- Mortgage insurance specifically takes care of your mortgage in the unfortunate event of your death, total and permanent disability or terminal illness, so that your loved ones will not have to continue paying off the mortgage.

- Mortgage insurance covers the outstanding loan amount approved by the bank or chosen sum assured, whichever is lower.

- The coverage from other insurance products could be for various purposes, such as taking care of hospitalization and medical expenses, or income protection, savings, or retirement needs for you and your family.

Group Mortgage Insurance

Safeguard your home with Group Mortgage Insurance

Do not let your home become the greatest liability for your family.

Group Mortgage Insurance takes care of your outstanding home loan in the unfortunate event of your death, terminal illness or total and permanent disability.

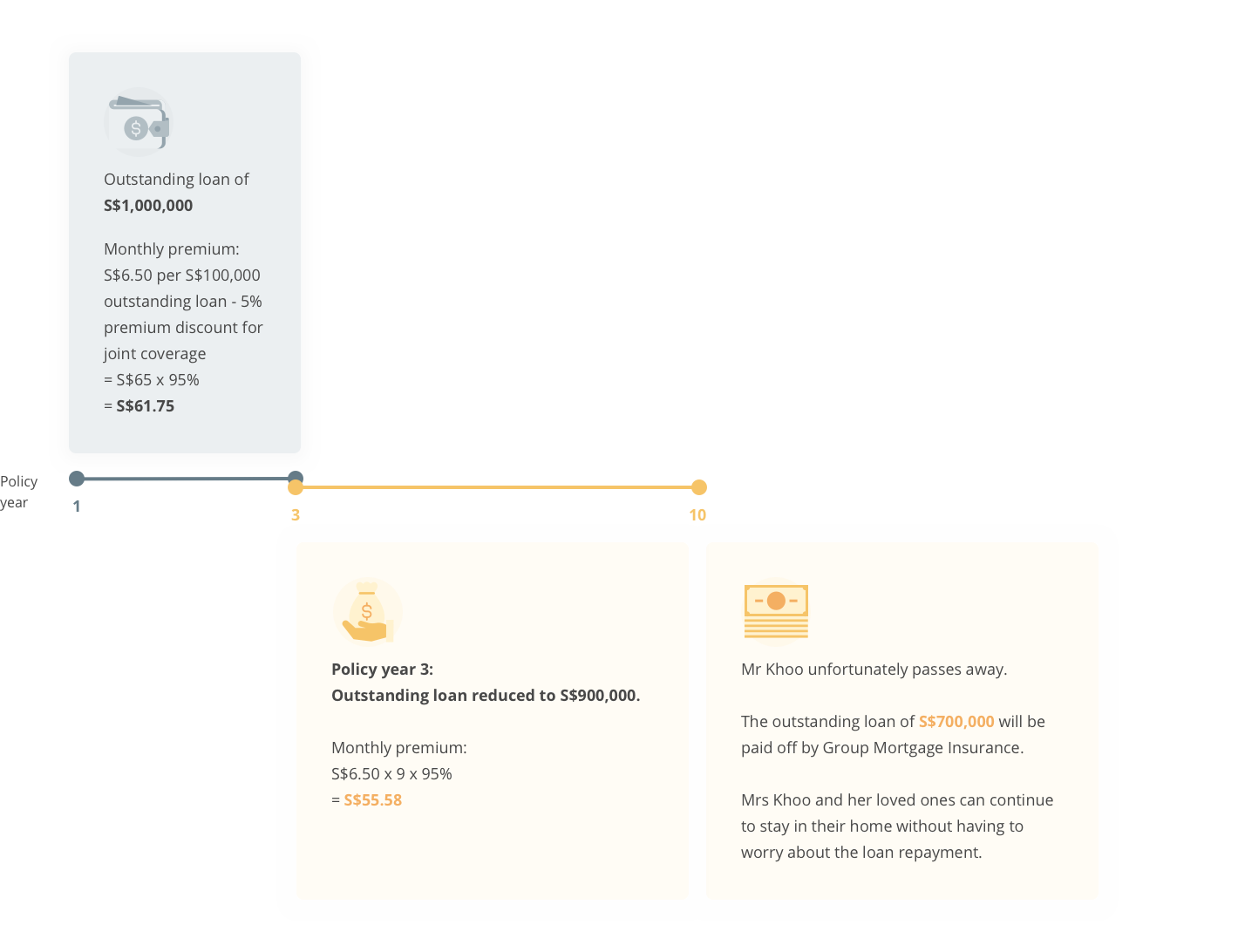

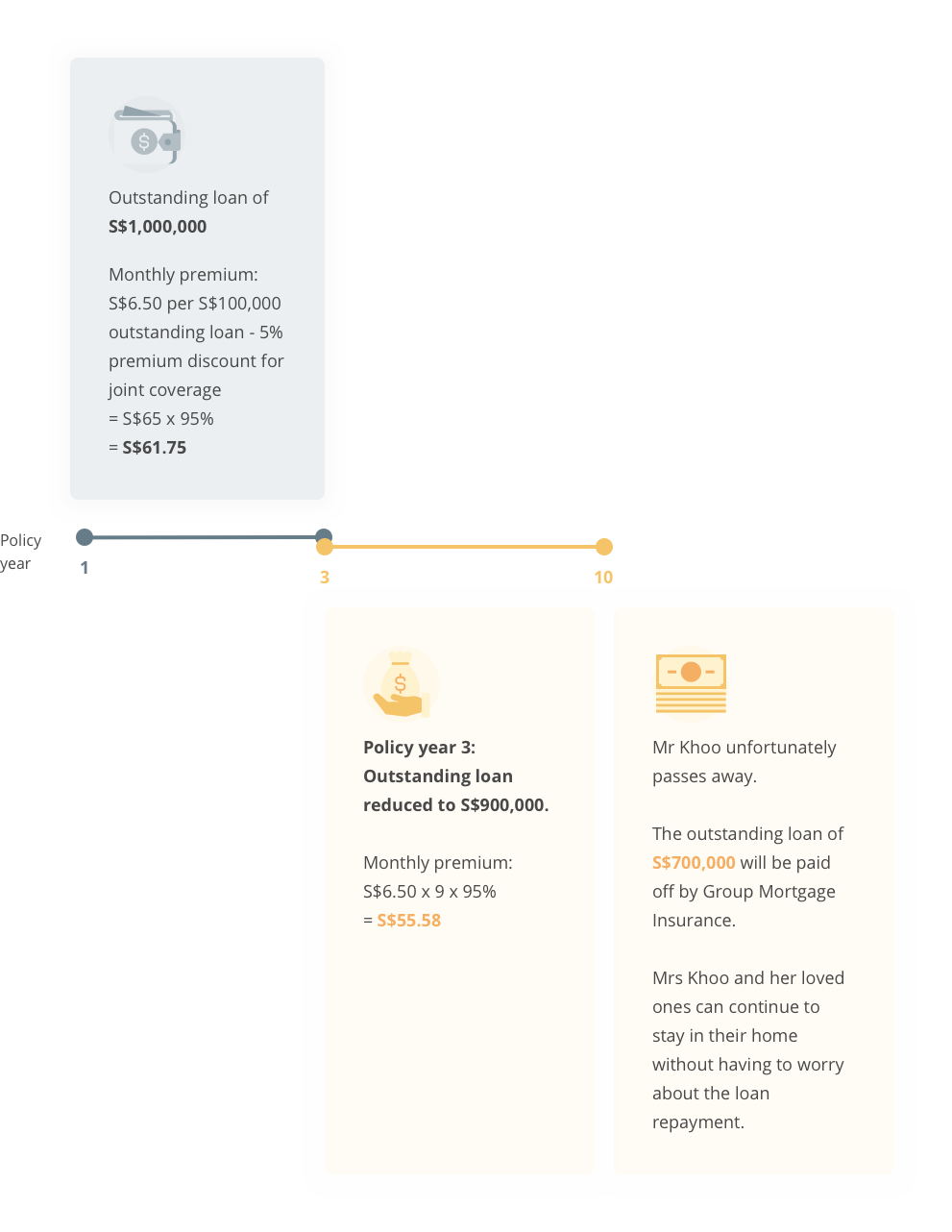

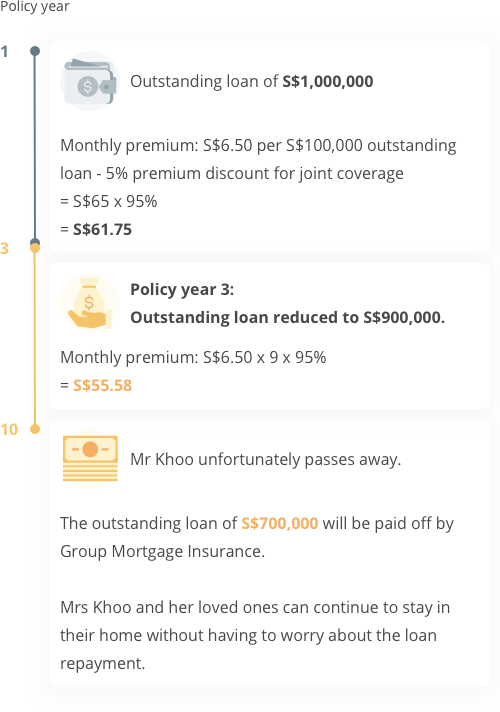

Affordable premiums

Your premiums will automatically be adjusted every year as you are paying off your home loan.

Your premiums will automatically be adjusted every year as you are paying off your home loan.

No medical underwriting

Applicable for mortgages up to S$1.25 million.

Applicable for mortgages up to S$1.25 million.

Insurance coverage is portable

Portable after 3 years, ensuring that you are always covered.

Portable after 3 years, ensuring that you are always covered.

Guaranteed yearly renewal

Enjoy peace of mind that your insurance coverage will continue throughout your home loan tenure.

Enjoy peace of mind that your insurance coverage will continue throughout your home loan tenure.

Enjoy 5% premium discount every year

Valid when you and your joint borrower(s) sign up together.

Valid when you and your joint borrower(s) sign up together.

This is not a fixed or savings plan, but a guaranteed yearly renewable group term insurance plan.

Mr and Mrs Khoo's Profile

40 years old (age next birthday)

They jointly purchase a condominium and take up an OCBC Home Loan with a loan amount of S$1 million for a tenure of 25 years

They opt to be jointly covered by Group Mortgage Insurance

- Examples of monthly premium payable (rounded off to nearest cent)

- S$500,000 outstanding loan

- S$800,000 outstanding loan

- S$1,000,000 outstanding loan

| Age next birthday |

Monthly premium payable for every S$100,000 of outstanding loan |

Examples of monthly premium payable (rounded to nearest cent) |

||

|---|---|---|---|---|

| S$500,000 outstanding loan |

S$800,000 outstanding loan |

S$1,000,000 outstanding loan |

||

| 18 - 35 | S$3.75 | S$18.75 | S$30.00 | S$37.50 |

| 36- 45 | S$6.50 | S$32.50 | S$52.00 | S$65.00 |

| 46 - 55 | S$18.08 | S$90.42 | S$144.67 | S$180.84 |

| 56 - 70 | S$44.08 | S$220.42 | S$352.67 | S$440.84 |

Note:

- Premium rates for ages 66 to 70 are applicable for renewals only.

- Premium rates are not guaranteed and The Great Eastern Life Assurance Company Limited reserves the right to amend the premium rates.

- Monthly premium rate will be determined at the start of each policy year and will remain unchanged during policy year.

- Examples of monthly premium payable (rounded off to nearest cent)

- S$500,000 outstanding loan

- S$800,000 outstanding loan

- S$1,000,000 outstanding loan

| Age next birthday | Examples of monthly premium payable for every S$100,000 of outstanding loan | Examples of monthly premium payable (rounded off to nearest cent) |

Examples of monthly premium payable (rounded off to nearest cent) |

Examples of monthly premium payable (rounded off to nearest cent) |

|---|---|---|---|---|

| S$500,000 outstanding loan | S$800,000 outstanding loan | S$1,000,000 outstanding loan | ||

| 18 - 35 | S$3.75 | S$18.75 | S$30.00 | S$37.50 |

| 36- 45 | S$6.50 | S$32.50 | S$52.00 | S$65.00 |

| 46 - 55 | S$18.08 | S$90.42 | S$144.67 | S$180.84 |

| 56 - 70 | S$44.08 | S$220.42 | S$352.67 | S$440.84 |

Note:

- Premium rates for ages 66 to 70 are applicable for renewals only.

- Premium rates are not guaranteed and The Great Eastern Life Assurance Company Limited reserves the right to amend the premium rates.

- Monthly premium rate will be determined at the start of each policy year and will remain unchanged during policy year.

Eligibility requirements

Age (next birthday)

18 to 65 years old

Prerequisite

All OCBC Home Loan customers

Important notices

Policy Owners' Protection Scheme

Important notes

Group Mortgage Insurance is provided by The Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited and a member of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies. All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 14 February 2020.

More information on Group Mortgage Insurance

More questions and answers- No, GMI cannot replace the HPS if you are utilising CPF funds to service the loan on your HDB flat. You can choose to sign up for GMI as an additional coverage to supplement HPS.

- Yes. In the event of your demise, total and permanent disability or terminal illness, the insurance payout will pay off the mortgage fully so that your loved ones can keep the property.

- Do note that mortgage insurance covers the outstanding loan amount approved by the bank or chosen sum assured, whichever is lower. If you have chosen a sum assured that is lower than your outstanding bank loan, it will not be sufficient to pay off your mortgage loan.

- Yes. This plan offers guaranteed renewability, giving you and your loved ones peace of mind for the duration of your loan tenure.

- Group Mortgage Insurance is underwritten by The Great Eastern Life Assurance Company Limited (“Great Eastern”), a wholly-owned subsidiary of Great Eastern Holdings and a member of the OCBC Group.