How PinkPharm keeps its cash flow and customers in the pink of health

How PinkPharm keeps its cash flow and customers in the pink of health

It’s no secret that Singapore has a rapidly ageing population. By 2030, the old age support ratio will be 2.7 – which means that one in four Singaporeans will be over 65 years of age. This ratio is not just limited to economic support, but also points to more caregivers for their elderly loved ones.

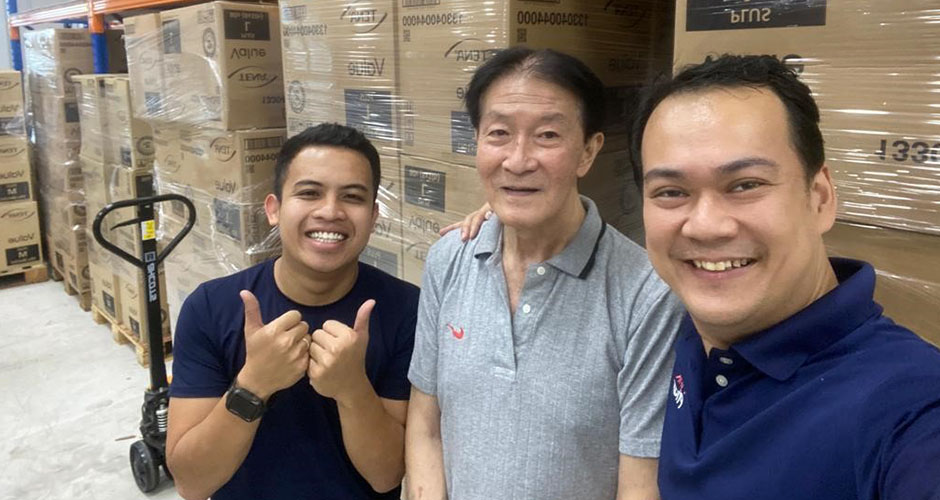

As a caregiver for several family members, Kenny Lo was often left frustrated that he “couldn’t get quality products at reasonable prices and on time”. This served as an inspiration for him to build PinkPharm.com, an online healthcare marketplace, in 2013 offering quality products that are necessary for every stage of care and general well-being.

OCBC works closely with PinkPharm for its banking and financial needs. We took the opportunity to chat with co-founder Kenny about his business and expansion plans.

You didn’t have a background in healthcare. How did you even get the business off the ground?

I started my career in audit and moved on to be a commercial banking manager. Subsequently, I ventured into reclamation projects – another totally different field.

It was then that I started taking care of my mom and other family members. It was taxing being a caregiver and my work hours were long. Therefore, I wanted to find an angle to try to help other caregivers in a similar position and be able to make purchases quickly and conveniently.

We started PinkPharm in 2013 as an e-commerce platform for consumers to conveniently purchase healthcare products on mobile or via our online store. We had to lobby the major brands to allow us to retail their products online. At first, they were skeptical because there were no online-only distributors back then.

We got our break when a leading Swedish incontinence care brand and the world’s largest adult nutrition healthcare company agreed to trial us. We started from there and have kept growing, with the addition of new products across new verticals including wound care, vitamins and glucometers.

More recently, we have also ventured into growing the business abroad as we believe ageing is an international issue and we can replicate the successful business model that we have built over the years. Together with our principals, we partner with government organisations to develop frameworks to ensure caregivers and patients have easy access to these medical supplies.

At the same time, we are passionate about helping the less fortunate in our society. This has also shaped the PinkPharm philosophy – a commitment to making an impact on the lives of those around us, not just providing care.

PinkPharm is an online marketplace. It feels like your competition is against the biggest e-commerce names in the world. How do you stand out?

Being key distributors of brands, we did not want to lose out on the opportunities these e-commerce platforms provided. Marketplaces such as Shopee, Lazada and Amazon complemented our business model and our presence led us to be the Top 3 Senior Care Category Suppliers.

Moreover, we are building a marketplace for products in a healthcare niche. Besides mainstream products like diapers and milk, we also carry wound dressings, feeding tubes, insulin syringes and other medical-based tools. Hence, it is more important for us to build and gain our customers’ trust, as compared to other online marketplaces.

Today, we have a base of about 40,000 customers comprising caregivers, patients, nurses and doctors. It is a very targeted base of buyers.

It’s really a new normal in the business environment today. Rising geopolitical tensions, interest rates going up, inflation spiking, supply chains getting disrupted. How are you reacting to all these uncertainties?

COVID-19 boosted our business. Initially, people did not want to go out, so they kept buying online – and coming to us. The main challenge was having sufficient stock as the hospitals and medical institutions had increased demands, and shipments into Singapore slowed due to logistical delays abroad. COVID-19 test kits, sanitisers, nasal sprays and masks were also flying off the shelves.

We had to increase inventory levels in our warehouses to avoid supply disruptions and ramp up our workforce across all departments to cope. With the large increase in purchases, we had to enlist OCBC to aid with financing options and this enabled us to fulfill the demands.

Inflation has been on an upward trend over the past year and this has affected many patients’ ability to cope with the higher healthcare spend. Also, with higher costs of running the business due to increased fuel prices and COE, we had to think of ways to manage. Two of which are to allow for self-pickups and zoning of deliveries. This allowed us to stay competitive and keep our patients happy.

It’s often said that cash flow is more important than profitability, especially in the short run. How do you manage your everyday cash flow, while ensuring that your long-term profitability does not suffer?

Cash flow is king for all businesses and good management of it will enable us to grab opportunities as they arise. This is where OCBC has helped greatly with financing. One instance was when PinkPharm was given the opportunity to supply a large number of low-income families, which required increased stock purchases. OCBC’s support has allowed us to reach even more needy families over time and gives great meaning to our PinkPharm outreach initiatives.

We are also launching new verticals, like OTC medicine, specialised children’s nutrition, probiotics and medical devices that will grow our business and improve our services for customers. Certain new verticals, especially for medical devices, require licensing audits and inventory control systems. This can add a heavy commitment cost of S$30,000 to S$50,000.

Having a short-term financing facility with OCBC will allow us to tap these opportunities to grow our business, while our daily cash needs remain unaffected.

Tap short-term financing to finance new business expansion initiatives

You always want to have a strong cash flow to seize expansion opportunities when they come along. Like PinkPharm, this could come in the form of purchasing fast-moving product lines or embarking on longer-term projects such as building up your overseas offices or growing your B2G business.

Today, PinkPharm’s B2G arm contributes 30% of their revenue stream. Apart from the initial funding to kickstart this part of the business, it also requires an active short-term financing facility to keep their cash flow healthy as the business grows.

Every business has a unique story, and unique challenges to meet. The OCBC team will work to understand your needs, so we can provide solutions that make sense for your business. OCBC Short-term Financing is one such solution, enabling a growing business, like PinkPharm, to tap on both short-term opportunities like cash purchases for COVID-19 test kits and introducing new products, as well as long-term plans for growing their B2B business from scratch and overseas expansion.

Disclaimer

You may be directed to third-party websites. OCBC Bank shall not be liable for any loss suffered or incurred by any party for accessing such third-party websites or in relation to any product and/or service provided by any provider under such third-party websites.

Any opinions or views of third parties expressed in this article are those of the third parties identified, and not those of OCBC Bank. The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors.

No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about: