the applicable laws, regulations and policies; and

• Suspending or imposing any conditions on the access or operations of your account or services provided to you, or restricting the channels available to access or operate your accounts

We seek your cooperation and support should you receive such enquiries from us.

Together, we can safeguard the health and integrity of our financial system and also protect your interests and assets.

Thank you for banking with us. We look forward to serving you again.

1This includes the use of OCBC’s electronic services (including electronic banking channels and/or platforms) from the sanctioned countries and territories.

-

Revisions to the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme (“The Programme”) with effect from 1 November 2022

Dear Valued Corporate Customers,

Effective 1 November 2022, there will be revisions to the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme (“The Programme”).

Under The Programme, cardholders will now enjoy up to 1% rebate on their everyday business spend:

- 0.2% base rebate on all Base Transactions; and

- 0.8% bonus rebate on Business Travel, E-commerce Business and E-commerce Retail transactions, in addition to the 0.2% base rebate.

For a revised copy of the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme, visit the OCBC website > Business Banking > SMEs > Transactions > Transfers in Singapore dollars > Scroll down to Business Debit Card.

If you require more information, please contact our hotline at 1800 363 3333.Thank you for banking with OCBC.

-

Revision of Fees for CHF and EUR Business Accounts from 1 November 2022

Dear Valued Corporate Customers,

With effect from 1 November 2022, there will be a revision to the service charge for CHF and EUR Business Accounts.

Foreign Currency Business Accounts Currency

Daily Balance

Service Charge Payable

(In respective currency)Service Charge CHF

CHF 25,000 and below

Waived

Above CHF 25,000

Waived

EUR

EUR 25,000 and below

Waived

Above EUR 25,000

Waived

Service charge will be calculated on daily basis and is subject to periodic revision based on market conditions.

Thank you for banking with us.

-

Revision of Fees for Business Growth Account from 1 November 2022

Dear Valued Corporate Customers,

With effect from 1 November 2022, there will be a revision to the monthly service charge for Business Growth Account as follows:

Business Growth Account Service Charge S$15 per month if monthly average balance falls below S$1,000 Thank you for banking with us.

-

Express Bulk Cash Deposit New Cut-off Time

Dear Express Bulk Cash Deposit Customers,

We are revising the daily cut-off time for the deliverance of security bags with effect from 15 August 2022.

Branches Current Cut-off Time New Cut-off Time - Ang Mo Kio Central

- Bedok

- Causeway Point

- Choa Chu Kang

- Clementi

- Compass One

- Harbourfront

- Hougang Mall

- ION Orchard

- Jurong East

- Jurong Point

- Marine Parade

- NEX

- Northpoint

- Orchardgateway

- Tampines

- Toa Payoh Central

- Waterway Point

6pm (Mon - Sun)

After 6pm, the cash will be counted and credited on the next working day.5pm (Mon - Sun)

After 5pm, the cash will be counted and credited on the next working day.- Bishan

- City Square Mall

- Holland Village

- Paya Lebar Square

- United Square

- White Sands

6pm (Mon - Sun)

After 6pm, the cash will be counted and credited on the next working day.5pm (Mon - Sun)

After 5pm, the cash will be counted and credited on the next working day.1.30pm (Sat)

After 1.30pm, the cash will be counted and credited on the next working day.No change - Bukit Batok

- Bukit Panjang

- North

- OCBC Centre

- Serangoon Garden

- Sixth Avenue

- Thomson

4pm (Mon - Sun)

After 4pm, the cash will be counted and credited on the next working day.No change 11.30am (Sat)

After 11.30am, the cash will be counted and credited on the next working day.No change We apologise for any inconvenience caused and appreciate your kind understanding.

-

Revision of Fees for Business Foreign Accounts from 1 August 2022

Dear Valued Corporate Customers,

With effect from 1 August 2022, there will be a revision to the monthly account fee and monthly service charge for Business Foreign Accounts – SGD Chequing Account and Multi-Currency Business Account as follows:

SGD Chequing Account Multi-Currency Business Account Monthly Account Fee S$50 per month per account.

Waived for first 2 months.US$50 per month per account.

Waived for first 2 months.Monthly Service Fee S$200 per month if monthly average falls below S$30,000.

Waived for first 2 monthUS$200 per month if monthly average balance falls below US$30,000.

Monthly average balance is determined based on aggregated balances across all currencies in one account.

Waived for first 2 months.Visit https://www.ocbc.com/business-banking/help-and-support/accounts-and-services/business-foreign-accounts-pricing-guide for more information.

Thank you for banking with us.

-

Service Fee for Cash Withdrawal at non-OCBC ATMs in Malaysia

With effect from 15 May 2022, there will be a change in service fee charged for cash withdrawal performed at non-OCBC ATMs in Malaysia. For cash withdrawals performed in Malaysia using OCBC Corporate ATM Card and Business Debit Card, below fees will apply:

At OCBC Malaysia ATMs Free At other Malaysia ATMs that accept:

VISA/Mastercard- Nominal 3% service charge on the S$ equivalent of the amount withdrawn (minimum S$5 and maximum S$20 per transaction)

- Administrative fee of 2.25% of the foreign currency transaction^

- Additional service fee, which may vary from bank to bank, may be imposed by the ATM bank

^Foreign currency transactions are converted to local currency based on the rate determined by the respective card associations. Cost incurred by the Bank due to this currency conversion, together with the administrative fee, will be debited to your account as part of the foreign currency transaction.

The change in service fee for cash withdrawal performed at non-OCBC ATMs in Malaysia is due to the discontinuation of MEPS-NETS service. More details on the discontinuation of the MEPS-NETS service are available at https://www.ocbc.com/personal-banking/help-and-support/atms/general#meps-discontinuation-wef15may22.

Thank you for banking with OCBC.

-

Implementation of Best Execution Policy from 3 March 2022

With effect from 3 March 2022, we will be implementing written policies and procedures in respect of our placement and/or execution of customers’ orders on the best available terms (commonly referred to as “Best Execution”). For more details, please refer to the “Best Execution Policy” document that will be made available on https://www.ocbc.com/group/policies.

-

Revisions to OCBC Business Account Terms and Conditions from 1 January 2022

Dear Valued Corporate Customer,

With effect from 1 January 2022, the OCBC Business Account Terms and Conditions will be amended.

The amendments can be found in the Singapore Product Addendum:

- New Clauses 11.14 to 11.16

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/business_account_terms_and_conditions.pdf from 1 December 2021.

Thank you for banking with us.

-

Revisions to OCBC Business Account Terms and Conditions from 8 November 2021

Dear Valued Corporate Customer,

With effect from 8 November 2021, there will be revisions to the OCBC Business Account Terms and Conditions.

The revisions can be found in the Singapore Product Addendum:

- New Clause 12

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/iwov-resources/sg/ocbc/business/pdf/business_account_terms_and_conditions.pdf from 8 November 2021.

Thank you for banking with us.

-

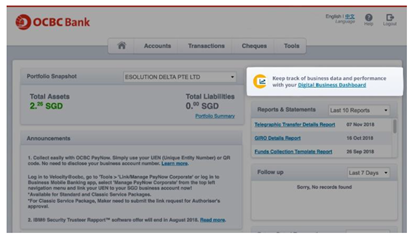

The Digital Business Dashboard will be discontinued on 29 November 2021

Digital Business Dashboard Frequently Asked Questions

If you have registered and been using the Digital Business Dashboard before 29th November 2021, please take note of the following.

GENERAL

1. What has changed?

The Digital Business Dashboard will no longer be available effective from 29th November 2021. Consequently, from 29th November 2021, you will no longer be able to access the Digital Business Dashboard through the display link from Velocity that is current found on the top right-hand corner as depicted below.

2. Is there any impact to my data that was previously reflected on the Digital Business Dashboard?

No. The Digital Business Dashboard is a dashboard that draws data from the online business applications provided by your relevant service providers that you already use and have.

Your respective metrics (Tiles) data from your respective online business applications will not be affected. You can still access the data from your respective applications.

3. What will happen to the other apps that I have purchased online previously?

The subscriptions for the other third party applications and services you may have connected or purchased through the Digital Business Dashboard will still be active and unaffected. You may still be able to login directly through the respective platforms and/or applications provided by the relevant third party service providers.

4. Is there any cost to me now that the Digital Business Dashboard is no longer available?

No. The Digital Business Dashboard was provided free of charge, and there is similarly no charge now that the dashboard is no longer available.

5. What happens to my data previously displayed on the Digital Business Dashboard?

The data that is generated, collected and/ or processed by the online business applications provided by the relevant third-party service providers (as made available through Digital Business Dashboard) will continue to be stored and processed by them, in accordance with their relevant terms and conditions and privacy policies. Please refer to them directly for more details.

Your banking data (including without limitation, data relating to your accounts and the services and/or products provided by OCBC to you) will only be retained on the Digital Business Dashboard for a limited duration to ensure a smooth transition before it is deleted and removed from the Digital Business Dashboard. Your banking data will continue to remain available in Velocity.

6. Do I need to terminate the connections from my existing apps to the business dashboard?

No. There is no action required on your end and you would still be able to access your respective online business applications from the platforms and/or applications provided by the relevant third party service providers.

-

Our Business Banking Desk at OCBC Centre Branch will only be available from Monday to Friday

With effect from 4 December 2021, our business banking desk at OCBC Centre branch is available from Monday to Friday, 9.00am to 4.30pm. We are closed on Saturday, Sunday and Public Holidays.

OCBC Centre Branch

65 Chulia Street #01-01

OCBC Centre

Singapore 049513Our business account opening service remains available online 24/7. Simply scan on the QR code or search for ‘OCBC Business Account’.

For other enquires, visit https://www.ocbc.com/business-banking or contact our Business Banking Service Managers at +65 6538 1111, from Monday to Friday, 8am to 8pm.

-

Revision of Service Fee from 1 October 2021

Dear Valued Corporate Customers,

Kindly note that we will be revising the Service Fee to Service Charge in our pricing guide.

In addition, the Service Charge for CHF, EUR and JPY Business Accounts will be computed based on daily balance instead of monthly average balance. There are no changes to existing threshold or interest rates.

Foreign Currency Business Accounts Service Charge Currency Daily balance Service charge payable

(in respective currency)CHF CHF 25,000 and below Waived Above CHF 25,000 2.5% p.a. for a daily balance* in excess of CHF 25,000 EUR EUR 25,000 and below Waived Above EUR 25,000 0.75% p.a. for a daily balance* in excess of EUR 25,000 JPY JPY 3,000,000 and below Waived Above JPY 3,000,000 0.5% p.a. for a daily balance* in excess of JPY 3,000,000 *Service charge will be calculated on daily basis, and is subject to periodic revision based on market conditions.

Thank you for banking with us.

-

Revision of Hardware token pricing from 1 October 2021

Dear Valued Corporate Customers,

With effect from 1 Oct 2021, the hardware token fee will be revised from $20 to $50. Customers are encouraged to switch to digital token (OCBC OneToken).

Please complete the Apply and Manage OCBC Velocity Form and submit it through one of these options

- Email: Use the email address linked to your OCBC Business Account to email us at bizupdate@ocbc.com

- Mail: The address can be found on the Form.

- Any OCBC Bank branch (except FRANK Stores and Premier Banking Centres)

-

Toa Payoh Central Business Banking Desk will be permanently closed from 1 June 2021

We wish to inform you that Toa Payoh Central Business Banking Desk will be permanently closed from 1 June 2021.

To open a new business account, simply apply online.

Our Business Banking Desk services are available at:

OCBC Centre Branch

65 Chulia Street #01-01

OCBC Centre

Singapore 049513Operating Hours

Mon-Fri: 9.00am to 4.30pm

Sat: 9.00am to 11.30am

Sundays and Public Holidays: ClosedPlease contact our Business Banking Service Managers at +65 6538 1111 if you have further queries. Our hotline is open from Mondays to Fridays, 8am to 8pm.

Thank you.

-

Revisions to OCBC Business Account Terms and Conditions from 1 June 2021

Dear Valued Corporate Customer,

With effect from 1 June 2021, there will be revisions to the OCBC Business Account Terms and Conditions.

The revisions can be found in the Singapore Local Addendum:

- New Clause 5.8

- New Clause 5.9

- New Clause 5.10

The revised version of the OCBC Business Account Terms and Conditions will be available on https://www.ocbc.com/business-banking/Forms.html from 1 June 2021.

Thank you for banking with us.

-

Revision of terms and conditions for trade finance applications with effect from 1 May 2021

Dear Valued Corporate Customer,

Effective 1 May 2021, we will be revising the terms and conditions for trade finance applications.

Please download the latest application forms with the revised terms and conditions from https://www.ocbc.com/business-banking/help-and-support/trade, starting 1 May 2021.

Do note that old application forms will no longer be accepted after 30 June 2021.

Please contact our Trade Finance service staff through the Trade Hotline at (65) 6318 7777 if you have further queries.

Thank you for banking with us. We look forward to your continued support.

-

Revisions to the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme (“The Programme”) with effect from 1 April 2021

Dear Valued Corporate Customers,

Effective 1 April 2021, there will be revisions to the Terms and Conditions Governing OCBC Business

Debit Card Rebates Programme (“The Programme”). The revisions are as follows:Under Clause 3: Other Conditions

Clause 3(d) will be revised to expand on the list of excluded transactions, along with their

Merchant Category Code and Description

The revised copy of the Terms and Conditions Governing OCBC Business Debit Card Rebates

Programme (“The Programme”) can be found at bit.ly/BDCApr21.

If you require more information, please contact our hotline at

Thank you for banking with OCBC. -

Free Business Deposit Card Issuance extended till 30 June 2022

Dear Corporate Customers,

We encourage you to transact digitally with OCBC, we will be extending our current promotion of free business deposit card issuance till 30 June 2022, e.g., waiving the card issuance fee for each business deposit card issued.

Business Deposit Card

Description Card Issuance/Replacement Charges Card Issuance S$5 per card (Promotion extended: Free for application before 30 June 2022) Replacement of card due to lost/stolen/ damaged card S$5 per card Benefits of using Business Deposit Card:

- Skip the branch queues. Deposit cash anytime at an OCBC ATM

- No personal identification number (PIN) required

- No account balance displayed

- No need to memorise account number

To apply, kindly visit https://www.ocbc.com/business-banking/smes/transactions/business-deposit-card

Thank you for banking with us.

-

Revision of Outward Remittance Telegraphic Transfer Cable Charge for Branch with effect from 1 June 2021

Dear Valued Corporate Customers,

With effect from 1 June 2021, the branch cable charge fee for Outward Remittance Telegraphic Transfer will be revised as follows:

Outward Remittances

Telegraphic Transfer Account Holder Cable Charge OCBC Velocity

(Business Internet Banking)Branch All Accounts Flat fee of S$25 Flat fee of S$35 Customers are encouraged to login to OCBC Velocity account to make Telegraphic Transfer transaction.

Please feel free to approach any of our branch staff if you need further assistance on this matter. Alternatively, you can contact our Business Banking Commercial Service Centre at +65 6538 1111.

Thank you for banking with us.

-

Revisions to the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme with effect from 1 April 2021

Dear Valued Corporate Customers,

Effective 1 April 2021, there will be revisions to the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme (“The Programme”). The revisions are as follows:

Under Clause 3: Other Conditions

Clause 3(d) will be revised to expand on the list of excluded transactions, along with their Merchant Category Code and Description

The revised copy of the Terms and Conditions Governing OCBC Business Debit Card Rebates Programme (“The Programme”) can be found at bit.ly/BDCApr21.