GREAT TERM 2

Comprehensive coverage for you and your family

An affordable term life insurance plan to meet your protection needs.

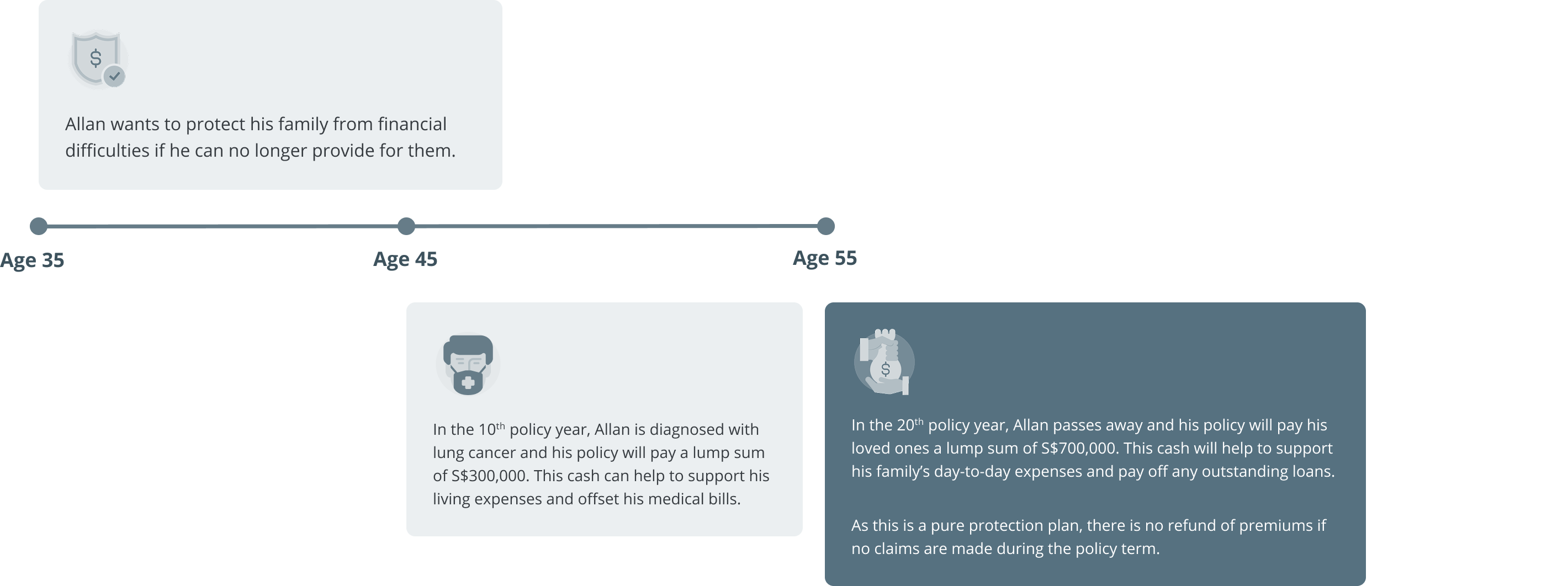

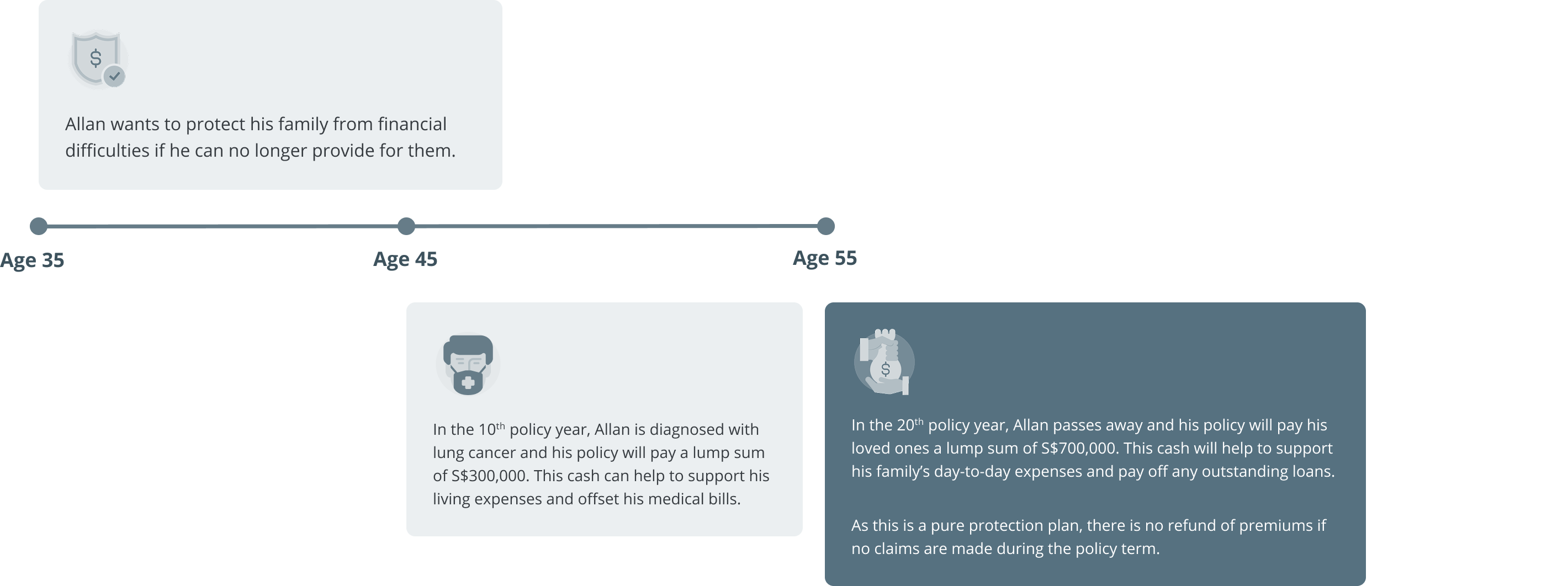

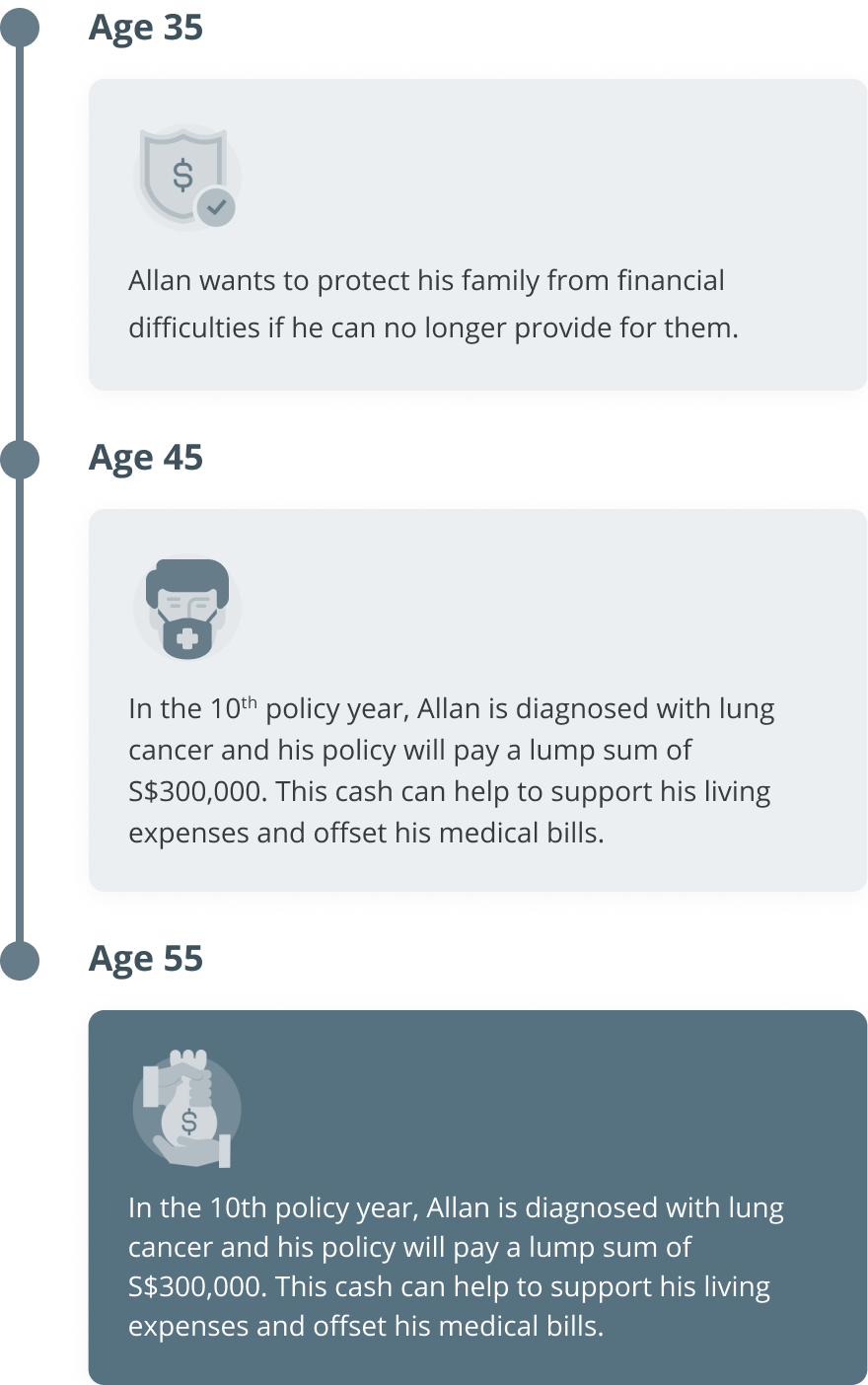

Allan's profile:

35 years old

Married with kids and non-smoker

Policy details:

He chooses a sum assured of S$1,000,000 with coverage term up to age 65 (30-years policy term).

He adds Living Care Rider 2 (covers 53 critical illnesses) with a sum assured of S$300,000 with coverage term up to age 65 (30 years policy term).

His premium is S$134.50 (S$79.50 + S$55.00) a month.

The figures used are for illustrative purposes only. All ages specified refer to age next birthday. Premium rates for the Living Care Rider 2 are not guaranteed and may be adjusted based on future experience.

Find out how much coverage you need

Get personalised suggestions for each type of coverage on the OCBC app.

Eligibility requirements

Age (next birthday)

1 to 75 years old

Important notices

Policy Owners' Protection Scheme

This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the Life Insurance Association (LIA) or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

Important notes

GREAT Term 2 is underwritten by Great Eastern Life Assurance Company Limited, a wholly owned subsidiary of Great Eastern Holdings Limited, part of the OCBC Group. This plan is not a bank deposit and OCBC Bank does not guarantee or have any obligations in connection with it.

This document does not take into account your particular investment and protection aims, financial situation or needs. You may want to seek advice from a financial adviser before committing to buy the product. If you choose not to seek advice from a financial adviser, you should consider whether the product is suitable for you.

As this product has no savings or investment feature, there is no cash value if the policy ends or if the policy is terminated prematurely. It is usually detrimental to replace an existing accident and health plan with a new one. A penalty may be imposed for early plan termination and the new plan may cost more, or have less benefits at the same cost.

This document is for general information only. It is not a contract of insurance or an offer to buy an insurance product or service. It is also not meant to provide any insurance or financial advice. The specific terms and conditions of the plan are set out in the policy documents. If you are interested in the insurance policy, you should read the product summary and policy illustration (available from us) before deciding whether to buy this product.

We do not guarantee, represent or warrant that any of the information provided in this document is accurate and you should not rely on it as such. We do not undertake to update the information or to correct any inaccuracies.

All information may change without notice. We will not be liable for any loss or damage arising directly or indirectly in connection with or as a result of you acting on the information in this document.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information presented as at 28 January 2026.

Try it now

Start planning via the OCBC app

Open the all new OCBC app > Login > Click on ‘Plan’ > Under ‘Insure’, click on ‘Calculate your needs’ .

If you are still on the previous version of the app, then click on ‘Insure and stay protected’ after logging in.