No, you do not require a trade facility or limit to apply. The bank guarantee will be issued against a 100% cash margin to be debited from your designated OCBC Business Account.

Cash-Backed Bank Guarantee

Apply for a bank guarantee

A Cash-Backed Bank Guarantee assures your customers so you can secure new contracts and expand your business. All you need to support your application is a cash margin from your OCBC Business Account.

Time saved

Forget branch visits or having to wait for calls. Simply apply online.

Forget branch visits or having to wait for calls. Simply apply online.

No additional set-up needed

The bank guarantee is issued against the cash margin from your chosen OCBC Business Account.

The bank guarantee is issued against the cash margin from your chosen OCBC Business Account.

Pre-filled application

Fields will be populated for your convenience. Just review and provide any details required before submitting!

Fields will be populated for your convenience. Just review and provide any details required before submitting!

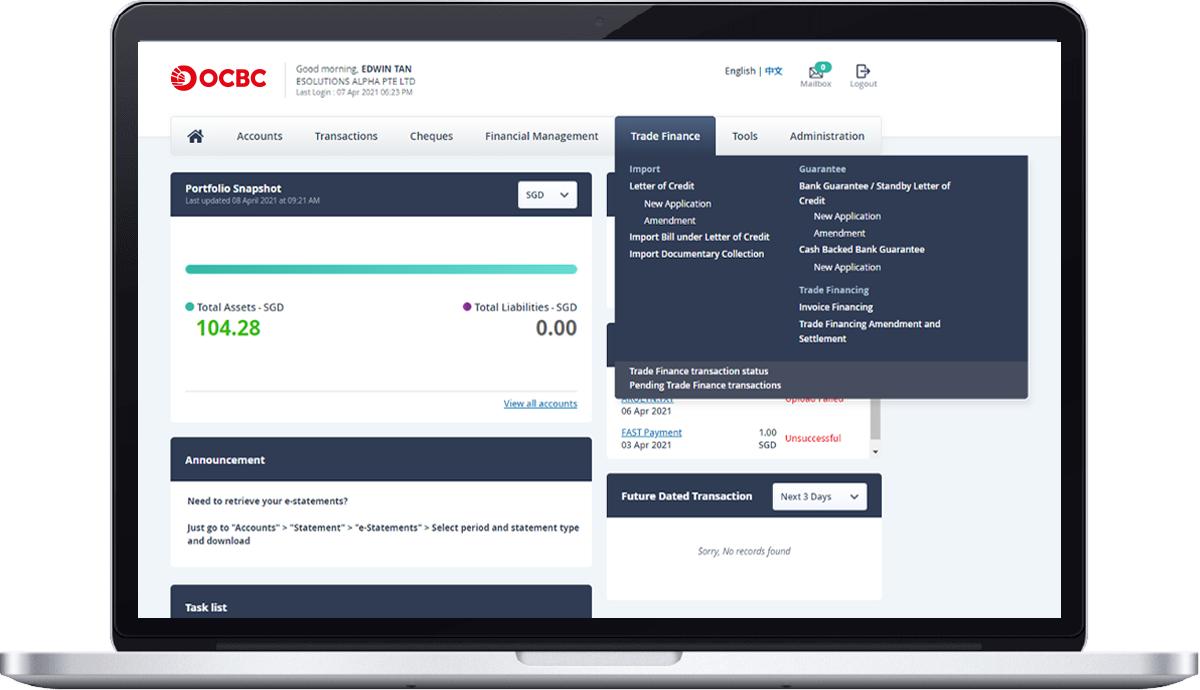

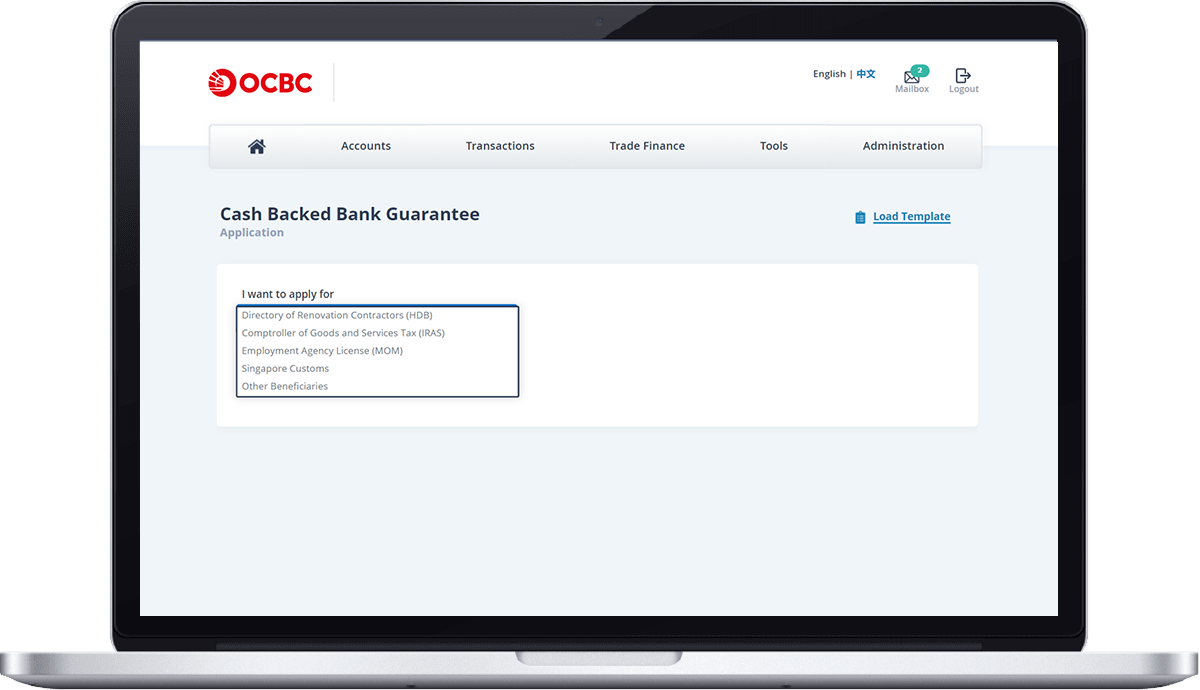

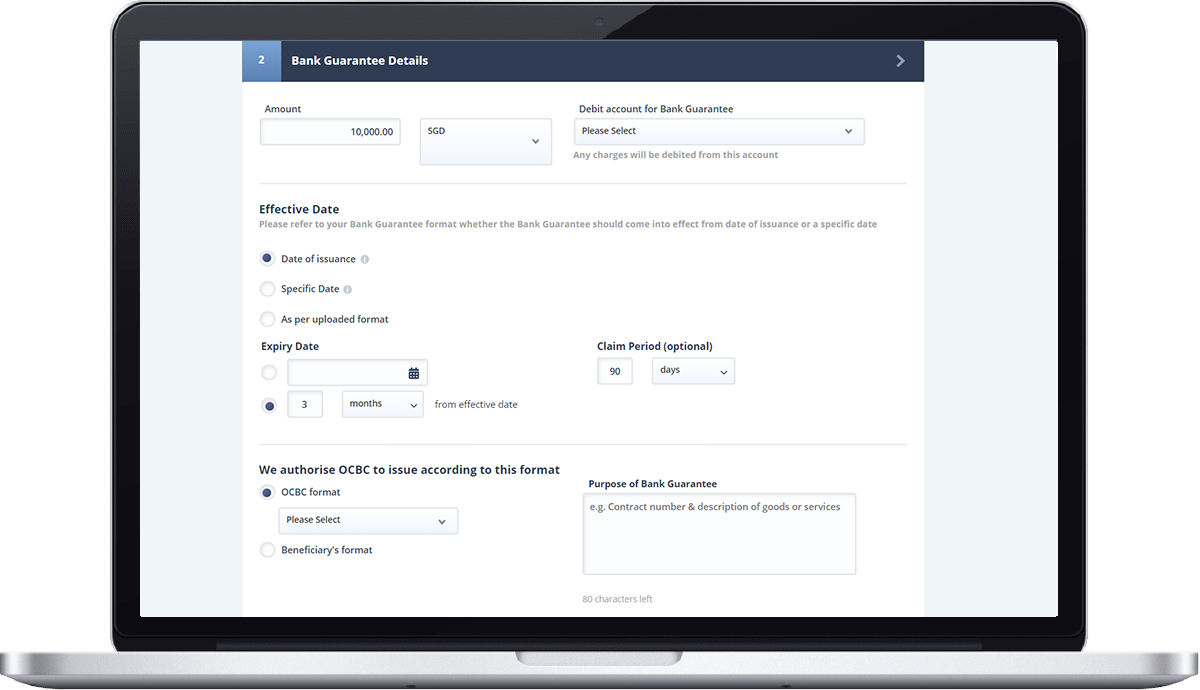

Log in to OCBC Velocity to apply now.

Apply for OCBC Velocity to speed up your application.

We recommend that you submit your application through OCBC Velocity where possible. Otherwise, please use this form.

Please complete and email the form to BusinessBG@ocbc.com. We will contact you within 1 working day.

Fees and charges

Common questions

The Cash-Backed Bank Guarantee is issued against a 100% cash margin. This will be held in the same currency and amount as the bank guarantee. If the designated account for debiting is not in the same currency as the bank guarantee, OCBC will apply the prevailing exchange rate. For example, if you have an SGD debiting account and wish to issue a US$10,000 guarantee, you will need to have S$13,500 for debiting if the prevailing exchange rate is US$1:S$1.35.

There are foreign exchange risks where the currency of the debiting account differs from the currency of the bank guarantee. If there are no claims, refund of cash margin will be based on the bank’s prevailing exchange rate. As foreign currencies are subject to inherent exchange rate fluctuation risk, you shall bear the foreign currency risk and expenses associated with the bank guarantee. Any and all currency conversions shall be at the bank’s prevailing foreign exchange rate unless otherwise arranged beforehand. For example, in a case of SGD debiting account and USD bank guarantee, if there is no claim, and the foreign exchange is US$1:S$1.35, we will credit your SGD account with S$13,500. However, if the prevailing rate is US$1:S$1.40, we will credit your SGD account with S$14,000.

Find out how OCBC can help your business

Call us at +65 6318 7777. Mondays – Fridays, 9am to 6pm (excluding public holidays).

Invoice Financing (Sales)

Finance your invoices for better cash flow management

Commercial Property Loan

Own or refinance your commercial property at low rates

SME Sustainable Financing

Financing to help you achieve your sustainable development goals