Income investing without borders, bias and benchmarks

Income investing without borders, bias and benchmarks

The merits of income investing in uncertain times

Resilient economic data, softening inflation and optimism about new technologies as well as sturdy earnings have buoyed risk sentiment of late. Yet there remains considerable uncertainty about where growth, inflation and interest rates will settle amid one of the most rapid rate hike cycles in forty years.

Faced with a fluid macro environment, income investing can prove useful to navigate uncertainty. Consistent cash flows from bonds and dividend equities can help mitigate portfolio volatility, while presenting opportunities to gain exposure to the broader market upside.

Opportunities for income abound

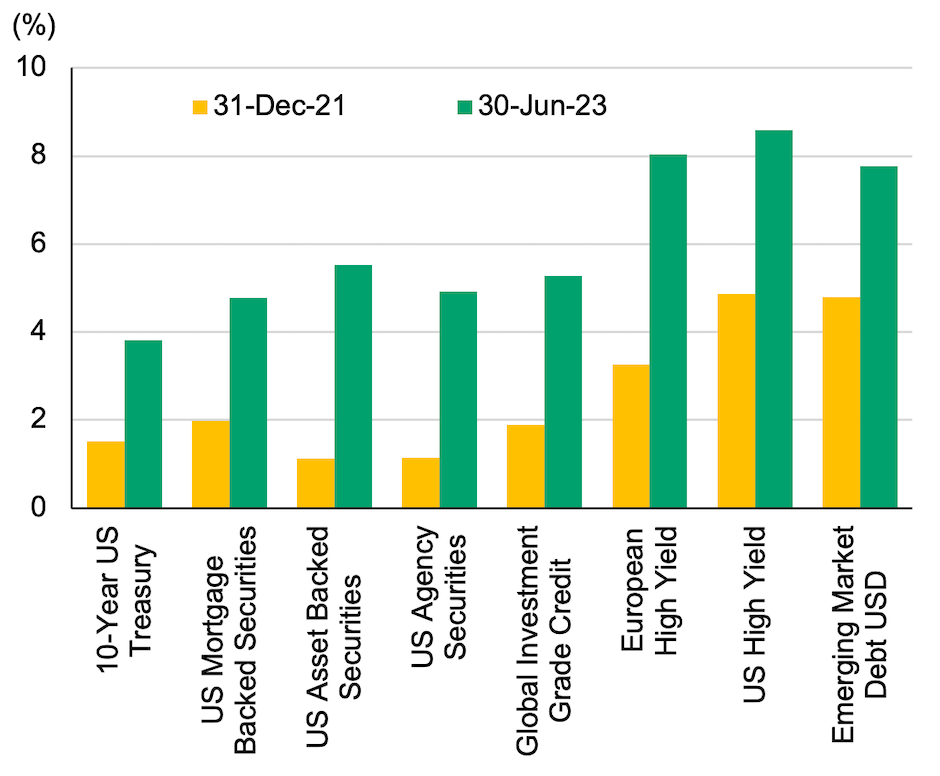

The opportunity set for income has widened meaningfully since 2022. In fixed income, yields across many sectors have climbed to multi-year highs. Coupled with normalising stock-bond correlations, fixed income presents an attractive source of income opportunities and can function as a useful counterbalance to other risky assets in portfolios.

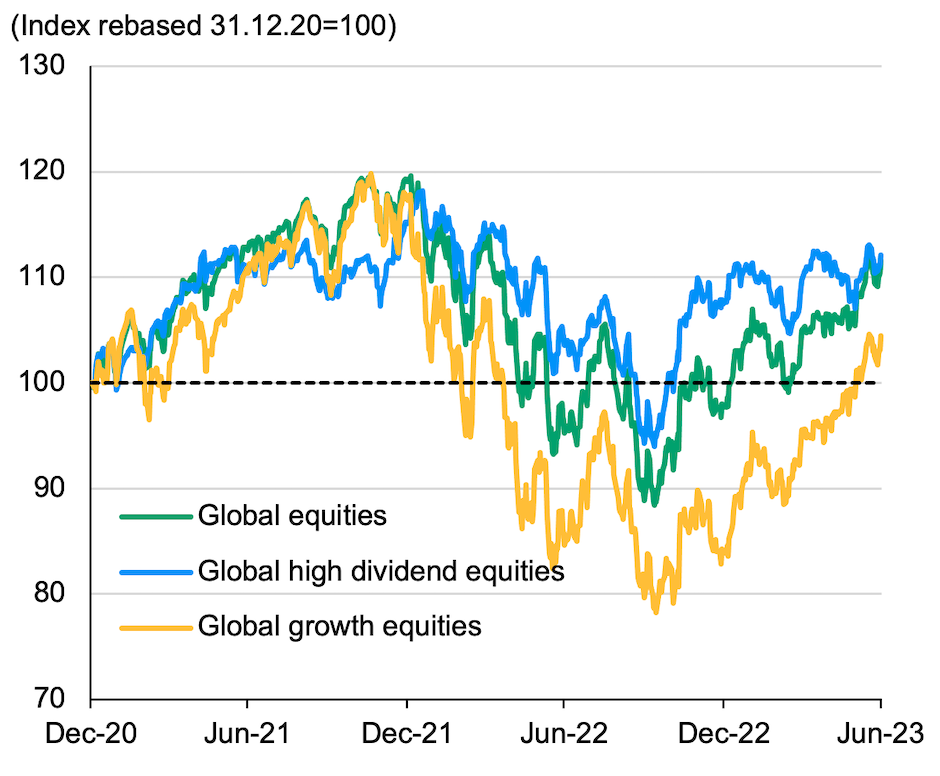

In the equity space, global dividend stocks have handily outperformed their growth peers over the last 2.5 years, and with lower volatility versus the broader index. Notably, dividend pay-out ratios have been low relative to profitability. Contingent on the economic outlook, this could suggest plenty of room for dividend growth.

Bond yields have increased significantly across many fixed income sectors

Global dividend equities have outperformed the broader index and growth equities over the past 2.5 years

Source: Bloomberg, FactSet, ICE BofA Merrill Lynch, J.P. Morgan Economic Research, J.P. Morgan Asset Management. Data as of 30.06.2023.

(LHS) US Mortgage Backed Securities1 represented by Bloomberg US Mortgage Backed Securities Index; Asset Backed Securities1 represented by Bloomberg US Asset Backed Securities Index; US Agency Securities1 represented by Bloomberg US Agencies Index; Global Investment Grade Credit represented by Bloomberg Global Aggregate Corporate Index; US High Yield2 represented by Bloomberg US Corporate High Yield Bond Index; European High Yield2 represented by Bloomberg Pan European High Yield; Emerging Market Debt USD represented by J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified Index.

(RHS) Global equities represented by MSCI All Country World Index (MSCI ACWI). Global high dividend equities represented by MSCI ACWI High Dividend Yield Index. Global growth equities represented by MSCI ACWI Growth Index.

Provided for information only to illustrate macro trends, not to be construed as offer, research or investment advice. Investments involve risks. Not all investments are suitable for all investors. Indices do not include fees or operating expenses and are not available for actual investment. Past performance is not indicative of current or future results. Yield is not guaranteed. Positive yield does not imply positive return.

Evaluating opportunities with a multi-asset lens

Invariably, there is a perennial temptation to lean into instruments or asset classes that presents the highest yield to meet an investor’s income goals. However, this is seldom a wise strategy for generating a consistent and enduring income stream, not least because it elevates concentration risk and limits one’s ability to tap into other attractive yield opportunities that can present benefits beyond just income, such as capital growth. Moreover, market leadership is seldom static or consistent as it constantly shifts on the back of evolving economic conditions.

An active, global multi-asset approach can help investors manage these trade-offs. It can draw on global opportunities for income and capital growth, while diversifying risk across a wide variety of asset classes and regional markets. Here, reach and flexibility can create a meaningful difference4.

The flexibility to search and allocate

Reach and flexibility are indeed the hallmarks of the JPMorgan Global Income Fund. With exposure to over 3000 individual securities in over 90 markets3, the Fund operates with a genuine diversification remit. It taps into a broad investment universe that stretches across asset classes, geographies and the full breadth of the capital structure. The Fund can seek opportunities from traditional sources of income such as high yield bonds2, investment grade corporate credit, emerging market debt, high dividend equities and securitised assets1, as well as non-conventional income generating assets such as preferred equities, convertibles and equity-linked-notes. By integrating rigorous bottom-up security selection with active top-down asset allocation, the Fund seeks to harness the income and capital growth potential of a deep and expansive opportunity set.

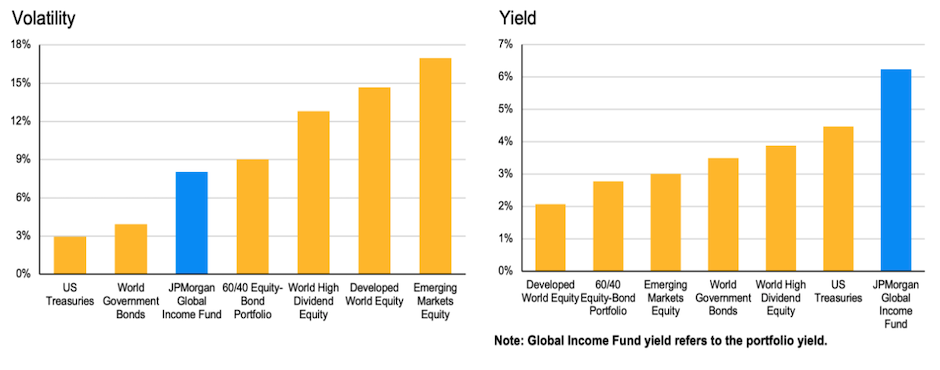

The flexibility to search far and wide for yield opportunities and the ability to actively adjust allocations in the face of changing market conditions have helped the Fund generate competitive portfolio yield with lower volatility versus individual asset classes as illustrated below4.

The JPMorgan Global Income Fund has recorded higher yield and lower volatility versus broad market indices

Source: Bloomberg Barclays. Data as of 30.06.2023. Volatility is based on annualised 10-year volatility. Running yields are based on current yield-to-maturity for bonds and dividend yield for equities. Developed World Equity: MSCI World Index; Emerging Markets Equity: MSCI Emerging Markets Index; World High Dividend Equity: MSCI All Country World High Dividend Yield Index; World Government Bonds: FTSE World Government Bond Index; US Treasuries: Bloomberg US Intermediate Treasury Index; 60/40 Equity-Bond Portfolio: MSCI World 100% Hedged to EUR Index (60%) / Bloomberg Global Aggregate Index (40%). Past performance is not indicative of current or future results. Yield is not guaranteed. Positive yield does not imply positive return. Click here to check the latest performance of the Fund.

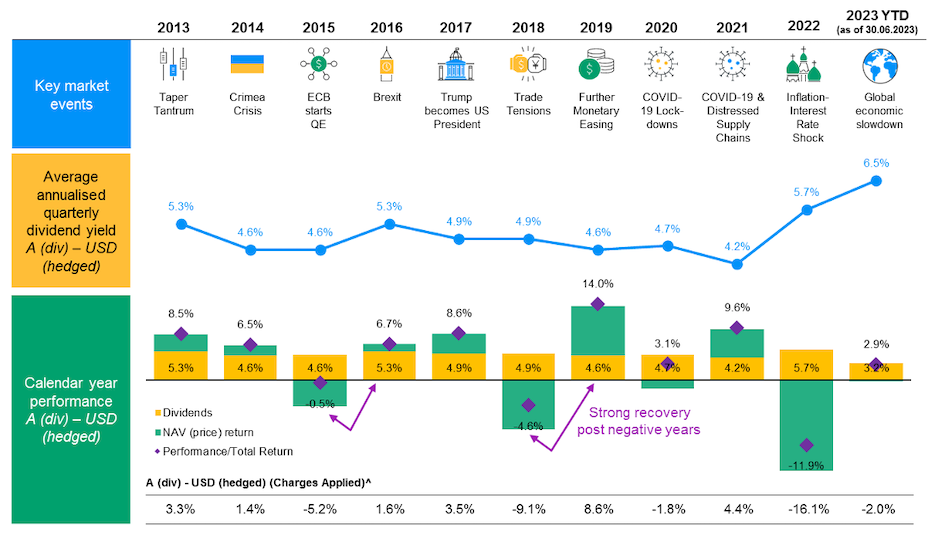

This has been a consistent feature of the Fund over the years and across market cycles. By employing a flexible strategy, the Fund has navigated multiple market challenges over the past decade. As illustrated below, income has been a consistent contributor to the Fund’s overall performance over time and has cushioned total return during volatile periods. Broad diversification and active asset allocation have been instrumental in mitigating downside risks.

Moreover, with access to a vast investment universe, the Fund seeks to harvest opportunities for capital growth and participate in the upside as markets recover. Notably, the Fund has a track record of robust recoveries post negative years. This has contributed to a consistent and resilient total return profile across market cycles.

The JPMorgan Global Income Fund has exhibited a consistent income and performance track record through a decade of market challenges, with strong recovery post negative years

Source: J.P. Morgan Asset Management, Bloomberg. Data as of 30.06.2023.

The figures stated are average annualised quarterly dividend yields based on share class A (div) - USD(hedged) since inception. Annualised yield is calculated based on the latest dividend distribution of share class A (div) in USD with dividend reinvested and may be higher or lower than the actual annual dividend yield. Past pay-out yields and payments do not represent future pay-out yields and payments. Positive yield does not imply positive return. Dividend is not guaranteed. Distributions may be paid out of capital or distributable income or both. Any payments of distributions by the Fund are expected to result in a decrease in the net asset value per share on the ex-dividend date. Investments involve risks and are not comparable to deposits. The value of the units and the income accruing, if any, may fall or rise. Funds that invest in or where pay-out may be generated from financial derivatives strategies may involve higher risks. The declaration and payment of dividends is at the discretion of the manager and is subject to the dividend policy referred in the Offering Documents. Please refer to the Offering Documents for details on the Fund’s investment strategy including risk factors and the dividend policy. For detailed disclosures please visit www.jpmorganam.com.sg.

Fund performance is shown based on the NAV of the share class A (div) in USD with income (gross of shareholder tax) reinvested including actual ongoing charges excluding any entry and exit fees. Past performance is not a reliable indicator of current and future results.

^Due to a change in pricing model, post 31 October 2016 (effective date), performance calculations are on a single pricing basis, taking into account any initial and redemption fees. Prior to 31 October 2016, performance calculations are on an offer-to-bid basis. The maximum initial charge (if any) is taken into account for performance calculations.

Click here to check the latest performance of the Fund.

No borders. No bias. No benchmarks.

In summary, the JPMorgan Global Income Fund approaches income investing without borders, bias and benchmarks.

- First, the Fund transcends borders, scouring the globe for high conviction income opportunities in a risk aware fashion.

- Second, the strategy has no inherent bias, with the Fund maintaining a highly diversified portfolio across asset classes, regional markets and the capital structure. The Fund actively adjusts these allocations as market conditions evolve.

- Third, without a benchmark as a starting point, the Fund adopts an unconstrained approach and wields a broad investment toolkit to manage risk, optimise yield and seek robust returns.

Altogether, such flexibility has been instrumental in helping the fund navigate different market environments, all while seeking consistent income and capital growth.

Grow your wealth with the JPMorgan Global Income Fund.

through OCBC Online Banking or visit us at a

branch to open an account immediately.

Important notices

JPMorgan Global Income Fund is the marketing name of the JPMorgan Investment Funds – Global Income Fund.

Diversification does not guarantee investment return and does not eliminate the risk of loss.

- Securitisation is the process in which certain type of assets, such as mortgages or other types of loans, are pooled so that they can be repackaged into interest-bearing securities. Examples of securitised debt include asset-backed securities and mortgage-backed securities.

- High-yield credit refers to corporate bonds which are given ratings below investment grade and are deemed to have a higher risk of default. Yield is not guaranteed. Positive yield does not imply positive return.

- Source: J.P. Morgan Asset Management. Data as of 30.06.2023.

- For illustrative purposes only based on current market conditions, subject to change from time to time. Not all investments are suitable for all investors. Exact allocation of portfolio depends on each individual’s circumstance and market conditions.

Important Information

The fund(s) mentioned in this document has/have been approved as recognised scheme(s) under the Securities and Futures Act, Chapter 289 of Singapore. Any offer or sale, or invitation for subscription or purchase of the Fund(s) must be accompanied with the relevant valid Singapore Offering Documents (which incorporates and is not valid without the relevant Luxembourg prospectus). Please refer to the Singapore Offering Documents (including the risk factors set out therein) and the relevant Product Highlights Sheet for details before any investment at http://www.jpmorgan.com/sg/am/per/.

Issued by JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K). All rights reserved.

Copyright 2023 JPMorgan Chase & Co. All rights reserved.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank's written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees [collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties] is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

Collective Investment Schemes

- A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

- The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

- Investment involves risks. Past performance figures do not reflect future performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

- The indicative distribution rate may not be achieved and is not an indication, forecast, or projection of the future performance of the Fund.

Cross-Border Market Disclaimers

- General: The document provided by Oversea-Chinese Banking Corporation Limited, Singapore [*OCBC Singapore”) is for general information only and is not intended for anyone other than the recipient. It does not take into account the specific investment objectives, financial situation or particular needs of any particular person, and does not constitute an offer or solicitation by OCBC Singapore to buy or sell or subscribe for any security or financial instrument or to enter into a transaction or to participate in any particular trading or investment strategy nor an advice or a recommendation with respect to such financial products. This document may not be published, circulated, reproduced or distributed in whole or in part to any other person without OCBC Singapore's prior written consent. This document is not intended for distribution to, publication or use by any person in any jurisdiction, where such distribution, publication or use would be contrary to applicable law or would subject OCBC Singapore and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

- Brunei: This document has not been delivered to, licensed or permitted by the Autoriti Monetari Brunei Darussalam, the authority as designated under the Brunei Darussalam Securities Markets Order, 2013 and the Banking Order, 2006; nor has it been registered with the Registrar of Companies, Registrar of International Business Companies or the Brunei Darussalam Ministry of Finance. The products are not registered, licensed or permitted by the Autoriti Monetari Brunei Darussalam or by any other government agency or under any law in Brunei Darussalam. Any offers, acceptances, sales and allotments of the products shall be made outside Brunei Darussalam. Indonesia: The offering of the investment product in reliance of this document is not registered under the Indonesian Capital Market Law and its implementing regulations, and is not intended to constitute a public offering of securities under the Indonesian Capital Market Law and its implementing regulations. According, this investment product may not be offered or sold, directly or indirectly, within Indonesia or to citizens (wherever they are domiciled or located), entities or residents, in any manner which constitutes a public offering of securities under the Indonesian Capital Market Law and its implementing regulations.

- Malaysia: OCBC Singapore does not hold any licence, registration or approval to carry on any regulated business in Malaysia (including but not limited to any businesses regulated under the Capital Markets & Services Act 2007 of Malaysia), nor does it hold itself out as carrying on or purport to carry on any such business in Malaysia. Any services provided by OCBC Singapore to residents of Malaysia are provided solely on an offshore basis from outside Malaysia, either as a result of “reverse enquiry” on the part of the Malaysian residents or where OCBC Singapore has been retained outside Malaysia to provide such services. As an integral part of the provision of such services from outside Malaysia, OCBC Singapore may from time to time make available to such residents documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of Malaysia). Nothing in such documents or information is intended to be construed as or constitute the making available of, or an offer or invitation to subscribe for or purchase any such capital markets product.

- Myanmar: The provision of any products and services by OCBC Singapore shall be solely on an offshore basis. You shall ensure that you have and will continue to be fully compliant with all applicable laws in Myanmar when entering into discussion or contracts with OCBC Singapore.

- Oman: This document does not constitute a public offer of investment, securities or financial services in the Sultanate of Oman, as contemplated by the Commercial Companies Law of Oman (Royal Decree No. 184/2019), Banking Law of Oman [Royal Decree No. 114/2000) or the Capital Market Law of Oman (Royal Decree No. 80/1998] and the Executive Regulations of the Capital Market Law [Ministerial Decision No. 1/2009] or an offer to sell or the solicitation of any offer to buy non-Omani investment products, securities or financial services and products in the Sultanate of Oman. It is being provided to a limited number of sophisticated investors solely to enable them to decide whether or not to make an offer to invest in financial products mentioned in this document, outside of the Sultanate of Oman, upon the terms and subject to the restrictions set out herein and may not be reproduced or used for any other purpose or provided to any person other than the original recipient. Additionally, this document is not intended to lead to the making of any contract within the territory or under the laws of the Sultanate of Oman. The Capital Market Authority of Oman and the Central Bank of Oman take no responsibility for the accuracy of the statements and information contained in this document or for the performance of the financial products mentioned in this document nor shall they have any liability to any person for damage or loss resulting from reliance on any statement or information contained herein.

- Russia: The investment products mentioned in this document have not been registered with or approved by the local regulator of any country and are not publicly distributed in Singapore or elsewhere. This document does not constitute or form part of an offer or invitation to the public in any country to subscribe for the products referred to herein.

- Taiwan: The provision of the information and the offer of the service concerned herewith have not been and will not be registered with the Financial Supervisory Commission of Taiwan pursuant to relevant laws and regulations of Taiwan and may not be provided or offered in Taiwan or in circumstances which requires a prior registration or approval of the Financial Supervisory Commission of Taiwan. No person or entity in Taiwan has been authorised to provide the information and to offer the service in Taiwan.

- Thailand: Please note that none of the material and information contained, or the relevant securities or products specified herein is approved or registered in Thailand. Interests in the relevant securities or products may not be offered or sold within Thailand. The attached information has been provided at your request for informational purposes only and shall not be copied or redistributed to any other person without the prior consent of OCBC Singapore or its relevant entities and in no way constitutes an offer, solicitation, advertisement or advice of, or in relation to, the relevant securities or products by OCBC Singapore or any other entities in OCBC Singapore's group in Thailand.

- The Philippines: The information contained in this document is not intended to constitute a public offering of securities under the Securities Regulation Code of the Philippines.

- Dubai International Financial Centre (DIFC): OCBC Singapore is not a financial institution licensed in the Dubai International Financial Centre ("DIFC") or the United Arab Emirates outside of the DIFC and does not undertake banking or financial activities in the DIFC or the United Arab Emirates nor is it licensed to do so.

- United Kingdom: In the United Kingdom, this document is being made available only to the person or the entity to whom it is directed being persons to whom it may lawfully be directed under applicable laws and regulations of the United Kingdom [such persons are hereinafter referred to as ‘relevant persons’). Accordingly, this document is communicated only to relevant persons. Persons who are not relevant persons must not act on or rely on this document or any of its contents. Any investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with relevant persons. Relevant persons in receipt of this document must not distribute, publish, reproduce, or disclose this document (in whole or in part] to any person who is not a relevant person. The deposits referred to in this communication are maintained with Oversea-Chinese Banking Corporation Limited, Singapore (“OCBC Singapore”). OCBC Singapore is incorporated in Singapore and is authorised and regulated by the Monetary Authority of Singapore. Certain deposits offered by OCBC Singapore are covered by the Singapore Deposit Insurance Scheme, subjected to conditions. The bank's paid up capital and reserves exceeds SGD 1.5 billion — further information about the capital position of OCBC Singapore may be found at OCBC Bank's website: > OCBC Group > Investors > Annual report and AGM.

- United Arab Emirates (UAE): The offering of certain products in this document has not been and will not be registered with the Central Bank of United Arab Emirates or Securities & Commodities Authority in the United Arab Page 2 of 2 CBMD -20210615 Co.Reg.N0:193200032W Emirates. Any products in this document that are being offered or sold do not constitute a public offering or distribution of securities under the applicable laws and regulations of the United Arab Emirates. This document is not intended for circulation or distribution in or into the UAE, other than to persons in the UAE to whom such circulation or distribution is permitted by, or is exempt from the requirements of, the applicable laws and regulations of the United Arab Emirates. The distribution of the information contained herein by the recipient is prohibited. Where applicable, this document relates to securities which are listed outside of the Abu Dhabi Securities Exchange and the Dubai Financial Market. OCBC Singapore is not authorized to provide investment research regarding securities listed on the exchanges of the United Arab Emirates.

- United States of America: This product may not be sold or offered within the United States or to US persons.