GREATASSURE ENDOWMENT INSURANCE

Get potentially higher returns with capital guarantee upon maturity

Safe just got interesting with GREATAssure Endowment Insurance.

Because it does not just guarantee 100% of your capital back upon maturity. It even earns you up to 3.01% a year. This is not a fixed or savings deposit, but a non-participating endowment insurance plan.

Potential upside to grow your wealth

Earn potentially higher returns of up to 3.01% a year upon maturity.

Earn potentially higher returns of up to 3.01% a year upon maturity.

100% capital guaranteed upon maturity

Be assured that your capital is 100% guaranteed when the policy matures, regardless of market conditions.

Be assured that your capital is 100% guaranteed when the policy matures, regardless of market conditions.

Guaranteed acceptance

Hassle-free application without medical underwriting.

Hassle-free application without medical underwriting.

Short premium payment term

Pay yearly premiums only for the first 5 years of the 10-year policy term. The Guaranteed Survival Benefit will pay off 100% of the annual premium for the remaining 5 years if the insured person survives. What is more, get a 2.5% premium discount if you make a lump sum upfront payment.

Pay yearly premiums only for the first 5 years of the 10-year policy term. The Guaranteed Survival Benefit will pay off 100% of the annual premium for the remaining 5 years if the insured person survives. What is more, get a 2.5% premium discount if you make a lump sum upfront payment.

Insurance coverage

Receive coverage for death, terminal illness (TI), and total and permanent disability (TPD) throughout the policy term.

Receive coverage for death, terminal illness (TI), and total and permanent disability (TPD) throughout the policy term.

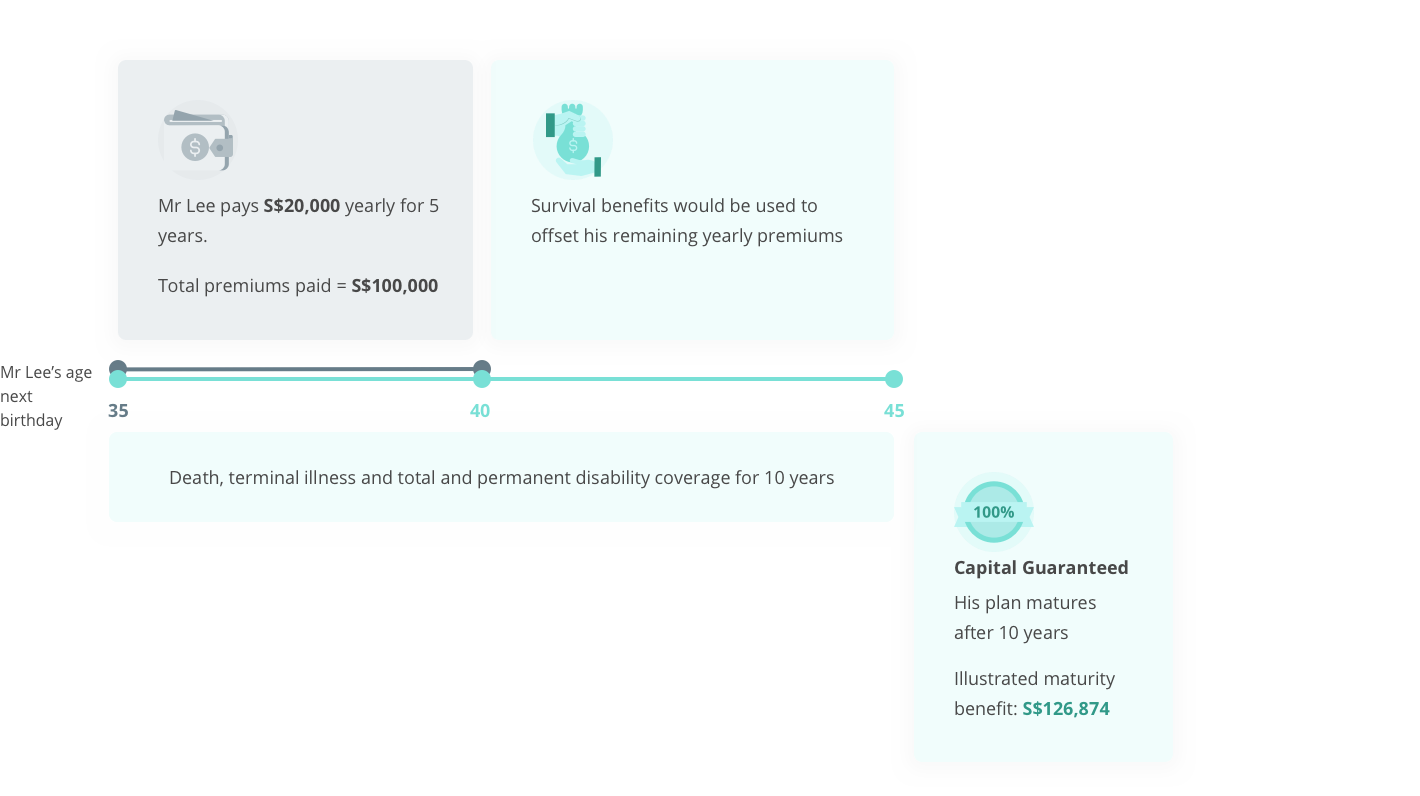

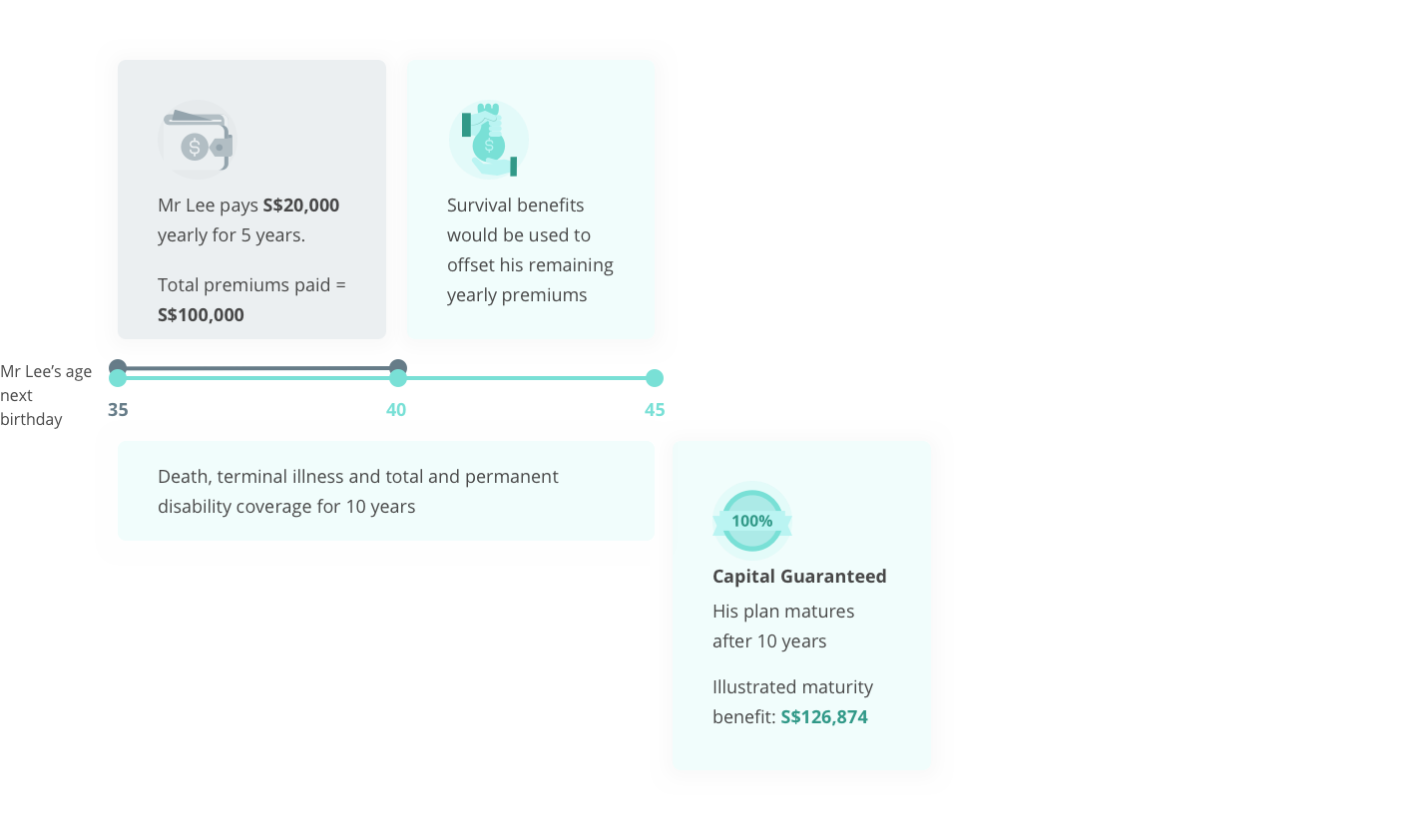

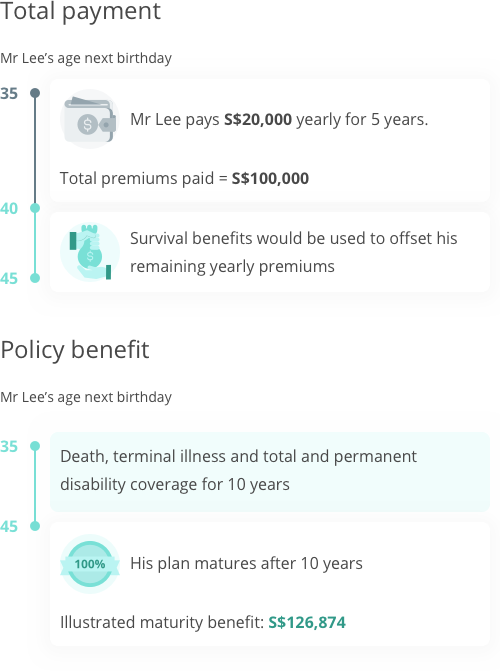

Mr Lee’s Profile:

35 years old (age next birthday)

Non-smoker

He buys GREATAssure Endowment Insurance with a yearly premium of S$20,000.

Mr Lee’s capital of S$100,000 is guaranteed at the end of 10 years in the event of market downturn.

Capital is guaranteed upon maturity, provided no withdrawals are made. The figures used are for illustrative purposes only and are rounded to the nearest dollar. Please refer to the policy illustration for the exact values. The maturity benefit is based on an illustrated crediting rate of 4.75% a year. Based on an illustrated crediting rate of 3.25% a year, the maturity benefit will be S$113,160 and the illustrated yield at maturity will be 1.55% a year. The actual benefits payable are dependent on the actual crediting rates and charges, as well as the amounts of any miscellaneous debts and partial withdrawals made. The crediting rate is non-guaranteed and is dependent on the future performance of the non-participating fund.

Eligibility requirements

Age (next birthday)

Exactly 1 month old to 65 years old

Terms and conditions

Important notices

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

or contact us at +65 6722 2293

Operating hours are from 9am to 6pm, Monday to Friday (Excluding public holidays)

Important notes

GREATAssure Endowment Insurance is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies. All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 14 February 2020.