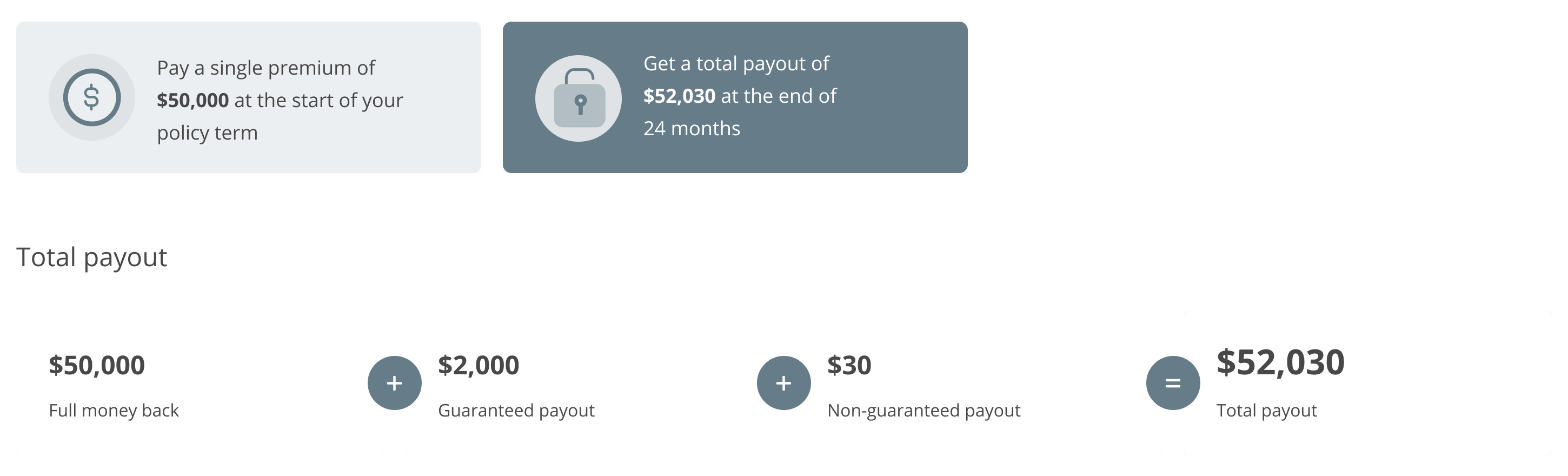

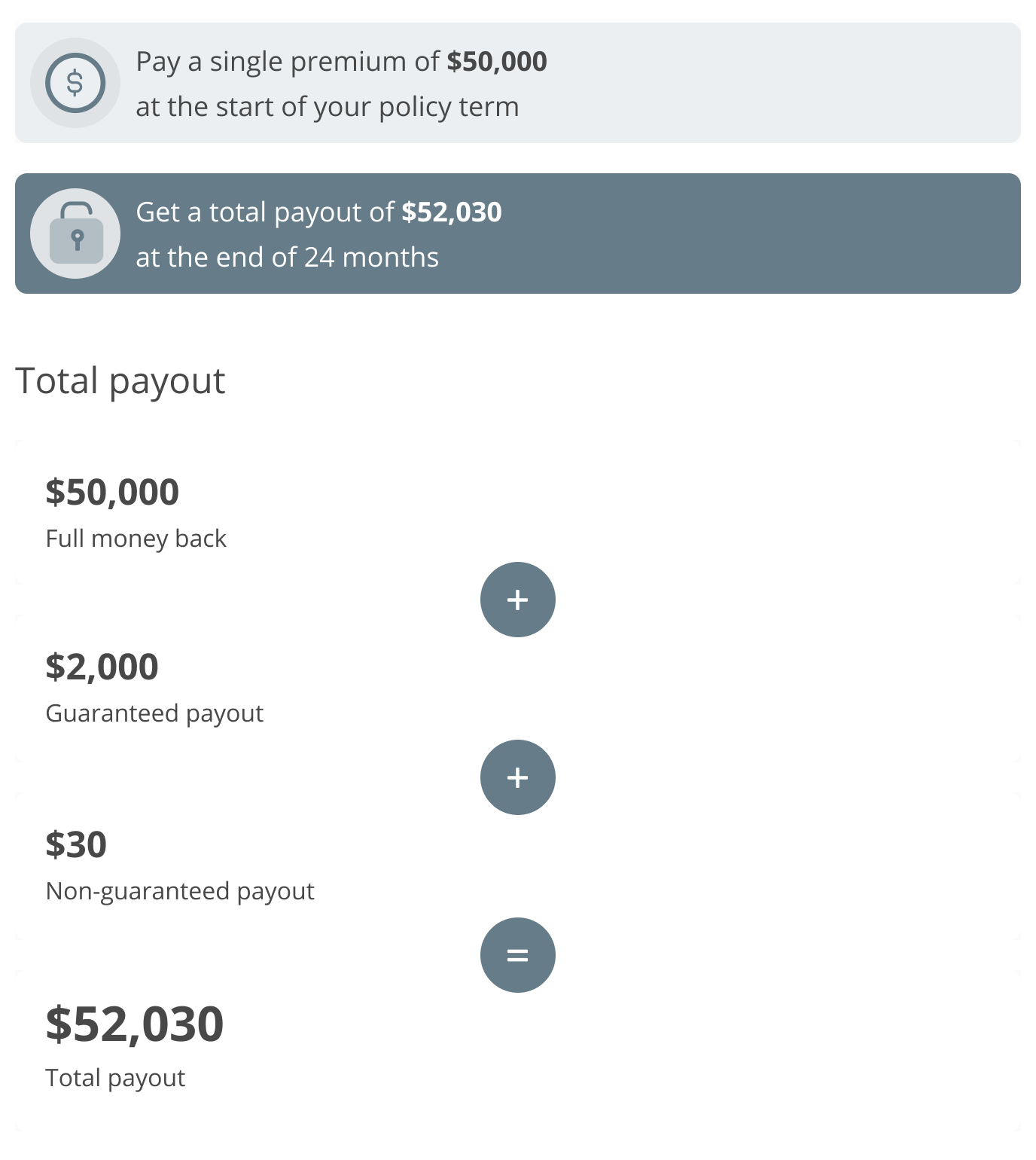

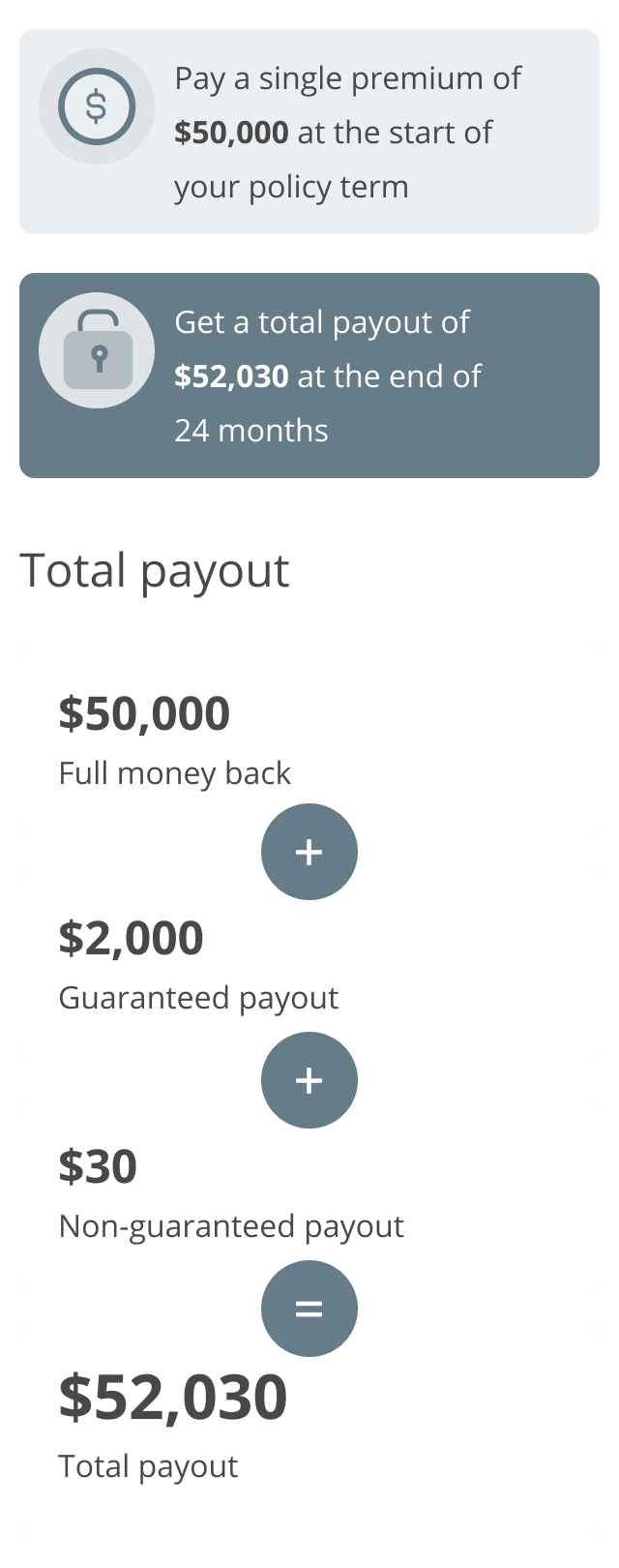

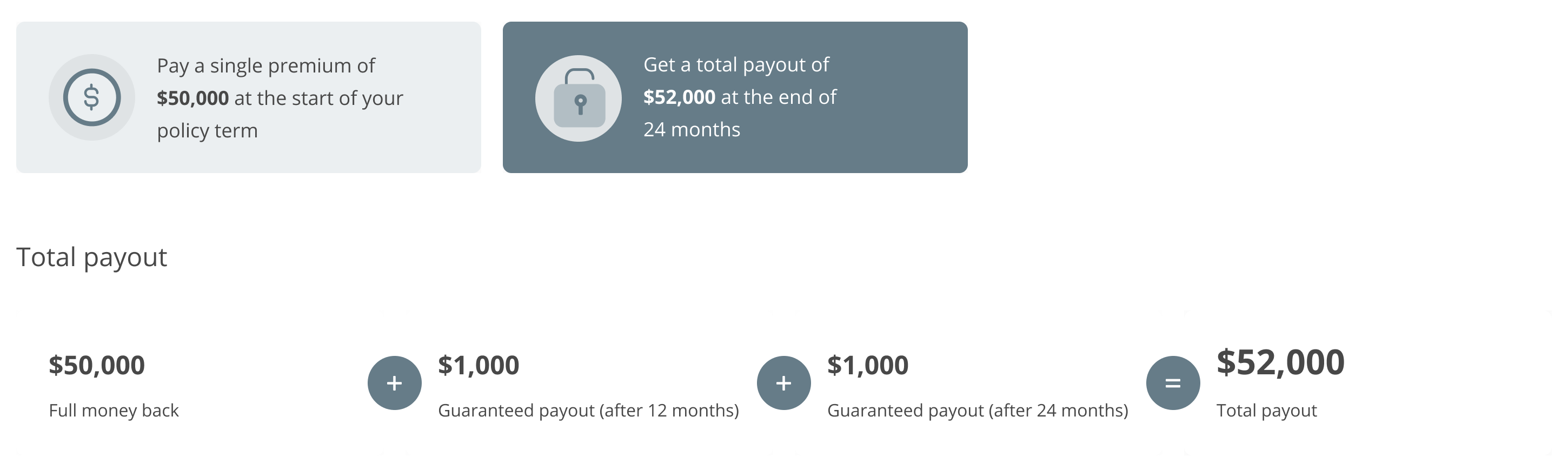

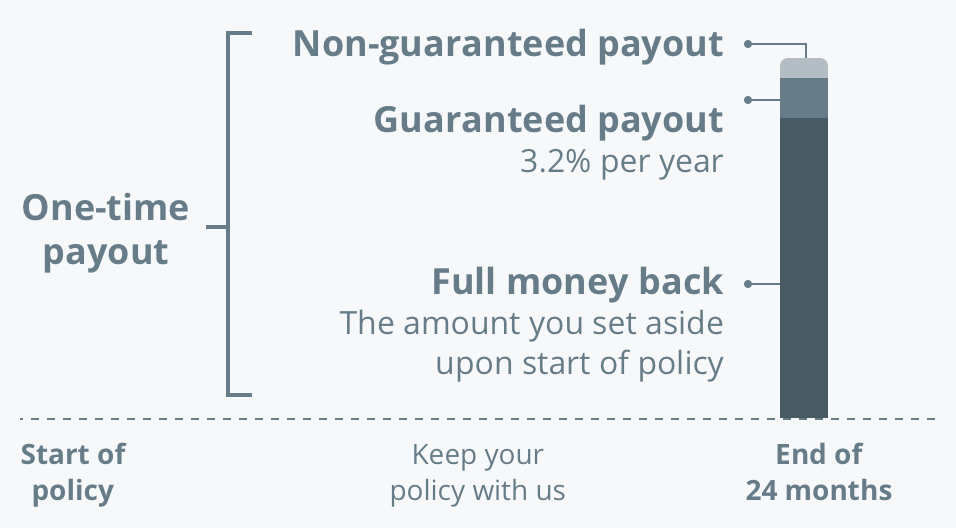

GREAT SP is a single premium insurance plan. You only need to make a one-time payment. The minimum single premium will depend on the entry age (as of next birthday) of the life assured and the payment method.

| Age next birthday | Cash | Supplementary Retirement Scheme (SRS) funds |

| 65 and below | 10,000 SGD | 10,000 SGD |

| 66 to 75 | 20,000 SGD | 15,000 SGD |