Balance Transfer

Get instant cash at 0% interest1

1The 0% interest rate will cease to apply after the repayment period (tenor) indicated in your Balance Transfer application, or upon full repayment of the loan amount, whichever is earlier. The interest rate will then return to the prevailing one (or another preferential rate, if applicable). The one-time processing fee will be charged to your EasiCredit/credit card account.

2We will review your application – and assess whether we can provide instant approval – based on the Terms and Conditions and in our sole discretion.

Enjoy the flexibility of paying a higher or lower amount each month.

Example: You have an outstanding amount of $7,000 over a 12-month period with Bank X.

Bank X

Your outstanding amount with Bank X

$7,000

Your credit card interest rate

26% per annum

What you need to pay Bank X

$1,820

OCBC Bank

Your outstanding amount with OCBC

$7,000

Your interest rate with Balance Transfer

0%

One-time processing fee

4.5%

What you need to pay OCBC

$315

You saved 82% on interest charges!

Apply for a Balance Transfer via the OCBC app for instant approval2 and cash. Enjoy personalised rates with zero interest1 (EIR from 3.98% p.a.) in a few simple steps.

Enter the amount you wish to borrow and choose a loan tenor to see the fees and charges that will apply.

The interest rate and processing fee eventually offered to you will depend on your personal credit profile; they may differ from the rates shown here and from rates we offer to other borrowers.

Your preferred loan amount and tenor

Total repayment amount

$0

Loan amount

$0

One-time processing fee (0% of approved amount)#

$0

0% interest p.a.#

$0

Total repayment amount*

(EIR: 0% p.a.)

*Actual amount may differ from what is shown during your application.

Monthly repayment amounts

Month 1

You have a total repayment amount of $0, to be paid over months.

Month 0

You will need to pay at least $0 in the first month.

In subsequent months, you will need to pay 3% of your outstanding balance or $50 (whichever is higher).

After your loan tenor ends, the interest rate will return to the prevailing rate for your OCBC credit card or EasiCredit account.

Month 1

Month 0

#The interest rate and processing fee offered to you is based on your personal credit profile. Please note that it may differ from the published rate and rate offered to other borrowers.

Loan amount:

- Interest Rate (per annum)

- Nominal interest rate

- Effective Interest Rate (EIR)

- Effective Interest Rate

| Period (months) | 3 months | 6 months | 12 months | |

| One-time processing fee | 1.80% $18 |

2.50% $25 |

4.50% $45 |

|

| Nominal interest rate | 0% per annum | |||

| Effective Interest Rate (EIR) | 7.38% per annum | 5.34% per annum | 5.20% per annum | |

| Repayment period |

| One-time processing fee |

| Nominal interest rate |

| Effective Interest Rate (EIR) |

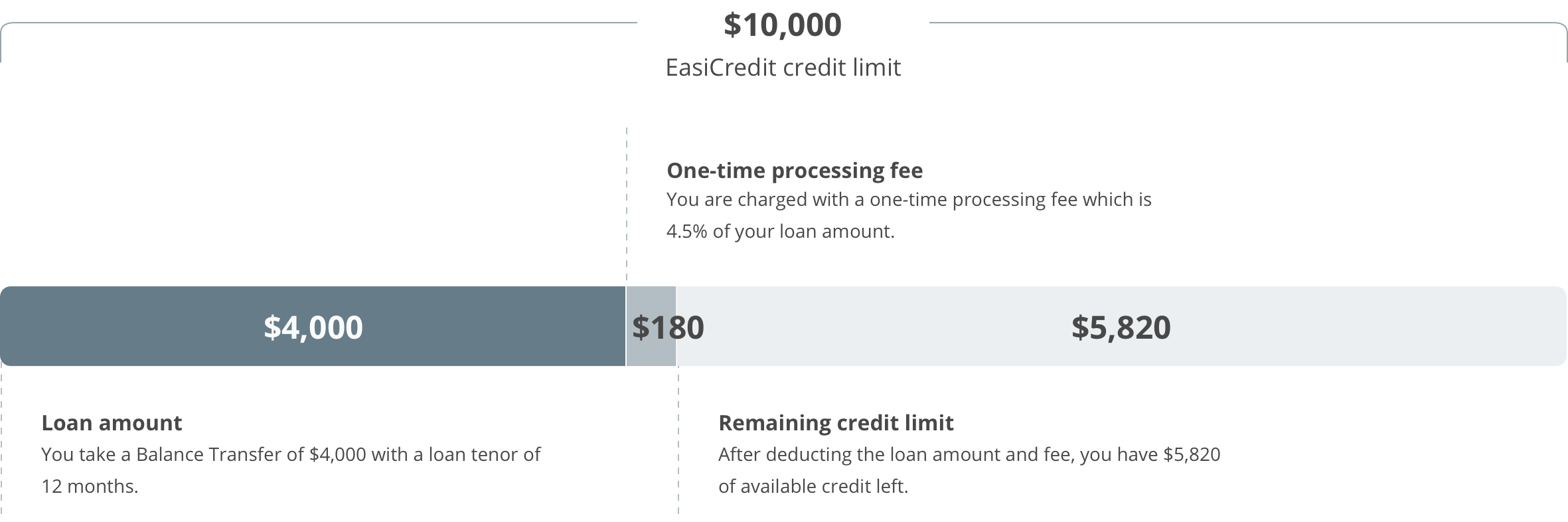

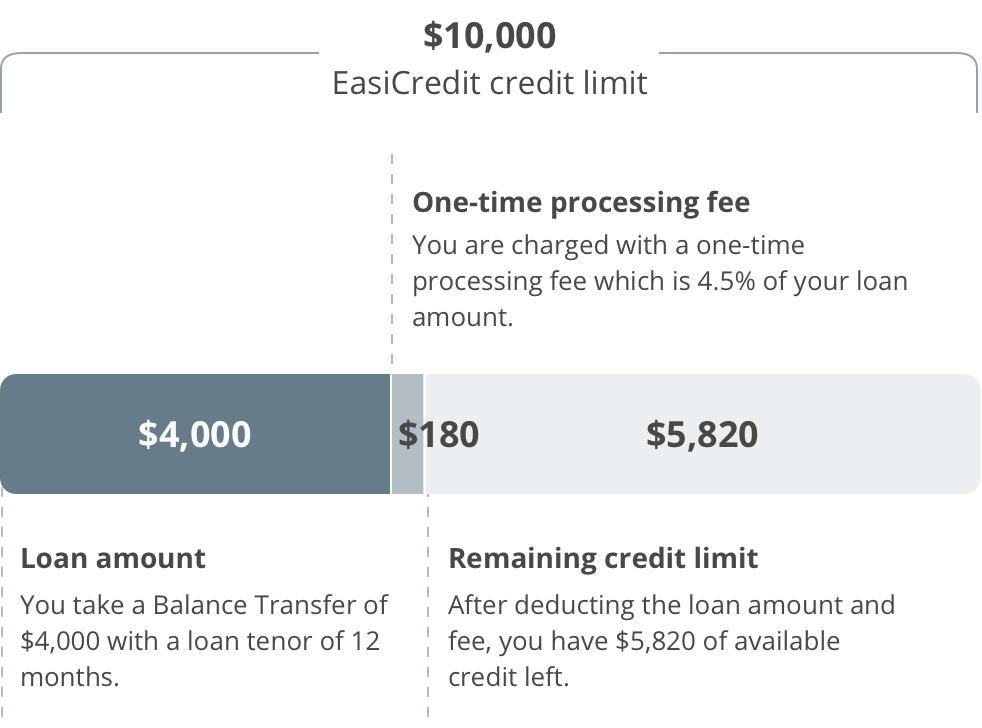

Here’s an illustration of what will happen if you were to take out a loan from your existing EasiCredit or credit card account.

1

2

3

Eligibility requirements

Minimum age

21 years old

Annual income

$30,000 and above for Singaporeans and Singapore PRs

$45,000 and above for foreigners

Product holding

Existing OCBC Credit Card or OCBC EasiCredit account holder

Apply for Balance Transfer today

An EasiCredit account or OCBC Credit Card is required to apply for Balance Transfer.