Do you have passive income?

Do you have passive income?

Earning passive income in your retirement years

Planning for your retirement can be more than just accumulating enough to last you through the years. It can also be about building a reasonable collection of investments that yields cash flow at regular intervals, be it quarterly, semi-annually, or annually, without having to sell the investment.

Passive income is technically the money that continues to come in with almost no additional effort on your part. Creating an income-generating portfolio takes time and planning, as you build and complement your investments over your working lifetime, such that it results in predictable pay-outs down the road.

Some of the more common sources of passive income include:

-

Dividends: Some companies pay their shareholders dividends, which is a portion of the company’s profits, at regular intervals. This dividend payment is similar to profit sharing, as you get a portion of what the company has made. Most often, the dividend is paid in cash though some companies may give you the option to reinvest the dividend and own more shares. You can choose to reinvest the dividend if you are not in need of cash at that point in time.

Blue-chip companies, like Singapore Press Holdings (SPH), have a long dividend payment history.

SPH’s latest dividend payout was S$0.07 per share in May 2016, which gives you a dividend yield of 1.81 per cent at the prevailing price of S$3.86, or $70 for 1,000 shares.

An alternative for this sort of income stream is Real Estate Investment Trusts or REITs.

REITs are collective investment schemes, consisting of a portfolio of income generating real estate assets such as shopping malls, offices, hotels or serviced apartments. They are professionally managed and usually established with a view to generating income for investors.

Individuals invest in a REIT by purchasing units of the trust, similar to shares of a common stock. Unit holders then receive dividend income, usually from rental income, and capital gains from the profitable sale of real estate assets.

-

Bonds: When you invest in bonds, you essentially lend money to an organization. Until the bond matures, you will receive regular coupon payments similar to earning interest on a loan. When the bond’s term expires, you receive the face value of the bond which you can then re-invest in another bond if you want, and continue to receive interest as a source of income.

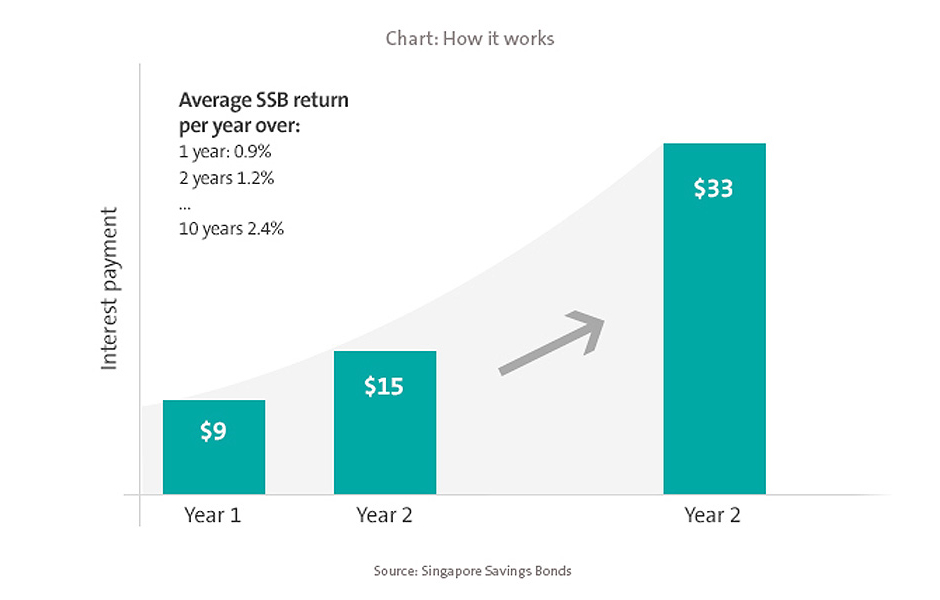

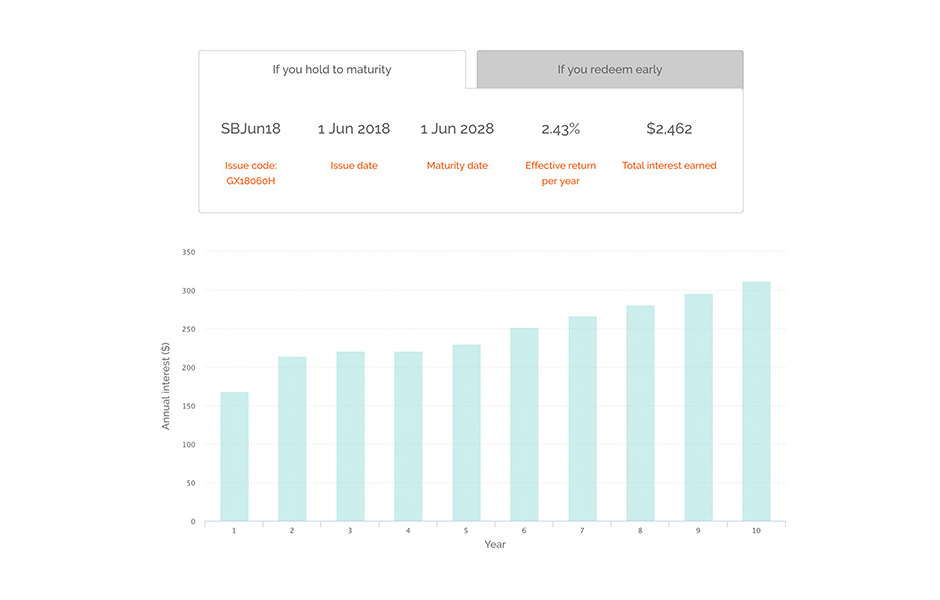

Singapore Savings Bonds are tax-exempt bonds that are fully backed by the Singapore government, which means you are assured of your investment amount back in full with no capital loss. You can start with as little as S$500 and earn step-up interest on your savings while having the flexibility to access your funds within a month. If you hold your Savings Bond for the full 10 years, your return will match the average 10-year Singapore Government Securities (SGS) yield the month before your investment. In the last 10 years, the 10-year SGS yield has been between 2 per cent to 3 per cent most of the time.

Using calculators available at their official site, we came up with the following example for a modest investment sum of S$10,000 held till maturity:

-

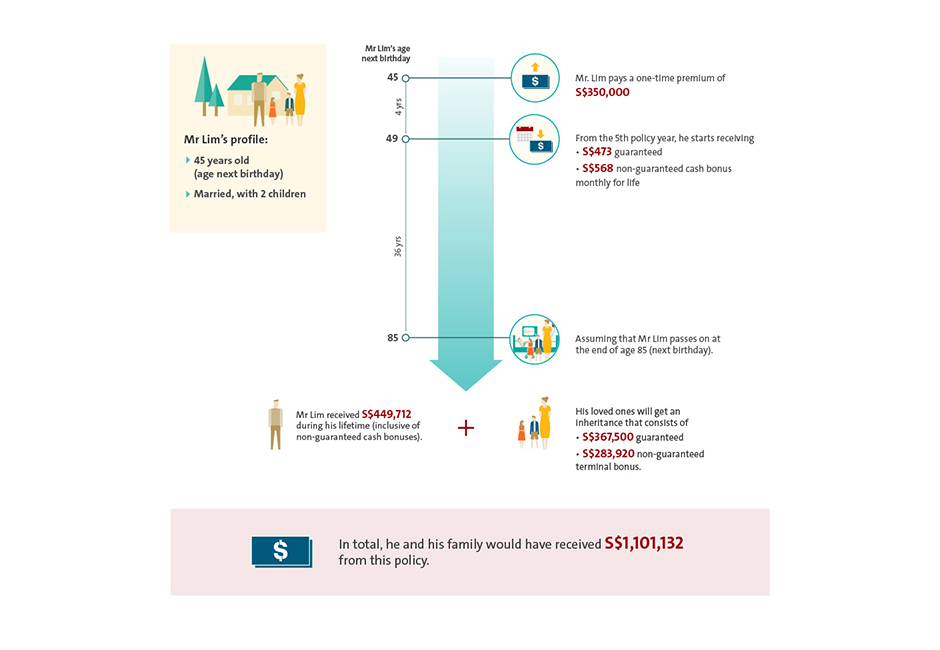

Annuities: It is a type of life insurance policy, whereby premiums may be payable as a lump sum or through regular payments for a fixed period of time. A regular monthly income becomes payable upon retirement, and is payable until death.

An example using PremierLife Generation:

-

Rental Income: Purchasing a property and renting it out to earn rental income. However, this may not be for everyone in view of the expenses involved in owning a second property in Singapore, such as maintenance charges and property tax, in addition to the stamp duty when you buy the property.

On a smaller scale, if you have an empty nest syndrome, you could consider renting out a room or two in your home. This may be a little risky, as you are allowing strangers into your home, but the advantage is that you are not incurring extra expense on the property, which may already be paid for by the time you retire.

There are new house-sharing services too, such as Airbnb, which let those living in private homes offer a room – or the whole house at a time – to travellers who need a place to stay. While still in an exploratory stage, renting out a room for $50 each night under this scheme can earn you $1,500 each month in passive income. There may be some cleaning expense involved after each guest leaves, but this is likely to be a fraction of the income earned.

It is possible to use a combination of all three or four options provided above, building your portfolio, continuously adding to it and reinvesting the returns until you reach a point where you have accumulated enough to be able to survive an entire year on the annual returns of your passive income.

How to start?

It is always better to start early, and in stages, as you may not have sufficient capital to invest in all options available to you at once.

It is also important to ensure that you diversify your investment across various asset classes. Check what your risk tolerance is, as a company could default on a bond for example, or be shut down, thereby depriving you of your dividends. Ensure that whatever capital you may lose in such an event is tolerable to your risk appetite.

You could adopt a dollar cost average strategy to invest in dividend paying stocks, so that you build up your position in the company gradually, over time. Work out how much money you can set aside for this strategy each month so that you avoid paying a lump sum upfront to purchase the entire stock.

You could also invest in income-oriented funds that have a collection of dividend-paying stock and bonds, so that you minimise any risk to your investments.