Cash-on Instalments is now more rewarding than ever! Enjoy up to 2% cashback (capped at S$1,000) when you apply with a minimum approved loan amount of S$5,000 and a tenor of 36, 48 or 60 months.

This Lunar New Year, receive 1.60% a year or a Disney’s Winnie the Pooh plushie when you top up an eligible OCBC savings account.

T&Cs apply. Insured up to S$100k by SDIC.

Enjoy exclusive Disney rewards when you bank with us! T&Cs apply.

Conveniently and securely exchange AUD, CAD, CHFNEW, CNH, EUR, GBP, HKD, JPY, NZD and USD, 24/7 via OCBC Digital, for your overseas transfer, travel payments, online spends, investments and more.

Reduce your taxable income by the same amount contributed to your SRS Account, with a maximum yearly contribution of S$15,300 for Singaporeans and Singapore PRs, and S$35,700 for foreigners.

The OCBC SeniorCare Programme empowers you through four key pillars: Health, Wealth, Lifestyle and Literacy.

Achieve your goals with proper financial planning.

Get data and insights into the financial wellness of Singaporeans.

Get rewarded for what matters: your salary, your lifestyle, and your smart savings habits.

From financial planning tools, investment options and insurance, our comprehensive array of solutions have been built to get you ahead in your every goal and ambition.

Fancy shopping at a bank branch or even enjoying a sushi meal there? At OCBC Wisma Atria, you can do all these and more – visit us to experience it firsthand!

With our suite of travel products and services, spend less effort managing your travel and more time enjoying life's journeys.

Instant approval2 and cash disbursement when you apply online

Lower interest rate from 1.98% p.a. (EIR from 4.19% p.a.) and a one-time processing fee

Affordable fixed repayments across 1 to 5 years

Singaporean or Singapore PR above 21 years old with an annual income of at least $30,000

Foreigner above 21 years old with an annual income of at least $45,000

Get up to 2% cashback!Find out more

1The interest rate and fee indicated is the lowest published rate and may differ from what is offered to you. The interest rate and fee offered to you will be displayed during your application and is based on your personal credit and income profile, subject to the bank’s discretion.

2We will review your application – and assess whether we can provide instant approval – based on the Terms and Conditions and in our sole discretion.

3Valid from 1 February to 31 March 2026. T&Cs apply. Find out more

Apply for a Cash-on-Instalments plan via the OCBC app for instant approval2 and cash. Enjoy personalised rates of as low as 1.98% p.a. (EIR from 4.19% p.a.)¹ in a few simple steps.

Enter the amount you wish to borrow and choose a loan tenor to see the fees and charges that will apply.

The interest rate and processing fee eventually offered to you will depend on your personal credit profile; they may differ from the rates shown here and from rates we offer to other borrowers.

I would like to make fixed repayments over 0

1 year

5 years

For a loan that you can repay over a period of less than a year, check out OCBC Balance Transfer.

Loan amount

One-time processing fee (0% of approved amount)#

Interest of 0% p.a.#

Total repayment amount* (EIR: 0% p.a.)

*Actual amount may differ from what is shown during your application.

Month 1

You have a total repayment amount of $0, to be paid over 0 in fixed monthly instalments.

Month 0

You will need to pay $0^ a month for 0 year.

^This is the indicative amount for the first month.

^This is the indicative amount for the first month.

After your loan tenor ends, the interest rate applicable to any outstanding balance will return to the prevailing rate for your OCBC credit card or EasiCredit account.

Month 1

Month 0

#The interest rate and processing fee offered to you is based on your personal credit profile. Please note that it may differ from the published rate and rate offered to other borrowers.

Enjoy processing fee waiver if your approved loan amount is S$5,000 and above, and if your loan tenor is 48 or 60-months.

Additionally, get up to 2.0% cashback if your approved loan amount is S$5,000 or more, (capped at S$2,000).

Valid till 31 January 2025.

Terms and conditions apply.

Cash-on Instalments is now more rewarding than ever! Enjoy up to 2% cashback (capped at S$1,000) when you apply with a minimum approved loan amount of S$5,000 and a tenor of 36, 48 or 60 months.

Valid from 1 February to 31 March 2026. T&Cs apply.

Minimum age

21 years old

Annual income

$30,000 and above for Singaporeans and Singapore PRs

$45,000 and above for foreigners

Product holding

Existing OCBC Credit Card or OCBC EasiCredit account holder

An EasiCredit account or OCBC Credit Card is required to apply for Cash-on-Instalments.

Refer to the table below for monthly instalment breakdown based on the same loan amount, with different loan tenors from 12 to 60 months, applicable interest rate and effective interest rates.

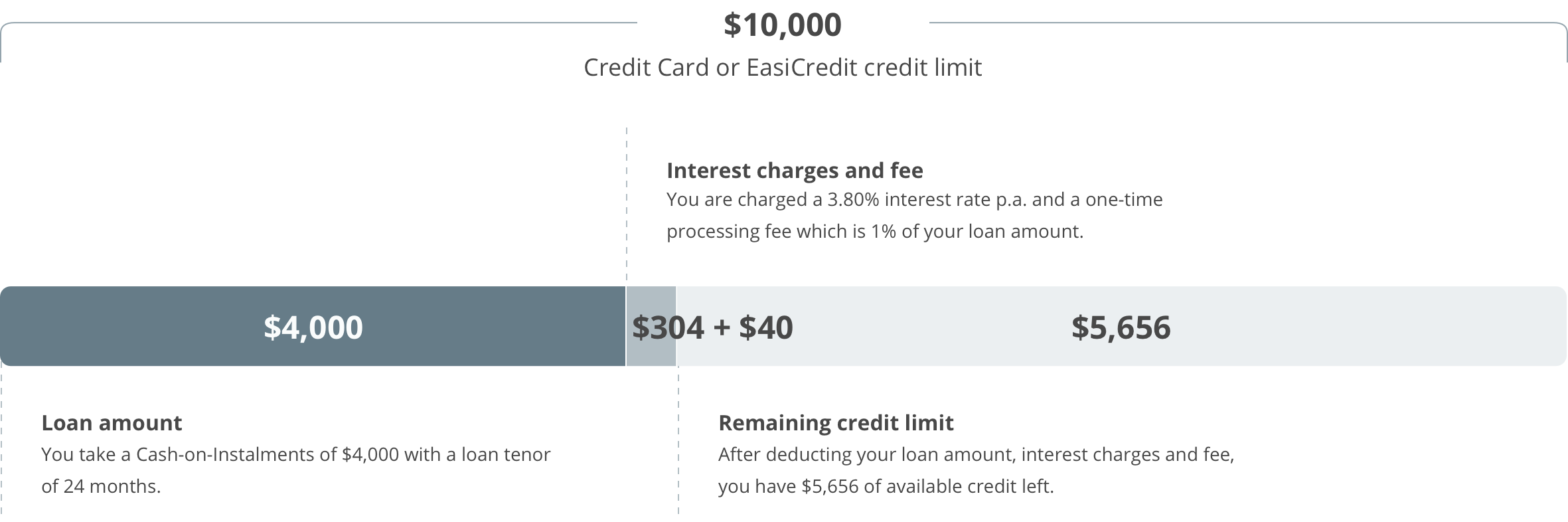

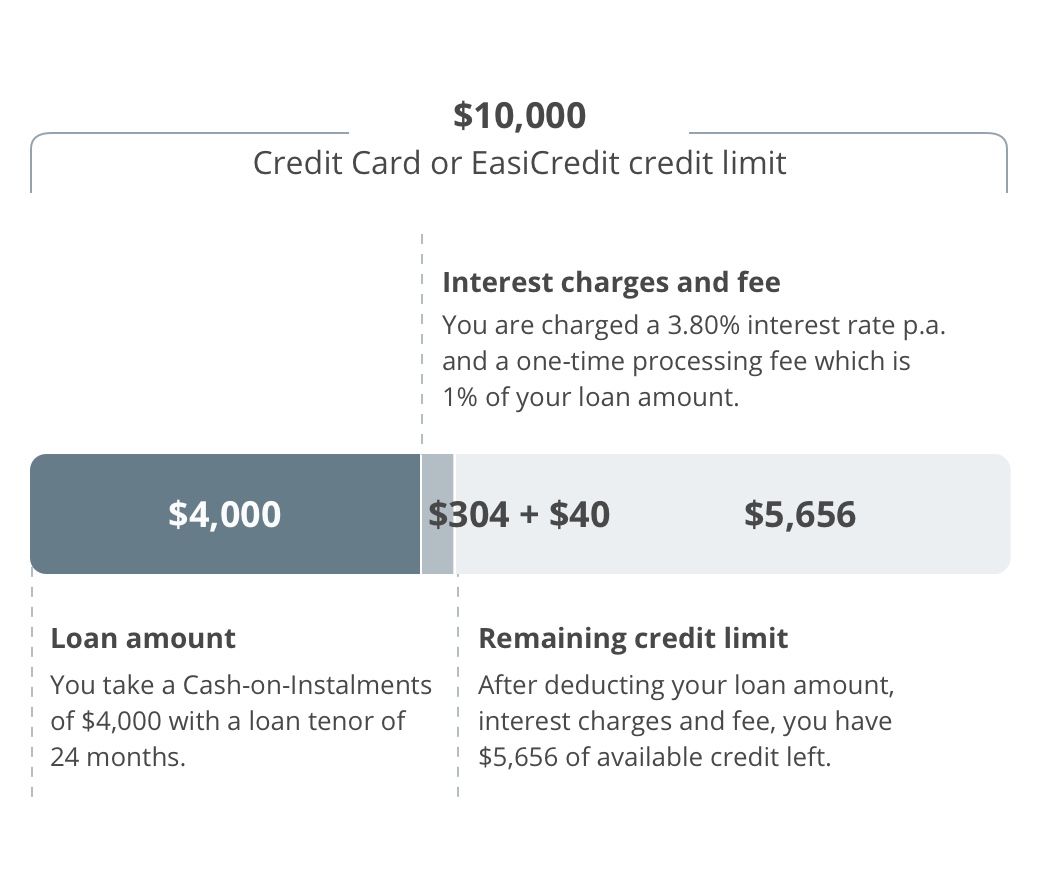

Illustration:

Approved Loan Amount: $10,000

Processing Fee: 1.00%

| Repayment Period | Interest Rate (Flat Rate)1 |

Monthly Rest Rate2 | Effective Interest Rate3 |

Monthly Instalment4 |

|---|---|---|---|---|

| 12 months | 3.80% | 6.94% | 8.82% | $865.00 |

| 24 months | 7.13% | 8.12% | $448.33 | |

| 36 months | 7.14% | 7.82% | $309.44 | |

| 48 months | 7.11% | 7.63% | $240.00 | |

| 60 months | 7.06% | 7.49% | $198.33 |

1 Interest on loan amount as quoted in the loan application form.

2 Interest on loan amount is calculated on a monthly rest method, excluding processing fee.

3 Effective interest rate is inclusive of a one-time processing fee.

4 Instalment amounts are calculated based on a fixed monthly instalment payment option and are simplified for illustration purposes.

Total interest on Cash-on-Instalments will be calculated on a flat-rate basis and shall be fixed for the entire loan. Please note that this excludes the one-time processing fee.

Total interest to be paid will be computed using the following information:

Illustration:

Approved Loan Amount: $10,000

Interest Rate (Flat Rate) as quoted in the loan application form being 3.8%

Selected Tenor: 12 months

Total Interest for repayment period:

Interest Rate (Flat Rate) x Approved Loan Amount x Selected Tenor / 12 months

3.8% x $10,000 x (12/12) = $380

| Monthly Instalment: | Final Instalment: |

|---|---|

| Approved Loan Amount + Total Interest

|

Approved Loan Amount + Total Interest - sum of Monthly Instalments billed (i.e. Monthly Instalment x (Selected Tenor -1)) |

Please see the next question for illustration of the above.

Monthly interest is computed by using a monthly rest basis applying the monthly rest rate on the outstanding amount of the Approved Loan Amount. The interest collected will be reduced as repayments are made each month.

Illustration:

Approved Loan Amount: $10,000

Interest Rate (Flat Rate) as quoted in the loan application form being 3.8%

Selected Tenor: 24 months

Total Interest (based on Selected Tenor): 3.8% x $10,000 x (24/12) = $760

| Month | Outstanding unbilled principal ($) | Interest ($)1 | Principal ($) | Monthly Instalment ($) |

|---|---|---|---|---|

| 1 | $10,000.00 | $59.44 | $388.90 | $448.342 |

| 2 | $9,611.10 | $57.13 | $391.21 | $448.34 |

| 3 | $9,219.89 | $54.81 | $393.53 | $448.34 |

| 4 | $8,826.36 | $52.47 | $395.87 | $448.34 |

| 5 | $8,430.49 | $50.11 | $398.23 | $448.34 |

| 6 | $8,032.26 | $47.75 | $400.59 | $448.34 |

| 7 | $7,631.67 | $45.37 | $402.97 | $448.34 |

| 8 | $7,228.70 | $42.97 | $405.37 | $448.34 |

| 9 | $6,823.33 | $40.56 | $407.78 | $448.34 |

| 10 | $6,415.55 | $38.14 | $410.20 | $448.34 |

| 11 | $6,005.35 | $35.70 | $412.64 | $448.34 |

| 12 | $5,592.71 | $33.24 | $415.10 | $448.34 |

| 13 | $5,177.61 | $30.78 | $417.56 | $448.34 |

| 14 | $4,760.05 | $28.29 | $420.05 | $448.34 |

| 15 | $4,340.00 | $25.80 | $422.54 | $448.34 |

| 16 | $3,917.46 | $23.28 | $425.06 | $448.34 |

| 17 | $3,492.40 | $20.76 | $427.58 | $448.34 |

| 18 | $3,064.82 | $18.22 | $430.12 | $448.34 |

| 19 | $2,634.70 | $15.66 | $432.68 | $448.34 |

| 20 | $2,202.02 | $13.09 | $435.25 | $448.34 |

| 21 | $1,766.77 | $10.50 | $437.84 | $448.34 |

| 22 | $1,328.93 | $7.90 | $440.44 | $448.34 |

| 23 | $888.49 | $5.28 | $443.06 | $448.34 |

| 24 | $445.43 | $2.75 | $445.43 | $448.183 |

| Total | $760.00 | $10,000.00 | $10,760.00 |

1 Interest on loan amount is calculated using the Monthly Rest Rate (i.e. calculated on a monthly rest method), excluding processing fee.

2 ($10,000 + $760) / 24 = $448.34

3 $10,000 + $760 – ($448.34 x 24-1) = $448.18

An administrative fee of $150 or 3% of unbilled Cash-on-Instalments outstanding principal amount, whichever is higher, or at such rate as OCBC Bank may determine, may be imposed at the discretion of OCBC Bank if the Facility is terminated (whether arising from the termination of your Card Account, EasiCredit Account or otherwise). The administrative fee shall be charged to and debited from the Card Account or EasiCredit Account.

Illustration:

Approved Loan Amount: $10,000

Selected Tenor: 12 months

| Month | Outstanding unbilled principal ($) | 3% of unbilled Cash-on-Instalments | Applicable administrative fee1 |

|---|---|---|---|

| 1 | $10,000.00 | $300.00 | $300.00 |

| 2 | $9,192.83 | $275.79 | $275.79 |

| 3 | $8,381.00 | $251.43 | $251.43 |

| 4 | $7,564.47 | $226.93 | $226.93 |

| 5 | $6,743.22 | $202.30 | $202.30 |

| 6 | $5,917.21 | $177.52 | $177.52 |

| 7 | $5,086.44 | $152.59 | $152.59 |

| 8 | $4,250.85 | $127.53 | $150.00 |

| 9 | $3,410.44 | $102.31 | $150.00 |

| 10 | $2,565.16 | $76.95 | $150.00 |

| 11 | $1,715.00 | $51.45 | $150.00 |

| 12 | $859.91 | $25.80 | $150.00 |

1 Higher of $150 or 3% of unbilled Cash-on-Instalments outstanding principal amount.

Enjoy processing fee waiver if your approved loan amount is S$5,000 and above, and if your loan tenor is 48 or 60-months.

Processing fee will still be charged upon loan approval but will be credited back to the EasiCredit or Credit Card account used to apply for the Cash-on-Instalments within 3 months from the end of Promotion Period.

Additionally, you can get cashback if your loan tenor is 48 or 60-months, with a minimum approved loan amount of S$5,000.

| Loan tenor | Approved loan amount | Cashback |

| 48 or 60-months | S$5,000 – S$14,999 | 1.0% |

| S$15,000 and above | 2.0% (capped at S$2,000) |

You are leaving the OCBC Bank website and about to enter a third party website that OCBC Bank has no control over and is not responsible for. Before you proceed to use the third party website, please review the terms of use and privacy policy of their website. OCBC Bank’s Conditions of Access and Privacy and Security Policies do not apply at third party websites.