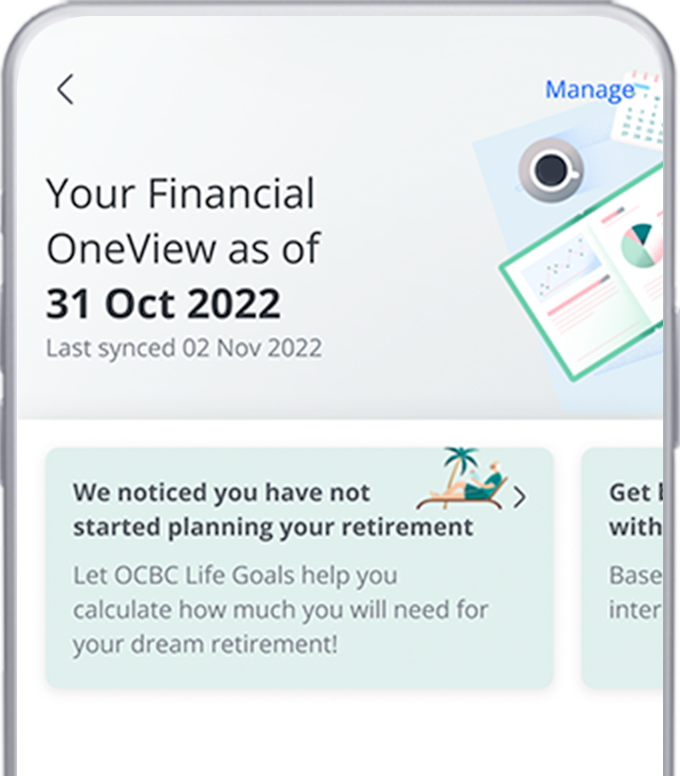

Show me how to achieve financial wellness with OCBC Financial OneView

Start managing your finances on OCBC Financial OneView with our step-by-step guides and common questions.

-

Where can I use OCBC Financial OneView?

You can use OCBC Financial OneView via OCBC Internet Banking and OCBC app. -

Am I automatically opted in for OCBC Financial OneView?

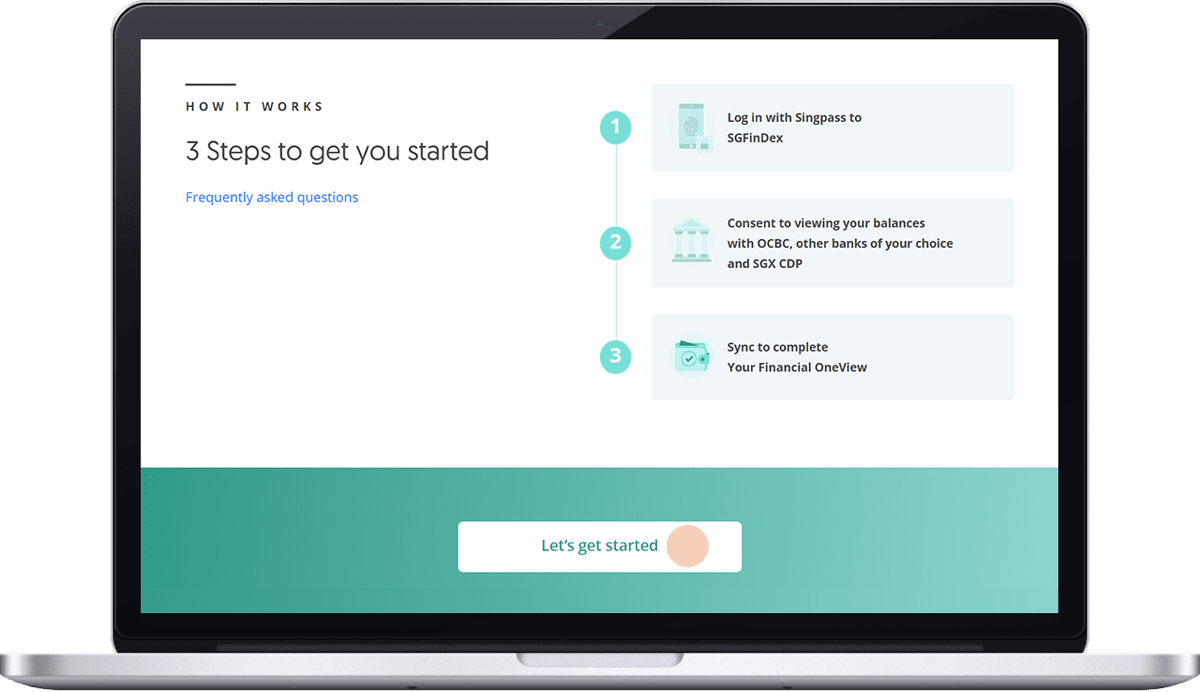

No. You must give your consent to connect to and retrieve your information through SGFinDex using Singpass before you can use OCBC Financial OneView to see information on your banks’, insurers’, SGX CDP and/or government agencies’ accounts. It is always your choice. -

Do I need to pay to use OCBC Financial OneView?

No, this is free of charge. -

Is it safe to share my data via SGFinDex?

There are stringent security measures in place to safeguard your personal data that passes through SGFinDex (e.g. end-to-end encryption). SGFinDex does not store or have access to your financial data. -

I do not bank with any of the 7 banks, can I still use OCBC Financial OneView and SGFinDex?

You will need to set up a banking account with the participating banks before you can use OCBC Financial OneView and SGFinDex. -

Are there other prerequisites to use OCBC Financial OneView and SGFinDex?

You need to have a Singpass account to log in to SGFinDex, and access to OCBC Internet Banking to use OCBC Financial OneView.

If you are a foreigner or if you have recently received your Singapore Permanent Resident status, please update FIN or PR status/Singapore NRIC with us.

-

Why do I have to use my Singpass to log in to SGFinDex?

As SGFinDex is an industry platform that leverages on Myinfo infrastructure, Singpass is the official digital identity that allows users to securely access SGFinDex to connect their bank accounts. -

Are all OCBC customers able to use OCBC Financial OneView?

No, corporate customers will not be able to use OCBC Financial OneView.

In addition, customers who are accredited investors (AI) will not be able to view their information from participating banks whom they are registered as AI customers. They may continue to use OCBC Financial OneView to retrieve and view information from other participating banks, insurers, SGX CDP and government agencies.

-

I have given consent to connect my banks to SGFinDex. Does that mean that all banks will automatically have my data?

No, your data will not be shared automatically. You will need to use the other banks’ digital banking platforms to retrieve your data through SGFinDex again. -

How long does my consent last?

Your consent period will last for one year from the time your first consent was provided. Should you give an instruction to retrieve your data within the one year period, your consent period will be automatically extended for an additional one year by financial institutions whose systems support such extension 1 2.

For example, if you had provided consent to Bank A to provide your data through SGFinDex on 1st January 2023, and subsequently had provided consent to Bank B on 1st March 2023, all consents (i.e., consent to Bank A and B) will expire on 31st December 2023, should there be no instruction to retrieve your data before the expiry date.

Should you give an instruction to retrieve your data on 5th April 2023, all consents will be automatically extended for an additional one year (i.e., consent to Bank A and B) and will expire on 4th April 2024.

1 From 31st October 2023 to 30th November 2023, your HSBC Bank and / or Standard Chartered Bank data will not be available for retrieval via SGFinDex, and your consent to share HSBC Bank and / or Standard Chartered Bank data through SGFinDex will not be extended by HSBC Bank and / or Standard Chartered Bank. For further enquiries, please contact HSBC Bank and / or Standard Chartered Bank.

2 From 31st October to 30th November 2023, should you give an instruction to retrieve your data through HSBC Bank’s and Standard Chartered Bank’s financial planning application/websites, your data will not be returned from all financial institutions and your consent will not be extended by all financial institutions. For enquiries, please contact HSBC Bank and Standard Chartered Bank respectively.

-

Can my consent period be set to last forever?

No. For your security, your consent is set to expire after one year. Should you give an instruction to retrieve your data within the one year period, your consent period will be automatically extended for an additional one year by financial institutions whose systems support such extension 1 2.

1 From 31st October 2023 to 30th November 2023, your HSBC Bank and / or Standard Chartered Bank data will not be available for retrieval via SGFinDex, and your consent to share HSBC Bank and / or Standard Chartered Bank data through SGFinDex will not be extended by HSBC Bank and / or Standard Chartered Bank. For further enquiries, please contact HSBC Bank and / or Standard Chartered Bank.

2 From 31st October 2023 to 30th November 2023, should you give an instruction to retrieve your data through HSBC Bank’s and Standard Chartered Bank’s financial planning application/websites, your data will not be returned from all financial institutions and your consent will not be extended by all financial institutions. For enquiries, please contact HSBC Bank and Standard Chartered Bank respectively.

-

Can I amend my consent at any time?

If you decide not to view selected bank account balances, you may revoke your consent for the specific bank via SGFinDex.

If you change your mind subsequently, you may still give your consent to connect your preferred banks at any time.

-

Who has access to my information?

Just like how you normally bank with us, we are always invested in safeguarding your data.

As per your consent to retrieve data to OCBC Financial OneView, only authorised personnel will have access to your information for such purposes. -

Do I need to update my account balances regularly?

Yes, as your information is not updated automatically. We encourage you to sync your balances on the 7th day of each month to get an updated view. -

Why is the amount shown on OCBC Financial OneView different from my current bank balance?

Data retrieved via SGFinDex are your bank account's last month-end balances or last statement balances and will not be automatically updated. For example, if you retrieve your data on 7 Dec 2020, the data retrieved will be as of 30 Nov 2020.

Your government data are the latest available balances.

-

Why is the SGX CDP data shown on MyMoneySense or participating banks’ (e.g. Bank A) financial planning applications/websites different from the data shown on CDP’s portal?

The information retrieved through SGFinDex represents the month end account balance or statement balance. This may be different from what is displayed on CDP’s portal which may be more updated.

If there are missing data, it could be due to a technical issue either at SGX CDP’s end or the financial institution that you are retrieving your data. Please contact the affected financial planning application/ website for further assistance.

Plan ahead with personalised financial tips from OCBC Financial OneView

New to OCBC Financial OneView?

Get started and track all your finances on one free financial dashboard.

If you do not have the OCBC Digital app, you can download the app on the Apple App Store, Google Play Store or Huawei App Gallery.

For existing OCBC Financial OneView users

Continue to get a holistic overview of your finances and sync to view your latest balances.