What SMEs must know about invoice financing (sales)

What SMEs must know about invoice financing (sales)

There is a saying in business that revenue is vanity, profit is sanity, and cash flow is reality. Every business owner intimately understands this and is aware that there can be a big and lengthy gap between revenues and cash flow. This is especially so when you have customers who demand “generous” payment terms.

Enter invoice financing (sales). It allows SMEs to bridge the gap between revenues and cash flow by pledging their unpaid invoices to the bank in return for an immediate cash advance. This advance amount is a percentage of the invoice amount, which is usually between 70% to 90%. The duration will also match the invoice’s maturity, which can span anywhere from weeks to months, and the borrower will have to repay the advance as a lump sum.

Before we get started, please note that invoice financing (purchase) is a separate type of facility that allows you to finance the payments of your suppliers’ invoices instead. To learn more about invoice financing (purchases), check out this article.

Now, let’s see how your business can benefit from invoice financing (sales).

The first thing to check is if you have the type of business that can benefit from invoice financing (sales). The main characteristic of such a business is that it has a significant amount of assets “locked up” in receivables. If receivables make up a very high percentage of your current assets, perhaps because of overly lengthy payment terms, you might run into working capital issues.

If this accurately describes your business, then you are in the ideal position to take advantage of invoice financing (sales).

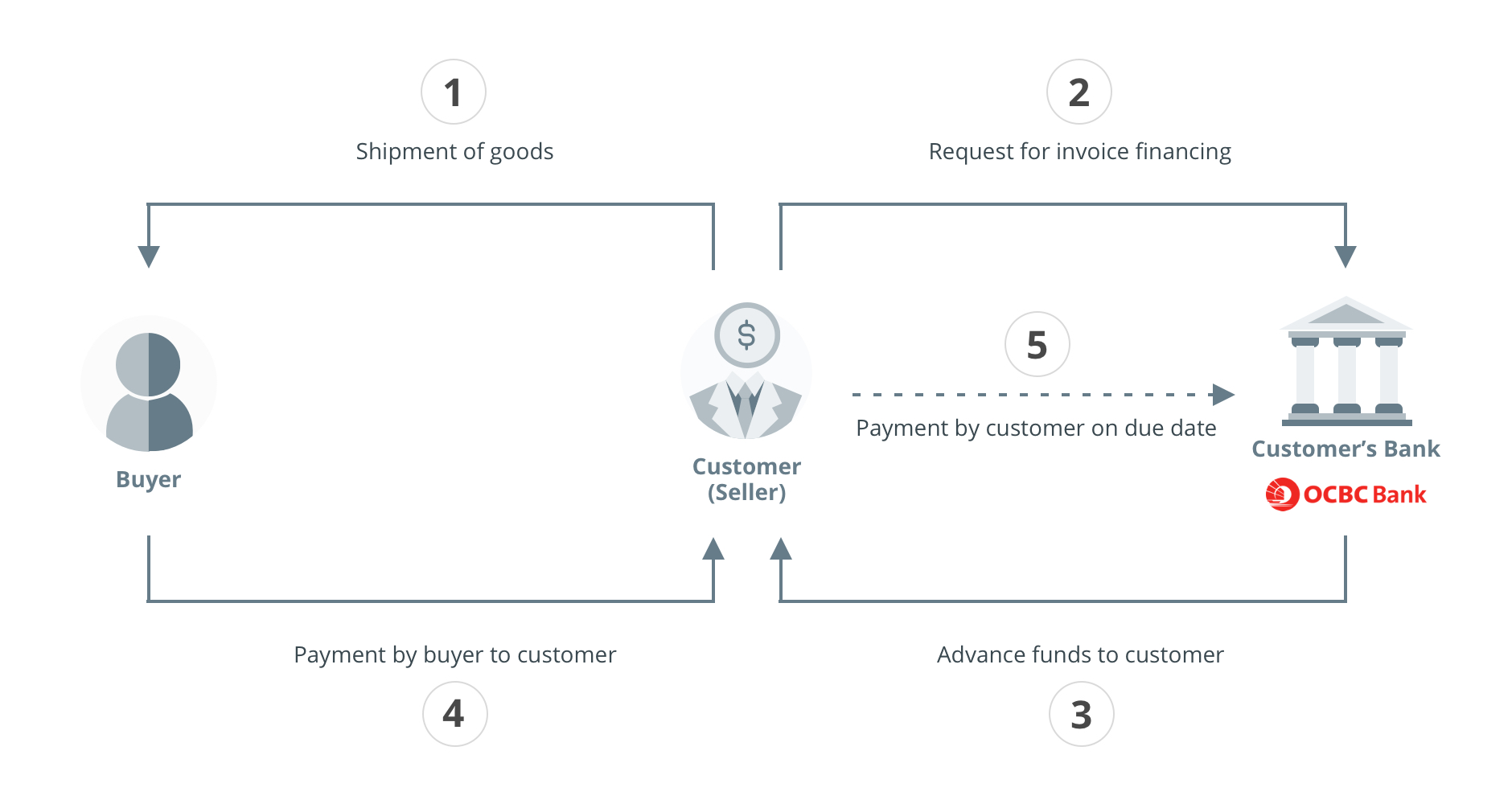

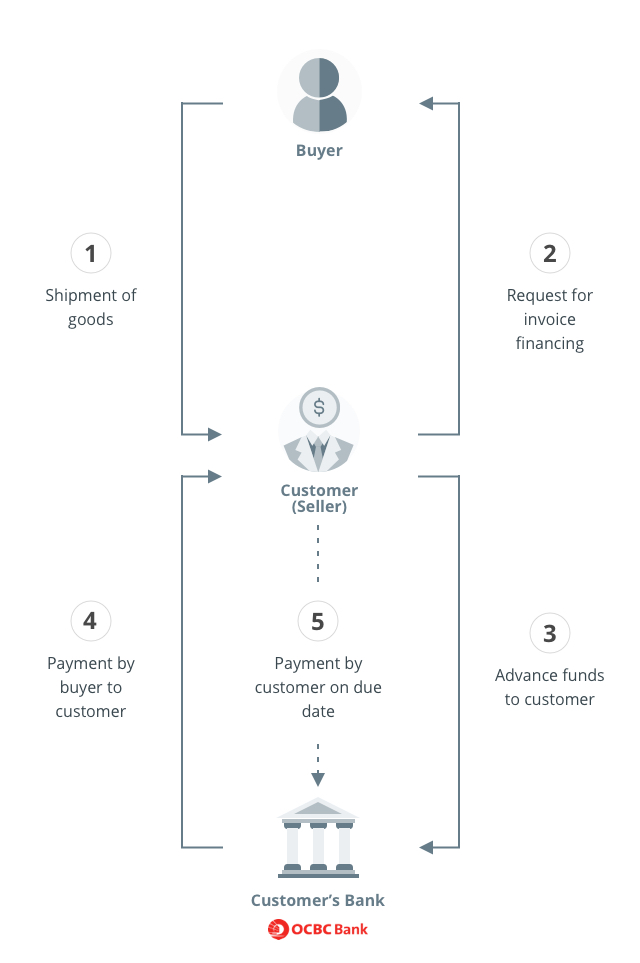

Invoice Financing - Sales

A facility where the bank provides financing for open account sales transactions by advancing funds to the seller prior to the receipt of proceeds from the buyer on due date.

The 3 business benefits of invoice financing (sales)

Depending on the specific nature of your business, some of these benefits might apply more than others. But generally, invoice financing (sales) is beneficial because:

- You can access immediate cash flow and speed up the working capital cycle

The longer your invoices take to get paid, the longer your working capital cycle will be. Invoice financing (sales) allows you to shorten that cycle, which will help you boost efficiency and free up cash for more productive uses. Because invoice financing typically has very fast processing times, you can access the cash flow almost immediately. - You can confidently offer longer payment terms

Many businesses turn to invoice financing because of inflexible payment terms. But another way of looking at it is that invoice financing (sales) empowers you to offer your buyers a more generous payment term, knowing you can convert it into cash well before the due date. This will then allow you to target larger and more established businesses that typically prefer more favourable payment terms from their suppliers. - The financing amount scales along with your business

As your business grows, so will the size of your receivables, and the amount of financing you will be able to get. Invoice financing (sales) hence gives you access to a quick source of capital that automatically ramps up with your business, helping you create a positive feedback loop to spur even more growth.

Invoice financing (sales) can bring numerous benefits for the right type of business. But like any financing tool, it must be used wisely. Before applying for invoice financing (sales), SMEs should keep in mind a few factors.

3 considerations when using invoice financing (sales)

When taking any sort of financing, businesses must be aware of the risks going in. In the case of invoice financing (sales), the 3 main things to consider beforehand are:

- You still face collection risk

Although the invoice amount will more than cover the financing amount, you still face the risk that your customer may be unable to settle the invoice on time for whatever reasons. This exposes you to potential financial penalties from delayed payments or having to cover the full amount yourself. - You cannot seek financing against the same invoice multiple times

Because invoices act almost like a kind of “collateral” in this type of financing, you are limited to only one financing per invoice. - You should carefully consider your overall borrowings

Although invoice financing (sales) is often thought of as cash in advance, it is still a type of borrowing. Hence, you must be careful not to become overleveraged.

If you are aware of the risks of invoice financing (sales) beforehand, you will have a great chance of benefiting from this versatile financing service.

So the next question is, “what do I need to know about the invoice financing (sales) process?”

Interpreting invoice financing terminology

Before diving into the process, it is important to understand the meanings behind the various jargon you will encounter along the way. The five key terms to understand are:

- Financing amount: Expressed as a percentage of the invoice value, typically between 70% to 90%

- Financing tenure: The duration before the financing amount must be repaid (as a lump sum comprising principal, interest and fees).

- Fee: There is often an upfront fee upon a successful application, usually a percentage of the invoice value. At OCBC, we charge a minimal fee of just 0.25% or S$100 (whichever is higher).

- Disbursement period: The time it takes from application to when you receive the cash. This varies from bank to bank.

Now that you have grasped the relevant terminology, the next part is to understand each step of the process, from application to final repayment.

Invoice financing (sales) application process

A key advantage of invoice financing (sales) is quick access to capital. As such, the application process should also be quick and easy. Here is how you can apply for invoice financing (sales) with OCBC.

- Drop us a note at trade@ocbc.com to discuss your trade financing needs, and to apply for a credit facility.

- Upon successfully applying for a credit facility, submit your invoices and supporting documents online via Velocity@OCBC.

- Upon a successful drawdown, your funds will be credited into your account within 5 working days and you’ll receive an instant notification.

- Repay the financing amount on the maturity date.

Manage your working capital better with OCBC’s Trade Finance Services

At OCBC, we offer a variety of trade finance services specifically designed to meet the needs of our SME clients and you. From invoice financing to bank guarantees and letters of credit, we have you covered. See all our trade solutions or drop by your nearest Trade Service Centre to find out more.

Disclaimer

You may be directed to third party websites. OCBC Bank shall not be liable for any loss suffered or incurred by any party for accessing such third party websites or in relation to any product and/or service provided by any provider under such third party websites.

The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about: