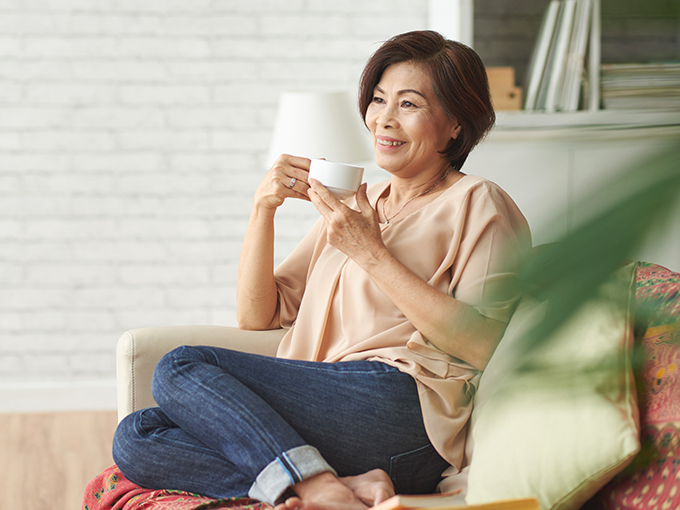

What memories will you create at 55 and beyond?

Turning 55 is an important milestone. Start planning for your next chapter with OCBC Silver Years.

Retirement can be the start of an exciting chapter. Whether you plan to travel, start a new hobby or fulfil a long-held dream, it is important that you are financially prepared for the lifestyle you wish to lead.

As you turn 55 and take the first steps towards retirement, we can offer the right solutions to protect and grow your retirement funds, so you can make the most of your Silver Years.

Note: The data above is from OCBC Financial Wellness Index. Read more at https://www.ocbc.com/simplyspoton/financial-wellness-index.html.

Are you prepared to cope with the rising cost of living? At the age of 65, you will begin to receive monthly CPF LIFE payouts. But with inflation and rising standards of living in Singapore, this amount might only be sufficient to fulfil your basic needs.

To sustain your desired retirement lifestyle, it is important for you to consider other wealth solutions that can supplement your CPF savings.

How have prices risen over the years?

Note: The data above is adapted from https://blog.seedly.sg/20-price-differences-in-singapore-between-1990s-vs-2010s/ and PUB data from 1990 and 2017. The projected prices in 2030 are calculated based on the assumption of an annual inflation rate of 3%.

Are you prepared to cope with the rising cost of living? At the age of 65, you will begin to receive monthly CPF LIFE payouts. But with inflation and rising standards of living in Singapore, this amount might only be sufficient to fulfil your basic needs.

To sustain your desired retirement lifestyle, it is important for you to consider other wealth solutions that can supplement your CPF savings.

How have prices risen over the years?

Coffee

year 2030

year 2030

- 1990 - S$0.40

- 2010 - S$1.10

- 2030 - S$1.99

year 2030

- 1990 - S$0.40

- 2010 - S$1.10

- 2030 - S$1.99

Fishball Noodle

year 2030

year 2030

- 1990 - S$2.00

- 2010 - S$4.50

- 2030 - S$8.13

year 2030

- 1990 - S$2.00

- 2010 - S$4.50

- 2030 - S$8.13

Water Prices

per cubic metre

year 2030

- 1990 - S$0.75 / cubic metre

- 2010 - S$2.10 / cubic metre

- 2030 - S$3.79 / cubic metre

year 2030

- 1990 - S$0.75 / cubic metre

- 2010 - S$2.10 / cubic metre

- 2030 - S$3.79 / cubic metre

Note: The data above is adapted from https://blog.seedly.sg/20-price-differences-in-singapore-between-1990s-vs-2010s/ and PUB data from 1990 and 2017. The projected prices in 2030 are calculated based on the assumption of an annual inflation rate of 3%.

At age 55, a Retirement Account will be created for you. You can choose from three levels of retirement sums to set aside in your account: Basic, Full and Enhanced. This will determine the level of monthly payouts you will receive from the age of 65.

Guide to CPF LIFE payouts based on retirement sum

|

|

Build the right retirement plan for your lifestyle. At OCBC Bank, we are here to help you transition seamlessly into your Silver Years with our holistic approach to retirement planning.

or contact us at +65 6722 2293

Operating hours are from 9am to 6pm, Monday to Friday (Excluding public holidays)