You can subscribe to a Structured Deposits by visiting an OCBC Branch for a sales representative to assist you with your application, or through the OCBC app/Internet Banking.

STRUCTURED DEPOSITS

Stretch your investment with potentially higher returns

Invest online conveniently

OCBC is the first Singapore local bank which allows you to invest in Structured Deposits online conveniently

OCBC is the first Singapore local bank which allows you to invest in Structured Deposits online conveniently

Get started with just S$1,000

Start your investment journey from as little as S$1,000 - the lowest minimum investment amount for Structured Deposits available in the market today.

Start your investment journey from as little as S$1,000 - the lowest minimum investment amount for Structured Deposits available in the market today.

Payouts may be varied

In some cases, the interest payout may be linked to the performance of the underlying assets (e.g. equity, foreign exchange). If predetermined payout conditions are not met, you may not receive any interest payout for some or all interest payment periods.

In some cases, the interest payout may be linked to the performance of the underlying assets (e.g. equity, foreign exchange). If predetermined payout conditions are not met, you may not receive any interest payout for some or all interest payment periods.

2.5 Years Interest Rate Linked Structured Deposits

The new OCBC Interest Rate Linked Structured Deposits gives you a fixed interest every 6 months until maturity, unless an Early Termination Event occurs or the deposit is redeemed early. The mechanics are shown in the table below:

- Mechanics

- Tranche (as of 25th November 2025)

| Tranche (as of 25th November 2025) | ||||

| Mechanics | Tenor | 2.5 Years | ||

| Interest Period (each period is 6 months) | 1st and 2nd period | 1.30% | ||

| 3rd and 4th period | 1.31% | |||

| 5th period | 1.32% | |||

| Your principal is 100% protected and guaranteed upon maturity.* | ||||

*Initial investment amount will be returned if held to maturity and the bank remains solvent.

*Penalty fee will be imposed if cancellation is made after the end of subscription period.

Why invest in structured deposits with ocbc?

A Structured Deposits is not a Fixed Deposit. Here's a comparison table of the main differences:

See FAQs for the full comparison table.

Updated as of 10 October 2025.

Plus, a quick look at how we compare with other Structured Deposits offerings in the market.

|

|

Structured Deposits can be purchased using cash or Supplementary Retirement Scheme (SRS).

Important notices

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 25 July 2023.

Common questions

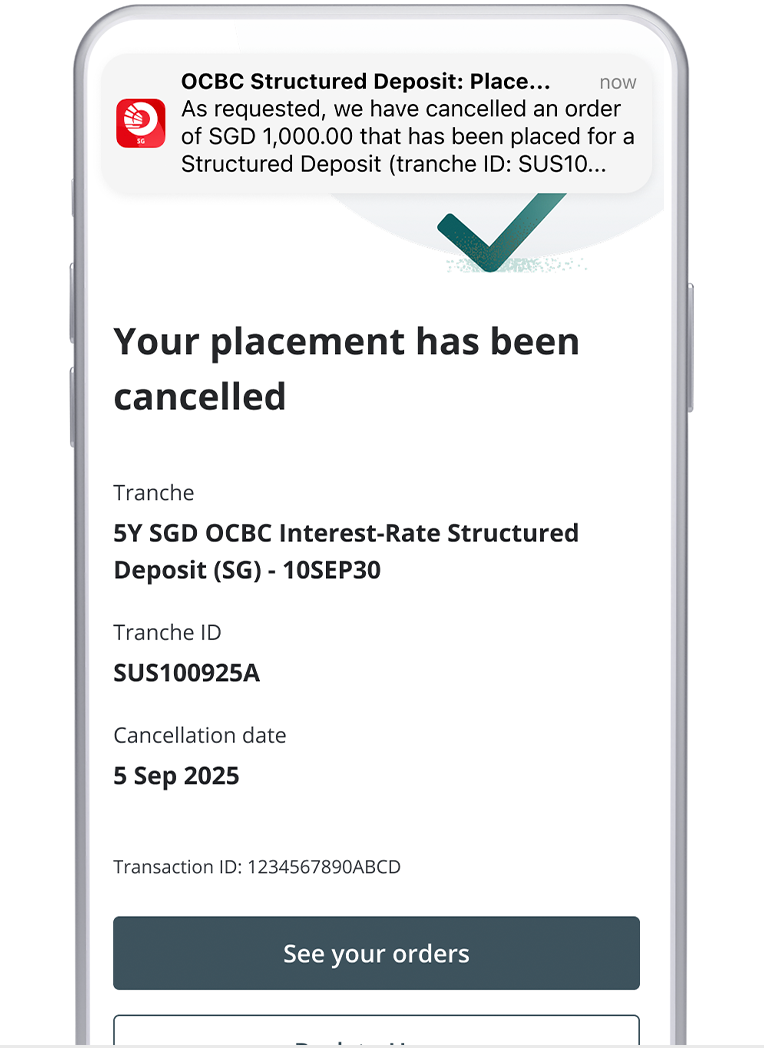

Before the end of the subscription period:

- You can cancel your Structured Deposits via the OCBC app or by going down to branch for a sales representative to assist you. The funds will be made available to you in the settlement account that you have selected once the cancellation has been submitted.

After the end of the subscription period:

- You may submit a withdrawal for your Structured Deposits by going down to branch for a sales representative to assist you, with a pre-mature withdrawal penalty fee incurred. The penalty fee can only be provided to you by the sales representative at the branch, at the point of your inquiry. The amount repaid may be zero or substantially less than the initial placement amount.

- We will process the instructions on your withdrawal, and funds will be made available to you based on the following weekly timelines.

| Date of submission of instructions | Funds availability in settlement account | Whether Friday is a Business day |

|---|---|---|

| By Wednesday 5pm | By Friday | Yes |

| By Tuesday 5pm | By Thursday | No |

While your Structured Deposits application may have been successfully submitted, there are several reasons why it could have been rejected upon further review:

| Tranche availability | Each successful launch will be contingent on the prevailing market conditions prior to the tranche start date. |

| Funding availability | If funds are unable to be debited from the settlement account that you have selected during application, we will not be able to proceed with Structured Deposit placement. |

| Account eligibility |

Please note that the following accounts are excluded for Structured Deposit settlement:

|

For all rejected Structured Deposits applications, we will be notifying you on the application outcome at least 2 working days before the tranche start date. You will be able to access the funds immediately which were previously set aside in your settlement account, once you have received the rejection notification.

For the full list of FAQs, please refer to this PDF.

Start investing in Structured Deposits today

For OCBC customers

To invest in Structured Deposits online, customers will need to have:

- An OCBC deposit account, and

- Login credentials for the OCBC app

Download the OCBC app to open an OCBC 360 Account instantly. If you do not have Singpass, you can apply at any OCBC bank branch with these documents

For Singaporeans and Permanent Residents:

- NRIC and an image of your signature

For foreigners:

- Passport

- Employment Pass (EP) or S-Pass or Student Pass

Initial deposit:

- S$1,000

Include any one of the following documents:

- Phone bill

- Half-yearly CPF statement

- Any bank statement

For new customers

Download the OCBC app to open an OCBC 360 Account instantly. If you do not have Singpass, you can apply at any OCBC bank branch with these documents

For Singaporeans and Permanent Residents:

- NRIC and an image of your signature

For foreigners:

- Passport

- Employment Pass (EP) or S-Pass or Student Pass

Initial deposit:

- S$1,000

Include any one of the following documents:

- Phone bill

- Half-yearly CPF statement

- Any bank statement

Alternatively, visit any OCBC Branch. Or get us to contact you at your convenience.

Please apply via OCBC Internet Banking (Login > Open an account > Savings) or visit any OCBC Bank branches.

Download nowTo invest in Structured Deposits online, customers will need to have:

- An OCBC deposit account, and

- Login credentials for the OCBC app

Open OCBC app

Continue to plan on the OCBC app

Appy for an OCBC 360 Account

General disclaimer

- Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

- This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

- Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

- If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

- We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

- No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

- OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

- Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

- Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

- The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

- OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

- You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

- Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

Structured Deposits is not an insured deposit for the purposes of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011

Structured Deposits disclaimer

- Structured Deposits are not insured deposits for the purposes of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 of Singapore.

- Unlike traditional deposits, Structured Deposits have an investment element and returns may vary. The initial investment amount of a Structured Deposit will be returned to you only if you hold it until the maturity date. Early withdrawal of Structured Deposits may result in you receiving significantly less than your initial investment amount. You further understand that you will bear any costs and charges associated with such early withdrawal of the Structured Deposits. OCBC Bank may have the right to terminate the Structured Deposits and return an amount in cash to you from the due settlement of the Structured Deposits before the maturity date. You may be exposed to inherent exchange rate risks and exchange controls when you place a Structured Deposit.

- You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should carefully consider whether this product is suitable for you.

- The proposed transaction(s) herein (if any) is/are subject to the final expression of the terms set forth in the definitive agreement(s) and/or confirmation(s).

- Any forecast on the economy, stock market, bond market and economic trends of the markets provided is not necessarily indicative of the future or likely performance of the Structured Deposit.

- Any past performance of the Structured Deposit, or that of its underlying financial instruments or assets provided to illustrate possible returns of such Structured Deposit, is not necessarily indicative of future performance of such Structured Deposit.