Understanding invoice financing (purchase) for SMEs

Understanding invoice financing (purchase) for SMEs

There is a tension that exists between every business and their suppliers. Suppliers want to get paid as fast as possible to shorten their working capital cycle and improve cash flow. But the business will prefer to stretch the payment terms instead, for the very same reason. This can cause disputes and strain relationships, neither of which are beneficial for either party.

Invoice financing provides a solution to this ever-present dilemma. On the suppliers’ side, they can use invoice financing (sales) to leverage on the unpaid invoices to their buyers and receive an immediate cash advance from the bank. This is something we have extensively discussed in our other article.

Businesses can also use invoice financing to support their purchases. Using invoice financing (purchase), they can pay their suppliers on time while deferring the payment dates till later. This creates a “win-win” scenario for both parties, making it a common practice used by many businesses, from SMEs to large multinational corporations.

To show you how invoice financing (purchase) can benefit both parties, let us specify what invoice financing (purchase) is, and how it differs from invoice financing (sales).

Understanding invoice financing (purchase versus sales)

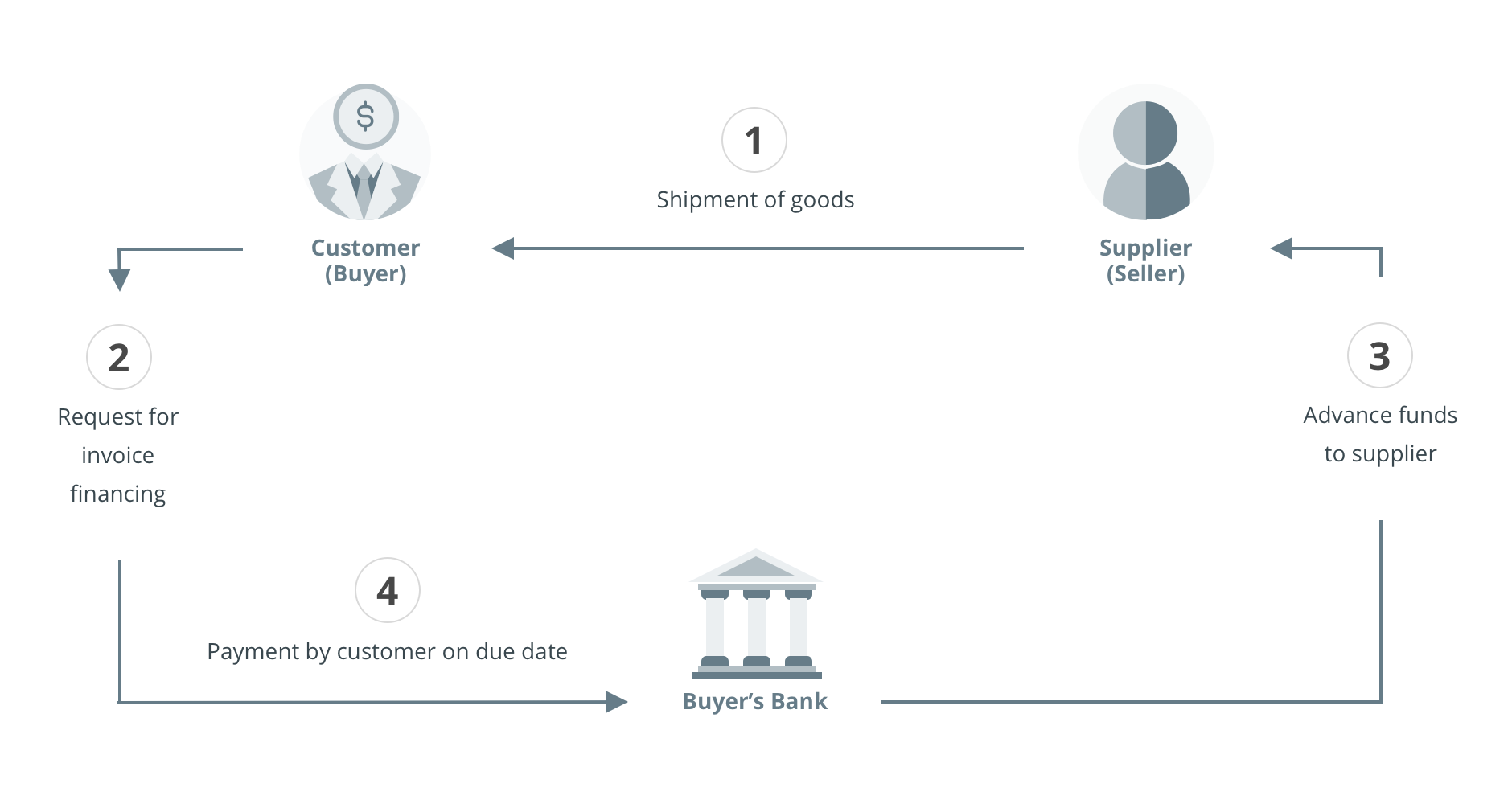

In an invoice financing (purchase) transaction, the buyer obtains financing from the bank for their purchases. The bank then directly remits the relevant purchase amounts to the respective suppliers. At a later date, the buyer then pays the financing amount, plus a fee, to the bank. Note that suppliers can either be providers of goods or (in select cases) services too.

On the other hand, with invoice financing (sales), the suppliers will have to pay a fee to get a cash advance on their unpaid invoices before the invoice due date. Beyond the core transaction structure, other differences to note are:

- Financing amount

In invoice financing (sales), the financing amount is usually between 70% to 90% of the invoice value. In invoice financing (purchase), the standard is 100% of the invoice value. However, do note that these are just general standards, and each transaction will be assessed on a case-by-case basis. - Maturity date

In invoice financing (sales), the amount must generally be repaid by the actual invoice due date. In invoice financing (purchase), the repayment date will typically be later than the invoice due date, although the specific date will vary depending on the buyers’ preferences and their credit standing.

The motives are also different. In invoice financing (sales), it is clear as to why a supplier would want to receive a cash advance ahead of the invoice due date. But why would a buyer be willing to bear an additional cost so their suppliers can get paid faster?

7 reasons why buyers use invoice financing (purchase)

Although it may not be immediately obvious, there are many reasons why buyers willingly pay a financing cost for a facility that does not appear to benefit them. The six main reasons are:

- Improve days payable outstanding (DPO)

Invoice financing (purchase) allows companies to essentially defer settling their payables past the actual invoice due date. Even with financing cost, the cost reductions in their procurement-to-payment cycle may more than offset it. - Better cash flow control

Businesses can apply for differing maturity dates, and thus decide how they want to stagger their payments instead of being dictated by their suppliers’ payment terms. The result is better control over their cash flow. - Strengthened relationships with suppliers

By paying their suppliers in a timely manner, companies can strengthen their relationships with suppliers and make doing business with them a much smoother experience. - Potential discounts

In return for paying their suppliers quicker, companies may sometimes negotiate early settlement discounts with their suppliers. While this varies from case to case, it is possible for such discounts to offset the financing cost. - The financing amount scales along with the business

As your business grows, so will the size of your purchases. Even so, you can still scale the amount of invoice financing you receive. No matter the size of your business, you will be able to reap all the benefits of invoice financing. - Supply chain risk mitigation

Like the size of your purchases, your supply chain might also get longer and more complex as your business grows. This opens you up to greater supply chain risk. For example, if your suppliers run out of working capital, the entire production process can get affected.

If these are smaller suppliers, they may not be able to qualify for invoice financing (sales), but may still wish to extend their payment cycles as much as possible. In this scenario, invoice financing (purchase) gives you a way to achieve both objectives simultaneously. - Being able to confidently purchase from bigger suppliers

When purchasing from large and established suppliers, the payment terms are usually fixed. If you own a smaller business, you will also not likely have any leverage to negotiate. Invoice financing (purchase) thus allows you to confidently meet big suppliers’ payment terms while still retaining more working capital for your own needs.

As you can see, in many cases, the benefits to the buyer can far outweigh the cost of invoice financing. However, there are also a few limitations to bear in mind.

Limitations and risks of invoice financing (purchase)

There are risks and limitations in every type of financing, and invoice financing (purchase) is no different. Here are 2 main ones to be aware of.

- Limit is dependent on the buyer’s credit standing

Much like a traditional loan, the ability to service the invoice financing (purchase) is on the applicants. This means the amount of invoice financing (purchase) you can access will be limited by your own credit standing. - You must closely monitor your overall borrowings to avoid being overleveraged

Invoice financing (purchase) still shows up on the balance sheet as debt. Hence, a business that is overly reliant on using invoice financing to pay its suppliers may find it harder to obtain additional financing.

The fact is that, in invoice financing (purchase), buyers are incurring financing costs to pay their suppliers quicker. While as we have seen that there are tangible benefits in doing so, these benefits may not necessarily outweigh the costs. This is a judgement each company must make for themselves as it will be dependent on their own unique circumstances.

The good news is, now that you are aware of all the benefits and risks ahead, you are in a position to make much better judgement calls as to whether invoice financing (purchase) would provide a net benefit. If you have decided that it is indeed a net benefit for your business, here is how you can obtain one.

Invoice financing (purchase) application process

A key advantage of invoice financing (purchase) is quick access to capital for purchases. As such, the application process should also be quick and easy. Here is how you can apply for invoice financing (purchase) with OCBC:

- Get in touch with us to discuss your trade financing needs and apply for a credit facility by filling up an application form.

- Upon successfully applying for a credit facility, submit your invoices and supporting documents online via OCBC Velocity.

- Upon a successful drawdown, your funds will be credited into your account within 5 working days and you’ll receive an instant notification.

- Repay the financing amount on the maturity date.

Disclaimer

You may be directed to third party websites. OCBC Bank shall not be liable for any loss suffered or incurred by any party for accessing such third party websites or in relation to any product and/or service provided by any provider under such third party websites.

The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about: