Understanding the purpose and benefits of a Banker’s Guarantee

Understanding the purpose and benefits of a Banker’s Guarantee

Business cannot happen without trust. For instance, if you sell goods to another company (especially on credit terms), it means you trust the company’s capability and willingness to pay you when the invoice comes due. But what happens if you don’t trust that a company is able to pay you? Do you forgo the business altogether even if it might be detrimental to both you and them? On the other hand, what if you sell goods to a buyer that turns out to be incapable of paying you? How do you handle the financial loss?

It is truly a dilemma. But what if there was a reputable and financially strong third-party who was willing to guarantee payment for your potential buyer? And if the buyer did not meet their payment obligations to you, you can simply demand that the third-party pay you instead.

Another instance would be if you have secured a contract to supply goods and services to another company. Under the contract, you may be required to give a cash deposit as security to assure the buyer that you will indeed perform the supply contract. In lieu of this cash deposit, the buyer can also accept a guarantee from a reputable and trusted financial institution. Such undertakings to pay, issued by a financial institution, are called a Banker’s Guarantee (BG).

What is a BG?

The above, in essence, describes the two most common reasons as to why a buyer or seller would want a BG in the course of their business dealings.

A BG in its most common form is a payment undertaking by a financial institution to pay the beneficiary up to the specified maximum sum upon the receipt of a documentary demand. This is provided that the terms and conditions of the BG are complied with. In most cases, the financial institution is typically a bank.

Keep in mind that the bank is not a party to your underlying contract and not privy to your contractual terms. This means the bank’s obligation under the BG shall be independent of your underlying contractual terms. Once the BG is issued, it is irrevocable except with the consent of all parties. Banks therefore issue independent demand guarantees as opposed to suretyships.

How does a BG work?

Let’s take an in-depth look at how using a BG can protect you from non-payment risks when selling under an open account, and propel your business forward with new opportunities.

To understand the mechanism of a BG, we will be using 2 scenario-based illustrations.

Illustrative scenario #1

How can you mitigate non-payment risks with a BG when you’re selling to a new buyer on an open account?

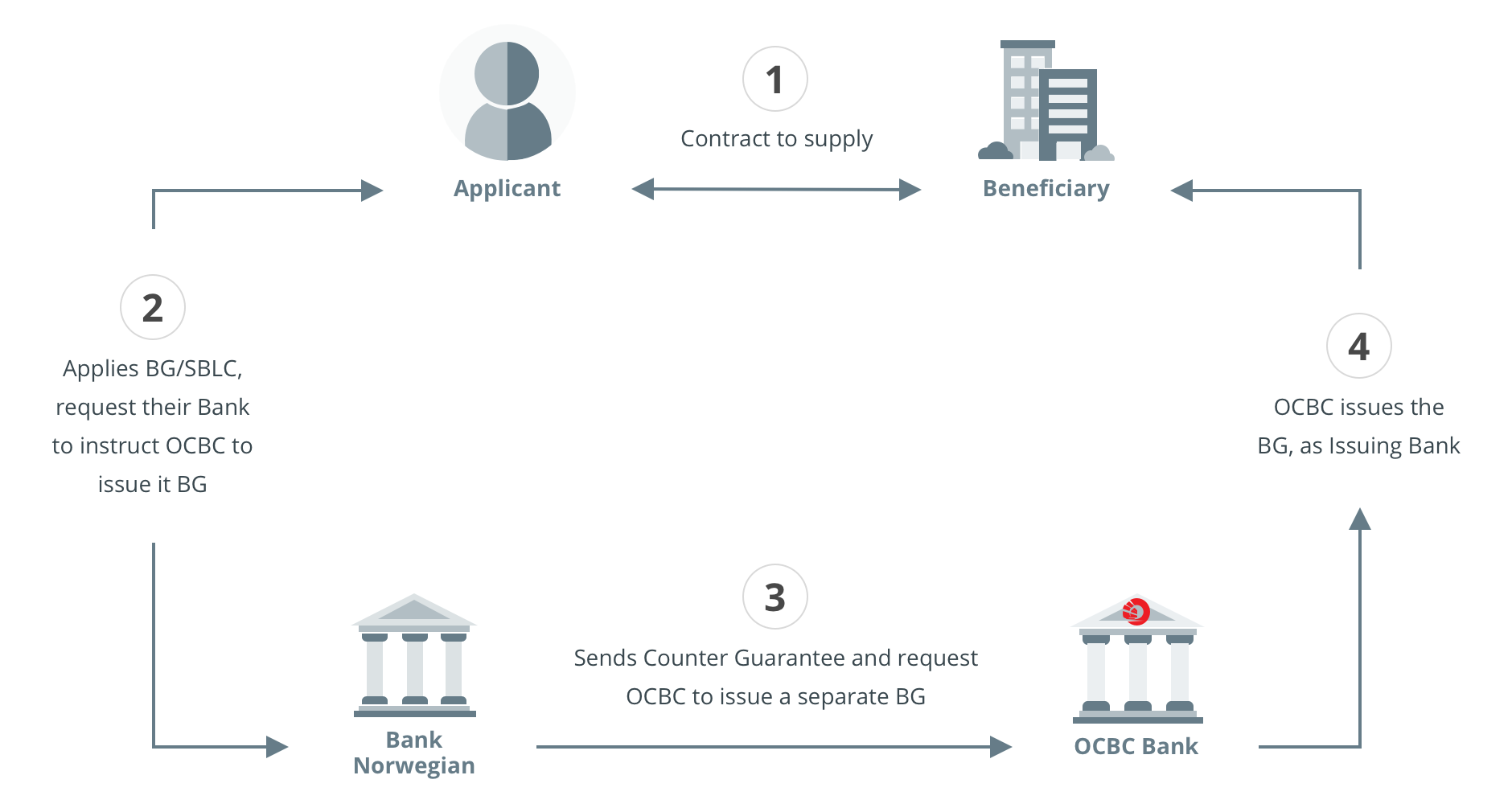

Your company has a sales enquiry for a large order worth EUR10,000,000 from a new buyer in Norway. They are willing to place the order immediately if you can offer them an open account with a 60-day payment term. Your credit team is worried about this new buyer’s ability to pay and is only willing to allow a credit limit of EUR6,000,000, while the remainder credit limit is covered by a BG instead. The buyer offers you a BG from their bank in Norway, but this does not meet your company’s credit rating criteria.

To overcome the above concerns, you can approach OCBC to issue the BG in your favour against the receipt of a counter guarantee from the Norwegian Bank.

Here’s how that would work:

With this inward indirect guarantee structure, you will be able to fulfil your company’s criteria and secure your contract.

Illustrative scenario #2

As a seller, how can a BG from a reputable bank open up new business opportunities for you?

Your company was awarded the contract for a sum of USD10,000,000, and now has to issue a Performance Guarantee (PG) for USD1,000,000 within 30 days of signing the contract or pay the security deposit in cash. You also require a 20% advance payment, in which the buyer has asked you to furnish an Advance Payment Guarantee (APG).

You find out that the beneficiary requires the guarantees to be issued by a bank with a strong credit rating. However, the guarantee must also be sent to a local bank for authentication and advising.

By leveraging OCBC’s strong credit rating, you can fulfil your obligation to furnish the BGs, and quickly receive the advance payment after the BGs are delivered via authenticated SWIFT.

The many uses of a BG (and how it can benefit your business)

BGs can be used for various purposes to satisfy the commercial intentions of the parties. This however depends on how the agreement is negotiated. Banks like OCBC play an important role when negotiating BG terms as we seek clear and unambiguous terms that are equitable, and balance the interest of both the applicant and beneficiary.

Because BGs are so versatile, they are often referred to by many different names, depending on their specific use. Here are a few examples of a BG and Standby Letter of Credit (SBLC) in their many forms and uses. Please note that the term “guarantee” and “bond” are often used interchangeably.

As you can see, BGs are a versatile instrument with many applications. This makes them highly sought-after as a trade instrument.

The primary benefits of a BG are:

- Opening up business opportunities

A BG issued by a reputable and trusted bank, with strong credit standing provides the assurance that the beneficiaries need when they are dealing with an unknown seller or buyer for the first time. When the seller can procure the type of BGs from a reputable and trusted bank, it immediately puts them in good standing with the new customer. Of course, working with a bank which cares and takes the time to understand the commercial interest of the parties and your relative bargaining position in the negotiation is crucial to you speedily coming to an agreement with your potential new customer. - Improved working capital

Once you are able to secure a BG facility, you can review all your contracts for which you had placed a security deposit on. This includes the cash security deposit for the rental of your company’s premises. You can then get your landlord to issue a Rental BG in lieu of the security deposit. After which, the security deposit will be released to you for working capital purposes. - Ease of claim

Let’s go back to illustrative scenario #1. If you are the beneficiary and wish to have peace of mind and ease of claim on a bank in Singapore, you can ask for an inward counter guarantee to be issued in favour of your banker. Your bank will then manage all the effects of foreign law and lack of credit ratings, and assure you the right to make your claims in Singapore. This is particularly critical during the pandemic as document delivery is unpredictable due to the lockdowns in various countries. - Tapping on the bank’s extensive network

When you sell your goods overseas, your customers may prefer to receive your Performance Guarantees through their local bank. This is because, even though OCBC might be acceptable as the bank issuing the BGs, your beneficiary may want to ensure that the BG is genuine with their trusted banker instead.

However, if the beneficiary requires the BG to be issued by a bank domiciled locally or under the supervision of their National Regulators, OCBC will then have to arrange for a bank in your beneficiary’s country to issue the BG. Currently, OCBC has offices in 15 countries, plus local expertise to issue the guarantees are subjected to local governing laws, and honour the payment in local currencies. We will also be able to advise you on the requirements for local law guarantees, avoiding any unnecessary risks.

For countries where OCBC does not have a presence, we have lined up an extensive network of partner banks to assist OCBC clients to issue local guarantees. These guarantees are denominated in the local currencies and issued in over 150 countries, in their local languages.

This is known as an outward “indirect BG” where OCBC does not issue the BG directly to the beneficiary but requests another bank to do so instead. Customers need not establish an account or relationship with these overseas banks. They can simply go through OCBC, and we will handle the rest.

How to apply for a BG or SBLC with OCBC

For OCBC customers, all it takes is these 3 simple steps to get a BG or SBLC.

- Tell us whether you are a seller or buyer, whether you are receiving a BG or need to furnish a BG, and whether your counterparties prefer a BG or SBLC.

- Give us the details of your transaction, currency and amount, validity period, the prescribed format, and the requirements of the Issuing Bank.

- Contact our trade customer service or a relationship manager to make prior arrangements for a BG facility or if you’re agreeable to provide a cash deposit as consideration.

- Download and fill out either the BG application form or the SBLC application form if you’re requesting OCBC to issue a direct or indirect BG or SBLC.

For SBLCs, you will also have to fill out a separate cash margin authorisation form. If you’re expecting to receive a BG or SBLC and would like OCBC to issue the BG or confirm the SBLC, do check with us first for availability of limits on the Issuing Bank. - If the beneficiary did not prescribe any format, please download OCBC’s standard BG or SBLC format, and make sure you show it to the beneficiary to get their acceptance, before instructing OCBC to issue it.

- Submit all the documents via email to BusinessBG@ocbc.com.

After your submission, one of our friendly representatives will give you a call by the next working day. As the collateral is already provided via a fixed deposit or cash margin account, all applicable fees and charges will be deducted automatically, saving you the hassle of manual payments.

Let OCBC’s Trade Finance Services help you grow your business

Opportunities always exist even in volatile times. Whether you’re at home or abroad, OCBC Trade Finance is here to give you the tools you need to seize those opportunities and grow your business while giving you more control over your working capital.

Discover all our available trade solutions or drop by your nearest Trade Service Centre and speak to one of our representatives in person.

Disclaimer

You may be directed to third party websites. OCBC Bank shall not be liable for any loss suffered or incurred by any party for accessing such third party websites or in relation to any product and/or service provided by any provider under such third party websites.

The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about: