Save and download your plan

If you would like to keep a copy of the plan you made, please provide your details to us.

This Lunar New Year, receive 1.80% a year or a Disney’s Winnie the Pooh plushie when you top up an eligible OCBC savings account.

T&Cs apply. Insured up to S$100k by SDIC.

Enjoy exclusive Disney rewards when you bank with us! T&Cs apply.

Conveniently and securely exchange AUD, CAD, CHFNEW, CNH, EUR, GBP, HKD, JPY, NZD and USD, 24/7 via OCBC Digital, for your overseas transfer, travel payments, online spends, investments and more.

Reduce your taxable income by the same amount contributed to your SRS Account, with a maximum yearly contribution of S$15,300 for Singaporeans and Singapore PRs, and S$35,700 for foreigners.

The OCBC SeniorCare Programme empowers you through four key pillars: Health, Wealth, Lifestyle and Literacy.

Achieve your goals with proper financial planning.

Get data and insights into the financial wellness of Singaporeans.

Get rewarded for what matters: your salary, your lifestyle, and your smart savings habits.

From financial planning tools, investment options and insurance, our comprehensive array of solutions have been built to get you ahead in your every goal and ambition.

Fancy shopping at a bank branch or even enjoying a sushi meal there? At OCBC Wisma Atria, you can do all these and more – visit us to experience it firsthand!

With our suite of travel products and services, spend less effort managing your travel and more time enjoying life's journeys.

Plan

The current minimum retirement age is 62 under the Retirement and Re-employment Act

02 Mar 2019 08:10 PM

02 Mar 2019 08:10 PM

|

|

Please keep this copy for reference

|

Children's education plan document |

OCBC Life Goals – Children's educationYou have a shortfall of 626,875 SGD |

Children's educationgoal |

|

| Your daughter/son education will cost 760,656 SGD in 17 years' time | |

| Citizenship Citizenship | |

| Degree type | |

| Country | |

Declared savings and investments |

|

| Declared savings and investments set aside for Goal in SGD |

Important notes |

|

Company registration number: 193200032W Oversea-Chinese Banking Corporation Limited, 65 Chulia Street, OCBC Centre, Singapore 049513, Website: www.ocbc.com |

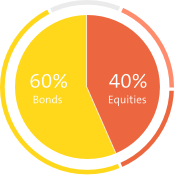

Endowments can help you build the stable foundation, and a unit trust portfolio adds flexibility and possibility to boost the return.

By combining these two products types, you can lower the risk while capitalising on market developments.

For purpose of this simulation, this amount will be assumed to be invested into a portfolio at a growth rate of 5%

| Name | Premium amount | Type |

|---|---|---|

|

-

|

-

|

By provision of your contact details, you consent for OCBC Bank to send Marketing messages related to the above content.

The information is intended for general circulation only. It does not consider the specific investment objectives, financial situation or needs of anyone. Before you make an investment, you should speak to a financial adviser who will assess whether the products are suitable to you based on your investment objectives, financial situation or needs. If you choose not to do so, you should consider if the investment product is suitable for you.

We are not making an offer, nor solicitation to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document.

| Name | Market value |

|---|

| Category | Amount |

|---|---|

| Food | SGD / mth |

| Utilities | SGD / mth |

| Travel |

SGD

|

| Others | SGD / mth |

| Total expenses | SGD / mth |

| Category | Amount |

|---|---|

| Rental income | SGD / mth |

| Allowance | SGD / mth |

| Payout from existing | SGD / mth |

| Others | SGD / mth |

| Total income | SGD / mth |

| Name | Market value (SGD) | Growth rate |

|---|

| Name | Investment amount (SGD) | Growth rate |

|---|

| Name | Premium amount | Years paid |

|---|

| Name | Premium amount | Years paid | Years to go |

|---|

You have seen how a potential investment could reduce your shortfall

Save and download your plan

If you would like to keep a copy of the plan you made, please provide your details to us.

Speak to us

If you would like to continue this conversation, leave us your contact details and our staff will reach out to you

Explore more

View some solutions that may help you reduce your gap. These include our Unit Trust model portfolio and Endowment plan

We will get your RM to contact you

Insurance product is provided by The Great Eastern Life Assurance Company Limited, a wholly-owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. Insurance product is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it. You may want to seek advice from a financial adviser before committing to buy the product. If you choose to not seek advice from a financial adviser, you should consider if the product is suitable for you. Buying a life insurance policy is a long-term commitment. An early termination of the policy usually involves high cost and the surrender value payable, if any, may be less than the total premiums paid.. This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product. We do not guarantee, represent or warrant that any of the information or to correct any inaccuracies. All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document. This document may be translated into the Chinese language. If there is any difference between the English and Chinese versions, the English version will prevail.

Inflation rate is based on a 10-year geometric average of the Singapore CPI.

Source: Statistics Singapore – Time series on CPI (2015=100) & Inflation Rate (Year 1980 to 2016)

Goal amountThis is the estimated amount required at retirement age to achieve your goal. It is calculated based on inflation adjusted expected expenses, net of expected income.

InvestmentsAll investments (E.g. Endowments, Unit Trusts) are assumed to be liquated at start of retirement.

Regular endowments upon maturity are invested in lump sum endowments with similar rate of return. For Unit Trust, the dividends are assumed to be re-invested.

Savings /Investment growth rateThe following growth rates have been used for each of the below savings/ investment types

This is the sum of the projected values of current value of savings / investments and regular savings / investments set aside for the goal using the respective growth rates.

The OCBC Education Planner is designed to illustrate potential future education costs based on information provided by you and does not consider your specific investment objectives, financial situation and particular needs. The illustration shall not be regarded as recommendation or advice by the Bank. The amount calculated is meant to illustrate combined tuition and living expenses based on the assumptions below. Actual cost may vary depending on economic conditions. The information and analysis provided by these tools are based on various assumptions, which are subject to change at any time without notice.

Number of years to universityThe age of university studies is assumed at 19 years old for girls and boys, except for Singaporean and Permanent Resident boys for whom the age of university studies is assumed at 21 years old due to 2 years of National Service commitment.

First-year average tuition costFirst-year average tuition cost is based on the average of latest first-year General and Medicine degree costs released by three sampled universities for each country:

For USA, Canada, UK, Australia and New Zealand, the amount is based on the figures available from Edupoll's study abroad website (www.edupoll.org).

For Singapore, this is based on the average of figures from three websites: NUS Office of Admissions (www.nus.edu.sg), NTU Undergraduate International Admissions website (admissions.ntu.edu.sg) and SMU International Students Useful Information (www.smu.edu.sg).

Inflation rateInflation rate for tuition and living costs is based on 10-year geometric averages published by the statistics bureau for each country:

Based on average exchange rates published by www.oanda.com using interbank +1%, from 1 Jan 2016 to 1 Nov 2017.

Goal amountThis is the estimated amount required at start of university age. It is calculated based on inflation adjusted tuition costs and living costs.

InvestmentsAll investments (E.g. Endowments, Unit Trusts) are assumed to be liquated at start of university.

Regular endowments upon maturity are assumed to be invested in lump sum endowments with similar rate of return. For Unit Trust, the dividends are assumed to be re-invested.

Savings /Investment growth rateThe following growth rates have been used for each of the below savings/ investment types

This is the sum of the projected values of current value of savings / investments and regular savings / investments set aside for the goal using the respective growth rates.

Any opinions or views of third parties expressed in this material are those of the third parties identified, and not those of OCBC Bank. The information provided herein is intended for general circulation and/or discussion purposes only. It does not take into account the specific investment objectives, financial situation or particular needs of any partifcular person. Before you make any investment decision, please seek advice from your OCBC Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs. In the event that you choose not to seek advice from your OCBC Relationship Manager, you should carefully consider whether the product is suitable for you. This does not constitute an offer or solicitation to buy or sell subscribe for any security or financial instrument or to enter into any transaction or to a participate in any particular trading or investment strategy.

A copy of the prospectus of each fund is available and may be obtained from the relevant fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in this fund. The value of the units in this funds and the income accruing to the untis, if any, may fall or rise. Please refer to the propectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

OCBC Bank, its related companies, their respective directors and/or employees (collectively ‘Related Perons') may have positions in, and may effect transaction in the products mentioned herein. OCBC Bank may have alliances with the product providers, for which OCBC Bank may receive a fee. Product providers may also be Related Persons, who may be receiving fees from investors. OCBC Bank and the Related Person may also perform or seek to perform broking and other financial services for the prodcut providers.

No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeless or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does undertake an obligation to update information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. OCBC Bank shall not be resonsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result or any person acting on any information provided herein. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance or countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future or likely performance. Any reference to any specific company, financial prodcut or asset class in whatever way is used for illustrative purposes only and does not consitute a recommendation on the same.

The contents hereof may not be reproduced or disseminated in whole or in part without OCBC Bank's written consent.

You are leaving the OCBC Bank website and about to enter a third party website that OCBC Bank has no control over and is not responsible for. Before you proceed to use the third party website, please review the terms of use and privacy policy of their website. OCBC Bank’s Conditions of Access and Privacy and Security Policies do not apply at third party websites.