4 things Business Owners should consider doing in 2020, to prepare their company for a post-pandemic world

4 things Business Owners should consider doing in 2020, to prepare their company for a post-pandemic world

For many business owners in Singapore, 2020 has likely been one of the most challenging years in recent times. Companies in specific industries such as tourism and F&B have probably seen the impacts of it, given the two-month circuit breaker and safe distancing measures required.

However, even companies outside of these industries have been badly affected too. At the very least, adjustments will need to be made for offices to adhere to these safe distancing measures.

As business owners, it’s important to remember that adapting is part and parcel of business building. Even if COVID-19 did not happen, businesses would still need to evolve anyway. And while 2020 has not been a good year for businesses, we can make some changes today to better prepare ourselves for a post-pandemic world.

#1 Adopt PayNow for your business

As a Singapore-based business, you should adopt the use of PayNow for Business if you haven’t already done so.

With more than 2.8 million users, PayNow is already the most widely used cashless payment system in Singapore and would likely grow. One can argue that it ranks only behind cash and cards when it comes to the most popular payment method in Singapore.

And in a post-pandemic world, customers will prefer contactless payment methods. PayNow is perfect for this if you are running a consumer-facing business such as an F&B establishment.

Even if you are a B2B company, it makes sense to have PayNow for your business. On top of giving vendors an additional payment option, it is also more convenient as compared to sending cheques during this period.

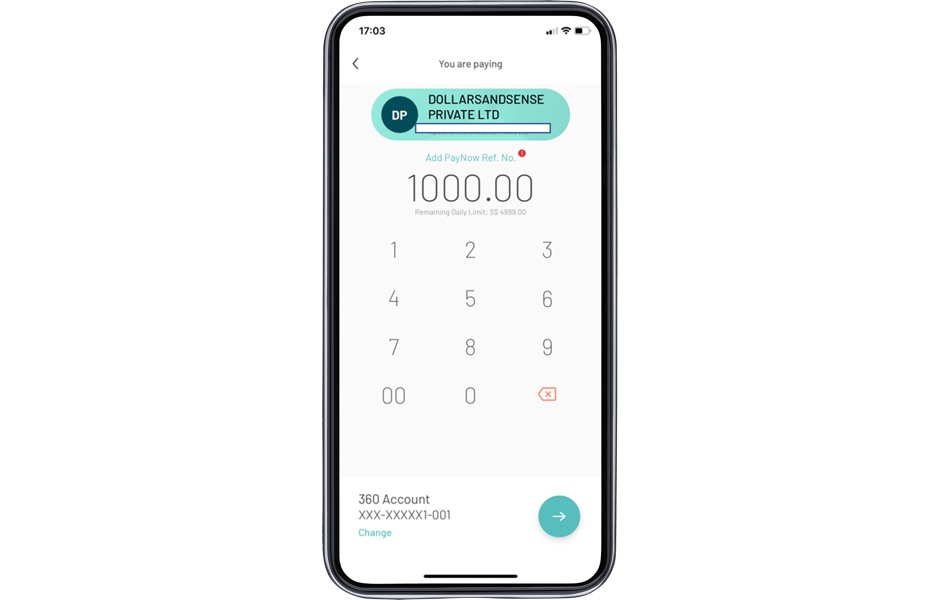

Furthermore, you can include QR codes in your invoices and have your partners scan and pay you instead. For example, if our business partners scan the QR code in the invoice we sent them, they will see that they are paying DollarsAndSense. This is faster, safer and funds are received immediately.

As a bonus, the government is also using PayNow to disburse funds to companies from various schemes, such as the Jobs Support Scheme.

Registering for PayNow for your business can be done quickly and entirely online. Simply sign up for PayNow through your business account’s bank. Log in to the respective online business banking website or app to do so.

If like us, you are an OCBC business banking user, you can register your business account for PayNow via Velocity@ocbc or on your OCBC Business Mobile Banking app. Then link your account to your company’s Unique Entity Number (UEN)

#2 Take a business loan, even if you don’t need to

For many SME owners who have run their companies well using internal cash flow or personal savings, taking a business loan may be something that they are not comfortable with. This is perfectly understandable.

However, business loans have a place in the business world and can provide numerous advantages for companies that can wield it correctly and responsibly. For example, business loans can help ease short-term cash flow challenges, allowing business owners to focus on profitable long-term decisions instead.

Similar to finance, credit history is important when applying for a business loan. Lenders prefer borrowers who have already shown a strong track record of making timely repayments for their previous loans. Unfortunately, a first-time borrower is not considered a likely good borrower.

Even if you do not need an urgent loan, 2020 might be a good reason to just take one up anyway. Because from now till 31 March 2021, eligible SMEs in Singapore can tap into the Temporary Bridging Loan. This government-assisted loan helps local companies ease their short-term cash flow challenges with access to working capital at a low cost.

Even though it’s a collateral-free loan, interest rates are exceptionally low because of the government’s support, at potentially 3% or less. This is an excellent time for businesses to build up their credit history at a low cost, which will help them to access funding easily in the future.

#3 Work from home or office

While there have been discussions in the past about remote working, this has never been adopted widely in Singapore until circuit breaker. Since then, most companies, which were previously not comfortable with letting employees work from home, have adopted it.

As a business owner, if you are in a position to allow your employees to work from home, you might want to continue this arrangement. For a start, there will be tighter rules governing safe distancing measures for offices in the future which can result in an unhappy environment.

Furthermore, if your employees have already adopted good work-from-home habits, getting them to return can result in lost productivity.

#4 Reconsider what your ideal office looks like

Depending on your decision on whether your employees will be working from home, you will have to reconsider your ideal office for the future.

For example, companies that previously intended to expand their team, may no longer find it necessary to get a bigger office space, if they are looking to adopt a partial work’from’home arrangement.

For companies that intend to have their workers return to office, business owners will need to reconfigure a new ‘ideal’ office layout to ensure their employees comply with safe distancing measures.

This could mean giving up previously valued common areas such as a hotdesking space, in favour of more personal space per employee. Traditional office cubicles may also be reintroduced again.

Disclaimer

You may be directed to third party websites. OCBC Bank shall not be liable for any loss suffered or incurred by any party for accessing such third party websites or in relation to any product and/or service provided by any provider under such third party websites.

The information provided herein is intended for general circulation and/or discussion purposes only. Before making any decision, please seek independent advice from professional advisors. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake any obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation on the same.

Discover other articles about:

Digitalise your business today

Explore a range of useful digital solutions to help your business buy, sell and operate better.