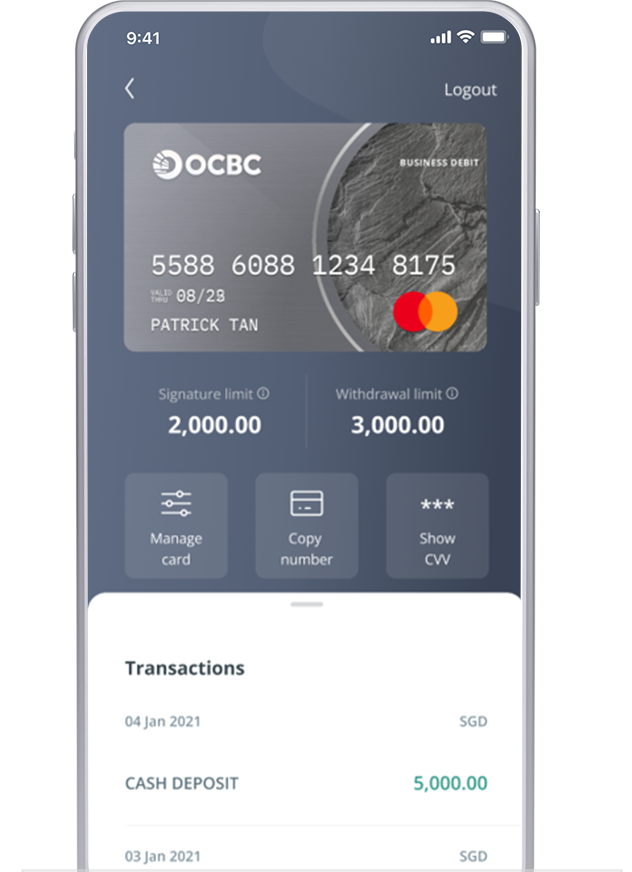

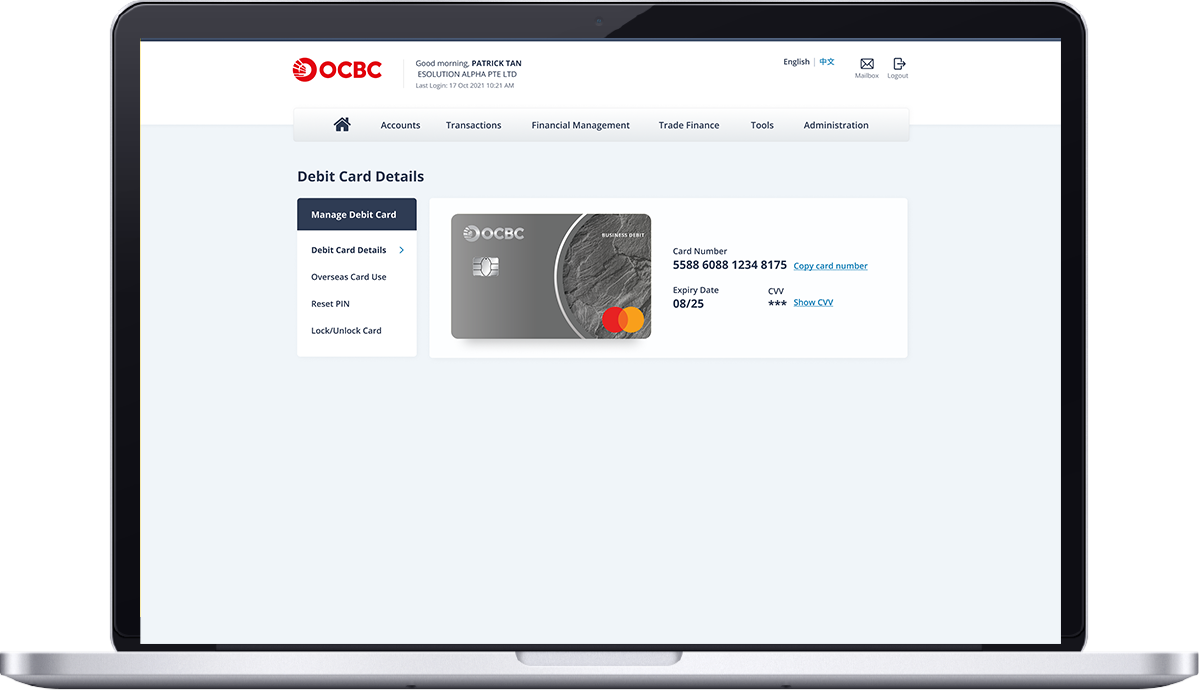

A digital card is the debit or credit card that you can easily access from the OCBC Business Mobile App or OCBC Velocity after the approval of your application.

The digital card will have the same card number and expiry date as the physical card that you will receive. The only difference between the digital card and physical card is that of the CVV.

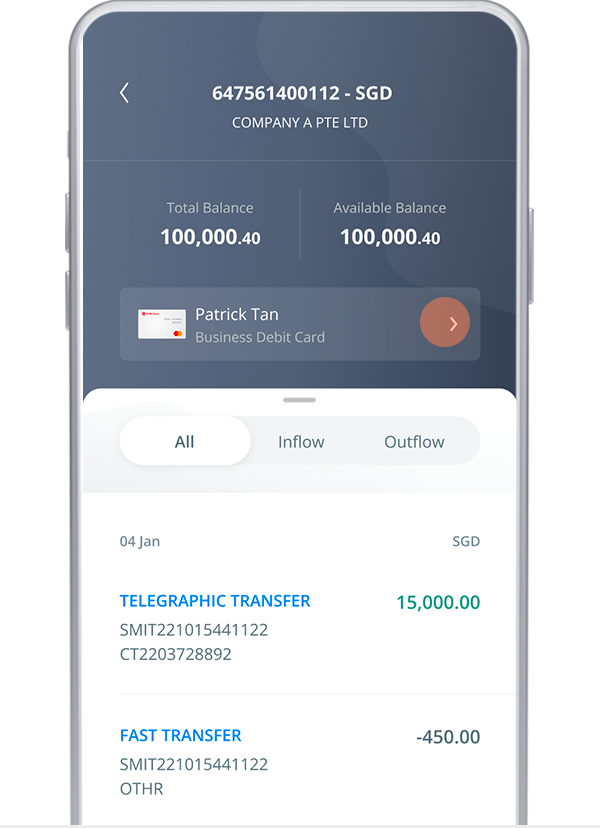

Follow this guide to learn how to access your digital debit card details and start using it. Please ensure that your OCBC Business Mobile App is updated.