OCBC Education Loan

Power your ambitions wherever you choose to study

Unlock a world of endless learning opportunities, no matter where your aspirations take you.

Low interest rate

Enjoy an interest rate from just 4.5% per annum (EIR of 5.17% per annum1) with a one-time processing fee of 2.5% of your approved loan amount.

Enjoy an interest rate from just 4.5% per annum (EIR of 5.17% per annum1) with a one-time processing fee of 2.5% of your approved loan amount.

Up to 10 times your monthly income

Borrow up to 10 times your monthly income or S$150,000, whichever is lower.

Borrow up to 10 times your monthly income or S$150,000, whichever is lower.

Flexible repayment options

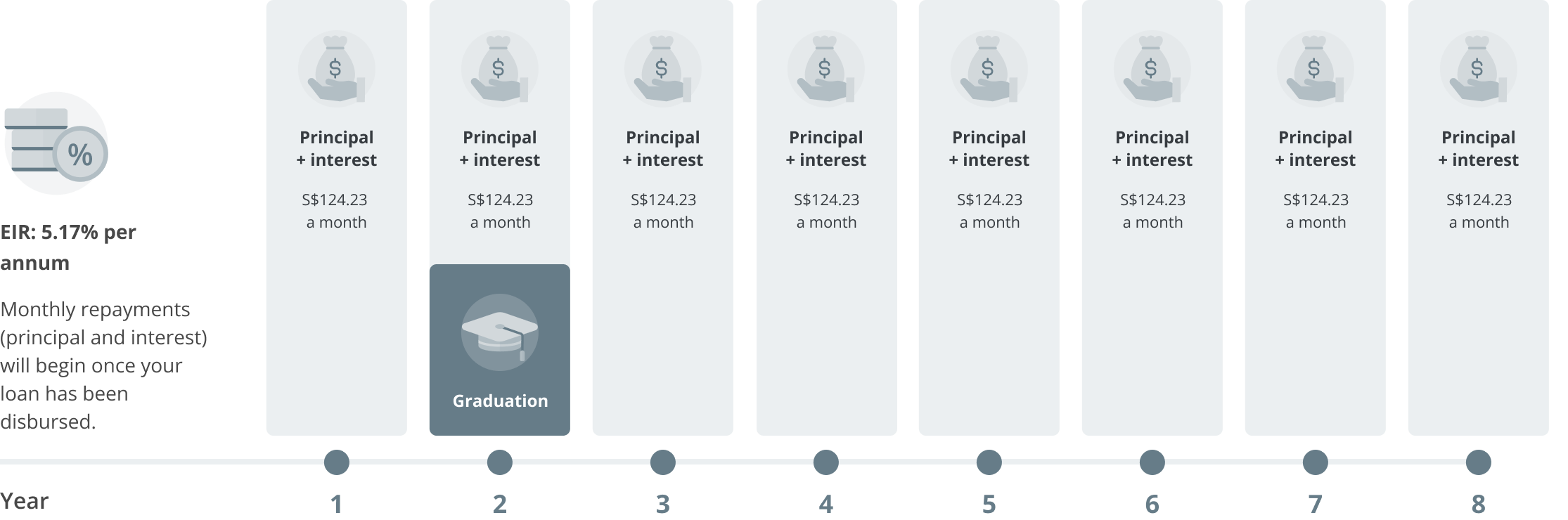

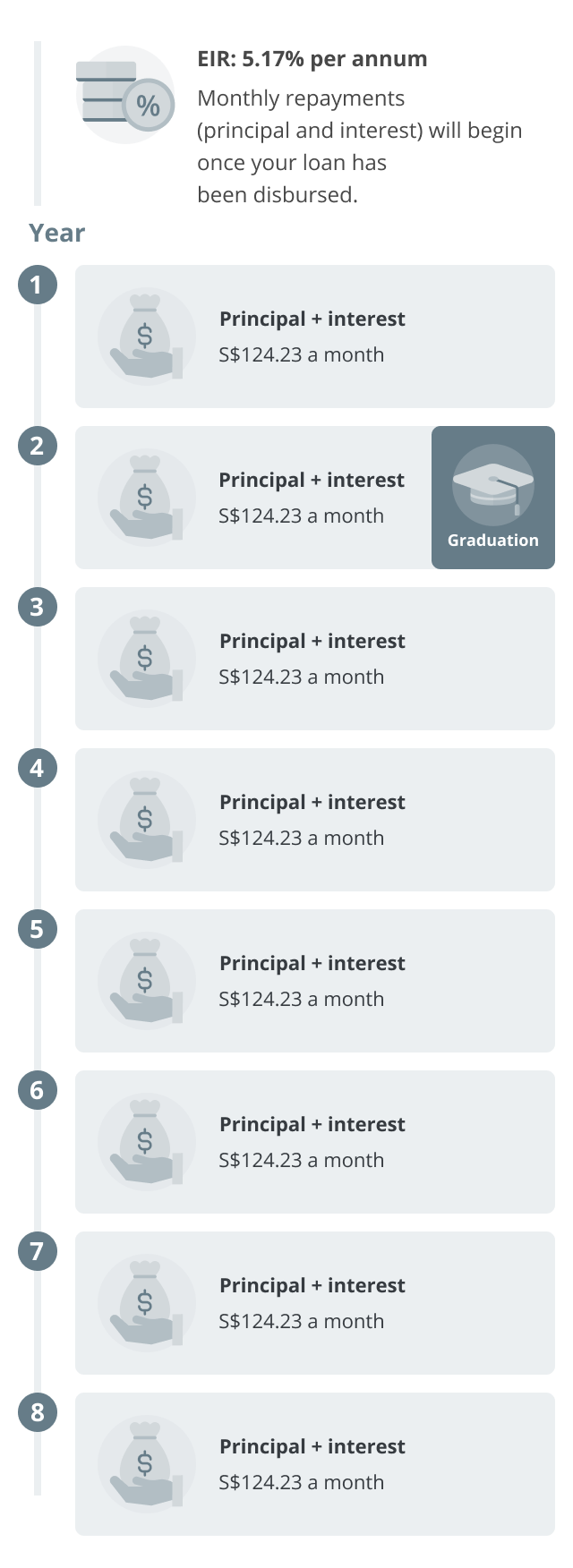

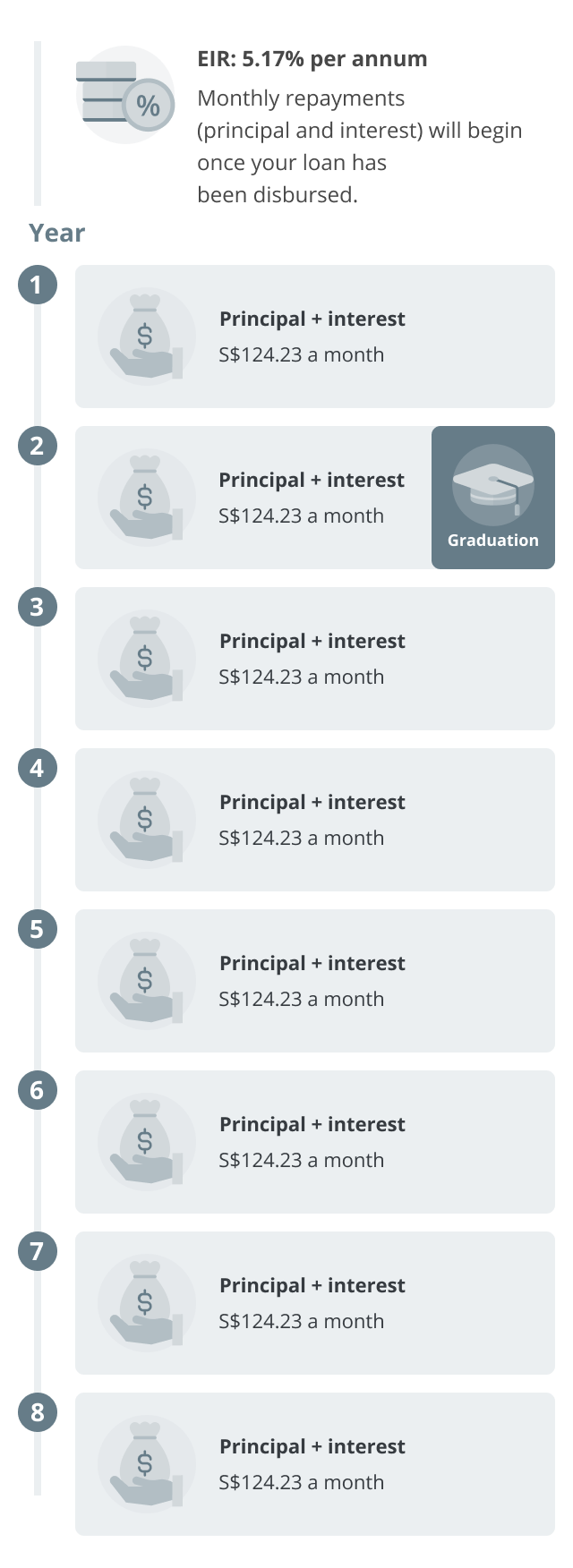

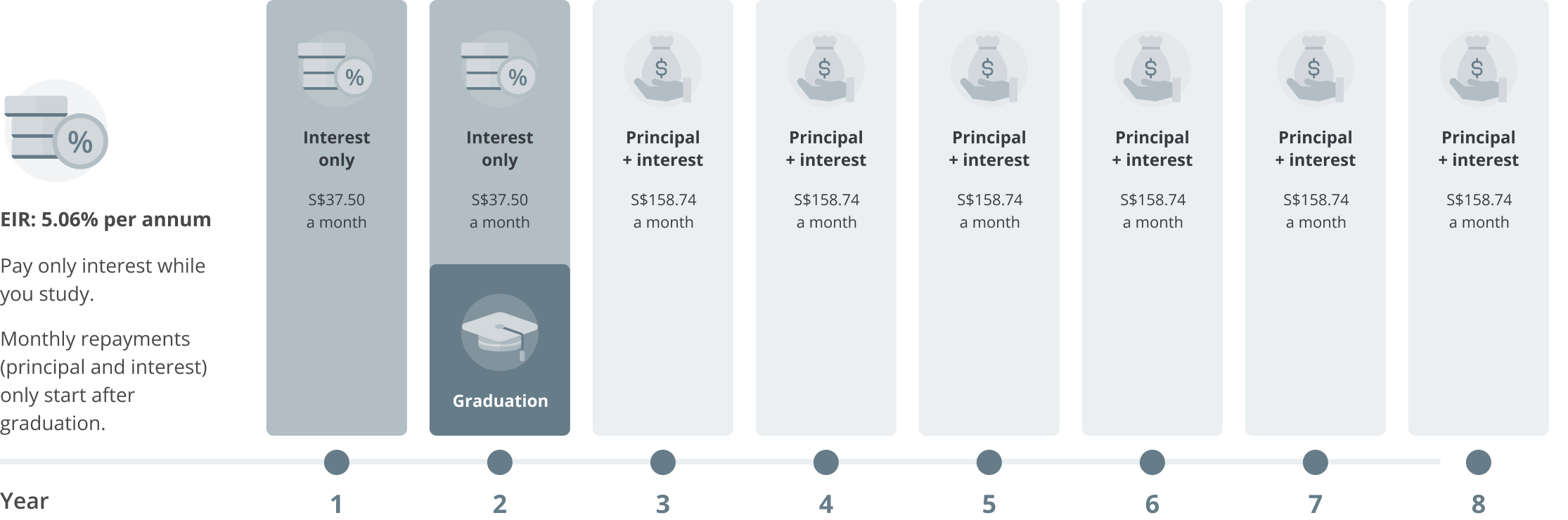

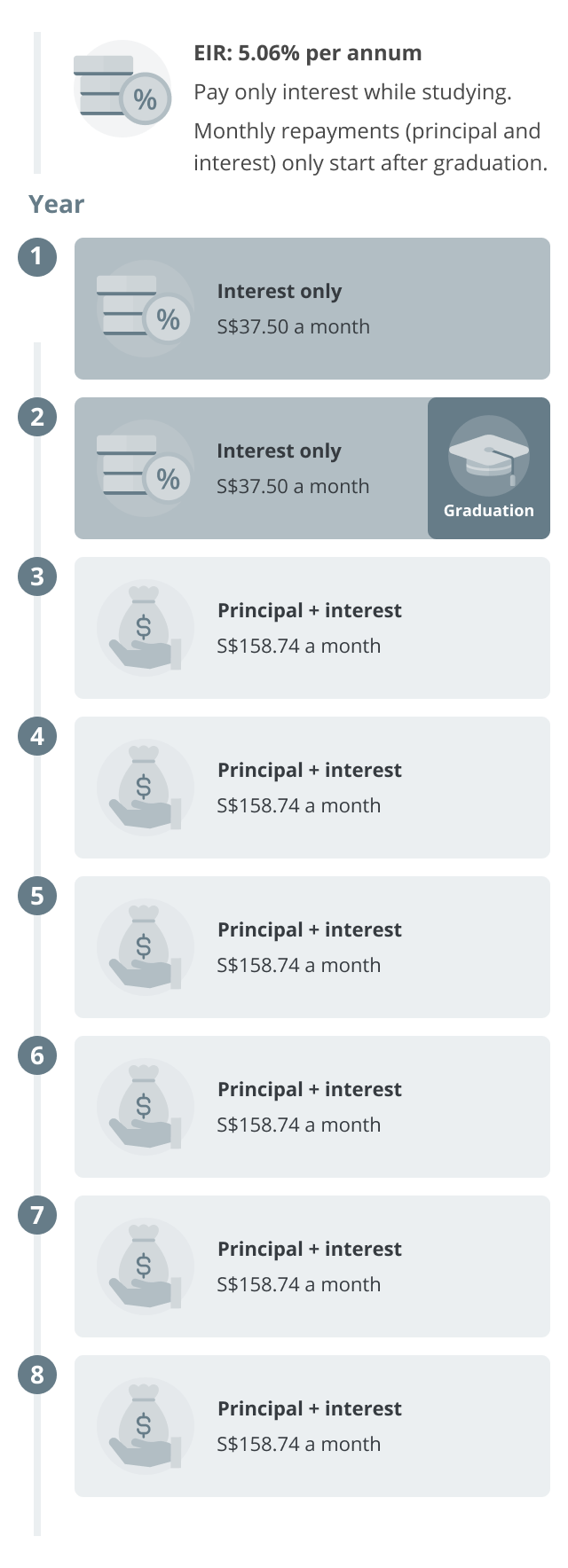

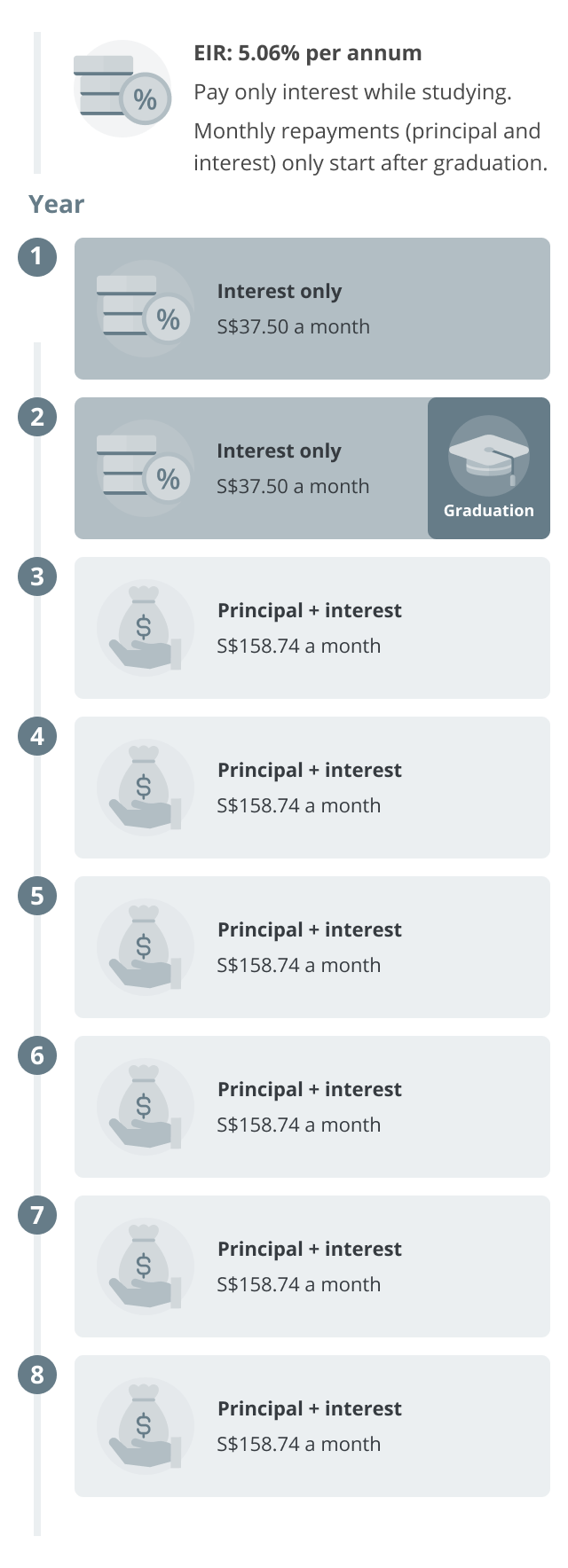

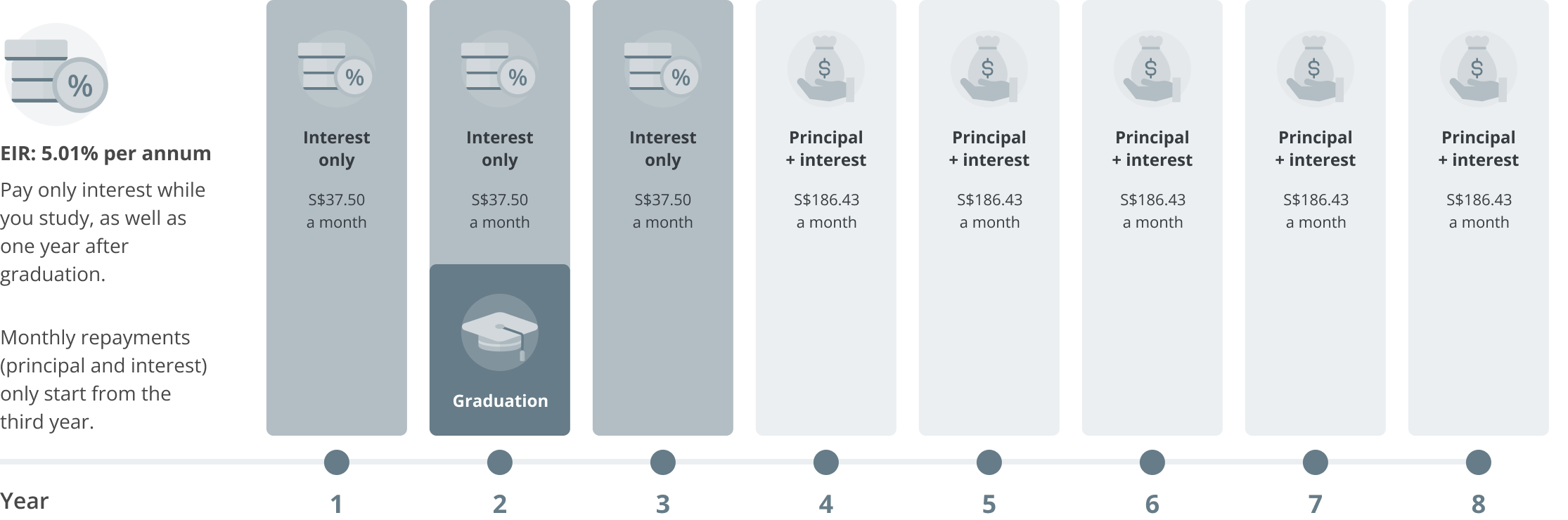

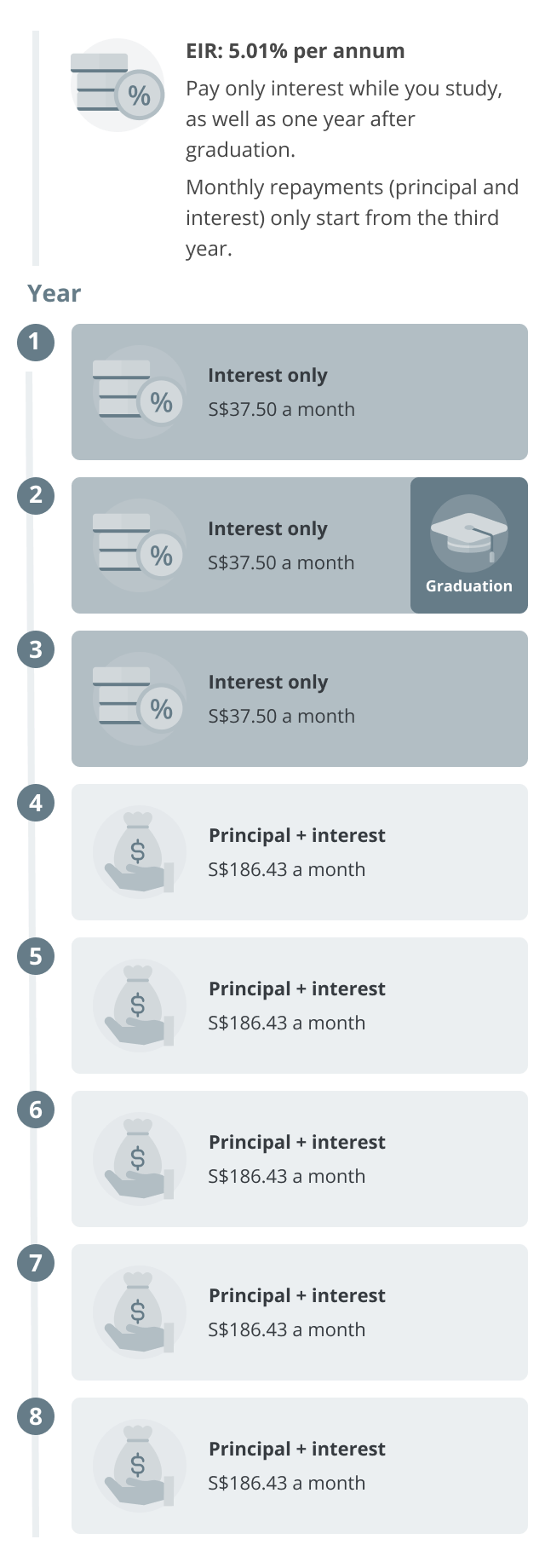

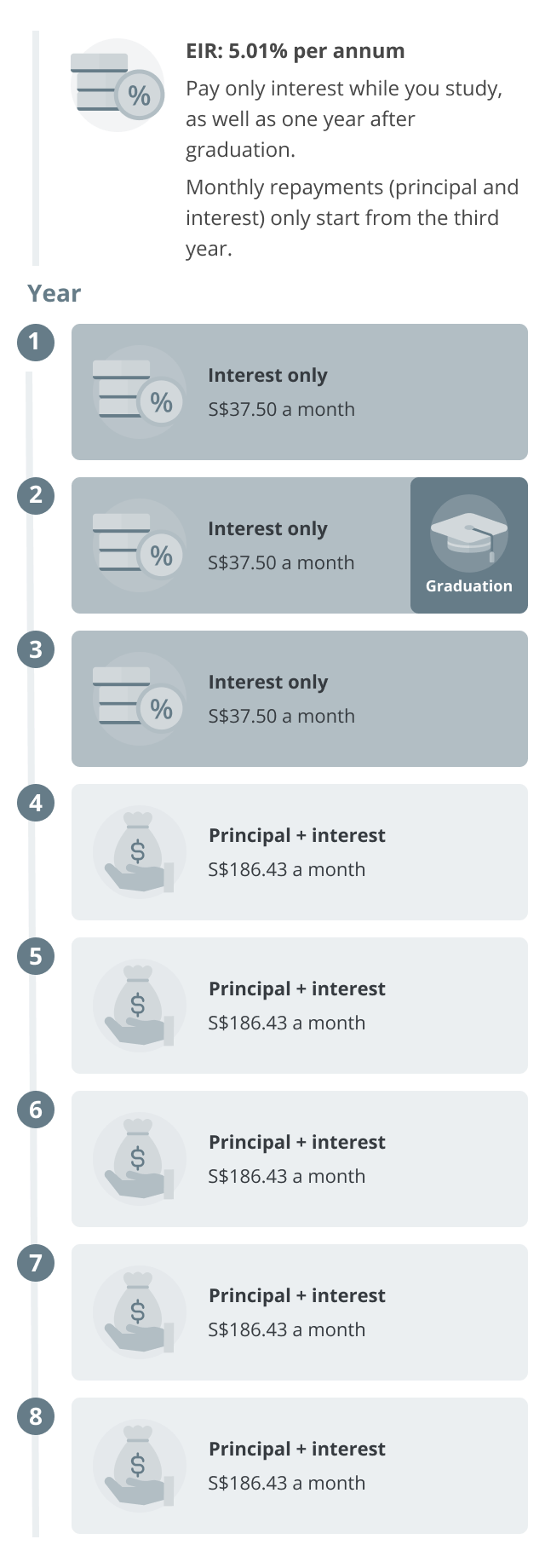

Choose a loan tenor of up to 8 years and select any of our three repayment options that best suits your needs.

Choose a loan tenor of up to 8 years and select any of our three repayment options that best suits your needs.

1 The Effective Interest Rate (EIR) has been calculated based on a 2-year course of study, a repayment period of 8 years and the Standard Repayment Method (shown below). The EIR includes an interest rate of 4.5% per annum – calculated on a monthly rest basis – and a processing fee of 2.5% of the approved loan amount.

Repayments have been calculated based on these assumptions:

A S$10,000 course of study that lasts 24 months

An 8-year repayment period

An interest rate of 4.5% per annum

For the Graduated and Graduated Plus repayment options, the loan tenor includes the period of study.

The Effective Interest Rate (EIR) includes an interest rate of 4.5% per annum – calculated on a monthly rest basis – and a processing fee of 2.5% of the approved loan amount. The EIR will vary depending on your loan amount and tenor. For the Graduated and Graduated Plus Repayment Methods, we have assumed a 24-month course of study.

Age requirements

For main borrower

Singaporean or Singapore PR aged 17 years old and above

For joint borrower (if any)

Singaporean or Singapore PR aged 21 years old and above. He/she cannot be older than 65 years old when the loan matures

A joint borrower is required if:

- The main borrower is below 21 years old; or

- The main borrower intends to study overseas.

Income requirement

A combined income of at least S$24,000 per annum

For example:

- The main borrower has no income but the joint borrower earns S$24,000 per annum; or

- The main and joint borrowers both earn S$12,000 per annum.

Documents required

For main borrower and any joint borrower

The original copy of a telephone bill or bank statement dated within the last 3 months

A copy of the acceptance letter from your school, stating your course type and period of study

A copy of the payment schedule for your course, if it is not stated in your acceptance letter

For salaried employees

If you do not credit your salary to an OCBC account, please submit the following documents as well:

Option 1

- Your latest CPF statement showing your contribution history for at least the last 3 months; and

- Your latest Notice of Assessment.

Option 2

- A digital copy of your latest payslip; and

-

One of these documents:

- Your latest bank statement showing your employer’s name

- Your latest CPF statement showing your contribution history for at least the last 3 months

- Your latest Notice of Assessment

Terms and conditions

Take the next step towards achieving your academic goals with OCBC Education Loan

and submit it with your joint borrower, if any, at an OCBC branch.