You can apply for an OCBC Debit Card easily in Singapore. Apply online using MyInfo for instant approval or complete an online application form and we will get in touch in 5 working days. Alternatively, you can visit an OCBC branch near you today.

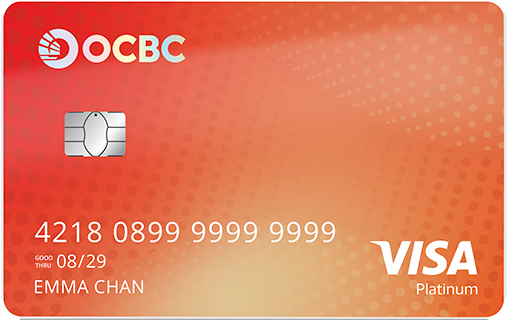

OCBC DEBIT CARD

The card that gives you limitless cashback

|

|

Be in control of your debit card

Lock/unlock your card, report it lost, get a replacement or activate/deactivate ATM withdrawals via the OCBC Digital app.

Lock/unlock your card, report it lost, get a replacement or activate/deactivate ATM withdrawals via the OCBC Digital app.

Link your OCBC Debit Card to a Multi-Currency Global Savings Account to avoid foreign currency transaction fees when you make online transactions

Remember to keep sufficient funds in the relevant currencies!

Eligibility

Minimum age

16 years old

Annual income

No annual income required

Fees

Annual fee

S$0

Replacement card fee

S$21.80 (including GST)

Overseas ATM cash withdrawal service charge

3% of the transaction amount, subject to a minimum of S$5 and maximum of S$20. There is no charge if you withdraw money from OCBC ATMs overseas.

Other fees and charges

Terms and conditions

Apply for the OCBC Debit Card today

or visit us at a branch with

these documents.

Common questions about OCBC Debit Card

With OCBC Personal Banking services, you can get your OCBC Debit Card in 3 simple steps, with instant approval. Connect via MyInfo to apply for an OCBC Debit Card online > verify your details and submit the application > Get a link to access your digital card and use it instantly. Find out more.

Log in to OCBC Online Banking with your access code and PIN or fingerprint ID and select “Card services” on the left menu. Navigate to “Activate credit/debit card” on the mobile app. If using your desktop, click on Customer service, and under “Cards”, select “Activate credit/debit card”. Begin to activate your card according to the prompts. Find out more.

Log in to OCBC Online Banking with your access code and PIN or fingerprint ID and select “Card services” on the left menu. Navigate to “Change card daily limit” on the mobile app. If using your desktop, select on Customer service, and under “Cards” select “Card withdrawal & spending limit”. Choose your OCBC Debit Card that you would like to check or change your limit for > update limit > tap on “Next” > Review and confirm. You’ll have to authorise this action using OneToken. Find out more.

Six weeks from the date of the letter, we will send an OCBC Debit Card to your address in our records – unless you tell us otherwise. For more information, refer to these FAQs.

Important notes

My GREAT PA Plan is underwritten by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

You may terminate the policy during the free-look period (if any) if you decide that the purchased policy is not suitable for you. Note that by doing so, the insurer may recover from you any underwriting expense incurred.

It is usually detrimental to replace an existing accident and health plan with a new one. A penalty may be imposed for early plan termination and the new plan may cost more, or have less benefits at the same cost.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies.

All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The daily premium rate is calculated based on the annual premium of S$305.20, rounded to the nearest cent. It includes the prevailing GST rate, which may change from time to time. The premium is not fixed and may change in the future.

Understanding posted transactions

Understanding posted transactions

While you may make a transaction on Day 1, the merchant may only process it a few days later – this is the posting date and what will count towards the minimum spending required within a month.

The usual fee for foreign currency transactions is 3.25%. However, If your Global Savings Account is linked to your OCBC Debit Card and you have sufficient foreign currency funds in your account, purchases made in foreign currencies and overseas ATM cash withdrawals will be automatically deducted from your respective foreign currency account at no foreign currency transaction fees. Otherwise, we will deduct from your SGD account linked to your card and fees for foreign currency transactions will apply accordingly.

Fees for foreign currency transactions

Foreign currency transactions, other than USD transactions, are converted to USD first before being converted to SGD based on the rate determined by the respective card associations.

All foreign currency transactions are subjected to a currency conversion charge imposed by the respective card associations (1%) and a bank administrative fee (2.25%) of the foreign transaction amount.

However, If your Global Savings Account is linked to your OCBC Debit Card and you have sufficient foreign currency funds in your account, purchases made in foreign currencies and overseas ATM cash withdrawals will be automatically deducted from your respective foreign currency account at no foreign currency transaction fees. Otherwise, we will deduct from your SGD account linked to your card and fees for foreign currency transactions will apply accordingly.

Currency conversion fee

An additional fee will be levied on all Visa and MasterCard transactions effected in Singapore dollars and processed overseas (including online transactions). This includes but is not limited to (i) any Visa or MasterCard retail transaction presented in foreign currency that you choose to pay in Singapore dollars via dynamic currency conversion and (ii) any online retail card transaction charged to your Visa and MasterCard cards on overseas websites in Singapore dollars. The additional fee charged is 2.8% on all converted Singapore dollar amounts for each Visa and MasterCard transaction.

Rewards to earn

Rewards to earn

The following table shows how you will receive the cash rebates on your first 10 OCBC Debit Card transactions, capped at $5 per transaction.

TransactionAmount spentRebate awardedTotal rebates awarded| 1st | $2 | $2 | $36 |

| 2nd | $1 | $1 | |

| 3rd | $5 | $5 | |

| 4th | $10 | $5 | |

| 5th | $200 | $5 (capped) | |

| 6th | $4 | $4 | |

| 7th | $23 | $5 (capped) | |

| 8th | $3 | $3 | |

| 9th | $1 | $1 | |

| 10th | $5 | $5 |

For Singaporeans and Singapore PRs:

NRIC

For foreigners:

Passport

Employment Pass (EP); or S-Pass or Student Pass

The following table shows how you will receive the cash rebates on your first 5 OCBC Debit Card transactions, capped at S$10 per transaction.

| Transaction | Amount Spent | Rebate Awarded | Total Rebates Awarded |

| 1st | S$5 | S$5 |

S$36 |

| 2nd | S$200 | S$10 (capped) | |

| 3rd | S$1 | S$1 | |

| 4th | S$13 | S$10 (capped) | |

| 5th | S$10 | S$10 |

Rewards to earn

Rewards to earn

The following table shows the possible rewards you can get based on your spending amount.

| Spending amount | Rewards |

| S$200 or more | 1-year Burpple Beyond Premium Membership |

| S$500 or more | 1-year Burpple Beyond Membership + S$30 cash rebate |

BLACKPINK WORLD TOUR <DEADLINE> IN SINGAPORE

Get special access to presale tickets for the BLACKPINK WORLD TOUR <DEADLINE> IN SINGAPORE with OCBC Debit Card.

- Valid on 11 June 2025, from 4pm to 11.59pm.

Terms and Conditions

- Valid on 11 June 2025, from 4pm to 11.59pm, for online ticket purchases via visa.com.sg/campaign/blackpinkpresale.

- Valid for OCBC Visa credit or debit card issued in Singapore, Malaysia, Indonesia, Hong Kong and Macau.

- Not valid in conjunction with other discounts, membership privileges, promotions or vouchers.

- Merchant’s terms and conditions apply. Please contact the merchant directly for full details.

- OCBC reserves the right at its absolute discretion to terminate the promotion or vary, delete or add to the promotion, or any of these terms and conditions, at any time without notice including without limitation, the dates of the promotion.

- OCBC shall not be responsible for the quality, merchantability or fitness for any purpose or any other aspect of the promotion or any product/service relating to the promotion. Notwithstanding anything herein, OCBC shall not at any time be responsible or held liable for any defect or malfunction in any product or the deficiency in any service provided, and/or any loss, injury, damage or harm suffered or incurred by or in connection with the use of the promotion, or any product/service relating to the promotion, by any person.

- OCBC’s decision on all matters relating to the promotion will be final and binding on all participants. No correspondence or appeal shall be entertained by OCBC. In the event of any inconsistency between these terms and conditions and any brochure, marketing or promotional material relating to the promotion, these terms and conditions shall prevail.

- These terms and conditions shall be governed by the laws of Singapore and each participant in the promotion irrevocably submits to the non-exclusive jurisdiction of the courts of Singapore. A person who is not a party to any agreement governed by these terms and conditions shall have no right under the Contracts (Rights of Third Parties) Act 2001 to enforce any of these terms and conditions.

Spend and be rewarded with cash!

Make 3 card transactions* by the month's end and receive S$15 cash rebate!

The cash rebate will be credited to your account at the end of the next month.

*The eligible card spend transaction does not include payments or transactions relating to AXS Payments, NETS, Cash withdrawal, spend incurred on or in connection with any stored value and prepaid products, and any Foreign Currency Transaction Fee that is imposed by OCBC.

Terms and conditions apply.

Terms and conditions

- View the full terms and conditions.